Trading is a full-time and difficult job that only a few people can do and make a good performance. Professional traders who participate in copy trading platforms have the opportunity to share their experiences and skills with novice traders, creating a mutually beneficial relationship. This approach to trading has become increasingly popular, as it allows for knowledge sharing and collaboration among traders, ultimately leading to better outcomes for all involved.

These measures start with landing on the right copy trading platform. Here on Finestel, we will discuss and narrate a holistic view of cryptocurrency copy trading, especially making Binance copy trading platforms comparison. First, we will walk you through the technicalities and show you how to link your account to a strategy provider. Then, you will learn about a brief overview of copy trading and the ways to benefit. Finally, we have chosen the top 5 Binance copy trading software in 2024 July and thoroughly reviewed each.

Introduction to Copy Trading and Its Benefits for Pro Traders

Copy trading is the process of automatically replicating a trader’s trades on an exchange account or third-party software, which are then transferred to the accounts of their clients or investors who mirror them. In advanced models, the replication of trades is done proportionally, encompassing all aspects of the trade setup. This comprehensive approach allows for automated asset management, streamlining the process for both professional traders and their followers.

For professional traders who are active on copy trading platforms, this process has several advantages. The first benefit is that traders can earn more profit by expanding their follower base. As the number of followers grows, the trader’s trading volume also increases, which can lead to a surge in their income.

Another advantage that traders can gain from this process is an enhancement in their reputation and credibility in the trading industry. With more followers, traders can augment their reputation and credibility in the trading industry and become known as successful traders.

How Does Binance Copy Trading Platforms Work?

Copy trading apps connect to this exchange using a Binance API key (Application Programming Interface); an API is what two or more pieces of software, computers, or applications talk to each other through. There are two types of API configurations for connecting a Binance account to a copy trading platform. The first is a trade-only API configuration, which is used by investors who want to copy the trades of professional traders. This API access allows the copy trading app to place or cancel orders in the investor’s account based on the trades made by the copied trader.

The second type of API configuration is a read-only API configuration, which allows the copy trading app to read and copy orders, portfolios, or positions from the connected trader account. Copy trading platforms typically use this to copy the trades of crypto trader bots, asset management firms, or professional portfolio managers. By using a read-only API configuration, the copy trading app can replicate the trades of the professional trader without having the ability to place or cancel orders in the investor’s account.

Read more about the best Binance trading bots and tools in 2024.

How to Get Started with Binance Copy Trading

To copy trade with Binance is simple and almost similar on different platforms and apps; all you have to do is listed below:

- Open an account: The starting point to use Binance copy trading is to refer to the Binance website and register and open an account.

- Account verification: To use services provided by Binance, your account must be approved and verified. You will be asked for identity documents to use Binance copy trade services.

- Make a deposit: Top up your account by using copy trade services.

- API link: Click on the profile icon menu. From there, select the “API Management” option. You will need to verify your Binance credentials, and once you have done so, you will see a button labeled “Create API.”

- Log in to your copy trading platform account and navigate to the API settings section.

- Enter your Binance API key and secret key into the appropriate fields.

- Choose the permissions you want to grant the copy trading platform. For example, you may choose to grant read-only access or trade-only access.

- Save your API settings and test the connection to ensure that it is working properly.

Top 5 Binance Copy Trading Platforms Comparison

Binance cryptocurrency exchange recently added a social/copy trading service, but some third-party copy trading platforms offer more advanced copy trading services on Binance. Here in this article about Binance copy trading platforms comparison, we first detected each platform’s features; then we mentioned the advantages and disadvantages of using each platform.

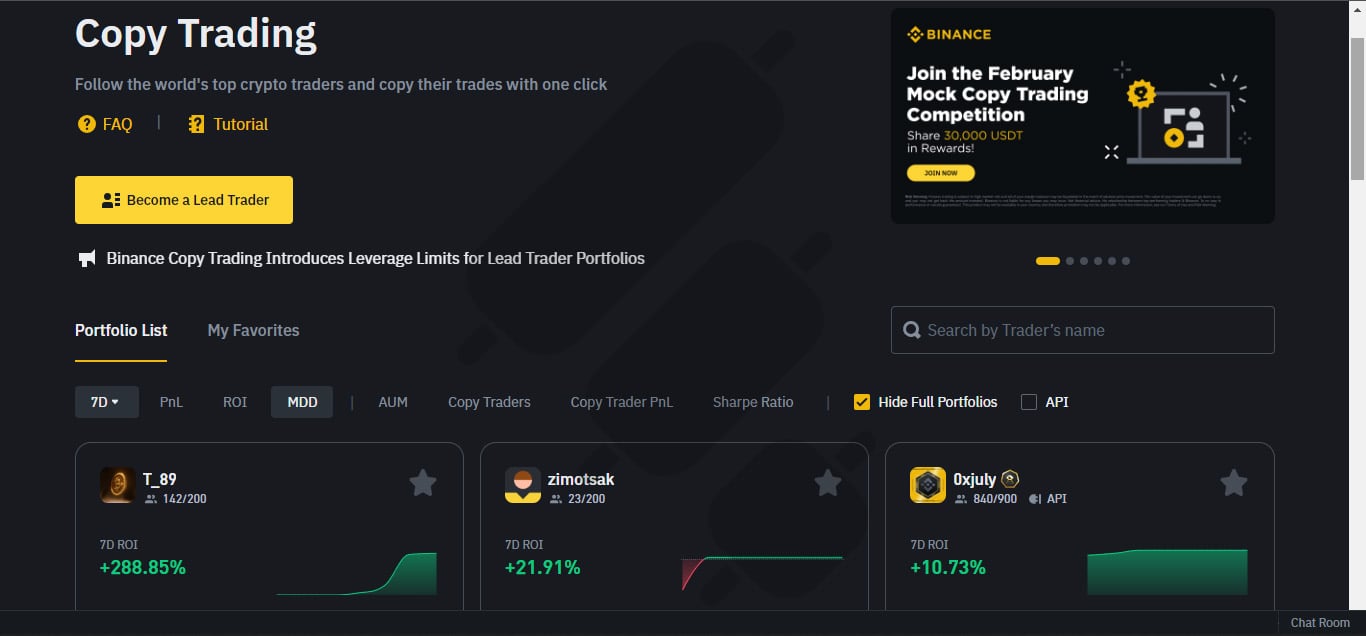

1. Binance Native Social Copy Trading

Binance has launched a social copy trading feature that allows users to copy the trades of experienced traders. This aims to provide an educational platform and allow traders to monetize their strategies.

Read more about social copy trading, is social copy trading profitable?

Key Features:

- Two investment modes: Fixed amount or fixed ratio copying

- Traders can earn a 10% profit share from copy traders

- Copy traders can follow up to 10 lead traders

- Transparency into lead trader stats and performance

1.1. Binance Spot Copy Trading

- Educational Platform: Beyond just replicating trades, Binance aims to educate users by providing insights into the strategies of experienced traders.

- Monetization: Experienced traders can earn a 10% profit share from the profits generated by copy traders who follow their strategies. This incentivizes skilled traders to share their knowledge and strategies with the community.

- Risk Management: Users can choose between two investment modes—Fixed Amount and Fixed Ratio—based on their risk tolerance and investment strategy preferences.

Fixed Amount Mode:

- Description: Users specify a fixed dollar amount they want to allocate to copying a lead trader’s portfolio.

- Example: If a user designates $1,000 and the lead trader executes a trade representing 10% of their portfolio, the copy trader’s account will mirror this trade with $100, maintaining proportional alignment with the lead trader’s actions.

Fixed Ratio Mode:

- Description: Users allocate a percentage of their total account balance to replicate the lead trader’s portfolio.

- Example: If a user allocates 20% of their balance and the lead trader executes a trade with 5% of their portfolio, the copy trader’s account will replicate this trade using 20% of their total balance.

1.2. Binance Futures Copy Trading

In addition to spot trading, Binance also extends its copy trading feature to futures trading, catering to users who prefer derivative markets:

- Similar Features: The futures copy trading platform offers similar functionalities to the spot trading version, including fixed amount and fixed ratio copying modes.

- Enhanced Risk Management: Futures copy trading accounts for leverage and margin requirements, ensuring that copied trades align with the specific risk profiles of derivative traders.

- Educational Resources: Like the spot trading platform, Binance Futures copy trading aims to educate users on trading strategies while allowing them to profit from the expertise of seasoned traders.

Pros

- Learning opportunity for novice traders

- Flexible investment options

- Community interaction

Cons

- Lead trader’s strategy leakage

- Eligible Regions: The feature is initially available in a few eligible regions, but it will likely expand to more users over time.

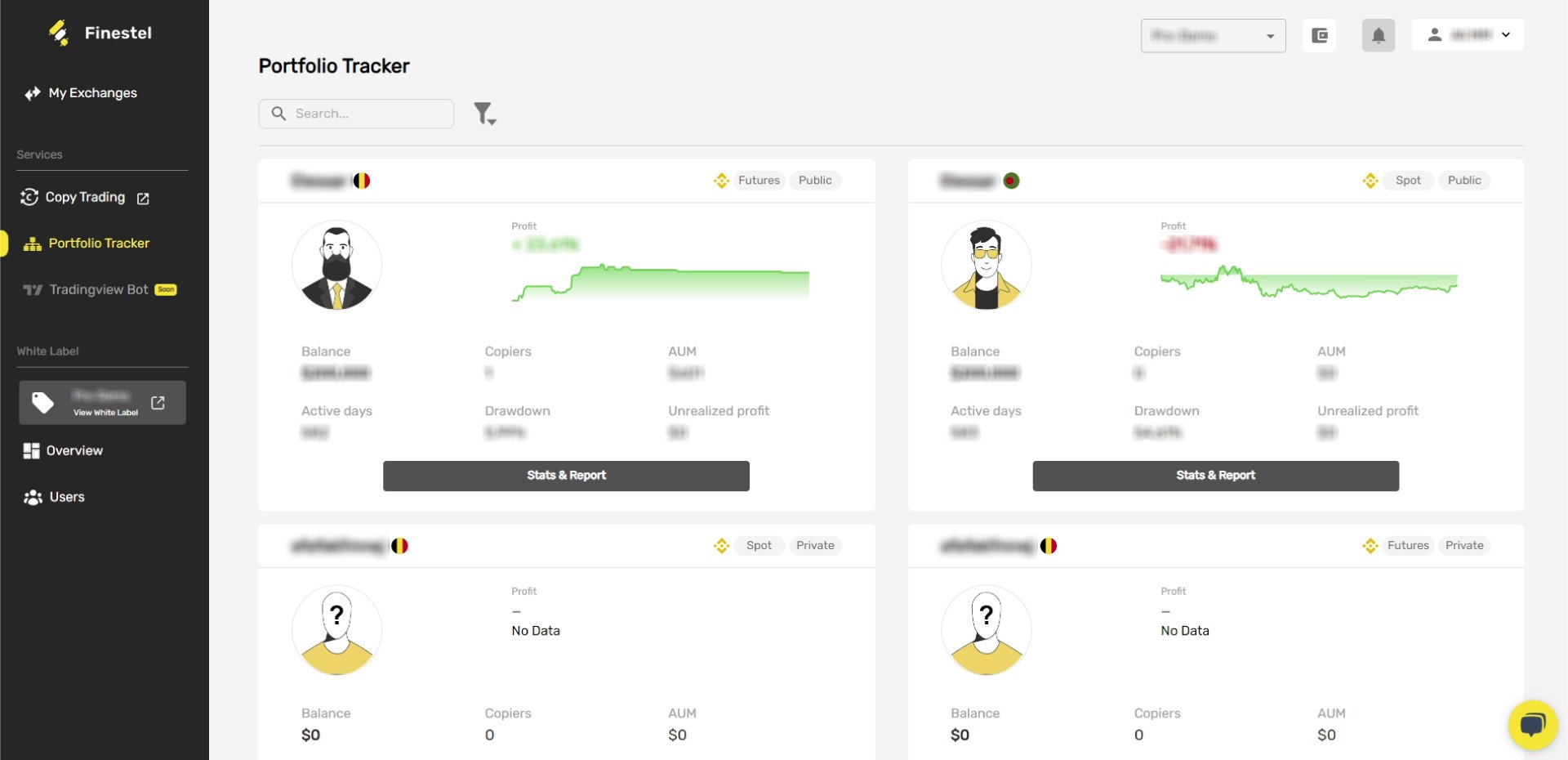

2. Finestel

Finestel provides innovative copy trading solutions on futures and spot markets for cryptocurrency traders on the Binance exchange. Their technology allows both new and experienced traders to leverage the skills of others or manage funds for investors.

Below are overviews of Finestel’s basic copy trading bot service and their more advanced white label platform. These solutions help Binance users replicate trades, share strategies, and build professional asset management businesses on the world’s largest crypto exchange.

Finestel offers a powerful copy trading bot that allows traders on Binance to share and replicate their strategies easily. The bot works through the Binance API to instantly and accurately copy all trades from a master trader’s account into followers’ accounts proportionally. This provides a seamless way for traders of all levels to leverage the expertise of more successful peers.

The Finestel bot is highly reliable, executing copies with minimal delays or differences. It also gives traders useful risk management tools to help protect both master and follower funds from losses. For smaller traders just starting, the basic bot service is a great, affordable option. However, experienced money managers with larger operations may prefer the more advanced white label solution.

The Finestel white label software is an all-in-one solution tailored for professional asset managers on Binance. Rather than building infrastructure from scratch, the turnkey system handles everything from technical plumbing to administration.

Key features include advanced portfolio tracking of Binance accounts, a powerful admin dashboard, performance analytics, and flexible pricing models. Traders can customize pricing structures for different strategies based on subscription fees, performance fees, and more.

Billing, accounting, customer support, and more are fully automated through the white label platform. It also provides sales and marketing tools to help partners grow their businesses. This includes a multi-level referral program, customized emails, and a Telegram bot – all branded under the trader’s name.

In summary, Finestel’s white label solution removes all the back-end work so Binance traders can focus on their strategies. It gives experienced money managers a complete turnkey product for launching and scaling a professional crypto asset management business on Binance.

Key Features

Pros

- Simple interface

- White label social copy trading for investment managers

- Client management dashboard

- Comprehensive portfolio tracker

- Flexible billing

- Crypto MLM software

- Full branded integration

- Development on demand

Cons

- No support for MT4 and MT5

Read more about Finestel in our “What is Finestel” article.

3. Wundertrading

The Wundertrading copy trading software connects novice traders and professional traders. Wundertrading is primarily famous for offering a straightforward interface to users. Its supported exchanges include Binance (Spot and Futures), KUCOIN, BITFINEX, Derbit, Bitget, BitMEX, OKX, WOOX, BYBIT, Coinbase Pro, MEXC Global, Kraken, Huobi, Gate.io. Also, in this platform, the traders can use cryptocurrency trading bots, and the traders can automate scripts provided by Tradingview.

Key Features

The score of Wunderbit on Trustpilot is 4.2, which is acceptable. Like many other copy trading platforms, it is subject to local regulations. Additionally, the number of traders on Wunderbit exceeds 60,000, and the trading volume surpasses $380M.

Technically speaking, the parameters that a trader accesses are transparent, and they have access to all the necessary features. Regarding security, there are no reports of the website being down or data leakage about Wunderbit.

More and above that, the traders can activate the 2FA security on their dashboard on Wunderbit. Simplicity is a must, and Wunderbit is famous for its simple and easy-to-use platform and dashboard. Finally, the traders can link their exchanges to their Wunderbit dashboard. The exchanges that traders can connect to are varied, including Binance, Binance futures, BYBIT, and OKX, to name a few.

Pros

• A simple and easy-to-use interface

• Offering a variety of exchanges for copy trading

• Advanced analytical tools for automatic trading

• Advanced security features

Cons

• Lacking a mobile app

• Limited technical features for advanced traders

• A limited number of traders

• Changing services fee

• Weak portfolio tracking system

4. Kryll.io

Kryll.io is another copy trading platform that we reviewed. They started the business in 2018, and they are located in France. Their motto is “what you see is what you trade”; however, they did not explain the concept on their website.

Regarding the Binance copy trade, the traders can choose the Binance marketplace on Kryll.io. The traders can activate spot trading and margin trading on Kryll.io. Also, the US. citizens can enjoy Binance US. copy trading on Kryll.io. Besides Binance, traders can link their accounts from cryptocurrency exchanges like Coinbase, Bybit, Kraken, and Kucoin.

Moreover, on kryll.io, traders can develop their strategy on cloud software, which is active 24/7. Their main focus is on building strategies, and they claim that the strategy editor is the core feature of the platform. In addition, they introduce a block panel, where traders access all copy trading tools together with a strategy editor. Finally, they have their native utility token named Kryll, whose rank on Coinmarketcap is 777.

Key Features

Their score on Trustpilot is 4.2, which is satisfying, and there are no fraud or data leakage reports. However, they do not provide an about us page; hence, we have no information about the number of traders and investors on this platform. Their main focus is on strategy editor options, and it seems this platform is mostly used for strategy trading. They do not provide a free demo account; users should verify their account to use the features. Finally, on kryll.io you can choose blocks and develop a customizable strategy.

Pros

• A strong trading strategy builder

• Available in multiple languages

• Covering technical analysis tools

• A wide range of trading bots

Cons

• A complicated interface

• No demo account is available

• Poor customer support

Find out the best MEV bots in 2024.

5. Zignaly

The Zignaly crypto copy trading platform is a well-known platform and was founded in 2018. Zignaly platform started its copy trade journey with Binance and Kucoin. Then, they started to add other exchanges like Bitmex and OKX.

One of the features that the Zignaly platform offers is RSA in Binance cryptocurrency wallets, where the API keys are encrypted. Finally, the Zignaly platform headquarters do not undertake risks, and they do not support Binance US. and the traders inside the US. Cannot link their Binance account.

Key Features

The Zignaly score on Trustpilot is 3.9, which is satisfying, and there are no fraud reports, nor are they on a red list. Regarding the number of traders, they have 70,000 users with a trading volume of $1.7 billion. In addition, the interface on Zignaly is simple, the platform operates on a 24/7 basis, and the support team is available too. Finally, they allow you to develop your strategy and create and use trading bots. For more information, please check out the Zignaly review article.

Pros

• Diversity of Exchanges

• Profit-sharing feature

• Free features for beginners

• Simple interface

• Trading bots diversity

Cons

• Overwhelming information

• No mobile app

• US citizens not allowed

• Subscription fee

• Poor trading bots

6. Coinmatics

Coinmatics is a crypto copy trading platform located in the Netherlands. Traders can link their exchange accounts from Binance Spot, Binance Futures, OKX, and BYBIT. The minimum price on Coinmatics is relatively high, and the amount for traders is 500 USD and 150 USD for subscribers.

Key Features

There are some complaints about this copy trade app regarding the high prices. The Trustpilot score for this broker is 2.5, which is defined as poor. Speaking of the numbers, the order replication on Coinmatics has been reported in less than 2 seconds. The number of users on this platform exceeds 60,000, and they claim to manage more than $50M annually. The trading volume on Coinmatics surpasses $2.3B.

Pros

• Extra technical tools for pro traders

• Free demo account

• Simple interface

• Customer support

Cons

• High subscription fee

• $50 minimum deposit

• Limited account types

Read more about the best Binance trading bots and tools.

What Is the Most Profitable Crypto Copy Trading Platform?

To answer this question, several factors must be considered in the Binance copy trading platforms comparison. Some of the factors include the trader’s appetite for risk, and some of the factors pertain to technical parameters offered by crypto copy trading platforms. Each platform listed above provides unique features that each trader or investor may find most suitable for themselves. For instance, Zignaly offers a profit share plan that may suit traders.

On the other hand, Finestel is more technological, and investors can customize their portfolios on request. Finally, Kryll.io is a good option for those seeking strategy trading. Generally speaking, several factors make a copy trading platform profitable, and one should have a holistic view in choosing a platform.

Binance Copy Trading Platforms Comparison, 2024 Summary

| Platform | Supported Exchanges | Pros | Cons | Launch Date | Trustpilot Score |

| Binance | Binance futures | Learning opportunities for novice traders, Flexible investment options, Community interaction

|

Lead trader’s strategy leakage, Eligible Regions | 2023 | – |

| Finestel | Binance spot, Binance Futures, Kucoin, Bybit, OKX | Simple interface, white label social copy trading for investment managers, client management dashboard, comprehensive portfolio tracker, flexible billing, crypto MLM software, full branded integration, development on demand |

No support for MT4 and MT5 |

2021 | 4.6 |

| Wundertrading | Binance, Kucoin, Bitfinex, Derbit, Bitget, BitMEX, OKX, WOOX, Bybit, Coinbase Pro, MEXC Global, Kraken, Huobi, Gate.io | Simple interface, varied assets, advanced tools | No mobile app, service fee, weak portfolio tracker | 2021 | 4.2 |

| Kryll.io | Binance US., Coinbase, Kraken, Kucoin | Strategy builder, technical analysis tools | Complicated interface, no demo account, poor Customer support | 2018 | 4.2 |

| Zignaly | Binance, Bitmex, Kucoin, OKX | Diversity of exchanges, simple interface, trading bots | Overwhelming information, no US. traders, Subscription fee | 2018 | 3.9 |

| Coinmatics | Binance Spot, Binance Futures, OKX, Kucoin | Free demo account, strategy builder, simple interface | No margin, $50 minimum deposit, limited account types | 2018 | 3.2 |

Conclusion

In this article, we have addressed the features that work well, especially with one of the best crypto trading platforms, Binance. The reason for choosing Binance was the fact that Binance is the most popular and the most important exchange in the world. There are dozens of copy trading apps worldwide; however, we have selected the top 5 crypto copy trading platforms.

In addition, we did a thorough overview of Binance copy trading platforms comparison. In addition, the features were discussed, and the pros and cons were scrutinized. Finally, the best way to choose a copy trading platform is to do a self-research on the subject and make an informed decision.

FAQ

What is the best crypto copy trading website for beginners?

The answer to this question depends on your needs, but according to the research, a beginner-friendly and simple platform for beginners is Coinmatics. However, if you are a pro trader, on Kryll.io, you can create your own strategy for trading. Also, for those who seek trading bots, Zignaly will finally satisfy them. Finally, asset managers and pro traders can enjoy Finestel’s customizable and comprehensive copy trading and asset management technology.

Is Binance copy trading profitable?

Many factors determine your profit in copy trading. These factors are a risk management system, a secure and fast-copy trading platform, and the trader you choose to follow. Overall, other indicators that determine the profitability of copy trading are time constraints, the capital amount invested, and the cryptocurrency market.

What are the fees associated with using a copy trading platform on Binance?

The fee amount varies among the platforms. However, it starts with a minimum of $20 on Coinmatics and $50 on Zignaly. Also, the subscription fee on Wunderbit varies, and the plan includes Basic ñ $9.95; Pro ñ $24.95; Premium ñ $44.95. On Kryll.io, they have a versatile plan that depends on the amount customers trade on their platform; for instance, if you trade $1000, the subscription fee for one month is $10. Finally, the service fee for investors on Finestel is $29, and the traders can enjoy a $0 service fee.

This theme is simply matchless :), very much it is pleasant to me)))

which is the best copy trader for begginers?

If you’re a complete beginner to trading with a small group of around 10 clients, Finestel’s copy trading bot service could be a good starting point. However, if you’re a complete beginner who simply wants to copy a trader without managing clients, Binance’s native copy trading service might be a better fit.