Backtesting is the process of evaluating a trading strategy by applying it to historical market data. It provides traders with the ability to assess how a strategy is likely to perform in live trading. Backtesting enables traders to identify and address weaknesses in their strategies prior to putting real money at risk. When implemented effectively, backtesting offers invaluable insights that can be used to optimize and improve trading systems.

This method can provide you with valuable information, such as how your system can potentially perform, what its weaknesses and strengths are, and how you can optimize it. There is almost no way that a trader can make a strategy work without testing it properly. Backtesting offers you a risk-free way to perform this evaluation.

In this article by Finestel, we will examine the fundamentals of backtesting and how it can be used to enhance trading strategies. We also state the key factors that can aid you in getting accurate, beneficial results from backtesting. We finally introduce Finestel’s backtesting software, which is currently in the development phase.

What is Trading Strategy Backtesting?

As humans, we often base our judgments and predictions on previous events and what our past decisions have led to. You can do the same in trading the financial markets via backtesting.

Backtesting involves retroactively applying the rules and logic of a trading strategy to historical price data. By reconstructing the trades that would have occurred in the past based on the strategy’s criteria, backtesting simulates how the strategy may perform in live markets. It serves as a risk-free method for traders to gain an understanding of the viability of their trading ideas.

Successful traders who have not tested their strategy before implementing it in live market conditions are extremely rare. It is only logical first to assess a strategy you want to risk your money with before diving into the market.

Advantages of Backtesting Your Strategy

Backtesting is highly advantageous when you are trying to evaluate and refine your trading system. Here are the main benefits of backtesting:

- Performance Evaluation: You can assess the effectiveness of your trading strategy by backtesting it using past market data.

- Risk Assessment: Backtesting allows traders to assess the risk profile of a strategy across different market environments. Modifying strategies with identified vulnerabilities can mitigate risk.

- Optimization: Analyzing trade outcomes and performance statistics enables traders to identify areas for improvement. Strategies can be refined based on insights gained.

- Confidence Building: Favorable backtesting results can increase a trader’s conviction in a strategy. This instills confidence when transitioning to live trading.

- Mistake Avoidance: Flaws in the logic or risk controls of a strategy can be detected through methodical backtesting. This avoids costly errors when real capital is at stake.

- Market Understanding: You can train your eye with backtesting and studying past market movements to increase your understanding of the market.

- Realistic Expectations: Analyzing a series of backtested trades provides you with a realistic expectation about how well your strategy can potentially perform.

What Do You Need for Backtesting a Strategy?

First things first, to backtest a strategy, you obviously need a trading plan with clearly defined rules. You would also require a charting platform or software and access to historical data. The next step is to specify a certain period for backtesting.

Some of you might be more convenient to backtest your strategy automatically. In this case, you would require some coding knowledge, too, as you should set up your strategy to be executed automatically in the first place and then evaluate the results.

Backtesting vs. Scenario Analysis vs. Forward Performance Testing

Backtesting involves applying a trading strategy to a certain set of historical market data to see how it would have performed in the specified timeframe. On the other hand, scenario analysis is testing how your strategy’s returns would be affected by different scenarios like interest rate changes and other economic or non-economic events. Finally, forward performance testing, called paper trading or demo trading, is another system evaluation method. In this method, you would simply test your strategy in live market conditions but with hypothetical funds.

Does Backtesting Really Work?

Backtesting is a valuable tool in the arsenal of traders and investors, allowing them to assess the historical performance of their strategies and potentially predict future market movements. However, the question remains: Does backtesting genuinely work?

The answer is both yes and no, depending on how it’s utilized. Backtesting can provide critical insights into how a trading strategy might have performed in the past under specific market conditions. It allows traders to refine their approaches, optimize parameters, and gain confidence in their systems. In this sense, it works as a valuable learning and strategy development tool.

However, it’s essential to recognize that past performance is not a guarantee of future success. Backtesting is based on historical data, which may not fully capture the dynamics of ever-changing markets. Unexpected events, shifts in market sentiment, and unseen factors can impact real-time trading outcomes. Therefore, while backtesting can be a valuable part of the trading process, it should not be the sole determinant of trading decisions. It should be complemented with real-time monitoring and adaptability to navigate the uncertainties of financial markets effectively.

Types of Backtesting Strategies

There are several different ways you can approach backtesting. Yet, some are more common than others. Here are 3 of the main backtesting strategies traders use:

Walk-Forward Backtesting

The walk-forward backtesting method is used to evaluate a strategy’s robustness and adaptability to different market conditions. This is an advanced method that involves breaking historical data into multiple time segments, like dividing a year of data into 4 quarters. You should then test your strategy’s performance on the first segment and make refinements to optimize the return.

Then, you would test the newly refined system on the next period and refine it again. You would repeat these steps for every segment, and an optimized strategy is what you end up with.

Multi-Asset Backtesting

In this method of backtesting, you apply your strategy to different markets and asset classes. These instruments can range from bonds and stocks to forex and cryptocurrencies. By evaluating the performance of your trading system in each of these markets, you would then determine the optimal market to use your strategy in and also which asset class does not provide a suitable environment for your system. So, to magnify your returns, you would focus on asset classes that demonstrate the best results.

Monte Carlo Simulations

Running a Monte Carlo simulation involves generating hypothetical scenarios using random sampling based on statistical distributions derived from historical data. This method is mainly a statistical, computer-run method of testing.

Monte Carlo simulations provide you with valuable feedback on how your strategy would perform in different scenarios and market conditions. Each scenario has a different set of parameters, like economic factors, and produces unique results. You can then create a distribution of possible outcomes and calculate the probability for each set of results.

Crypto Backtesting Process

Constructing a rigorous backtesting process entails several steps:

- Formulating a Strategy – A trading strategy with well-defined, objective rules should be developed. Ambiguous logic cannot be backtested.

- Gathering Data – Sufficient historical crypto backtesting data relevant to the trading universe of the strategy must be gathered. Quality data is imperative.

- Coding the Rules – Strategy logic should be translated into a precise computer-executable form. This eliminates discretion and bias.

- Running the Backtest – The coded strategy is then applied to the historical data set. Trades are simulated based on the strategy specifications.

- Analyzing Results – Key performance metrics are calculated to evaluate the hypothetical profitability and risk characteristics of the strategy.

- Refining the Strategy – The strategy is modified to address shortcomings and suboptimal elements identified through metrics analysis.

How to Backtest in Python?

Python has emerged as the programming language of choice for trading strategy development and backtesting. Python provides access to financial data APIs and has extensive statistics/analytics libraries for analyzing results. Coding in Python allows for automation and optimization of the backtesting process.

The main steps are:

- Import Python libraries for financial analysis like NumPy, Pandas, Matplotlib. These provide the building blocks for strategy backtesting.

- Obtain historical OHLCV (open, high, low, close, volume) market data. Python has APIs like Yfinance to download price data for backtesting.

- Calculate performance metrics like daily returns for comparison against buy and hold. This benchmarks the strategy’s performance.

- Code the strategy logic into Python functions. For example, create indicators, signals, and positions for a Bollinger Bands strategy.

- Run the backtest by applying the strategy to the historical data. This simulates how the strategy would have performed.

- Analyze backtest results using Python libraries like pyfolio for metrics like cumulative returns, risk metrics, drawdowns, etc.

- Evaluate strategy performance compared to benchmarks. Optimize parameters to improve returns and lower risks.

In summary, Python provides the tools and libraries to program a trading strategy, obtain historical data, run a backtest, and analyze the results. Coding in Python allows traders to backtest strategies in an automated, efficient manner before risking live capital. Results should be scrutinized before going live to avoid common backtesting pitfalls.

What is a Crypto Backtesting Spreadsheet?

A crypto backtesting spreadsheet is a tool used by cryptocurrency traders and investors to perform backtesting of trading strategies or investment portfolios using spreadsheet software, such as Microsoft Excel or Google Sheets. This spreadsheet is specifically designed to analyze historical price data of cryptocurrencies and evaluate how a particular trading strategy or investment approach would have performed in the past.

Here’s how a typical crypto backtesting spreadsheet works and what it includes:

- Historical Data Input: Users enter historical data for various cryptocurrencies, including price, volume, date, and potentially other relevant information. This data can typically be obtained from cryptocurrency exchanges or financial data providers.

- Strategy Parameters: Users define the parameters of their trading strategy or investment approach within the spreadsheet. This includes setting entry and exit criteria, risk management rules, and any other relevant strategy components.

- Calculations: The spreadsheet performs calculations based on the historical data and the defined strategy parameters. It simulates how the strategy would have performed over the specified historical period.

- Performance Metrics: The spreadsheet generates various performance metrics and statistics, such as total returns, average returns, drawdown, risk-adjusted measures (e.g., Sharpe ratio), and other relevant indicators. These metrics help users assess the effectiveness and risk associated with their strategy.

- Visualization: Many crypto backtesting spreadsheets include charts and graphs to visualize the strategy’s historical performance. Visual representations can be helpful for quickly identifying trends and patterns.

- Scenario Testing: Users may have the option to conduct scenario testing by adjusting strategy parameters or testing variations of the strategy to see how different approaches would have performed historically.

Crypto and Bitcoin backtesting spreadsheets serve as valuable tools for traders and investors to gain insights into the historical performance of their strategies without risking real capital. They enable users to refine and optimize their strategies based on past data and make more informed decisions in live trading.

How Much Backtesting is Enough?

Backtesting is super important for traders, but how much of it is really enough? This depends a lot on your situation.

If the markets are going crazy, you’ll probably want to backtest more scenarios to be ready for anything. Simple strategies don’t need as much testing as complex ones with lots of moving parts. Better quality data means you may not have to test as much, and day traders will be backtesting way more than long-term investors. And if you’re risk averse, more backtesting will help you feel confident and avoid big losses.

If you’re always tweaking your strategy, you’ll have to keep testing to make sure the changes work. There’s no magic number, but don’t get caught up testing so much that you never start trading. Do enough to feel comfortable, then trust yourself and take action. You can keep evaluating as you go.

Top Crypto and Forex Trading Backtesting Software

Various backtesting tools are available for both crypto and forex markets. Here are the top backtesting programs for both forex and cryptocurrencies:

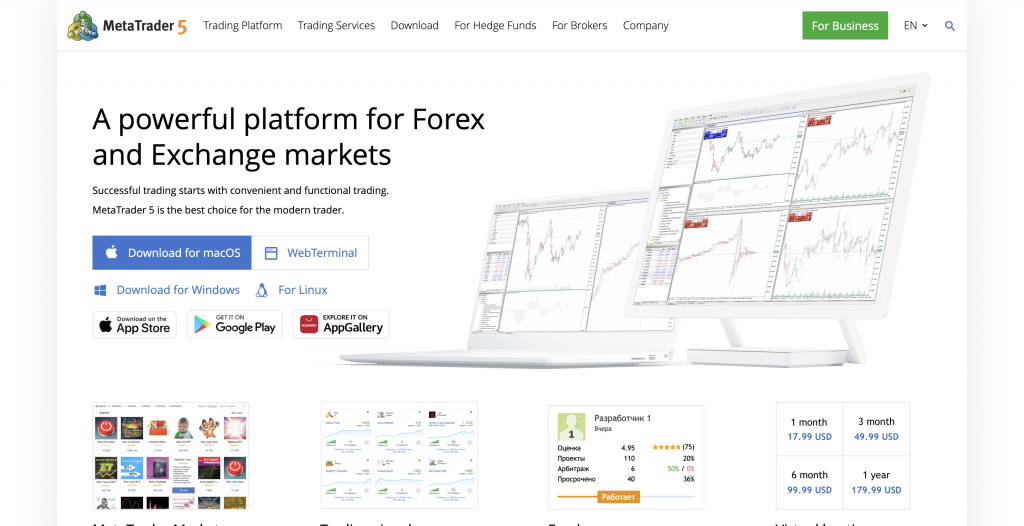

- MetaTrader: MetaTrader 4 and MetaTrader5 are among the most popular trading platforms in the trading community. You can also use MT4 and MT5 for backtesting your trading strategy using historical data.

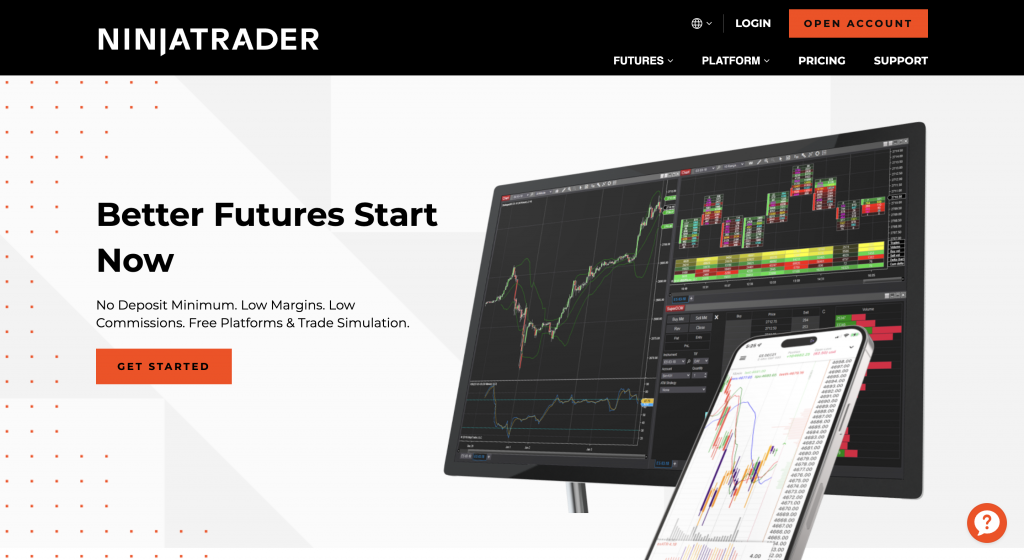

- NinjaTrader: Being one of the most comprehensive trading platforms available, NinjaTrader offers backtesting functionalities as well as charting tools and trading capabilities.

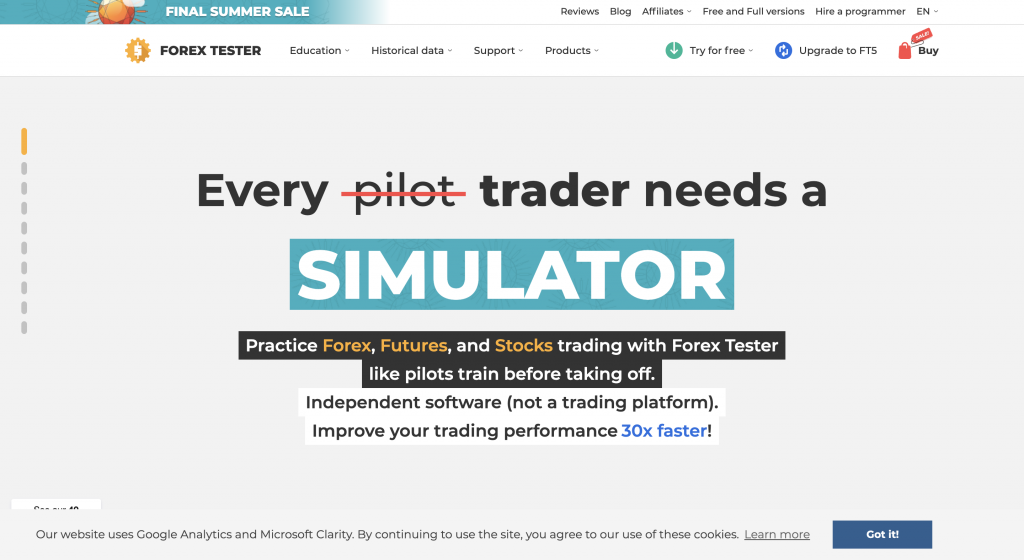

- Forex Tester: Forex Tester is a helpful software dedicated to backtesting both forex and crypto markets. It creates an environment similar to MetaTrader and allows you to execute and manage trades using past market data. It also calculates the key performance metrics, making it easier for you to evaluate your strategy.

- TradingView: The most commonly used charting platform in the world, TradingView can also be used for manual and automatic backtesting. For manual backtesting, you can use the replay mode and test your strategy by using past price action. In order to backtest automatically, you should write your strategy’s code in the Pine script editor and modify it to test the strategy over a specified date range.

Advanced Backtesting Techniques

In addition to the backtesting strategies introduced earlier, there are some advanced techniques you can apply. These techniques require deeper knowledge of the markets and statistics to be fully understood. Here are two of the most prominent ones:

Out-of-Sample Testing (OOS)

Out-of-sample testing is a process that involves testing a strategy’s performance on data that was not used in the development phase of the strategy. To clarify further, we first need to define what in-sample and out-of-sample data are:

- In-Sample Data: The historical data used for creating, developing, and refining a trading strategy.

- Out-of-Sample Data: A distinct data set that was not used during the development phase of the strategy.

So, you can conduct out-of-sample testing by evaluating an already developed strategy in a piece of historical data you have set aside earlier and have not used to create the system. Out-of-sample testing is supposed to decrease the risk of overfitting and assess the performance of the trading strategy in different market conditions.

Randomized Out-of-Sample Testing (ROOST)

Randomized out-of-sample testing aims to measure the robustness of your trading strategy. By introducing an element of randomness in the selection of out-of-sample data. This technique reduces the risk of data mining bias and overfitting tendencies. In this case, instead of selecting a fixed out-of-sample data set, you randomly select multiple sets of data. You should then backtest your strategy on each data set to end up with a distribution of the key performance metrics.

Implementing Backtesting Techniques

Several backtesting techniques have been briefly mentioned in this article. However, some are particularly useful and essential, especially when you are backtesting your strategy automatically.

Coding and Automation Tools

To backtest your strategy automatically, you first need to choose a coding language. Python is the most prevalent one because of its extensive libraries for trading. Moreover, due to its exceptional functionality in this field, Python is one of the most used programming languages for data analysis. You should then select a compatible trading or backtesting platform and acquire the historical data you need. Finally, your strategy should be written in a clear, step-by-step code and should be run on the data you gathered. The results can then be used to make valuable interpretations and optimization of your strategy.

Choosing the Right Timeframes

Depending on the type of trader you are or the strategy you designed, you should select the most suitable timeframe for backtesting. For instance, scalpers mostly use timeframes below 15 minutes, and so should you if you are testing a scalping strategy. Note that intraday strategies require minute or tick data. So, your data-gathering process is reliant on the timeframes you choose.

Selecting Relevant Performance Metrics

After each round of backtesting, you would be left with the results that are still raw data. In order to interpret the data and turn it into information, you should calculate several performance metrics. The most relevant metrics include:

- Profitability Metrics: Every trader’s main goal is achieving profits. So, you should calculate the profitability metrics such as total profits or losses and monthly and quarterly averages if you are backtesting a year of data or more.

- Win Rate and Risk-Reward Ratio: The two most important metrics in evaluating a trading strategy are win rate and risk-reward ratio. Find out the percentage of your wins out of all trades taken for calculating the win rate. For the risk/reward ratio, divide your average wins by your average losses.

- Maximum Drawdown: arguably, the most important risk assessment metric is the maximum drawdown of the strategy goes through. Drawdown challenges traders and investors emotionally and should be minimized as much as possible. Calculating the maximum drawdown is the first step to do so.

- Market Benchmarking: Compare the average return of your strategy to the market indices or assets you are trading, like S&P500 and Bitcoin, if you are trading U.S. stocks or crypto, respectively. Your trading strategy should be more profitable than just investing in the benchmarks to be worth the additional risk and management effort.

Interpreting Backtesting Results

The next step after acquiring the backtesting results and calculating the relevant performance metrics is to interpret those results. Here are some key ways you can interpret the information:

- Analyzing Risk-Return Ratios: While a higher risk-reward ratio is considered better, there are some additional risk-adjusted metrics evaluating return:

- Sharpe Ratio: A higher Sharpe ratio means a better risk-adjusted return for your strategy. Values above 1 are generally considered acceptable.

- Sortino Ratio: Being quite similar to the Sharpe ratio, Sortino focuses on downside risk instead of overall volatility of returns. Again, higher values are better.

- Calmar Ratio: This ratio is useful when you backtest more than a year of data. The Calmar ratio compares the average annual return of the strategy to the maximum drawdown. Higher values are obviously better in terms of risk-adjusted returns.

- Assessing strategy robustness: You can evaluate your strategy’s robustness by analyzing its performance over various segments of data and under different scenarios and market conditions.

- Identifying Overfitting: Make sure your strategy performs well on both in-sample and out-of-sample data. This indicates that there is less over-fitting. Also, complex strategies built on historical data often exhibit high overfitting. Keep things simple.

- Data Snooping: If you test various versions of your strategy and choose the best-performing one, you might be falling into data snooping bias. Use proper statistical methods to correct it.

Avoid Common Backtesting Pitfalls

While offering several benefits, backtesting also exhibits some common pitfalls and biases. Below are the most prominent pitfalls you should try to avoid to gain the most you can from backtesting.

Survivorship Bias and Its Impact

Survivorship bias occurs when you only consider assets that have survived and ignore the ones that have been delisted. Public companies that have been delisted from the stock market during your backtesting period are a good example. Remember to include the data related to these assets to eliminate this bias and achieve more realistic results.

Incorporating Transaction Costs

Backtesting often fails to take transaction costs such as fees, commission, and swap into account. Slippage and spread are also important and can significantly affect your performance. Trading, in reality, includes all of these costs, and you should try to incorporate these costs into your backtesting using various methods available.

Dealing With Non-Stationary Markets

Market phases and trends change over time. As a trader, you are dealing with a dynamic market, and you should consider this factor in backtesting, too. Try to backtest your strategy on different market regimes or on periods long enough that include shifts in market trends.

Overfitting

One of the most common pitfalls associated with backtesting is overfitting. This issue occurs when you optimize your strategy based on a segment of historical data to achieve the highest returns possible. However, keep in mind that past performance is not indicative of future results. Use aforementioned techniques like walk-forward testing and scenario analysis to minimize overfitting.

How to Enhance Trading Strategies through Backtesting

Improving a trading strategy’s performance requires a continuous process of testing and refining. Here is how you can enhance trading strategies through backtesting:

Iterative Optimization Techniques

You should continuously backtest your strategy and try to optimize it based on the results you get from each step. Try to experiment with different parameters of your trading system to achieve the best performance level. Also, be wary of the pitfalls we previously mentioned, like overfitting and data snooping.

Adapting to Changing Market Conditions

Analyze your strategy’s performance over different market conditions. For instance, monitor the results during both bull markets and bear markets or trending and ranging markets. An advanced upgrade to your strategy would be modifying certain parameters based on trend and volatility to ensure getting the highest returns in each market phase.

Incorporating Machine Learning in Backtesting

You can use machine learning algorithms to make your strategy automatically optimize itself over time. Therefore, machine learning enables you to create strategies that learn and evolve over time based on the data you provide them.

Does Finestel Provide Backtesting Software as Well?

Finestel, a trading strategy solutions provider is currently working on developing a backtesting software for its clients, and it will soon be available. However, if you are an enterprise and want early access to our backtester, you can contact us. We would put your request as a top priority and develop customizable, tailor-made backtester software for you to cover your specific needs.

Moreover, if you want us to include this tool in your white-label admin dashboard, besides copy trading service and other portfolio management tools currently accessible, make sure to leave us a message. We would also like to know how much you are looking forward to our backtester and if you want us to accelerate its development, so feel free to contact us. As a trading solution provider, we are here to cater to your needs and facilitate your business procedures.

Finestel’s Private Strategy Marketplace: Bridging the Gap Between Traders and Platforms

The Private Strategy Marketplace directly bridges the long-standing gap between skilled crypto traders lacking assets under management and white label platforms needing proven, profitable trading strategies to offer their users.

This marketplace seamlessly allows white labels to integrate top-tier veteran traders, accessing unique strategies their clients are unable to replicate alone. Benefits to platforms include:

- Instantly expanding trader talent and strategy diversity

- Increasing platform capabilities and client offering

- Boosting client profit potential and satisfaction

- Growing income streams through performer fees

For traders, our marketplace facilitates monetizing expertise for an exponentially wider audience by tapping into leading white label ecosystems.

The model champions performance-fee-sharing, incentivizing profits for all parties:

- Traders set their own fee percentage for sharing proven strategies

- Platforms charge clients subscriptions + additional performance fees

- Platforms keep their charged fees, sharing trader-set commissions

Our Private Strategy Marketplace allows white labels to rapidly augment trader variety and expertise. Clients gain access to elevated profit opportunities. Traders with limited reach can unlock their income potential. It’s a true win-win-win for all stakeholders.

Why Backtesting Does Not Work for Everyone

While a trading strategy tester is a powerful tool for some traders, it may not yield the same results or benefits for everyone. Several factors can limit the effectiveness of backtesting:

Data Quality: Backtesting relies on historical data, and the quality of that data is crucial. Inaccurate or incomplete data can lead to flawed results.

Overfitting: Traders may fall into the trap of over-optimizing their strategies based on historical data, leading to strategies that perform exceptionally well in the past but poorly in real-time markets.

Market Dynamics: Markets are not static, and backtesting may not capture the nuances of changing market conditions, particularly during significant events or regime shifts.

Psychological Factors: Real trading involves emotions and decision-making under pressure, which cannot be fully replicated in a backtesting environment.

Risk Management: Backtesting often assumes ideal execution and neglects real-world factors like slippage and liquidity issues, affecting risk management strategies.

Black Swan Events: Extraordinary, unforeseen events can dramatically impact markets, and backtesting may not account for these outliers.

While these limitations don’t negate the value of backtesting, they emphasize the need for a balanced approach to trading. Backtesting should be combined with risk management, real-time monitoring, and adaptability to navigate the complexities of financial markets successfully. It is a valuable tool, but it’s most effective when used as part of a comprehensive trading strategy.

Trading Strategy Backtesting Infographic

Conclusion

In this article, we delved deeply into one of the most thrown-around phrases in the trading industry, backtesting. We emphasized the importance of testing your strategy’s performance using historical data before implementing it in real-time market conditions. We also pointed out the steps included in backtesting and how you can get the most out of it while avoiding some common pitfalls.

Backtesting your trading strategy helps you identify the potential risks and weaknesses your strategy has. These insights help you in refining and eventually optimizing your trading strategy. Therefore, you would increase the profitability of your strategy and minimize the losses you would encounter in live trading.

FAQ

What is backtesting, and why is it important for traders?

Backtesting is the process of testing a trading strategy using historical data. The goal is to evaluate its potential performance. It helps traders assess how well the strategy performs without risk and provides insights into its strengths and weaknesses.

Can backtesting guarantee trading success?

No, backtesting doesn’t guarantee trading success. Historical data and real market conditions can differ, and unexpected events might occur.

What are some advanced techniques for backtesting complex strategies?

Advanced techniques for complex strategies include walk-forward testing, Monte Carlo simulations, and incorporating machine learning to optimize and adapt your strategies.

How can I backtest a trading strategy?

You must specify the period you are willing to backtest and then use backtesting platforms or software to either do it manually or automatically. For instance, TradingView’s replay mode is a basic method to backtest your strategy manually.

What is the best way to backtest a trading strategy?

The best way is to use historical data from reliable sources. Also, you should implement realistic execution conditions and factor in transaction costs. Finally, verify the results by out-of-sample testing to eliminate overfitting.

Why Does Your Backtesting & Forward Testing Results Are Different?

Differences are usually a result of human error and psychological issues if the strategy is traded manually. We all act differently when real money is at stake.

Leave a Reply