Liquidity is like the blood pumping in the vessels of any financial market, and the crypto market is no different. For any market to be efficient, there is a need for sufficient liquidity. In traditional financial markets, liquidity is often synonymous with the volume of trading activity and the depth of the order book. Yet, in the crypto market, liquidity includes the availability of crypto assets across various trading pairs and exchanges. In this Finestel article, we will present a list of the top 10 crypto liquidity providers.

We will begin the article by defining what liquidity is and why it is essential for any financial market’s stability. Then, we will analyze the role of crypto market makers and liquidity providers. Yet, there are subtle distinctions between crypto liquidity providers and market makers that we will also explain. Finally, we will present the top 10 crypto liquidity providers list in 2024.

What Is Liquidity in Financial Markets?

Referring to our finance books, liquidity is defined as the degree to which an asset can be quickly bought or sold without significantly moving its price. In simpler terms, liquidity represents the ease with which an asset can be converted into cash. This definition alone can highlight the importance of liquidity in any financial market. But, more on that later.

Assets that are highly liquid are easily tradeable. That is because there is a large number of buyers and sellers in the market. This allows transactions to be executed quickly without considerably impacting the asset’s price. Low liquidity markets, on the other hand, suffer from high volatility, as buying and selling orders can significantly affect the price.

Why Is Liquidity Essential for Markets?

As already mentioned, liquidity is essential for financial markets to behave smoothly. Here are some of the most prominent reasons why liquidity is crucial:

- Price Stability: High liquidity translates to a high volume of buyers and sellers available. Thus, they can quickly absorb large orders and prevent significant price fluctuations.

- Efficient Price Discovery: In liquid markets, prices accurately reflect assets’ true supply and demand dynamics. As a result, investors can make more informed decisions based on market prices. This is because prices truly represent values.

- Reduced Transaction Costs: High liquidity typically results in narrower bid-ask spreads. Therefore, it reduces the cost of trading, making it cheaper for investors to buy and sell assets. Read more about reducing crypto trading fees.

- Increased Market Participation: Liquidity attracts more market participants, including investors, traders, and institutions. Consequently, it can lead to a sustainable growth for the market.

- Facilitates Fund Flows: Liquid markets allow investors to easily enter and exit positions. So they can quickly rebalance their portfolios in response to changing market conditions. This flexibility makes a market very attractive.

What Are Crypto Liquidity Providers?

A crypto liquidity provider is an entity that facilitates the trading of crypto assets. It does so by supplying liquidity to the market. The primary role of a liquidity provider in the crypto market is to make a continuous supply and demand for the asset. So, whenever you want to buy or sell the coin, there is a counterparty to meet your order. Crypto liquidity providers do so by placing limit orders on the exchange order books.

As already mentioned, crypto liquidity providers play a crucial role as they offer liquidity. They contribute to narrowing spreads and reducing price volatility. So, traders can easily and quickly trade their crypto assets without executing at an undesired price. This improves market stability and attracts new investors. So, the crypto market can be a more stable place for investors.

In addition to supplying liquidity to crypto exchanges, liquidity providers may also offer other services. These can include market making, arbitrage trading, and risk management. Some liquidity providers specialize in specific cryptocurrencies or trading pairs. Meanwhile, others can provide liquidity across a wide range of assets. All in all, there is no denying that the presence of crypto liquidity providers is essential for the market to grow sustainably.

The Difference Between Crypto Liquidity Providers and Market Markets

Crypto market makers and liquidity providers are integral components of cryptocurrency markets. Yet, they perform separate roles. Market makers actively participate in the market by providing buy and sell prices for assets. Their primary objective is to “make the market.” They do so by making trading at the competitive bid and ask prices available for traders.

The best crypto market makers use automated algorithms to make the market. They determine optimal bid and ask prices based on various factors. These factors include order book depth, trading volume, and historical data. Moreover, a crypto market maker’s revenue model relies on profiting from the spread. They earn a profit with each executed trade. High-frequency trading firms and algorithmic trading platforms usually act as market makers in the crypto market.

On the contrary, liquidity providers focus on supplying liquidity to the market by placing orders on exchanges. They ensure a continuous flow of assets available for trading. Make no mistake. Crypto liquidity providers may engage in market-making activities. However, their primary goal is to enhance market stability and efficiency. They do so by narrowing bid-ask spreads and reducing price volatility.

Crypto liquidity providers contribute to market liquidity by providing a consistent supply of assets. So, traders can execute trades quickly at competitive prices. Similar to crypto market makers, liquidity providers may earn revenue from spreads. Yet, they can also generate income by getting paid by crypto exchanges. Hedge funds, proprietary trading firms, and specialized liquidity providers are common liquidity providers in crypto.

Discover the best crypto institutional services in 2024.

List of the Top 10 Crypto Liquidity Providers

Now that we have defined what liquidity is and what is the role of liquidity providers, we can introduce the list of the best crypto liquidity providers in 2024:

Galaxy Digital Trading

Galaxy Digital Trading is one of the best crypto market markers and liquidity providers. It manages over $2.5 billion in assets for more than 960 institutional clients. The company offers world-class pricing to brokers. Investors can trade at competitive prices, and it guarantees reliable scalability using its custom-built ecosystem. As a publicly listed company, Galaxy observes strict governance and employs sophisticated compliance oversight to maintain its transparency and client trust.

The company’s trading business, GT, provides spot and derivative executions, as well as liquidity to institutional clients, counterparties, and venues that transact in cryptocurrencies and other digital assets. GT acts as an institutional-grade liquidity provider with market expertise and global access to over 100 different cryptocurrencies for over 930 counterparties.

GT engages in a number of activities on behalf of customers and for its own account. These activities revolve around the buying, selling, lending, and borrowing of cryptocurrencies. GT’s full suite of service offerings includes OTC spot liquidity provision, on-exchange liquidity provision, OTC derivatives options trading, and lending. GT also engages in proprietary quantitative, arbitrage, and macro trading strategies.

Galaxy Digital’s trading business is a diversified revenue stream that can have varied and/or little correlation with crypto prices. In fact, the correlation of GT’s results to the values of cryptocurrencies can vary greatly. This is due to its implementation of derivatives and hedging strategies, market-neutral trading activities, and other quantitative trading strategies. GT’s counterparty-facing trading activities, while impacted at times by the underlying values of cryptocurrencies, can also result in profitmaking during periods of elevated volatility.

GSR Markets

GSR Markets is another top crypto liquidity provider. The company offers various liquidity solutions for digital assets trading. It is known as a leading crypto market maker and LP. It has over a decade of experience and a proven track record of success. GSR Markets is committed to delivering liquidity services with top quality. With its proprietary trading technology and deep market insight, GSR Markets helps its clients to access liquidity necessary for their trading activities.

GSR Markets is capable of creating a fluid market environment of crypto exchanges and institutions. They use programmatic execution methods to meet the unique needs of each client. So they can ensure favorable pricing and liquidity provision for exchanges. Clients can access the best crypto liquidity pools with GSR Markets and operate efficiently.

Empirica

Empirica is another notable presence in the cryptocurrency industry. This is mainly due to its wide range of liquidity solutions. As a leading crypto liquidity provider, Empirica has a decade of experience as a trading software company. It evolved into a top liquidity provider through its proprietary software. Empirica serves as the crypto market maker responsible for executing a significant portion of popular exchanges’ daily volume.

The Empirica LP concentrates on small and medium token projects. It specializes in offering feeless liquidity provision and flexible business models. Empirica can facilitate the liquidity process for token projects within 6-12 months. It can also ensure their listing on top-tier exchanges. Empirica addresses common challenges faced by token issuers and provides innovative solutions. Therefore, it has become a trusted partner for crypto projects seeking liquidity and market access.

B2Broker

B2Broker is another force within the crypto liquidity providers sector. It operates in over 40 countries and serves more than 500 clients. Established in 2014, B2Broker has gained numerous accolades for its award-winning strategies. It aids clients in achieving remarkable milestones within the cryptocurrency market. With a focus on creating a liquid market, B2Broker utilizes several distribution systems. So, it can provide investors and exchanges access to the best crypto liquidity pools.

B2Broker offers settlement options via wire transfers in major fiat currencies, leading cryptocurrencies, and stablecoins. It caters to corporate, professional, and institutional clients, providing innovative liquidity solutions. Despite the vast array of offerings, B2Broker prioritizes client satisfaction and aims to simplify the liquidity process. Thus, it provides convenient access to liquidity pools for clients worldwide.

Cumberland

Cumberland, established in 2014, is a subsidiary of DRW, a diversified trading firm based in Chicago with over 30 years of experience. This cryptocurrency liquidity provider operates globally. It offers round-the-clock responsiveness to provide a superior trading experience. Cumberland facilitates spot cryptocurrency liquidity services. It requires zero pre-funding and uses time-weighted average price (TWAP) execution methods to optimize trading.

Cumberland has a stellar reputation and major clients like Goldman Sachs and Nomura. It opens access to deep liquidity pools and therefore, provides clients with competitive pricing and efficient trade execution. Cumberland caters to the diverse needs of institutional clients, ensuring access to liquidity whenever needed. It also facilitates traditional financial entities’ entry into the crypto ecosystem.

B2C2

B2C2 was founded in 2015 and acquired by a Japanese firm in 2020. It is one of the pioneering crypto liquidity providers that offers institutional access to cryptocurrencies. Its mission is to introduce traditional market practices to crypto markets. B2C2 provides reliable liquidity across various market conditions. Operating as the first single dealer platform in the industry, B2C2 launched the world’s first bitcoin/gold derivative. This alone showcases its commitment to innovation and market leadership.

Headquartered in the UK and with offices in Japan and the US, B2C2 operates globally. It serves institutional clients in major markets worldwide. Leveraging proprietary crypto-native technology, B2C2 enables efficient trade execution. Seamless access to liquidity empowers clients to trade the cryptocurrency market confidently. As a trusted partner to institutional clients, B2C2 continues to drive advancements in the crypto market.

Genesis

Genesis is another one of the largest crypto market makers. It offers a marketplace for trading, borrowing, and lending cryptocurrencies. Genesis is regulated by reputable bodies such as the SEC and FINRA. It operates across 50 countries, providing users with access to a vast crypto liquidity pool. They can utilize this liquidity for custody, working capital, hedging, and speculative investments. Genesis focuses on security and compliance. It creates a reliable and transparent trading environment for its global clientele.

As a leading liquidity provider, Genesis caters to a wide range of users. These range from individual traders to institutional investors. Genesis provides diverse investment opportunities and financial services. With its extensive experience, Genesis has earned a reputation for market-leading efficiency. It provides world-class pricing and access to over 100 cryptocurrencies. By prioritizing transparency and scalability, many institutional clients trust Genesis for market maker crypto services.

BlockFi

BlockFi is a prominent player in the cryptocurrency ecosystem. It differentiates itself as a leading cryptocurrency market maker. BlockFi offers a diverse range of financial services tailored to meet the evolving needs of digital asset investors. BlockFi provides access to the highest yield liquidity pools. It allows users to maximize their returns while maintaining liquidity in the cryptocurrency market.

As one of the top crypto market makers, BlockFi leverages its extensive experience and expertise to provide unmatched liquidity solutions. It creates convenient trading and investment opportunities for its clientele. Through its robust platform, BlockFi serves as a trusted cryptocurrency liquidity provider. It helps users navigate the complexities of the digital asset market with confidence and security. Whether users seek to borrow, lend, or trade cryptocurrencies, BlockFi stands ready to deliver tailored solutions to institutional investors.

LedgerPrime

LedgerPrime is another distinguished player in the cryptocurrency market. It is famous for its expertise in automated market makers crypto solutions and its role as a prominent liquidity provider crypto example. As one of the top market makers in crypto, LedgerPrime uses advanced algorithms and cutting-edge technology to optimize liquidity provision across digital asset markets.

With a focus on innovation and efficiency, LedgerPrime leverages its position as one of the biggest market makers in crypto. It provides seamless access to crypto liquidity pools and facilitates smooth trading experiences for its clients. It actively participates in the market as a market maker crypto exchanges trust. LedgerPrime plays a pivotal role in shaping the market and driving liquidity in the crypto ecosystem.

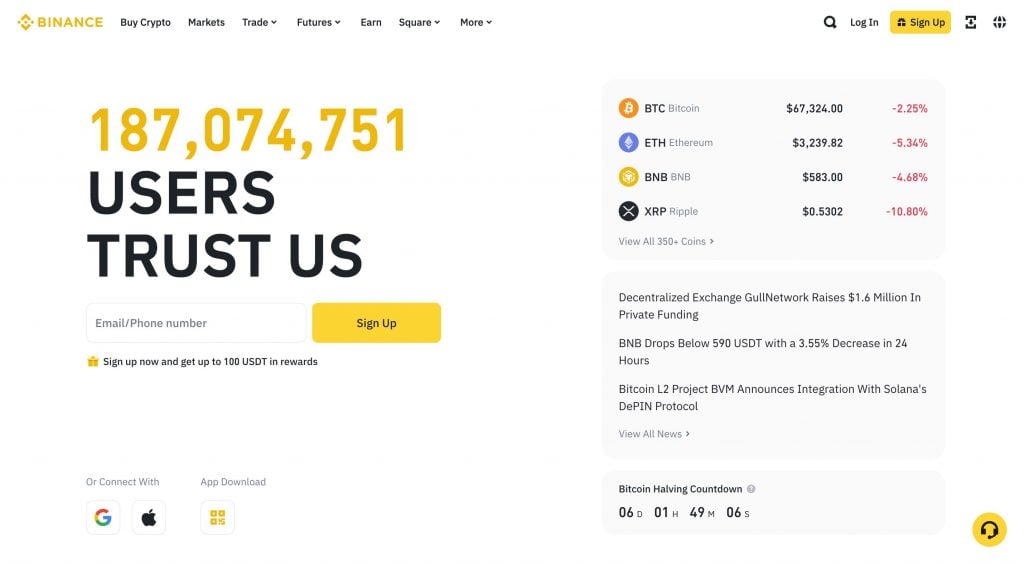

Binance

Binance is a powerhouse in the cryptocurrency industry. It is popular for its role as a leading cryptocurrency exchange and liquidity provider. With its user-friendly interface and robust trading platform, Binance has solidified its position as a cornerstone of the digital asset market.

As one of the largest cryptocurrency exchanges globally, Binance serves as a vital hub for traders and investors seeking access to a diverse range of digital assets. Its extensive liquidity pools and advanced trading features make it a preferred choice for both novice and experienced market participants. Binance’s commitment to innovation and customer satisfaction has earned it a reputation as a trusted cryptocurrency liquidity provider.

Conclusion

In conclusion, crypto liquidity providers play a crucial role in ensuring the efficiency and stability of cryptocurrency markets. As we’ve explored throughout this article, liquidity is the lifeblood of any financial market, including the crypto market. It enables seamless trading by providing ample opportunities for buyers and sellers to transact without significantly impacting asset prices. Without sufficient liquidity, markets can become volatile and inefficient, hindering price discovery and deterring market participants.

The top 10 crypto liquidity providers listed here exemplify the industry’s commitment to providing reliable liquidity solutions. From established players like Galaxy Digital Trading and Cumberland to innovative firms like BlockFi and LedgerPrime, these providers play a vital role in shaping the future of the cryptocurrency market. As the crypto ecosystem continues to evolve, the presence of reputable liquidity providers will remain essential for fostering growth, attracting new investors, and ensuring the long-term sustainability of the market.

Leave a Reply