Trying to keep up with the fast-paced crypto markets can feel like a full-time job. Between tracking prices, reading news, and actually executing trades, it’s no wonder traders are looking for the best crypto trading bots to lighten the load. On Telegram, an entire ecosystem of crypto bots has sprung up to provide useful tools and automation right at your fingertips.

But not all bots are created equal. Finding the right match among the ever-growing lineup can be overwhelming. This guide by Finestel, will overview 10 top crypto Telegram bots for 2024 options and summarize their key features, intended users, and pricing.

What are Crypto Telegram Bots?

Crypto telegram bots are automated programs built to run inside the Telegram app providing various services related to cryptocurrencies. They are designed to provide quick and easy access to crypto market data, news, portfolio tracking, trading and more right within the Telegram messaging app.

With the rising adoption of cryptocurrencies over the past few years, crypto telegram bots have emerged as an essential tool for traders, investors and enthusiasts to stay updated on the fast-moving crypto markets. They can subscribe to different bots within Telegram to get customized alerts and information without having to switch between multiple websites and platforms.

Some key features of crypto telegram bots include price alerts, portfolio tracking, technical analysis, trading signals, airdrop notifications, news aggregation, and more. Leading crypto exchanges like Binance, Coinbase, and FTX have also developed official telegram bots to provide quick access to account information for their users. Find out the best crypto Telegram signals groups and channels.

Overall, crypto telegram bots represent one of the most popular and convenient ways for the crypto community to stay on top of the latest developments and manage their portfolios through a simple, intuitive interface right within the Telegram app. The accessibility and customization they offer explain their rapidly growing adoption.

Find out the top 14 crypto podcasts in 2024.

Types of Crypto Telegram Bots

Many traders use Telegram to access crypto bots, and there are several major types of crypto telegram bots providing various use cases:

- Price tracking bots – These allow users to monitor prices of top cryptocurrencies like Bitcoin, Ethereum, track portfolios and set customized alerts.

- Trading bots – More advanced trading bots can place and execute orders automatically based on preset trading strategies and technical analysis.

- Portfolio bots – Portfolio tracker bots connect with users’ exchange accounts or wallets to provide a quick overview of all assets and the latest values.

- Tax calculator bots – Some bots can track trading activity and generate capital gains reports for tax purposes.

- News bots – News bots aggregate the latest news, analysis, articles and updates from the crypto industry and share the curated items.

- Airdrop bots – Airdrop bots alert users about new token giveaways, bounties and other promotions offered by crypto projects.

- Wallet bots – Wallet bots allow users to access information from their crypto wallets, like transaction history, balances, etc.

- Exchange bots – Leading crypto exchanges like Binance, Coinbase, FTX have official bots on Telegram to provide quick access to account details.

With the expanding functionalities of crypto bots, they are becoming one-stop solutions for all kinds of information and services investors and traders need through a unified interface.

Are Crypto Telegram Bots Legit?

The question of whether crypto telegram bots are truly safe and legitimate is a fair one that every wise investor must consider. These clever programs promise great convenience by delivering market data, alerts and trading powers right to your fingertips within Telegram. But we must be cautious of any offer that seems too good to be true, as native trust has allowed many a crypto keeper’s coins to vanish mysteriously.

While reputable bots from honorable developers can certainly grant useful boons, be wary of shady spirits peddling shortcuts and get-rich-quick schemes. Do not surrender the keys to your coin vaults lightly, and cast a skeptical eye on any bot that demands more than it needs. Start by testing small amounts and keep larger hoards secured in offline wallets beyond any bot’s reach.

Review feedback from fellow travellers, but also watch for signs of trouble yourself. Strange trades or withdrawals should raise the alarm like a dragon awakening. Revoke an untrustworthy bot’s access immediately before your riches disappear like a wizard’s trick.

With prudence and care in choosing your crypto companions, the top bots may safely unlock knowledge and power to ease your burdens. But disregard the warnings of others at your peril. In the end, your wealth and wisdom are your own to cultivate and protect. Choose your guides well, and keep your coins close.

Top Crypto Telegram Bots Compared (June 2024 Update)

| Bot Name | Key Features | Pros | Cons | Fee Structure | Best For |

| Finestel | Portfolio tracking, customizable client reports, signal providing and execution automation | Streamlines signal broadcasting, intuitive interface, end-to-end automation | Limited supported exchanges | Fully customizable pricing, referral program | Advanced signal providers, investment managers |

| Unibot | AI and machine learning for trade optimization, user-friendly interface | Minimizes risks, extensive data insights, customizable | Long-term performance unproven, AI reliance risks | Free basic features, $29/month Pro plan, 1% performance fee | Beginners and advanced traders |

| Wagie Bot | Basic trading rules, easy setup, minimalist interface | Simple to operate, lower risk, affordable pricing | Lacks advanced analytics, limited features | Free basic configurations, $9/month for more options | Beginners |

| Mizar | DeFi and CeFi trading tools, proprietary research tools | Provides both DeFi and CeFi tools, free research tools | No loyalty program | No monthly fees, 15% performance fee on profits | DeFi and CeFi traders |

| Maestro | Advanced customization, professional-grade tools | Powerful tools, lifetime license with affordable fees | Steep learning curve, requires ongoing optimization | $25/month basic tools, up to 2% performance fees | Experienced traders |

| Cornix | In-app trading, portfolio monitoring, customizable alerts | Convenient, real-time alerts, highly customizable | Potential security risks, steeper learning curve | Free version, $25/month premium plan | Telegram-centric traders |

| Cryptohopper | Automated trading, cloud-based setup, user-friendly interface | Easy for beginners, automated strategies | Missed opportunities if market changes rapidly | Free starter plan, $19/month Pro plan | Beginners |

| Coinrule | Customizable strategies, backtesting tools | Highly customizable, robust backtesting | Initial learning curve, ongoing optimization | Free starter plan, $29/month Pro plan, $79/month Premium plan | Traders looking for custom strategies |

| Banana Gun | Advanced sniping, wallet management | Quick token acquisition, manual and auto buying options | Higher fees for advanced features, learning curve | 0.5% fee for manual buy, 0.85% fee for auto sniper | Traders focusing on new token launches |

1. Finestel

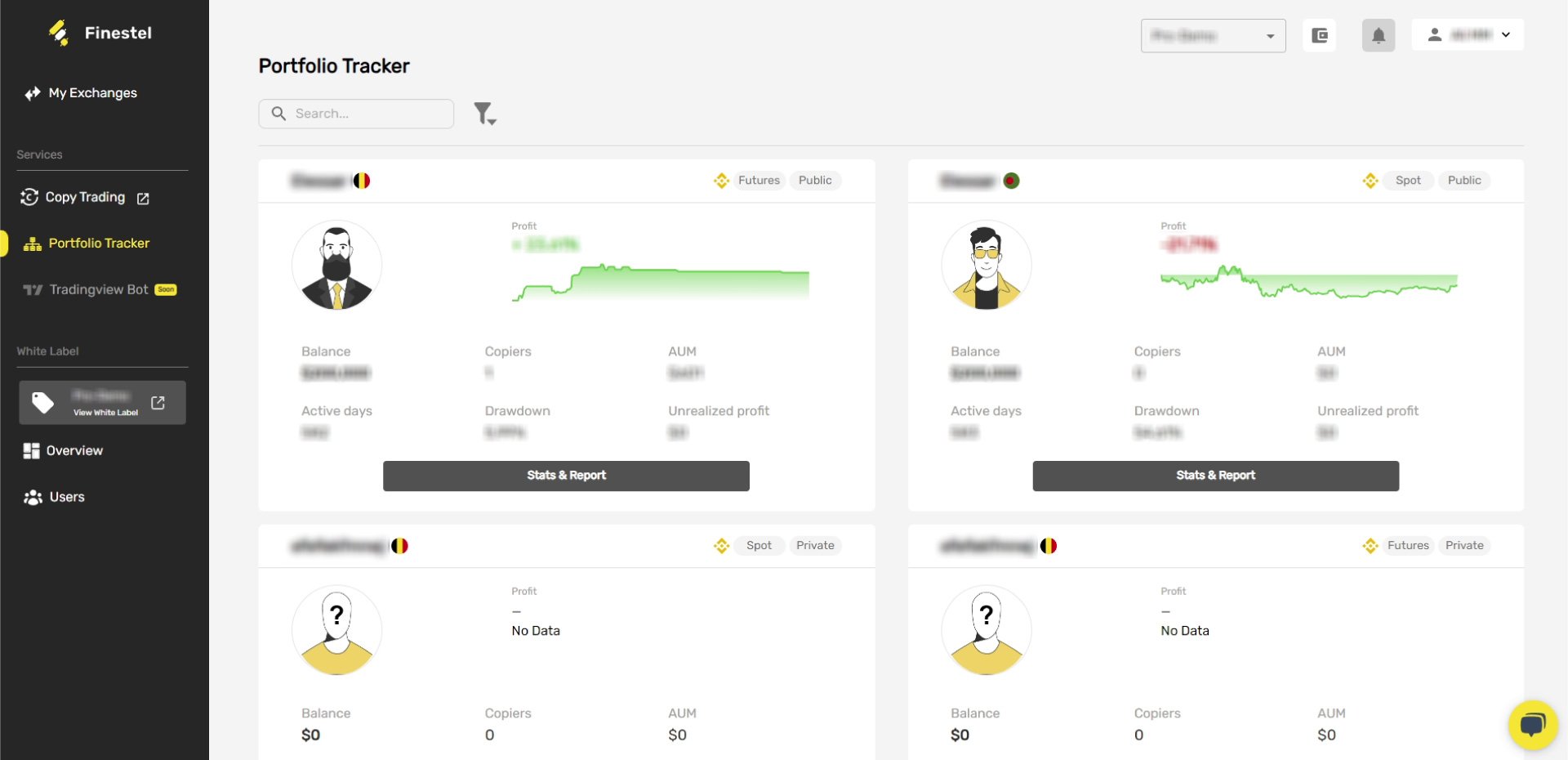

Finestel’s Telegram Crypto Trading Bot is a good example of a crypto telegram bot that provides advanced features and benefits for traders, investors, and signal providers. Finestel is a leading crypto trading software development company that offers a revolutionary approach to delivering and executing cryptocurrency trading signals through its cutting-edge white-label copy trading software.

Finestel’s Telegram crypto trading bot allows users to transform their social media presence into a legitimate investment management business. The customizable white label software interface links platforms like Telegram, Twitter, and Discord into one seamless copy trading experience. Users can also earn passive income by referring trading signal admins to use the platform, as they get a portion of Finestel’s income from their activity through their referral code.

Tools

- Portfolio Tracking: The bot enables easily automated investment, trading, and portfolio tracking reports (of your connected exchange accounts on Finestel) directly in your Telegram account. You can customize schedules to receive daily, weekly, or monthly reports containing key performance metrics for all connected exchange accounts. This simplifies monitoring returns across your multiple portfolios in one place. Read more on our comprehensive review on the best crypto portfolio trackers in 2024.

- Fully Customizable Clients Reports: This feature is for those Finestel users and partners that already run a crypto investment management business (like trading signal providing) and have integrated their business on top of Finestel’s copy trading service or white label copy trading solution. They will receive reports of their trading status (exchange errors, partial filling of orders, etc.), their clients’ activities (sign-ups, new subscriptions, cancels, etc.) and much more. You get complete visibility into your client base and operations through the bot’s administrative dashboards and automatic report delivery. This streamlines administration.

-

Signal Providing Automation:

The bot includes a specialized workflow to make broadcasting your trading signals and tips incredibly easy. Just enter the key details like entry price, stop loss, take profit, etc., in our formatted template.

With one click, the bot then instantly generates and publishes your full, detailed, branded signals across all connected Telegram trading groups and channels. This saves loads of time while allowing you to push signals at scale. By the way, you don’t need to integrate your whole signal-providing business on Finestel to use this feature. - Signal Execution Automation: Beyond broadcasting signals, the bot also enables seamlessly executing your trades directly from Telegram on:

a) Your (admin) exchange account + b) also on your clients’ multiple exchange accounts concurrently.

So, to use the first feature (a), you must have connected your exchange account to Finestel via trade-only API access. To use the 2nd (b), here’s where you should manage your signal business on top of Finestel’s copy trading service or white label copy trading solution.

Pros

- Streamlines signal broadcasting and management

- End-to-end automation improves efficiency

- Intuitive experience native to Telegram

- Helps scale client base as a signal provider

Cons

- Limited supported exchanges

Fee Structure

- Fully customizable pricing

- Referral program available

User Testimonials:

Nice experience with a simple and straightforward technology. It’s worth trusting them to empower your business.

To run your branded Telegram bot for your business, contact us via the chat icon on the right below corner, or message us on Telegram for a faster answer. You’ll find other ways to contact us here.

2. Unibot

Unibot is a crypto trading bot launched in May 2022 that leverages artificial intelligence and machine learning to optimize trading strategies. Developed by a team of former Google engineers, Unibot analyzes massive amounts of data, including news stories, social media posts, and financial metrics to identify profitable opportunities. According to its developers, Unibot is able to beat market benchmark returns by 5-7% consistently.

In beta testing, the bot delivered an impressive average monthly return of 11% with relatively low volatility compared to simply holding Bitcoin. Unibot aims to make advanced AI-driven trading strategies accessible to regular crypto investors and traders.

Key Features

- Uses AI and machine learning algorithms to optimize trades

- Analyzes data from news, social media, and financial reports

- Provides portfolio management, monitoring, and advanced analytics

- Very user-friendly interface suitable for beginners

Pros

- AI-powered trading strategies minimize risks

- Lots of data sources provide better insights

- Customizable options to suit every trader’s needs

- Easy to use even for crypto trading beginners

Cons

- As a new bot, long-term performance remains unproven

- Overreliance on AI predictions has risks if market shifts

- More advanced traders may want more complex options

Fee Structure

- Free version with basic features

- $29/month “Pro” plan with full features

- 1% performance fee on profitable trades

Find out the best crypto Onchain analysis tools and the best crypto market sentiment analysis tools in 2024.

3. Wagie Bot

Wagie Bot offers an easy way for beginners to get started with basic crypto trading. Launched in 2021 by a solo developer known as “WagieWojak” on social media, Wagie Bot has a simple interface that focuses on core functionality over complex features. Users can configure basic trading rules and set buy/sell limits without requiring coding skills or advanced technical knowledge.

While it lacks some features offered by more sophisticated competitors, Wagie Bot’s straightforward approach has garnered praise within the retail trading community. It fills a niche for an affordable crypto bot tailored to new traders just getting their feet wet. Even experienced investors may appreciate Wagie Bot for its “set and forget” utility.

Key Features

- Rules-based trading using preset configurations

- Allows manual trade execution and tracking

- Minimalist, no-frills interface

- Suitable for basic trading needs

Pros

- Simple and straightforward to operate

- Lower risk approach adheres to defined rules

- Easy to set up with basic options

- Affordable basic plan pricing

Cons

- Lacks AI and advanced analytics

- Less flexibility or customization

- Limited features compared to other bots

- Not ideal for advanced traders

Fee Structure

- Free plan allowing basic configurations

- $9/month for more options

- No performance or trading fees

4. Mizar

Mizar is a one-stop platform for cryptocurrency trading across centralized and decentralized exchanges. The platform provides a suite of free and automated trading tools to help users capitalize on emerging opportunities in the DeFi space. Backed by major investors and with over 20,000 traders, Mizar is poised to become a leading platform for both experienced and new cryptocurrency traders alike.

Key Details

- Backed by Nexo, KuCoin, Huobi, MEXC

- Over 20,000 traders

- No monthly fees

- CeFi and DeFi trading bots

- Token Sniffer research tool

- Telegram trading signal scanner

- Sniper bots for DEX listings

- Automated CeFi and DeFi bots

- Copy trading functionality

- Web app and Telegram access

- Free public research tools

- Automated DEX trading bots

- Usable directly from Telegram

- Support for emerging altcoins

5. Maestro

Maestro aims to provide crypto traders with professional-grade analytics and automation tools to execute advanced strategies. The bot, launched in 2018, is geared towards experienced traders who want to take a hands-on approach to optimizing their crypto investments.

Maestro lets users fully customize trading signals, technical indicators, and preset execution rules. After thorough backtesting, traders can automate their refined strategies. The bot specializes in algorithms tailored for short-term swing trades, arbitrage, and other active tactics – rather than just long-term holding.

While Maestro requires an upfront time investment to configure, its customization options are nearly limitless. Traders can combine various indicators and parameters to create automated systems personalized to their trading style and risk tolerance. For dedicated crypto traders, Maestro provides research, testing, and execution tools previously only found at institutional firms.

Tools

- Advanced crypto trading signals & indicators

- Highly customizable strategies

- Automated trading across chains

- Powerful tools for experienced traders

- Lifetime license with affordable fees

- The steepest learning curve of the bots

- Requires ongoing strategy optimization

Fee Structure

- $25/month for basic tools

- Up to 2% performance fees on profitable trades

- Lower fees for higher-volume traders

6. Cornix

Cornix is an advanced crypto trading bot that operates directly within the Telegram app. It allows users to monitor portfolios, execute trades, and configure notifications without leaving the messaging platform.

Key Features

- In-app trading from Telegram

- Portfolio monitoring and alert tools

- Customizable notifications and triggers

- Community chat and support options

Pros

- Convenient trading through Telegram interface

- Real-time alerts and tracking

- Highly customizable for each user’s needs

- Helpful community of Cornix users

Cons

- Potential security risks of connecting Telegram

- Steeper learning curve for setup

- No web or mobile app, Telegram-only

Fee Structure

- Free version with limited features

- Premium plan: $25/month

- Transaction fees but no performance fees

7. CryptoHopper

CryptoHopper provides easy-to-use crypto trading bots with cloud-based setup and predefined strategies. For those desiring a first foray into bots, Cryptohopper provides predefined automation recipes requiring little expertise. However, its basic ingredients may leave more advanced alchemists wanting. Use Cryptohopper for simple automation, but don’t expect deep wisdom or custom powers. The Cryptohopper review shows Telegram bot allows alerts on over 50 exchanges.

Key Features

- Cloud-based bots without installation

- Choose from existing bot templates

- Automated trading based on signals

- Works with all major exchanges

Pros

- Simpler setup and use compared to rivals

- Good for beginners with basic trading needs

- Affordable pricing

- Reputable company with support

Cons

- Functionality is not as robust for advanced traders

- Limited customization and control

- Security risks of linking API keys

Fee Structure

- Free starter plan with limited features

- Pro plan: $19/month

- No performance or transaction fees

8. Coinmatics

Coinmatics lets users automatically copy the trades of vetted professional crypto traders on Binance.

Key Features

- Copy trading mirrors pro traders’ moves

- Choose traders based on past performance

- No crypto trading experience required

Pros

- Benefit from pro traders’ experience

- Easy for beginners to get started fast

- Incentives encourage top talent

Cons

- Risks of copied trader underperforming

- Limited exchange support beyond Binance

- Lower control over actual trade details

Fee Structure

- Free account mirrors 3 pro portfolios

- Premium: $16/month for more options

- 15% fee on profitable copied trades

9. Coinrule

A feature-rich platform for building customized algorithmic trading bots. Coinrule empowers traders to backtest, optimize, and automate their own strategies at scale across exchanges.

Tools

- Automated bot creation platform

- 150+ strategy templates

- Backtesting tools to refine bots

- Connect all major exchanges

Pros

- Build automated trading systems

- Customizable with different indicators

- Robust backtesting options

- A Large active user community

Cons

- Initial learning curve to master tools

- Ongoing bot optimization required

- Potential for poorly optimized bots to lose

Fee Structure

- Free starter plan

- Pro plan: $29/month

- Premium: $79/month with more features

- No performance fees

10. Banana Gun

Banana Gun is gaining popularity for its advanced sniping features and manual buying capabilities, making it a preferred choice for traders looking to capitalize on new token launches.

Key Features

Advanced Sniping: Banana Gun offers two tiers of services: Manual Buy and Auto Sniper, allowing users to buy tokens automatically as soon as they are posted in selected channels.

Wallet Management: The bot can generate wallets and includes anti-blacklist measures to protect users from scams.

Pros and Cons

Pros:

- Advanced sniping features for quick token acquisition

- Manual and automatic buying options

- Continuous updates and enhancements

Cons:

- Higher fees for advanced features

- Potential learning curve for new users

Fee Structure

- Tier 1: Manual Buy with a 0.5% fee

- Tier 2: Auto Sniper with a 0.85% fee

11. FreqTelegram Bot

FreqTelegram is a tool that works with Freqtrade, a free and open-source crypto trading bot. Written in Python, this bot helps you automate trading on major cryptocurrency exchanges. You can control it through Telegram or a web interface.

With FreqTelegram, you can manage your trades and monitor your activity right from your phone. You can open or close trades, check your account balances, and get alerts for specific market conditions. It’s designed to make your trading easier and more efficient, giving you the flexibility to handle your trades on the go.

Pros:

Open-Source: Customizable and transparent.

Backtesting: Optimize strategies with historical data.

Wide Exchange Support: Compatible with major crypto exchanges.

Cons:

Technical Skills Needed: Requires knowledge of Python and trading.

Complex Setup: Initial configuration can be challenging.

Using Crypto Trading Bots on Telegram: Things to Consider

If you’re interested in cryptocurrency trading but don’t have a lot of time to monitor prices and markets, using a trading bot on a platform like Telegram could seem appealing. Trading bots are automated programs that buy and sell digital assets based on preset rules and algorithms. While bots may take some of the work out of trading, it’s important to go into it with open eyes about both potential benefits and risks.

Trading bots aim to capitalize on small, frequent price changes without needing constant human oversight. In theory, this could help generate returns around the clock. However, there are no guarantees, and markets can be unpredictable. Make sure to fully research any bot’s track record and understand its strategies before investing real money. Only use funds you can afford to lose.

When using bots on Telegram, privacy and security are also important concerns. Telegram is not designed specifically for financial services, so think carefully about the level of access you give a bot and how your personal information and crypto assets could be at risk if the platform or bot were to be compromised.

Overall, crypto trading bots may offer convenience but also carry risks, just like any automated investment tool.

Do thorough research, start small, and don’t rely on bots as a replacement for learning markets yourself over time. With the right precautions and understanding of both benefits and limitations, bots could potentially complement an overall long-term investment strategy on your terms. Just be sure trading remains an informed choice.

Top 5 Crypto Telegram Bots Infographic

Conclusion

Overall, Telegram continues to be a great place to find legit crypto investment bots and signals. The top crypto trading bots on Telegram offer a variety of powerful tools to help automate trading strategies and gain insights from the market. However, as with any automated investing system, there are risks to be aware of as well as opportunities. Doing thorough research on the strategies, track records, and security practices of the different bots is essential before linking accounts or investing real funds.

Crypto trading requires an understanding of market dynamics that doesn’t come overnight. While bots can take some of the legwork out of the process, no tool replaces the wisdom that comes from experience. Start by experimenting in demo or paper trading mode to truly understand how different bots operate before risking capital. Observe how strategies perform in varying conditions. Maintain a balanced portfolio that isn’t overly reliant on any single bot or signal.

Overall, the Telegram ecosystem holds promise for streamlining access to trading tools and insights. With prudent integration matched to one’s own experience and goals, bots may complement long-term strategies. But trading bots should not be seen as a get-rich-quick scheme or replacement for developing trading skills over time in changing markets. By approaching bots as learning aids first and profit generators second, traders can maximize their utility while mitigating risk on the journey toward market mastery.

Frequently Asked Questions

What are Telegram wallet bots?

Telegram wallet bots are automated programs within Telegram that let users manage their cryptocurrencies. They can store, send, receive, and track transactions directly through the chat interface.

Are Telegram Wallet Bots Safe?

Telegram wallet bots can be safe if they come from reputable developers and have strong security features like 2FA and encryption. Always verify the bot’s authenticity, use bots with good reviews, and avoid storing large amounts of cryptocurrency in them.

Are there any Telegram arbitrage bots?

Yes, there are Telegram arbitrage bots, such as:

- ArbiSmart: Automated arbitrage trading across multiple exchanges.

- HaasOnline: Supports custom arbitrage strategies.

- Bitsgap: Scans exchanges for price differences.

- Blackbird: Open-source bot for Bitcoin arbitrage.

What are the best Crypto Telegram price bots?

- Crypto Price Bot: Provides real-time cryptocurrency prices and alerts.

- CoinMarketCap Bot: Offers market data, price alerts, and updates directly from CoinMarketCap.

- Cryptocurrency Alerts: Allows users to set custom alerts for various cryptocurrencies and receive notifications when specific price targets are reached.

- CryptoSignal: Provides price updates, trading signals, and market analysis.

- CoinGecko Bot: Offers real-time prices, market data, and alerts based on the CoinGecko API.

- CryptoWhale Bot: Gives real-time price updates, market trends, and alerts.

- Binance Price Bot: Specifically integrated with Binance to provide real-time prices and alerts for cryptocurrencies listed on Binance.

- Crypto News Bot: Combines price tracking with the latest news and updates from the crypto world.

These bots are well-regarded for their accuracy and reliability in providing cryptocurrency price updates and alerts.

It’s the most detailed and helpfull content about crypto Telegram bots. I loved it, Thanks.

Thanks for your comment.

Thankfulness to my father who stated to me concerning this webpage, this webpage is truly remarkable.

Thanks for the comment!