Crypto market sentiment represents cryptocurrency investors’ and traders’ collective mood and psychology. Positive sentiment fuels bullish price action, while negative sentiment can trigger selling pressure and bearish trends. Understanding and gauging crypto sentiment is crucial for managing your investments amid the crypto sector’s inherent volatility.

We will begin the article by introducing the concept of market sentiment. Multifactorial crypto market sentiment analysis is another concept that we will explore. We also explain why sentiment analysis is important to many crypto traders. After stating the most prominent factors for crypto sentiment analysis, we will introduce the best crypto market sentiment analysis tools available.

What Is Crypto Market Sentiment?

Crypto market sentiment is the collective mood of crypto investors and traders. It can be either positive, negative, or neutral. Crypto sentiment is the overall perception of the market’s direction and future movements. So, in general, the sentiment crypto investors have indicates whether they think the market will rise or fall.

The positive crypto sentiment shows investors’ optimism. This leads to increases in crypto prices more often than not. On the other hand, negative sentiment reflects investors’ pessimism and uncertainty. Consequently, it would likely result in selling pressure and bearish price trends.

Understanding the market sentiment can be crucial for you. There are various crypto sentiment indexes that quantify how investors feel about the market. You can use this data by simply searching “crypto market sentiment today” on your browser. Several websites and crypto sentiment platforms will then be accessible to you. Further in the article, we will analyze how these crypto market sentiment indexes really work.

Find out the best crypto trading courses in 2024.

What Is Multifactorial Crypto Market Sentiment Analysis?

Multifactorial crypto market sentiment analysis is an approach that considers multiple factors and indicators to assess sentiment and crypto market emotions. This type of analysis involves evaluating a range of quantitative and qualitative metrics. These include factors such as market volatility, trading volumes, social media sentiment, on-chain data, and other key indicators. Therefore, you can gain a holistic understanding of crypto market sentiment.

By incorporating various factors into the analysis, multifactorial crypto sentiment analysis aims to provide a more comprehensive view of the emotions and psychology of crypto market participants. This approach, also known as multifunctional crypto market sentiment analysis, helps traders and investors make more informed decisions by considering a diverse set of factors.

Master the crypto market with the best crypto trading psychology books.

The Importance of Crypto Market Sentiment Analysis

Cryptocurrency sentiment analysis is very popular among many crypto investors and traders. Here are the key factors why sentiment crypto analysis is important:

- Insights into Market Psychology and Investor Behavior:

Market sentiment analysis offers insights into the overall crypto market emotions and mood. Sentiment is a key driving factor for market trends. The aggregated behavior of market participants can significantly influence prices.

- Identify Potential Trading Opportunities:

Traders and investors can identify potential opportunities by understanding the crypto market sentiment. These include anticipating price trends, spotting potential reversals, and capitalizing on sentiment-driven market movements.

- Enhanced Risk Management:

Crypto sentiment analysis can help traders and investors better manage their risks. They can identify potential periods of heightened volatility, complacency, or capitulation. It allows you to adjust your trading strategy accordingly.

- Complement for Fundamental and Technical Analysis:

Multifunctional crypto market sentiment analysis provides an additional layer of information. It can complement traditional fundamental and technical analysis. So, it results in a more comprehensive understanding of the market dynamics.

- Portfolio Construction and Options Trading:

Understanding market sentiment can assist investors in portfolio construction. Sector rotation and options trading strategies can also benefit from crypto sentiment indexes’ insights.

Factors Influencing Crypto Market Sentiment

Traders and investors are human. Numerous things can affect our general mood towards anything. Similarly, several factors influence crypto market emotions. Here are the most prominent ones:

News and Media

News articles, press releases, and media coverage play a significant role in shaping cryptocurrency market sentiment.

Positive crypto news, such as partnerships or adoption by mainstream institutions, fuels bullish crypto sentiment. Negative news, such as regulatory crackdowns or security breaches, can trigger bearish crypto sentiment. Investors can conduct crypto news sentiment analysis to evaluate their impact.

Read more about news based trading in the crypto market.

Regulations

Regulations and government policies can have a deep impact on crypto market sentiment. Clarity and favorable regulations often boost crypto sentiment. On the contrary, uncertainty or restrictive actions may lead to negative market sentiment. Generally, a major part of cryptocurrency sentiment analysis is focused on regulations.

Market Trends

While the price is influenced by cryptocurrency sentiment, it also affects the crypto market emotion itself. Price trends can heavily alter the sentiment cryptocurrency investors feel. For example, a lengthy bullish trend creates a positive crypto sentiment. In this situation, investors expect prices to continue rising. Conversely, a prolonged bearish trend creates negative crypto sentiment and may trigger panic selling. So, the sentiment analysis crypto market participants conduct is heavily dependent on the price itself.

Social Media Activity

Platforms like X (Twitter) and Reddit are excellent resources of sentiment analysis for cryptocurrency. Positive or negative words and messages by investors and especially influential figures can heavily impact the overall market sentiment. The attitude of these platforms’ users is valuable data for crypto market sentiment analysis. In fact, many variations of market mood index crypto platforms offer work based on these.

On-Chain Activity

On-chain activity, particularly on-chain transactions, plays a crucial role in determining crypto market sentiment. They provide a direct window into blockchain network activity and even adoption levels. These metrics can be considered futures market sentiment indexes of their own. This is because they can show both supply and demand by market participants at any point in time.

Futures Market Metrics

Futures market metrics like funding rates and open interest are other valuable crypto sentiment indicators. Funding rates can help evaluate crypto sentiment as their increases show bullish sentiment, and their decrease point to pessimism. Open interest is also used as a crypto sentiment index. High open interests are mostly associated with positivity, and declines can point to negative crypto sentiment.

Common Crypto Market Sentiment Indicators

As we’ve already mentioned, analysts use various crypto market sentiment indexes. Here are some of the best crypto sentiment analysis indicators:

Crypto Fear and Greed Index

This crypto sentiment index is created by Alternative.me. The index is practically a fear and greed indicator crypto analysts use to measure the overall crypto market sentiment. The crypto market index greed indicator is based on factors like volatility, market momentum/volume, social media, Bitcoin dominance, and trends. It provides a score from 0 (extreme fear) to 100 (extreme greed). This is arguably the most used sentiment crypto index.

Bitcoin & Crypto Sentiment Index

Provided by CoinCodex, this crypto sentiment metric evaluates technical indicators to estimate the crypto sentiment today. Like most crypto sentiment meters, it also has a score ranging from 0 (bearish) to 100 (bullish). This one is also a popular crypto coin sentiment analysis index worldwide.

CoinStats Fear and Greed Crypto Index

The working of this crypto sentiment index is very similar to that of the fear and greed crypto index by Alternative.me. However, this index allows you to view fear and greed index for a range of cryptocurrencies, not just Bitcoin and large caps. Therefore, it is also good for altcoin sentiment analysis.

Sentiment Balance

The Sentiment Balance is the difference between Positive Sentiment and Negative Sentiment. This sentiment crypto index is a quantitative measure of the balance between positive and negative sentiments towards a particular coin or the overall ecosystem. A positive Sentiment Balance shows that positive crypto sentiment outweighs negative crypto sentiment, while a negative Sentiment Balance suggests the opposite.

Sentiment Weighted

Sentiment Weighted is an improved version of the Sentiment Balance metric. It adjusts the values by considering the number of mentions. This helps to standardize the data and make the crypto market sentiment metrics more comparable. This crypto market mood index takes into account not just the positive and negative sentiment but also the overall volume or number of mentions.

Best Crypto Market Sentiment Platforms

Now that we know what crypto market sentiment is and what crypto sentiment indexes are, we should evaluate the top platforms. These are the best online platforms dedicated to sentiment analysis for crypto market:

CryptoQuant

CryptoQuant is a top cryptocurrency market sentiment data provider. It offers various metrics and crypto sentiment indexes. The primary strength of CryptoQuant is its extensive on-chain and futures market data. As already stated, this information is widely used in crypto market sentiment analysis.

The metrics and crypto sentiment indicators on the CQ platform include transaction volumes, exchange flows, whale activity, and futures market metrics like funding rates and open interest. This comprehensive set of data can provide users with valuable insights about how market participants perceive the current state of the market. Thus, CryptoQuant offers great tools for sentiment analysis for the cryptocurrency market.

Santiment

Santiment is another one-stop platform for sentiment analysis in cryptocurrency market. It’s wide range of tools and services can help users evaluate crypto market sentiment. What sets Santiment apart is its holistic approach to sentiment analysis for crypto trading. The tools offered by Santiment combine both on-chain and social media metrics, and that’s what makes them very interesting.

On the on-chain side, Santimate provides aggregate data from various blockchain networks. It provides crucial insight into transaction volumes, network behavior, and miners’ activity. You can track the flow of funds to perform an accurate crypto sentiment analysis. It also offers altcoin sentiment metrics besides ETH and BTC.

Moreover, the social crypto Santiment tools are also very helpful. Analyzing metrics like the crypto fear and greed index, social media trends, and topics can be very insightful. Santiment allows users to identify the overall cryptocurrency market sentiment through these tools and metrics. So, Santiment might just be the most complete platform dedicated to sentiment analysis crypto investors can use.

Messari

Messari is another prominent platform for sentiment analysis crypto investors use. The platform’s services can provide users with a window to observe the crypto sentiment clearly. Yet, Messari does even more for those looking beyond sentiment crypto indexes.

At its core, Messari offers crypto research, on-chain metrics, and AI news summaries. As already explained, both are key factors in a multifunctional crypto sentiment analysis. On-chain data can determine the demand and supply profile in real-time. The AI news summaries can also be used for crypto news sentiment analysis.

Considering the comprehensive data and tools Messari offers, it is one of the best crypto sentiment analysis tools available. With Messari, you can make well-informed decisions that will help you have a safe and profitable investment journey in the crypto market.

Glassnode

Glassnode is a household name when it comes to sentiment analysis for cryptocurrency market. It is arguably the best on-chain data provider worldwide. One of its primary strengths is its extensive collection of on-chain metrics and crypto market sentiment indexes.

Some of the primary insights offered by Glassnode are based on transaction analytics, exchange flows, and miners’ behavior. These metrics can be used for crypto sentiment analysis by both new and experienced investors. The platform’s intuitive design makes it understandable for almost everyone.

Additionally, Glassnode offers in-depth market intelligence through customizable dashboards. Users can utilize Glassnode’s data to conduct advanced sentiment analysis in the cryptocurrency market. The platform also offers various crypto market sentiment indexes like the fear and greed crypto index and other tools. So, if you are looking for advanced tools and crypto sentiment indicators, Glassnode is for you.

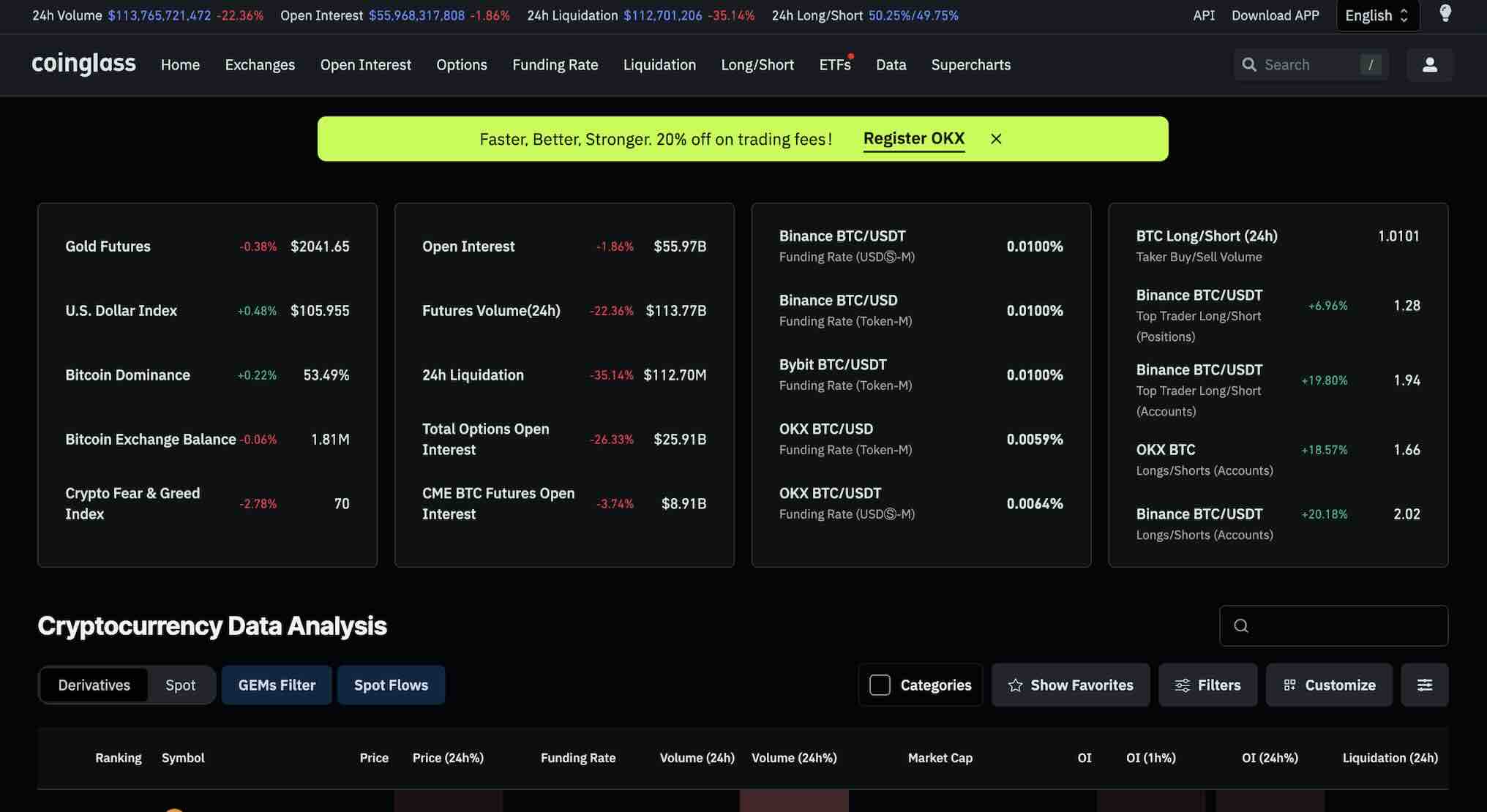

CoinGlass

Another top platform for multifactorial crypto market sentiment analysis is CoinGlass. One of its notable features is the Fear and Greed Indicator Crypto Index, which is a useful crypto sentiment meter. This indicator clearly demonstrates crypto market emotion, from extreme fear to extreme greed.

This cryptocurrency market sentiment metric is based on various factors like volatility, market momentum, and social media activity. You can quickly understand the crypto market sentiment by checking this index. The metric can also be used simultaneously with other CoinGlass indicators for multifunctional crypto market sentiment analysis.

CoinGlass provides detailed analytics on the futures market for Bitcoin and Ethereum. These metrics include funding rates, open interest, and liquidation data. Additionally, CoinGlass also offers various on-chain metrics. This comprehensive set of tools, paired with the platform’s top-notch visual design, makes it one of the best crypto sentiment analysis tools around.

Conclusion

Throughout this article, we have explored crypto sentiment analysis. We defined crypto sentiment as the collective mood and perception of cryptocurrency investors and traders regarding the market’s future direction. We then delved into multifactorial sentiment analysis, an approach that considers multiple quantitative and qualitative metrics to gain a holistic understanding of market emotions. Moreover, we examined some of the most widely used sentiment indicators and indexes like the Crypto Fear and Greed Index and Sentiment Balance. Finally, we evaluated the best crypto sentiment platforms worldwide.

Crypto sentiment analysis is crucial because it provides invaluable insights into the crypto trading psychology and behavior of investors. It allows you to identify potential trading opportunities and enhance risk management. It complements fundamental and technical analysis and aids in portfolio construction and options trading strategies. By mastering multifunctional crypto market sentiment analysis, traders and investors can protect their capital against the inherent volatility of cryptocurrencies.

Leave a Reply