As a crypto trader, you have a plethora of investment opportunities. With thousands of tokens available to invest in, tracking your portfolio manually can be very difficult. This is where crypto portfolio trackers come in. You’ll no longer need to dedicate a huge amount of time to recording and monitoring investments. Just invest in the best crypto portfolio tracker to automate the process.

In this article, we’ll explain what a crypto portfolio tracker is and why it’s important. Another key point you’ll need to know to identify the best crypto portfolio tracker for you is the features it should have. After going through these points, we will take a look at the best crypto portfolio trackers in 2024 and help you decide which one’s for you.

What Is a Crypto Portfolio Tracker?

Think of a crypto portfolio tracking software as your personal accountant. It records your trades in different assets. These recordings should include crucial details such as entry prices, average purchase price, PnL, and so on.

![]()

Yet, crypto portfolio management apps are more than an accountant. They also visualize this data and provide dashboards, charts, and other insightful information. So, no matter where your funds are and what they are invested in, you can monitor your whole portfolio from a single dashboard.

While there are alternatives like TradingView portfolio tracker made by the TV community, or Google sheet crypto portfolio trackers, they don’t count as crypto portfolio management apps.

Why Are Crypto Portfolio Trackers Important?

The crypto market is still relatively small in terms of capitalization. However, it offers many more investment opportunities compared to traditional asset classes. With thousands of cryptocurrencies to hold, keeping track of a well-diversified portfolio can cause headaches.

Moreover, as a conservative crypto trader, I personally prefer to keep my holdings in several places. These include hot wallets, cold wallets, and exchanges. You don’t want to be one of FTX’s victims who lost their whole life savings, right?

Some tokens are even listed on one or a few crypto exchanges only. You cannot trade every crypto on one single exchange. A portion of your holdings might even be in margin or futures positions. So, to track various assets and instruments over several exchanges manually is almost impossible. That’s why you need an automated solution, and I’m here to help you find the best crypto portfolio management software for you.

Key Features of the Best Crypto Portfolio Trackers

As crypto traders and investors, our goals are certainly different. Some of us are gem hunters, while others prefer large-cap traders. In fact, crypto market participants consist of a wide range of categories. Whether you are a Bitcoin maximalist, a futures speculator, or a diversification lover like myself, there are some basic qualities and features you expect from a crypto portfolio tracking app.

![]()

Let’s take a look at the essential features of the best crypto portfolio trackers:

- Real-time Data: A decent crypto portfolio management app should provide real-time data (such as crypto prices). In fact, this is one of the most important advantages of these tools compared to manual tracking.

- Automatic Updates: The tracker should automatically update your portfolio with the latest data. So, there would be no need for manual input, and it’ll save you a lot of time.

- Diversification Analysis: Best crypto portfolio trackers analyze your portfolio’s diversification. They provide visual insights like graphs to help you manage your risk.

- Performance Analytics: A crypto portfolio tracking software should providedetailed performance analytics. Metrics such as ROI, volatility, and benchmark comparisons can help you optimize your portfolio.

- Alerts and Notifications: Top crypto trackers offer customizable alerts and notifications. You should be able to set specific criteria for alerts, such as price changes or news updates.

- Compatibility: The best crypto portfolio management software tools are usually the most compatible. And, they should not only support various exchange, but should also be multichain portfolio trackers for different coins and wallets.

- Tax Reporting: This one is a plus, but a huge one. Especially if you live in a country that requires you to file your crypto gains and losses for tax purposes. Make sure the tracker is compatible with common crypto tax software tools.

Best Crypto Portfolio Trackers in 2024: Top 5 List

If you’ve even skimmed through the text up to this section, you’ll know how important it is to choose the best portfolio tracker. You also know what to look for in a tracking software.

![]()

Meanwhile, I’m going to make things even easier for you. Here’s a list of the best crypto portfolio management software tools you can choose from:

| Feature | Finestel | CoinStats | Kubera | Koinly | CoinGecko |

| Cheapest Paid Plan | Free | Premium ($15.99/mo) | Personal ($150/year) | Newbie (€49/year) | Free |

| Free Plan Available | Yes | Yes | No | Yes | Yes |

| Support | Priority Support | Priority Support | Priority Support | Basic | Basic |

| Automatic Updates | Yes | Yes | Yes | Yes | No |

| Auto-Trading | Yes | No | No | No | No |

| Tax Reporting | No | No | No | Yes | No |

| Unique Features | White Label Copy Trading Bot | AI Price Predictions | Dead Man’s Switch | Tax Integration | – |

| Mobile App | No | Yes | Yes | Yes | Yes |

Finestel

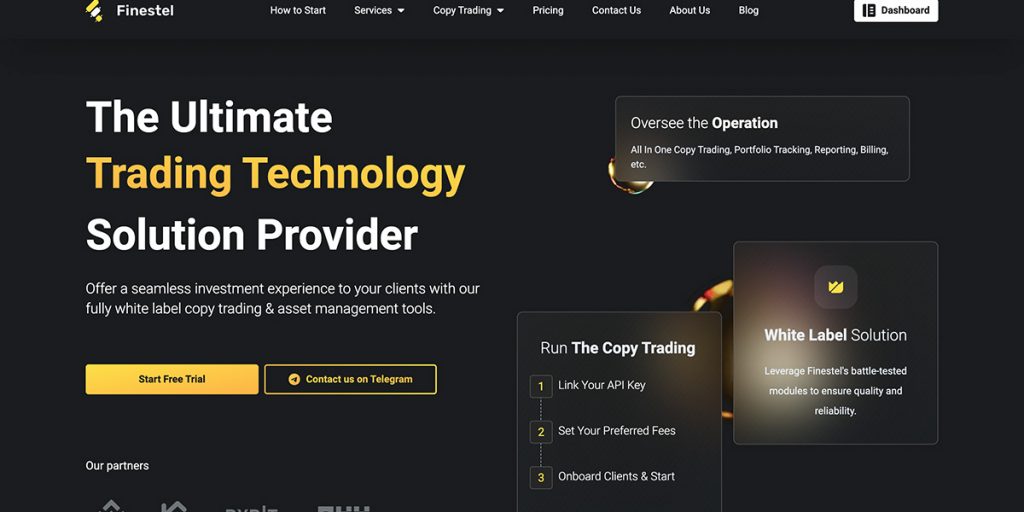

Best For Professional Traders, Crypto Portfolio Managers, and asset management businesses

Finestel is much more than a simple crypto portfolio tracker. In fact, our product is so comprehensive that the crypto portfolio manager just seems like an add-on. However, it doesn’t mean we’ve not put much work into it.

At Finestel, we work with professional traders and crypto portfolio managers. Some of our clients even have 8 figures of assets under management (AUM). It’s not a secret how much efficient and accurate portfolio tracking and management means to them. Our crypto portfolio tracking software is one of the primary reason they’ve chosen us, alongside our cutting edge copy trading bot and white-label services.

Finestel’s crypto portfolio tracker allows you to monitor any crypto asset or position you have on top exchanges through a single dashboard. You can also view all of your open positions (spot, futures), orders (limit, stop), and trading history. Moreover, as our software is connected to live exchange price feeds, you can view your profits and losses in real-time for both spot and futures holdings.

Meanwhile, Finestel’s services go much further than a simple app for tracking crypto portfolios. Our cheapest paid plan, which is the Starter plan, allows you to connect up to 3 exchange accounts and take advantage of our lightning-fast copy trading bot. As a result, you can execute trades simultaneously on different exchanges from one single dashboard and in one single blink of an eye.

Let’s take a look at Finestel’s pricing plan before moving on further:

| Features | Free | Starter | Pro | Business | Enterprise Plan |

| Price | Free | $19/mo ($13.3/mo billed annually) | $49/mo ($34.1/mo billed annually) | $199/mo ($139.1/mo billed annually, Time-limited offer) | Contact Sales Team |

| Exchange Accounts | Up to 3 | Up to 3 | Up to 10 | Up to 100 | Customizable |

| Portfolio Tracker | Yes | Yes | Yes | Yes | Yes |

| Copy Trading | No | Yes | Yes | No | Yes |

| Dedicated Support | No | No | No | Yes | Yes |

| White-label Asset Management | No | No | No | Yes | Yes |

| Orders Rate Limit (Per Account) | N/A | 10 orders/min | 10 orders/min | 30 orders/min | Customizable |

| Technical Development | No | No | No | No | Yes |

| Trading Algorithm Development | No | No | No | No | Yes |

| MLM Software | No | No | No | No | Yes |

| Dedicated Servers On Demand | No | No | No | No | Yes |

Overall, if you want the best crypto portfolio management software with sophisticated capabilities, Finestel is for you. With the competitive pricing plans and tons of added features, it surely tops the list. I personally use it to actively manage my spot crypto portfolio and futures positions on several exchanges.

So, I definitely recommend trying Finestel’s free plan (at least) because I know the software itself will convince you to upgrade your plan for more advanced features.

Coinstats

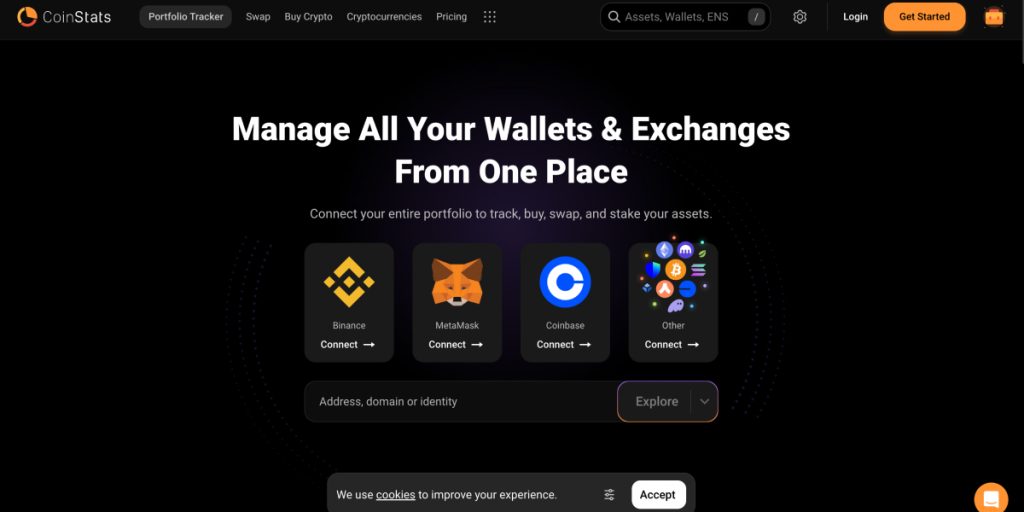

Best for Individual Crypto Traders

Coinstats is another great crypto portfolio management app I’ve used back in the day. Unlike Finestel, it is a dedicated portfolio tracking software available in both web-based and mobile app formats. You can connect Coinstats multichain portfolio tracker to over 300 crypto exchanges and wallets. It really allows you to track all crypto in one place. In fact, when it comes to accessibility, Coinstats is arguably the best crypto portfolio tracker.

Another great feature of the Coinstats crypto portfolio manager is that it also allows you to track your NFT holdings. It also connects to over 1000 DeFi protocols and supports more than 20,000 cryptocurrencies, making it one of the best defi portfolio trackers. These details just show you how versatile Coinstats is as an app for tracking crypto portfolios.

Moreover, you can also connect up to 50 portfolios to Coinstats and track up to 100,000 transactions. This is a huge number for most of us. Yet, some asset managers or even high-frequency traders can find it very useful. There are in-depth profit and loss analytics also available, as they should be with any top crypto portfolio tracker.

Another feature I really found interesting is Coinstats’ AI-powered crypto price predictions. With the recent advances in AI, this integration shows how much the Coinstats team strives to keep up with technology. While I personally don’t use AI for price predictions, some beginner traders might find it very helpful.

Let’s take a look at Coinstats’ pricing plans:

Sure, here’s a table summarizing CoinStats’ pricing plans and their features:

| Feature/Plan | Basic (Free) | Premium ($15.99/month) | Degen ($89/month) | Team (Custom Pricing) |

| Portfolios | 10 | 100 | 500 | Custom |

| Transactions | 20,000 | 100,000 | 1,000,000 | Custom |

| Daily Sync Count per Portfolio | 40 | 200 | Unlimited | Custom |

| Support | Basic (Under 72 hours) | Priority (Under 24 hours) | VIP (Under 1 hour) | VIP via Dedicated Channel |

| Portfolio Performance Analytics | Yes | Yes | Yes | Yes |

Overall, Coinstats can be a great tool for less professional crypto investors. While the platform lacks the various features of Finestel, it is definitely among the best crypto portfolio trackers. As a trader who has used Coinstats in the past, it can be a good choice as a simple crypto portfolio tracking software. Yet, some crucial features are only available in Premium and Degen plans, unlike Finestel, which offers a complete full portfolio tracker in its free plan.

Kubera

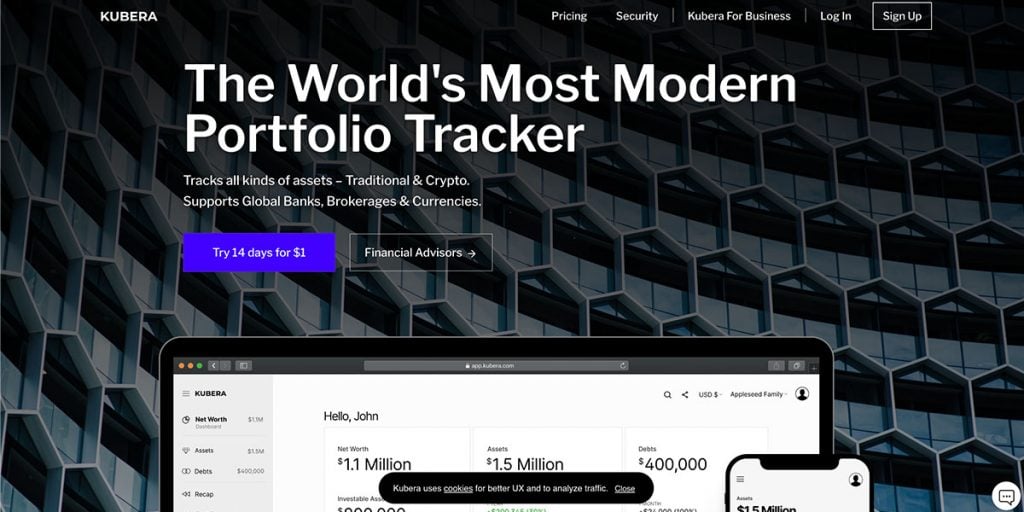

Best stock and crypto portfolio tracker

Kubera is an easy-to-use personal finance platform. It combines your crypto portfolios, DeFi, NFTs, and even traditional financial assets like stocks and ETFs. The platform is ideal for traders who do multiple types of investments, not just crypto. It is compatible with cryptocurrency exchanges and wallets, including Trezor, MetaMask, and The Ledger.

Kubera tracks numerous assets, with billions of dollars checked daily. It offers various services, including banks, brokerages, crypto, DeFi, NFTs, and real estate. Moreover, the Kubera crypto portfolio tracker provides traders with high privacy and security. There is no sneaky data mining, ads, or upselling, and their encryption is top-of-the-line.

Kubera’s unique feature is its cool “dead man’s switch” feature. It sends the traders’ financial information to any specified person if something happens to the account owner. All these features make it the best stock and crypto portfolio tracker available.

Here’s a brief overview of the Kubera portfolio tracker’s pricing plans:

| Plan | Personal | Family | Business |

| Price | $150/year | $225/year | Starting at $150/month |

| Description | For individuals who manage their own portfolios. | Collaborate with your family and your extended team. | All-in-one Client Portal for Financial Advisors & Multiple Family Offices |

| Trial | 14 days for $1 | 14 days for $1 | Contact Sales |

While I’ve not used the Kubera crypto portfolio management app extensively, I gave it a try to write this review. In my honest opinion, it’s arguably the best stock and crypto portfolio tracker. It connects to most stock brokers, crypto exchanges, and even banks. So, you can really track almost all of your investments in one place. Yet, while offering a free trial, the absence of a free plan makes it a choice for professional traders only.

Koinly

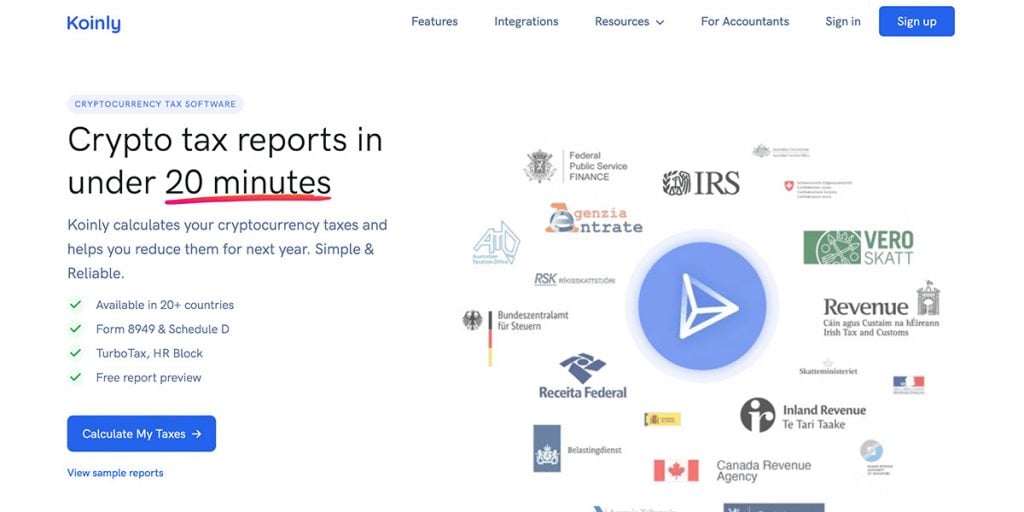

Best for crypto portfolio tax reporting

The next entry to our list of best crypto portfolio trackers is Koinly. Meanwhile, Koinly is more than just an ordinary portfolio tracker. First of all, it offers portfolio management software services to individuals, businesses, and even accountants. In fact, Koinly is as close as it can get to a crypto accountant and tax software.

Furthermore, upon signing up, Koinly allows you to choose if you only need a crypto portfolio management app or if you also want tax reporting. Its tax reporting feature works for over 200 countries worldwide. You can connect several exchanges, crypto wallets, and even online banking apps like Revolut.

Koinly is also among the best DeFi portfolio trackers, as it integrates with various DeFi protocols via API. Moreover, it offers an overview of your NFT holdings and futures and margin positions. So, it really allows you to view and track all crypto in one place.

Here’s a brief overview of Koinly’s pricing plans and features:

| Features | Free | Newbie (€49/year) | Hodler (€99/year) | Trader (€199/year) |

| Transactions | 10,000 | 100 | 1,000 | 3,000 |

| Wallets & Exchanges | Unlimited | Unlimited | Unlimited | Unlimited |

| Tax Reporting | – | Yes | Yes | Yes |

| Export to TurboTax, TaxACT | – | Yes | Yes | Yes |

| Priority Support | – | – | Yes | Yes |

For traders with more than 10,000 transactions, Koinly offers custom solutions. You can request a quote for personalized pricing and support.

Having an automated app for tracking crypto portfolios and tax reporting is an outstanding option. I’ve tried Koinly’s free plan, and it worked very well. If you also need tax reports like Form 8949 and integrations with tools like TurboTax, Koinly’s paid plans are a no-brainer. You won’t need any accountants for your crypto tax, Koinly does it for you.

CoinGecko

Best for casual crypto traders

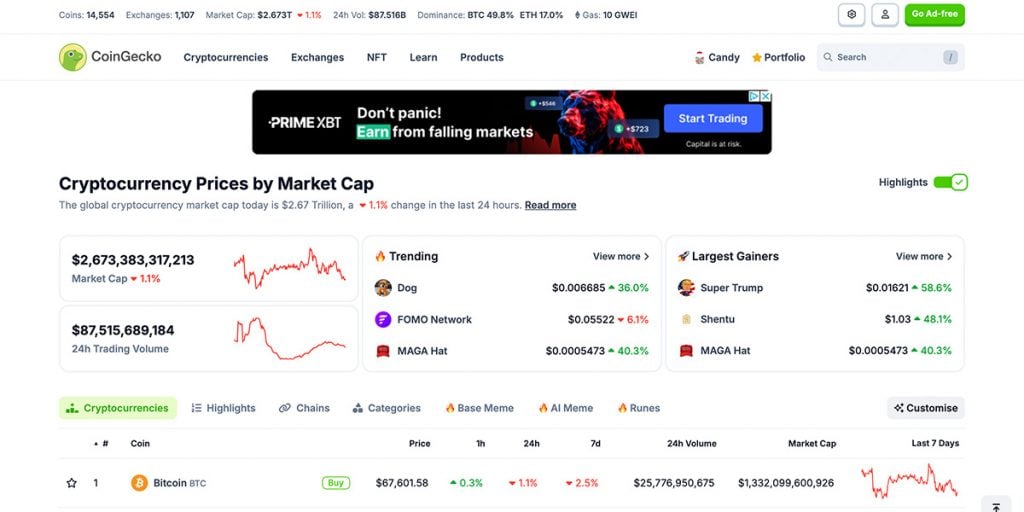

CoinGecko is a household name in the crypto industry. It’s known as best website to track cryptocurrency prices and an excellent crypto news source. Yet, the free CoinGecko portfolio tracker is our main focus. As someone new to the crypto market, I once used the CoinGecko portfolio tracker briefly. While it is a straightforward tool, it lacks the in-depth features of its competitors.

First and foremost, the CoinGecko portfolio tracker is free. This should make it a tempting option for many crypto traders. You can simply choose from tons, and I mean tons of cryptocurrencies, and add them to your portfolio. The CoinGecko multichain portfolio tracker allows you to choose the trade amount and time of transactions. You can also transfer assets between portfolios.

CoinGecko offers one of the most credible price feeds in the crypto industry. Thus, you will be able to track your portfolio’s performance accurately and in real-time. However, the CoinGecko portfolio tracker works manually. I mean, you should take the time to enter your transactions yourself, as it does not connect to exchanges and wallets via API. Needless to say, this can be a headache for asset managers and day traders like myself. But still, it’s a huge upgrade over pen and paper.

Another shortcoming of the CoinGecko multichain portfolio tracker is that, well, it’s just a portfolio tracker. You cannot expect anything else from it. While that might be all you’re looking for and expect from a free crypto portfolio tracker, I prefer some additional features on the side. So, in my opinion, the CoinGecko portfolio tracker is only suitable for casual crypto traders. In fact, it wouldn’t have made the list if it wasn’t for its ease of use, the availability of numerous tokens, and, of course, CoinGecko’s reputation as the best website to track cryptocurrency prices and news.

Conclusion

In this article, we’ve talked about what a crypto portfolio tracker is and how it works. We’ve also defined some criteria to help you find the best crypto portfolio tracker for your needs. Moreover, we introduced and briefly reviewed some of the best crypto portfolio management apps to help you narrow your choices.

Remember, the most important thing in choosing the best app for crypto portfolio tracking is to consider what you require. Overall, if you need comprehensive and professional asset management and crypto portfolio tracking software, Finestel is for you. Take a look at our comprehensive Finestel review to find out more about our services.

FAQ

Can I Use Multiple Crypto Portfolio Trackers Simultaneously?

Yes, it depends on your need to collect and track your distributed assets at a glance.

Are There Any Fees Associated With Using A Crypto Portfolio Tracking App?

Not per check but by subscription, YES. Although a few crypto portfolio trackers are graceful as FREE, some have pricing plans for a specific period.

How Do I Choose The Best Crypto Portfolio Tracker For My Needs?

First, determine your assets’ classification, then meet your need by choosing a crypto portfolio tracker that works as simply as possible for reporting.

Are There Any Free Crypto Portfolio Trackers Available?

YES, Finestel is FREE and of the top crypto portfolio trackers ever that traders can manage their assets onto.

Leave a Reply