I’ve been trading forex and crypto for years. One thing I quickly learned is that managing more than one account manually is a nightmare. At first, I copied trades by hand. It was slow, and I missed a lot of good setups. Then I found trade copiers. They made everything simple. My trades synced across accounts in real time, and I could focus on strategy instead of clicking buttons. That’s what you get when you have the best forex trade copiers at hand.

In crypto, however, copiers look and feel much more modern. In forex, the tools often feel a bit behind. That is why picking the best forex trade copier really matters. In this guide, I will show you how they work, how they compare to crypto versions, and which ones I think are the best right now.

What Are Forex Trade Copiers?

A forex trade copier is a tool that lets you copy trades from one account to another. You take a trade on your main account, and the copier sends it to all the connected accounts right away. Think of it like executing an order once and letting the copier handle the rest.

How They Work

It starts with a master account. This is the account where you place your trades. Then you link one or more follower accounts. When you buy, sell, or close a trade on the master account, the copier instantly does the same thing on every follower account.

Some copiers let you change the settings, too. You can adjust trade size, set different risk levels, or filter which trades get copied. This way, follower accounts are not locked into copying trades exactly as they are.

Of course, among the many options out there, only the best forex trade copiers are able to replicate trades accurately, quickly, and offer customizable settings.

Platforms They Support

The best forex trade copiers are usually built for MT4 and MT5, since these platforms dominate the forex market. A few also work with cTrader. So, choosing the right copier usually depends on which platform you trade on.

Why Choosing the Best Forex Trade Copier Matters

If you only trade one account, you might not see the value of a copier. But once you move into managing more than one account, or if you start handling investor money or trading on prop firms and funded accounts, it quickly becomes essential. In fact, a good trade copier might be one of the best asset management tools to add to your arsenal.

The best forex trade copiers save you hours of manual work. They remove the stress of trying to enter the same trade across different accounts at the same time. Even a small delay can cause slippage, different entry prices, or missed trades. With a copier, all accounts update instantly and stay in sync.

Consistency is another big reason. When every account mirrors your master account, you do not have to worry about forgetting a trade, entering the wrong lot size, or closing positions too early. Everything runs smoothly and automatically.

I have tried it both ways. In the early days, I managed multiple accounts by hand. It was messy, full of errors, and honestly, a nightmare. Once I started using a copier, the difference was huge. I could finally focus on strategy and execution instead of repeating the same clicks again and again.

That is why choosing the best forex trade copier matters so much. A good one makes trading scalable, reliable, and stress-free. A bad one can cost you money, time, and even clients.

Forex vs Crypto Trade Copiers: Key Differences

After trading both crypto and forex for years, I can tell you the trade copier experience is not the same. The best crypto copy trading platforms and bots feel like polished products. Meanwhile, the best forex trade copiers are more functional but a bit behind.

Here’s a quick comparison:

|

Aspect |

Crypto Trade Copiers |

Forex Trade Copiers |

|

Design & Experience |

Platform-based, slick UI, modern dashboards, mobile-friendly. |

SaaS-focused, less polished, basic design, slower updates. |

|

Target Users |

Mainly retail traders and investors (B2C). |

Professional traders, prop firms, asset managers. |

|

Integrations |

Direct exchange integrations, easy plug-and-play. |

Heavy reliance on MT4 and MT5 connections. |

|

Innovation |

Fast updates, advanced features, and a modern product feel. |

Reliable and stable, but slower to add new features. |

Bridging the Gap: Finestel Comes to Forex

Now, we’re about to change the forex copy trade software space. Finestel already proved itself in crypto with an enterprise-grade B2B2C copy trading bot. The features we offer to crypto traders are very popular, like modern dashboards, smooth user experience, quick integrations, and white-label solutions for businesses.

Now, the good news is, all of that is coming to forex. Finestel is bringing its crypto-grade technology into the forex world. We aim to fully support MT4 and MT5. This means asset managers, prop firms, and professional traders in forex can finally get the same level of experience that crypto users have enjoyed for years.

This is quite a big shift. Forex copy trading is finally catching up with the times, and we’re here to make sure it does.

Top 5 Best Forex Trade Copiers in 2025

There are many copiers out there, but only a few stand out if you are serious about trading or managing accounts. Among all the many trade copiers for MT4 and MT5, here are my top five picks for the best forex trade copiers in 2025.

|

Feature / Copier |

Traders Connect |

Duplikium |

Social Trader Tools (STT) |

FX Blue Personal Trade Copier |

Local Trade Copier (LTC) |

|

Supports |

Forex (limited crypto support) |

Forex only |

Forex + limited Crypto |

Forex only |

Forex only |

|

Platforms Supported |

MT4, MT5 |

MT4, MT5 |

MT4, MT5, some crypto brokers |

MT4, MT5 |

MT4, MT5 (runs as MQL plugin) |

|

White-label |

No |

No |

Limited |

No |

No |

|

Ease of Use |

Simple but professional |

Straightforward SaaS |

Clean, user-friendly |

Basic DIY setup |

Advanced customization (manual or VPS required) |

|

Innovation Level |

Medium (steady improvements) |

Medium (stable, proven) |

Medium (good UI, retail focus) |

Low (minimal features) |

High (flexibility, filters, multi-account features) |

|

Target Audience |

Asset managers, small to mid-size firms, pro traders |

Independent traders |

Retail traders, small providers |

Individual budget traders |

Professional traders, signal providers, and some prop firms |

|

Pricing |

Mid-range |

Mid-range |

Mid-range |

Free / very low cost |

Mid-range (one-time license or subscription, depending on plan) |

|

Best for |

Reliable, professional setups without white-label |

Traders who want fast and stable SaaS |

Retail and semi-pros who want a polished dashboard |

DIY traders on a budget |

Pro traders who want advanced customization and control |

1. Traders Connect

Traders Connect has become one of the most reliable choices for professional traders and small firms. It is built with speed and reliability, and as one of the best forex trade copiers, it offers low-latency trade copying between MT4 and MT5 accounts. The platform also includes advanced risk management features, such as proportional lot sizing and equity-based adjustments.

What I like about Traders Connect is how it balances professional-grade performance with simplicity. The interface is straightforward and does not overwhelm you with unnecessary features. It focuses on what matters: fast, accurate copying and strong account control.

2. Duplikium

Duplikium has been around for years as a forex trade copier service and has earned a solid reputation in the forex world. It is a SaaS-based copier that runs in the cloud, meaning you do not need to leave your trading computer running all the time. This makes it stable, reliable, and very easy to manage.

It supports both MT4 and MT5, and one of its strongest points is the low execution delay. For traders running strategies where speed matters, Duplikium is a dependable option. The setup process is simple, and the company has consistently kept the software updated for the needs of professional traders.

3. Social Trader Tools (STT)

The next entry on our list of the best forex trade copiers is STT. Social Trader Tools has grown in popularity thanks to its modern, web-based interface and flexibility. It works with MT4 and MT5 and also offers some integrations with crypto brokers. This makes it appealing to traders who want to operate across both markets.

The platform includes features like trade mirroring, account grouping, and performance tracking. One of the biggest advantages is the clean dashboard, which makes it easy for both traders and followers to manage copy trading. STT is especially strong for smaller traders or strategy providers who want to build a following without investing in heavy infrastructure.

4. FX Blue Personal Trade Copier

FX Blue is one of the oldest and most trusted names in forex tools. It is also still one of the best forex trade copiers in 2025. Their Personal Trade Copier is lightweight software that allows traders to copy trades between MT4 and MT5 accounts with very low delay.

It is often free or available at a very low cost, which makes it attractive for traders who want basic functionality without paying for premium platforms. While it does not have the enterprise-level features or sleek dashboards of other copiers, it is extremely reliable and perfect for individual traders who want a simple and effective solution.

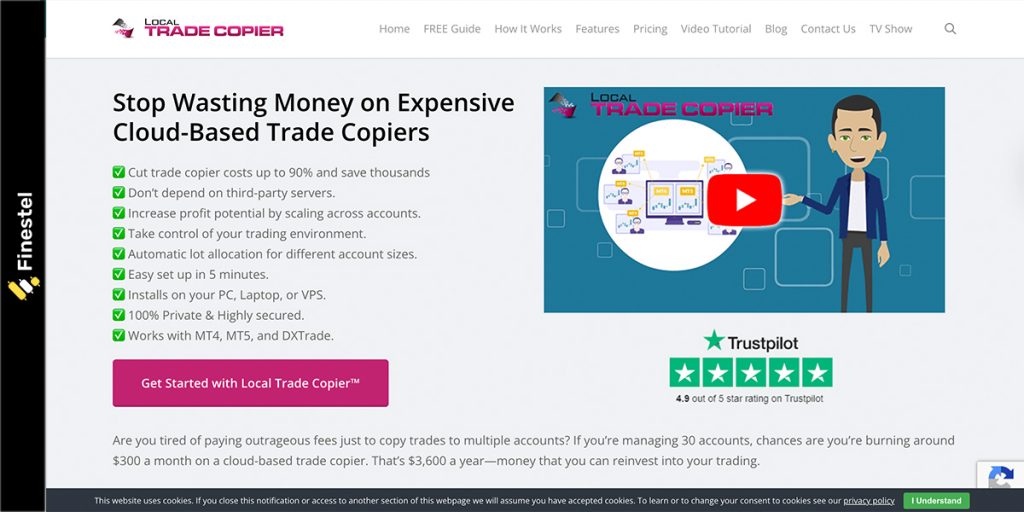

5. Local Trade Copier (LTC)

Local Trade Copier is a powerful solution for traders who want to manage multiple accounts directly from their own computer. It works as an MQL-based plugin for MT4 and MT5, meaning it runs inside your trading platform.

What sets LTC apart is its flexibility. You can customize lot sizing, apply filters to copy only certain trades, and manage dozens of accounts at once. It is a favorite among professional traders, signal providers, and even some prop firms. While it requires your computer or VPS to be online, it makes up for that with precision and control.

How to Choose the Right Forex Trade Copier

Not every copier forex traders use fits every one of them. The right choice depends on how you trade, how many accounts you manage, and what kind of clients or investors you work with.

If you are running just one or two accounts, you probably do not need the most advanced features. Something simple like FX Blue can get the job done without extra cost. But once you start handling bigger money or multiple accounts, you will need stronger tools with better control.

Think about latency first. In fast markets, even a small delay can make a big difference. The best forex trade copiers should execute trades instantly across all accounts. Platforms like Traders Connect and Duplikium are solid for this.

Next is compatibility. Make sure the copier supports your trading platform. Most focus on MT4 and MT5, but if you also touch crypto or cTrader, you need a tool that integrates smoothly.

Do not ignore scalability. If your goal is to grow into managing more clients or accounts, pick a copier that can handle dozens of accounts without slowing down. Local Trade Copier is strong in this area because of its customization and filters.

Finally, consider your budget vs needs. Free or low-cost solutions like FX Blue are great when you are starting out. But if you are managing investor money, spending on a premium copier is not a cost; it is an investment in reliability and trust.

Conclusion

A forex trade copier can make a huge difference in how you trade. It keeps accounts synced, removes manual errors, and lets you scale without extra stress. So, if you’re running one account or managing money for clients, the best forex trade copiers can help you trade smarter and faster.

But the key is to match the tool with your needs. If you are just starting, a simple and affordable option will work fine. But if you manage larger accounts or investor capital, go for a professional-grade copier that gives you speed, reliability, and control.

Leave a Reply