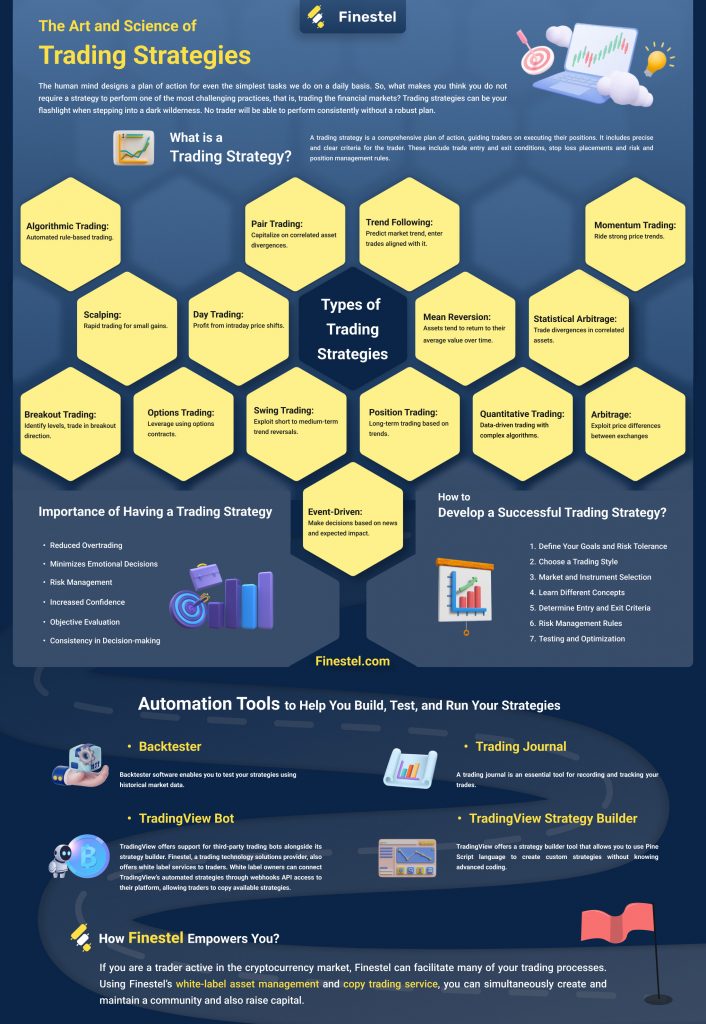

The human mind designs a plan of action for even the simplest tasks we do on a daily basis. So, what makes you think you do not require a strategy to perform one of the most challenging practices, that is, trading the financial markets? Trading strategies can be your flashlight when stepping into a dark wilderness. No trader will be able to perform consistently without a robust plan.

In this article by Finestel, we explore the core concept of a trading strategy or trading plan. By introducing the common types of strategies, their advantages, and their pitfalls, we aim to provide readers with valuable information and help them build their own trading strategies. Moreover, we discuss how one can develop their system from scratch.

What is a Trading Strategy?

A trading strategy is a comprehensive plan of action, that guides traders on executing their positions. It includes precise and clear criteria for the trader. These include trade entry and exit conditions, stop loss placements, and risk and position management rules.

These rules and criteria depend on various things like the personality of the trader, the asset class and instrument being traded, the timeframe, etc.

Importance of Having a Trading Strategy

A reliable trading strategy is one of the main foundations of a successful trading career. Here are a few important of having a strategy:

- Minimizes Emotional Decisions: Real money is at stake in trading, and it also exhibits a significant resemblance to gambling. Therefore, there certainly are many emotions involved when a trader engages with the markets. Having a clear strategy can help you manage your behavior and prevent emotional decision-making.

- Consistency in Decision-making: Trading involves repeating the process of executing based on a fixed trading strategy. This consistency helps you avoid random, arbitrary trading and have a structured approach to the market.

- Risk Management: The most important part of a system is the risk management section. The predetermined rules related to position sizing, stop-loss placement, leverage usage, and setting risk-reward ratios are included in this section. These conditions can ensure your longevity and survival in the market.

- Objective Evaluation: Having a trading strategy allows you to evaluate your performance objectively. Analyzing historical data and tracking your trading results can aid you in optimizing your system.

- Reduced Overtrading: Having no clear, predefined criteria to enter and exit trades, might lead to the most devastating danger that threatens a trader, that is overtrading. Without a structured plan, you would probably execute trades excessively and suffer from numerous losses and considerable transaction costs.

- Increased Confidence: Having a structured, step-by-step roadmap that its performance is backed by historical data, can boost your confidence. This confidence can aid you in overcoming the fear of losing and enable you to execute when the time is right.

Elements of a Trading Strategy

Trading strategies include a few different elements. Here are the essential parts of a comprehensive trading strategy:

- Entry points: Your trading strategy must include clear criteria for setup identification and trade execution. You can base these conditions on a combination of technical, fundamental, and even sentiment analysis.

- Exit points: When you open a position, you should always know when and under what circumstances you must exit or take profits. Your exit might be based on technical analysis or return expectations like achieving a certain amount of profit.

- Stop-loss placement: Stop-losses are protective orders, designed to control the maximum amount you risk in a position. Your trading strategy should involve clear criteria about where you should place your stop-loss order.

- Position sizing: Another key element of the risk management section of your trading strategy is position sizing. You should calculate the suitable volume you wish to enter the market with, based on the amount you are willing to risk.

- Timeframe Preferences: There are different types of traders depending on the timeframes they trade. These involve scalpers, day-trader, swing traders, and position traders, from the lowest timeframe to the highest. Your strategy should mention the type of trader you are and which timeframes you use for analysis and execution.

- Preferred Instrument: You must state the asset classes and instruments you trade, according to the performance your strategy has in different markets.

Types of Trading Strategies

There are numerous different trading strategies that retail traders and even institutional traders use. Each trading strategy has its own characteristics and applications. Here are some of the most common strategies:

- Trend Following: To use the trend following system, you should first determine the likely trend of the market. Then, you would look for trade setups in line with the predicted direction to enter. Note that trend following is suitable for trending phases of the market, not rangebound price action.

- Mean Reversion: Mean reversion strategies are based on the idea that asset prices tend to revert to their average value over a specific period of time. Therefore, you can look for overbought or oversold signals from indicators like the RSI to take advantage of this system.

- Breakout Trading: The first step to trade breakouts is to identify key support and resistance levels. You should then determine whether the price is likely to break past the level. In this case, you can position yourself in line with the breakout and aim to capture the subsequent move.

- Arbitrage: An asset might have different prices in different exchanges. For example, Bitcoin might be slightly more expensive on Coinbase compared to Binance. To perform a basic arbitrage, you can buy Bitcoin cheaper at Coinbase and quickly sell at Binance. Your profit would then be the difference margin.

- Statistical Arbitrage: Statistical arbitrage involves taking positions in negatively correlated assets or taking opposing positions in positively correlated ones. You can utilize this plan when the assets’ prices diverge from their historical correlation.

- Event-Driven: When using an event-driven system, you make your decisions based on the news and economic events and the impact you expect them to have on asset prices.

The strategies we introduced above are just a few of the simplest around. Moreover, even the ones above are only explained briefly. Each of them obviously involves more comprehensive steps to follow.

Factors to Consider When Choosing a Trading Strategy

Every trader should use a unique and best trading strategy for themselves. When choosing your specific system, you should consider several important factors. Here are the most prominent ones:

- Risk Tolerance: You should determine your risk tolerance based on your personality. This would help you determine the amount of capital you are willing to risk in any given position. Depending on whether you are a conservative or aggressive trader, you should select a suitable plan to stick to.

- Time Commitment: Consider how much time you are able to dedicate to trading. If you have sufficient time to monitor the markets constantly, scalping and day trading might be suitable. If not, you should look for a longer-term system.

- Market Conditions: Another one of the determining factors when choosing a trading strategy is the market condition you are going to trade in. Some strategies are best suited to trending markets, and some might perform better in ranging ones.

- Trading Captial: The amount of capital you are trading is also a key consideration you should keep in mind. Some strategies might require larger amounts of capital and some might only be applicable with smaller funds.

- Experience: Your level of experience in the markets is also important. Some more advanced strategies require more experience to utilize. If you lack sufficient experience, stick to simple strategies and try to develop your system over time.

- Psychological Compatibility: Your chosen strategy must be aligned with your personality and your psychological characteristics. For instance, swing or position trading is more suitable for patient people, while quick decision-makers would be better off scalping or day trading.

- Costs and Fees: Some strategies require you to execute with a high frequency. Therefore, they might result in excess amounts of fees and commissions, depending on the brokerage firm or exchange you are working with. Consider these costs when you are choosing your strategy.

How to Develop a Successful Trading Strategy?

Developing a reliable trading strategy requires you to take a few steps. We have broken these steps down below:

- Define Your Goals and Risk Tolerance: In trading, just like any other career, you should set realistic goals regarding your income. You should always determine your risk tolerance which relies heavily on your financial state and personality. These are the first building blocks to construct your strategy.

- Choose a Trading Style: Considering the time you can dedicate to trading and your characteristics, you should then state the trading style you wish to utilize. These styles include scalping, day trading, swing trading, and position trading.

- Market and Instrument Selection: Identify the asset classes you will trade. These instruments include currencies, stocks, commodities, cryptocurrencies, or derivatives of these assets.

- Learn Different Concepts: To create a comprehensive trading plan, you must study different concepts and various aspects of the market. You would then be able to build the analysis part of your plan based on them.

- Determine Entry and Exit Criteria: Determine the exact conditions under which you should execute trades. Also, plan and explain your exit criteria for different scenarios.

- Risk Management Rules: You might use different risk management techniques like fixed stop losses, trailing stops, hedging, etc. Clarify your risk management process, and also determine the portion of your capital you want to risk on your trades.

- Testing and Optimization: Using methods like back-testing, forward-testing, and live trading, you would end up with loads of data and trade results. Analyzing this information can help you constantly optimize and improve your strategy. You would also be able to adapt your strategy to different market conditions.

Importance of Back-Testing

Backtesting is particularly important when it comes to strategy development. To back-test, you should test its performance using historical data. Remember to back-test your plan on the asset classes you wish to trade, as each system produces different results in different markets.

Backtesting helps you evaluate the effectiveness and potential performance of your system, yielding two advantageous outcomes. Firstly, you would be able to make tweaks and identify weaknesses without risking any money. Secondly, it will boost your confidence in following your plan with real funds.

Benefits of Forward Testing

You should also test your system in live markets, utilizing a demo account. These accounts enable you to trade and asses your live trading performance without risking real money. Forward-testing has similar benefits to back-testing, in addition to helping you evaluate how you can trade your strategy in real time.

Common Pitfalls to Avoid

When developing your plan and using methods like back-testing and forward-testing, there are some common pitfalls you should avoid. These include over-optimization, limited sample size, lack of risk management rules, ignoring transaction costs, spread, and slippage, only to name a few.

Psychological Factors in Trading Strategies

To successfully implement your trading strategy in live market conditions, you should consider the trading psychological factors involved. Here are some of the most common factors:

- Emotional Discipline: Trading is a challenging profession, especially during periods of drawdown and losing streaks. Sticking to your trading strategy and risk management rules requires you to maintain emotional discipline at all times.

- Patience: Patience is one of the most important characteristics a trader should possess. Impatience can lead to sub-optimal entries and premature exits, which can, in turn, lead to a decline in performance.

- Overconfidence: Success in a few trades can lead to overconfidence, causing traders to take on higher risks or deviate from their strategy. Always keep yourself and your emotions in check, and try to stay humble.

- Loss Aversion: You may become loss-averse, refusing to exit losing trades in hopes of a turnaround. which can lead to larger losses. Therefore, you should always stick to your trading plan and risk no more than the pre-defined amount

- Greed and Fear: Greed and fear are the basic emotions in trading, and many of the emotional challenges traders encounter are rooted in them. Traders must manage these emotions and prevent them from affecting their actions.

Are There Differences between Crypto, Forex, and Stock Trading Strategies?

Yes, there are clear distinctions between strategies developed for different markets. For instance, market hours are very important in your trading strategy. While crypto is a 24/7 market, Forex and Stock are traded only on weekdays. Volatility is also a determining factor, as highly volatile markets require different systems compared to more stable ones.

You should also consider liquidity when designing a strategy for a specific market. Being able to execute trades or exit them when you should require liquidity. You cannot implement the plan you follow on EUR/USD, which is the most liquid market in the world, on a small cryptocurrency. Market maturity and regulation, news and events affecting the price, and even the trading platforms you should use to trade specific markets are also key determinants.

All of the Automation Tools to Help You Build, Test, and Run Your Strategies

Various automation tools are available to help traders build, test, and run their strategies. Here are some of the popular ones:

Backtester

Backtester software enables you to test your strategies using historical market data. You would then be able to evaluate how the strategy would have performed in the past. This helps you validate the effectiveness of the strategy and identify potential weaknesses.

Trading Journal

A trading journal is an essential tool for recording and tracking your trades. It helps analyze their performance and identify areas for improvement. You can also determine the conditions that your system performs the best and worst, adjusting your risk management criteria for these situations to maximize your returns.

TradingView Strategy Builder

TradingView is the most popular web-based trading platform in the world. They offer a strategy builder tool that allows you to use Pine Script language to create custom strategies without knowing advanced coding. The strategy builder function also enables you to visualize and backtest your system directly on TradingView charts.

TradingView Bot

TradingView offers support for third-party trading bots alongside its strategy builder. These bots apply algorithms to automatically execute trades. By connecting your TradingView account to available brokers, you can trade directly from the platform using these bots and experience auto trading in TradingView. Finestel, a trading technology solutions provider, also offers white label services to traders. White label owners can connect TradingView’s automated strategies through webhooks API access to their platform, allowing traders to copy available strategies.

The Next Steps After Building Trading Strategies

While being the most important factor in your trading career, developing a system is the first step. There are additional steps you should follow to achieve success in the long term.

Raise AUM

Professional traders do not trade their own funds. The next step after creating a profitable system and achieving consistency is to raise capital. Remember to keep a detailed, valid track record of your trades. Investors would request your performance records to decide whether they can delegate their investment management to you.

Making a Community

To promote your brand and introduce your services, you need to build a community. You can establish a website, create social media accounts, and interact with influencers to increase your brand awareness.

How Finestel Empowers You

If you are a trader active in the cryptocurrency market, Finestel can facilitate many of your trading processes. Using Finestel’s white-label asset management and copy trading service, you can simultaneously create and maintain a community and also raise capital.

What is a Trading Strategy? An Infographic

Conclusion

In this article, we defined what a trading strategy is, the advantages of having one, and what the common types are. We analyzed the importance of having a clear plan, emphasizing its importance for success in the long term. Moreover, we introduced essential elements for trading strategy development and explained thoroughly how you can create your own strategy based on your goals and personality. Finally, by stating the next steps in your trading journey, we discussed how Finestel can empower you to raise capital and build a community.

While this article has provided valuable insight for readers, the financial markets are constantly developing. Therefore, discipline and consistency in learning and adapting to changes are crucial. Remember to stay updated with new strategies and the evolution of financial markets, especially the rapidly developing crypto market.

FAQ

What is a trading strategy?

A trading strategy is a systematic plan of action designed to guide an investor or trader in making decisions. It outlines specific rules and criteria that help traders identify potentially profitable opportunities and manage their risk effectively.

How to backtest a trading strategy?

To backtest a trading strategy, historical market data is used to evaluate how the strategy would have performed in the past. Traders can use specialized backtesting software or platforms and even backtest automatically.

What are some of the trading strategies for options?

Some common trading strategies for options are Covered Call, Long Straddle, Long Strangle, Iron Condor, and Bull Put Spread.

What is the 1% risk management strategy in trading?

The 1% risk management strategy in trading involves risking only 1% of your trading capital on any single trade.

What is the 5 3 1 trading strategy?

This strategy involves five currency pairs to focus on, 3 trading strategies to implement, and choosing 1 time in a day to trade.

What is the most profitable trading strategy?

There is no single most profitable trading strategy. Profitability depends on various factors, including market conditions, trader skill, risk tolerance, and the selected strategy’s suitability for specific markets.

That was wonderful! Thanks.