What are the chances of buying a cryptocurrency randomly and making a profit? The answer to this question reveals two facts: 1. You are a gambler, or you have windfall money, or 2. You think the odds of a random profit are hardly any. If you seek indicators, plan, stop-loss, position size, and risk management, to name a few, you have a crypto trading strategy. A crypto trading strategy is a method or plan you use as a trader for making trades. So why do you need a crypto trading strategy? The volatility and unpredictability nature of the crypto market is the answer. However, there are many strategies, and we will elaborate on the best crypto trading strategies.

In this post on Finestel, we will elaborate on the best crypto trading strategies and the features each provides to traders. In addition, for the reader’s convenience, the strategies are divided between pro and novice traders. Also, we have concluded from which perspective these strategies can be the best, like riskier, more profitable, and more technical crypto trading strategies. By reading this detailed analysis, traders can identify which strategy suits them most and which strategies they should avoid.

What Is a Crypto Trading Strategy?

Simply put, a crypto trading strategy is a set of rules, techniques, and plans for buying, selling, and holding cryptocurrencies. Exploring at a deeper level, the basic principle of trading in all markets is to buy low and sell high to profit from the price difference.

Now, let’s suppose you want to buy a coin or token. The first question is, which coin should I buy? The answer to this question is a strategy called fundamental analysis. Then, how much should I buy, and what should I do if I lose money? This unveils the truth that traders need a strategy to manage the risks in the market. To conclude, we can say that a crypto trading strategy is a systematic approach to trading that helps traders identify opportunities, manage risk, and maximize profits.

Crypto Trading Strategy Types for Experienced Traders

As mentioned earlier, the practice of buying and selling a cryptocurrency requires knowledge and expertise. Moreover, the story does not end here; for experienced traders, it is more comprehensive and intricate. Experienced traders’ strategies require understanding markets like derivatives and market-making trading and trading dynamics like algorithmic and high-frequency trading. Here, we have provided an overview of most cryptocurrency strategies for experienced traders and beginners.

Algorithmic Trading

In an audacious assertion published in ELSEVIER by Robert Kissell, he found that “trading algorithms rather than humans perform 92% of trading in the Forex market“. So why is algorithmic trading advancing rapidly? The reason is the applications of advanced statistics, optimization, and machine learning techniques. Exploring further, from a technical standpoint, algorithmic trading uses algorithms to automate trading decisions like entry and exit points, position sizing, and volume.

find more information about autotrading on TradingView.

Regarding usage, algorithmic trading is widely adopted by hedge funds, investment banks, and pension funds, where executing larger orders is widely practiced. Methodically, algorithmic trading sets rules in a programming language for defining trade goals, controlling risks, and generating news stories to cite some. Hence, traders use historical and real-time market data to develop patterns and correlations for market analysis. Also, traders connect algorithms to trading platforms by using APIs to enable positions automatically.

Concerning profitability, the critical point in algorithmic trading is identifying profitable opportunities like price movements, technical indicators, and market trends. As for the functions, algorithmic trading generates trade signals, order placement, and real-time market data analysis. Regarding risks, algorithmic trading is liable to technological failures like connectivity issues, inaccurate data, and cyber threats. In conclusion, algo trading carries risks related to market movements and technical vulnerabilities, and traders must be aware of these risks and implement risk management practices.

High-Frequency Trading (HFT)

A method of trading that uses complex algorithms using computer programs for the execution of a large number of orders. High-frequency trading was first utilized by exchanges to supply liquidity; however, as time passed, it became a trading strategy. Here, we provide some features of high-frequency trading in detail.

- Order execution: orders executed by HFT are low latency and fast.

- Trade volumes: HFT enables a large number of trades in a matter of microseconds.

- Market making: HFT firms use this strategy for a continuous bid and ask quotes and provide liquidity to the market.

- Algorithms: HFT firms use sophisticated algorithms to analyze market data and identify patterns.

What was mentioned was a brief overview of High-frequency trading. However, many critics question the fairness of this strategy and state that HFT provides non-realistic liquidity to the market.

Concerning profitability, high-frequency trading mostly relies on small price discrepancies and exploits market inefficiencies to achieve profitable returns. In terms of risks, this trading strategy deals with market fluctuations, which can lead to potential losses. Also, traders or firms that use high-frequency trading must consider legal and operational risks. With respect to usage, HFT is usually employed by institutional investors, hedge funds, and propriety trading firms. Finally, HFT generates profits by leveraging speed and advanced algorithms, requiring sophisticated technology and expertise to succeed.

Derivatives Trading

A derivative is an investment that derives its value based on an underlying asset. For example, opening a future contract and speculating on the future price movement of an asset is called derivative trading. Here we provided the readers with different types and concepts of derivatives trading strategies.

Types of derivatives

- Future contracts: when a buyer or seller opens a position with a predetermined price.

- Contract for difference (CFD): speculation on the price movements of an asset.

- Options contracts: when a buyer and seller are given the right to buy or sell an asset.

Concepts of derivative

- Hedging: using hedging as a form of insurance to control price fluctuations.

- Leverage: traders can use leverage in derivatives where buying with a smaller amount and larger position is possible

- Long and short positions: using long positions expecting the price rise and short positions expecting the price fall.

In relation to profitability, traders first speculate on derivative contracts like options or futures, then utilize leverage to amplify potential profits. Regarding risks, derivatives trading carries market and liquidity risks due to leverage and high market volatility. Touching on usage, individuals generally use derivative instruments to generate income through options trading and futures contracts. Finally, derivative trading is a widely used trading strategy that individuals and market participants use for their diverse functions and benefits.

Quantitative Trading

It is a trading strategy using mathematical computations and processing numerical data to identify trading opportunities. The data inputs or the numerical data are mostly price and volume. The traders using quant trading must be familiar with data analysis approaches like data extraction, cleaning, and processing techniques. Moreover, quant traders back-test data in multiple trading scenarios to identify the most profitable trading patterns. Also, quantitative trading eliminates emotional decision-making where emotion has no space in mathematical models.

Regarding usage, quant trading is mainly used by financial institutions and hedge fund firms. However, for individuals they can connect their algorithms to trading platforms and exchanges using APIs. Finally, quantitative trading uses a large amount of data extracted from real-time and historical market data to execute trades with high precision automatically.

Like other trading strategies, quantitative trading’s profitability depends on strategy effectiveness, market conditions, and implementation costs. Concerning risks, quantitative trading deals with execution and model risks and potential inaccuracies and errors of these models. Since quantitative trading reduces human biases, this strategy is used by banks and institutional investors. In conclusion, quantitative trading finds extensive usage among different market participants, providing systematic approaches to trading and enhancing overall trading performance.

Market Making

Market making is a trading strategy that uses order books to capture the price difference between asks and bids. In a market-making strategy, the algorithm extracts the data to detect order imbalances to find informed traders. However, there are yet some regulations that market makers should abide like minimum quoting requirements and bid-ask spreads. In addition, market makers use statistical models to estimate risk exposure, and this is due to imbalances in buy and sell orders.

Moreover, technology is prevalent in market making, and market makers use trading algorithms to analyze data and adjust quotes. After doing all these measures, a question may arise here: how market-making strategy leads to profit? So the profitability of market making is derived from the bid-ask measure where the trading volume is high, and the profit is small but consistent.

As for profitability, the profit stream in market making depends on the bid-ask spread and providing liquidity to financial markets. Also, the risks involved in the market pertain to price fluctuations at the desired prices. Regarding usage, market-maker firms and brokerage firms use market-making strategies to maintain liquidity and orderly trading in financial markets. Finally, market makers play a critical function in maintaining market efficiency, and their usage is widespread across different financial markets and instruments.

Copy Trading

Copy trading is an investment strategy where investors can automatically copy other traders’ positions and orders. What makes copy trading distinct from social and mirror trading is the exact replication of the trader’s orders like position, stop-loss, and take-profit, to name a few. Here, we provided a list of what you should know about copy trading.

- It is believed that copy trading is a subcategory of social trading.

- Copy trading works well with novice investors and professional traders.

- The process of selecting a trader is both manual and automatic.

- Check if the trader’s risk management strategy is suitable for your capital.

- The time frames traders use may vary depending on their strategy, like daily and weekly.

- Investors can back-test different strategies by following multiple traders.

Professional traders who need to reap gain walk novice investors, and the profit stream is mostly performance fees. However, professional traders’ movements and trades can damage their credibility since they are available to everyone in the market.

In terms of profitability, copy trading allows individuals and investors to replicate the trades of successful traders. Also, the traders receive a commission and performance fee based on the profit the investor gains. With respect to risks, investors should have an in-depth overview of who they are following and accessing their risk management records. Finally, irrespective of whether you are an investor or trader, copy trading is a win-win strategy. However, not knowing the basics and techniques of entering this market can cause traders’ and investors’ capital loss.

Day Trading

As the name may suggest, day trading is a trading strategy for short-term traders who seek to open and close positions in one day. It is wise to say that trading started with day trading when the internet was not alive, and there were trading houses. Day trading strategy uses market conditions and fluctuations to profit. However, traders who use day trading must be highly skilled in technical analysis and emotional factors.

Going further, day traders actively monitor the market, which could be a miserable task for many individuals. In addition, day traders use high-frequency trading, news-based trading, and range trading techniques. Speaking of disadvantages, due to human’s instant gratification thirst, day trading is prone to scams, and they can easily deceive amateurs. The prerequisites to be a day trader are having in-depth knowledge, sufficient capital, and discipline.

Regarding profitability, day trading takes advantage of short-term and intraday price fluctuations. Besides, several risks are associated with this strategy, like liquidity, market, and psychological risks, together with constant market monitoring. In terms of usage, day trading is smaller in scope, where the traders usually trade from home or small offices. Finally, day trading normally deals with small individuals who trade on the same day, and accordingly, the risks and profits are small.

Swing Trading

Unlike day trading, we cannot suggest the meaning based on the name. Swing trading is a strategy grounded on market swings in the short to medium term. Swing traders use technical analysis to determine when to open a position. After opening a position, they determine the exit points no matter how long it takes to get there. Hence, swing trading requires more expertise than day trading since the traders must identify the trends.

Moreover, swing traders use moving average crossovers, head and shoulder patterns, and flags in their trading strategy. In addition, swing traders use risk/reward to assess trades, and this will indicate where they enter or where to place a stop-loss order. However, swing trading still has some drawbacks where traders may lose short-term profits due to having a long-term perspective and analysis.

As for profit, swing trading focuses on price movements and the profits generated by capturing price swings and trends. In terms of risk, market volatility, timing, and market risks are prevalent, and traders must identify when to enter a position and when to close the position. Regarding usage, this strategy is used by both individuals and institutional bodies, especially those who lack time to constantly monitor the market. Finally, swing trading focuses on price fluctuation other than timing and individuals and institute can profit from this market type.

Scalping

Like swing trading, scalping is a trading strategy that seeks to capture and profit from price movements. However, the key difference is the time frame, where scalping is a trading strategy that happens in minutes or seconds. In addition, the scalping strategy is ample in size and low in profit; traders open multiple positions and capture the small profits resulting from the bid-ask spread.

Also, scalpers use range trading, leverage, and arbitrage trading tools to harvest profit. Speaking of advantages, scalping, especially in the crypto market, offers more opportunities for traders to reap gains due to volatility. Also, scalping is less prone to adverse market events since they open and close their positions in minutes and seconds. Regarding disadvantages, scalping is time-consuming, and it requires constant market monitoring. Also, the experts warn that opening multiple orders cause transaction fees, and this can eat into profit.

Scalpers target small and quick trades, and the profit stream is by accumulation of numerous trades during a trading session. As for risks in this strategy, transaction costs and rapid market fluctuations can result in losses since scalpers operate in a fast-paced environment. Concerning usage, day traders, algorithmic traders, and other active traders use a scalping strategy. Finally, scalping is a highly fast-paced strategy, and traders take advantage of differences in prices.

The Best Crypto Trading Strategies for Experienced Traders

Hitherto, we mentioned some crypto trading strategies for experienced traders; however, let’s delve into more details and see why they suit experienced traders. The reason is that these strategies require profound aptitudes, like risk management regimes, constant monitoring, and robust skills in the market. After doing thorough research, we identified the best trading strategies depending on the features they offer. Concerning risks in the market, derivative trading, high-frequency trading, and scalping are riskier than other strategies.

Also, the following strategies require an in-depth understanding of technical analysis, High-Frequency Trading, algorithmic trading, and quantitative trading. Furthermore, algorithmic trading, High-Frequency Trading (HFT), and quantitative trading are commonly considered profitable strategies. Please note that what was mentioned was just an overall analysis of features, and they are prone to change from person to person and strategy to strategy.

Crypto Trading Strategies for Beginners

Exploring the world of cryptocurrency trading as a beginner can be both exciting and daunting. With numerous strategies available, finding the right approach can seem overwhelming. However, there are several factors that beginners must consider before addressing the strategies.

First, research in the crypto market is essential, and research takes time; however, remember that time is gold, and you are securing profit. Then, keep in mind that, unlike other markets like FOREX, the crypto market is highly volatile, and you may lose your capital in hours and days. Remember the %99 drops of LUNA in hours.

Afterwards, remember that the crypto market is highly technological, and keep your passwords and key phrases secure. Finally, be familiar with events and news and follow the community forums to gain insight into this market. After addressing some basic challenges and key points that beginners should know, let’s probe some beginner-friendly strategies.

Hodl

The term ‘HODL’ is a misspelling of the term ‘HOLD’ that took form in a Bitcoin forum post in 2013. The simple connotation of this word is the idea of not selling when the market is in a downtrend. The term is a mantra apart from a trading strategy in stark contrast to FOMO (Fear of Missing Out) and FUD (Fear, Uncertainty, and Doubt). Expanding on that, there are several factors that hodling is now a strategy aside from a philosophy.

First, hodling is a long-term investment with the anticipation that the coin’s value will increase over time. Then, it is simple and straightforward, where novice traders are not required to monitor the market constantly. Finally, hodling involves fewer transactions, and this can help reduce transaction costs. Overall, do not forget the Bitcoin price was $4 in 2011.

Regarding profitability, hodling is a long-term strategy, and it depends on the overall market conditions, where regulations are still inconsistent. Furthermore, speaking of the risks, since hodling is a long-term strategy, it is one of the low-risk strategies currently available. In terms of usage, it is mostly used by cryptocurrency enthusiasts and maximalists who believe that blockchain technology will never fail. Finally, hodling is a sound and low-risk trading strategy that is mostly an investment type and traders or, let’s say hodler’s believe they are finally the winners in this market.

Position Trading

Unlike day trading, seeking quick gains, position trading is the practice of holding a trading position for weeks or months to achieve profit. Position traders mostly rely on fundamental analysis and track movements made by fundamental factors. However, position traders use technical strategy to identify a long-term asset price trend together with volume. Considering risks, let’s suppose a sudden change happens in trend; if the trader cannot gauge it, they will lose their capital. Digging deeper, as stop losses are wider in position trading, the traders are prone to higher losses in case of mistakes. On the other hand, position traders can identify big price movements of an asset as they are experts in doing so. Hence, position trading can be both profitable or incurring losses, and trader should analyze past data and derive patterns.

In terms of profit, position trading is a long-term trading strategy where significant price movements generate the profit stream. Also, the risks associated with this strategy stem from timing factors, market fluctuations, and price gaps. Pertaining to usage, traders with a long-term perspective and those with a less active approach benefit from this strategy. Finally, position trading focuses on long-term profitability, where traders take advantage of price movements.

Dollar-cost averaging (DCA)

With its straightforward principles, Dollar-cost averaging (DCA) is a strategy that investors steadily build their portfolios regardless of short-term market volatility. The best example is a 401(k) plan for retirement, where employees regularly invest regardless of the amount. This approach allows investors to accumulate assets over time regardless of short-term market volatility.

In addition, DCA is also psychologically effective, promoting disciplined and consistent investing, where monitoring of market and downtrends is missing. On the contrary, DCA can incur losses, where the traders will miss the opportunities for significant gains if prices rise rapidly. Regarding usage, it suits traders seeking investment in a stress-free situation and those who prefer automatic investing over regular intervals. Overall, Dollar-cost averaging (DCA) can lower the average amount traders spend on investments, and it suits traders who seek to build wealth over time.

In reference to profitability, DCA investors profit from consistency, and the time and market condition factor is ignored. In terms of risks, it is wise to say that DCA is a low-risk strategy; however, if the value of investments fluctuates greatly, they can lose capital. In reference to usage, DCA is mostly used for retirement plans, and the 401(k) retirement plan in the USA best serves as an example. Finally, dollar-cost averaging generates profit by consistently investing a fixed amount over time and is widely used by long-term investors.

Auto Trading

With its ability to remove human emotions and execute trades based on predefined parameters, auto trading is an approach to buying and selling currencies automatically. Auto trading uses a computer program that monitors the market movements and trades at the optimum moment. The factors that programmers use to develop an auto trading program are as follows:

- Designing effective trading strategies: creating algorithms and rules to analyze market data, identify trading opportunities, and execute trades based on predefined criteria.

- Optimizing performance: programmers fine-tune the code, improve execution speed, minimize latency, and maximize efficiency.

- Customization: providing configurable settings that allow traders to personalize the program according to their preferred trading styles, risk tolerance, and investment goals.

Auto trading enables traders to minimize their emotions and the opportunity for back-testing and preserving discipline. However, that could not be the case for many traders since the start-up and maintenance costs may only be affordable for some.

With respect to profitability, auto trading resembles algorithmic trading, and the revenue stream stems from pre-defined strategies. Also, since auto-trading is a technical trading strategy, the risks are mostly associated with system or strategy failures. Speaking of the usage, auto trading is utilized by both individual and institutional investors and traders. Finally, auto-trading, depending on the rules, generate profits based on pre-defined algorithms while minimizing human biases and emotional influences.

Trend Trading

In the trading world, where timing is crucial, trend trading provides a systematic framework for traders to enter and exit positions based on prevailing market trends. Uptrend and downtrend are the moment’s trend trading strategy taken advantage of. It works when the price is about to make new highs or lows. Technically, trend traders use trend lines, moving averages, and other indicators to identify the price direction.

A great example of trend trading is using the Relative Strength Index (RSI) indicator since this indicator shows overall uptrends and downtrends. In addition, trend traders use Moving Average Convergence Divergence (MACD) as a confirmation signal to validate their entry or exit points. To conclude, trend traders can succeed if they identify price highs and lows using technical analysis techniques.

The profit stream in trend trading stems from identifying and capitalizing on sustained price trends in the financial markets. Also, the risks associated with this strategy pertain to trend reversal, breakouts, and market volatility. In reference to usage, trend trading is utilized by short-term and long-term traders in most markets like stocks, forex, and cryptocurrency. Finally, trend trading, aiming to capitalize on sustained price trends, provides traders with a systematic approach to profit from market movements in the desired direction.

News-Based Trading

News trading, a strategy widely employed in financial markets, revolves around the timely analysis and interpretation of economic, political, and social events that impact the market. Regardless of your trading strategy, the news is an important indicator in all markets. Diving deeper, we have provided a list of features associated with news-based trading.

- Market and news: most markets react to news and events that cause market volatility.

- Sources: news-based traders must be aware of fake news and rely on authentic and governmental resources.

- Fundamental analysis: news-based trading incorporates fundamental analysis, especially analyzing underlying factors that drive the news.

- Timeline: news trading deals with economic calendars, and quick decision-making is crucial.

- Impact analysis: news-based traders analyze similar events, market expectations, and historical data to inspect how they impact price.

In terms of profitability, news-based trading aims to generate profitability by leveraging market reactions to significant news events. As for risks, traders are prone to receive fake news, and their interpretation may not be accurate, leading to potential losses. Per the usage, news-based trading is utilized by both individual traders and institutional bodies focusing on fundamental analysis. Finally, news-based trading provides traders with an opportunity to capitalize on the impact of significant news events, leveraging market reactions for potential profitability.

Arbitrage

When it comes to arbitrage trading strategies, the key point lies in identifying imbalances that exist within financial markets. The arbitrage trader buys and sells the same assets at different markets to reap gains resulting from price differences. Here, we provided the key metrics attributed to arbitrage trading.

- Price differences: the arbitrage trader looks for the price difference in two or more markets.

- Arbitrage types: there are various types of arbitrage trading, like spatial, temporal, and statistical arbitrage trading.

- Merging: arbitrage traders usually seek corporate mergers or events to profit from price discrepancies.

- Regulations: arbitrage strategies must be aware of legal requirements and trading regulations since arbitrage can be identified as market manipulation.

Arbitrage trading is more of a research-based strategy, and the traders must find multiple markets or exchanges with costs involved.

With respect to profitability, arbitrage is yet another strategy that takes advantage of price inefficiencies across different markets. Also, one of the risks associated with this strategy is the regulations and constraints implemented by external factors in the market. As for usage, arbitrage is mostly used by professional traders, hedge funds, and financial institutions. Finally, arbitrage provides traders with an opportunity to profit from temporary price differences, leveraging market inefficiencies and swift execution to capitalize on profits.

ICO investing

As the name suggests, ICO investing is instead an investment type than a trading strategy. ICO is participating in the fundraising process of a cryptocurrency project by purchasing newly issued tokens or coins. What are the key points that traders should be aware of?

- Whitepaper: the initiative to participate in ICO is reading the whitepaper to access the team behind the project, their track record, roadmap, and technology.

- Value in the market: as there are multiple token types, identify the value they propose to the market.

- Token allocation: before investing in a project, determine the number of tokens in articulation or possessed by the business owner.

- Portfolio diversification: ICO investors should know how much they should invest since it can help them manage risk or potential returns.

Remember that ICO requires careful consideration and research, and it can reap gains or diminish your capital.

As for profitability, ICO aims to generate profitability by participating in the early stages of blockchain-based projects, and a successful investment can lead to significant returns. Also, the risks mostly pertain to the project viability and market volatility, and some projects may fail to deliver their promised outcomes. In reference to usage, ICOs attract investors interested in supporting innovative concepts and technologies. ICO investing provides a way for investors to participate in the early stages of blockchain projects, offering the potential for significant returns.

Copy Trading

In the previous part, we mentioned copy trading strategy for experienced traders; here, we elaborate on how beginners can benefit from copy trading. As mentioned before, copy trading is the practice of replicating traders’ orders by investors. The issue that arises here is how beginners can benefit from copy trading.

- Learning opportunity: beginner investors can observe and learn from the strategies and decisions of experienced traders.

- Diversification: beginner investors can choose multiple traders to follow and check which trader’s strategies suits them most.

- Risk management: beginner investors learn stop-loss orders and other risk management strategies.

- Discipline: since beginners are prone to make emotional decisions, copy trading helps them to learn more about rational decision-making.

- Passive income: beginner investors can learn and profit from trades by replicating the trades of experienced traders.

With regard to profitability, depending you are an investor or trader, you can gain profit by copying successful traders or performance fees for traders. In relation to risks, investors can lose capital by copying low-skilled traders, and traders may lose their credibility as a consequence. As of usage, many novice traders use this strategy to learn from professional traders, and professional traders use it to profit from commission fees. Finally, copy trading provides a platform for investors to benefit from the success of experienced traders, simplifying the investment process and potentially enhancing profitability.

Social Trading

By creating a collaborative environment, social trading has revolutionized how people approach investing, where traders can learn and replicate successful strategies. Furthermore, social trading is a subcategory of social media where traders and investors share insight and strategies, and others can use them to make a profit. Here are the key points that a beginner trader and investor should know before using social trading.

- Social trading is a valuable learning opportunity, and beginners can gain insight into the market.

- Social trading enables novice traders and investors to connect with experienced traders when they seek advice.

- Beginner traders should consider the fact that relying on others can prolong their entry into the market.

- You can lose your capital by following a trader, which contrasts with your risk management system.

- The available information on social trading platforms is overwhelming, and it can be challenging for novice traders.

The profitability in social trading stems from leveraging the wisdom of the crowd and participating in communities to benefit from collective knowledge. However, the main point that makes this strategy risky is the inaccurate and overwhelming information that is unreliable or unsuitable. Regarding usage, novice investors and individuals seeking to learn from others participate in this strategy type. Finally, social trading creates an ecosystem where investors can tap into the collective wisdom of traders, fostering knowledge-sharing and potential profitability.

The Best Crypto Trading Strategies for Beginners

As you already witnessed, trading strategies that beginners can benefit from require less effort and hardly any in some cases, like hodling. Usually, questions like best strategies are subjective, and a trader may gain profit using a strategy that others may find useless. Hence we have tried to identify features and mention which strategies are the best of their kind. First, dollar-cost averaging (DCA), holding, and copy trading are often considered more suitable and potentially profitable strategies to start with.

Then, position trading, trend trading, and arbitrage require more technical analysis techniques for beginners due to their focus on market trends and price patterns. Finally, ICO investing, trend trading, and social trading offer learning opportunities for beginners allowing them to understand market dynamics, trends, and social sentiment. Please note that these trading strategies are particularly suitable for beginners due to their simplicity, long-term focus, and potential for learning and growth.

The Best Risk Management Strategies for Crypto Trading

Implementing effective strategies is vital for minimizing losses and maximizing long-term success. Risk management is vital in crypto trading for protecting investments and controlling the volatile nature of the cryptocurrency market. Furthermore, the ways to navigate these strategies mostly depend on the trader’s trading strategies. However, we have tried to mention some general risk management strategies that may suit most traders.

- Stop-Loss Orders: the most common risk management strategy.

- Diversification: traders must avoid putting all the eggs in one basket.

- Take-profit orders: traders should determine where to exit a trade.

- Risk-reward ratio: accessing the risk-reward ratio before entering a trade is crucial for traders.

- Identify risk in the market: highly volatile markets may have high potential risks.

- Capital allocation: allocating a disposable income to ensure it won’t affect your life.

Conclusion

Thus far, we found that having a strategy is crucial for all traders, notwithstanding of which market they are trading. By implementing these proven strategies and continuously honing their skills, traders can navigate the world of crypto trading with confidence and increase their chances of success. In this post, we have tried to thoroughly review the best crypto trading strategies for experienced and beginner traders.

After introducing the ten best strategies for beginners and the ten best strategies for experienced traders, we have elaborated on the features. The features like which one is riskier, more profitable, requires more effort, etc. Furthermore, we have provided the traders with the key factors they must know before using these strategies, like time allocation, who should use it, and why they should use it. Finally, with a solid foundation in these proven strategies and a commitment to continuous learning, traders can embark on the journey to successful crypto trading.

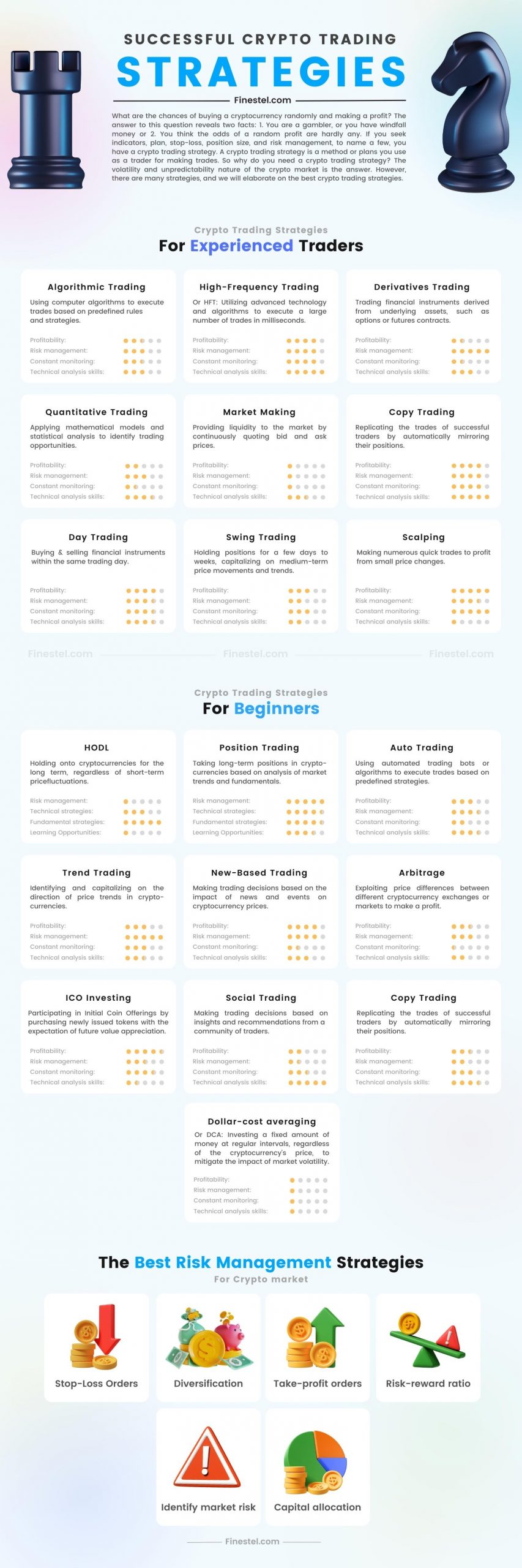

Best Crypto Trading Strategies Infographic

FAQ

What are the key differences between day trading and swing trading in crypto?

The key difference lies in time allocation and price fluctuation. Day trading involves executing multiple trades within a day to take advantage of short-term price fluctuations. On the other hand, swing trading focuses on capturing larger price movements over several days to weeks, allowing for potentially higher profits.

What are the most important risk management strategies in crypto trading?

Risk management strategies in crypto trading mostly depend on a trader’s strategy. However, the most common risk management strategies are stop-loss orders, portfolio diversification, and take-profit targets. In addition, these fundamental risk management principles suit both pro and novice traders.

What is a 1-hour trading strategy in crypto?

A 1-hour trading strategy in crypto involves analyzing price movements and executing trades within one hour. It is mostly a strategy that deals with price movements and takes advantage of market fluctuations. Comparatively, it resembles scalping; however, the time frame for scalping is often within minutes or seconds.

How much can one make a day trading crypto?

While it is naïve to find exact amounts reported in the market, the most common range reported varies from $40 to $100 per day. However, there are still numbers between the two mentioned extremes that may blow your mind, and it is wise to analyze day trading income annually. Since daily income is inconsistent, you may lose $200 and gain $100 another day. Hence, per more reliable resources, a day trader’s profit has been estimated at $113,304 annually.

Is copy trading profitable in crypto?

Copy trading is profitable for both novice investors and experienced traders. By learning passive income and portfolio diversification, novice investors can benefit from copy trading. Experienced traders can benefit from copy trading by receiving performance fees, gaining popularity, and other revenue streams.

Leave a Reply