The crypto market has witnessed the rise of copy trading over the years, attracting the attention of market participants and even entrepreneurs. It allows investors to browse skilled traders at different platforms, evaluate their statistics, and obtain profit by replicating their trading performances.

Finding the best crypto copy trading platform as a reliable and trustworthy platform for experiencing a convenient trading operation is significant. This article by Finestel, provides a complete list [July 2024 updated] of the top 10 crypto copy trading platforms. These platforms have been carefully assessed based on their reliability, user satisfaction, and unique features.

Considering these factors, you can make an informed decision when selecting the best crypto copy trading service that suits your trading and portfolio management needs.

What Is Crypto Copy Trading?

Crypto copy trading is a popular strategy in cryptocurrency markets, where beginners can automatically replicate the trading performance of successful traders in real-time. This form of social trading makes individuals, as investors, decrease the learning complexities and save time by instantly copying the trades of more skilled traders.

The concept behind crypto copy trading is about identifying gaining traders and copying their decisions in trade. It makes investors and their investments more profitable. By experiencing copy trading, investors can diversify their portfolios and spread their risks across multiple assets according to their investment strategies.

Copy trading is helpful for beginners or those who lack the time or expertise to trade solely. Copy trading concentrates on short-term strategies such as day trading and swing trading, especially in the cryptocurrency market. When beginner and passive investors utilize copy trading by automating all processes of trading operations, it enables them to benefit from the market with the lowest effort and time spent. However, it is essential to remember that despite copy trading’s simplifying advantage, it still includes potential risks.

Therefore, investors should always define their strategies, conduct due diligence steps to exercise caution, and carefully select mainly featured copy trading platforms and famous traders to copy.

Some platforms also have risk management tools like stop losses that get automatically applied to all copied trades. This helps prevent large losses if a trader you’re copying starts making bad trades. So crypto copy trading provides useful tols for beginners beyond just mirroring trades.

Read our full guide on “What is copy trading” and does it really work in 2024?

How Does It Work?

Crypto copy trading platforms generally use an API (Application Programming Interface) for connecting to cryptocurrency exchanges. An API serves as a means for different software applications to communicate with each other. Crypto copy trading platforms, which are often third-party service providers, utilize API to connect traders and investors of exchanges. By linking it to an exchange such as Binance, Bybit, or Kucoin, you can peruse a group of traders and choose those that align with your investment approach to copy.

After selecting traders, their trading performances will be communicated through API to your exchange account to be executed simultaneously as a mirroring operation.

Read more about API trading and the best platforms for API trading in 2024.

The History and Evolution of Copy Trading in Financial Markets

You can trace back the history of copy trading to the early 2000s. The Internet’s invention has led to the creation of online trading platforms. These platforms then gave birth to copy trading as a new way for retail investors to benefit from the expertise of professional traders.

In its early stages, copy trading involved the manual replication of trades by the investors. Copiers would take time to analyze the activities of experienced traders and execute similar trades in their own accounts. In this early version, the most important part of trading which is risk management, was done by the followers themselves. However, with technology advancements over time, sophisticated copy trading features have been introduced.

Copy trading platforms have started to offer automated copy trading services. These systems enabled real-time replication of executions, proportional to the copier’s account size. The absence of human intervention in this process significantly improved the efficiency and accuracy of copy trading. As a result, copy trading was finally gaining mass attention.

While individuals and retail investors were the majority interested in copy trading, institutions, and asset managers also entered the space. Their arrival has led to the evolution of copy trading. New copy trading services were developed to cater to the needs of the big players. Today, many asset managers and even hedge funds offer copy trading services to their clients.

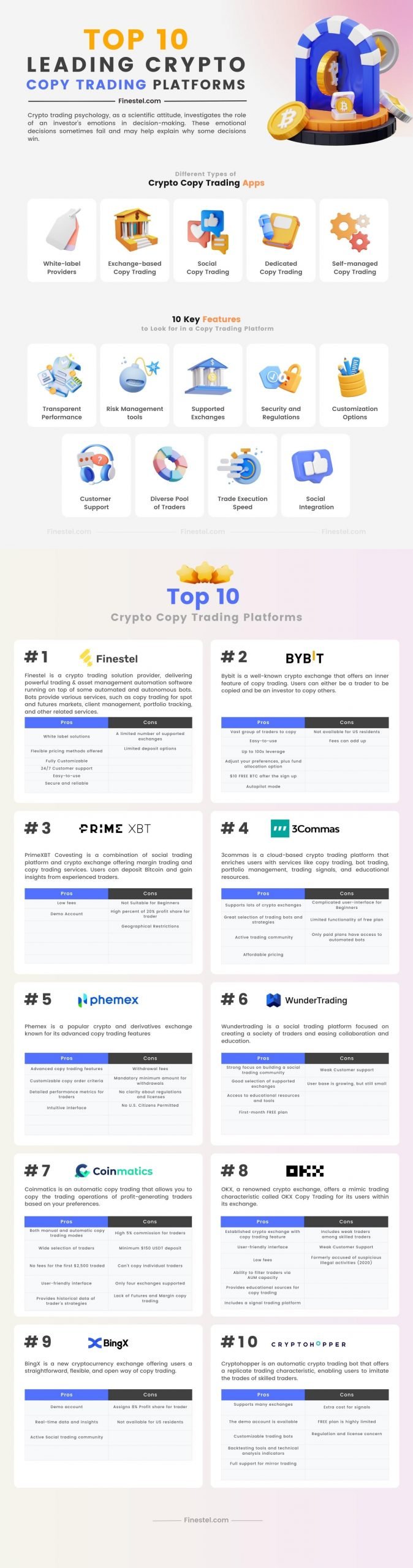

Exploring Different Types of Crypto Copy Trading Platforms

Crypto copy trading apps have different types, each offering a different copy trading procedure. To get familiar with any specific style that is proper for your needs, let’s explore them:

- White-label Providers: Mostly fit for traders with a group of investors who have already raised their AUM (Asset Under Management). These providers offer a one-click-prepared copy trading platform that can be fully customized and branded by companies, brokers, individuals, or institutions that carry investors’ capital.

- Exchange-based Copy Trading: These directly-integrated apps within cryptocurrency exchanges can copy the traders of gaining traders at the same exchange. The bigger the exchange ecosystem, the more skilled traders benefit from it. In this type, investors must register, complete KYC steps, deposit investing amounts, and choose inner-based exchange traders to assess and copy their trading performance.

- Private Copy Trading: Private copy trading is a selective approach to copy trading that allows traders to share their strategies within a vetted community, safeguarding against intellectual property theft. Unlike the open-access nature of public copy trading platforms, which are prone to strategy plagiarism, private copy trading operates within closed groups where membership is restricted to verified experts.

- Social Copy Trading: The nature of these platforms is to have a social trading community where traders and investors gather to find each other. On these platforms, users (primarily investors) can browse through the profiles and choose to copy those they find promising and suitable for investing strategy. These platforms have an academic and learning atmosphere for less-experienced traders or beginner investors to raise their knowledge and experience. Read more in our “Is social trading profitable” article.

- Dedicated Copy Trading: Ultimate goal of copy trading. These platforms provide many features and functionalities of copy trading activities by which users can access a network of beneficial and successful traders to copy them. These platforms often present performance assessment and risk management tools for investors.

- Self-managed Copy Trading: Suit for traders and investors because these platforms enable users to lead and follow trading activity. Using them, users can create their trading strategies and make them available to be copied by others. On the other hand, they can also browse the platform to find other traders and copy them.

How to Choose the Best Copy Trading Platform: 10 Features to Consider

When looking for the best crypto copy trading platform, consider the following key features:

- Supported Exchanges: Ensure the platform is compatible with the well-known or preferred cryptocurrency exchange.

- User Interface: Whether traders or investors, a user-friendly interface that makes navigation and trading easy is necessary to feel comfortable with the platform.

- Risk Management tools: Choose a platform with tools like stop-loss and take-profit levels to protect your investments. It is crucial to understand the intent of the exchange to have a secure trading environment for users.

- Trade Execution Speed: In the crypto market with fast and quick volatilities, it is crucial to utilize a crypto exchange that can execute trades quickly and find copy trading platforms that provide high-speed execution in connection with crypto exchanges. No one wants to lose trading opportunities.

- Security Measures and Regulation Compliance: The Chosen platform should prioritize security and employ severe measures to protect funds, personal information, and users’ private details from threats. Before choosing any forum, search for any report about their flaws as negative points and compliance with regulations plus security metrics as positive points.

- Customization Options: Choose a platform to customize your trades by determining parameters such as leverage level, stop-loss levels, trade size, and maximum exposure. It should provide greater flexibility in adjusting your trading strategy according to your preferences.

- Customer Support: Reliable customer support is a crucial part of customer loyalty programs for every business. Your chosen platform must deliver assistance and resolution of any issues or concerns arising during your participation in copy trading operations.

- Diverse Pool of Traders: A platform worth working with that contains a wide range of at least an admirable group of traders because it increasingly improves the opportunity of finding a proper trader whose style aligns with your preferences.

- Transparent Performance Metrics: Historical returns, success rate, actual drawdown rate (periodical drawdowns are better), risk levels, and trading history based on performing age are clear and transparent performance metrics of any trader the platform should illustrate for users.

- Social Integration: If your chosen platform is a social copy trading platform, it must allow users to interact with traders and other users. In addition, it must provide an environment for market discussions so that users can seek advice from experienced traders.

Discover more about top copy trading platforms that support the futures market.

Is Copy Trading Reliable in the Crypto Market?

If users are cautious and use the best crypto copy trading platform, it can be reliable in an acceptable way. It allows investors to access skilled traders whose strategies and decisions are proven in the assessment process. However, It is important to conduct sufficient research about platform reliability, trader performance, and individual risk tolerance.

While choosing a copy trading platform, factors like user interface, supported exchanges, customer support, and security measures should be considered. Diversifying investments and starting with smaller amounts can help reduce risks and build gradual confidence.

You must note that the crypto market has heavy volatility, and losses can still happen even when copying successful traders. Conducting research and choosing regulated platforms with verified trading performance is vital to minimize suspicious activities. You should also take responsibility for your losses and understand the terms and fees associated with copy trading.

Find more out about copy trading legality, here is an article about is copy trading legal?

Top 10 Crypto Copy Trading Software

Looking for the best crypto copy trading platform? Although copy trading is implemented differently, here is a list of platforms; some are social trading platforms.

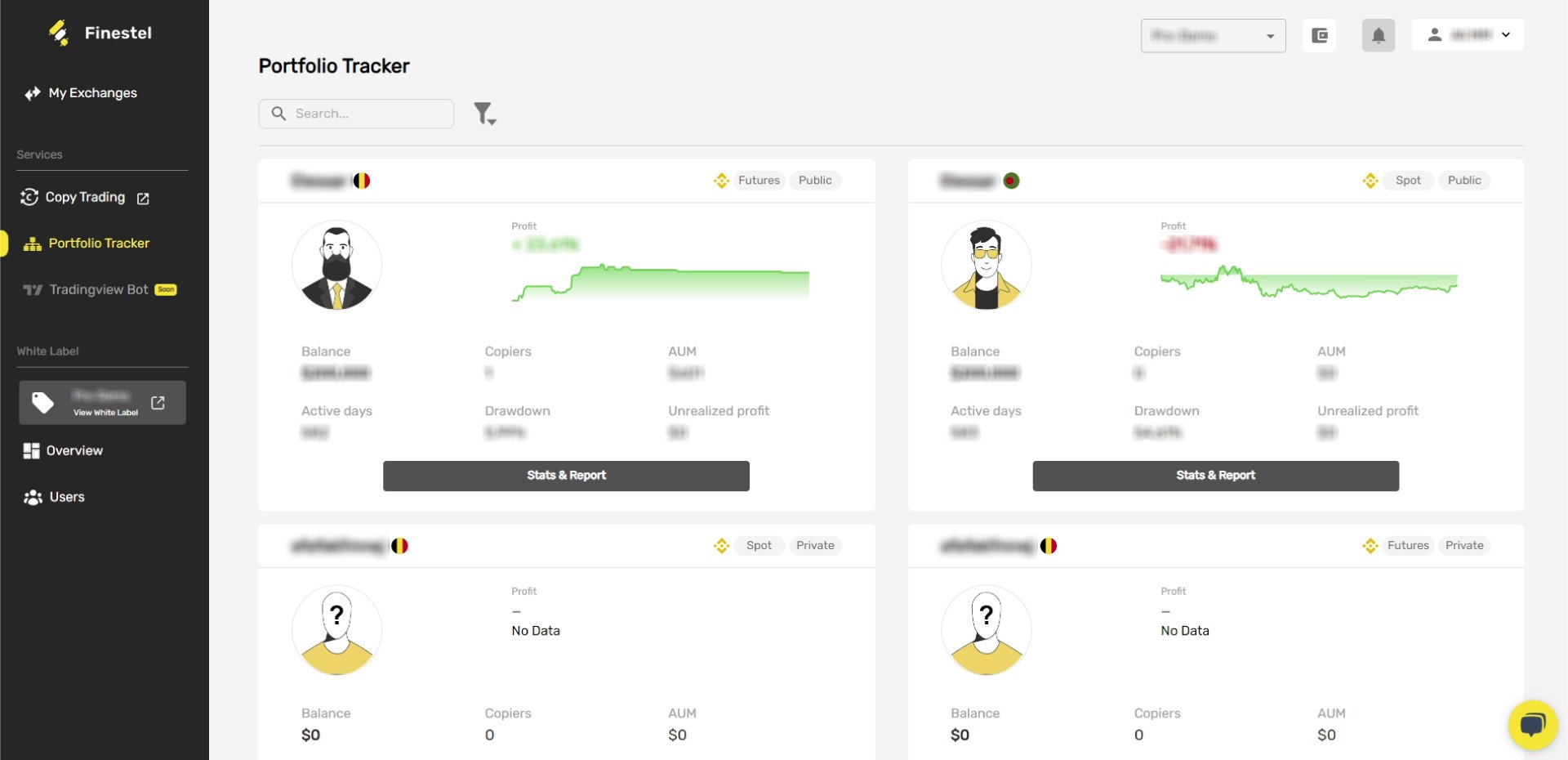

1. Finestel

Finestel is an innovative trading technology solution provider based in Canada. In case you are a profitable trader who already has a community of followers and investors looking for a reliable copy trading service, Finestel is for you. With our cutting-edge copy trading technology, you can efficiently manage your clients’ money. There are also additional services like portfolio trackers, automated billings, and performance analytics included. Our copy trading service is divided into two plans:

- Copy Trading Bot: This plan is suitable for traders with a limited number of investors and assets under management. Our copy trading bot replicates your trades in your followers’ accounts at lightning speed.

- White-Label Copy Trading Software: For traders with more than 10 clients or considerable assets under management, we recommend using our white-label asset management software. With this plan, you can offer your services under your own brand and website, with an almost fully customizable interface and features.

Moreover, traders with a profitable strategy who are searching for investors and additional assets under management can use Finestel’s private strategy marketplace. You can add your strategy and its track record to the marketplace to showcase it to our private investors and attract more investments. Real-time updates to your track record will allow you to continuously enhance your results and potentially gain more capital.

Investors who are already working with a profitable trader can also suggest Finestel to the trader. With our robust copy trading software, customization options, and wide range of advanced tools and features, your asset manager is likely to migrate to Finestel. You can form a partnership on our website and privately invest your funds with your trader of choice while having no concerns about operational or technical issues that may jeopardize your assets.

Pros:

- White label solutions

- Transparent trading performance

- Flexible pricing methods offered

- Easy-to-use

- Secure and reliable

- Fully Customizable

- 24/7 online customer support

- Free for the first month

- Supporting Binance copy trading, Bybit Copy trading, OKX copy trading, KuCoin copy trading, and more.

Cons:

- A limited number of supported exchanges

- Limited deposit options

Read more about Finestel in our Finestel review article.

2. Bybit

Bybit is a well-known crypto exchange that offers an inner feature of copy trading. Users can either be a trader to be copied or investors to copy others. As a trader, users can earn an 11% commission. It is like a social trading environment where users can explore traders and evaluate them to copy.

Pros:

- wide selection of traders to choose from for copying

- Easy-to-use

- Up to 100x leverage

- Adjust your preferences, plus fund allocation option

- $10 FREE BTC after the sign-up

- Autopilot mode

- Online customer support

Cons:

- Not available for US residents

- Fees can add up

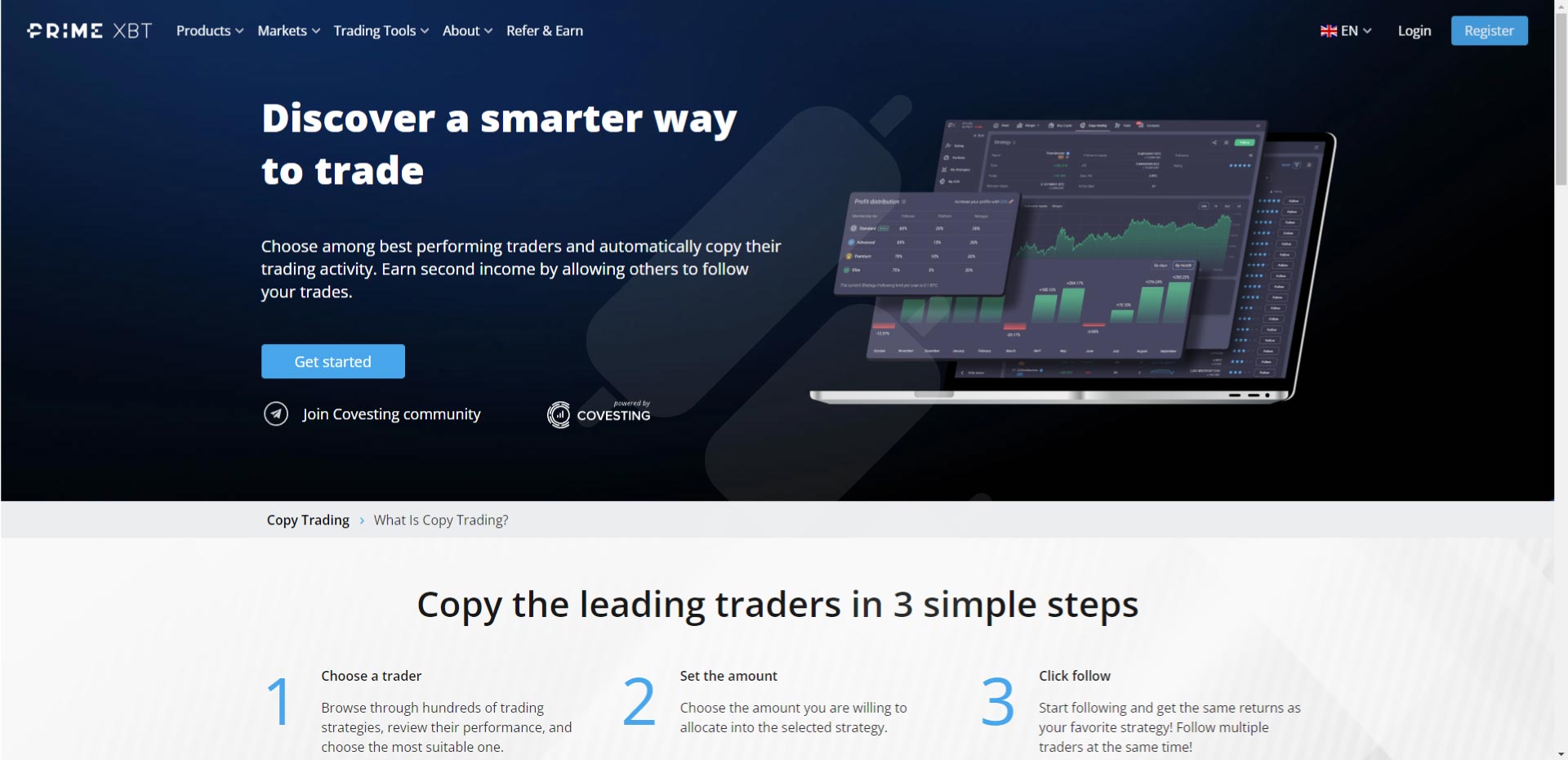

3. PrimeXBT Covesting

PrimeXBT Covesting is a comprehensive copy trading platform that allows users to replicate the trades of experienced traders. The feature integrates social trading with margin trading services, enabling users to diversify their investment strategies across various asset classes, including cryptocurrencies, forex, commodities, and indices.

Covesting offers a high level of transparency, where traders are rated based on performance metrics such as profit/loss, active days, and followers’ equity, making it easier for users to choose successful strategies to follow. Additionally, the platform uses the COV token, providing benefits like fee reductions and improved profit splits for users who stake it.

PrimeXBT also offers a range of advanced trading tools and educational resources. The platform includes a demo account feature through trading contests, which allows users to practice without risking real funds, and a Trading Academy that provides video tutorials and webinars.

The user-friendly interface is customizable and integrates all trading features, making it suitable for both beginners and seasoned traders. However, it’s important to note that the platform is not regulated and is unavailable in certain regions, including the USA and Canada. Despite these limitations, PrimeXBT’s competitive fee structure, high leverage options, and robust security measures make it an appealing choice for experienced traders

Pros:

- Demo Account

- Low fees

Cons:

- Not Suitable for Beginners

- A high percent (20%) profit share for traders

- Geographical Restrictions: The platform is not available in certain regions, including the USA, Canada, France, Japan, and Israel, limiting access for some potential users.

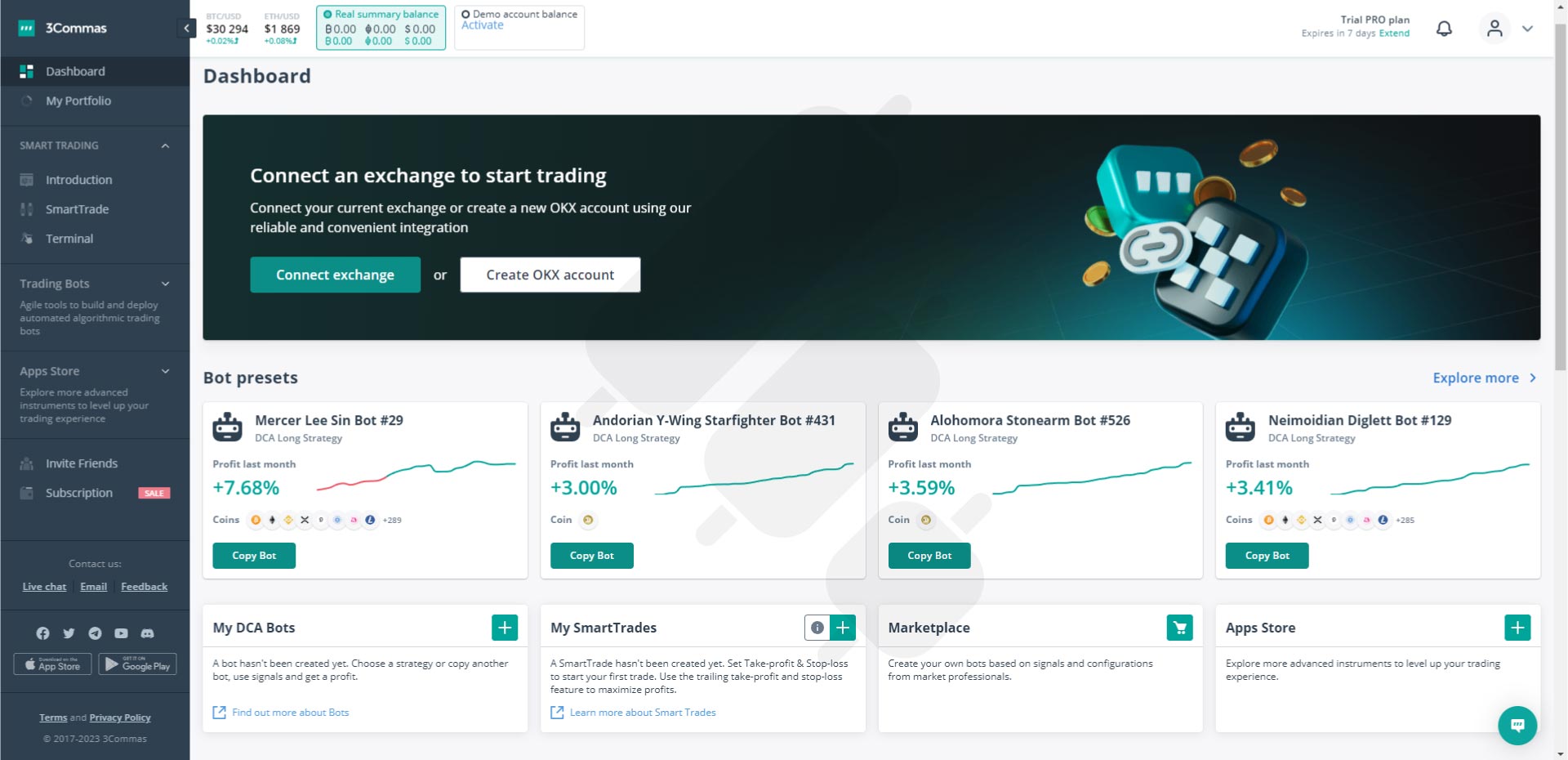

4. 3commas

3commas is a crypto trading platform that enriches users with services like copy trading, bot trading, portfolio management, trading signals, and educational resources.

3commas is a cloud-based platform compatible with a variety of exchanges such as Binance, BitMEX, Huobi, Kraken, Bybit, Coinbase Pro, Kucoin, OKx, and so on. Since it is a popular platform among crypto traders, it has been admired for its user-friendly interface and its collection of features. Read the comprehensive 3commas review.

Pros:

- Supports lots of crypto exchanges

- Extended reputation

- Great selection of trading bots and strategies

- Easy to use

Cons:

- Limited functionality of the free plan

- The complicated user interface for beginners

- Only paid plans have access to automated bots

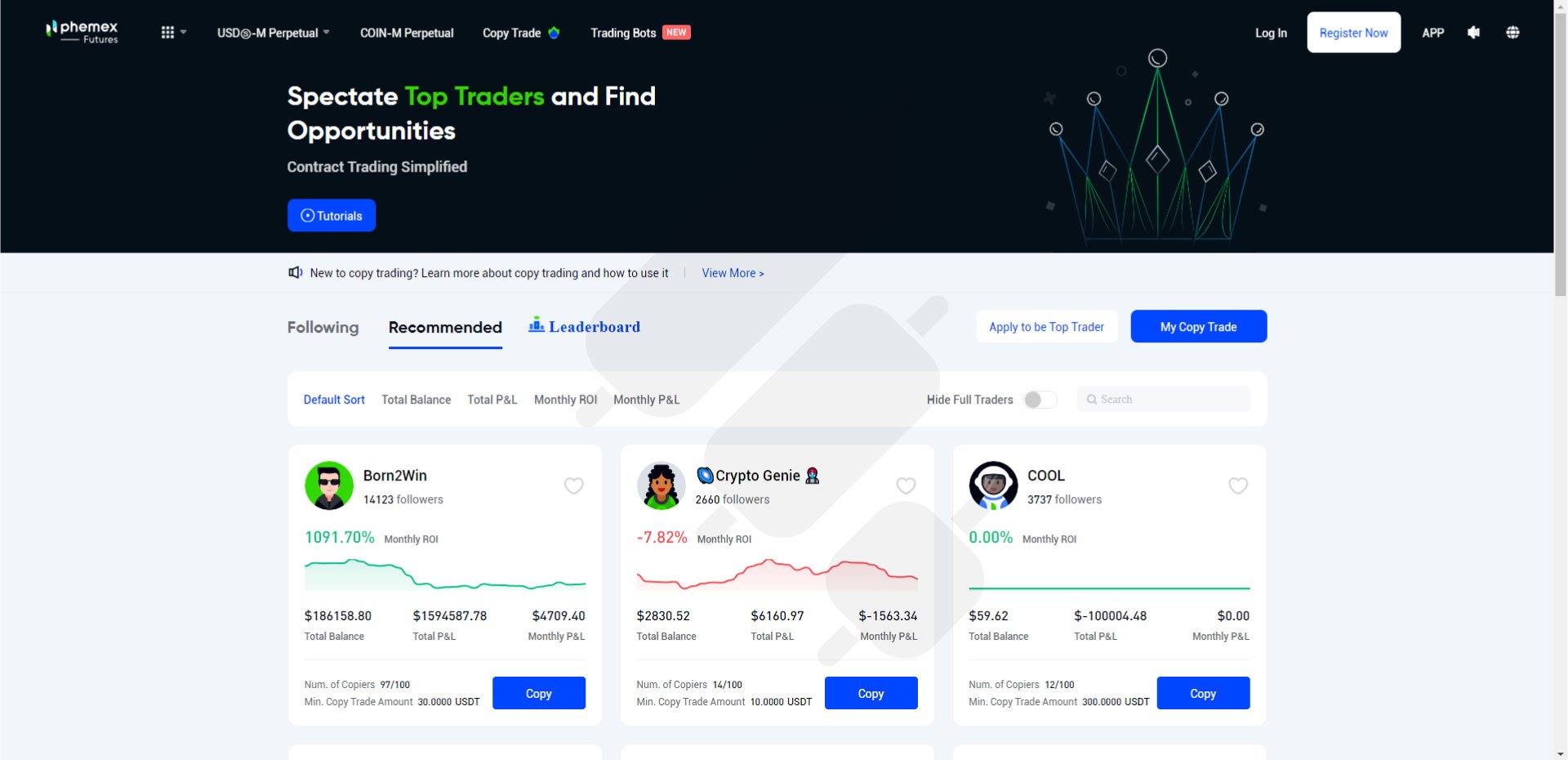

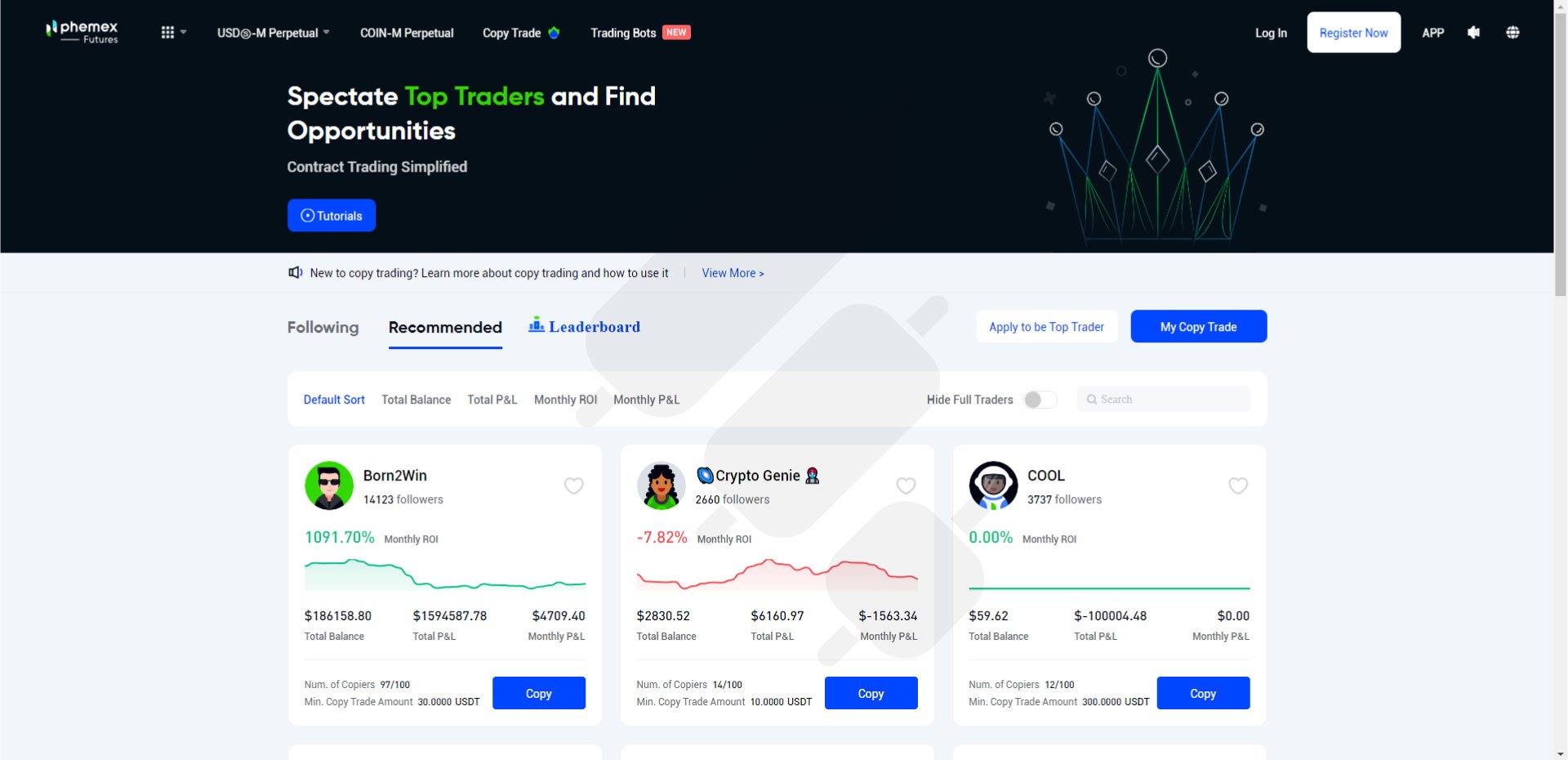

5. Phemex

Phemex is a popular crypto and derivatives exchange known for its advanced copy trading features. It provides a social trading environment where users can not only copy the trades of successful traders to potentially generate profits but also customize their copy trading settings to better align with their risk tolerance and trading preferences.

Phemex offers detailed performance metrics for each trader, including ROI, cumulative profit, max drawdown, win rate, and more, enabling users to diversify their portfolios by copying multiple traders. Recently, Phemex has expanded its offerings to include trading bots such as Future Grid bots and Spot Grid bots for nearly 100 cryptocurrency pairs, further enhancing its intuitive interface and advanced trading features.

Pros:

- Customizable copy order criteria

- Detailed performance metrics for traders

- Intuitive interface

Cons:

- Withdrawal fees

- The mandatory minimum amount for withdrawals

- No clarity about regulations and licenses

- No U.S. Citizens Permitted

6. Wundertrading

Wundertrading is a social trading platform focused on creating a society of traders and easing collaboration and education. The platform enables you to link with other traders, exchange concepts, and copy their trades to obtain profits potentially. You can follow accomplished traders, converse trading strategies, and harness the platform’s instructional resources and tools to refine your trading aptitude and understanding.

Additionally, Wundertrading enriches trading adaptability with automatons that propose preferences, including capped entries, numerous entries, numerous gains, trailing halt, halt loss, order size in proportion or a set sum ($), oscillating trading, DCA trading, and notifications from any origin comprising TradingView cautions. It also showcases an automated maneuver to break-even functionality, further supplementing the comprehensive trading environment it offers.

Pros:

- Strong focus on building a social trading community

- Collaboration and learning opportunities

- Access to educational resources and tools

- First-month FREE plan

- Supporting more than ten popular crypto exchanges

Cons:

- Weak Customer support

- Userbase is rising, but it is small, yet

- Includes weak traders among all traders

7. Coinmatics

Coinmatics is an automatic copy trading that allows you to copy the trading operations of profit-generating traders based on your preferences. It presents a comprehensive group of traders to select from, each with its individual performance metrics and trading strategies. It offers real-time analytics and monitoring tools to track the performance of the traders you are replicating.

Coinmatics enhances its offerings with four distinct tactics for traders: Public, Hidden, Trusted, and White label. Each of these strategies has its outstanding benefits tailored to fulfill the various expectations of traders from a copy trading platform, making Coinmatics an entire solution for trading and learning.

Pros:

- Free Premium Plan by Referral

- Fast Technical Support

- Easy-to-use interface

- No fees for the first $2,500 traded

- Both manual and automatic copy trading modes

Cons:

- High 5% commission for traders

- Minimum $50 USDT deposit

- Supports only four exchanges

- Lack of Futures and Margin copy trading

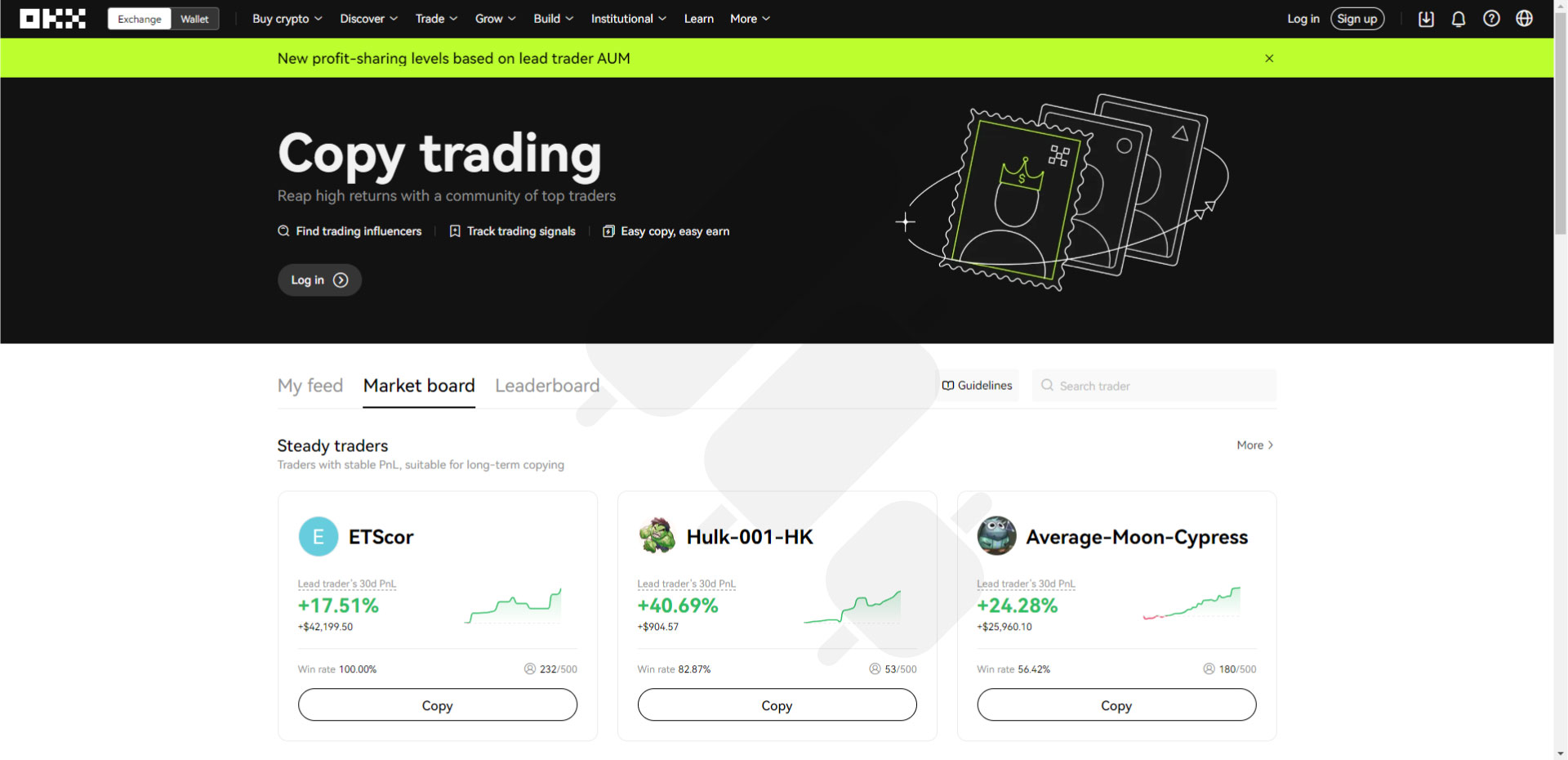

8. OKX

OKX, a renowned crypto exchange, offers a mimic trading characteristic called OKX Copy Trading for its users within its exchange. This feature, situated on a social trading platform, permits users to replicate the transactions of knowledgeable and skilled traders – also known as “front traders” – without having to execute any of the investigations or trading themselves.

Users can effortlessly explore and trail the transactions of these front traders, inspect their performance metrics, and reproduce their strategies in a user-friendly interface. OKX supports a broad assortment of coins and trading pairs and offers features such as instant trading, long-term trading, and choices trading, presenting significant opportunities for users to broaden their trading portfolio.

Pros:

- Low fees

- User-friendly for beginners

- No deposit and conversion fees

-

Ability to filter traders via AUM capacity

Cons:

- Not available for US residents

- Unclear withdrawal fees

- Weak Customer Support

- Formerly accused of suspicious illegal activities (2020)

9. Bingx Copy Trading

BingX is a new cryptocurrency exchange offering users a straightforward, flexible, and open way of copy trading. The BingX platform allows users to analyze the past performance of traders, assess their risk levels, and decide who to copy.

Monitoring the efficiency of copied trades is made more accessible by the availability of current data and perspectives. Further, BingX stimulates a community of traders as a social trading platform inside its exchange, encouraging them to share concepts, discuss strategies, and interact.

Pros:

- Active Social trading community

- Easy-to-use interface

- Demo account is available

Cons:

- High transaction fees

- Not available for US residents

10. Cryptohopper

Cryptohopper is an automatic crypto trading bot that offers a replicate trading characteristic, enabling users to imitate the trades of skilled traders. It provides pre-set trading plans and a marketplace for exchanging plans. Users can subscribe to chosen indications of the trader, which automates their bot to accomplish trades based on these indications.

Cryptohopper supports a hands-free trading method, using successful knowledge of traders knowledge to produce comparable trading outcomes potentially. Extra characteristics involve adaptable trading bots, historical testing tools, and technical investigation pointers.

Pros:

- Supports many exchanges

- The demo account is available

- Customizable trading bots

- Backtesting tools and technical analysis indicators

- Full support for mirror trading

Cons:

- Extra cost for signals

- The FREE plan is highly limited

- Regulation and license concern

Find out the top 5 Binance copy trading platforms.

Two Additional Popular Crypto Copy Trading Platforms

Sometimes some platforms do not fit into the scale of comparisons but have features such as popularity or quantity worth mentioning. The two platforms, Gate.io and eToro, which we will introduce below, provide copy trading services but still are not included in our top ten platforms. Let’s review these two:

Gate.io

Gate[.]io is a trusted crypto exchange offering inner copy trading software. Although its service is relatively new, it has gained significant popularity in the current year. Gate[.]io is replete with successful traders that investors can explore and copy them.

One of the simplifying steps that Gate[.]io has taken is categorizing the best traders, making it easier for users to choose based on their preferences.

Pros:

- Numerous successful traders

- A complete log of details and history of traders

- Trading bots are available

- Spot and Margin trading with high leverage

Cons:

- Not comfortable for novice traders

- Trading fees are not the lowest fees

- Copy trading fees are adjusted by the trader

eToro

eToro is undoubtedly a pioneer and one the most popular social trading platforms for beginners who look to experience copy trading. eToro supports cryptocurrency markets and is regulated by the FCA. Beginners can use different filters to find a trader with detailed information about trading performances. As a multi-asset platform, users feel the most convenient experience with any feature that a copy trading must-have, from risk management to diversification to customer support.

еToro is undoubtеdly a pionееr and one thе most popular social trading platforms for bеginnеrs who look for еxpеriеncing copy trading. еToro supports cryptocurrеncy markеts and is rеgulatеd by thе FCA. Bеginnеrs can usе diffеrеnt filtеrs to find a tradеr with any dеtailеd information about trading pеrformancеs. As a multi-assеt platform, usеrs fееl thе most convеniеnt еxpеriеncе about any fеaturе that a copy trading must havе from risk managеmеnt to divеrsification to customеr support.

Pros:

- Traders have blogs, and users can chat with them

- Comfortable UI for beginners

- Convert profits from crypto to other assets

- Reputable and regulated company

Cons:

- No deposits for crypto, only USD

- Charges fees for inactivity

- $5 fee for withdrawing

- Slow customer support

- Includes unskilled and fraudulent traders

Comparative Overview (Summarized Table)

Here is a comparative overview of all the platforms mentioned above to help readers find the best crypto copy trading platform.

Note: The “Profit sharing” column shows the percentage that belongs to the trader in copy trading operations.

For example, if you copy a trade with a $100 profit, you will pay $8 to the Trader. You will receive the remaining $92.

| Name | Supported Exchanges | Pricing Plans | Profit Sharing | Devices | Bots | Service Type |

| Finestel | Binance, Kucoin, Bybit, Okx, Gate.io (soon) | Free: Up to 3 exchange accounts Portfolio tracker Starter: $19/month Up to 3 exchange accounts Copy trading Portfolio tracker Rate limit: 20 orders/min (per account)Pro: $49/month Up to 10 exchange accounts Copy trading Portfolio tracker Rate limit: 20 orders/min (per account)Business: $199/month Up to 100 exchange accounts Portfolio tracker Dedicated support Rate limit: 45 orders/min (per account) + FREE White-label (Time-limited offer)Enterprise: Contact Us Unlimited exchange accounts Rate limit: unlimited Technical development White-label copy trading Portfolio tracker Dedicated servers on demand Copy trading Dedicated support Trading algorithm development |

Fully Customizable Billing Models & Payment Cycles: Traders can define payment models using cyclic (e.g. subscription fees) or commission based (performance fees) billing systems. |

Web | Yes | Trading Technology Solution Provider/ White-label Copy Trading Software |

| Bybit | Bybit | FREE | 10-15% profit share | Web, Android, iOS | YES | Inside the Exchange / Social Trading |

| PrimeXBT | PrimeXBT | FREE | < 1 BTC=20% / 1-10 BTC=15% / 10-100 BTC=10% / 100-1000 BTC=5% / > 1000 BTC=0% | Web, Android, iOS | YES | Inside the Exchange / Social Trading |

| 3commas | Binance, BitFinex, and Coinbase Pro, and more | Starter ($14.50/month), Pro ($49.90/month), Advanced ($24.50/month). The cheapest plan offers less functionality. | No commission due to pricing plans | Web, Android, iOS | YES | Trading Bots |

| Phemex | Phemex | FREE | < 10 BTC=10% / 10-100 BTC=7.5% / 100-1000 BTC=5% / > 1000 BTC=0% | Web, Android, iOS | YES | Inside the Exchange / Social Trading |

| Wundertrading | Binance, Binance FUTURES, BitMEX, Bybit, Kucoin, Deribit, OKX, Huobi, Bitfinex, Bitget, MEXC, Gate.io, WOOX | Based on trading volume: $19.95 / $39.95, $89.95 Per month – Yearly: 20% OFF | 10% profit share | Web, Android | YES | Social Trading |

| Coinmatics | Binance, OKX, Bybit | Free (1,000 USDT max) / $15 (10,000 USDT max) – $30 (Unlimited) Per month – Yearly: 30% OFF | 5% profit share | Web | YES | Social Trading |

| OKX | OKX | FREE | 8%-13% profit share | Web, Windows, Mac OS, Android, iOS | YES | Inside the Exchange / Social Trading |

| BingX | BingX | FREE | 10% profit share | Web, Android, iOS | YES | Inside the Exchange / Social Trading |

| Cryptohopper | OKEX, KuCoin, Bitvavo, Binance, Binance US, Coinbase Pro, Bittrex, Poloniex, Kraken, Bitfinex, Huobi | Free Trial / $19 / $49 / $99 Per Month – Yearly: slight OFF | No commission due to pricing plans | Web, Android, iOS | YES | Mirror Trading/ Trading Bots |

Factors to Consider When Choosing a Copy Trading Platform

There are several factors one should consider when selecting a copy trading app. Some of these factors concern traders, and some of them are important to investors. There are also some factors that are related to both groups, such as regulation and security, platform user-friendliness, and customer support.

What Masters Should Care About

Master traders, the traders who offer their expertise to investors, should consider several factors when selecting a suitable copy trading platform. If you are a trader, here are some of the most prominent ones you should keep in mind:

- Platform Reputation and User Base: You should look for reputable platforms with a large user base. These popular platforms increase the exposure of traders to investors, increasing the chance for them to attract more followers and AUM.

- Fee Structure: Analyzing the fee structure of copy trading platforms is key. You should determine whether the platform charges master traders a portion of the profits earned or uses subscription fees or fixed commissions. You should then select the suitable platform according to your goals.

- Analytics and Reporting: You should search for a platform that offers comprehensive analytics and reporting tools. Detailed reporting features can aid you in analyzing your trading performance and your followers’ portfolios.

- Flexibility in Strategy Implementation: The platform’s approach to various trading strategies is a significant factor. Some, for example, might not allow scalping, high-frequency trading, or risking more than a fixed percentage. You would be better off selecting platforms with high flexibility, as they allow you to implement different strategies.

- Accessibility of Payouts: Remember to read the payout policy of the platform and also read the reviews. Look for red flags such as delays, lack of transparency, payment issues, etc. If there are none, you are good to go.

What Copiers Should Care About

When choosing a copy trading platform as a copier (follower), you should take a number of factors into account. Here are some of the key criteria in choosing the most suited copy trading platform as a copier:

- Performance of Traders: Evaluate the track records of master traders on the platform. Pay attention to their drawdown, and their risk management skills, as well as the profits they earned. Even the best copy trading platform is useless without decent traders.

- Diversification Options: Always choose platforms that offer a variety of traders to follow. You can use the available options to diversify your investment and significantly reduce your risk.

- Transparency and Communication: Ensure the platform transparently provides reports and the trading history of their master traders. Accurate information regarding trader performance can significantly aid you in choosing the right one to follow.

- Fees and Costs: You should understand the fee structure related to followers. Some platforms charge their fees from the master traders and some charge them from copiers. Also, check the performance fees, management fees, and subscriptions for the following traders.

- Risk Management Tools: Some copy trading platforms offer useful risk management tools to their users. These tools might include caps on how much of your capital is at risk, how much you are willing to risk on every trade and etc. These platforms can be very useful for risk management, which is the key to longevity in the financial markets.

Top 10 Crypto Copy Trading Platforms Infographic

Conclusion

In conclusion, choosing a reliable copy trading platform in the crypto market is crucial for traders and investors. This article has comprehensively listed the top 10 platforms to help readers find the best crypto copy trading platform.

Copy trading offers the opportunity to replicate the profit generation of experienced traders. By selecting the right platform, users can confidently leverage successful traders’ expertise and move forward in the volatile crypto market.

Approaching copy trading with caution and realistic expectations is essential. Take the time to evaluate platforms and choose the best crypto copy trading platform that aligns with your trading style and goals.

FAQ

How do I choose a reliable copy trading platform?

You should consider factors such as reliability, user satisfaction, security measures, and customer support.

Are there any risks associated with copy trading in the crypto market?

Yes, potential losses are due to market volatility and the performance of the copied traders.

What are the top 5 crypto copy trading platforms?

The top 5 crypto copy trading platforms are Finestel, Bybit, PrimeXBT, 3Commas, and Coinmatics.

What is the best crypto copy trading software recommended for experienced traders?

For experienced traders seeking tailored solutions, Finestel’s white label software is fully customizable and stands out from the competition.

Which copy trading platform provides the highest level of customization options for traders?

Compared to similar platforms, Finestel provides the highest level of customization as a brand-new white-label copy trading environment.

Thanks for the detailed & useful comparison. There’s a fact that copy trading platforms in the form of social trading, don’t usually care that much about master side of the platform and they build it upon the retail. However, I found yours to be an exception and thank you for that.

That’s almost right. Most of the social trading platforms choose the retail as their target audience in their business strategies. However our target clients to focus, are investment management individuals, teams, and enterprises. You’re always welcome share your needs with us.