When trading cryptocurrencies, every fraction of a percentage can make a huge difference. These small gains can even come from minimizing crypto trading fees. As the crypto industry evolves, implementing effective strategies to reduce crypto trading fees can improve your profitability and optimize the overall performance of your portfolio. If you are searching for methods to minimize your crypto trading fees, look no further than this article.

In this comprehensive guide, we introduce crypto trading fees, how they work, and how they affect your returns. We move on to present different types of fees you should pay as a crypto trader with centralized exchanges. Moreover, we suggest some common strategies that can assist you in minimizing crypto trading fees and familiarize you with Finestel’s services and how they can also facilitate this process.

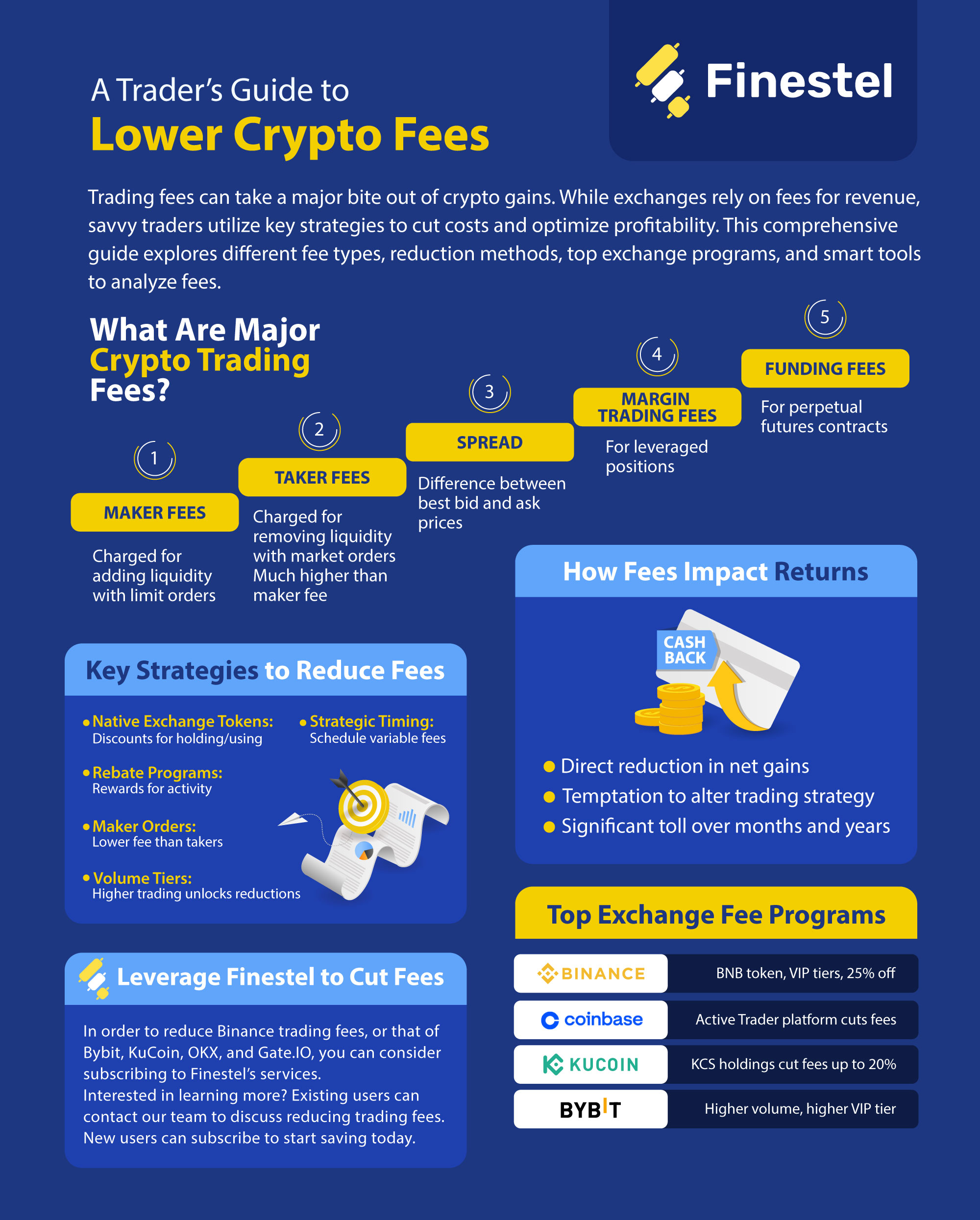

The Silent Killer of Returns: What Are Crypto Trading Fees?

Cryptocurrency exchanges use trading fees as their primary source of revenue. They allow you to seamlessly trade in the crypto market with just a few clicks. They provide a comprehensive dashboard with various tools, charts, and order books for you to proper decision making. In return, they require you to pay fees when you use their services. The amount of these fees is usually based on different factors like your trading volume and order type.

Trading fees are a non-negotiable part of every crypto trader’s career. It is almost impossible to trade crypto without fees. Therefore, every trader needs to gain a deep understanding of trading fees, how they work, what different types of fees are, and how they impact returns over the long run to ensure they navigate a profitable trading journey.

How Crypto Trading Fees Impact Your Returns

Crypto trading fees play a pivotal role in shaping the overall performance of crypto traders. The impact of fees on performance is particularly significant in a volatile market such as crypto. Reduction of returns is the most direct effect that you can experience, as fees have the potential to eat into your gains. Moreover, frequent trading and scalping may incur a substantial cost over time and significantly decrease your profits in the long run. It might even push you to the losing side.

Beyond the direct impact on individual trades, trading fees can influence your trading strategy and decision-making. High crypto trading fees can discourage you from executing your strategy. Moreover, you might also experience the temptation to hold trades longer than you should in order to reduce the impact of trading fees by aiming for a higher profit target. This is an unacceptable mistake, as you are directly going against your risk management rules and overall trading plan. As a result, it is essential for any trader to become familiar with fee structures and try to reduce crypto trading fees for a sustainable crypto trading career.

Common Types of Crypto Trading Fees

Crypto trading fees come in various forms. Knowing each one of these categories and their purpose is crucial for any trader who is seeking to optimize their trading and investing strategies and reduce crypto trading fees. Here are some of the most prominent types of these fees:

Maker Fees

Maker fees are fees traders have to pay when they provide liquidity to the market by placing limit orders, which are orders that do not get filled immediately. Maker fees are often the lowest of exchange trading fees as their purpose is to encourage liquidity provision by market participants.

Taker Fees

Unlike makers, takers are traders who take liquidity from the market by matching orders placed by the makers in the orderbook. Market orders are subject to taker fees and exchanges charge takers significantly higher than makers, as they aim to discourage removing liquidity from the order book.

Read more about maker vs.taker fee and tips and tricks to reduce them.

The Spread

While not a trading fee by definition, the spread practically works the same. It is the difference between the highest bid price (buy) and the lowest ask price (sell) in the order book. When you enter a trade with a market order, you will also have to pay the spread.

Margin Trading Fees

These fees are associated with borrowing funds for leveraged margin trading. Their primary purpose is to compensate the exchange for the excess risk they are taking by lending money to traders. Some exchanges might not charge this fee separately and would add it to the maker and taker fees in margin trading.

Funding Fees

Crypto futures are mostly perpetual contracts, which do not have an expiry date, in contrast to traditional futures contracts. To ensure the price of these contracts continuously converge to that of the spot market, exchanges use funding fees. These fees are paid by the buyers to the sellers or the other way around, depending on the funding rates.

When the funding rates are positive, buyers are required to pay the funding fee to the sellers. On the contrary, negative funding rates force short sellers to pay the buyers. Funding fees are quite different from the previous types of fees, as they are not charged one time (when you execute the trade). They are commonly settled every 8 hours.

Proven Strategies to Reduce Crypto Trading Fees

You might be a crypto trader wondering how you can reduce Binance, Coinbase, KuCoin, or other exchanges’ trading fees. There are a variety of different strategies for reducing these fees, ranging from using native exchange tokens to optimizing order placement. Yet, you should note that these methods might affect your strategy’s performance.

Utilize Native Exchange Tokens to Reduce Crypto Trading Fees

Most cryptocurrency exchanges that have native tokens offer users various benefits for holding or trading them, including fee discounts. Therefore, you should consider acquiring and holding these platform-specific tokens to benefit from fee reductions. Some exchanges even offer tiered systems where the more native tokens you hold, the less your trading fees become. This strategy not only lowers your trading costs, but it also does not affect your strategy’s performance.

Reduce Crypto Trading Fees By Using Maker Orders

As already explained, market makers are incentivized by the exchanges with significantly lower trading fees. As a result, you can also become a market maker and provide liquidity to the order book by placing limit orders. Trading with limit orders can considerably reduce crypto trading fees compared to market orders. However, note that this strategy might influence your trading performance in a negative way if your trading plan is based on executing market orders.

Optimize Trading Volume for Fee Discounts

Crypto exchanges like Bybit, Bitfinex, MEXC, and Bitstamp offer volume-based trading fee discounts. Higher trading volumes often result in trading fee reductions. This strategy is of course if you possess sufficient capital and your risk management plan allows you to increase your trading volume. Unless you do not enter trades with enormous volume, you can enjoy reduced crypto trading fees while leaving your performance unaffected on a percentage basis.

Time Your Trades Strategically and Reduce Crypto Trading Fees

Some cryptocurrency exchanges implement a dynamic fee structure, meaning that fees vary based on market conditions like volatility. You can analyze the fee schedules of these exchanges and consider optimizing your trading time. Consequently, you can lower your trading fees. However, note that this strategy can also affect your trading plan and its performance.

Explore Fee Rebate Programs

Certain exchanges offer fee rebate programs that reward active traders. The more you trade with these exchanges, the less your trading fees become. These programs can help you reduce your crypto day trading fees, improving your profitability over the long run. Meanwhile, keep in mind that many of these programs are suitable for traders who trade frequently like scalpers and day traders.

How to Reduce Crypto Trading Fees on Top Exchanges

While we have offered an overall guide for reducing crypto trading fees, you can utilize different methods for each individual crypto exchange. In this section, we provide a more in-depth instruction other than the general ones to lower crypto trading fees on the most popular exchanges worldwide. Note that utilizing maker orders applies to all the exchanges below and therefore, is excluded from the instructions.

Binance

In order to reduce Binance trading fees, you can use a variety of methods. First and foremost, using affiliate sign-up links can help lower your trading fees by up to 20% per trade. Moreover, Binance itself encourages you to use BNB to pay your trading fees and save up to 25%. Of course, you will need to hold some BNB in your Binance account to do so. Another proven solution to reduce binance fees is upgrading your VIP level. To achieve this end, you should increase your monthly trading volume. Note that this method is suitable for traders with large trading capital.

Coinbase

There is a straightforward solution to reduce the spot, as well as the Coinbase futures trading fees. You only need to switch your account to Coinbase Advanced Trade to reduce Coinbase Exchange fees. Coinbase Advanced Trade fees are considerably lower than the original Coinbase. Furthermore, the exchange uses a tiered fee structure like most other cryptocurrency exchanges. By increasing your monthly trading volume, you can move up the tiers and Coinbase charges you less trading fees.

KuCoin

KuCoin offers discounts to users who use its native exchange token to pay for fees. By holding KCS and choosing to pay fees from your KCS holdings, your KuCoin trading fees will drop up to 20%. Moreover, KuCoin also offers different trading fee levels to traders. So, by trading more volume in a month, you will raise your level and will be charged less KuCoin futures trading fees and spot fees.

Bybit

Just like other cryptocurrency exchanges, Bybit also offers a tiered trading fee structure. To decrease Bybit futures fees, spot fees, and even margin trading fees, you can always raise your monthly trading volume and move higher on the VIP ladder. As a result, you will enjoy paying less fees per trade. You can also use affiliate links to register on the platform and pay less Bybit fees.

Gemini

Similar to Coinbase, Gemini users have a simple solution to reduce their trading fees. Gemini Active Trader fees are significantly lower than the basic platform. All you need to do is to take your trading endeavors to the Active Trader platform. You can also increase your average daily trade volume and Gemini will charge you lower trading fees when you move to higher tiers.

Bitstamp

The typical way to reduce Bitstamp fees is by trading more capital and raising your 30-day trading volume in USD. As a result, you will pay less fees by upgrading your account to higher tiers. Moreover, you can use special sign-up links and get considerable discounts on your Bitstamp trading fees.

Kraken

To reduce Kraken crypto trading fees, there are a variety of solutions. First, you can simply trade on the Kraken Pro platform and enjoy cheaper fees. Furthermore, like other top crypto exchanges, Kraken’s fee structure is based on trading volume. Therefore, increasing your 30-day trading volume would help you pay lower Kraken fees trading your crypto of choice.

Gate.io

Gate.IO uses a similar tiered fee structure, like other centralized cryptocurrency exchanges. To reduce Gate.IO trading fees, you can bump your trading volume and level up your VIP tier. Consequently, Gate.io will charge you lower fees for both futures and spot trading. You can also sign up with affiliate links to receive a further discount on your trading costs.

Huobi (HTX)

Huobi or HTX offers two different fee structures. For professional traders, Huobi charges less trading fees. Moreover, for both normal and professional traders, increasing monthly trade volume can minimize fees. The higher your tier is, the lower your trading fees will be as a Huobi user.

MEXC

In order to lower your MEXC trading fees by up to 50%, you can use the exchange’s native token. By holding at least 1,000 MX Tokens, your trading fees will be cut in half. Increasing trading volume is another option for reducing MEXC fees, similar to other popular cryptocurrency exchanges.

Phemex

Phemex is yet another crypto exchange that offers trading fee discounts when you hold their native token. By staking Phemex Token (PT), you can achieve VIP trader status and enjoy lower trading fees. Furthermore, Phemex Token holders can choose to pay their trading fees using PT and reduce their trading fees by 20% for spot trading and 10% for futures.

How Can Finestel’s Solutions Help You Reduce Crypto Trading Fees

Finestel is a trading technology provider, specializes in offering professional traders and money managers personalized trading software. With Finestel’s copy trading as a bot or its white-label asset management solution, you can benefit from portfolio trackers and analytics to track your trading fees.

In order to reduce Binance trading fees, or that of Bybit, KuCoin, OKX, and Gate.IO, you can consider subscribing to Finestel’s services. Our solutions allow you to manage your trading in any of these exchanges utilizing a comprehensive dashboard. You can place orders, modify positions, and optimize your volume and timing from a sole trading panel. Feel free to contact us if you seek to reduce crypto trading fees and are curious about our products.

Traders Guide to Lower Crypto Fees Infographic

Conclusion

In this article, we focused on crypto trading fees, their different types, and how they can impact your performance and returns. We also offered a few proven strategies to tackle the issue and reduce your crypto trading fees significantly. Finally, we introduced Finestel’s services and how they can help you optimize your performance by minimizing trading fees.

Meanwhile, note that some of the strategies we analyzed in this article might go against your rules and trading plan. Therefore, they are capable of reducing your profitability, if implemented without prior evaluation and backtesting. While crypto trading fees are the primary cost of your trading career, minimizing them should not affect your overall performance in a negative way.

Leave a Reply