API trading has become increasingly popular in the cryptocurrency market, allowing traders to automate their trading strategies and execute trades programmatically. With the right API trading platform, traders can access real-time market data, historical data, and execute trades quickly and efficiently.

In this article by Finestel, we will introduce the top 5 API trading platforms, including Finestel, Alpaca Trading, Oanda, Saxo Bank, and FXCM. We will also discuss the benefits and features of each platform, as well as their strengths and weaknesses.

Understanding the Basics of API Trading

API, or Application Programming Interface, is a set of protocols, tools, and standards that enable different software applications to communicate with each other. In the context of cryptocurrency trading, an API acts as a bridge between a trader’s automated trading system and the exchange’s trading engine, allowing for seamless data exchange and trade execution.

Through API trading, traders can access a wide range of functionalities, including retrieving real-time market data, placing orders, checking account balances, managing portfolios, and monitoring trade execution. This level of integration and automation can provide traders with a significant advantage over manual trading, as it eliminates human errors, emotions, and the limitations of manual order placement.

The Benefits of API Trading in Crypto

- Faster Execution: API trading enables traders to execute trades at lightning-fast speeds, often outpacing manual trading and taking advantage of fleeting market opportunities.

- Improved Efficiency: By automating the trading process, API trading reduces the time and effort required to monitor the market, analyze data, and place orders. This allows traders to focus on developing and refining their trading strategies.

- Reduced Errors: Automated trading systems powered by APIs are less prone to human errors, such as typos or delayed order placement, which can have significant consequences in the volatile cryptocurrency market.

- Backtesting and Optimization: API trading allows traders to backtest their strategies using historical data, enabling them to refine and optimize their trading algorithms for better performance.

- Scalability: API trading platforms can handle a large number of trades and market data, making them suitable for both individual traders and institutional investors.

- Customization: API trading provides a high degree of customization, allowing traders to integrate their own trading algorithms, indicators, and risk management strategies into their automated trading systems.

The Best Strategies for API Trading

The best strategies for API trading in the cryptocurrency market include:

Copy Trading: Copy trading is a powerful tool for traders looking to automate their trading strategies and replicate the trades of successful traders. By following best practices and integrating APIs into their trading strategies, traders can harness the full potential of this technology while minimizing risks and ensuring a safer trading environment.

Moving Average Trading: This strategy uses the Simple Moving Average (SMA) or the Exponential Moving Average (EMA) to analyze the price data and generate trading signals. It is a popular strategy that can be customized to suit long-term and short-term investors.

Relative Strength Index (RSI): This momentum indicator determines the speed and magnitude of an asset’s recent price changes. It also reveals the bearish and bullish price momentum of the specific asset, which can be used to make informed trading decisions.

MACD Trading: The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It can be used to identify potential buy and sell signals.

Fibonacci Retracement Strategy: This strategy uses the Fibonacci retracement levels to identify potential support and resistance levels. It can be used to make informed trading decisions based on the price movements of the asset.

Arbitrage Trading: This strategy takes advantage of price disparities across two or more markets for the same asset. It involves buying an asset in one market and selling it in another market at a higher price to make a profit.

Market Making: This strategy involves buying and selling assets at different prices to profit from the spread between the buy and sell prices. It requires a deep understanding of the market dynamics and the ability to execute trades quickly and efficiently.

High-Frequency Trading (HFT): This strategy uses advanced technologies like machine learning and AI to execute trades at hyperkinetic speeds. It requires a high-speed internet connection and the ability to process large amounts of data quickly.

Algorithmic Trading: This strategy uses pre-defined rules and algorithms to execute trades automatically. It requires a deep understanding of the market dynamics and the ability to develop and implement complex algorithms.

Portfolio Management: This strategy involves managing a portfolio of assets to maximize returns and minimize risks. It requires a deep understanding of the market dynamics and the ability to develop and implement complex algorithms. Read more about the best crypto portfolio trackers in 2024.

Backtesting: This strategy involves testing a trading strategy on historical data to evaluate its performance. It requires a deep understanding of the market dynamics and the ability to develop and implement complex algorithms.

These strategies can be implemented using automated trading bots that use APIs to communicate with the cryptocurrency exchanges. The bots can analyze market data, execute trades, and manage portfolios automatically, allowing traders to focus on other aspects of their business.

The Best API Trading Platforms in 2024

This section provides an overview and detailed analysis of the top five API trading platforms, including Finestel, Alpaca Trading, Oanda, Saxo Bank, and FXCM. It highlights the unique features, benefits, and potential drawbacks of each platform.

1. Finestel

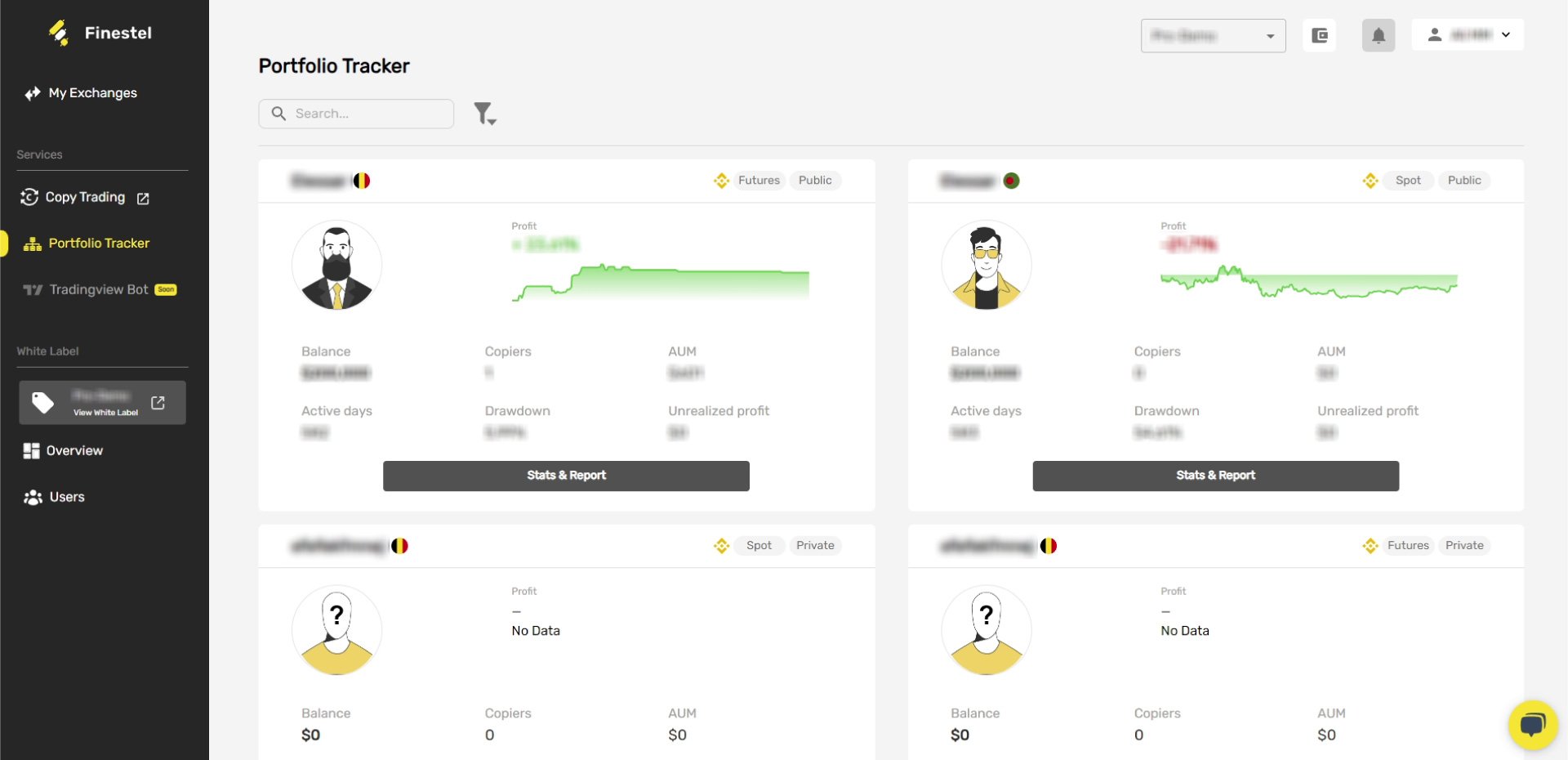

Finestel is a leading API trading platform that offers a cutting-edge copy trading technology solution for profitable traders. With its advanced copy trading software, traders can efficiently manage their clients’ money and offer their services under their own brand and website.

The platform is divided into two plans, the Copy Trading Bot and the White-Label Copy Trading Software, catering to traders with different needs and assets under management. Finestel also offers additional services like portfolio trackers, Telegram bots, and performance analytics.

As a profitable trader with a community of followers and investors, I have found Finestel to be an invaluable tool for managing my clients’ money. The platform’s copy trading technology is efficient and reliable, allowing me to replicate my trades in my followers’ accounts at lightning speed.

The White-Label Copy Trading Software has also allowed me to offer my services under my own brand and website, with a fully customizable interface and features. The additional services like portfolio trackers, Telegram bots, and performance analytics have also been helpful in managing my clients’ investments.

For investors looking for a reliable copy trading service, Finestel offers a private strategy marketplace where you can showcase your profitable strategy and track record to private investors. The platform’s real-time updates to your track record also allow you to improve your results and potentially gain more capital.

Additionally, if you are already working with a profitable trader, you can suggest Finestel to them, as the platform’s robust copy trading software, customization options, and wide range of advanced tools and features are likely to attract them to migrate to Finestel. Overall, Finestel is a top-tier API trading platform that offers a comprehensive and customizable copy trading solution for traders and investors alike.

Read more about Bybit API key and Binance API trading.

2. Alpaca Trading

Alpaca Trading is a top-rated API trading platform that offers commission-free trading for stocks, ETFs, and options. It is known for its robust API, which provides real-time market data, historical data, and the ability to execute trades programmatically. The platform is also known for its user-friendly interface and strong security measures.

As a user of Alpaca Trading, I have found the platform to be a game-changer for my trading strategy. The API is easy to use and provides real-time market data, which has helped me make more informed trading decisions. The platform’s security measures also give me peace of mind, knowing that my account and personal information are safe.

3. Oanda

Oanda is a leading API trading platform that offers access to Forex, CFDs, and commodities markets. It is known for its powerful API, which provides real-time market data, historical data, and the ability to execute trades programmatically. The platform is also known for its low spreads, fast execution speeds, and strong security measures.

As a user of Oanda, I have been impressed with the platform’s ability to provide real-time market data and execute trades quickly. The API is easy to use and has helped me automate my trading strategy, saving me time and effort. The platform’s low spreads and strong security measures also give me confidence in my trades.

4. Saxo Bank

Saxo Bank is a top-tier API trading platform that offers access to a wide range of financial markets, including Forex, stocks, and commodities. It is known for its advanced API, which provides real-time market data, historical data, and the ability to execute trades programmatically. The platform is also known for its strong security measures and high-quality customer service.

As a user of Saxo Bank, I have been impressed with the platform’s ability to provide real-time market data and execute trades quickly. The API is powerful and has helped me automate my trading strategy, giving me an edge in the market. The platform’s strong security measures and high-quality customer service also give me peace of mind and confidence in my trades.

Read our full guide on Kucoin API key.

5. FXCM

FXCM is a well-established API trading platform that offers access to Forex, CFDs, and commodities markets. It is known for its powerful API, which provides real-time market data, historical data, and the ability to execute trades programmatically. The platform is also known for its low spreads, fast execution speeds, and strong security measures.

As a user of FXCM, I have been impressed with the platform’s ability to provide real-time market data and execute trades quickly. The API is easy to use and has helped me automate my trading strategy, saving me time and effort. The platform’s low spreads and strong security measures also give me confidence in my trades.

Conclusion

In conclusion, the world of API trading offers a plethora of opportunities for traders and investors in the cryptocurrency market. We have explored the top 5 API trading platforms, including Finestel, Alpaca Trading, Oanda, Saxo Bank, FXCM, each offering unique features and benefits to cater to a diverse range of trading needs. From commission-free trading to advanced copy trading technology, these platforms empower users to automate their trading strategies, access real-time market data, and execute trades efficiently.

Choosing the right API trading platform is a critical decision that can significantly impact a trader’s success in the market. Whether you are a seasoned trader looking for advanced tools or a beginner seeking user-friendly interfaces, each platform has something to offer. By understanding the strengths and capabilities of these platforms, traders can make informed decisions to optimize their trading strategies and achieve their financial goals. With the right tools and technology at their disposal, traders can navigate the complexities of the cryptocurrency market with confidence and efficiency.

Leave a Reply