As liquid staking protocols continue to disrupt the DeFi landscape, Jito Network built on Solana is spearheading innovation utilizing maximum extractable value (MEV) to reward its liquid stakers. This comprehensive article by Finestel will explore the varied facets of the Jito ecosystem including its liquidity protocol, governance token economics, community initiatives, product offerings, and the roadmap ahead.

What is Jito Network?

Jito Network is a permissionless liquid staking protocol developed to alleviate the negative impacts of MEV on Solana by redistributing MEV profits equitably to stakers. Users can stake their SOL tokens with Jito to receive JitoSOL – a liquid derivative representing their staked tokens.

The Jito Stake Pool then delegates the staked assets to MEV-enabled validators who earn profits from transaction re-ordering, arbitrage and other strategies. These profits are channeled back to increase APY for JitoSOL holders allowing them to benefit from both staking yields and MEV rewards.

By harnessing MEV, Jito unlocks higher earning potential along with liquidity and direct participation in on-chain governance for SOL holders.

JTO Crypto: The Governance Token Powering Jito

JTO Crypto is the native utility and governance token of the Jito Network entitling holders to actively participate in shaping the future direction of the protocol.

JTO Crypto empowers the community to drive decisions such as:

– Voting on proposals for protocol upgrades

– Determining fee structures

– Guiding treasury management

– Contributing to platform development initiatives

Additionally, based on their JTO Crypto holdings and community contributions, token holders may qualify for a share of revenues generated from Jito’s suite of MEV products and services.

20% of the total supply is allocated to the community via an airdrop with 100 million JTO Crypto tokens going to Solana validators, 50 million to JitoSOL holders, and 50 million to users of Jito’s MEV-infrastructure – marking a defining moment in decentralizing power.

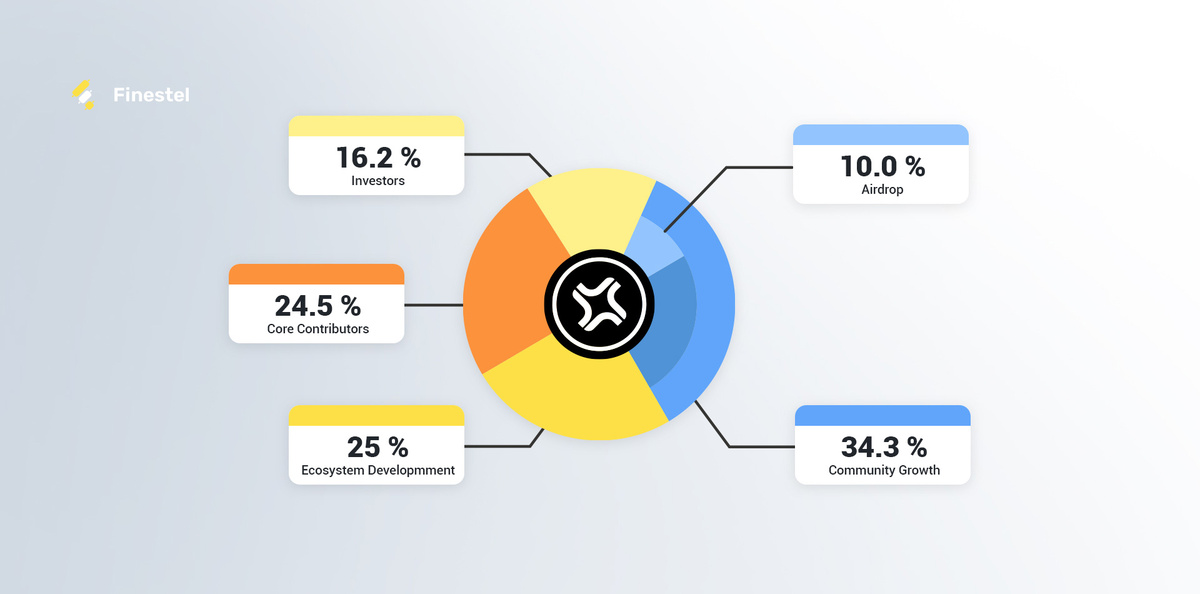

JTO Crypto Distribution

- 250 million JTO for ecosystem development, aimed at funding communities and contributors aiding the project’s growth.

- 245 million JTO for the team, encompassing employees, partners, and other internal project contributors. These tokens will be evenly distributed across three years, commencing one year post-airdrop.

- 162 million JTO for investors, to be similarly distributed over three years, beginning a year after the airdrop.

- 343 million JTO for community growth, with 100 million designated for the airdrop and the remainder managed by DAO governance on the Realms platform.

Read our Comprehensive guide about Launching a successful ICO.

Use Cases of JTO Token

The JTO Crypto token transforms passive SOL stakers into active contributors directing the growth and development of the Jito Network through:

- Managing JitoSOL Liquidity Pools: JTO Crypto holders can govern critical parameters of the pools like fees, staking caps etc.

- Updating Delegation Strategies: Token holders can participate in fine-tuning the delegation algorithms to balance risks and returns.

- Driving Protocol Upgrades: JTO Crypto allows holders to vote on proposals for new feature additions and protocol optimizations.

- Funding Ecosystem Initiatives: Initiatives enhancing infrastructure, tooling and evangelism efforts can be funded from the community pool.

By unlocking governance capabilities, JTO Crypto seeks to nurture a vibrant community of aligned incentives driving the rapid growth of Jito Network.

How To Stake on Jito Network

Jito Network has emerged as the leading liquid staking protocol on Solana offering attractive yields by redistributing MEV profits to stakers. For those interested in earning lucrative returns, here is a step-by-step guide on how to stake on Jito:

Set Up Solana Wallet

The first step is to set up a compatible Solana wallet like Phantom, Solflare or Slope. This wallet will be used to connect to the Jito dApp for staking operations. Make sure to store the seed phrase securely as it controls access to your assets.

Fund Wallet With SOL

Once the wallet is set up, fund it by purchasing SOL through an exchange or transferring it from another wallet. A minimum of 1 SOL is required but staking higher amounts like 10 SOL or more is recommended to maximize staking returns.

Connect Wallet to Jito dApp

Head over to the Jito dApp and click on Connect Wallet. Select your Solana wallet and approve the connection request. This allows the dApp interface to detect your wallet balance.

Select Stake Amount

Based on your risk appetite and desired token balance, decide how many SOL to allocate for staking. You can choose 50%, 75% or 100% of your wallet balance. This allocated amount will be transformed into JitoSOL upon staking.

Stake Tokens & Receive JitoSOL

Upon confirming the stake amount, click on the Stake button. Pay the transaction fee using your remaining SOL balance. Once successful, you will automatically receive JitoSOL representing your staked SOL in your connected wallet.

Track & Grow JitoSOL Balance

As your staked tokens get delegated in the background to MEV validators, you can track your JitoSOL balance grow daily with staking rewards and added MEV yield!

Redeem or Unstake

You preserve the flexibility to unstake the SOL by redeeming JitoSOL for the underlying assets at anytime. Redeem it partially as per liquidity needs or fully exit when desired.

Where To Trade JTO Token

The top cryptocurrency exchanges for trading JTO tokens currently are:

- Binance

- Bybit

- Bitrue

- BingX

- BitMart

These exchanges offer various features and benefits for JTO holders like low fees, high liquidity, user-friendly interfaces, and exclusive promotions.

If you are a profitable crypto trader who already has a community of followers or investors looking to copy your trades, you may want to consider using Finestel’s Binance copy trading and Bybit copy trading services. Finestel provides innovative trading technology solutions for traders to efficiently manage their clients’ money.

Finestel offers two main copy trading plans:

- Copy Trading Bot: This plan suits traders with a limited number of investors and assets under management. The copy trading bot replicates your trades in your followers’ accounts instantly.

- White-Label Copy Trading Software: For traders managing more than 10 clients or considerable assets under management, Finestel recommends the white-label asset management software. With this plan, you can offer your trading services under your own brand and customized interface.

In addition, profitable traders looking to expand their investor base can showcase their trading strategy and performance track record in Finestel’s private strategy marketplace. This allows you to attract investments from new investors on the platform. As you update your track record in real-time, you can continue improving your results and gaining more capital.

Overall, for crypto traders with a community of followers, Finestel provides the technology to efficiently copy your trades and manage your clients’ capital.

JTO Compatible Wallets

Some popular crypto wallets that support storage and staking of the JTO token include:

Phantom: A browser extension and mobile app that enables swapping JTO across different blockchains. Phantom supports JTO as a token pair.

TokenPocket: A multi-chain DeFi wallet that supports Solana. TokenPocket enables staking JTO into Jito Network’s pools.

Sollet: A web-based Solana wallet for interacting with dApps. Sollet facilitates staking JTO into Jito’s liquid staking protocol.

By supporting leading wallets like Phantom, TokenPocket, and Sollet, JTO offers users a wide range of storage and utilization options catering to different needs and risk appetites.

Future Outlook for Jito & JTO Crypto

The introduction of JTO Crypto governance capabilities marks a pivotal juncture, empowering Solana validators and DeFi users to have a greater say in assessing trade-offs and directing on-chain development.

While the current focus revolves around staking derivatives, Jito plans to expand its offerings by leveraging MEV across a range of verticals like DEXes, marketplaces, lending/borrowing pools etc. to improve capital efficiency.

Jito Network’s innovations combined with community-centric growth fueled by JTO Crypto create a high-growth environment for the protocol to cement its position as the leading MEV-enabled liquid staking solution on Solana.

As more protocols acknowledge the viability of MEV as an untapped revenue source, Jito is primed to capture significant mindshare – allowing SOL holders and JTO Crypto holders to reap disproportionate economic benefits.

JTO Crypto Price Prediction

The JTO price prediction is difficult to forecast accurately given the nascent stage of the project. However, considering the innovative tokenomics model and the integral role of JTO in the Solana ecosystem, significant price appreciation potential exists in 2023-2025 if adoption milestones are achieved.

With wider decentralization and community participation, JTO valuation could reach $5-10 levels depending on staking mechanisms and utility scope. However, failure to gain developer mindshare poses downside risks potentially limiting upside to double digit growth.

Conclusion

Jito Network is pushing the envelope in liquid staking innovation by developing a platform to equitably allow stakers to benefit from MEV profits based on their economic contributions.

Backed by a community-first vision, and powered by the JTO Crypto governance token – Jito has broken ground by converging two areas primed for exponential growth: liquid staking and MEV.

By sustainably harnessing MEV for the community instead of extractive mining by a few, Jito Network pioneers a shared growth model allowing regular stakers to shape the future direction of the protocol.

Leave a Reply