Welcome to the forefront of cutting-edge trading technology with Finestel. But, what is Finestel? Finestel is the ultimate trading software solution provider for money managers, asset managers, traders, and community managers. To survive and thrive in the competitive, fast-paced, and cruel arena of the financial markets, you require more than simple expertise and knowledge.

Finestel is here to provide you with a comprehensive set of innovative and highly personalized trading tools and solutions essential for your success in the long run.

Overview of Money Managers’ Pain Points

Traders and asset money operate in a highly risky environment. The financial markets are no playground and can inflict enormous monetary and even psychological damages to individuals and businesses. As a result, asset managers should be well-prepared before engaging in the markets and trading with investor funds.

Yet, while trading and investing carry inherent risks, there are other issues that investment managers face in the modern era. Here are some of the primary pain points of asset management businesses:

1. Engagement, Diversification, and Accessibility

One of the most prominent challenges asset managers face in their daily operations is in the section of engagement, diversification, accessibility, and custody. The process of maintaining robust client engagement is getting increasingly difficult as the market dynamics evolve.

Moreover, the diversification of their client base is also hindered by geographic constraints and regulatory issues. As a result, asset managers & money managers can face limits in their reach and growth potential.

2. Technical Expertise and High Costs

The realm of asset management presents another challenge for professionals; technical expertise and high operational costs. Asset managers are constantly grappling with the evolution of trading technology. Therefore, they need to make continuous efforts to maintain pace with this rapidly changing environment.

To meet the client’s demand to keep up with the latest trends and provide customizable solutions, they need to hire experts in technical fields. Consequently, these requirements add up to high operational costs for businesses.

3. Tracking Performance

Transparent and efficient measuring of trading and portfolio performance poses another challenge for asset managers. It usually requires significant time and effort on their part. This process is quite complex and can be difficult to manage due to the complicated nature of evaluating various performance metrics and considering different economic factors.

So, tracking the profitability of trading strategies demands a comprehensive approach that would be a significant headache for asset managers.

4. Scaling and Compliance Challenges

Asset managers face the tricky task of growing their operations while being in line with the ever-changing compliance rules. Expanding your business to meet increasing demand and simultaneously ensuring that you are following all the shifting rules and regulations is very challenging.

Meanwhile, scaling up is essential for business growth and needs a smart balance of resources and processes, so it does not interfere with the quality of the main service they provide, managing clients’ funds.

5. Custody Issue

Keeping clients’ assets safe while handling the custody concern of the client’s assets is a big deal for asset managers. It is not just about making sure the money is safe and accessible, it is also about meeting strict rules and regulations.

Most asset managers prefer not to take the clients’ assets’ custody, The main challenge is to create impregnable and secure systems that protect client money against these risks. They should also convince investors that their funds are kept safe, in order to be able to raise more capital.

What Is Finestel’s Innovative Plan to Tackle These Issues

At Finestel, we constantly work on alleviating pain points for our clients. We aim to ensure that you only need to focus on trading and managing your investors’ portfolios while we handle other aspects required for achieving sustainable growth for your business. Our innovative solutions to address the challenges mentioned above are introduced in the following sections.

1. Engagement, Diversification, and Accessibility

As previously explained, engagement, diversification, custody, and accessibility issues pose significant challenges for asset managers. Yet, Finestel acts as a strategic partner as we provide innovative solutions to enhance client engagement, broaden the client base, and overcome geographic and regulatory barriers. By leveraging Finestel’s services, you do not need to worry about these issues anymore.

2. Technical Expertise and High Costs

In order to tackle the challenge of technical expertise and high operational costs, Finestel offers transformative Software-as-a-Service (SaaS) solutions. By providing access to enterprise-grade technology and dedicated customer support, Finestel removes the asset managers’ need to stay up-to-date with the latest technological trends.

Furthermore, we offer maximum customization options that create tailored solutions for asset managers’ different needs. This approach allows investment managers to outsource the technical procedures to our tech-savvy team and we will take complete care of the matter.

3. Tracking Performance

Finestel’s cutting-edge approach makes performance tracking of trading strategies and portfolios much easier. Our data analytics dashboard and automated performance reporting tool unlock complete transparency in understanding trading performance.

Gone are the days of frustrating manual tracking. Instead, both asset managers and investors have real-time access to insights and detailed analytics. This transparency empowers asset managers to keep their investors satisfied and also raise more capital effortlessly.

4. Scaling and Compliance Challenges

To tackle the issues associated with scaling and compliance, Finestel offers a game-changing solution. Our flexible investment management platform is designed to relieve asset managers from compliance-related headaches. Thanks to this innovative platform and the fact that asset managers can operate non-custodial, a balance is created between regulatory requirements and operational efficiency.

Moreover, with the integration of automation and sophisticated administrative tools, scaling operations becomes much more convenient. This dual functionality of the investment management platform streamlines both compliance procedures and scaling efforts, making life much easier for asset managers as they can solely focus on their job which is to pursue profits for their clients.

5. Custody Issue

To address the custody issue, Finestel introduces innovative secure, and non-custodial protocols. These protocols provide a unique solution as they allow asset managers to closely monitor and manage investments without taking direct custody.

This process not only ensures a high level of security but also empowers end-users (copy traders) to retain control of their assets. The resulting transparency and security go a long way when asset managers are negotiating to attract new investors.

Finestel’s Main Services and Who Can Benefit the Most?

Finestel offers two main services to its clients. These services are designed to cater to your specific needs as an individual or asset management business. Yet, asset managers are not the only cohort who can benefit from our products.

In the following sections, we describe Finestel’s services in more depth and introduce a few different groups of market participants who can leverage our software to grow their businesses.

Finestel’s Main Services

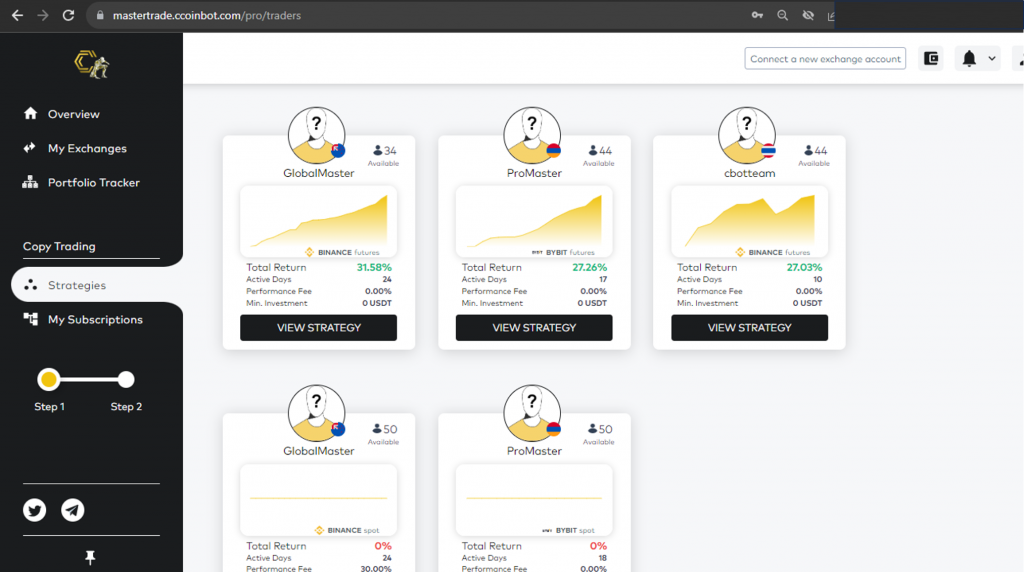

Finestel’s two primary services are copy trading as a bot and white label social copy trading turnkey. Each of these services is useful for a certain group and is distinguished based on some factors, including the number of clients you have.

What Is Finestel’s Copy Trading as a Bot

For traders & money management teams and individuals, Finestel offers a straightforward copy trading software solution as a bot. Clients have the flexibility to manually connect both master and copier exchange accounts to the platform via one single dashboard.

This approach is suitable for businesses with smaller-scale operations and those with a limited number of investors. Finestel’s cutting-edge copy trading bot ensures maximum efficiency and precision with almost instant replication of orders.

Discover more about the top crypto copy trading platforms.

What Is Finestel’s White Label Social Copy Trading Turnkey?

The white label social copy trading turnkey is the ultimate solution for larger crypto asset management businesses. Teams and individuals with a large number of clients are recommended to opt for this service as it provides a comprehensive dashboard, and set of tools & features to manage investor capital and large communities.

Finestel offers you a client-view web application that can be on your domain or our subdomains and presented under your brand. This arms you with a more professional approach and also helps you increase brand awareness and attract serious investors.

The white label social copy trading turnkey is almost completely customizable and specifically designed for large-scale operations. Your clients can easily connect their exchange accounts to the platform using the client-view dashboard and start replicating your executions.

Who Can Benefit the Most from Finestel’s Offerings?

While asset managers can significantly benefit from Finestel’s products, they are not the only client type we have. Other market participants like networkers, KOLs, community managers, and even exchanges and crypto & trading educational institutions utilize our services to launch new business lines, monetize their user base, launch trading competitions and create a social trading platform, and also to facilitate their operations and reduce their costs.

Interested in whether social trading is profitable? Read more about it.

![]()

Let’s see how our clients use our services:

Investment Management Individuals, Teams, and Firms

Finestel’s solutions are tailor-made for investment management individuals, teams, and firms. We offer comprehensive copy trading software, armed with a suite of tools to address the specific challenges that professionals face in the asset management industry.

Finestel empowers investment managers with the means to enhance client engagement, tackle compliance & custody issues, and streamline their operations. With our professional services and innovative solutions, asset managers can stick to their trading and investing activities while we take care of the rest for them.

Crypto Community Managers and Networkers

For crypto community managers and networkers, Finestel provides the game-changing white label social copy trading turnkey solution. This product enables community managers to create their own branded social copy trading platform effortlessly and expand their services while also growing their brand.

Features like portfolio tracking, performance analytics, trading competition, and more customization options enable community managers and networkers to engage with a wider audience, launch new monetization channels, and offer unique services to their clients and followers.

Crypto & Trading Educational Institutions

Educational crypto trading institutions can leverage Finestel’s innovative solutions to expand their offerings. The platform’s insightful data analytics dashboards and automated performance reporting tools provide a great opportunity for educators to create a complementary learning environment for their students and even create trading courses and mentorships hold competitions and offer non-custodial AUM as an incentive/prize. This allows you to develop a distinctive educational service and attract a significant number of clients.

Enterprise Crypto Trading Firms (Exchanges, …)

Enterprise crypto trading firms such as crypto exchanges can also benefit from Finestel’s offerings. We are currently partners with some of the top cryptocurrency exchanges worldwide and facilitate a seamless trading experience for their users.

As a result, we are able to boost their trading volume and consequently, their fee revenue, which is an exchange’s primary income source. We work with exchanges via different models: supporting their exchange on our software, launching their copy trading service on top of our infrastructure, etc..

Partnerships and Supported Exchanges

Finestel consists of an aspiring team of tech and finance experts who are aiming to offer transformative services to the trading industry. Our innovative solutions paired with our professionalism have enabled us to partner with some of the largest A-tier cryptocurrency exchanges in the space.

These exchanges include Binance, which is the most renowned and reliable centralized crypto exchange in the world, as well as other top exchanges like Bybit, KuCoin, and OKX. Traders and investors who have registered accounts with these platforms can easily use Finestel’s services like Binance copy trading, Kucoin copy trading, OKX copy trading, and Bybit copy trading, and much more to grow their businesses and increase their profitability in the cryptocurrency market.

Finestel’s User Journey: A Detailed Overview

To start using Finestel’s services, you should take a journey through our website to register your account and connect your exchange accounts to the copy trading bot or create your own white label copy trading. Detailed instructions are presented below.

Copy Trading as a Service (Bot)

To embark on the Copy Trading journey with Finestel’s Bot service, users first need to register on the platform. Once registered, they will have the opportunity to connect their master trader exchange account manually. This step involves linking their primary trading account to the Finestel software via API. After successfully connecting the master trader exchange account, users can then proceed to connect the investor (copier) exchange account. This is the account where they intend to replicate the trading strategies of the master account.

With both accounts linked, users can navigate to the Copy Trading section. Here, they can choose to copy the master account, initiating the replication process and allowing them to benefit from the trading strategies employed by the master trader. This user-friendly process ensures a smooth journey for smaller-scale clients looking to engage in copy trading using Finestel’s Bot service.

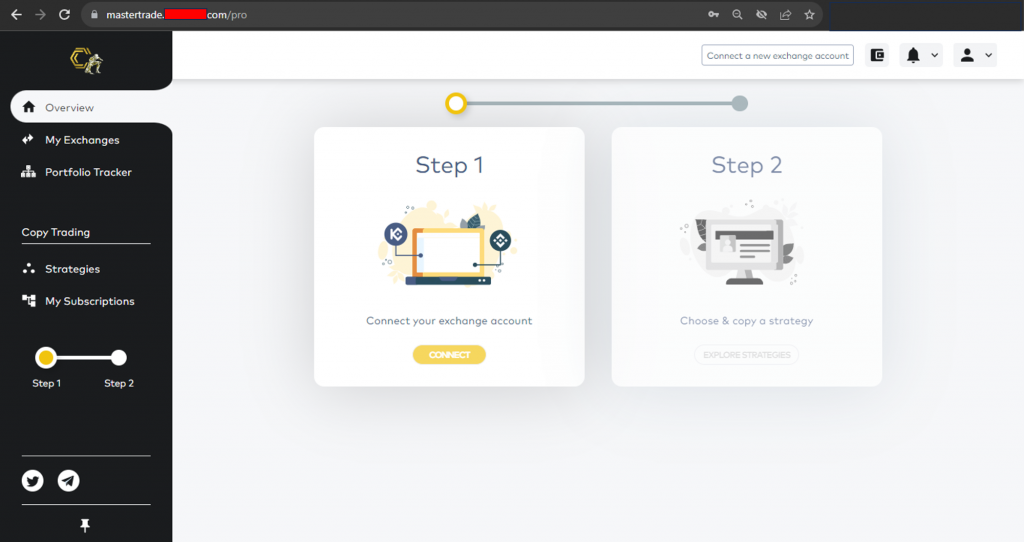

White Label Copy Trading

For those opting for the White Label Copy Trading Turnkey service, once again, the user journey starts with registration on the Finestel platform. After registration, users gain access to a comprehensive client-view dashboard.

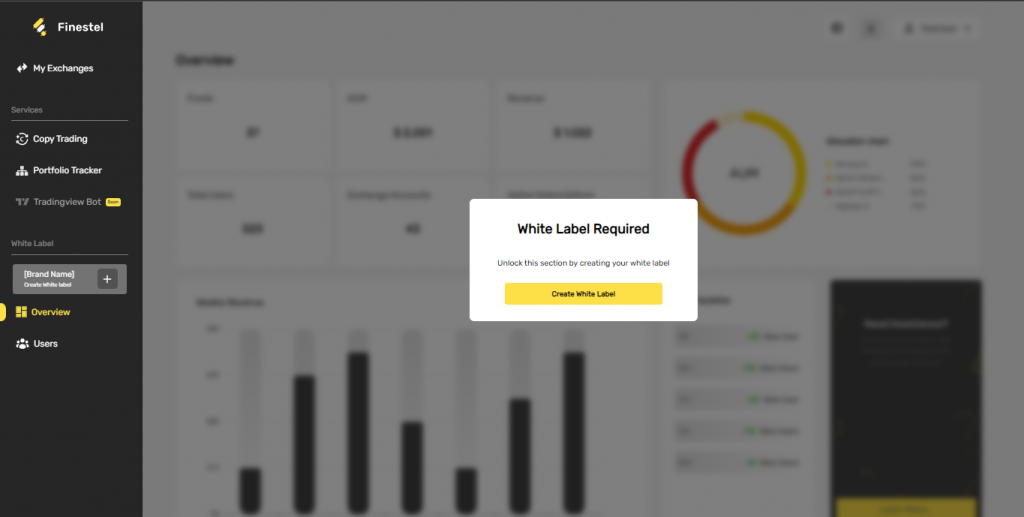

In this dashboard, they can easily connect their exchange accounts to the platform using API. With the master account linked, you should navigate to the platform’s left menu and click on “Create White Label.” This step initiates the process of creating a personalized White Label dashboard. Users should then respond to a series of questions and the White Label dashboard is created after that.

To refine and customize the White Label platform to your specific needs, you should contact Finestel support on any channel. We create dedicated Telegram groups for each white label owner with dedicated support agents to onboard you from the start and along the way. After any necessary adjustments are made, the White Label is ready for use. With a fully operational White Label dashboard, users can seamlessly invite and onboard clients in the front office.

How Finestel Delivers Its White Label Service

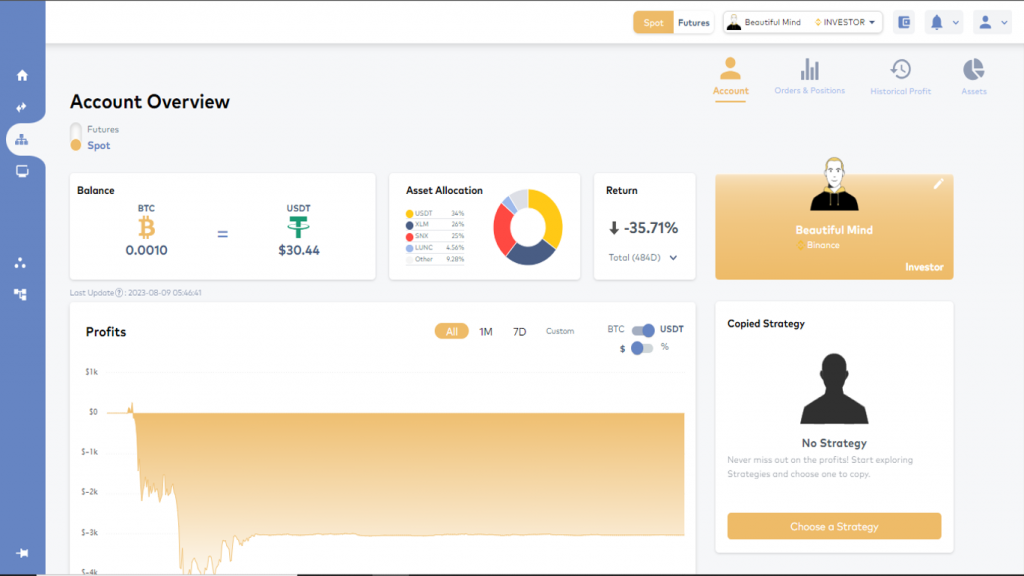

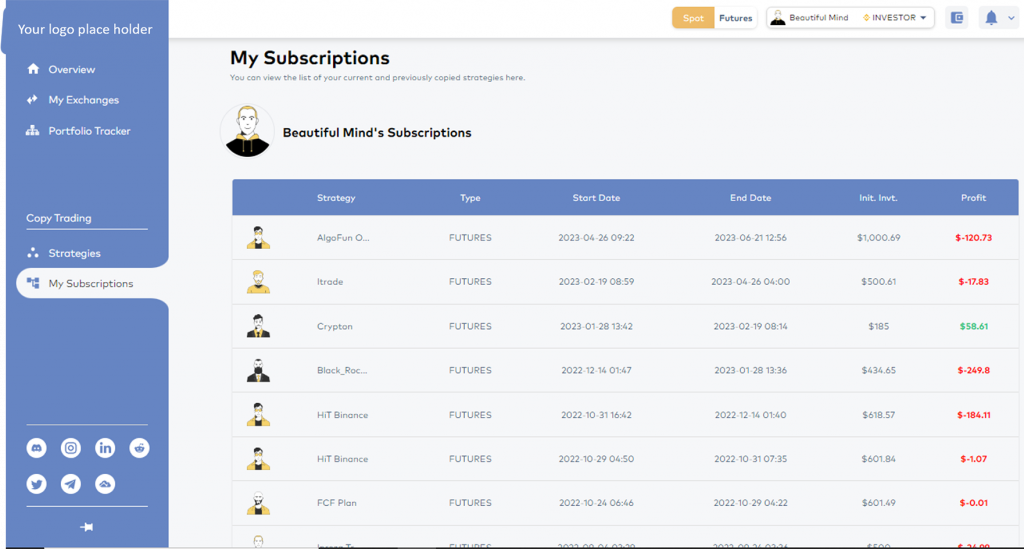

Finestel delivers its premium service under two distinct solutions, the white label front office (client view) and the back office (admin) panel. Each of these solutions has a distinct function and is designed to maximize efficiency and effectiveness.

White Label Front Office

The white label front office from Finestel is the client’s gateway to a seamless, branded social copy trading experience. The client-view dashboard is where the investors will interact with your social copy trading business and sign up. They can connect their exchange accounts and copy your strategies through the dashboard. The front office is completely customized and tailored to your brand & identity.

The professional touch by Finestel ensures that your clients will have no difficulties in accessing your services.

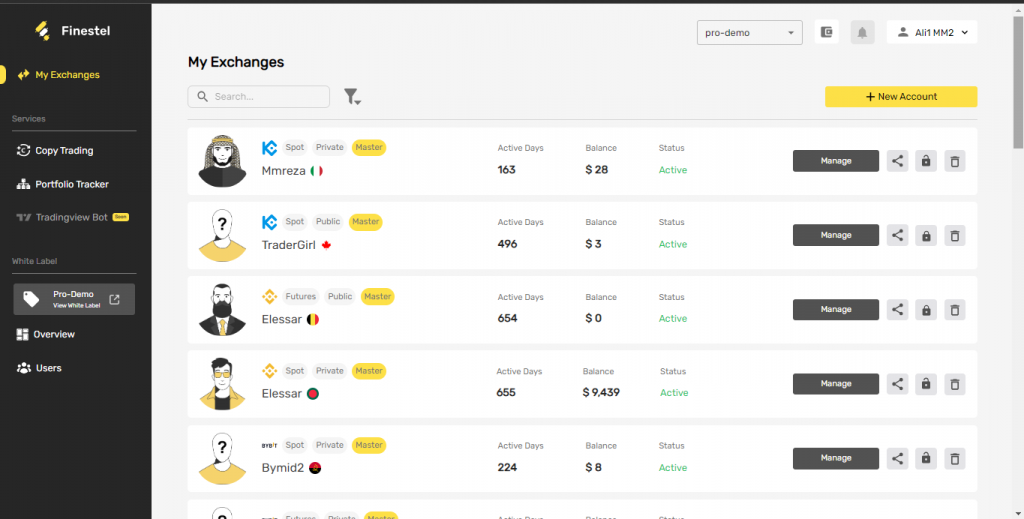

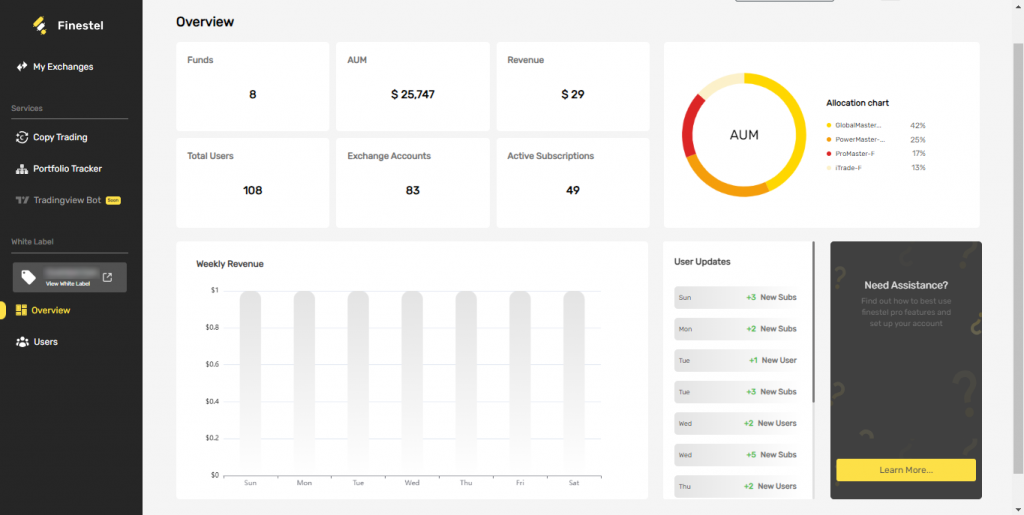

Back Office Solutions

The back office solution offered by Finestel is the admin panel for the white label owners. You can oversee your business operations through the back office dashboard. With a comprehensive suite of tools and features, you will be able to manage every aspect of your social copy trading and asset management business and make informed decisions.

Through the back office, you can take administrative actions, set fees and pricing, monitor clients and portfolios, take care of accounting, and much more.

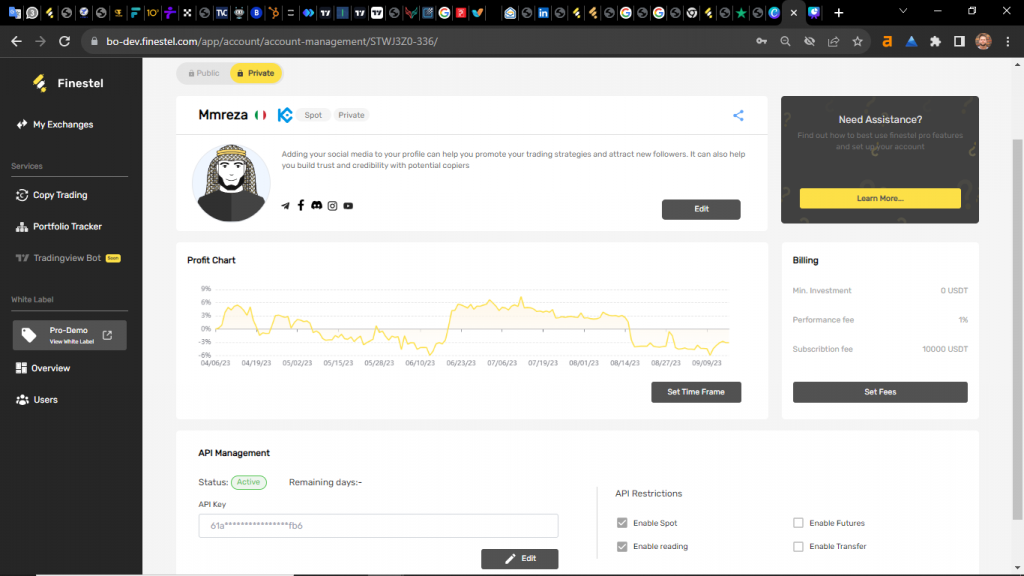

Exploring Finestel’s Back Office Admin Dashboard

As already described, Finestel’s back office AKA admin dashboard is a comprehensive command center. It offers white label owners and master traders an extensive set of tools to efficiently manage the crucial aspects of their copy trading business.

You will have full control over your business operations and track your clients thanks to the useful tools and features we provide on the dashboard. Here are the primary features of the back office panel:

Key Features of the Back Office Admin Dashboard

- Admin Panel for centralized control

- User management tools such as Kick/Ban Users

- Manual order adjustments on clients’ accounts

- Ability to change performance time frames

- Integrated billing and accounting software for seamless financial management

- Detailed account management, including bios and fee structures

- Reporting, portfolio tracking, and an Admin Alert Telegram bot for real-time notifications

- Subscription history charts for tracking user engagement

- Tracking of Profit and Loss (P&L), live positions, and total profit for both masters and copiers

- Full history of copy trading sessions for analysis

- Flexible billing infrastructure supporting both subscription fees and performance fees

- Performance evaluation tools for assessing the effectiveness of trading strategies

- A gifting tool for increasing user engagement

- Integrated crypto wallet for secure and efficient financial transactions (Your client’s payments)

- Much More!

Learn more about how to attract high net worth investors.

Front Office and White Label Customization

The front office (client view dashboard) component of Finestel’s white label is a fully customizable toolbox. It is designed for professional traders and asset managers to create their own branded copy trading business. It also empowers community managers and networkers to create a community of followers that can replicate the strategies onto their exchange accounts. The white label front office includes several tools and customization features:

Front Office Services & Tools:

- Portfolio Tracker: Efficiently track and manage trading portfolios.

- Flexible Payment Methods Infrastructure: Support for crypto payments (and fiat payments soon).

- Branded Telegram Bot: Offering reporting, alerts, and portfolio tracking to clients.

- Performance Analytics: In-depth analysis of trading strategy effectiveness and portfolio performance.

Customization Features:

- Brand Name and Logo: Personalize the platform with your unique branding.

- Front Office Primary & Secondary Colors: Customize the color scheme to match your brand identity.

- Branded Transactional Emails: Maintain client engagement through custom email communications.

- MLM Software: Integrated hyper-customizable multi-lavel-marketing software.

- Custom Sidebar Menus: Improve user experience with personalized menus.

- Custom Chart Theme: Customize chart visuals to your liking.

- Referral/Affiliate Dashboard: Provide clients with tools to engage in affiliate marketing and manage their referrals.

- Reporting & Notification Telegram Bots: Offer real-time updates for both traders and investors.

- Customizable Copy Trading Capacity: Set copier limit for each strategy.

- Custom Domain Address: Choose between a Finestel subdomain or a personal domain for a branded web address.

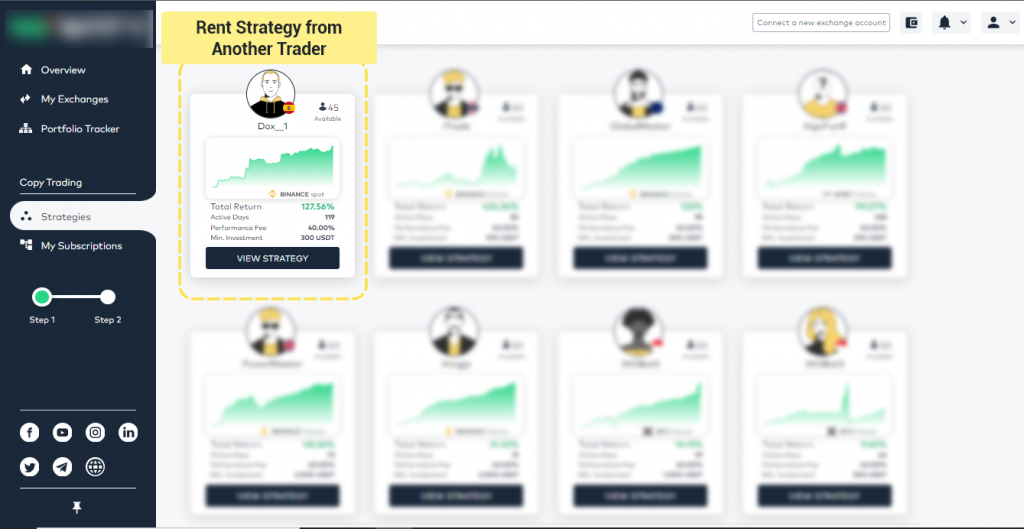

What is Finestel’s Private Strategy Marketplace?

Finestel takes innovation in the crypto trading space to the next level with the introduction of the Private Strategy Marketplace. This cutting-edge service connects skilled crypto traders and white label platform owners seeking profitable strategies to improve their services. The marketplace facilitates the integration of top-performing trading strategies into white label platforms. It brings a new dimension to the trading experience for both platform owners and their clients and offers several benefits.

Key Benefits:

- Access to Diverse Strategies: White label owners gain access to a pool of reliable traders and strategies.

- Platform Expansion: You can enhance your platform’s capabilities and offer a wider variety of traders and strategies to your client base.

- Higher Profit Potential: Clients benefit from increased options and profit potential by selecting from a range of profitable trading strategies. Consequently, White label owners will increase their subscription/performance fee revenue.

Performance Fee Sharing Model:

- Trader Set Fees: Professional traders set their own fee percentage as compensation for sharing their strategies on the marketplace.

- Subscription and Performance Fees: White label owners can charge clients both subscription fees and additional performance fees for each strategy.

- Revenue Sharing: White label owners retain the charged performance fees and share a portion with the original trader, creating a mutually beneficial model.

With the Private Strategy Marketplace, Finestel introduces a win-win-win scenario. White label owners can instantly expand their platform’s trading talent, clients can gain access to a broader range of strategies, and skilled traders can monetize their expertise with a wider audience. This creates a thriving ecosystem for all involved parties.

How the Private Strategy Marketplace Works

Engaging with the Private Strategy Marketplace through Finestel is a straightforward process. Traders have the opportunity to share their successful strategies with multiple white-label owners, who seamlessly integrate these strategies into their platforms. In return, the strategy owner earns performance fees while maintaining the confidentiality of their strategy.

This collaborative approach ensures that everyone involved—strategy providers, white-label owners, and clients—benefits from the arrangement. To get started, all parties need to do is express their interest in this service to Finestel, and we will take care of the entire process.

Finestel’s Game-Changing Telegram Bot

Finestel has developed an innovative crypto Telegram bot that completely transforms the management of crypto trading, investing, copy trading, and signaling operations – all directly within Telegram.

This bot acts as an administrative Swiss army knife that consolidates a suite of vital functions: portfolio tracking, client reporting, broadcast signaling, trade execution, and brand customization.

It thoroughly integrates Telegram as the core operating layer. This eliminates juggling disjointed platforms, sites, and manual spreadsheets. All crucial workflows are now streamlined into Telegram alone – order status, client admin, performance analytics, and more.

Automating these cumbersome tracking and broadcasting tasks ultimately saves hours of daily administrative work. This lets you redirect focus purely into trade strategy analysis and execution at scale. Our pioneering Telegram bot solutions reshape crypto business processes for the 21st century through simplicity, automation, and insight. The future starts now.

Core Benefits Accelerated

★ Regained Time

Stop wasting energy tracking metrics manually. Automate portfolio, order, and user reporting via Telegram instead. This workflow efficiency lets you prioritize high-value trade execution and decision making.

★ Consolidated Console Manage every business operation like client contracts, signaling broadcasts, order mirroring, or branding customization directly in Telegram itself, no longer toggling between various other platforms and sites. Telegram has become the reliable single source of truth.

★ Auto-Piloted Workflows Tedious admin workflows like client onboarding alerts, scheduled exchange portfolio reports and bulk signaling broadcasts run on auto-pilot thanks to deep automation. The focus turns to oversight and optimization.

★ Prominent Brand Presence For white label partners, promote your distinct brand prominently within Telegram via tailored bot interfaces and client interactions fully matching your business style, terminology, and messaging.

Capabilities to Utilize

Customizable Portfolio Reporting: Set scheduled reports on desired metrics across connected exchanges, wallets, and accounts – including ROI, volume, margins, and more trading analytics.

Enhanced Client Oversight: The administrative dashboard centralizes all user subscription status, signups, cancellations, billing events, and account changes with alerts.

Streamlined Signal Management: Pre-configure signal templates for easy editing. Broadcast customized signals out to channels in one click, saving hours of manual work.

Simplified Trade Execution: As an admin, execute trades directly on connected exchange accounts via Telegram. Clients mirror orders automatically for seamless unified flows.

Tailored Bot Experience: For white label users, customize Telegram bot with your business name, brand style and terminology for consistent client interactions.

How Does Finestel’s Affiliate Program Work?

Finestel’s affiliate marketing plan offers a great opportunity to individuals who are looking for a passive income stream through recurring, subscription-based referrals. Affiliate marketers or referrers will have access to a comprehensive dashboard that presents them with their referral link’s performance metrics. As an affiliate, you can track visits, clicks, and sign-ups made via your link and closely monitor your affiliate income.

Moreover, Finestel’s affiliate program includes an exceptional 50% affiliate commission. Since Finestel’s services are subscription-based, you will earn this 50% commission as long as your invitees renew their subscriptions.

To illustrate further, consider this example. As a referrer, you invite 10 users to Finestel’s business plan, which is priced at $199 per month. So, you will earn a whopping 50% commission for each invite, and multiplied by 10, it would add up to approximately $1,000 per month. Yet, the benefits do not stop here. Our affiliate program tracks referrals up to the second level. This will allow you to make an additional 10% of the revenue generated by the individuals you invited if they also make referrals themselves. As a result, you can think of Finestel’s affiliate program as a multi-level marketing scheme.

Finestel’s White-Label Affiliate Program

In addition to individual affiliates, Finestel also offers its affiliate program to asset managers, crypto business owners, and community managers through a white-label solution, known as the white-label affiliate program. Utilizing this solution, white-label owners can create and personalize their own multi-level marketing affiliate programs to attract more customers via referrals.

The customization options of the referral program include setting the number of layers, commission rates, and earnings sources such as subscription fees, performance fees, and so on. Furthermore, Affiliates under the white-label program will have access to an affiliate dashboard that is almost identical to what the white-label owner uses. This insightful dashboard empowers affiliates to efficiently track and manage their networks and referrals.

White-label owners can set a specified reward for every new sign-up to be paid to the referrer. Moreover, as a white-label owner, you can set a specific percentage of the subscription fees or even the performance fees for every new copier in the copy trading plan to be paid to the relevant referrer. Note that you can set up to 8 levels of referees to create your own multi-level marketing program.

Ready to Get Started with Finestel?

We are committed to helping you push Finestel to its full potential and love to talk to you in person. Book a meeting here with our partnership managers or contact us on Telegram and we will guide you on how we can collaborate and form partnerships.

Finestel was born from years of practical operations and experiences performed by numerous crypto traders, portfolio managers, and financial market experts. Our platform is developed to be fully customizable. Therefore, we kindly ask you to share your needs and requirements with us as it will make Finestel even better. As a result, we will be able to serve you and the industry even more.

Leave a Reply