In the wild West of cryptocurrency trading, it pays to have an expert by your side day and night. Enter crypto trading bots – your tireless robotic companion in the volatile crypto markets. These ingenious pieces of software utilize the power of artificial intelligence to remove the stress, fatigue, and guesswork from crypto trading.

By connecting to your preferred exchanges via API keys, crypto bots can seamlessly execute trades on your behalf 24/7. It’s like having a custom-programmed super trader at your fingertips! Bots react instantly to market movements, capitalize on fleeting opportunities, and stick to objective trading rules – things no emotional human trader can consistently do.

This article explores the benefits of trading bots, types of bots available, factors to consider when choosing a bot, whether bots can be profitable, and the top 12 bots on the market right now. Read on to learn how these robotic traders can take your crypto game to the next level!

What Are Crypto Trading Bots?

In the futuristic world of crypto trading, robots aren’t just taking over manual labor – they’re taking over trading too. Crypto trading bots are ingenious pieces of software that use artificial intelligence to automate cryptocurrency trading. These bots are like tireless automated traders that never sleep. They analyze market data around the clock and execute your customized trading strategy based on pre-programmed algorithms. Unlike unpredictable human traders, bots stick consistently to objective rules and models.

Imagine never having to watch the volatile crypto charts again. Bots react instantly to price movements so you don’t have to. They can scan and detect trading opportunities in milliseconds that would take a human much longer. The lightning-fast reaction time of bots allows you to capitalize on fleeting chances that human traders often miss out on.

Crypto trading bots have become popular among traders. By connecting your preferred exchanges to the bots via API keys, they can seamlessly trade on your behalf 24/7. It’s like having a custom-programmed expert trader at your fingertips day and night!

So don’t be stuck making emotional trading decisions or glued to your screen. Let intelligent crypto trading bots do the work for you, in a robotic way! Automated bots minimize mistakes and maximize opportunities – giving you a profitable edge in the dynamic crypto space.

Benefits of Using Crypto Trading Bots

Tapping into the power of artificial intelligence gives crypto traders an array of advantages. Trading bots remove exhausting emotional decisions and manual effort from the equation. By letting smart bots handle the trades, you get to reap some amazing benefits.

For starters, bots trade around the clock without tiring. They react instantly to market movements while you sleep so you’ll never miss a beat. Bots are also consistent and disciplined – they stick to preset trading rules instead of making impulsive decisions. This disciplined approach pays off in the volatile crypto markets.

Bots enable you to execute advanced algorithmic trading strategies too complex for mere mortals. Techniques like arbitrage across exchanges, momentum trading, quantitative models, and more can be programmed into bots. Just backtest and tweak the strategies for optimal results.

Intelligent bots can also help manage your risk exposure. You can set exact parameters for stop losses, profit taking, position sizing, and maximum risk per trade. Bots follow these preset limits to the letter, removing the risk of emotional trading mistakes.

Things to Consider When Choosing a Crypto Trading Bot

- Supported Exchanges and Coins

- Research which major exchanges the bot connects with

- Ensure the bot trades any cryptocurrencies you want to trade, like Bitcoin, Ethereum, etc

2. Backtesting and Customization

- Test strategy against historical market data for optimization

- Adjust indicators, rules, risk/reward ratios, and other settings

- Tweak strategy for maximum performance and fit to market conditions

3. Security Protections

- Cloud hosting, SSL encryption, 2FA protection for your account and API keys

- Secure login and data transfer protocols to prevent intrusions

- Protects against data breaches, hacking attempts, and unauthorized access

4. Ease of Use

- Look for intuitive dashboards and setup wizards

- Detailed guides and 24/7 customer support

- Seamless connectivity and management for new users

Types of Crypto Trading Bots

There are several categories of crypto trading bots to choose from, each with their own strengths and ideal users. Getting to know the major types of bots available can help you decide which is best suited for your needs and trading style.

Arbitrage Bots – These bots take advantage of price discrepancies across different exchanges and markets to profit from arbitrage opportunities. They buy assets on one exchange where the price is lower and simultaneously sell on another exchange where the price is higher to pocket the difference. Speed is critical for arbitrage bots to capitalize on short-lived mismatches.

Market Making Bots – Market making bots provide liquidity to exchanges by posting buy and sell limit orders. They aim to make profitable spreads by buying low and selling high. Exchanges often incentivize and pay market making bots a percentage of the spread for contributing liquidity.

Portfolio Automation Bots – This type of bot automates portfolio management strategies like portfolio diversification, periodic rebalancing, tax-loss harvesting, and more. They automatically maintain target allocations and rebalance based on preset rules. Useful for hands-off crypto portfolio management.

Technical Trading Bots – These bots base their trades on technical analysis indicators like RSI, moving averages, volatility, volume, and more. They follow short and long-term trading strategies guided by price action and technical signals. Require programming indicators and strategies.

Social Trading Bots – Social trading bots execute trades based on trading signals and strategies from experienced traders, top-performing portfolios, and sentiment analysis of social media groups. Useful for mimicking expert or crowd-sourced trading.

There are also specialty bots focused on specific use cases, like grid trading bots, scalping bots, etc. Evaluating your needs and trading style will help determine which type of trading bot suits you best.

Are Crypto Trading Bots Profitable?

Can crypto trading bots churn out serious profits? The answer isn’t so black and white. These crafty bits of AI can be money-making machines, but they also come with their share of pitfalls and Gotchas.

Like any trader, bot, or human, profits depend on making more winning trades than losing ones. A bot is only as good as its trading strategy. Bot trading based on backtested models and technical analysis tends to fare better than simple buy-and-hold sets of rules. But even the fanciest algorithm won’t guarantee profits in the volatile crypto market.

Bots need babysitting, too! Don’t just set it and forget it. As market dynamics shift, a profitable bot strategy today could start tanking tomorrow if it’s not adjusted. Keep a close eye on performance and tweak that bot to keep it profitable through bull and bear markets.

And speaking of costs – those monthly bot subscription fees don’t come cheap. Make sure your bot’s extra trading profits justify the recurring bill. Otherwise, it might not be worth it.

Even robots make mistakes. Don’t rely on bots alone to perfectly manage risks. Set sane stop losses and position sizes yourself. Bots can execute losing trades, too, so prudent risk settings are key.

And don’t expect exchanges to give bots free rein. Safeguards like throttling API requests can cramp their style. Plus, all those extra bot trades rack up transaction fees quickly.

So, while crafty bots can absolutely generate crypto profits, they aren’t a surefire way to print money unless used wisely. Treat them as helpful trading sidekicks, not as a complete autopilot replacement. With realistic expectations and a thoughtful strategy, trading bots can boost your profits without doing all the heavy lifting!

Top 12 Crypto Trading Bots

With so many crypto trading bots now available, it can be tough to compare the options and decide what’s best for your needs.

Reviewing this side-by-side comparison can help give you a quick sense of the core capabilities and costs of top trading bots. The bots included range from pioneers like 3Commas and Finestel, to newer players like Botsfolio, covering algorithmic trading, arbitrage, copy trading, and more. Continue reading for bots that align with your strategy, exchanges, experience level, and budget. Let it serve as a handy reference point as you evaluate trading automation tools!

Bot |

Key Features | Pricing |

| 3Commas | Pre-made trading bots, portfolio management | $0 – $99/month |

| Finestel | Copy trading automation, Telegram bot, Tradingview bot, portfolio management | White label (Fully customizable) pricing |

| Coinrule | Visual programming, backtesting | $0 – $450/month |

| Cryptohopper | Algorithmic trading, social trading | $19 – $99/month |

| TradeSanta | Grid/DCA bots, virtual trading | $0 – $70/month |

| Shrimpy | Social trading, portfolio automation | $15 – $299/month |

| Bitsgap | Arbitrage bots, backtesting, mobile app | $24 – $123/month |

| ArbitrageScanner.io | Manual arbitrage bot, personal support | $69 – $1,199/month |

| Kryll | Visual programming, backtesting, paper trading | $0 – $50/month |

| Botsfolio | Multiple trading bots, fixed returns | $5 – $20/month |

| HaasOnline | Custom bots, backtesting | 0.009 – 0.026 BTC/month |

1. 3Commas

3Commas is a leading crypto trading bot platform that offers a wide selection of pre-made bots for automated trading.

Key Features and Tools

- 23 different trading bots, including grid, DCA, arbitrage, and composite bots. Each bot type serves a different strategy.

- Visual drag-and-drop interface to easily customize bots. No coding is required.

- Built-in marketplace to buy/sell pre-made trading strategies.

- Portfolio management tools to optimize profit across multiple exchanges.

- Analytics dashboard providing real-time tracking of all your trades and bot performance.

- Paper trading simulator to test strategies risk-free before going live.

- Radar tool that scans market opportunities 24/7 and sends alerts.

- Smart order types, including stop-loss and take-profit to manage risk.

- Fast order execution through API integration with supported exchanges.

- Secure architecture using API keys, 2FA, and IP whitelisting.

Types of 3Commas bots

- Grid bots place a series of automatic buy and sell orders at set price levels, creating a grid. This allows traders to profit from price fluctuations without constantly watching the market. Grid bots work well in markets that aren’t trending strongly up or down.

- Dollar-cost averaging (DCA) bots automatically place regular buy orders at predetermined intervals. This helps traders average out their purchase price over time, regardless of market direction. DCA bots are useful in volatile markets with lots of ups and downs.

- SmartTrade bots let users create custom trading strategies visually without coding. You can design all kinds of strategies, like arbitrage between exchanges, market making, or trend following.

- Options bots automate trading cryptocurrency options contracts. You can set up strategies like covered calls, puts, or straddles that involve both buying and selling options.

- Composite bots combine multiple trading bots into one. This allows complex strategies that would be hard or impossible with individual bots alone.

- Take profit and stop loss bots automatically close positions when the price hits a certain level. They help manage risk and lock in gains.

Suitable For:

- Active traders who want access to advanced trading strategies.

- Hands-off investors seeking a set-and-forget trading solution.

- Beginners looking for an easy entry point to automated trading.

- Expert traders who want to backtest or build custom bot strategies.

Pricing

3Commas offers four pricing plans: Free, Starter, Advanced, and Pro. The Free plan has limited features, but it is a good way to get started with 3Commas. The Starter plan includes unlimited trading bots, backtesting, and paper trading. The Advanced plan adds social trading features and priority customer support. The Pro plan adds enterprise features, such as APIs, risk management, and portfolio management.

| Plan | Price per month | Features |

|---|---|---|

| Free | $0 | Limited features |

| Starter | $14.50 | Unlimited trading bots, backtesting, and paper trading |

| Advanced | $24.50 | Unlimited trading bots, backtesting, paper trading, social trading features, and priority customer support |

| Pro | $49.50 | Unlimited trading bots, backtesting, paper trading, social trading features, priority customer support, and enterprise features |

All of 3Commas’ plans have annual subscription options.

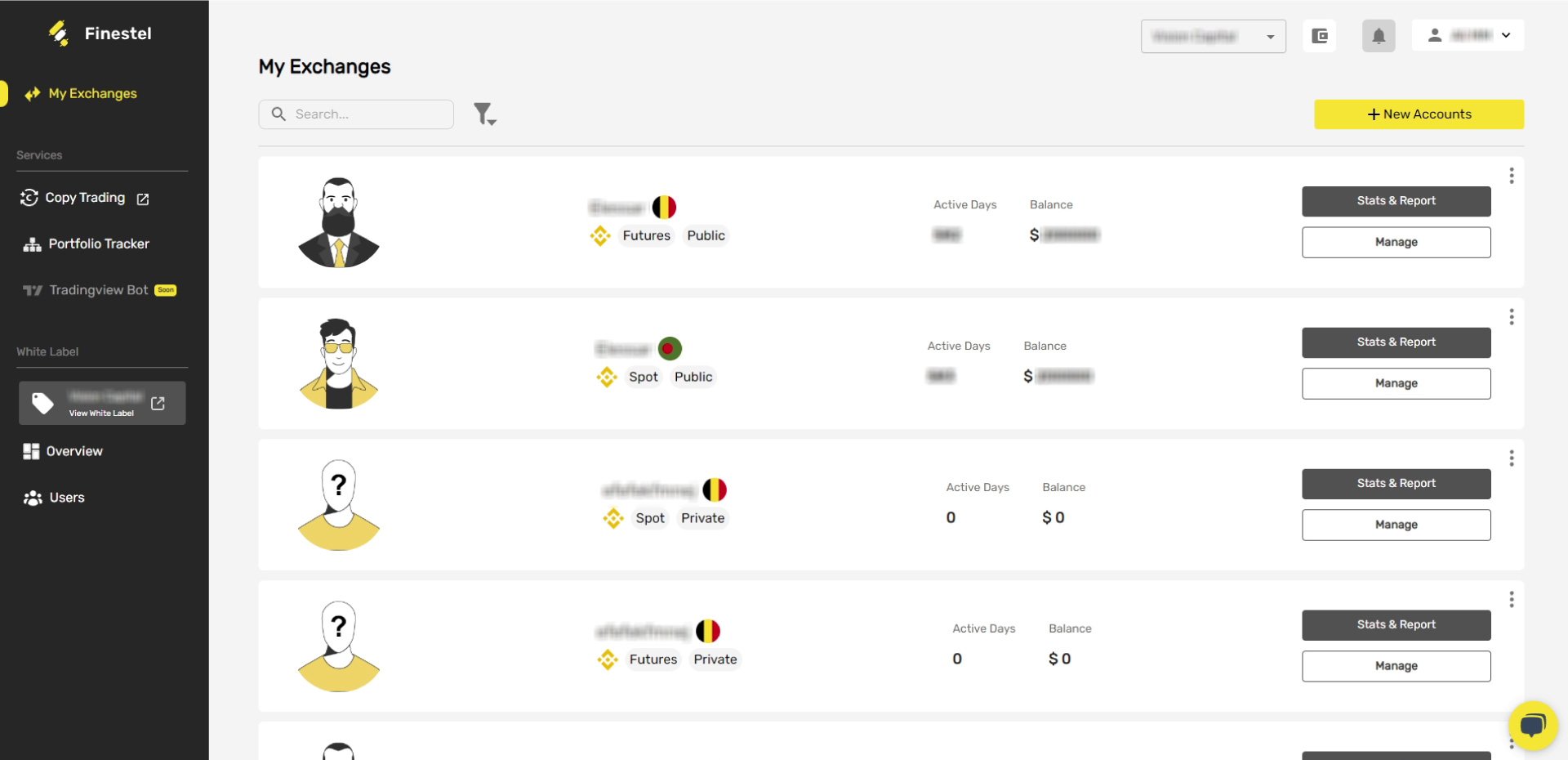

2. Finestel

Finestel is a trading solutions provider that offers a white label crypto trading platform with automated trading, copy trading, TradingView bot, and Telegram bot capabilities.

Key Features:

- Automated trade execution for spot and futures markets

- Instant and delayed syncing models for spot copy trading

- Uses technology to minimize slippage on copy trades

- Alerts for missing/failing copy trades via Telegram

- Integrates TradingView bot strategies via API

- Branded Telegram bot for portfolios, reporting, signals

- The best crypto copy trading platform for the Pros

Suitable For:

- Companies and individuals wanting to offer white label trading services

- Traders and investors seeking copy trading capabilities

- Businesses that need customer reporting automation

- Anyone who wants to broadcast signals at scale

Pros:

- Automates complex copy trade execution

- Options for spot portfolio syncing or new trades only

- Minimizes slippage on copy trades

- TradingView integration expands strategies

- Telegram bot enhances services and reach

Cons:

- More tailored for institutional/B2B clients

- Limited count of supported exchanges

Pricing

Fully Customizable Billing Models & Payment Cycles

3. Coinrule

Coinrule emphasizes easy visual bot programming for custom automated trading strategies. It allows users to create custom trading rules using a visual programming interface. Coinrule Offers a variety of pre-made trading templates.

Key Features and Tools

- Drag-and-drop interface to build automated bots visually without coding.

- 10 pre-made bot templates for basic strategies like DCA, grid trading etc.

- 200+ trading rules can be combined to create complex bots.

- Scanners for detecting trading opportunities across 2000+ coins.

- Embedded trading signals and SuperTemplates for advanced automation.

- Backtesting tool to validate strategy performance using historical data.

- Paper trading to simulate live trading risk-free.

- Portfolio management tools to optimize profit across exchanges.

- Integrates with TradingView for advanced charting and analytics.

Suitable For:

- Traders focused on building custom trading strategies.

- Developers or coders looking for flexible tools.

- Analytical traders who rely on backtesting historical data.

- Anyone who values an easy-to-use visual programming interface.

Pros

- Wide range of features, including automated trading bots, backtesting, paper trading, social trading, portfolio management, and educational resources.

- User-friendly interface, even for beginners.

- Variety of pricing plans to meet the needs of traders of all levels of experience.

- Top investors back it and has a good reputation.

Cons

- Some features, such as the AI-Based Trading Bot Marketplace and leverage trading, are only available on higher-priced plans.

- Monthly fees can be expensive, especially for the Pro plan.

- Some users have reported customer support issues.

Overall, Coinrule is a powerful cryptocurrency trading platform with a wide range of features. It is a good option for both beginners and experienced traders. However, it is important to note that the monthly fees can be expensive, especially for the higher-priced plans.

Pricing

Coinrule offers four pricing plans: Free, Hobbyist, Trader, and Pro. The Free plan has limited features, but it is a good way to get started with Coinrule. The Hobbyist plan includes unlimited trading bots, backtesting, and paper trading. The Trader plan adds social trading features and priority customer support. The Pro plan adds enterprise features, such as APIs, risk management, and portfolio management.

| Plan | Price per month | Features |

|---|---|---|

| Free | $0 | Limited features |

| Hobbyist | $30 | Unlimited trading bots, backtesting, and paper trading |

| Trader | $60 | Unlimited trading bots, backtesting, paper trading, social trading features, and priority customer support |

| Pro | $450 | Unlimited trading bots, backtesting, paper trading, social trading features, priority customer support, and enterprise features |

All of Coinrule’s plans have annual subscription options. Coinrule also offers a lifetime free plan, but it is very limited in features.

4. Cryptohopper

It is a cloud-based crypto trading bot that offers algorithmic trading and external signals to automate trades. Cryptohopper offers a variety of trading bots, including grid bots, DCA bots, and arbitrage bots. It also has a social trading platform where users can copy other users’ trades.

Key Features

- Algorithmic trading bots using 30+ indicators and 90+ candlestick patterns

- Connects to 9 major crypto exchanges

- Leverages external signals for buy/sell decisions

- Tools like backtesting, templates, trailing stops

- Web-based platform with no mobile app

Suitable For:

- Traders looking for pre-configured algorithmic trading

- Investors who want to leverage external signals and insights

- Anyone seeking a hands-off approach to crypto trading

Pros:

- Wide range of configurable trading bots

- Can capitalize on external signals for trading

- Useful backtesting and customization features

Cons:

- No mobile app, web-only

- Less flexibility for custom strategy building

Pricing

| Plan | Price per month | Features |

|---|---|---|

| Pioneer | Free | 1 bot, 10,000 transactions per month, 15 indicators, 2 TA scans per hour |

| Explorer | $19 | 10 bots, 50,000 transactions per month, 30 indicators, 5 TA scans per hour |

| Adventure | $49 | 50 bots, 150,000 transactions per month, 90 indicators, 10 TA scans per hour |

| Hero | $99 | 100 bots, 500,000 transactions per month, 90 indicators, 20 TA scans per hour |

All plans include a free trial.

Overall, CryptoHopper is a powerful cryptocurrency trading platform with a wide range of features. It is a good option for both beginners and experienced traders.

5. TradeSanta

Offers a variety of trading bots, including grid bots, DCA bots, and arbitrage bots. It has a user-friendly interface and a variety of educational resources. Also, TradeSanta offers cloud-based trading bots for automated crypto trading strategies.

Key Features

- Grid, DCA, and Smart Order trading bots

- Stop losses and take profit tools

- Virtual trading to backtest strategies

- Support for major exchanges

- Futures and margin trading options

- Unified interface for manual trading

Suitable For:

- Traders seeking automation for proven strategies

- Those looking to minimize risk with stop losses

- Anyone who values backtesting and virtual trading

- Traders who use both long and short positions

Pros:

- Good variety of automated bot strategies

- Virtual trading to test strategies

- Helps manage risk through stop losses

- Works for futures and margin trading

Cons:

- Limited free plan options

- It is less customizable than some platforms

- Smaller exchange support list

Pricing

| Plan | Price per month | Features |

|---|---|---|

| Free | $0 | 1 bot, trading terminal |

| Basic | $25 | 49 bots, unlimited trading pairs, Telegram notifications, trading terminal, all trading strategies |

| Advanced | $45 | 99 bots, unlimited trading pairs, trading terminal, all trading strategies, Telegram notifications, trailing take-profit feature, TradingView signals |

| Maximum | $70 | Unlimited bots, unlimited pairs, trading terminal, all strategies, Telegram notifications, trailing take profit, custom TradingView signals, futures bots, trading terminal |

6. Shrimpy

Shrimpy specializes in social and copy trading for crypto portfolio management. It offers a variety of trading bots, including grid bots, DCA bots, and arbitrage bots.

Key Features

- Social trading to follow and copy other traders

- Auto portfolio rebalancing and allocation

- Unified dashboard across 16 exchanges

- Backtesting tool to trial strategies

- 50% affiliate commission for referrals

- Web-based with no mobile app

Suitable For:

- Social traders who want to leverage proven strategies

- Hands-off investors seeking auto portfolio management

- Beginners looking to learn from veteran traders

- Anyone wanting to track assets across exchanges

Pros:

- Social and copy trading capabilities

- Automated portfolio allocation

- Backtesting to validate strategies safely

- Affiliate program to earn commission

Cons:

- No mobile app, web-only

- More limited bot options than some platforms

- Less customizable bots

Pricing

Here is a table for Shrimpy pricing:

| Plan | Price per month (annual billing) | Features |

|---|---|---|

| Starter | $15 | 3 bot types (1 of each type), 20 minute rebalancing interval, limited features |

| Professional | $63 | Unlimited trading bots, 15-minute rebalancing interval, customizable features |

| Enterprise | $299 | Unlimited trading bots, 10-minute rebalancing interval, customizable features, priority support, white-glove applications, and trade automation |

All plans include a free trial.

7. Kryll

Kryll is a cloud-based cryptocurrency trading platform that allows users to create and automate trading strategies. It offers a variety of features, including a visual programming language, backtesting, paper trading, and portfolio tracking. Kryll supports over 15 cryptocurrency exchanges.

Key Features

- Automated trading bots: Kryll allows users to create and automate trading strategies using a visual programming language. No coding is required.

- Backtesting: Kryll allows users to backtest their trading strategies against historical data to see how they would have performed.

- Paper trading: Kryll allows users to paper trade their trading strategies to test them without risking real money.

- Portfolio tracking: Kryll allows users to track their cryptocurrency portfolio and performance.

- Exchange support: Kryll supports over 15 cryptocurrency exchanges.

Pros

- Powerful and flexible trading platform

- Wide range of features, including automated trading bots, backtesting, paper trading, and portfolio tracking

- Supports over 15 cryptocurrency exchanges

- User-friendly interface

- No coding required to create trading strategies

- Large and active community

Cons

- Monthly fees can be expensive, especially for the higher-priced plans

- Some users have reported customer support issues

Suitable For

Kryll is a good option for both beginners and experienced cryptocurrency traders. It is especially well-suited for traders who want to automate their trading strategies or who want to use backtesting to optimize their strategies.

Pricing Plans

| Plan | Price per month | Features |

|---|---|---|

| Free | $0 | 1 bot, 10 KRL/month for trading fees, 1 strategy, 1 backtest |

| Starter | $2 | Unlimited bots, 10 KRL/month for trading fees, unlimited strategies, unlimited backtests |

| Pro | $10 | Unlimited bots, unlimited KRL for trading fees, unlimited strategies, unlimited backtests, priority support |

| Enterprise | $50 | Unlimited bots, unlimited KRL for trading fees, unlimited strategies, unlimited backtests, priority support, dedicated account manager, custom features |

8. Bitsgap

Bitsgap offers crypto trading bots and arbitrage trading for beginners and advanced traders.

Key Features

- Arbitrage trading bots across 25+ exchanges

- Pre-defined strategies based on backtesting

- Demo trading mode to test strategies

- Other bots like DCA, futures, grid trading

- Portfolio management and TradingView indicators

- Mobile app for iOS and Android

Suitable For:

- Beginner traders looking for easy arbitrage

- Advanced traders who want to customize strategies

- Anyone seeking automated portfolio management

- Traders who value backtesting and demo trading

Pros:

- Good variety of trading bots

- Backtested pre-defined strategies

- Demo mode to test with virtual funds

- Mobile app in addition to web platform

Cons:

- Manual rebalancing between exchanges required

- Less customizable than some platforms

- More limited exchange support than some

Pricing

| Plan | Price per month | Features |

|---|---|---|

| Basic | $24/month | 1 bot, 10 exchanges, 200 trades per month, arbitrage, DCA, grid bots, automated portfolio management, smart algorithmic orders, TradingView indicators, cloud trading, email and live support |

| Advanced | $57/month | 5 bots, 25 exchanges, 500 trades per month, all Basic features plus trailing stop-loss, take-profit, and rebalancing |

| PRO | $123/month | 10 bots, unlimited exchanges, unlimited trades per month, all Advanced features plus TradingView custom indicators and strategies |

9. ArbitrageScanner.io

ArbitrageScanner.io scans for arbitrage opportunities across multiple crypto exchanges. It offers a variety of tools for managing and automating arbitrage trades.

Key Features

- Manual trading bot without API connection

- Tracks price differences across 75+ exchanges, including DEXs

- Customizable Telegram alerts

- The personal manager provides guidance and tips

- Built-in profit opportunity screener

Suitable For:

- Manual traders focused on arbitrage opportunities

- Traders who value personalized service and education

- Anyone seeking to maximize opportunities across centralized and decentralized exchanges

Pros:

- Does not require API keys for security

- Supports both CEXs and DEXs

- Personalized service and features

Cons:

- Less automated than some bots

- Higher pricing tiers to access full features

Pricing:

Plans range from $69 to $1,199 per month based on desired access and support.

| Plan | Price per month | Features |

|---|---|---|

| Test | $69 | A manual bot with no API request necessary supports over 75 exchanges, connects to any token and exchange for seamless tracking, free training, and access to a closed community; get the latest market insights via the ArbitrageScanner.io Message feature |

| Pro | $199 | All features of the Test plan, plus a dedicated personal manager |

| Expert | $399 | All features of the Pro plan, plus priority customer support |

| Guru | $1199 | All features of the Expert plan, plus access to exclusive trading strategies and signals |

Overall, ArbitrageScanner.io is a good option for users who are looking for a manual crypto arbitrage bot with a variety of features and a flexible pricing structure.

10. Pionex

Pionex is a cryptocurrency trading platform that offers a variety of trading bot features. The bots are designed to help traders automate their trading strategies and make profits from market volatility. Bots are easy to use and do not require any coding knowledge.

Pros

- Wide range of trading bot features

- User-friendly interface

- No coding required

- Low fees

Cons

- Limited number of supported exchanges

- Some bots can be complex to set up and manage

- Customer support can be slow

Key Features

- Grid bot: This bot places buy and sell orders at predetermined price levels to capitalize on market volatility.

- Arbitrage bot: This bot takes advantage of price differences between different cryptocurrency exchanges.

- Infinity bot: This bot places orders at multiple price levels to ensure that an order is executed, even if the market price moves quickly.

- Trailing take-profit bot: This bot automatically places a take-profit order at a certain distance behind the current market price.

- Trailing stop-loss bot: This bot automatically places a stop-loss order at a certain distance behind the current market price.

Additional bot types:

- DCA bot: This bot automatically buys a fixed amount of cryptocurrency at regular intervals.

- Futures bot: This bot allows traders to trade cryptocurrency futures contracts.

- Margin bot: This bot allows traders to trade cryptocurrency with leverage.

It also offers a variety of other features, such as copy trading and social trading, which are available for an additional fee.

Pricing

The platform offers a variety of pricing plans for its trading bot services. The pricing plans are based on the number of bots that you want to use and the amount of trading volume that you have.

| Plan | Price per month | Features |

|---|---|---|

| Free | $0 | 1 bot, max trading volume of $100,000 per month |

| Basic | $9 | 5 bots, max trading volume of $500,000 per month |

| Professional | $19 | 10 bots, max trading volume of $1,000,000 per month |

| Enterprise | $49 | Unlimited bots, unlimited trading volume |

All plans include a free trial.

11. Botsfolio

Botsfolio offers multiple crypto trading bots for arbitrage, fixed returns, and customizable strategies. It offers a variety of trading bots, including grid bots, DCA bots, and arbitrage bots.

Key Features

- 5 built-in bots for different strategies (scalping, trend, etc)

- Customizable bot allocation and balancing

- Preset and customizable trading strategies

- Analytics dashboard to monitor performance

- iOS and Android mobile apps

Suitable For:

- Traders wanting to run multiple strategies

- Those seeking fixed return investment options

- Users who value easy customization and balancing

Pros:

- Multiple trading bots and strategies

- Fixed returns available

- Easy customization and bot allocation

Cons:

- Limited exchange support currently

- No backtesting capabilities

Pricing

| Trading Volume | Price per month |

|---|---|

| Up to $3,000 | $5 |

| $3,000 to $10,000 | $10 |

| $10,000 to $50,000 | $15 |

| Above $50,000 | $20 |

12. HaasOnline

HaasBot is a crypto trading bot offering diverse strategies for developers, beginners, and advanced traders. It offers a wide range of trading bots, including grid bots, margin bots, and arbitrage bots and Has a variety of advanced features, such as backtesting and paper trading.

Key Features

- Supports trading on Binance, Poloniex, BitMex, OKX, and more

- Pre-made strategies or ability to build custom bots

- Backtesting tools to validate strategies

- Developer license to test bots risk-free

- Charting tools and technical indicators

- Works on Windows, Linux, Mac, and VPS

Suitable For:

- Developers who want to build and test trading bots

- Advanced traders looking for customization

- Anyone seeking to backtest strategies before live trading

Pros:

- Diverse pre-made trading strategies

- Custom bot development and backtesting

- Supports major exchanges

- Advanced features for developers

Cons:

- No mobile app, desktop only

- It can be complex for beginners

Pricing

Pricing based on features and capabilities unlocked at each tier:

| Plan | Price | Features |

|---|---|---|

| Beginner | 0.009 BTC/month | 1 bot, 1 trading strategy, 1 backtesting strategy |

| Simple | 0.016 BTC/month | 5 bots, 5 trading strategies, 5 backtesting strategies |

| Advanced | 0.026 BTC/month | 10 bots, 10 trading strategies, 10 backtesting strategies, developer license |

Conclusion

Crypto trading bots offer a wide range of potential benefits, from automated execution to risk management and even social trading. However, they also come with costs and require active monitoring. By understanding the strengths and limitations of different bot types, traders can determine if tapping into AI aligns with their strategy.

This overview of 12 top crypto trading bots provides a starting point for evaluating options suited to your needs. Keep in mind there is no one-size-fits-all bot for every trader. Do your research to find the automation tool that best complements your trading style and risk temperament. Used judiciously, bots can enhance your profits without completely replacing human oversight. In the right hands, these crafty AI traders can stack the odds for success in the exciting crypto markets!

Leave a Reply