The world of cryptocurrency and blockchain technology has exploded in recent years, with more high net worth individuals (HNWIs) investing substantial amounts into this emerging asset class. Crypto investors span the spectrum from retail traders to ultra-high net worth (UHNW) whales who deploy hundreds of millions into digital assets. As a financial advisor or investment manager, being able to attract and serve crypto-savvy HNW clients represents a major opportunity to grow your business.

But how can financial professionals tap into this lucrative market and attract high net worth clients who are interested in or already investing in crypto? What are the challenges and opportunities of marketing to this niche segment? What do HNWIs who are into crypto want from their financial advisors or service providers? How can financial professionals find and reach out to these potential clients? And how can they differentiate themselves from the competition and attract ultra high net worth individuals (UHNWIs) who are into crypto?

These are some of the questions that this article by Finestel will answer by providing some tips and strategies on how to attract high net worth clients who are into crypto.

HNI, HNW, UHNW, and HNWI: What Sets Them Apart?

Before we dive into the intricacies of catering to high-net-worth individuals, let’s clarify some key terms that will lay the foundation for our discussion, This includes stocks, bonds, mutual funds, and now cryptocurrencies:

- High Net Worth Individual (HNWI): HNWI is a term used to describe individuals with substantial financial assets or investments. These individuals typically have a net worth between $1 million and $5 million, excluding their primary residence.

- Ultra-High Net Worth Individual (UHNW): UHNW individuals take it up a notch with a net worth exceeding $30 million, excluding their primary residence. Their wealth often spans various asset classes and investments.

- High Net Worth (HNW): HNW is a broader term encompassing both HNWI and UHNW individuals. It refers to anyone with significant financial resources.

- High Net Worth Client (HNC): This term is often used interchangeably with HNWI. It represents clients with considerable wealth and financial portfolios.

Within the HNWI population exist “crypto whales” – HNWIs with a particular appetite for digital currency investing. They have capital to deploy and are intrigued by crypto’s meteoric growth. Now more than ever, the whales are circling – ready to bite on the right crypto offerings.

Finding High Net Worth Prospects

To reach HNWIs interested in crypto investments, you need effective prospecting methods. Here are some strategic approaches:

- Network at Industry Events: Attend conferences and seminars focused on HNWI topics, such as Bacchus House, Tiger 21, or Family Office Exchange. These events offer prime networking opportunities to establish credibility and visibility.

- Leverage Centers of Influence (COIs): Collaborate with estate attorneys, CPAs, and business brokers who cater to HNWIs. They can provide warm introductions and referrals, increasing your conversion rates.

- Mine Public Data for Leads: Utilize services like WealthEngine and Wealth-X, along with advanced Google searches, to identify potential HNWIs based on public records and financial indicators. Personalize outreach based on their unique interests.

- Launch Prospecting Campaigns: Use a combination of strategic calls, email outreach, social media engagement, and direct mail to convert cold leads to warm prospects. Personalize your messages by tailoring them to their financial interests and associations.

- Spot Whales on LinkedIn: Research LinkedIn profiles for wealth indicators like “Family Office” or C-level executive titles. Utilize filters to isolate your most promising targets.

- Partner with Luxury Brands: Cooperate with prestigious brands catering to HNWIs, such as private aviation, luxury vehicles, elite real estate firms, and five-star hospitality. These partnerships provide access and build trust with their exclusive clientele.

You can gain AUM and raise your total assets under management by effectively tapping into this lucrative market.

Entering the Inner Circle: Attract High Net Worth Clients

To successfully engage and attract high net worth clients, take a thoughtful and personalized approach:

- Identify High Net Worth Venues: Determine where HNW prospects congregate, such as country clubs, luxury residential buildings, premium hospitality suites, and elite networking events. Frequent these venues to raise your visibility within their ecosystem.

- Establish Thought Leadership: Publish educational content tailored to attract HNWI attention. Ensure your expertise is visible through multiple channels to pique their interest.

- Leverage COI Relationships: Utilize your relationships with COIs to gain introductions into an HNWI’s inner circle. Warm referrals from trusted sources are more effective than cold prospecting.

- Listen and Educate: Avoid immediate sales pitches. Position yourself as a knowledgeable guide and actively listen to understand their financial goals and challenges. Propose a small crypto allocation (1-5%) to help them test the waters gradually.

This allows you to achieve higher AUM through establishing strong relationships.

Strategies for Attracting Ultra High Net Worth Crypto Investors

Ultra high net worth individuals (UHNWIs) possess unique characteristics and preferences that require tailored approaches. The crypto AUM from these elite clients can be substantial for advisors who demonstrate specialized expertise:

More Diversified Holdings

UHNWIs often have diverse portfolios that extend beyond traditional assets. This may include ownership of jets, yachts, businesses, and extensive real estate holdings. Understanding their varied holdings is essential when crafting investment strategies.

Complex Assets and Entities

Many UHNWIs hold illiquid shares in family businesses, trusts, and foundations. Advisors seeking to attract UHNWIs should be well-versed in handling complex asset structures and entities.

Demand for Exclusivity

UHNWIs expect personalized, bespoke financial services and absolute discretion from their service providers. Advisors should be prepared to offer exclusive services that cater to their specific needs.

To successfully attract UHNWIs, financial professionals must demonstrate a deep understanding of managing substantial wealth and be well-connected within the UHNW community. Offering specialized services and partnerships with experts in related fields can significantly enhance the appeal to this elite clientele.

How Finestel Can Help You Better Serve HNWIs

Partnering with an innovative fintech provider like Finestel can empower advisors to build, maintain and expand their crypto investment services efficiently. Finestel offers a customizable white label crypto copy trading platform, providing portfolio tracking, trade execution, client management, and other solutions to streamline operations.

By implementing Finestel’s white label solution, advisors can readily provide prospects with 24/7 portfolio tracking, advanced crypto portfolio strategies, market analyses, and other value-added services. This effectively demonstrates specialized expertise and thought leadership.

Finestel’s customizable platforms, trade automation, client management systems, and 24/7 VIP support empower advisors to provide elite services tailored to their HNWI clients’ unique crypto interests and needs.

Finestel’s automated copy trading and portfolio syncing tools help advisors seamlessly onboard new crypto-focused HNWI clients. This allows for efficient scaling of crypto AUM. The platform’s custody integrations and gradual allocation options build trust during the client acquisition process.

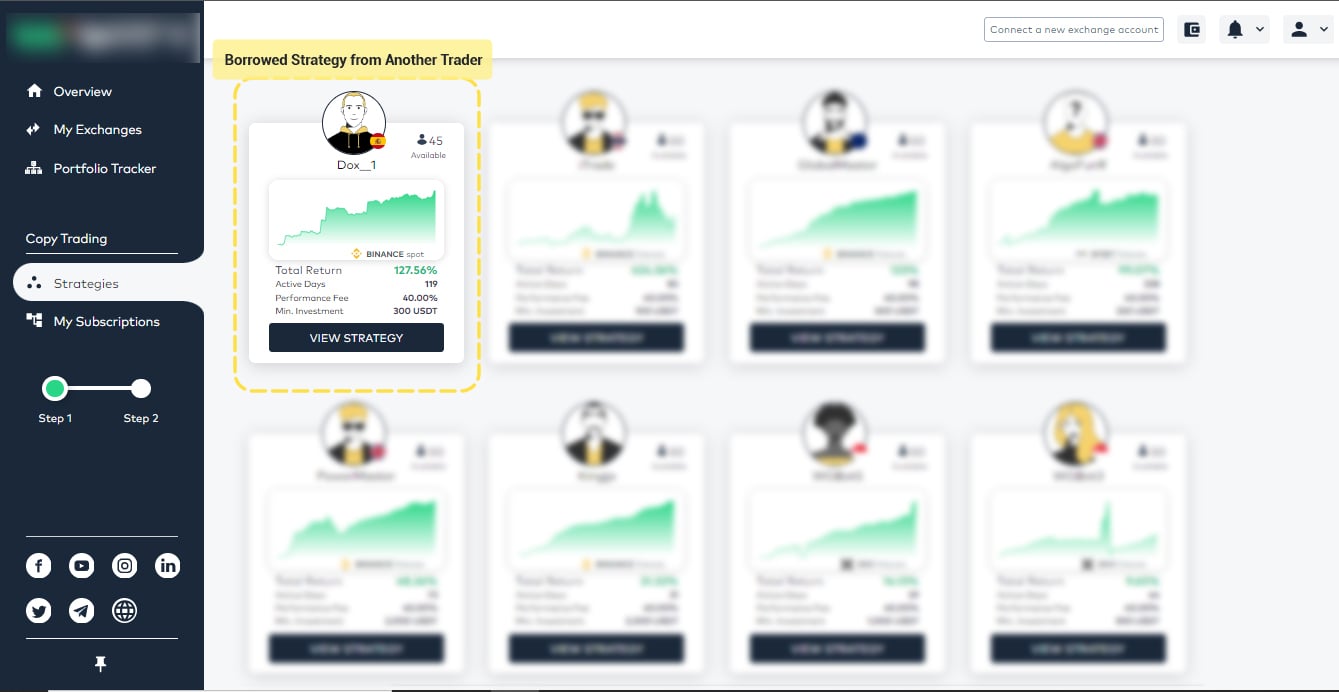

Finestel’s Private Strategy Marketplace

The Private Strategy Marketplace directly bridges the long-standing gap between skilled crypto traders lacking assets under management and white label platforms needing proven, profitable trading strategies to offer their users.

This marketplace also directly addresses a pressing need – helping skilled crypto traders with low assets under management rapidly scale their AUM. By joining our marketplace, traders with insufficient AUM instantly access vast new audiences and fast-growing client bases of white label crypto investors. This allows rapid expansion of reach and accumulation of assets under management.

With the ability to set customized performance fees, traders can quickly amass more crypto assets under management. And by leveraging white label infrastructure, customer service, operations and marketing, traders avoid many client servicing headaches.

For crypto traders hindered by low assets under management, our Private Strategy Marketplace offers the most efficient solution to aggressively scaling AUM and achieving growth potential.

Marketing Tactics That Resonate with Crypto-Savvy HNWIs

Reaching HNWIs interested in cryptocurrency requires a nuanced marketing strategy that aligns with their sophisticated needs and preferences:

Demonstrating Thought Leadership

Crypto-savvy HNWIs value advisors who can provide insights and expertise in the rapidly evolving world of cryptocurrencies. Demonstrating thought leadership by publishing reports, blogs, videos, and thought-provoking content on topics like tokenomics, blockchain technology, or the impact of significant crypto upgrades can enhance credibility.

Attending Relevant Networking Events

Crypto-focused networking events, such as SkyBridge Capital’s annual SALT Conference, are magnets for hedge fund managers, family offices, and high-net-worth individuals interested in digital assets. Attending these events provides opportunities to connect with crypto whales and blockchain venture capitalists, facilitating valuable relationships.

Highlighting Crypto Financial Engineering

To capture the attention of crypto-savvy HNWIs, advisors can showcase case studies that demonstrate the skillful structuring of crypto holdings to optimize returns. Real-world examples of crypto financial engineering can underscore specialized expertise in navigating the complexities of this asset class.

Customizing Outreach

Engaging potential HNW clients should involve tailored outreach. Advisors should invest time in researching their target’s background, financial interests, and investment preferences. Crafting personalized messages that resonate with these unique characteristics can significantly improve the chances of successful engagement.

Leveraging Referrals

Building relationships within the crypto community and securing referrals from respected business leaders can serve as a shortcut to establishing trust with crypto-savvy HNWIs. Warm introductions often yield higher conversion rates compared to cold calls.

Incorporating these tailored marketing strategies can help financial professionals effectively reach and engage with HNWIs who have a keen interest in cryptocurrency, ultimately leading to successful client relationships.

VIP Insights: 7 Strategies for Mastering the HNWI Landscape

Achieving success in retaining and attracting high net worth clients requires a nuanced understanding of their unique needs and preferences. While many strategies may seem conventional, it’s essential to tailor them to the specific context of cryptocurrency investments, adding depth and originality to your approach.

Overcoming Call Reluctance: Mastering the Art of Connection

Advisors often grapple with call reluctance, especially when reaching out to elite prospects. To overcome this hurdle, consider the following advanced techniques:

- Psychological Profiling: Dive deeper into the psychology of HNW individuals. Understand their behavioral traits, risk appetites, and communication preferences to tailor your approach effectively.

- Behavioral Economics: Incorporate principles from behavioral economics into your conversations. Highlight how cryptocurrency investments align with their individual financial goals and aspirations.

Prospecting Up the Wealth Pyramid: Building Your Client Base

While asking existing clients for introductions is a proven technique, you can add depth by refining your approach:

- Referral-Driven Seminars: Host exclusive seminars or webinars that address the unique investment challenges and opportunities within the cryptocurrency space. Encourage attendees to invite their HNW contacts, creating an environment conducive to referrals.

- Peer Networking Groups: Establish peer networking groups exclusively for HNW cryptocurrency enthusiasts. These groups can facilitate knowledge sharing and foster an environment of trust, making it easier for you to connect with potential clients.

Connect with Empathy: The Power of Personalized Engagement

Empathy remains a cornerstone of client relationships, but you can infuse originality into this practice:

- Behavioral Psychology Insights: Employ insights from behavioral psychology to understand HNW clients better. Tailor your communication style to match their personalities, whether they lean towards analytical thinking or are more emotionally driven.

- Customized Financial Journeys: Develop personalized financial journeys that align with each client’s unique life milestones and goals. Show them how cryptocurrency can play a pivotal role in achieving their financial aspirations.

Lead with Value: Beyond Traditional Services

Offering value upfront is a timeless strategy, but in the world of cryptocurrency, you can redefine what “value” means:

- Crypto Education Workshops: Host educational workshops specifically focused on cryptocurrency. Equip HNW clients with the knowledge and tools to navigate this complex asset class, demonstrating your commitment to their financial literacy.

- Crypto Investment Clubs: Establish exclusive investment clubs where HNW clients can collectively explore cryptocurrency opportunities. Share real-time insights, conduct group analyses, and foster a sense of community among like-minded investors.

Showcase Expertise: Elevating Your Cryptocurrency Authority

Demonstrating expertise in cryptocurrency is a key differentiator, and you can deepen your authority:

- Advanced Portfolio Strategies: Develop and showcase advanced cryptocurrency portfolio strategies that go beyond basic Bitcoin and Ethereum investments. Explore diversification into promising altcoins, DeFi projects, or NFTs while emphasizing risk management.

- Crypto Market Insights: Regularly publish in-depth reports and market analyses specific to cryptocurrency. Provide clients with comprehensive insights into market trends, emerging technologies, and regulatory developments, positioning yourself as a trusted source of information.

Harness Personal Observation: The Art of Serendipitous Connections

While chance encounters are valuable, you can proactively seek opportunities for deeper engagement:

- Crypto Thought Leadership Forums: Participate in or establish online forums where HNW individuals discuss cryptocurrency and blockchain. Engage in thoughtful conversations, answer questions, and provide valuable insights.

- Exclusive Crypto Events: Host exclusive events or meetups tailored to crypto-savvy HNW clients. These gatherings can provide a platform for genuine interactions and knowledge sharing.

Learn from Million Dollar Producers: Nurturing Ongoing Growth

Mentorship remains a powerful tool for professional growth. To add depth to this strategy:

- Cross-Generational Mentorship: Consider reverse mentorship arrangements where younger, tech-savvy individuals mentor experienced advisors on the intricacies of the cryptocurrency market. This cross-generational learning can lead to innovative approaches.

- Case Studies from the Crypto Frontier: Share success stories and case studies of how you’ve helped HNW clients achieve their financial goals through cryptocurrency investments. Highlight specific challenges and solutions to inspire confidence.

By infusing these advanced insights and strategies into your approach, you can provide a deeper and more original value proposition to high-net-worth individuals interested in cryptocurrency. This not only positions you as a trusted advisor but also enhances your ability to navigate the evolving landscape of crypto investments effectively.

Sealing the Deal: Transforming Prospects into High-Value Clients

Once you’ve hooked the interest of high-net-worth prospects, employing advanced landing tactics can help solidify these connections:

Lead with Discovery

Before proposing solutions, engage in thoughtful questioning to gain a deep understanding of your client’s financial situation, priorities, objectives, and pain points. Building rapport through engaged curiosity is paramount.

Propose a Gradual Portfolio Allocation

For clients new to cryptocurrency, we recommend starting with a modest allocation (1-5%) to allow them to acclimate gradually to this asset class. This cautious approach helps build trust and comfort over time.

Highlight Crypto’s Upside

Compare the exponential growth potential of cryptocurrencies against the more modest returns of traditional assets. Emphasize the potential for higher returns while acknowledging and managing the associated volatility.

Provide Custody Reassurance

Address security concerns by involving trusted institutions like Fidelity or reputable crypto custody services. Assure clients that their investments are secure for long-term holdings.

Encourage Small Initial Investments

Suggest low initial crypto investments as a way for clients to assess their comfort level before committing significant capital. This allows them to dip their toes into the crypto waters before diving in.

Mastering finesse, patience, and expertise is key to reeling in high-net-worth clients. Whales are often more responsive to thoughtful and informed approaches rather than hard sales tactics. Earning their trust over time will lead to successful client conversions.

Conclusion

Attracting and retaining high-net-worth clients, particularly those interested in cryptocurrency, is a strategic endeavor for financial professionals. Understanding their unique needs, implementing targeted marketing, and utilizing effective networking and prospecting strategies can lead to success in this competitive and evolving landscape. By combining thought leadership, personalized engagement, ethical practices, and the insights shared in this article, financial advisors can unlock opportunities and build enduring relationships within the high-net-worth community, ultimately contributing to their long-term success.

By leveraging innovative solutions from leading fintech providers like Finestel, financial advisors can unlock major opportunities to attract high net worth clients, and serve and retain them. Finestel’s trading platforms and automation empower advisors to scale their operations and provide elite services tailored to this lucrative client niche.

Leave a Reply