Almost all of us traders and investors have considered at least once in our journey to follow other expert traders or even hand our capital’s management to them. This is especially true for beginners or those who have not been able to crack the trading game yet. Or, you might be a trader looking for more capital because you are competent enough but can’t make ends meet with your own money. Well, this is where copy trading comes in, and in this article, I will address the question, “What is copy trading?” and is it still a good idea in 2024?

First, I will begin by introducing the concept of copy trading. This will include a general overview of the process and the parties involved. Then, I’ll delve deeper to show you how copy trading works. I’ll also present an answer for those of you wondering, “Is copy trading profitable?”. Finally, I will make a definitive comparison between private and social copy trading and guide you on the first steps to begin your journey the right way. So, let’s begin.

What Is Copy Trading?

We’ve all taken hard exams or exams we didn’t properly study for. Well, I’m not advocating for this, but our primary chance of passing was through copying the answers from others. Copy trading is the same, but of course, it is not as controversial as cheating on an exam. Yet, it is still controversial in a lot of different ways. More on that later.

Now, as an investor who either lacks the knowledge, time, or even passion to learn how to trade, copy trading is a straightforward solution. You leave the management of your money in the hands of pro traders, and they’ll deliver the gains for you. You will then pay them some of the earned profits as compensation. This is clearly a win-win scenario.

On the other hand, you might already be a consistently winning trader. However, who can really make significant income with small accounts (other than gamblers, of course)? In this case, it might be better for you to present your expertise to potential investors so they agree to let you manage their funds and take a share of the potential profits.

With copy trading, you will have the chance to magnify your profits without making your losses bigger. While this might not be consistent with the risk-reward theory, it is possible through this method. Who can possibly dislike this idea?

Find out the best crypto copy trading platforms in 2024, and the best Binance copy trading platforms.

How Does It Work?

I suppose you now have a general answer to “What is copy trading?”. However, to see how it really works, let’s have a deeper look. We have two primary parties connecting to each other via a specific platform: The master trader and the investor(s) (or follower, copier, …). In the case of investors, the trader can have numerous investors pooling their funds to replicate his/her strategy.

Now, the copy trading app connects the accounts of investors to those of the master trader, typically through API keys. This way, whenever the master trader executes a trade, the same position with the same parameters will automatically get executed on the investors’ accounts almost instantaneously.

Yet, you might ask how it is possible for a trade to be executed the same way on the master trader’s account with balance X and the investor’s account with balance Y. Well, the best copy trading platforms have tools and methods, like normalizing the risk percentage. I mean, when the trader sets a position with a 1% risk (of X), the investor’s account will also open a position risking 1% (of Y). Some platforms also allow investors themselves to set a risk per trade percentage for every order they replicate from the master trader’s account.

So, to wrap it up, a copy trading software or platform allows master traders and copiers to connect to each other using API keys. So, any order the master trader executes or modifies will be identically replicated on the investors’ accounts. Now, for crypto copy trading, platforms connect to crypto exchange accounts. On the other hand, in forex, it is done by connecting broker accounts to each other.

Copy Trading vs Manual Trading: Which Is More Popular?

The answer to this question depends on whether you are an investor or a trader. As an investor, it might be a good idea to invest some of your capital in a skillful trader. This not only helps your portfolio diversification, but also the trader’s active management can lead to significant gains.

On the other hand, for traders, this is a great opportunity. It allows you to attract investor capital to magnify your income from trading. Increasing your AUM without any significant risk is a great way to make your trading journey even more fruitful.

Meanwhile, in terms of popularity, most individual traders have been trading manually over the last few decades. However, with “copy paste trading” technology becoming more relevant thanks to bots, this method is gaining massive popularity, and it is primarily due to the reasons I’ve mentioned above.

Is Copy Trading Profitable?

Now, does copy trading work? To answer this one, let’s get back to our example of school exams. We all preferred to sit beside the best students during a test so that we could copy the best possible answers and get the best grade. No one wanted to sit beside a friend who’d even studied less than us. It is the same thing here.

In order to have a profitable copy trading journey, you should find the best traders to copy, and it might not be the one with the most gains. In fact, the best master trader is the one most aligned with your goals and preferences. So, you can’t blame your bad experience on the general concept.

Moreover, for master traders, increasing your AUM is never bad, especially with limited liability. As a master trader, typically, the most you can lose is the funds you are given to manage by investors. So, you are not risking a single penny and gaining more AUM. Obviously, that’s a very good deal.

However, this is not the whole picture. You might not get penalized for subpar performance, but you should always pay a subscription fee for using copy trading platforms’ services. In fact, another important factor for profitability is the use of the best copy trading apps available. You don’t want to go through this process on a bad platform. Additionally, the software might be good in itself, but the costs of using it may actually hurt your profitability.

How Profitable Is Copy Trading?

You might also ask: “How profitable is copy trading?” or “Is copy trading a good source of income?” Well, once again, it depends. In fact, the degree of profitability is also reliant on various factors. For investors, the primary profitability parameter is the master trader’s competence. For master traders, this method can magnify their profits. But, of course, they should be profitable in the first place.

Read more in “is social trading profitable?”

Types of Fees in Copy Trading

Copy trading platforms typically charge fees for their services, which can vary depending on the platform and the specific features offered. Here are some of the most common types of fees:

- Performance fees: Some copy trading platforms charge a performance fee, which is a percentage of the profits earned by the investor. This fee is typically charged on a monthly or quarterly basis.

- Spread fees: Platforms may also charge a spread fee, which is the difference between the buy and sell price of an asset. This fee is typically charged on each trade and can vary depending on the asset being traded.

- Subscription fees: A platform might also charge a subscription fee, which is a fixed amount paid by the investor on a monthly or yearly basis. This fee may provide access to additional features or services on the platform.

- Withdrawal fees: Copy trading platforms may also charge a fee for withdrawing funds from the investor’s account. This fee can vary depending on the platform and the withdrawal method used.

- Inactivity fees: Some platforms may charge an inactivity fee if the investor does not use their account for a certain period of time. This fee is typically charged on a monthly or yearly basis.

It’s important to carefully review the fee structure of any platform before deciding to use their services. Investors should also consider the potential returns and risks associated, as well as any additional costs such as taxes or fees.

Social Trading vs Copy Trading: Which One is Better?

Copy trading and social trading might seem quite similar. However, there are major distinctions. Let’s have an overview of the main differences.

| Aspect | Private Copy Trading | Social Copy Trading |

| Privacy | Private relationship between investor and trader | Public or semi-public community platform |

| Customization | More personalized settings and arrangements | Standardized features and settings |

| Interaction Level | Direct, one-on-one communication | Broader community interaction and discussions |

| Transparency | Trade details and performance are private | High transparency with publicly available metrics |

| Educational Value | Limited to the investor-trader relationship | High educational value from community learning |

| Suitability | Suitable for professional traders and investors | Suitable for beginners and casuals |

Privacy

First, in social trading, you can transparently observe any move made by the master trader. While this is very beneficial for investors, it can be a huge disadvantage for traders. This is because practically anyone can replicate the orders and the copy trading strategy. Not everyone is okay with letting their edge, which they’ve worked so hard to gain, be leaked.

This can even make the trader redundant, as investors can figure out the strategy on their own and stop paying any performance fees to follow the expert. Therefore, while social trading apps are very beneficial for beginners to learn how to trade, they are not so attractive for experts. Private copy trading is much more appealing in this case.

Automation and Interaction

Copy trading is also highly automated. Yet, social trading includes this feature and also offers a more interactive experience. The former focuses solely on mirroring trades, while social trading tools and platforms create a wider range of social interactions. Meanwhile, the degree of customization available on private copy trading platforms is much higher than social ones.

Furthermore, Copy paste trading is more passive and ideal for those serious investors who prefer a hands-off approach. Social trading, on the other hand, encourages active engagement with the trading community, suitable for those who want to learn and interact more.

Custody

Moreover, social trading platforms generally operate as custodial services. This means that when you sign up and deposit funds, the platform holds and manages your assets on your behalf. The platform executes trades, processes transactions, and maintains the security of your funds within its system. This might not be what many users want, especially in the risky and highly unregulated crypto space. On the contrary, the best copy trading platforms are non-custodial and link users’ personal accounts through API connections.

Check out this article for a more detailed private copy trading vs social trading comparison.

The Pros and Cons

Now, you’re aware of the difference between social trading and private copy trading. Yet, there are still some advantages and disadvantages to copy trading that we should discuss.

Benefits

Here’s a quick overview of the pros associated with copy trading:

- Increase AUM: With copy trading, you can attract investor capital to increase your assets under management and, consequently, magnify your potential income.

- Earn Based on Your Performance: Utilizing the concept of performance fees allows you to earn a certain share of the profits you make for your investors.

- Subscription Fees: If you are a trader with a private community, you can also charge subscription fees in addition to performance fees.

- Client Management: Advanced platforms like Finestel handle the profit transfers, fee settlements, and reporting operations.

- Diversification: You can connect multiple exchange accounts with different portfolio management strategies to diversify your AUM and the portfolios of your copiers.

- Portfolio Tracker: Most platforms contain a portfolio tracker app as it’s necessary for master traders and investors. Check out Finestel’s free crypto portfolio tracker app.

Drawbacks

There are also some drawbacks and disadvantages associated with copy trading. Here are the most prominent cons:

- Technical Issues: Glitches in automated software tools can always happen. They can cause slippage in order executions due to slow replication.

- Liquidity: Platforms can send a significant number of orders to a crypto exchange. If the exchange is small and lacks enough depth or a competent liquidity provider, this can cause sudden price moves or slippage in execution.

- Trading Terminal: Some copy trading apps require the trader to use the platform’s crypto trading terminal rather than the exchange terminal or TradingView. These terminals are not always as user-friendly.

- Limited Communication between Parties: Typically, the communication channel between traders and followers is through a chat box or even a comment section, which might not be good for thorough interaction.

- Limited Customization Options: Most platforms have fixed pricing models and rigid dashboards. They might also lack free trials and free plans.

- Custody of Investor Assets: On some crypto copy trading platforms, investors and traders should deposit their assets into the platform’s wallets instead of using nun-custodial asset management solutions through API keys.

- Lack of Privacy in Social Trading: Most social trading apps and platforms unwantedly disclose the executions and strategy of the master trader, which the trader might not be okay with. This problem is, of course, non-existent on private copy trading platforms.

How to Start Copy Trading?

Now that you know what is copy trading and how it works, you might be wondering how to start copy trading. I will guide you on how to get started with copy trading on Finestel. But first, let me introduce Finestel.

Finestel is a high-tech trading solution provider. Our primary service revolves around our cutting-edge copy trading bot and white-label services. We support popular crypto exchanges like Binance, Bybit, KuCoin, and OKX. Moreover, all of our services are non-custodial through API connections.

If you are a trader using each of the exchanges mentioned above and you are seeking to attract investors or manage the funds of the already existing ones, Finestel is here for you. You can simply sign up on Finestel and go through a seamless onboarding process for both yourself and your clients.

You will then be able to manage your copiers’ portfolios through a centralized dashboard without worrying about custody issues or strategy leaks. Your data and strategies are safe with us, and the funds are kept on each user’s personal exchange account.

How to Sign Up on Finestel Copy Trading Software: Step-by-Step Guide

Let me guide you on how you can quickly get started with copy trading on Finestel:

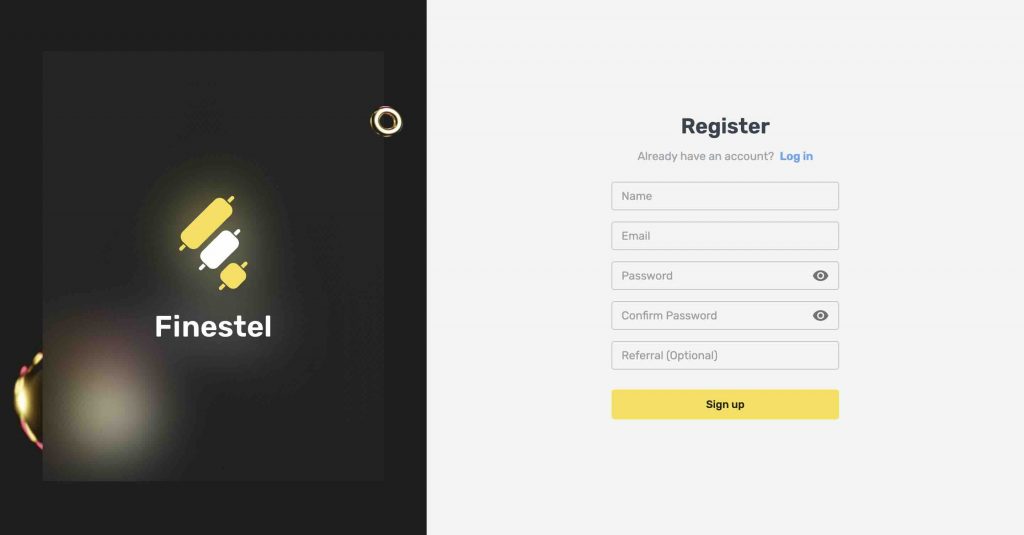

- Navigate to our website, Finestel.com, and click on “Start Free Trial”.

- Create your account by entering your credentials and verifying your email with the code sent to you.

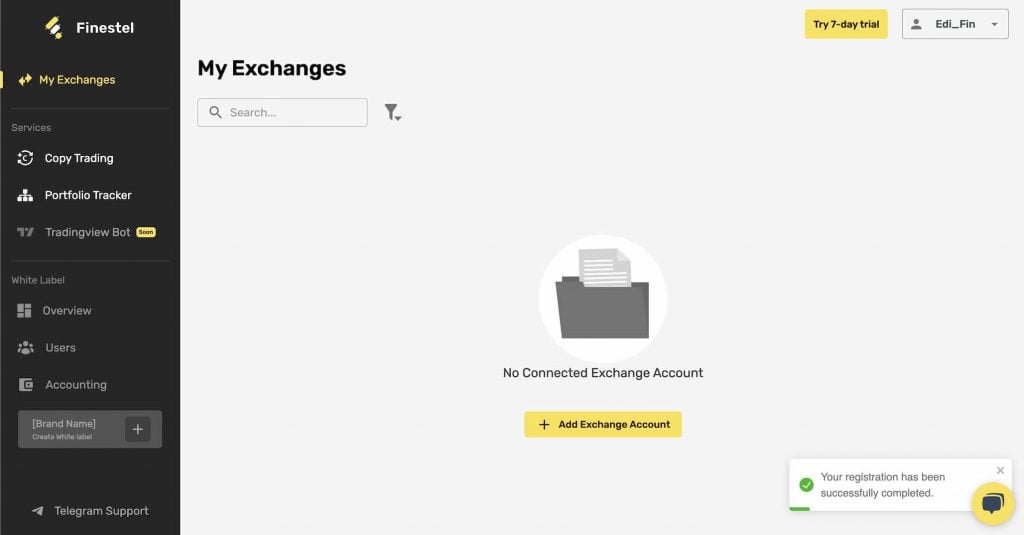

- You will then end up on your personal Fineste dashboard. You can either choose to use our 7-day free trial for paid plans or continue with the free plan (check our pricing page for more information). Either way, click on the “Add Exchange Account” button.

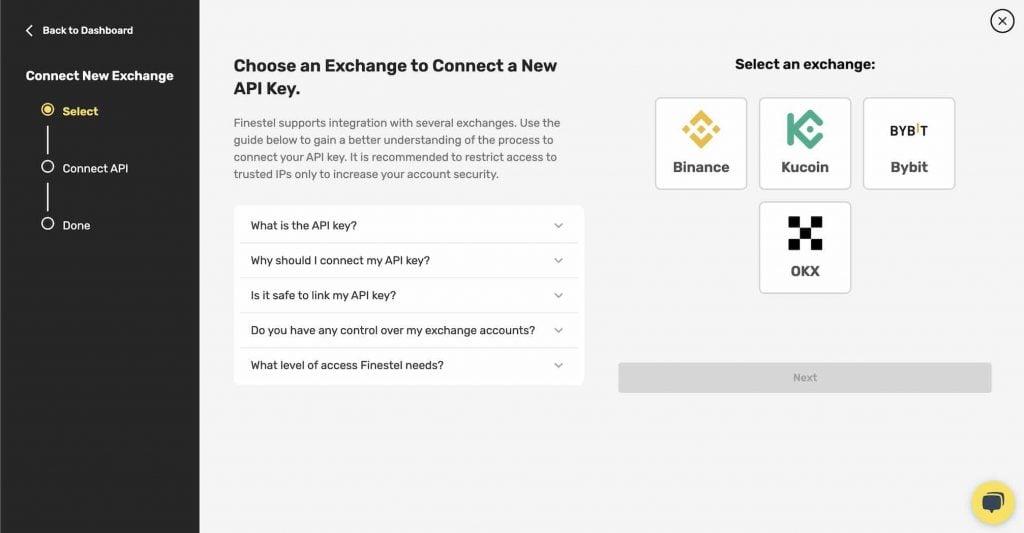

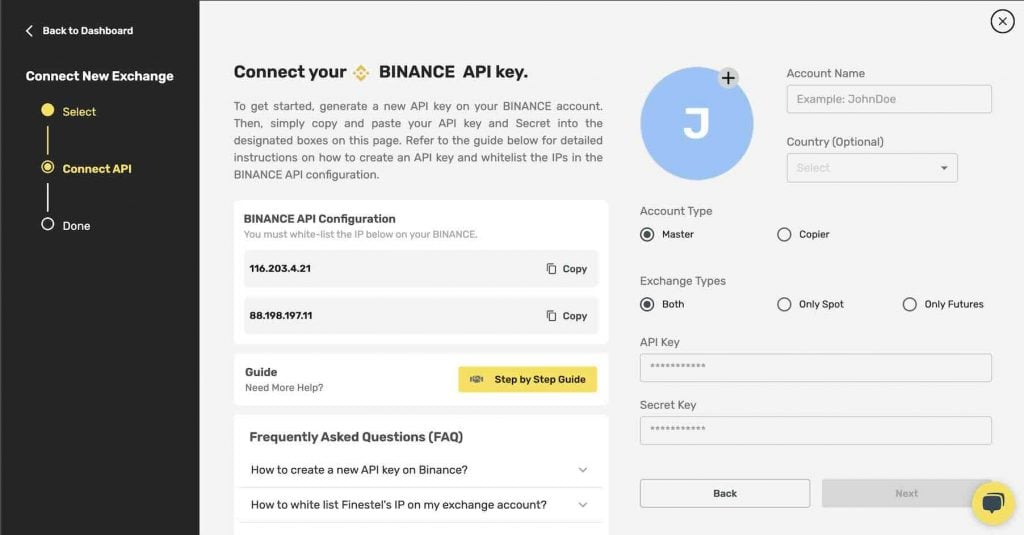

- On the next page, choose the exchange you want to connect to Finestel from the options available.

- Select an account name and your country. Then go to your exchange account and generate a new API key (a step-by-step guide available is on the page). Then, enter the API key and secret key you got from your exchange account. Also, specify whether you want to use Spot or Futures copy trading or select both.

- If you are a master trader or asset manager, select the “Master Trader” option.

- As a copier, select the “Copier option”.

- You are done now. As a master trader, your copiers can also go through the same process and you can start copy trading with Finestel in no time.

Conclusion

Copy trading is an extremely useful tool for traders looking to attract more AUM. This growing popularity in recent years is justifiable, of course, as it is an easy method to magnify returns without adding significant risk. With the advent of cryptocurrencies and web-based trading solutions, crypto copy trading platforms are gaining considerable traction.

Among the numerous private copy trading and social trading apps and platforms available, Finestel stands out as a top choice for serious traders and crypto asset managers. Our cutting-edge copy trading technology, paired with maximum customizability through our white-label solution, makes our services the sweet spot for professional money managers.

Begin earning passive income through copy trading with Finestel right now.

What Is Copy Trading Infographic

FAQ

Is Copy Trading Legal?

Crypto copy trading is legal in numerous countries. In fact, anywhere that you can trade crypto legally, you can also follow traders or attract investors to follow you. However, some crypto copy trading apps and platforms have some restrictions on certain countries. Make sure to read the platform’s terms and conditions for more information.

Is Copy Trading Safe?

You might also be wondering: “Is copy trading risky or safe?”. Well, it depends. As we already mentioned, copy paste trading can be profitable if you choose the right crypto copy trading platform. Moreover, as an investor, make sure to follow the right person, and as a master, attract investors with the same goals and preferences as you.

Is Copy Trading Halal?

YES. Copy trading is a legal practice in most jurisdictions. It is investment advice where investors replicate the orders of other, more experienced traders. Some regulations may apply, depending on the jurisdiction. In the United States, copy trading is regulated by the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). For Muslims’ consideration: It is halal and is not haram.

What is the subscription fee for copy trading apps?

Copy trading platforms charge a subscription fee to cover the costs of providing their services, including the development and maintenance of their platform, customer support, and other operational expenses. Subscription fees for copy trading apps vary depending on the platform and the specific features offered. They can range from a few dollars per month to several hundred dollars per year.

Is copy trading a reliable investment strategy?

Copy trading can be a reliable investment strategy if done correctly. It involves replicating the trades of successful traders, which can potentially lead to profits. However, it is important to thoroughly research and choose a reliable platform and to carefully select the traders to follow.

How can I find successful traders to copy?

Investors can identify them by searching the platforms and studying the portfolio of traders who have been slowly and steadily gaining. They can also analyze the trader’s trading history, risk management strategies, and performance metrics to determine if they are a good fit for your investment goals and risk tolerance.

What are the risks associated with copy trading?

Cryptocurrencies have high price volatility, which can lead to market risk and potential loss of capital. Copiers who do not define their maximum drawdown may also face liquidity risk. Additionally, there is a rare but possible systematic risk where capital could get locked up, and traders may not be able to exit positions.

How can copy trading help investors generate additional income streams and achieve financial independence?

Copy trading can help investors generate additional income streams and achieve financial independence by allowing them to follow and replicate the orders of successful traders, potentially leading to profits. It can also save time and effort by automating the trading process and allowing investors to focus on other income-generating activities.

Is copy trading guaranteed to make me money?

Copy trading is not guaranteed to make you money. While it can potentially lead to profits by replicating the positions of successful traders, there are also risks involved, such as market volatility, hidden fees, and the potential for losses. It is important to carefully research and choose a reputable platform and only invest what you can afford to lose.

The information provided in this blog post is highly valuable.