Many of us are interested in trading or investing in the financial markets to grow our wealth. However, we mostly lack the time, knowledge, or experience to do so. Copy trading is one of the solutions to this issue. You only need to find the best traders to copy, and you can delegate your asset management activities to them.

Copy trading is an investment strategy that consists of two parties: a master trader and an investor. The investor replicates a professional trader’s executions, looking to gain profit from the market. This way, investors can save themselves from many associated headaches and risks and trust professional traders to manage their funds.

In this article by Finestel, we try to provide you with general tips and tricks to find the best traders to copy. We explain “what is copy trading” and the factors you must consider to identify successful traders, like risk management, historical performance, reputation, and even psychological traits. We finally wrap up our discussion by introducing a list of the best traders to copy in both crypto and forex markets.

How Can I Find the Best Traders to Copy?

We can trace back copy trading’s origin to mirror trading. In mirror trading, you replicate the strategies of successful traders, trying to achieve the same gains. Yet, mirror trading has evolved with the development of the internet and social media.

Social trading has been introduced, which consists of a social media platform that allows traders to share their ideas. Copy trading was then born from the combination of the two. On copy trading platforms, investors can monitor traders, analyze their track records, and choose whether to follow their every move in the market or not.

Copy Trading: Replicating the Trades of the Best Traders

Copy trading is the act of following and replicating a professional trader’s executions automatically. Investors who engage in copy trading relieve themselves from the burdens of analyzing and speculating, leaving the hard work to the best traders they can find. Copy trading also has significant benefits for the traders, as it allows them to trade more capital and get compensated in the form of management fees, performance fees, or even subscriptions.

Why Follow the Best Traders in The Financial Markets?

One should always aim for the best in every practice they choose to engage in. Investment is no different. Investors would love to earn the maximum profits they can from the financial markets. Following the best traders through copy trading is one way to do so.

Finding the best traders and replicating their trades in your personal account is similar to hiring professional asset managers to invest your money. It would not only ease your mind but also provide the chance for you to draw consistent profits from the markets.

Factors to Consider When Identifying the Best Traders

When searching for the most suitable trader to follow according to your personal preferences and goals, there are several factors you should consider. Here are the main ones:

Performance Metrics: Evaluating Historical Returns and Consistency

One of the main factors for finding the best traders to follow is their historical performance. Look for consistent returns over a considerable amount of time. This shows the trader’s adaptability and flexibility in different market conditions. Avoid following traders with sporadic, volatile performance, as instability introduces risk.

Moreover, evaluate other performance metrics, such as winning ratio, average reward/risk ratio, maximum drawdown, etc., to find the traders most aligned with your goals and risk tolerance. Also, pay attention to the trader’s track record during bull and bear markets to avoid following a one-trick pony.

Trading Strategies: Analyzing Approaches and Techniques

A trader’s strategy says a lot about their potential performance and risk management. Some traders choose the more conservative path of investing for the long term, leaning more toward portfolio management. On the other hand, others might prefer more aggressive methods, like speculating with financial derivatives and leverage, to capture short-term profits.

After identifying each trader’s strategy and investment horizon, the second step is to select the one most suited to your investment objectives.

Risk Management: Assessing Methods to Protect Investments

Risk management is arguably the most important part of being a trader. Leaving your capital in the hands of a trader who constantly exposes your funds to significant risk or does not know how to protect your assets against potential losing streaks is the last thing you want to do.

It is crucial to look for traders with appropriate risk exposure per trade, negligible drawdown, and effective risk management techniques. These characteristics are mostly visible in a trader’s track record and historical performance.

Reputation and Community Feedback: Importance of Trust and Validation

The metrics introduced above are mostly quantitative. Yet, some qualitative attributes should be analyzed to find the best trader to copy. The most important one is the trust and validation of current investors. Consider community reviews and feedback to evaluate the credibility of a specific trader and determine whether they are suitable to manage your funds.

The Psychology of Successful Traders: Traits to Look for

Psychology is one of the crucial elements in trading. There are several psychological traits that successful traders possess. Here are the most significant ones to look for when searching for traders to follow:

Discipline

Trading requires a lot of discipline. Consistency in performance directly results from a trader’s discipline in sticking to their trading plan. Avoid following traders who make impulsive decisions and put their AUM at risk. This trait can be witnessed in the stability of the trader’s returns.

Patience

Patience is key in every business, as well as trading. Expert traders patiently analyze the charts and wait for their chance to execute. They do not enter positions when the market has not presented one of their trading setups. Impatience can be visible when a trader executes too many trades in a short time. This phenomenon is called overtrading and usually leads to losing streaks.

Emotional Control

Traders occasionally go through emotionally challenging periods. In these situations, lacking control over oneself can be very destructive and result in massive losses. Successful traders have a predefined game plan to deal with these difficulties and stay on track. Lack of emotional control usually translates to volatile results with sporadic wins and huge losses.

Realistic Expectations

Experienced traders think in terms of probabilities. They are aware that nothing is guaranteed in the financial markets and transfer these expectations to their followers. Promising unrealistically big gains in short timeframes is one of those red flags you should definitely keep in mind.

Confidence

Professional traders are always confident in their ability to generate profits in the markets consistently. Their confidence usually stems from a large amount of data validating their profitability over the long run. This data is usually extracted from backtesting and live trading. Confident traders do not second-guess their decisions when the market aligns with their execution criteria.

Best Traders to Copy in the Crypto Market

The cryptocurrency market is the most volatile financial market in the world. Therefore, you should conduct thorough research to identify the best traders to copy. Ironically, the best trader might not be the one who generates the most profits in a given timeframe but the one whose performance is most aligned with your expectations and risk tolerance.

Traders who outperform others based on their PnL in the short term might not be the best ones to copy for the long run because they might be overleveraging or overtrading. Both of these issues are almost guaranteed to lead to disastrous losses or lengthy losing streaks, which will ultimately result in massive financial losses for the investors.

It would be helpful to take a look at top copy trading platforms and their users to find the best traders to copy in the crypto market. However, we begin by explaining Finestel’s experience regarding finding the best traders to copy and continue by introducing the top traders in the most popular copy trading platforms.

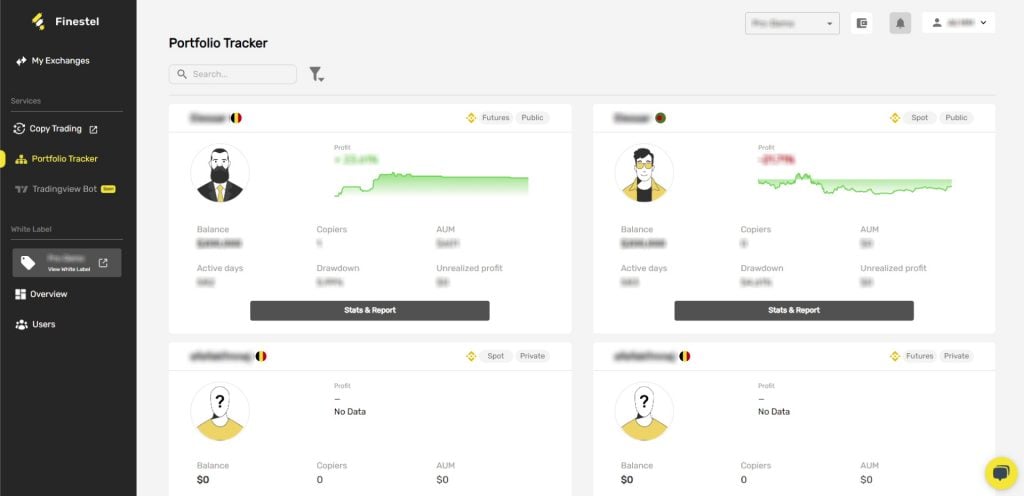

Finestel’s Experience

Finestel began as a top copy trading platform and has since evolved into a trading solution provider offering services like white-label asset management tools. Therefore, we are happy to share our experience with the users to help them find the best traders to copy.

Everyone has different expectations when entering the financial markets. Before determining who the best trader that you can follow is, you must review your goals and expectations. Therefore, you would be able to find traders whose targets are most aligned with yours.

Back when Finestel was just a copy trading platform, many investors and traders were dissatisfied with each other. Investors unfollowed traders because they did not trust the traders to lead them toward their financial goals. Traders were also frustrated as they could not grow their AUM and profits.

As we have gotten into the path of asset management and trading solution providing, things have changed. Asset managers and traders bring their own clients and investors on instead of offering their services to new clients on the website. As a result, investors are more familiar with the traders and are willing to work with them.

Moreover, communication has been one of the most effective ways for traders to gain the trust of their copiers. Traders who clarify their expectations and strategies and provide their followers with regular updates have been more successful in attracting new copiers and keeping the old ones. The resulting transparency increases the investors’ confidence in what the trader does and would worry less.

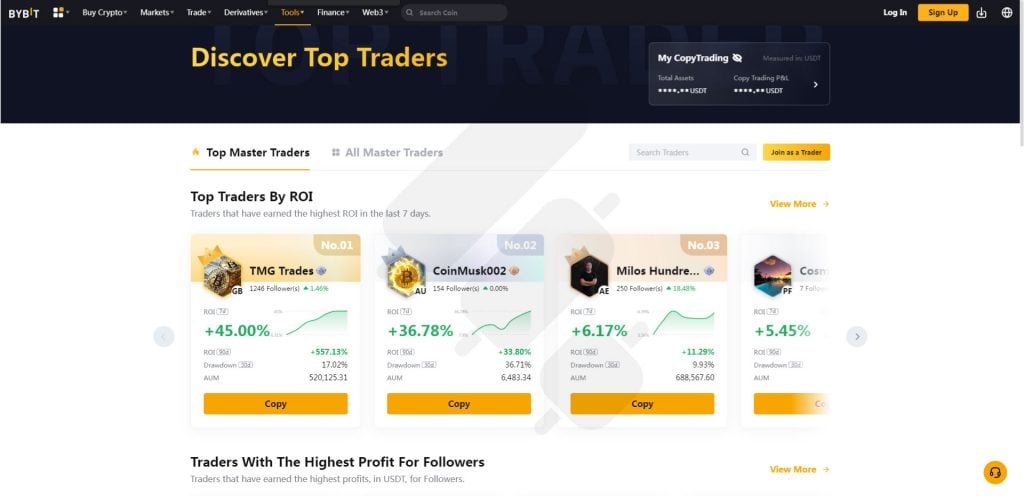

Best Traders to Copy on Bybit’s Social Trading Platform

Bybit is one of the leading cryptocurrency exchanges that offers copy trading services on the side. Their social trading platform is highly ranked in the crypto space. So, let’s take a look at the top 3 traders on Bybit:

| Name | 30-day RoI % | Win rate | AUM | Copiers |

| MayaCapital | 201.13% | 85.74% | $104,210 | 260 |

| SIGNAL BANK | 47.89% | 67.44% | $54,596 | 154 |

| Wealthgroup | 9.59% | 100% | $164,512 | 397 |

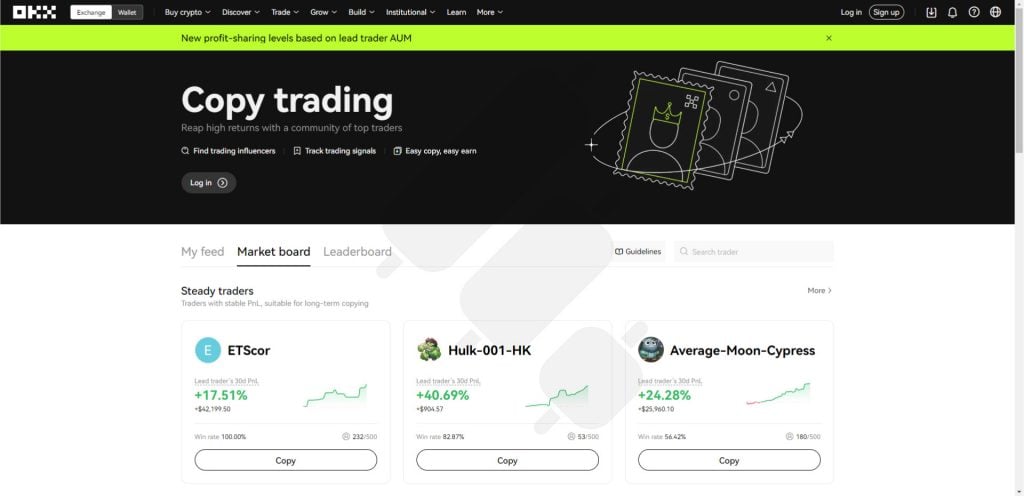

Best Traders to Copy on OKX’s Social Trading Platform

OKX is another one of the popular centralized crypto exchanges. They also have one of the top copy trading services in crypto, allowing investors to replicate expert traders’ executions. Here are the top 3 traders on OKX’s social trading platform:

| Name | 30-day RoI % | Win rate | AUM | Copiers |

| 真得鹿梦为鱼 | 51.54% | 69.67% | $626,783 | 644 |

| Alvin_Cryptodancers | 7.58% | 90.28% | $4,597,228 | 9,690 |

| JinCiRongTou | 9.59% | 94.60% | $137,921 | 473 |

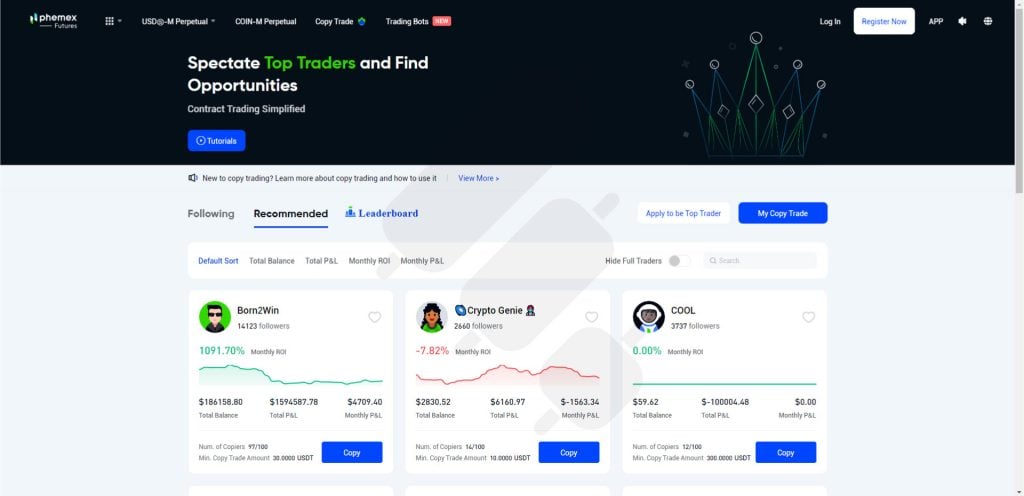

Best Traders to Copy on Phemex’s Social Trading Platform

Phemex is also a popular cryptocurrency exchange that supports copy trading. Users can view several traders, evaluate their performance using the metrics provided, and find the most suitable trader to copy on the platform. Here are the best traders on Phemex:

| Name | 30-day RoI % | Winrate | AUM | Copiers |

| Born2Win | 51.80% | 48.42% | $206,308 | 100 |

| Profit-hunter | 4.85% | 48.39% | $764,355 | 9 |

| Tecton | 0.87% | 46.89% | $61,140 | 81 |

Best Traders to Copy in Forex Market

Copy trading is also among the popular investing strategies in the Forex market. Below is a list of the best traders to copy on the top copy trading platforms in the Forex market.

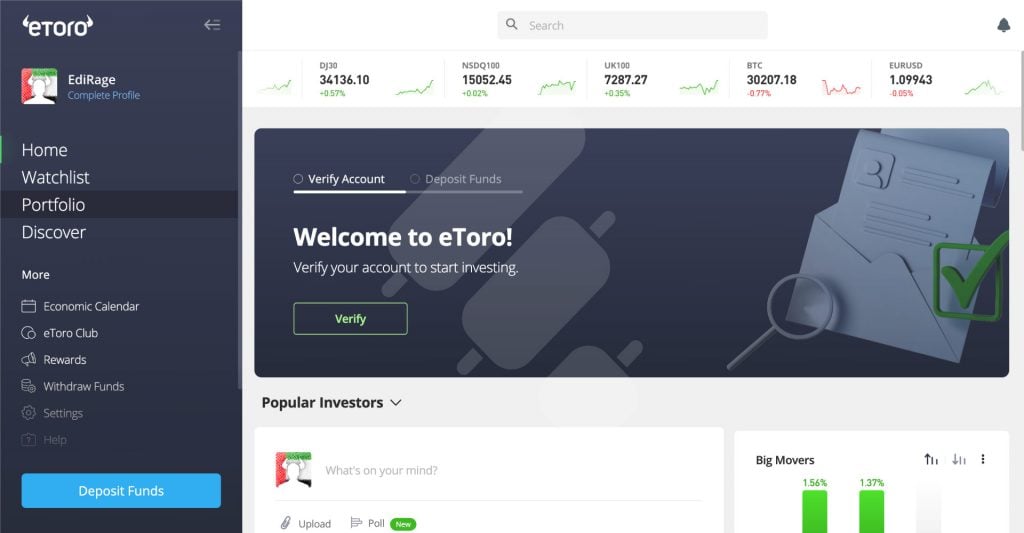

Best Traders to Copy on eToro

eToro is widely known as the best forex copy trading platform in the world. Their social trading platform is among the best in the market, especially for beginners. Here are the top 3 forex traders on eToro traders you can follow:

| Name | YTD ROI % | Win rate | AUM | Copiers |

| Alberto Nicoletti | 19.84% | 70.68% | $100K-$300K | 251 |

| Sebastian Kubica | 76.07% | 41.87% | $50K-$100K | 11 |

| Nehemiah Macabuhay | 22.96% | 86.22% | <$50K | 33 |

Best Traders to Copy on ZuluTrade

ZuluTrade is one of the most popular copy trading platforms in Forex, that works with many brokerage firms. The top 3 traders on this platform are:

| Name | Average ROI % | Win rate | AUM | Copiers |

| andrew888 | 225.78% | 76.6% | $111,831 | 391 |

| LIGHTNING SIGNAL | 52.89% | 77.3% | $101,105 | 253 |

| GoodTrader65 | 45.18%, | 85.1% | $165,164 | 57 |

Conclusion

In this article, we focused on how you can find the best traders to copy. We first briefly explained what copy trading is and what metrics you should consider to evaluate traders. Then, we moved on by discussing the psychological traits you successful traders possess. Lastly, we introduced the best traders in top crypto and forex copy trading platforms.

Remember that it is essential to find the best traders to copy if you want a favourable investment journey. These traders would relieve you of the pressures of trading and portfolio management while granting you exposure to the financial markets. Yet, note that the best traders are not necessarily the ones with the most PnL but the ones whose goals are closely aligned with yours.

FAQ

Are there tools or platforms to help identify the best traders?

Yes. Most popular copy trading platforms provide performance metrics, historical data, and community feedback to assist users in selecting the best traders to copy.

How can I effectively monitor and manage the traders I copy?

You can use the risk management tools provided by copy trading platforms, such as risk limits. You can also monitor the traders’ performance using the metrics offered by the platform you use.

What is the best crypto copy trading platform?

Finestel is the best copy trading platform in crypto. They offer the best copy trading technology in the market while providing it as a white label under your own brand.

Are there common strategies or patterns followed by successful traders?

While there are various analysis strategies that traders use, successful ones are guaranteed to have a strict risk management plan.

How can I assess the risk of copying traders?

There are several risk evaluation metrics that you can consider when finding the best traders to copy. These include profit/loss ratio, win rate, maximum drawdown, etc.

Leave a Reply