There are a ton of resources that discuss the pros and cons of crypto copy trading. However, most of those comparisons–if not all– are either from the copy traders’ approach or about the crypto copy trading itself.

In this post, we get into the trader side of the equation as well as the copy trader side. What you’ll read is from a couple of years of feedback from Finestel’s professional traders and public investors.

We’ll talk about the means of crypto copy trading, models, and their functions. The disadvantages and advantages of copy trading, especially in the crypto market, and lastly, we’ll introduce the most descriptive and helpful Finestel guides to you to know about how Finestel solves the copy trading issues and get the best out of its opportunities. It will help you find out if copy trading is a good idea for you and your business or not.

Briefly About Means of Copy Trading

According to good old Wikipedia, modern copy trading officially started around 2005 via an automated trading system called “Mirror Trader” by Tradency. Nowadays though, copy trading is available on various platforms (exchanges, apps, bots, etc.), with infinite functions, and for all financial markets.

You might’ve heard other terms being referred to as copy trading as well, like mirror trading, follow trading, social trading and more. First of all, there’s no fine line between them, secondly, they function almost virtually the same.

Technically, copy trading refers to executing replications of a trader’s actions (trades) on an exchange account or a third-party software into the exchange accounts of their clients or investors (copy traders).

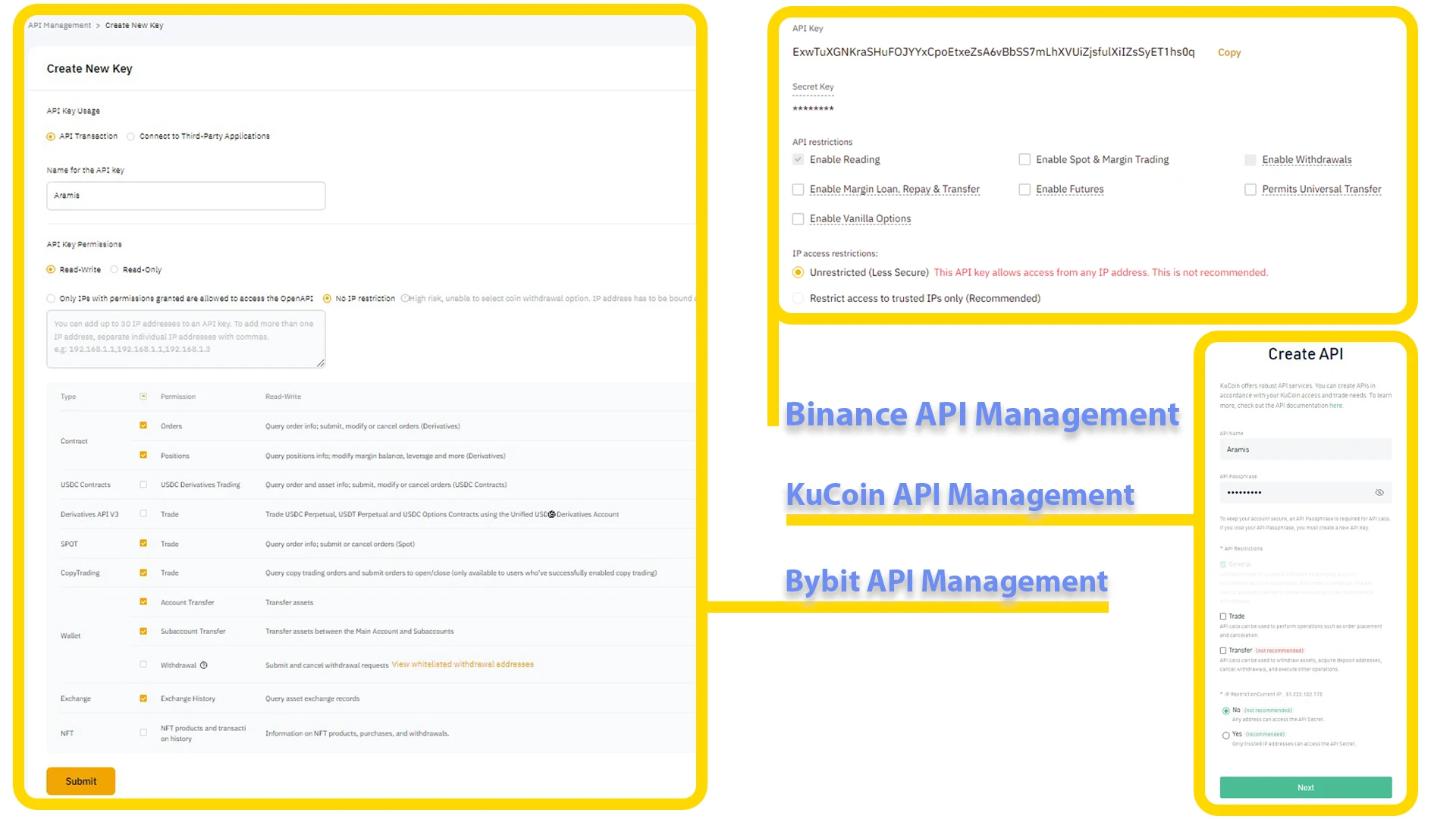

In more advanced models, the replication executions take place thoroughly proportional (including all the trade setup elements), which makes automated asset management possible. You can read more about that on other blog posts we’ve written before, but full details with Binance, KuCoin, and Bybit examples.

Crypto Copy Trading Models and How They Work

Generally two models exist, copy trading on a crypto exchange and via API access. Let’s tell you about APIs and how they are used in crypto copy trading, as it’s the primary scheme that we’ll talk about here, and then explain the two models separately.

What is API & What API Keys Are Used for in Crypto Copy Trading?

An API (Application Programming Interface) is a connection that applications talk to each other through, using API keys, which one can create on their exchange account or many other platforms.

API connections have many functions and use cases but generally two API key configurations are used in copy trading, “Read-Only” and “Trade-Only” API keys. These terms however, may be different among the providers like KuCoin calls read-only APIs as the “General” API configuration and Bybit uses “Read-Write” instead of trade-only API keys.

Besides, the “API Management” section may also differ. For example, KuCoin has a very simple API key configuration, while you have access to modify detailed API permissions on Bybit.

Read-Only API Keys for Crypto Copy Trading

Read-only API keys allow the copy trading platform to read and copy a trader’s operations (trades) on their exchange accounts. The read data is used to create reports and/or track portfolios, and so on and so forth. This is the API key that traders connect their exchange account to the copy trading platform with.

In advanced copy trading, the third-party (copy trading) platform uses the copied trades to execute proportional replications on the exchange accounts that are connected to the platform via trade-only API keys.

Trade-Only API Keys for Crypto Copy Trading

Trade-only API keys are what copy traders connect their exchange accounts to the copy trading platform with.

The trade-only API access allows the platform to execute trade replications – AKA trade – on the connected exchange account, also create reports, track portfolios and more.

Important

The “withdrawal” API keys, as the name suggests, are used to transfer or withdraw assets from accounts. While the key has its particular use cases, it’s not needed for copy trading. Who or whatever has withdrawal API access to your exchange account potentially has your assets.

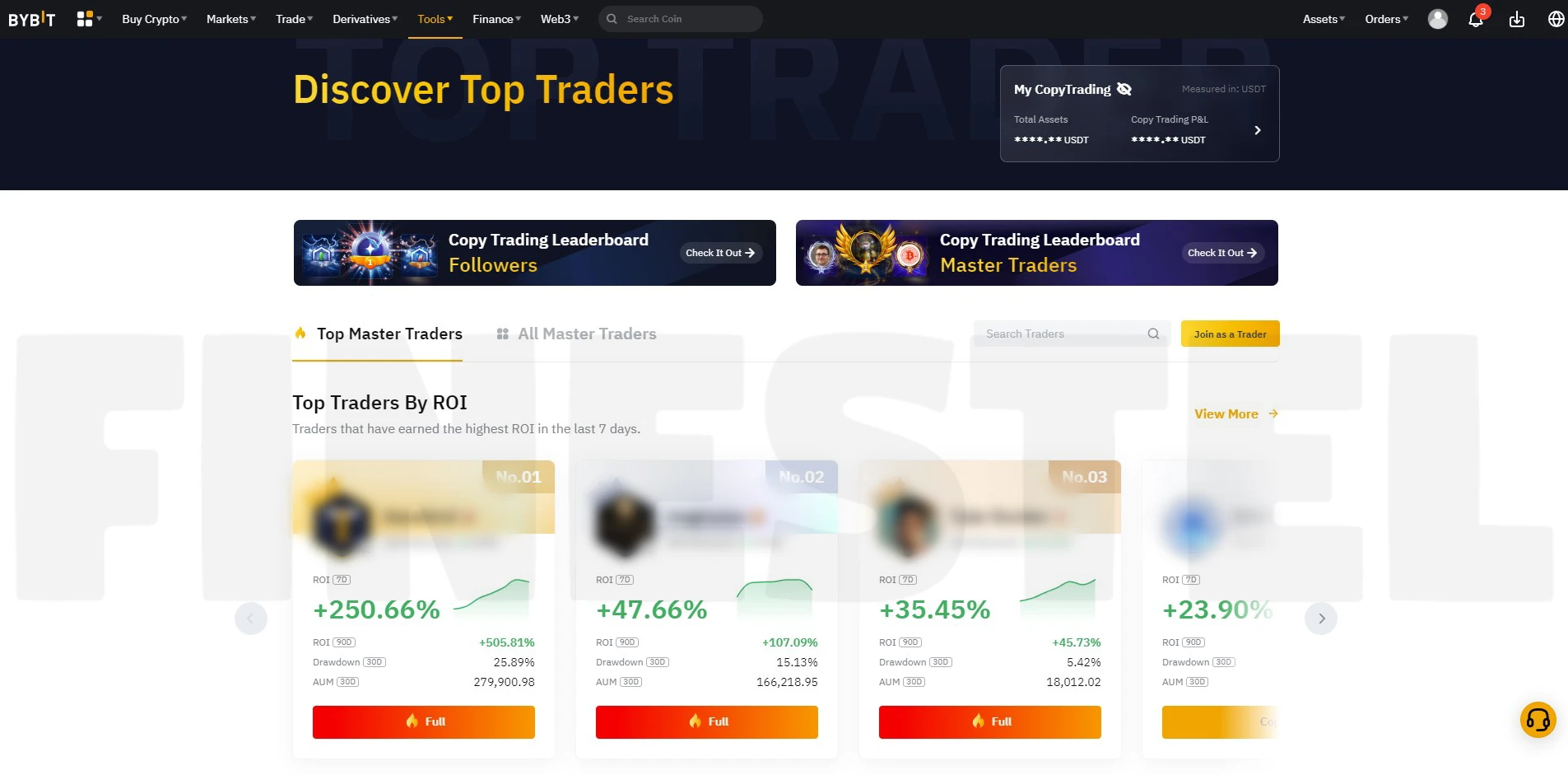

Crypto Copy Trading on Crypto Exchanges

Many crypto exchanges have copy trading available as a service. Namely, futures (referred to as derivatives) copy trading on Bybit or copying a trader bot on KuCoin.

The process is simple, dedicate some balance and copy a trader. If the trader makes a profit, the exchange will transfer the trader’s share from your balance to them; other fees such as subscription and/or management fees, may also include.

Crypto Copy Trading via API Access

Third-party crypto copy trading platforms are technically automated trade execution bots that connect to exchange accounts via API access to either read and copy trades from or execute orders on them.

The Trader Side

Pro crypto traders connect their exchange accounts to the platform via read-only API keys to make their trades available for the public crypto investors to copy. That way, the trader will be able to practically trade with a higher account balance; or gain AUM (Assets Under Management) but in a non-custodial manner.

If the trader makes a profit, their “performance fee,” which is the share of their copy traders’ profits, has the potential to exceed that profit or even multiple times higher!

The Copy Trader Side

The copier side of the equation connects via read-only API keys, allowing the platform to place/cancel the copied orders or trade on their exchange accounts.

So, in return for a subscription or performance fee, or a combination of both, crypto investors (non-traders–for any reason) will have a professional trader managing and maintaining their exchange accounts portfolio.

Crypto Copy Trading Pros and Cons

Crypto copy trading is a rapidly growing industry capable of taking non-custodial crypto asset management to the next level by automating it, but nothing’s perfect, right? There are issues that both copy trading participants (trader and copy trader) may encounter, let’s dive into them:

Crypto Copy Trading Pros & Cons for Traders

Most of the comparisons out there are from the copy trader side, as the majority of them are not professional traders. Considering the complexity of asset management, especially in the crypto space, traders’ POV in the copy trading concept is quite worth spending some time on; isn’t it?

Below is the comparison, but please keep in mind that some of the potentials and advantages are not available on all crypto copy trading platforms and only a few advanced platforms render them; such as thorough proportional replication executions or client management systems.

Advantages

- AUM: Copy trading allows pro traders to trade with higher – non-custodial – balance.

- Performance Fees: The trader’s share of their copy traders’ profits, capable of multiplying their income.

- Subscription Fees: Some traders, especially those with a private community, define cyclic fees such as management or subscription fees for their clients.

- Client Management: Advanced copy trading platforms handle all the client profit realizations, fee settlements, and reportings for both the traders and their clients.

- Investment Diversification: Traders can connect multiple exchange accounts, with various portfolio management strategies implemented on them, for their community to copy; which also provides risk management diversification for their clients as well.

- Portfolio Tracker: Most copy trading platforms contain a portfolio tracker app as it’s necessary for the copy trading participants. The app is usually freely available to the platform users even if they’re not a copy trading participant; Finestel’s free crypto portfolio tracker app.

Disadvantages

- Technical Issues: Machines are supposed to work flawlessly, but glitches are inevitable, which may cause order execution slippages.

-

- Slow Replication: Speed plays a vital role in a copy trading software. Some advanced platforms execute trade replications at the speed of light, yet accurately and some others lack replication execution speed, causing considerable execution price slippages.

- Liquidity: A copy trading platform has the potential to send a massive order for a trading pair to the destination crypto exchange, causing sudden price movements. In such situations, orders (market orders especially) may fill at different price points on some of the copy trader exchange accounts.

- Terminal of Choice: In some cases, the trader must use the platform’s terminal to implement strategies instead of using their exchange account terminal.

- Lack of Communication with Clients: In most copy trading platforms, the means of communication between the traders and their clients goes down to a chat box or comment section only, or private messengers, so they’re not quite in touch!

- Lack of Customizations: Most copy trading platforms have fixed pricing models and cycles for traders and many also lack reporting modifications.

- Lack of Non-Custodial Asset Management Ability: Some copy trading platforms require the participants to deposit their funds into the platforms for copy trading instead of using the API copy trading method.

- Lack of Private Copy Trading Service: Some traders might like to provide their services to their community only. Some traders might not be willing to share their clients with the copy trading platform. Moreover, traders might not like their private community to see other traders on the platform. Note: those issues mostly occur on social trading platforms.

Crypto Copy Trading Pros & Cons for Copy Traders

Just a little fact before moving on, copy trading is not much – maybe even at all – different from trading itself, especially in terms of risk. Copy trading is like hiring an expert trader for your exchange account.

Advantages

- Trading Like Experts with Zero Efforts: It’s not quite zero, to be honest; you gotta collect profits, whatsoever! Copy trading will get you rid of all the complex stages of trade setup developments (backtesting, strategizing, execution, etc.). You’ll leave all the hard work to the trader and just receive the final product in return of pre or post – or both – paid fees.

- Risk Diversification: Is this even a thing, though?! Anyways, copy trading is somewhat an investment. You invest in an expert trader’s skills or their trading and/or portfolio management strategy. Simply, one can copy various traders, who have different risk management tactics, using multiple copy trading dedicated exchange accounts/subaccounts (or portfolios).

- Live Trading Trainings: Feel a little poetic today! Many traders copy other traders to watch their operations and learn new stuff; I think it’s quite self-explanatory.

- Account Management Tools & Services: You have access to portfolio tracker tools, reporting services, alert and notification system and a bunch more on some copy trading platforms; Finestel has all that for free, BTW!

Disadvantages

- Less Control: The goal of copy trading is to have professional trading operations on your exchange account, which shouldn’t get manipulated after execution. In other words, you shouldn’t trade on the account that you’re copying a trader with.

- The Copied Trader’s Faults: Professional traders make mistakes, lose trades and money too, and are not 24/7 profitable.

- Technical Issues: Bugs and glitches may happen between the copy trading platforms and connected exchanges sometimes.

How to Get The Best of Crypto Copy Trading + Solutions for the Disadvantages with Finestel

Finestel is a crypto asset management solution provider, a powerful trading automation software running on top of a handful of automated and autonomous bots. The bots provide services such as fully proportional copy trading, client management, portfolio tracking services and more.

In addition to Finestel, there is its VIP service: Finestel Pro. A white label fully customizable crypto asset management software for pro crypto traders (or portfolio managers) with a community of clients. Finestel Pro contains all the Finestel services plus a few more but as a fully personalized (branded) web-application.

Finestel Pro is a highly customizable crypto asset management software.

The white-label owner has access to build and run crypto asset management services, integrate a currently running business with the white-label, or even use it as a copy trading strategy affiliation business; tell nobody!

You can order you own copy trading dashboard with your brand & tailored for you here.

Conclusion

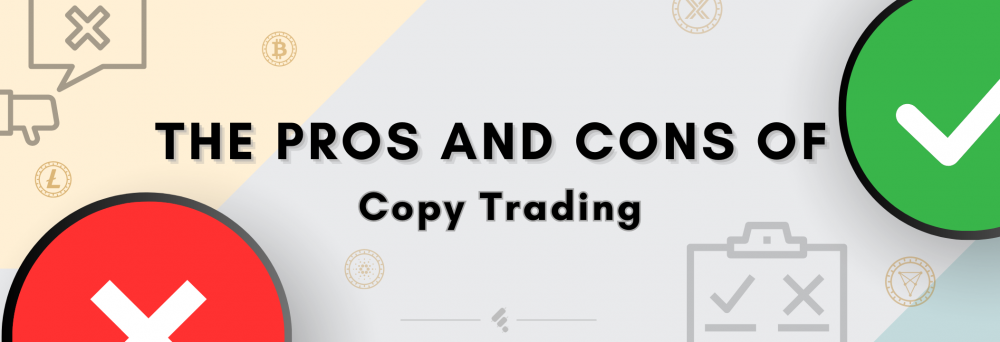

Here’s an infographic wrapping up all the cons & pros of copy trading and explaining the copy trading concept so fast. To see the high resolution image, click on the image:

Copy trading has introduced new methods of asset management to the crypto industry and in Finestel, we’re trying our best to make those methods available to the industry’s professionals as efficiently as possible. Thank you for reading all the way to the end.

Leave a Reply