Navigating the fast-paced world of crypto taxes can be daunting, making the right tax software critical for investors to handle intricate regulations. As cryptocurrencies evolve, robust tools for accurate calculations and simplified reporting grow more essential. This in-depth Finestel article highlights the key traits of a list of the best crypto tax software. We examine how they automate tracking and reporting across platforms.

Precise gain/loss calculations, user-friendly interfaces, strong security, and broad exchange/wallet support are revealed as pivotal capabilities of the best crypto tax platforms. Selecting software with these vital features emerges as a strategic choice for investors aiming to navigate the world of crypto taxes efficiently, accurately, and in compliance. As cryptocurrencies advance, having the ideal tax software becomes integral to effectively managing the multifaceted realm of crypto tax obligations.

What is Crypto Tax Software?

Crypto tax software helps investors calculate and report taxes on their crypto transactions. These tools track and categorize transactions from exchanges and cryptocurrency wallets. Transaction labels that the best crypto tax tools record include details like dates, amounts, and types of trades. So, they are basically crypto accounting software with tax-related features.

One of the core features of the best crypto tax tools is calculating capital gains or losses based on the original cost of the cryptocurrencies and their eventual sale price. The software can generate necessary tax forms and supports accounting methods like FIFO and LIFO to determine cost basis.

A top crypto tax software follows the regulations to provide accurate tax calculations and reporting. This helps users meet their obligations in the complex crypto tax regulation space.

Though these tools simplify the process, it is important to choose one tailored to your needs. These requirements include supported exchanges, integration capabilities, and usability. With proper cryptocurrency accounting software, individuals and businesses can more easily track their taxes. It will allow them to calculate and report their crypto-related tax liabilities much easier.

Get more details on the legal status of crypto trading through this article.

What are the Characteristics of the Best Crypto Tax Software?

The best crypto tax platforms have various characteristics in common. For instance, accurate calculation of capital gains and losses is essential for any robust crypto tax reporting software. An intuitive, user-friendly interface with clear instructions makes the process straightforward. Moreover, support for a wide range of exchanges and wallets, along with automated importing of transaction data, improves efficiency and reduces errors.

Security is also critical for any cryptocurrency accounting software. The best crypto tax tools have security features like encryption and two-factor authentication. These components protect users’ sensitive financial data. A decent crypto tax software should also stay updated on cryptocurrency regulations to be compliant with the rules.

Responsive customer service, one that provides timely support during tax season, is another must-have feature. All in all, top crypto tax software allows investors to understand the complexities of cryptocurrency tax rules.

Those interested may find more information on strategies to reduce crypto trading fees here.

Why Use a Crypto Tax Software?

Crypto tax tools offer clear advantages for investors. Especially when it comes to accurately and efficiently calculating and reporting taxes. First, automatically tracking and tallying transactions across exchanges and wallets minimizes manual errors and difficulties compared to doing it by hand.

Moreover, consolidating all transaction data in one cryptocurrency accounting software enables comprehensive monitoring and management of diverse portfolios. Seamless integration with exchanges to import transaction details eliminates backbreaking manual entry. Helpful tax form generation is another advantage that ensures regulatory compliance.

As a result, using the best crypto tax software saves significant time and effort compared to manual computation. It is especially helpful during tax season. Offering customer support and educational materials also helps users fully utilize the software and learn about complex crypto taxes. For investors and traders, using top crypto tax software yields accurate, automated, and efficient tax preparation compared to tackling it on your own.

An overview explaining the maker vs taker fee can be read at this page.

What is the Best Crypto Tax Software: Top 10 Overview

In this section, we analyze the best crypto tax platforms in 2024. We present a list of the nominees and introduce the useful features each software offers. Note that finding free crypto tax software is extremely hard, as these platforms mostly charge you for the value they offer. Without further a due, here is a comprehensive crypto tax software comparison:

TurboTax

TurboTax is arguably the best crypto tax tool. With a guaranteed accurate calculation, you can file your crypto taxes confidently. The TurboTax investor center helps you invest smarter by tracking tax impacts and estimating taxes to avoid surprises during tax season. Moreover, the Turbo Tax Investor plan is the cheapest crypto tax software, as it is free of charge.

Known as the crypto tax software for accountants, TurboTax simplifies the process by allowing you to auto-import your crypto activity quickly. This feature also covers NFTs, ensuring a convenient calculation of capital gains and losses. TurboTax takes the hard work out of cost-basis reporting. It tracks down missing values for you to ensure precise capital gain and loss reporting.

Additionally, TurboTax offers specialized crypto experts to provide unlimited tax advice, making it the best crypto tax software for USA traders. You can connect with these experts as often as needed for guidance on your investment and crypto taxes. This service is included with Assisted Premium and Live Full Service plans, making TurboTax a comprehensive solution and the best crypto tax software in the market.

Koinly

Koinly is another one of the best crypto tax tools. It simplifies the challenging task of calculating and reporting taxes on crypto transactions. With over 1.3k Trustpilot reviews, it is arguably the easiest crypto tax software to work with. The platform provides insightful metrics that allow users to track their crypto assets effortlessly. Koinly can measure total holdings, portfolio growth, and tax liabilities across multiple wallets.

A key strength of Koinly lies in its data importing capabilities. It supports automated importing through APIs from exchanges. For instance, it is the best crypto tax software for binance beginner traders. It is also adaptable to various wallet types. Koinly also offers a comprehensive free plan, making it the best free crypto tax software.

Koinly specifically excels in handling complex data related to margin and futures trading on popular exchanges like Binance. Additionally, Koinly is adaptable to the decentralized finance (DeFi) space. It recognizes income from diverse DeFi activities.

CoinTracker

CoinTracker is another entry on the list of the best crypto tax platforms. CT is arguably the best crypto tax software reddit users suggest. It can generate an optimized tax report in minutes by integrating with your exchange or crypto wallet. With over 2 million users, CoinTracker is a widely trusted crypto tax tool.

The CoinTracker software shines with robust integrations. It connects to 500+ exchanges and wallets, supports NFTs, 10,000+ coins, and 20,000+ DeFi contracts. It automatically tracks various crypto activities. These activities can include staking, mining, airdrops, royalties, and more. The CT crypto mining tax software is a must-have tool for miners.

![]()

With CT, you can easily file taxes through TurboTax, H&R Block, or your personal tax professional. In fact, CoinTracker might be the best crypto tax software for turbotax.

This platform employs various security measures like read-only data access, end-to-end encryption, and two-factor authentication. With backing from leading industry investors, CoinTracker can assist you in building wealth by saving on taxes. It’s diverse set of features indicate that CoinTracker aims to offer the best app for crypto taxes.

A list of countries where Binance’s services are unavailable is covered on Finestel’s page.

ZenLedger

ZenLedger is a leading crypto accounting software that makes calculating cost basis and capital gains on your crypto straightforward. This comprehensive platform simplifies tracking cryptocurrency income from various sources like airdrops, forks, staking, and DeFi.

As a crypto software for taxes, ZenLedger easily connects to over 400 exchanges, 100+ DeFi apps, and 10+ NFT marketplaces. They specifically provide one of the best DeFi crypto tax software tools. This leads to easy consolidation of gains and losses of your diverse crypto portfolio. To simplify reporting crypto taxes, it automatically generates the required IRS Form 8949 based on your transaction history.

This crypto tax tool’s useful features include Tax Loss Harvesting to optimize tax liability, Grand Unified Accounting for a full portfolio valuation report, and smooth integration with TurboTax and TaxAct for effortless tax filing. Moreover, premium customer support provides you with expert assistance for all cryptocurrency tax needs. All in all, ZenLedger is one of the best crypto tax platforms as it allows individuals to calculate and report their cryptocurrency taxes easily and accurately.

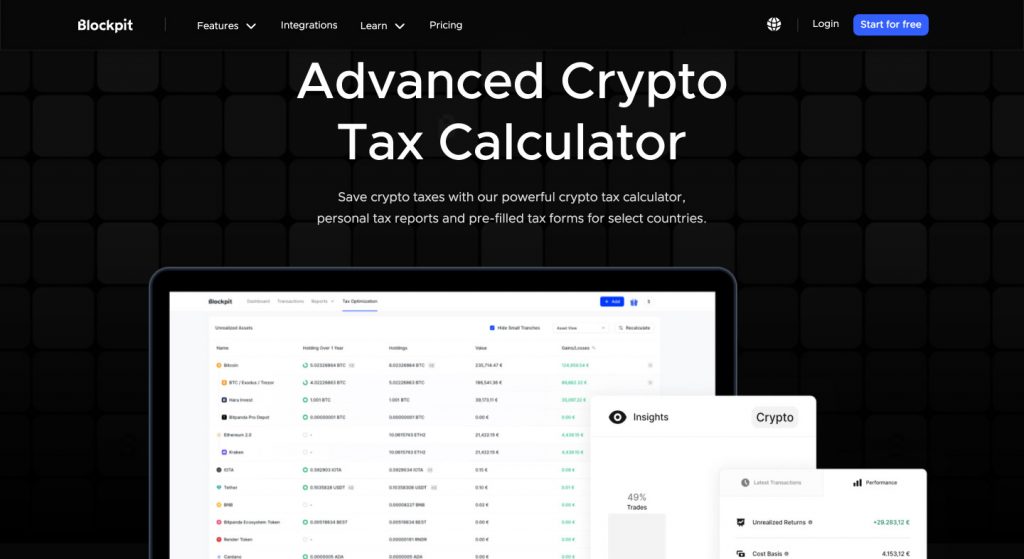

Blockpit

Blockpit offers some of the best crypto tax service that substantially simplifies and optimizes crypto tax reporting. With robust tools tailored for expert-level reporting, it seamlessly syncs with over 100,000 crypto assets and protocols, including NFTs, DeFi, derivatives, commodities, and more. Some Blockpit users even claim that it is the best crypto tax software for NFTs.

The Blockpit platform enables easy crypto tax calculation in just three steps. These steps include importing transactions, reviewing and optimization for tax savings, and generating tax reports. It automatically classifies transactions with auto-labeling and matching. Blockpit recognizes complex blockchain protocols, and handles active transaction fees efficiently.

Blockpit also provides detailed NFT reports. These reports showcase your NFTs in a personalized gallery with additional detail including accurate pricing, purchase history, and capital gain/loss data. With expert support and vast asset integration with major exchanges and blockchains, Blockpit is an elite solution for efficient crypto tax reporting.

TaxBit

TaxBit is a crypto tax software that helps businesses minimize tax compliance risks. It offers a comprehensive dashboard that centralizes customer account data, transaction details, and tax forms. Therefore, it gets the entire team on the same page with robust enterprise-level security. TaxBit’s on-demand availability allows access to up-to-date customer tax histories and compliance status through its APIs.

Tailored for scalability, TaxBit meets the needs of complex business models like multi-entity organizations, B2B2C companies, and those utilizing external consultants. It delivers actionable insights through clear indicators of tax compliance statuses coupled with customizable reports to dive into critical areas.

In essence, TaxBit empowers businesses to analyze live data, execute tasks like TIN verification and tax form creation, and access reporting to proactively tackle issues before they become compliance problems. This reduces tax compliance risk and makes TaxBit a tax software crypto investors love.

TokenTax

TokenTax is arguably the best crypto tax software for Australia-based traders, and a solid entry in the best crypto accounting software list. It meets every crypto tax need from forms to filings. TokenTax offers easy data import and syncing wallets and consolidates crypto data seamlessly without manual entry. The platform supports varied integrations, including API, wallet, DeFi, NFT, margin, and futures trading.

You can preview tax liability in real-time through its tax reports with calculations for FIFO, LIFO, minimization, and average cost methods. Moreover, it accounts for tax loss harvesting, mining/staking income, and even gas fees. TokenTax automatically generates every essential tax form like 8949, Schedule D, FBAR, and international paperwork. Whether you file through TokenTax or TurboTax, TokenTax ensures accurate, smooth crypto tax filing.

Crypto Tax Calculator

Crypto Tax Calculator software simplifies cryptocurrency taxes by transforming blockchain data into CPA-vetted tax reports. By collaborating with Coinbase, it enables easy import from over 1000 sources like wallets and exchanges. This partnership makes Crypto Tax Calculator the best crypto tax software for Coinbase. The platform follows IRS guidelines, optimizes taxes using a proprietary algorithm, and provides real-time previews of tax liability.

The calculator handles various tax forms, including 8949 and Schedule D, with TurboTax integration. It guarantees compliance with IRS reporting needs. As a trusted partner of Coinbase, Crypto Tax Calculator offers 5-star support. With positive crypto tax software reviews from over 200,000 users, it is truly a contender for the best accounting software for cryptocurrency.

CoinLedger

CoinLedger is among the best tax software for crypto that makes calculating and managing crypto taxes straightforward. It has a simple 3-step process. Users can import transactions seamlessly from wallets and exchanges, preview detailed tax reports, and generate official IRS forms. As an official TurboTax partner, CoinLedger enables direct import into TurboTax, TaxAct, and other tax platforms. Moreover, it works particularly well for Canadian investors, making it the best crypto tax software for Canada based traders.

CoinLedger is trusted by over 500,000 crypto investors. It provides a seamless tax preparation experience along with free portfolio tracking for easy crypto monitoring. CoinLedger’s international support is also very useful as it generates localized crypto gain/loss/income reports.

Positive user reviews highlight CoinLedger’s effectiveness in handling high transaction volumes, clarifying capital gains, and building confidence for tax filing. Some users label CoinLedger as the best crypto tax accountant. This top-notch crypto tax program simplifies complex crypto tax reporting experience for traders and investors.

An analysis of top crypto AI trading bots has been published over here.

CoinTracking

CoinTracking is a powerful cryptocurrency portfolio tracker and tax calculator. It is trusted by over 1.5 million individuals and 25,000 professionals. CoinTracking is also a competitor for being the best crypto tax software for UK residents.

![]()

The platform simplifies crypto investment management by importing data from 300+ exchanges for real-time tracking, customizable dashboards, and interactive charts. CoinTracking supports tax reporting for 100+ countries with 13 methods.

With 15 years of historical crypto data, CoinTracking is relied on by finance experts. Its robust features, like automatic trade import, secure encryption, and wallet compatibility, make it versatile for individual traders and crypto businesses. CoinTracking earns positive reviews for its user-friendly interface, precise tax calculations, and active community support.

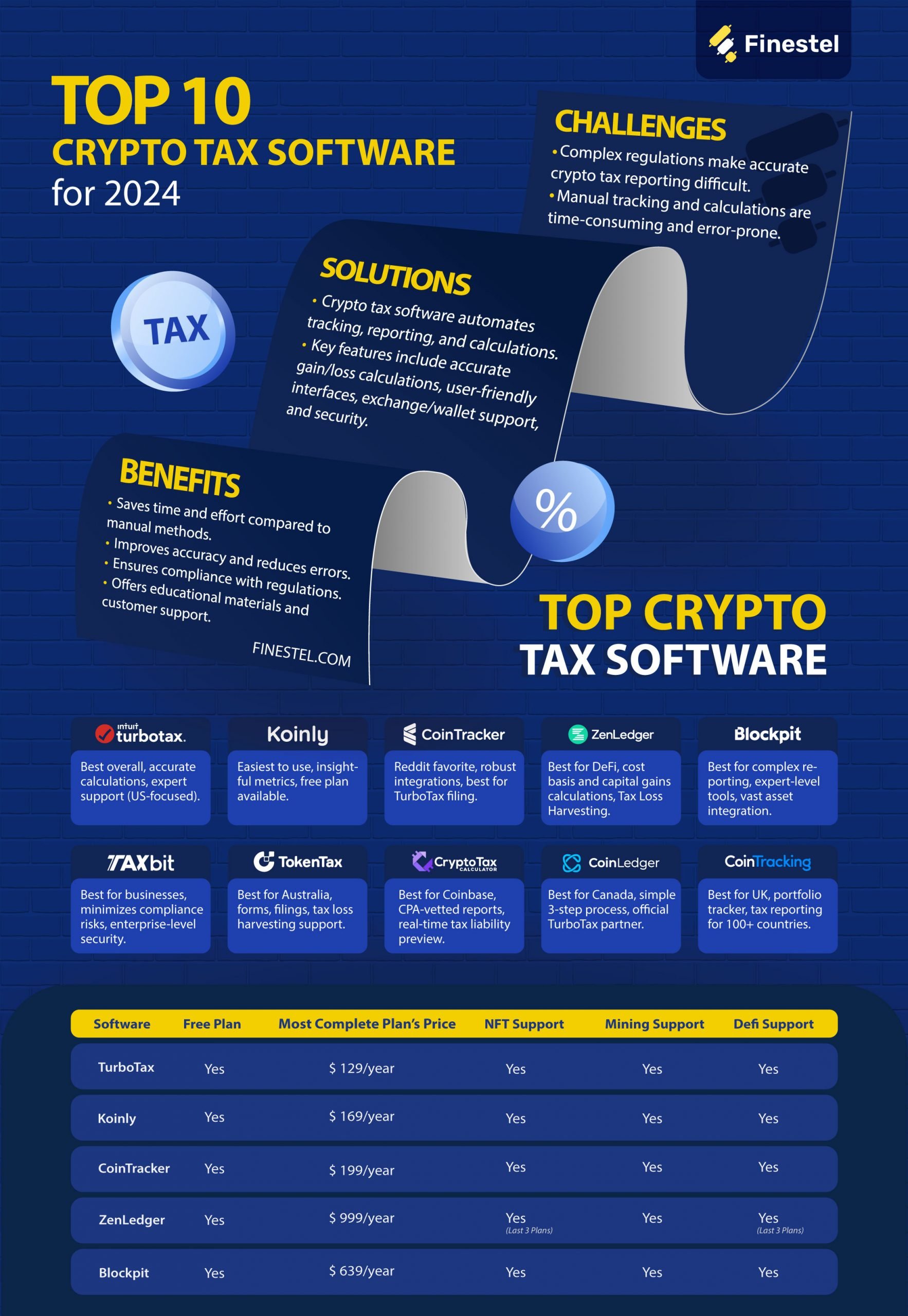

The Best Crypto Tax Tools Summarized

We have comprehensively introduced a list of the best crypto tax software tools. Now, we summarize the key factors in a concise table below:

| Software | Free Plan | Most Complete Plan’s Price | NFT Support | Mining Support | Defi Support |

| TurboTax | Yes | $129/year | Yes | Yes | Yes |

| Koinly | Yes | €169/year | Yes | Yes | Yes |

| CoinTracker | Yes | $199/year | Yes | Yes | Yes |

| ZenLedger | Yes | $999/year | Yes

(last 3 plans) |

Yes | Yes

(last 3 plans) |

| Blockpit | No | $639/year | Yes | Yes | Yes |

| TaxBit | Yes | $500/year | Yes | Yes | Yes |

| TokenTax | No | $2,999/year | Yes | Yes | Yes |

| Crypto Tax Calculator | No | $499/year | Yes

(last 3 plans) |

Yes | Yes

(last 3 plans) |

| CoinLedger | Yes | $199+/Year | Yes | Yes | Yes |

| CoinTracking | Yes | $69.99/year | Yes | Yes | Yes |

Top 10 Crypto Tax Software In 2024 Infographic

Conclusion

In the complex world of cryptocurrencies, picking the right crypto tax software is crucial for investors. In this Finestel blog article, we analyzed the top contenders for best crypto tax software in 2024, including Koinly, TurboTax, CoinTracker, ZenLedger, Blockpit, TaxBit, TokenTax, CryptoTaxCalculator, CoinLedger, and CoinTracking. They provide diverse options tailored to users’ needs. These platforms deliver vital tools like accurate gain/loss calculations, user-friendly interfaces, robust security, and broad exchange/wallet support.

As crypto evolves, using the best tax software is extremely beneficial. It simplifies the complex, time-consuming process of calculating and reporting crypto taxes. Users can stay compliant as regulations change rapidly. Key features like automated data import, real-time tax liability previews, and integration with popular filing platforms empower investors to achieve efficiency and accuracy. For investors, having the best crypto tax platform in their toolkit is crucial to easily pay crypto taxes.

Leave a Reply