Copy trading can be beneficial for both professional and novice traders. Traders can benefit from higher profits and a larger audience. Simultaneously, novice traders can benefit from lower risks and access to successful traders. The futures market is known for its high-risk nature, which can be challenging for new traders and profitable for expert traders, but using copy trading platforms that support the futures market will be a win-win transaction for both.

In this article, we will explore the top 5 copy trading platforms that support the futures market, examining their features, fees, and user ratings. Whether you are a professional trader looking to expand your audience or a novice trader looking to learn from the best, these platforms offer a range of benefits that can help you achieve your trading goals.

Only you can determine your choice of attitude. Choose wisely, choose carefully, choose confidently!

Charles R. Swindoll

What are Copy Trading Services that Support the Futures Market?

Copy trading services that support the futures market provide investors with a powerful tool for replicating the strategies and actions of successful traders. By automating trades and replicating the actions of experienced traders, copy trading makes it easy for investors to access the wisdom of the most successful traders in the futures market.

This not only saves time on research but also helps to reduce the risks associated with trading in this high-risk market. With the help of copy trading service providers that support the futures market, investors can benefit from the success of professional traders and avoid disastrous consequences, all while maximizing their potential profits.

Expert traders can also benefit greatly from copy trading services that support the futures market. By sharing their successful trading strategies and actions with other traders, expert traders can expand their audience and increase their profits.

Copy trading services provide a platform for expert traders to showcase their skills and attract new followers, which can lead to increased profits and a larger community of like-minded traders.

Additionally, expert traders can use copy trading services to diversify their portfolios and reduce their risks by replicating the trades of other successful traders. This can help to reduce the risks associated with trading in the futures market and increase the chances of success.

Why Crypto Futures Market?

A futures market is an auction market in which participants buy and sell commodity and futures contracts for delivery on a specified future date. Futures are exchange-traded derivatives contracts that lock in future delivery of a commodity or security at a price set today.

Futures contracts are standardized agreements traded on regulated exchanges, enabling traders to speculate on future price changes or underlying asset price movements.

The crypto futures market has become increasingly popular in recent years due to the high volatility and potential for significant profits. By trading futures contracts on cryptocurrencies, traders can speculate on the future price movements of these assets and potentially earn significant profits. Additionally, the crypto futures market provides traders with a way to hedge their positions and mitigate their risks, as futures contracts allow traders to lock in prices for future transactions. This can be particularly beneficial in the highly volatile crypto market, where prices can fluctuate rapidly and unpredictably.

Overall, the crypto futures market offers a range of benefits for traders looking to capitalize on the potential of cryptocurrencies and manage their risks effectively.

Differences Between USD-M and COIN-M Futures

Overall, the use of USD-M Futures in copy trading software can provide traders with a reliable and stable trading environment, which can help to reduce risk and improve trading outcomes. By settling in USD, traders can focus on their trading strategies and achieve their investment goals with greater confidence and ease.

Futures vs. Spot Markets: Key Differences

- One of the key differences between futures and spot markets is the timing of the transaction. The transaction settles immediately in the spot market, while in the futures market, the settlement will occur at a future date.

- The amount of leverage involved is one of the most important differences between futures and spot markets. The futures markets involve more risk and greater leverage, meaning profits and losses can be higher. On the other hand, spot markets involve no leverage, and hence, the gains and losses are much lower.

- If you want to use leverage in a spot market, you must first buy crypto coins and pay a transaction fee according to the exchange. On the other hand, futures markets have sufficient funds in their lending pools, which means they can offer higher leverage.

Key Features to Look for in Copy Trading Platforms that Support Futures Market

- User-friendly Interface: The interface must be intuitive, easy to use, and understandable, with clear performance metrics to monitor the performance of the signal provider. The broker’s trading platform should provide up-to-date charts, indicators, news feeds, and other necessary data.

- Reliable Execution and Low Fees: The crypto copy trading platform. Any trading platform must be able to protect traders’ funds, data, and trades at all times. Reputable platforms will have undergone rigorous security checks and tests and be compliant with various industry regulations.

- Advanced risk management Features: The risk management features of the platform include a system that lets users manage their money to limit their risk exposure. The platform must let traders set limits on the maximum open trades per signal provider and the maximum exposure and drawdowns.

- Diversification: Copy trading platforms should provide users with a considerable range of access to markets and assets and the capability to diversify their portfolios. These platforms should also offer a range of exchanges, allowing users to copy trades from multiple exchange platforms and diversify their investments across different markets.

- Transparency: Transparency is key when it comes to copy trading platforms. The platform should provide detailed information on its signal providers’ performance and in-depth risk management data. This data should include the number of open trades, the performance of each trade, and the drawdowns of individual signal providers.

Top 5 Futures Copy Trading Platforms

You’re not alone if you’re overwhelmed by the number of cryptocurrencies and traders in the market. Copy trading can be a great way to start, and our guide can help. We’ve compiled a list of the top 5 crypto copy trading platforms providing futures, each with advanced features and tools to help you replicate the trades of successful traders and potentially increase your returns.

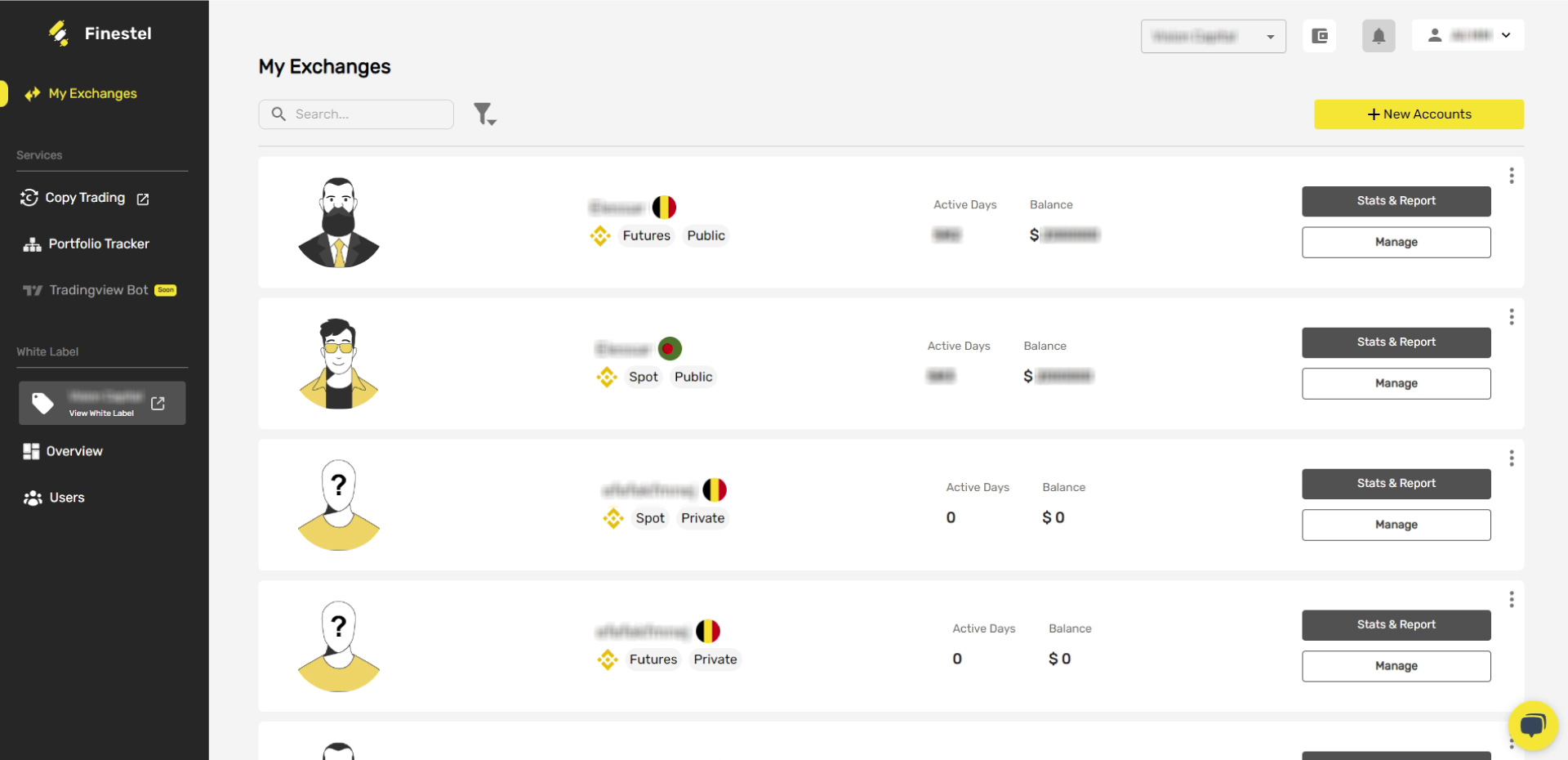

1. Finestel Futures Copy Trading

Finestel, based in Canada, provides advanced trading software for profitable traders with a community of followers and investors. Our service offers precision in fund management with additional tools like portfolio trackers, automated billing, and performance analytics.

Comprehensive Copy Trading Plans

Copy Trading as a Bot: Perfect for traders managing fewer investors, ensuring instant replication of trades with high speed and accuracy.

White-Label Copy Trading Software: Ideal for traders with over 10 clients, offering a customizable interface under your own brand.

Additional Services

Finestel is not limited to a copy trading service, it also includes these services:

Private Strategy Marketplace

Connects skilled traders with white-label platform owners to integrate profitable strategies. Benefits include access to diverse strategies, platform expansion, and higher profit potential through a performance fee sharing model.

Innovative Telegram Bot

Streamlines trading operations directly within Telegram, consolidating portfolio tracking, client reporting, broadcast signaling, trade execution, and brand customization. Benefits include time-saving automation, consolidated management, and enhanced brand presence.

Pros

- User-friendly design

- Kucoin copy trading, Binance copy trading, OKX copy trading, and Bybit copy trading all on spot and futures market are available, multiple exchanges will be supported in the near future.

- Provides risk management diversification.

- Flexible pricing methods offered

- White Label Solutions

- Flexible Pricing

- Secure and Reliable

- Fully Customizable

- 24/7 Online Customer Support

- Free First Month

- Supports Major Exchanges

Considerations

- Limited Exchange Support

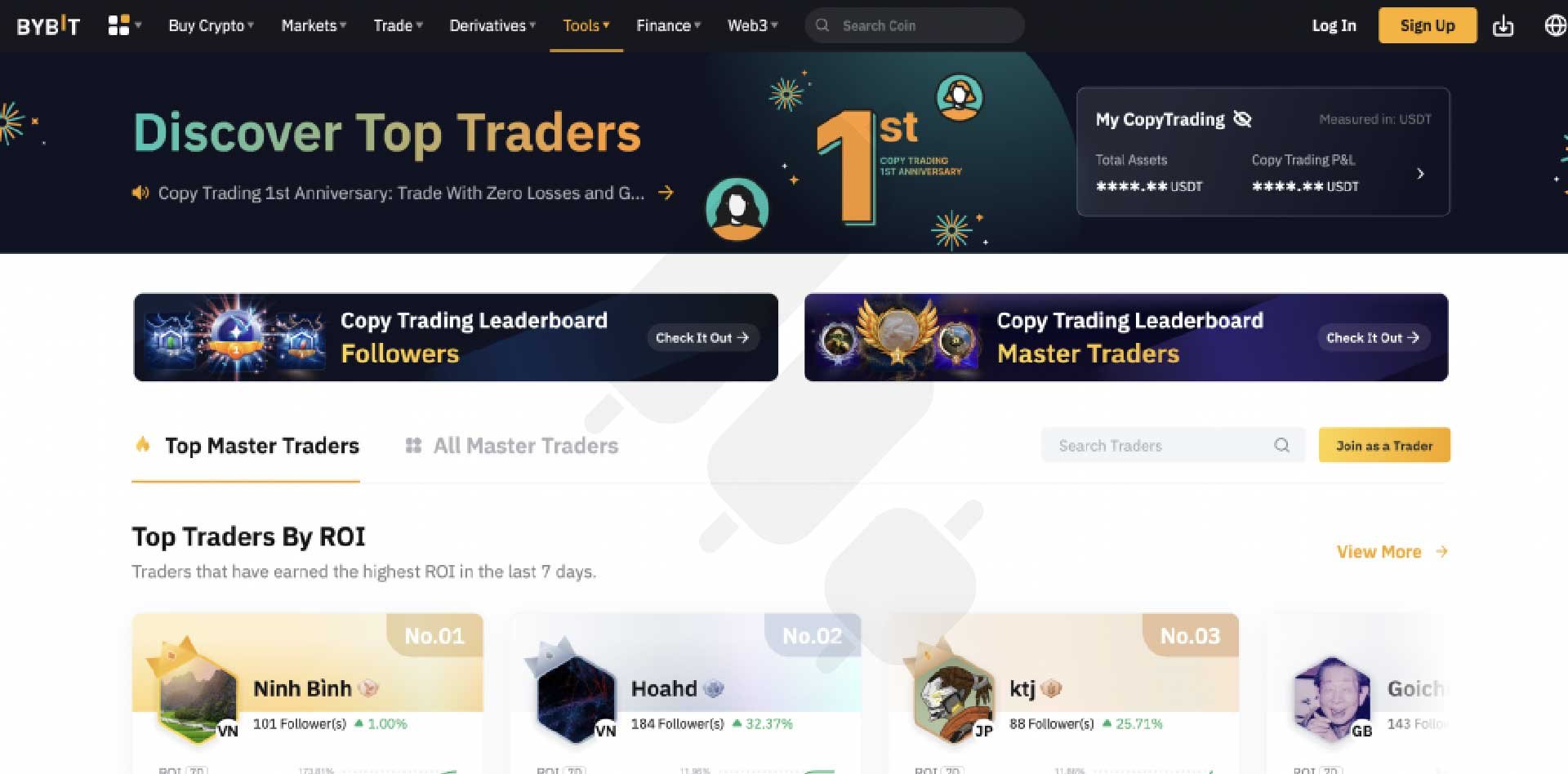

2. Bybit Futures Copy Trading

Supporting over 280 cryptocurrencies, 15 trading pairs, copy trading, spot trading, and futures copy trading are the pros of ByBit.

By becoming a Master Trader on Bybit, you can showcase your trading skills and potentially earn profit-sharing from followers who copy your trading strategy. This provides an opportunity for skilled traders to monetize their expertise and attract a larger following while enabling followers to benefit from the success of experienced traders.

Read more about the best Bybit trading apps and tools in 2024.

Bybit copy trading platform

Pros

- 100x leverage for crypto futures.

- Robust security protocols for funds.

- Customizable copy trading features.

Cons

-

- Limited trader information is available.

- High fees compared to others.

- Limited pricing flexibility.

3. Bitget Futures Copy Trading

Copy trading on Bitget allows users to clone experienced traders’ strategies and profit from their success. All traders need to do is choose a professional trader, set the copy rate, and watch the copy trading algorithm automatically mirror their trades.

Bitget Futures Copy Trading

Pros

- Wide range of trading strategies.

- Access to diversify analytics and data.

Cons

- Copied strategies may not apply to special situations.

Wundertrading Futures Copy Trading

Everyone can become an investor in the crypto market with complete transparency and security on WunderTrading. With the help of professional traders and over 60,000 users, 11,000 bots, and a monthly turnover of over USD300M, you can jumpstart your investment growth with the platform’s auto-pilot system. Enjoy a user-friendly experience with WunderTrading’s simple copy trading platform. Read more in Wundertrading review in 2024.

Pros

- Low-cost

- Easy to use

- Educational resources

Cons

- Monitoring copied traders can be challenging.

- Finding the best traders to copy can be difficult.

Coinmatics Futures Copy Trading

Coinmatics is a social trading platform delivering a copy trading service that provides a service in which the investors can replicate the performance of crypto traders and traders can share their strategies. Depending on whether the trader wants to copy their trades, the trade will execute automatically, and they can benefit from it.

Pros

- Diverse trading strategies are available.

- Advanced analytics and monitoring tools.

- Risk management features offered.

- User-friendly platform interface.

Cons

- Risk of mimicry

- Limited choice of traders

- Investment loss

- No access to advanced strategies

Best Copy Trading Platforms that Support Futures Market; 2024 Summary

| Platforms | Supported Exchanges | Minimum Deposit | User-friendly Interface |

| Bitget | Bitget | USD 10.00 | No |

| ByBit | ByBit | USD 100.00 | Yes |

| Coinmatics | BINANCE, OKX, BYBIT(S&F) | USD 100.00 | Yes |

| Finestel | BINANCE, KUCOIN, BYBIT(S&F), OKX | No limits | Yes |

| Wundertrading | BINANCE, KUCOIN, BITFINEX, Derbit, Bitget, BitMEX, OKX, WOOX, BYBIT, Coinbase Pro, MEXC Global, Kraken, Huobi, Gate.io | USD 10.00 | Yes |

Conclusion

The world of trading has seen a massive upswing in recent years as more and more traders begin to dabble in the markets to either make a quick buck or establish a long-term portfolio of investments.

Copy trading platforms allow traders to copy the strategies of more experienced and successful people in the trading world.

All crypto copy trading platforms that support futures trading mentioned earlier offer something unique and can be the perfect choice for traders of all levels. Whether you’re a novice or an experienced trader, there is sure to be a platform out there that will meet your needs. So do your research (DYOR) and find the one that best fits your requirements before diving into the world of futures trading.

FAQ

What are copy trading platforms that support the futures market?

Copy trading services that support the futures market are great for expert traders to showcase their skills in futures trading and attract new followers, which can lead to increased profits and a larger community of like-minded traders.

Is Copy Trading A Good Option For Trading In Futures Markets?

For those interested in trading the futures markets but feeling overwhelmed by the learning curve, copy trading is an alternative to manual trading to mimic the strategies and trades of experienced traders without learning the ins and outs of the market. On the other hand, it is also the best way for professional traders to test strategies and earn profits.

What Metrics Should I Take Into Account When Selecting A Futures Copy Trading Platform?

There are many factors to consider when selecting a futures copy trading platform, including:

- Number of supported exchanges, coins, and skilled traders

- Reliable execution and low fees

- Risk management features

- Diversification

- Transparency

- Integrated Portfolio Tracker

Leave a Reply