“Complex adaptive systems” explains Yaniv Altshulter (MIT computer scientist) on social trading. The advent of technology made the impossible possible, which also happened in financial markets. Social trading is an investment or trading strategy that enables traders to observe their peers’ trading behavior and activities. It was in the early 2000s that the Collective platform offered this functionality to traders, and social trading gained momentum no sooner than 2010. However, is social trading profitable and is yet to be proven and researched since it bears some risks.

In this post on Finestel, we have delivered information about social trading and how it differs from copy trading. Afterward, the risks and rewards of this trading strategy have been listed together with common mistakes traders may make. Going further, we dive into maximizing profitability in social trading for novice and pro traders. Finally, we have provided information about who should use social trading and whether it suits them.

Social Copy Trading Definition

Social trading is an investment strategy that enables traders and investors to communicate and analyze trading data to leverage collective wisdom in trading. Traders approach it via online trading platforms, and in this process, individuals observe, analyze, and copy other traders’ trading behaviors and activities.

Furthermore, social trading is a community and a subcategory of social media where the activities mainly include analyzing financial data and comparing trading strategies and techniques. Comparatively, it differs from copy trading, and the difference is in community and interaction, where interaction is missing in copy trading. However, it should also be mentioned that interaction is not the only difference, and we will elaborate on the features in this post.

Does Social Trading Work?

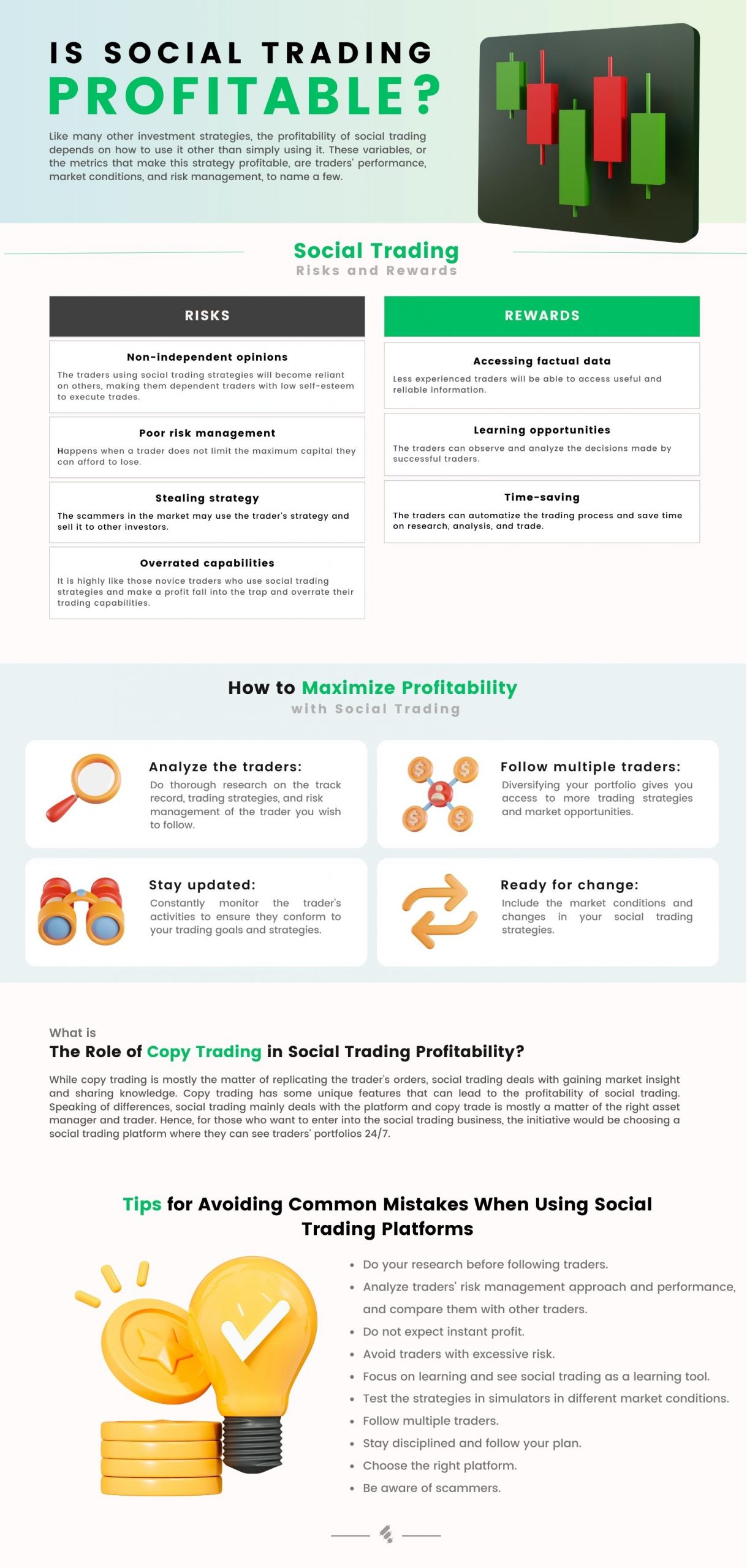

Like many other investment strategies, the profitability of social trading depends on how to use it other than simply using it. There are some variables or metrics that make this strategy profitable, like traders’ and investors’ performance, market conditions, and risk management, to name a few. Also, the emotional factors should be considered as well. For many professional traders, social trading is not what they seek since making the whole community behind them is not easy, and it could damage the trader’s credibility in the market.

Another reason that casts doubt on social trading is similar trades. Imagine you find a strategy profitable; there is no guarantee or measure that you will be the only person who is using this strategy. Hence, similar trades will increase, and as a result, the investors will flood the market, and the strategy will be hackneyed. Overall, both traders and investors should consider the risks before using this trading strategy.

The Risks and Rewards of Social Copy Trading

We have listed some important factors to have an in-depth view of the benefits and risks entailed in this trading strategy type.

Risks of Social Trading:

- Non-independent opinions: The investors using social trading strategies will become reliant on others, making them dependent traders with low self-esteem to execute trades.

- Overrated capabilities: It is highly like those novice investors who use social trading strategies and make a profit fall into the trap and overrate their trading capabilities.

- Poor risk management: It happens when an investor does not limit the maximum capital they can afford to lose.

- Stealing strategy: The scammers in the market may use the trader’s strategy and sell it to other investors.

Rewards of Social Trading:

- Accessing factual data: Less experienced traders can access useful and reliable information.

- Learning opportunities: The investors can observe and analyze the decisions made by successful traders.

- Time-saving: The traders can automatize the trading process and save time on research, analysis, and trade.

Is Social Trading Profitable for Pro Traders?

Pro traders can benefit from social trading in many ways; however, some variables determine profitability. First, the criteria for your strategy should be revealed by platforms. Imagine you follow a trader’s strategy and find it profitable, will you pay again and use it? The answer to this question reveals the fact that a strategy being exposed to investors may lose momentum.

Hence, pro traders must be aware of this fact, and per our research, there are still no guidelines that platforms can use to stop this strategy commonality. Another element that pros should be aware of is the fact that they cannot control the number of investors who are following them. So why should they be aware of that? The reason is that competitors or scammers can easily copy pro traders’ strategy and sell it on social media channels.

However, there are still ways that a professional trader in social trading can make a profit, like risk management systems, portfolio diversification, and strategies to control market volatility. To conclude, we can say that pro traders can make a profit if they follow some basic rules and if only they can manage the risks and responsibilities.

Is Social Trading Profitable for Beginners?

Social trading can be a good choice and profitable for beginners, direct and indirect. By direct, we mean choosing a profitable trader and a transparent and reputed trading platform and copying their traders to make a profit. However, wiser and more tolerant traders do not seek instant profit, and they will approach ways of becoming pro-traders and social trading experts. Social trading enables beginners to learn trading from experienced traders by accessing the trades of successful traders.

The story does not end here, and one of the things that a beginner trader must learn is risk management. Since risk management is more personal, beginners must learn and approach their risk level before copying expert traders. Finally, beginners can make a profit if they do proper research, conduct a risk management approach, and have a learning perspective other than their source of income.

How to Maximize Profitability with Social Trading

To maximize profitability with social trading, there are some items and tips that you must consider:

- Analyze the traders: Do thorough research on the track record, trading strategies, and risk management of the trader you wish to follow.

- Diversification: Diversifying your portfolio gives you access to more trading strategies and market opportunities.

- Do your own research: do research on both fundamental and technical analysis and then conclude who to follow.

- Be aware of the strategy: scalping, hedging, and Fibonacci indicator are the strategies that you should have knowledge of before using social trading.

The Importance of Risk Management in Social Trading Profitability

Risk management in social trading is mostly a personal element that determines a trader’s profitability in social trading. First, the initiative measure that social traders must be aware of is setting appropriate stop-loss orders and position sizes. Then, the traders must maintain a risk-to-reward ratio that meets their risk tolerance, leading to a potential profit. Risk and emotion are two sides of the same coin, and they both are fueled by greed.

However, traders must be aware of impulsive and irrational trading decisions in financial markets, especially in social trading. Finally, by maintaining risk management techniques, a social trader can navigate the loss potentials and ensure long-term profitability.

However, traders must be aware of impulsive and irrational trading decisions in financial markets, especially in social trading. Finally, by maintaining risk management techniques, a social trader can navigate the loss potentials and ensure long-term profitability.

The Role of Copy Trading in Social Trading Profitability

While copy trading is mostly the matter of replicating the trader’s orders, social trading deals with gaining market insight and sharing knowledge. Copy trading has some unique features that can lead to the profitability of social trading. Speaking of differences, social trading mainly deals with the platform and copy trade is mostly a matter of the right asset manager and trader. Hence, for those who want to enter into the social trading business, the initiative would be choosing a social trading platform where they can see traders’ portfolios 24/7.

On the other hand, copy trading is slightly different, and the investors must first choose who to follow. Simply put, they are both investment strategies, and it is wise to say that combining copy trading with personal insights gained in social trading can generate profit.

Which Type of Trading is Most Profitable? Copy Trading or Social Trading?

Copy and social trading are both viable investment strategies with some inherent features. Determining the profitability of each is not possible, as many features affect profitability. We can better answer this question if we draw a comparison of both strategies, then we can better conclude the profitability.

Copy Trading:

- Replicating the trades of successful traders.

- Copy trading better serves professional traders and reduces the strategy commonality.

- Reliance on others is more expected in copy trading.

- Experience and knowledge are less expected.

Social Trading:

- Social trading encompasses copy trading.

- Access to authentic resources and market insights is more expected.

- Social trading is more of a trading tool, and it serves beginner investors.

- Interaction with other traders is possible in social trading.

In conclusion, profitability is not guaranteed on both social and copy trading. However, social trading can be more profitable in the long run since it involves learning too.

Who Is Social Trading Suitable for?

According to the words around this trading strategy, social trading is mainly suitable for beginners. However, by doing more comprehensive research, we will find out that many people still benefit from social trading. First, the individuals who want to start but have limited time and knowledge. The next group are, surprisingly, the professional traders who want to stay connected with the financial market but cannot constantly monitor the market.

However, for these traders, we must issue a warning since scammers may easily steal their strategy. Instead, they can benefit from other social trading capabilities like interaction with other traders or portfolio diversification. The next group are those individuals who seek market knowledge and insight other than instant profit and engage in community discussions. Finally, those investors who lack confidence in their trade and seek validation from other traders.

Tips for Avoiding Common Mistakes When Using Social Trading Platforms

As humans have herd behavior, they may fall into the trap and addressing common mistakes is the best way to refrain from such behaviors. Here we provided some tips for both professional and beginner traders:

- Do your research before following traders.

- Analyze traders’ risk management approach and performance, and compare them with other traders.

- Do not expect instant profit.

- Avoid traders with excessive risk.

- Focus on learning and see social trading as a learning tool.

- Test the strategies in simulators in different market conditions.

- Follow multiple traders.

- Stay disciplined and follow your plan.

- Choose the right platform.

Conclusion

Social trading is another social media type where traders of different financial markets contribute, hoping to profit. Like many other trading strategies, there are both risks and rewards in this trading strategy, like learning opportunities, accessing market insights, and saving time. Additionally, we have answered the question is social trading profitable and found that social trading can be profitable, mostly for beginner traders. However, pro traders are at risk when their strategy loses momentum as a result of commonality. Finally, we elaborated on risk management in social trading and concluded that a poor risk management strategy could damage your portfolio, notwithstanding who and the strategy you follow.

To minimize the risks and losses in social trading, traders must know some facts. These facts are sometimes intrinsic, like self-overrated qualifications, poor risk management strategies, and reliance on others. On the other hand, there are still risks imposed by extrinsic factors like scammers, the platform you choose, and market conditions. To conclude, it is wise to say that to make a profit in social trading; traders must design plans to mitigate the risks and then make a profit.

FAQ

What Are Some Popular Social Trading Platforms?

As mentioned, eToro is the first platform that helped social trading go viral in 2010. Afterward, ZuluTrade was among the forerunners in social trading. Other social trading platforms are NAGA, FXTM, AVA Trade, and Interactive Brokers.

Can I Make Money By Being A Trader That Others Follow On Social Trading Platforms?

Social trading can be a valuable tool for professional traders, but it’s important to carefully consider the risks and benefits before participating. Professional traders should also be aware of the potential downsides, such as lack of control over who copies their trades.

Can Social Trading Be Used For Long-Term Investing?

Social trading is mostly suitable for those who want to learn other than trade. Since they can track the pro trader’s activities, and learning takes time, however, using social trading, in the long run, will bring a steady profit.

Can Social Trading Be Used For Day Trading?

Social trading can be used for day trading; however, like many other trading strategies, traders must research who to follow properly. Additionally, traders must conduct a risk management system that meets their expectations and goals.

Is Social Trading The Same As Copy Trading?

Social trading is an encompassing term, and copy trading is a subset of social trading. While social trading enables users to track the trader’s activities, copy trading replicates the trader’s account.

Leave a Reply