Trading can be a lonely endeavor. Hours spent analyzing charts and poring over technical indicators often lead to frustration – especially for new traders. The learning curve is steep, and mistakes are inevitable on the path to profitability. Fortunately, copy trading has emerged as a solution that allows individuals to tap into the skills of more seasoned traders. By copying the strategies and trades of experts, amateurs can fast-track their knowledge. However, not all copy trading is created equal. Public platforms harbor risks around intellectual property theft and signal dilution. For a secure and tailored experience, private copy trading within closed groups is the superior choice.

Private copy trading limits the sharing of proven methods to vetted communities. Strategies remain exclusive to verified experts, avoiding the pitfalls of public exposure. Groups unite like-minded traders, whether long-term investors or short-term speculators. It’s a Haven for serious traders to exchange ideas without worrying about plagiarism.

For those looking to learn from the best or money managers wanting to offer copy trading securely, private groups are the answer. Let’s explore their advantages and how new services are making professional private trading attainable.

What is Private Copy Trading?

For new traders, copy trading offers a fast track to profitability by mirroring the positions of experts. But public platforms expose strategies to potential plagiarism. Private copy trading limits sharing to vetted communities, protecting the intellectual property of skilled traders.

Unlike the Wild West of public copying, private trading groups carefully screen members. Only verified experts gain access to proprietary methods and collaborate in closed circles. Strategies remain exclusive to respected peers rather than copied ad infinitum.

For seasoned professionals, these private enclaves defend hard-earned edge from dilution. Newcomers learn efficiently through structured guidance, not public peeping. The door shuts firmly to safeguard each trader’s special sauce.

Private platforms empower both novices and veterans. Novices bootstrap skills through targeted education, while veterans retain control to prevent IP theft. Forget public sharing – private groups keep competitive strategies under lock and key for sustainable alpha.

Some private copy trading groups are formed around a single expert trader, granting members access to a specific, elite trading style. Others curate a selection of vetted experts, allowing members to diversify across different high-quality strategies. But both models emphasize exclusivity and collaboration for long-term profitability.

Find out the best crypto copy trading platforms in 2024.

Public Vs. Private Copy Trading

Public copy trading opens up trading signals and intellectual property to potential exploitation. Profitable strategies get diluted as more traders pile on, eroding returns. Private copy trading addresses these weaknesses through closed groups. Strategies remain exclusive to verified members, enabling secure sharing of IP. Copying is restricted to ensure methods retain their edge.

Private groups also allow screening members based on skill and risk tolerance. This creates a tailored trading community. Here is a detailed comparison:

| Feature | Public Copy Trading | Private Copy Trading |

| Access | Open access, no approval needed | Closed groups, approval, and vetting required |

| Community | Random mix of unfiltered traders | Hand-picked experts aligned to niche |

| IP Security | Signals exposed publicly, high plagiarism risk | Strategies only shared privately with trusted members |

| Knowledge Sharing | Public exposure leads to edge dilution | Strategies remain exclusive within closed circles |

| Customization | Limited to public platform features | White-label solutions for customized deployments |

| Technology | Basic public platform tools | Robust portfolio tracking and analytics |

| Support | Generic customer service | Dedicated account management and technical support |

| Trader Control | No input on who can copy | Traders select which members to allow copying |

Read our comprehensive guide on Binance native copy trading and third party platforms.

Who is Private Copy Trading For?

Private copy trading appeals to:

- New traders looking to learn from experts in a structured environment.

- Experienced traders who want to share signals securely without dilution.

- Money managers who want to offer copy trading as a service to their client base.

- Businesses who want to provide a branded and customized copy trading solution.

Public Copy Trading Risks

Public copy trading platforms open up trading signals and intellectual property to potential exploitation. As more traders pile on to copy profitable methods, the efficacy gets diluted eroding returns. Public platforms also risk strategies getting copied or front-run when made visible to all.

- Lack of Security: On public platforms, there is no way to limit sharing of signals. Once a trade is copied, it is out of the original trader’s control. This presents risks of their IP getting exploited without the ability to limit distribution.

- Loss of Competitive Edge: Widespread copying on public platforms reduces the returns of profitable methods. Traders see their edge deteriorate as more join and dilute the strategy. There is no way to carefully control who can access and copy trades.

- Inability to Filter Copy Traders: Public platforms do not allow screening potential copy traders based on skill, experience, or other attributes. Valuable trading insights get shared with an unfiltered, unqualified audience.

Benefits of Private Copy Trading

Private copy trading solutions address the pitfalls of public platforms by limiting copying to vetted groups. Traders can tap into experts’ wisdom in a controlled environment.

Increased Privacy and Security

When copy trading is done through private groups, there is much more privacy around the positions, strategies, and performance of the traders being copied. Traders’ information is not made public for anyone to see and potentially exploit.

This prevents profitable strategies from being copied by a wide audience or taken advantage of through front running. Private copy trading ensures the trader’s intellectual property is shared only with vetted individuals, protecting the edge of their strategy. This allows for more beneficial copying in a secure environment.

Public copy trading comes with the risk of many people copying, diluting the strategy’s efficacy. But with private groups, copying is limited for better returns.

Targeted Learning

Rather than one-size-fits-all public copying, private copy trading allows traders to join specific groups aligned with their interests and preferred strategies. For example, a short-term trader can join a group focused on day trading, while a long-term portfolio manager may prefer a group for position holders.

Some private communities center on specific assets like crypto or options. This customization allows traders to better leverage the skills of top performers who trade just like them.

Beginners can more rapidly learn strategies for their goals. Overall, targeted private groups empower traders with far more specialized knowledge versus general public copy trading.

Selective Access to Proven Traders

Public trading grants access to any follower. But private groups limit copying to verified experts through rigorous screening. Only traders with proven returns and activity are admitted to these elite circles. New copy traders thereby gain access to battle-tested methods from real professionals, not just anyone with a public account. Private platforms allow experts to carefully select who can replicate their proven strategies.

Ongoing Community Interaction

Beyond just copying trades, private groups enable communication between members. Traders can discuss market insights, refine techniques, and develop new strategies together.

Custom Risk Management

Private groups unite traders with similar risk profiles. Conservative copy traders can join low-risk communities while those seeking higher returns access more aggressive groups.

Models of Private Copy Trading

Private copy trading platforms utilize different models to structure expert-novice relationships and control the flow of trading strategies. Membership and signal replication are carefully managed depending on the specific model in use.

Closed Trading Groups

Some exchanges and brokers establish fully closed copy trading groups, requiring an application and vetting process to join. This creates an exclusive community of seasoned traders who want to collaborate and learn from each other’s proprietary methods.

Strict membership ensures only serious, experienced traders are allowed into the groups to share and refine successful strategies. This model allows exchanges to carefully evaluate traders, admit only those who meet performance and activity thresholds.

Once admitted, traders can feel secure sharing signals and allowing copying within the group. They can also communicate directly with others to discuss market insights. The closed environment is ideal for developing new techniques and safely benefiting from others’ expertise.

Find out the best crypto signal channels and groups in 2024.

White-Label Solutions

Rather than build copy trading functionality from scratch, many exchanges and brokers implement white-label solutions. This allows them to license and rebrand copy trading technology for their user base. Traders get the customized experience of copying only within their exchange community.

For the exchange, white-label solutions require less upfront development work to quickly offer copy trading. And they can tailor the experience, screening who can trade and be copied based on their own criteria and member needs. This model empowers exchanges to curate the copy trading environment for their traders. At the same time, traders benefit from copying within the closed exchange ecosystem versus a wide-open public platform.

Hybrid Public/Private Platforms

Some platforms take a hybrid approach with both public and private tiers. Public groups provide basic copy trading access while private clubs offer personalized guidance and mentoring.

This caters to both casual and serious copy traders. Public tiers reduce barriers to entry while private groups reward power users.

Finestel: Your Single Destination for Professional Private Crypto Copy Trading

Generic public platforms sell a watered-down vision of copy trading. Major exchanges like OKX, Bybit, Bingx, Binance, and Kucoin now offer private crypto copy trading capabilities and closed groups. For turnkey management, Finestel provides white label crypto copy trading software and solutions tailored to enterprises.

Finestel’s portfolio trackers, exchange integrations, and dedicated support enable professional private crypto copy trading services.

Complete White Label Solution

Finestel enables firms to fully brand and customize their own private copy trading platform through white label solutions. This allows launching a unique trading service with dialed-in features versus one-size-fits-all generics.

Finestel provides the technology infrastructure while empowering custom styling, integrations, pricing, support and more.

Management and Tracking Tools

Operating closed copy trading groups requires robust administrative tools provided out-of-the-box by Finestel.

This platform combines copy trading capabilities with portfolio monitoring, client management, and usage analytics. Groups are run efficiently via centralized trading, portfolio tracking, and admin.

Top Exchanges Integration

Expanding exchange connections is crucial for trader access. Finestel continuously integrates with top exchanges and supports Binance copy trading, Bybit copy trading, Kucoin copy trading, OKX copy trading, and more. This platform partners with leading brokers to ensure members can access the most important markets.

Bespoke Solutions and Support

While competitors offer pre-packed services, Finestel delivers tailored solutions customized to each client’s needs. From pricing models to technical integrations, it works hands-on to craft the ideal deployment. Ongoing premium support and account management enable a truly white-glove service.

Getting Started with Private Crypto Copy Trading

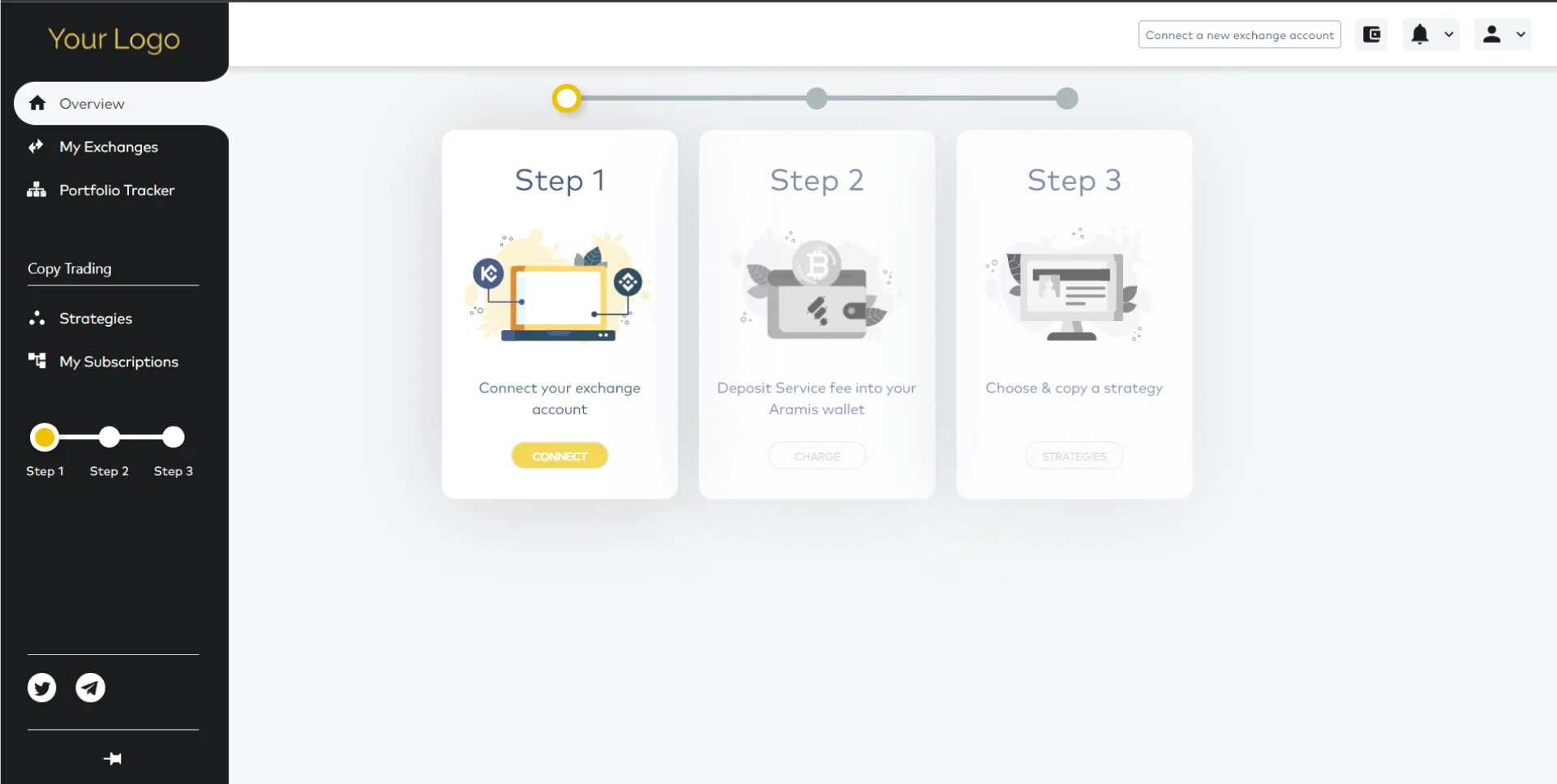

The Finestel white label copy trading platform has two main components: the Back Office and Front Office.

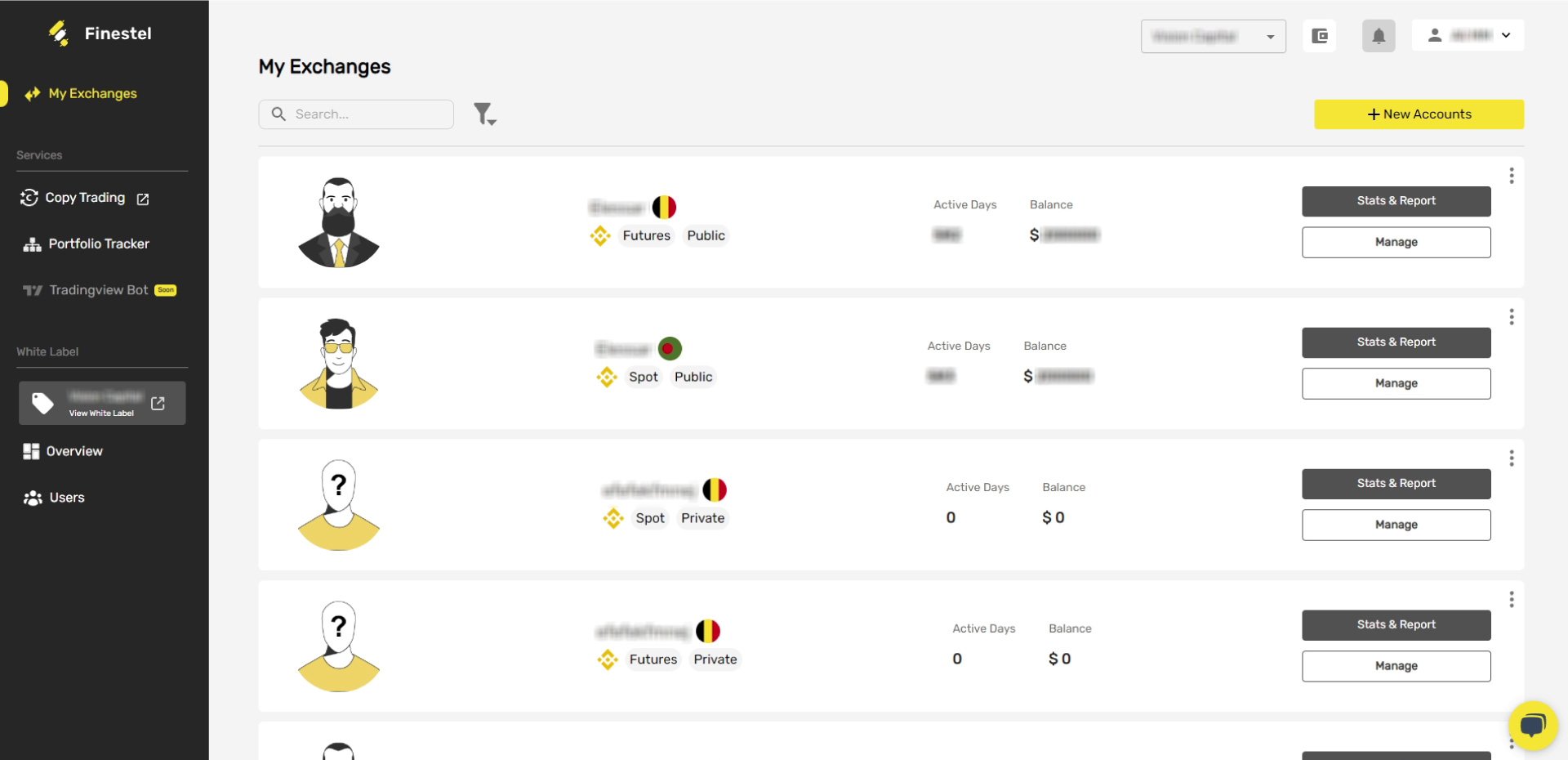

The Back Office is the administrator dashboard you access after logging into your Finestel account. Here, you can connect your exchange accounts (via read-only API keys) to either monitor them using the portfolio tracker or make them public to allow copying.

The Front Office is accessible through the Copy Trading menu in the Back Office. This is where you or clients can link investor exchange accounts (via trade-only API keys) to utilize the portfolio tracker or copy trading strategies.

Back Office Dashboard

The main back office menus and features:

- My Exchanges – Connect exchange accounts via read-only API keys to monitor or make public for copying. Manage account visibility, branding, timeframes, fees, etc.

- Stats & Reports – Performance stats, order history, and asset allocation for connected accounts.

- Services – Copy trading, portfolio tracker, Tradingview bot integration (coming soon), and more.

Front Office White Label Dashboard

Accessible from the back office. Customize your white label when first creating it – tailor it to an existing business or build a new one.

Key menus:

- Overview – Platform performance summary.

- Users – Subscriber count, assets under management, account stats.

- Strategies – Your public trading accounts are available for copying.

The white label allows full customization and branding of Finestel’s copy trading and portfolio tracker. Add your logo, name, URLs, integrate services, etc.

The Finestel white label provides several extra tools and services beyond the base platform:

- Customizable Client Management System (CRM) – White label owners can customize billing, reporting, portfolio tracker settings, and more. Fully automate client management.

- Marketing Tools & Support – Access customizable email, social media, and other marketing tools. Get consulting from Finestel’s marketing team.

- 24/7 Exclusive Technical Support – Direct access to Finestel’s support team via private Telegram group. They won’t contact your clients directly.

White label owners can further customize the front-end they’ve branded:

- Build digital money management firms or integrate with existing businesses.

- Customizable billing methods, reporting, portfolio tracker timeframes, etc.

- Exclusive Finestel technical support is rated highly by users.

- Access marketing tools – email, social media, etc. Integrate your existing services.

- Branded portfolio tracker app for your clients – set fees or make it free.

In summary, the white label allows full customization of client management, support, marketing tools, and the frontend interface. Take Finestel’s copy trading platform and make it your own.

Conclusion

The public free-for-all of open copy trading simply can’t match the benefits of curated private groups. Their security protections, customizable access, and interactive communities empower both new and experienced traders. For businesses, turnkey solutions like Finestel make delivering a managed private trading platform simple yet robust.

In the cutthroat world of trading, edge is everything. Public exposure leads to dilution, but private groups offer shelter from the storm. Traders can develop profitable strategies without worrying about plagiarism. For those looking to learn efficiently or share ideas securely, private copy trading finally levels the playing field. The future is closed groups, not open seasons. Traders owe it to themselves and their intellectual property to go private.

FAQ

What is private copy trading?

Private copy trading allows traders to share their strategies and have investors copy trades, but only with a select group of investors instead of the general public. It offers more exclusivity and control.

How does it differ from social copy trading?

Social copy trading is open to all on a platform. Private copy trading limits copying to a chosen group of investors invited by the trader.

What are the main benefits of private copy trading?

Greater control over who can copy you, build an exclusive group of investors you know and trust, more flexibility in fee structures and arrangements with copiers.

What platforms provide private copy trading services?

Platforms like Finestel, Darwinex, DupliTrade, Tradeo, and others offer white label solutions to launch private copy trading. Traders can also manage it independently.

Leave a Reply