Performance fees, or PF, are a type of fee structure used in asset management businesses. This fee is usually a percentage of gains on the investor’s capital, which the asset manager or trader receives as compensation. The key function of performance fees is aligning the traders’ and investors’ interests. The reason is that the traders should aim to gain higher returns to increase the fees they receive.

The performance fee is a kind of profit sharing and is different from management fees, commissions, and other types of fees. It has been gaining popularity in recent years. Therefore, we will thoroughly analyze this fee structure in this article. Drawing comparisons and stating the risks and advantages, we aim to provide you with valuable insight. Finally, we discuss the customizable performance fee structure in Finestel’s copy trading service and why it is highly beneficial to both traders and investors.

Introduction to Performance Fees in Trading

Performance fees in trading are cost structures that align the interests of investment managers or traders with those of their clients or investors. Unlike fixed management fees, PFs are calculated based on the trading performance of the asset manager. This means that the fee depends on the performance of the traders. As a result, it provides an incentive for them to consistently pursue higher returns for their investors.

Although there are various types of fees in finance, performance fees are quite common in the industry. From giant hedge funds to private equities and even individual investment managers, PFs are a key part of these businesses. Yet, PFs are not the only type of payment they charge, as they mostly mix up performance fees with other sorts of fees to ensure they make revenue, even if they are not profitable in a specified period.

Read our comprehensive guide on how to launch a crypto hedge fund in less than 90 days!

Typical Performance Fee Structures in Trading

Typical PF structures in trading are often based on a percentage of the profits earned by the asset manager. These fees are typically charged alongside a base management fee and are calculated as a percentage of the gains achieved above a predetermined benchmark or a specific hurdle rate.

These fee models aim to align the interests of the manager with the clients, providing an incentive for superior performance and rewarding successful strategies.

Key Components of Performance Fee

Performance fees include several key components that help calculate the suitable cost to charge. Here are the most significant elements of PF:

Hurdle Rate

The hurdle rate is the minimum rate of return that asset managers must achieve before they can charge the performance fee. For example, if the hurdle rate is 8%, and the fund’s actual return is 10%, PF would be calculated on the excess return of 2% (10% – 8%).

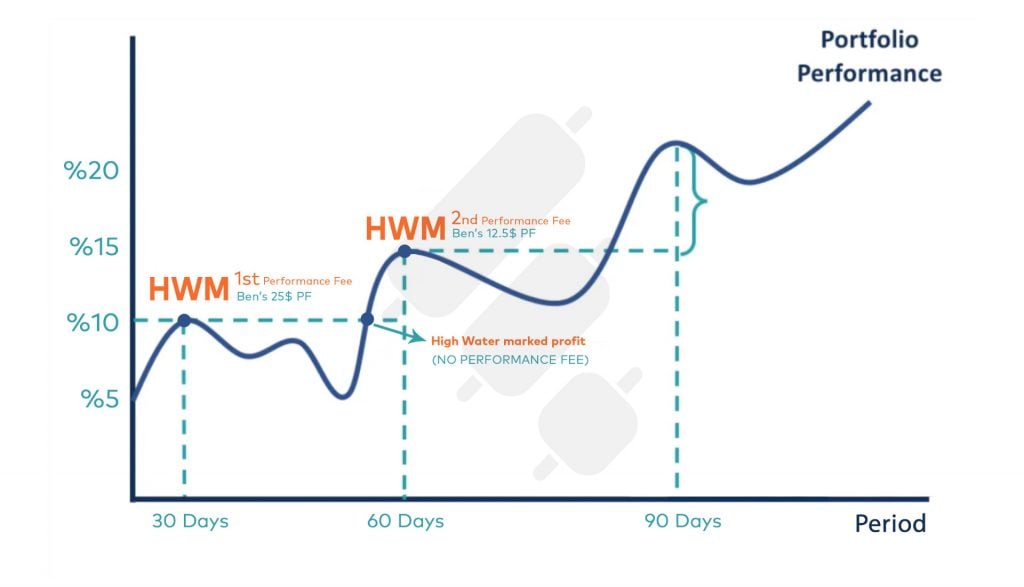

High-Water Mark

The high-water mark aligns the interests of investment managers and their clients. It is the highest net asset value or NAV a fund has reached in the past. The high-water mark works as a reference point for PF calculation. Here is how it works:

- When the asset manager achieves positive returns, we calculate the performance fee based on the profits exceeding the high-water mark.

- If the fund’s performance is below the high-water mark, the manager cannot charge a PF.

To further illustrate, take a look at the figure below. This chart depicts how you can calculate PF when a High-Water Mark is involved. You should determine the PF on the excess return above the HWM, and charge no PF when the fund’s return is below the HWM.

Fee Calculation Period

The performance fee calculation period is the period that the manager and investors evaluate the fund’s returns to determine if a fee is due and, subsequently, to calculate the fund performance fee. It could be a monthly, quarterly, or annual period, depending on the terms agreed between the two parties.

Fee Percentage

The fee percentage is the proportion of the fund’s positive returns that the investment manager receives as a performance fee. Performance fees in private equity vary based on the fund’s returns and even its reputation.

Example of a Performance Fee

Consider an investment fund with a performance fee structure that charges 10% of profits earned above a 5% hurdle rate. An investor initially invests $50,000 in the fund, and over a defined period, the fund generates a positive return of 8%, resulting in a final value of $54,000. To calculate the PF:

- First, you should calculate the hurdle rate, which equals 5% of the initial investment ($50,000) = $2,500.

- Then, calculate the excess return that is [Final value ($54,000) – Hurdle rate ($2,500)] = $1,500.

- Finally, you can calculate the PF. It equals 10% of the excess return ($1,500) = $150.

In this example, the PF charged to the investor is $150. The investor will receive $53,850 ($54,000 – $150) as the final investment value after deducting the performance fee.

Understand the difference between maker and taker fees in the trading world.

Comparing Performance Fees to Other Fee Models

There are various types of fees when it comes to asset management. Below is the list of most common fees and their comparison to performance fees:

Management Fee

The management fee is a fixed percentage of a client’s assets that the investment manager charges for managing the portfolio. It is charged regardless of the fund’s performance and is paid periodically. Performance fees and management fees are typically set together, like the 2 and 20 fee structure. A 2 and 20 fee example includes a 2% management fee plus a 20% performance fee, which is a common management and performance fee in the hedge fund industry.

Fixed Fee

A fixed fee is a predetermined, constant fee regardless of the performance or the size of the investment. It is not dependent on the fund’s returns, AUM, and market conditions.

Incentive Fee

An incentive fee is the same as a performance fee. Asset managers charge this fee based on the fund’s performance relative to a benchmark or a specific target. If the fund outperforms the benchmark or achieves the target, the investment manager charges a portion of excess profits as an incentive for their successful performance.

Commission

Commission-based fee models involve a fee paid to the investment manager or financial advisor based on the transactions they execute on behalf of the client. The commission is typically a percentage of the investment amount and may inspire the advisor to engage more in trading.

Expense Ratio

The expense ratio is the total cost of managing a mutual fund or an ETF. It is a percentage of the fund’s assets and includes management fees, expenses, and other operating costs.

Subscription Fee

A subscription fee is a one-time or periodic fee charged to the investor when they initially invest in a fund or when they subscribe to a service. It is not performance-dependent and is usually a fixed amount.

AUM Fee (Assets Under Management Fee)

An AUM fee is a percentage of the total assets under management. This fee structure also aligns the interests of the investment manager with the investor. The reason is that the manager’s compensation increases with the growth of the investor’s assets. Moreover, the investor may choose to invest more as a result of successful previous performance. This would also increase the AUM fee and, therefore, inspires the asset manager to perform better.

Dive deeper into strategies for attracting high-net-worth investors.

Performance Fee Models

Performance fees are mostly calculated following two main models.

These models include a fixed percentage of profits and a sliding scale fee structure:

Fixed Percentage of Profits

In the fixed percentage model, the investment manager receives a fixed percentage of the profits. The parties agree on the fixed percentage beforehand, and it is constant, no matter how well the manager performs. For example, if they set t at 20%, and the fund generates $100,000 in excess profits (above the hurdle rate), the investment manager would receive $20,000 (20% of $100,000) as PF. The amount the manager receives for outperforming the benchmark is the crystallized performance fee.

Sliding Scale Fee Structure

The sliding scale fee structure involves charging a PF that varies depending on the level of the asset manager’s performance. As returns increase, the performance fee percentage may also increase. It is a progressive model where the asset managers earn a higher fee as they gain more.

Here is an example of a sliding scale fee structure for hedge fund performance fee calculation:

- 10% PF for returns between 0% and 5%

- 15% PF for returns between 5% and 10%

- 20% PF for returns above 10%

Unlock the secrets to lowering and reducing your trading fees.

Performance Fees in Copy Trading

Performance fees in copy trading might have both benefits for traders and risks for investors. Let’s explore them:

Benefits for Traders

- Incentive to Perform Well: Performance fees provide a strong incentive for signal providers to perform well and generate positive returns for their followers.

- Additional Income Stream: For successful traders, PFs can be an additional source of income.

- Alignment of Interests: Performance fees align the interests of traders with their followers. Both parties benefit when the trader performs well, creating a mutually beneficial relationship.

Risks for Investors

- Higher Risk: Performance fees might incentivize traders to risk more than they should in order to receive more fees. This can lead to riskier trading strategies that may not be suitable for all investors, potentially exposing them to significant losses.

- Misaligned Goals: In some cases, traders may prioritize earning PFs over the long-term success of their followers. This could result in short-term focused trading strategies and a lack of a risk management system.

Top 5 Crypto Copy Trading Platforms Performance Fee Comparison

| Name | Pricing Plans | Performance Fees |

| Finestel | Free

Up to 3 exchange accounts Portfolio tracker

Starter: $19/month Up to 3 exchange accounts Copy trading Portfolio tracker Rate limit: 20 orders/min (per account)

Pro: $49/month Up to 10 exchange accounts Copy trading Portfolio tracker Rate limit: 20 orders/min (per account)

Business: $199/month Up to 100 exchange accounts Portfolio tracker Dedicated support Rate limit: 45 orders/min (per account) + FREE White-label (Time-limited offer)

Enterprise: Contact Us Unlimited exchange accounts Rate limit: unlimited Technical development White-label copy trading Portfolio tracker Dedicated servers on demand Copy trading Dedicated support Trading algorithm development |

Fully Customizable Billing Models & Payment Cycles:

Traders can define payment models using cyclic (e.g. subscription fees) or commission-based (performance fees) billing systems. |

| Bybit | FREE | The profit-sharing ratio is different according to the rank of Master Trader:

Cadet: 10% Bronze: 10% Silver: 12% Gold: 15% |

| PrimeXBT | FREE | 20% |

| 3commas | Free

Starter: $22/mo. Advanced: $49/mo. Pro: $99/mo. |

No PF due to pricing plans |

| Phemex | FREE | Profit sharing based on copiers’ total realized PNL:

1) <= $2M: 12% 2) >= $2M: 14% 3) >= $20M: 16% 4) >= $50M: 18% 5) >= $500M: 20% |

The Sweet Spot: Finestel’s Customizable Performance Fee Structure

As already demonstrated in the table above, most copy trading platforms have predetermined performance fees. Some use AUM as a benchmark of how much to charge, while others use fixed percentages. Then, there is Finestel, with its fully customizable PF structure. Finestel’s white-label service guides you on how to set up a crypto fund, which includes setting your own PF.

Benefits of Finestel’s Customizable Performance Fees

Finestel’s wide range of customization options allows asset managers to set performance fees adjusted to their goals, trading strategies, and even their clients’ preferences. Therefore, we can justifiably call Finestel’s PF structure the “sweet spot” as you decide what is suitable for your business.

Customizable performance fees allow for a more precise alignment of the interests of fund managers and investors. Moreover, customization provides flexibility and facilitates the adaptation of the performance fee structure to the unique characteristics of the investment strategy or traded asset class. Investors may also appreciate the transparency and fairness that come with customizable performance fees. Therefore, Finestel’s customizable performance fee structure not only benefits the fund managers as it provides flexibility and adaptation, but it also enhances investor satisfaction.

Regulatory Considerations for Performance Fees

Regulatory considerations for performance fees in portfolio management are of significant importance to both asset managers and investors. These considerations can vary based on the jurisdiction, traded asset class, and even the class of investors. Yet, here are some common regulatory considerations:

- Disclosure Requirements: Asset managers must provide transparent disclosure of the performance fee structure to investors before the agreement. This includes explaining the fee calculation methodology, fee percentage, fee calculation period, high-water mark policy, and any other relevant details.

- Fair Valuation: As already mentioned, PFs are typically calculated based on the net asset value (NAV) of the fund. Ensuring accuracy and fairness in valuation is essential to prevent any manipulation of NAV.

- Investor Consent: Some jurisdictions require explicit consent from investors before charging PFs. This ensures that investors fully understand and agree to the fee structure before investing.

- Performance Reporting: Investment managers often require to provide regular, accurate, and comprehensive performance reports to investors.

Infographic: Performance Fees in a Nutshell

Conclusion

In this article, we analyzed the role of performance fees in the asset management industry. We started by explaining what they are, their main components, how to calculate them, and their difference from other types of fees. The main benefit of a PF is that it is an effective tool for aligning the interests of both investors and asset managers because more profits mean more income for the manager. We also emphasized the advantages associated with traders setting suitable PF themselves, proceeding to introduce Finestel’s customizable performance fee structure.

While performance fees offer many advantages, they are also accompanied by a few risk factors and should be considered carefully. For instance, traders or investment managers may be incentivized to risk more than they are supposed to. That is because they might aim for higher PFs, which are a direct result of higher returns.

FAQ

What is a performance fee?

A performance fee is a fee charged by asset managers based on the fund’s performance relative to a benchmark. It incentivizes the manager to achieve positive returns for investors.

Can the performance fee be customized or negotiated?

Yes, PFs can be customizable and negotiable between investment managers and investors. For instance, Finestel’s copy trading platform offers a customizable performance fee structure.

How are performance fees typically paid or collected?

Performance fees are typically paid or collected periodically, usually at the end of a predetermined fee calculation period (e.g., monthly, quarterly, or annually). The manager deducts the fee from the returns before distributing profits to investors.

How is a performance fee calculated?

PFs are calculated based on the investment manager’s or fund’s performance over a specific period. The fee is often a percentage of the excess profits above a high-water mark or a hurdle rate.

Leave a Reply