“Crypto Risk management” and general risk management in financial markets is when a person or an entity studies all aspects of an investment. It’s not a strategy but a policy to identify, measure, and assesses to control risk to avoid possible risks of loss ahead. These risks could be financial, legal, strategic, and security risks.

Due to cryptocurrency’s market volatility and other risk factors, investing in this asset class is not risk-free. However, crypto risk management strategies can help minimize these risks. One way to do this is to understand the market and its potential rewards and risks. Market knowledge achieves by educating oneself on the different types of currencies and their properties. Diversifying holdings and practicing proper money management are also essential strategies.

Other essential practices include keeping records and staying up-to-date with the latest crypto developments. Finally, staying informed about the legal and regulatory environment is crucial. The Finstel Academy provides further insight into these strategies and ways to avoid losing all or a part of one’s capital. By following these strategies and practices, investors can better manage the risks of investing in cryptocurrencies.

Risk comes from not knowing what you’re doing.

“Warren Buffett”

What Is Crypto Trading Risk Management?

Crypto risk management refers to the strategies and practices employed by traders to minimize the risks associated with investing in cryptocurrencies. Trading cryptocurrency can be highly volatile, and the value of these currencies can fluctuate rapidly, making it challenging to predict the market’s movements. Effective risk management is crucial for traders to protect their investments and minimize losses.

The first step in crypto trading risk management is understanding the market and the various factors affecting prices. Traders should educate themselves on the different types of currencies and their properties besides knowing how to trade. Technical analysis tools such as charts and indicators can help traders identify trends in the market and make informed decisions about when to buy and sell.

Another important aspect of crypto trading risk management is proper money management. Then setting a stop loss, taking profit orders, and always double-checking the accuracy of transactions before executing any deals is necessary. Traders should diversify their holdings to spread the risk if one currency fails. By following these strategies and methods, traders can minimize the risks associated with crypto trading and protect their investments.

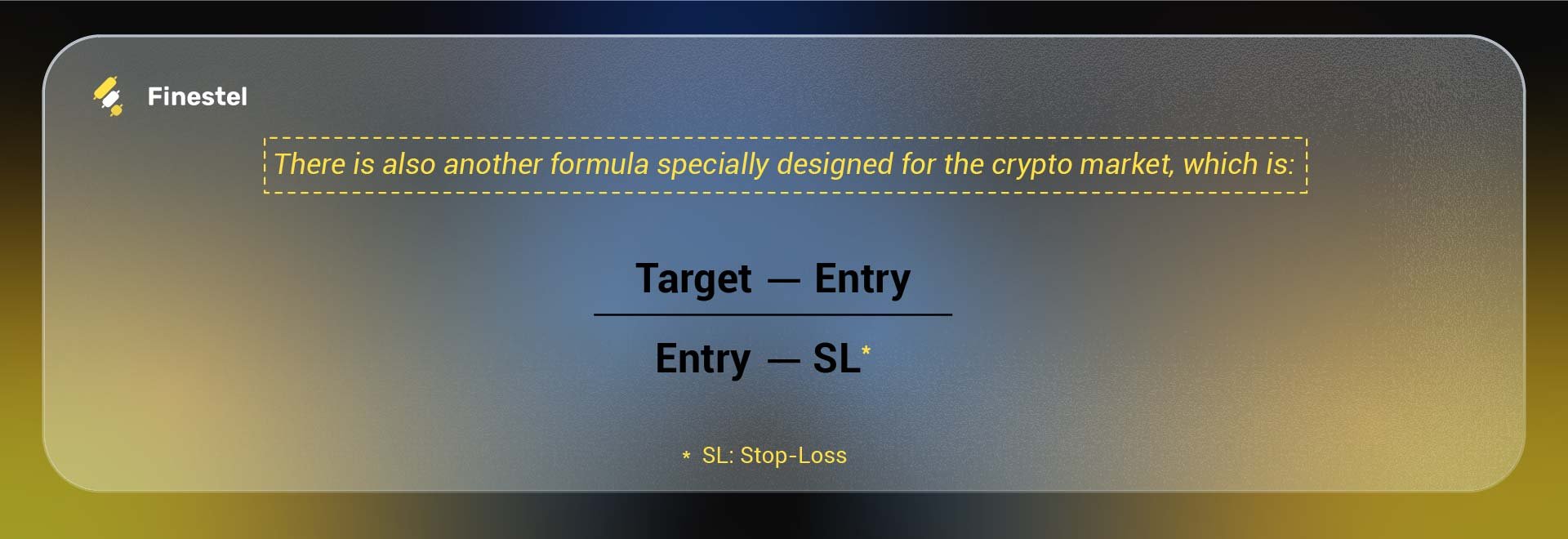

How to Calculate Risk Per Trade?

Determining risk parameters is the most prominent step in calculating risk per trade. The risk tolerance rate is the amount of money traders are willing to lose in a single trade, and position size is the amount of allocated capital to each trade. The accuracy of these numbers is critical, and traders must be honest with themselves while determining above mentioned rates.

After setting parameters, it’s time to calculate risk per trade. First, take the amount of money you are willing to risk in a single trade and divide it by the position size.

For example, if you have a risk tolerance of $100 and place a trade with a position size of $1000, risk per trade would be 10%.

6 Strategies for Effective Risk Management in Crypto Trading

Risk management is almost identical in different markets, including Forex, Commodity, OTC, and Crypto. Crypto trading is one of the fastest-growing investment strategies in the world. It presents much potential for traders, investors, and other involved parties.

Crypto trading entails a certain amount of risk, but its traders must take the necessary steps to ensure they don’t take too much risk. Risk management in crypto trading involves identifying, evaluating, and mitigating risks associated with trading in the crypto market. As mentioned, risk management aims to reduce potential losses while maximizing returns. This requires traders to use diversification, hedging, and stop-loss order strategies.

A good trading strategy helps traders identify potential entry and exit points in the market. Besides, let them set limits on the risk they are willing to take. This trading strategy will also indicate when to buy and sell cryptocurrencies. Limit orders are another important risk management factor allowing traders to set the maximum/minimum prices they are willing to pay.

Diversify Holdings

Diversifying holdings is an effective risk management strategy that involves investing in different types of cryptocurrencies or spreading investments across various asset classes. This strategy reduces the risk of losing the whole or a significant portion of the investment if one currency or asset class fails. By diversifying holdings, traders can increase their returns while minimizing risk exposure. However, it is essential to note that diversification does not guarantee profits or prevent losses entirely, but it does help to spread the risk and protect the investment portfolio.

Use Stop-Loss and Take-Profit orders.

Another effective risk management strategy in crypto trading is stop-loss and take-profit orders. These are automated orders set to execute when the price of a cryptocurrency reaches a certain level. A stop-loss order intends to limit losses by automatically selling a cryptocurrency if its price falls below a certain level. In contrast, a take-profit order secures profits by automatically selling a cryptocurrency if its price rises above a certain level. With these orders, traders reduce risk exposure and protect their investments by setting predetermined exit points. It can help traders prevent losses and lock in profits.

News Feed Tracker

Keeping track of the news is crucial for effective risk management in crypto trading. It helps traders stay informed about market-moving events and anticipate potential price movements. Following relevant news sources helps traders gain insights into the latest developments in the crypto world and make informed decisions. It helps them determine an appropriate time to buy or sell a cryptocurrency. However, traders should not rely solely on the news to make trading decisions. This strategy should combine with other risk management strategies, such as technical analysis and diversification.

Use Technical Analysis

Technical analysis involves analyzing charts and market indicators to identify market trends and patterns. Technical analysis helps traders decide when to buy or sell a cryptocurrency, set stop loss, and take profit orders. They can also use technical analysis to identify support and resistance levels, which can help them anticipate potential price movements. However, traders know that technical analysis is not foolproof and requires a deep understanding of the market and its complexities.

Hedging

Hedging is a risk management tool used by traders to offset potential losses. It’s a way to protect the crypto portfolio from significant losses. This strategy minimizes or eliminates risk while allowing traders to take advantage of favorable market movements in crypto markets. Hedging generally involves buying and selling different types of crypto-assets at different times. With this strategy, traders can offset the losses of one asset with another.

The hedging strategy also involves buying and holding multiple crypto-assets. This branch of hedging could include purchasing a basket of crypto-assets such as Bitcoin, Ethereum, Ripple, Litecoin, etc. By diversifying your portfolio in this way, you can reduce your exposure to risk in the event of a market correction.

Risk Arbitrage

This strategy involves taking advantage of the differences in price between the markets of two different coins or their underlying asset. But this strategy requires quick and informed decision-making to secure a profit. Arbitrage can be profitable, allowing traders to profit from small price discrepancies between markets.

When the price of a particular cryptocurrency is lower in one exchange than another, an arbitrage trader will purchase the cheaper coin and then sell it at a higher price. Please note that cryptocurrency markets are extremely volatile, and prices change quickly. Conversely, transaction fees can significantly reduce profits.

How to Manage Risk in Crypto Futures Trading

Crypto futures trading can be lucrative, but it requires understanding the risks involved. Risk management tools in crypto futures, such as position sizing and leverage, are two important considerations when trading. Position sizing allows traders to calculate the maximum exposure they should have on any one position depending on their risk appetite.

Leverage controls a large contract value with relatively small capital. Using leverage helps investors to maximize their profit potential in their endeavors of speculating on the price of an asset. Crypto Futures also allows traders to go short on a cryptocurrency they believe will lose value over time.

Novice traders can also use futures crypto trading, which is reliable on a few platforms. Futures copy trading is a method in which newbies copy trades or pro traders. By nature, they take the position after considering all risk factors and performing proper risk management strategies.

There is adequate information on the Finestel Academy for those who want to get familiar with this approach. They also can use other techniques, such as hedging, risk arbitrage, Swing trading, scalping, and other common investment methods to minimize the risk of loss.

Mistakes You Should Avoid for a Better Risk Management Strategy

Risk management is essential for any trader, regardless of experience level. Without it, traders set themselves up for unnecessary losses and, in extreme cases, even bankruptcy. What’s worse is that there are several common mistakes that traders tend to make when it comes to risk management. To start, traders must understand what an acceptable loss rate is. Too often, traders underestimate the amount of risk associated with trade and end up with losses that are higher than expected.

This can be avoided by setting a clear stop-loss limit to limit potential losses on a given trade. Traders must also keep track of the market and stay updated with news and announcements. Significant changes can drastically affect the market, so it’s important to be informed of current events. Moreover, traders need to keep their emotions in check as this can lead to bad decisions, which can have a massive negative impact on their trading performance.

Finally, it’s worth noting that many different risk management strategies exist. Traders can choose to use a single strategy or a combination of techniques. However, the key is to ensure that the risk management strategy selected is appropriate for the current market conditions. In conclusion, risk management is essential for any trader’s success. By following the above advice, traders can minimize their potential losses and maximize their chances of success.

Conclusion

In conclusion, managing risk effectively is essential for investors and traders in the cryptocurrency market. However, almost always, all financial markets, including securities, commodities, and currencies, follow the same pattern. Still, each market has its technicalities.

The fast-paced and volatile nature of the crypto market, coupled with the potential for significant returns and losses, highlights the need for a comprehensive crypto risk management strategy. To achieve this, investors and traders must understand the risks of investing and trading in cryptocurrencies and implement appropriate risk management techniques.

These may include diversification, technical analysis, stop-loss orders, position sizing, leverage control, and hedging. Furthermore, staying informed about the latest developments in the crypto market and monitoring market conditions is crucial. Mentioned punctilious allow investors and traders to make informed decisions and adjust their investment strategies accordingly.

One of the best ways to profit is to avoid loss, which is almost impossible. Abstaining from common mistakes, discussed earlier in this article, helps traders keep their funds safe. By taking a disciplined approach to risk management and avoiding those mistakes, investors and traders can increase their chances of success and cut losses in the volatile crypto market.

Rational decisions, stopping trading affected by emotional stimulants, and being organized would be key factors in choosing the best crypto risk management strategy. Each trade in each market has its loss risks, but risk management strategies are shields to keep our funds if we use them correctly and on time.

FAQ

How can I manage security risks in cryptocurrency trading?

These are just a few tips for managing security risks when trading cryptocurrencies. By understanding the market, using secure platforms, diversifying your investments, and setting limits, you can help to ensure that you trade successfully and safely.

What are the common risks associated with futures trading?

Futures trading is a great way to make a profit, but it is important to understand its risks. Not persuading market trends, ignoring new laws and regulations, taking no notice of price fluctuations, and so on are general mistakes novice traders might make.

How can I use hedging strategies to manage crypto trading risks?

To use hedging strategies for managing crypto trading risks, you can use futures and options contracts, correlation analysis, and stay informed about market developments. Effective risk management also involves understanding the market, diversifying holdings, and practicing proper money management.

What is the role of stop-loss orders in crypto trading risk management?

With stop-loss orders, investors can set predetermined exit levels and minimize their losses in case the market takes a sudden turn for the worse.

Leave a Reply