BingX is a cryptocurrency exchange that has been gaining significant popularity among crypto traders and investors. On top of their exchange services, they also offer a copy trading platform to their users. BingX traders and investors can engage in crypto asset management utilizing the BingX copy trading feature. In this article, we aim to provide a comprehensive BingX copy trading review.

We begin the article by briefly introducing BingX as one of the rapidly evolving crypto exchanges. Explaining what copy trading is and how it works, we then move on to review BingX copy trading and analyze its advantages and disadvantages. Finally, we analyze some BingX copy trading alternatives, most notably Finestel, as other options to improve your copy trading experience.

What is BingX?

BingX is one of the rapidly developing cryptocurrency exchanges in the world. Founded in 2018, it provides a variety of services to traders, including spot and derivatives trading, grid trading, and copy trading. BingX serves over 5 million users worldwide. The company is well regulated, holding licenses and certificates from Australia Trading Reports and the Monetary Authority license of Lithuania. BingX has offices in Asia, Oceania, Europe, and South America. Therefore, it is able to cater to traders from all around the globe.

While being a cryptocurrency exchange that supports over 500 crypto assets and trading pairs, BingX is widely known for its copy trading platform. The company has created a social trading platform aiming to connect skilled crypto traders to investors. Many crypto newbies or investors seeking diversification turn to BingX to find professional traders to trade their capital for them. As a result, we mainly focus on offering a comprehensive BingX copy trading review in the upcoming sections of this article.

Read more about whether copy trading is legal or not.

What is Copy Trading, and How Does it Work?

Copy trading is an innovative form of asset management. With the advent of the internet in recent decades, copy trading has become one of the most popular pathways for beginner traders and investors to gain exposure to the financial markets with lower risk and limited need for oversight. Similar to traditional investment management, copy trading is comprised of two parties. These include a master trader (the asset manager) and copiers (investors).

Copy trading works in the way investors (AKA copiers) first select a competent trader by analyzing their performance and then decide to copy their trades. By doing so, every trading activity of the master trader, such as placing and executing orders, is replicated in the copiers’ accounts. Therefore, the trader is practically managing investors’ money, similar to hedge funds and asset management firms, but with considerably fewer regulatory complications and custodial issues.

Advantages and Disadvantages of BingX Copy Trading Platform

Like every trading platform, copy trading on BingX has its fair share of pros and cons. Here are the most prominent advantages and disadvantages of BingX copy trading:

Pros:

-

- Accessibility: Allows individuals with little or no knowledge of trading to start engaging in crypto trading and investing.

- Learning Opportunity: Provides a chance to learn from professional traders by observing their trading activities and executions in real time.

- Mutual Benefit: The relationship between followers and traders can be mutually beneficial. Followers can profit with no effort, and traders can increase their AUM and, subsequently, their income.

- Earning Potential: Traders have the opportunity to earn a percentage of the total profit generated by their followers as compensation for their asset management efforts.

- Variety: There are various lists of traders with different profiles that investors can choose from. Their choice will depend on their goals and risk tolerances.

Cons:

-

- Market Risk: The most significant risk in BingX copy trading is exposure to market risk, especially in the highly volatile crypto market.

- Loss Possibility: Copiers may lose money if the BingX copy trader’s strategy proves to be unsuccessful.

- Liquidity Risk: Traders might face liquidity issues on BingX, due to the exchange’s limited liquidity. This occurs especially if trading pairs experience liquidity problems during market volatility.

- Technical Failures: Both traders and investors can lose money in case of somehow frequent technical failures on BingX.

- Lack of Privacy: Most professional traders want to keep their strategies a secret. BingX’s social copy trading platform does not provide this possibility. There is no BingX private copy trading.

- Limited Profit Sharing Rate: BingX copy traders cannot customize their performance fees. They are limited to a maximum of 20% profit-sharing ratio.

Let’s find the best crypto copy trading platform in this comparison article.

BingX Copy Trading Review: A Critical Analysis

In the burgeoning realm of cryptocurrency trading, copy trading has emerged as a tempting avenue for aspiring investors and seasoned professionals alike. BingX, a prominent player in this space, promises seamless integration with both spot and futures markets, attracting a growing community of over 7 million copy trade relationships. However, before embarking on this digital voyage, a thorough evaluation of BingX’s copy trading platform is essential.

Shining Beacons:

- Trustpilot Accolades: BingX boasts a respectable 4.4-star rating on Trustpilot, with users commending its user-friendly interface, diverse trader selection, and responsive customer support. This independent feedback serves as a testament to the platform’s overall user experience.

- Reddit Resonance: Exploring Reddit threads reveals a generally positive sentiment towards BingX, with users appreciating its extensive library of trading signals and the ability to simultaneously copy multiple traders. This community-driven endorsement suggests the platform’s potential to cater to diverse trading styles.

- Vibrant Ecosystem: With over 7 million established copy trade relationships, BingX boasts a thriving ecosystem of traders and investors. This expansive network implies access to a multitude of potentially profitable signal providers, increasing the potential for success.

Shadows in the Algorithm:

- Limited Lineage: Compared to established copy trading platforms, BingX is a relative newcomer. This lack of extensive historical data raises concerns about the platform’s long-term stability and the consistency of its signal providers’ performance.

- Fee Labyrinth: BingX’s fee structure can be intricate, encompassing platform fees, transaction fees, and potential profit-sharing arrangements with copied traders. Navigating these complexities may require careful consideration and financial planning.

- Signal Selection Conundrum: With 7 million options available, choosing reliable and profitable signals can be a daunting task. Investors must possess strong analytical skills and risk management strategies to navigate this vast landscape and avoid potential pitfalls.

BingX Copy Trading Fees

Furthermore, BingX copy trading fees are one of the most competitive fee structures in the space. BingX charges fees as low as 0.045%. This is the only transaction fee there is, as there are no spread charges or additional costs.

| Fee Type | Description | Amount |

| Platform Fee | Charged on each copied trade | 0.045% |

| Transaction Fee | Charged by BingX for executing trades | Varies based on the trading pair |

| Profit-Sharing Fee | Optional commission paid to the copied trader for their performance | Up to 80% of the copier’s profits |

Platform Fee:

The platform fee is a flat rate of 0.045% that is charged on each copied trade. This fee is charged to both the copier and the copied trader. The platform fee helps to cover the costs of operating the copy trading platform, such as server costs, customer support, and security.

Transaction Fee:

The transaction fee is charged by BingX for executing trades on the spot and futures markets. The transaction fee varies depending on the trading pair and the trading volume. For example, the transaction fee for spot trading BTC/USDT is 0.1% for trades under 1 BTC, and 0.05% for trades over 100 BTC.

Profit-Sharing Fee:

The profit-sharing fee is an optional commission that can be paid to the copied trader for their performance. The profit-sharing fee is typically between 10% and 80% of the copier’s profits. This fee can be set by the copier when they choose to copy a trader.

Example:

If a copier copies a trader who earns a profit of 10%, and the profit-sharing fee is 50%, then the copier would pay 5% of their profits to the copied trader. In this case, the copier would earn a net profit of 9.5%.

Overall, BingX’s copy trading fees are relatively competitive. The platform fee is low, and the transaction fee is comparable to other exchanges. The profit-sharing fee is optional, and copiers can set it to whatever they feel is fair.

BingX Copy Trading Tutorial: Where to Begin

In case you are wondering about how to copy trade on BingX, you should first sign up on the platform and determine whether you want to be a trader or a copier. Then, as a copier, you can follow these steps:

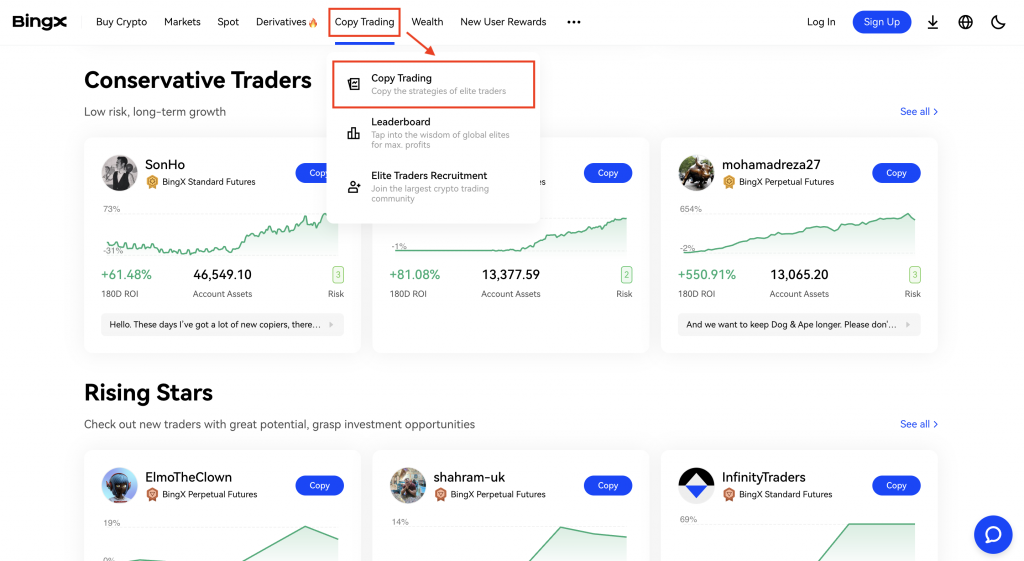

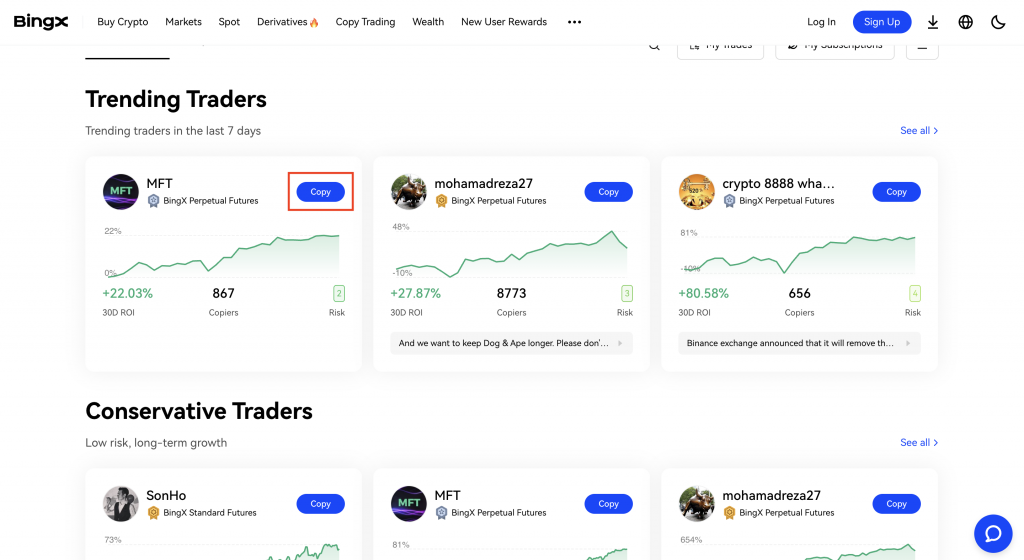

- Visit the BingX website and click on Copy Trade.

- On the next page, you will see the list of available traders to copy, both in the spot market and the futures market. You can analyze their performances and select the one you wish to replicate by clicking on “Copy” beside their name.

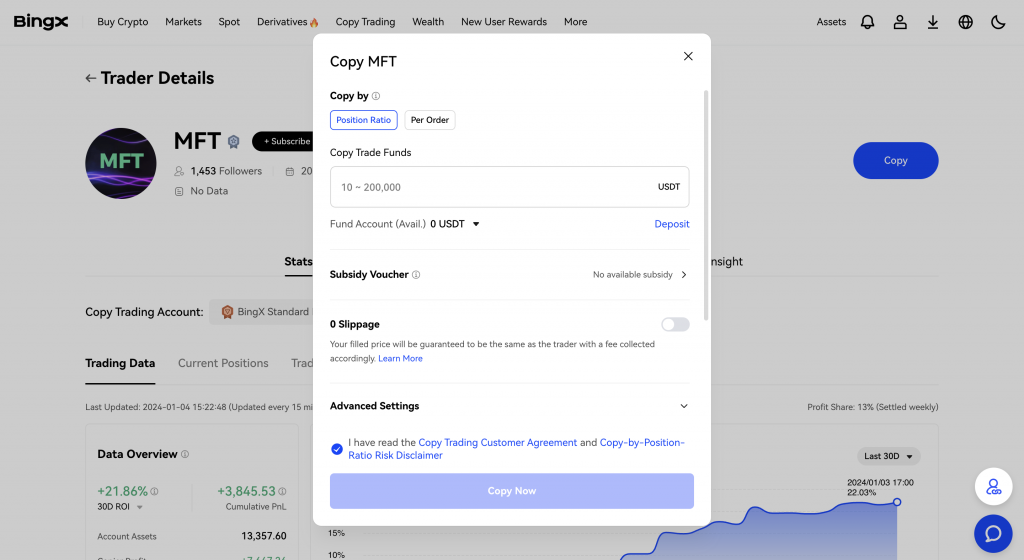

- Finally, you should set your copy trading options and start replicating the master trader’s executions by clicking on “Copy Now”.

In case you want to copy trade on BingX (becoming a copy trader), these are the steps you should follow:

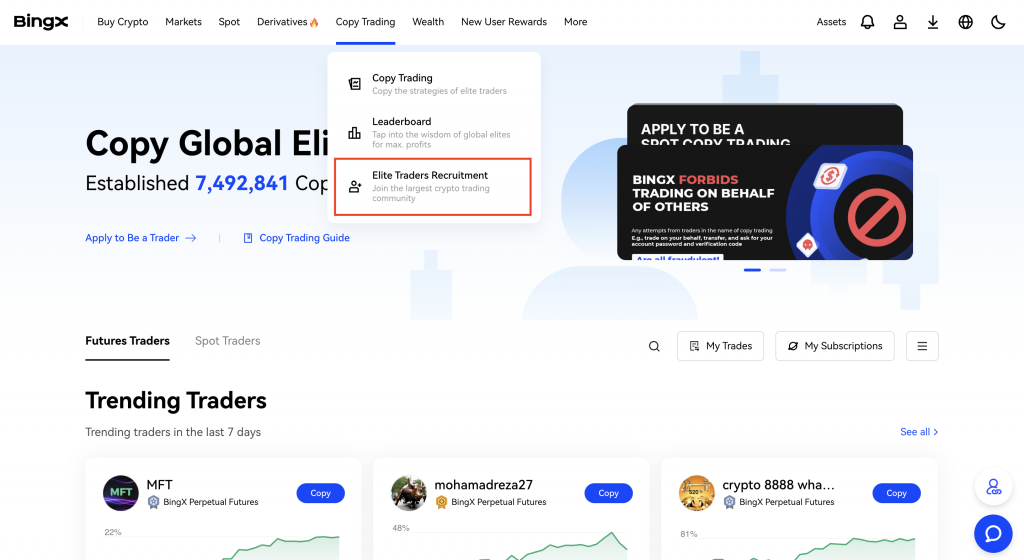

- First, you should click on the “Elite Traders Recruitment” option on the copy trading dropdown menu.

- You can then view the terms and conditions and apply to become a copy trader on BingX. You will join the list of over 15,000 elite traders.

BingX Alternatives: A Quick Overview

Considering the disadvantages associated with BingX copy trading, it would be beneficial to evaluate its alternatives. Here are the top BingX alternatives in 2024:

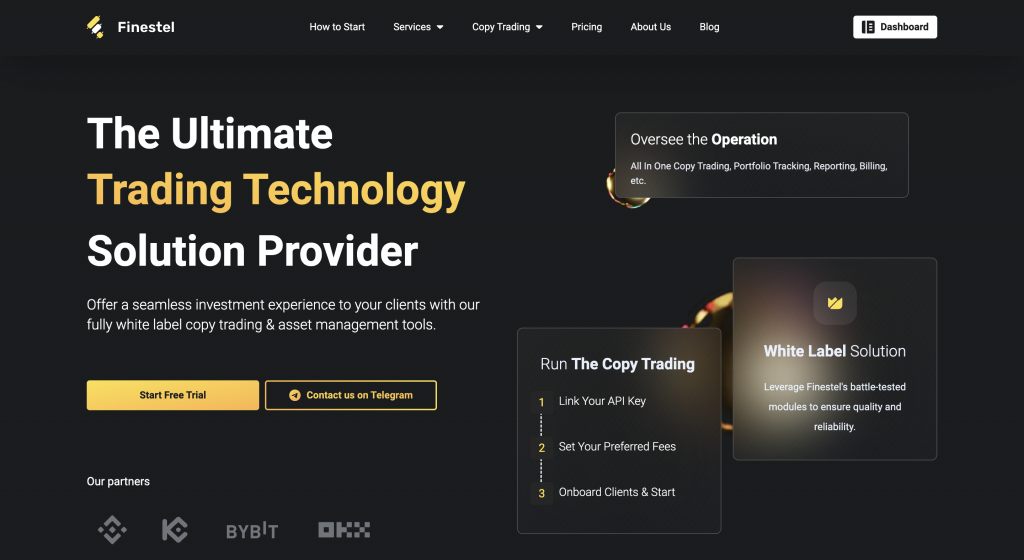

Finestel

Finestel is the top choice when it comes to BingX copy trading alternatives. Being a trading technology solution provider, Finestel offers a variety of services and products to serious crypto traders and investors. Note that Finestel does not provide a social copy trading platform but a private white-label copy trading feature.

With private copy trading, professional traders can ensure that their strategies are kept secret. Finestel uses an innovative protocol to mask your trading maneuvers from investors and the general public. Moreover, you can even create your own social trading platform using Finestel’s white-label solution. This allows you to take your engagement in copy trading to another level.

Finestel supports the top crypto exchanges for copy trading. You can link your accounts to Finestel and also onboard your investors to utilize our cutting-edge copy trading robot. Yet, the white-label solution is where Finestel thrives. We make it possible for you to engage in copy trading and crypto asset management under your own brand.

With maximum customization when it comes to profit sharing and performance fees and sophisticated tools like portfolio trackers and performance metrics, Finestel is the best BingX copy trading alternative.

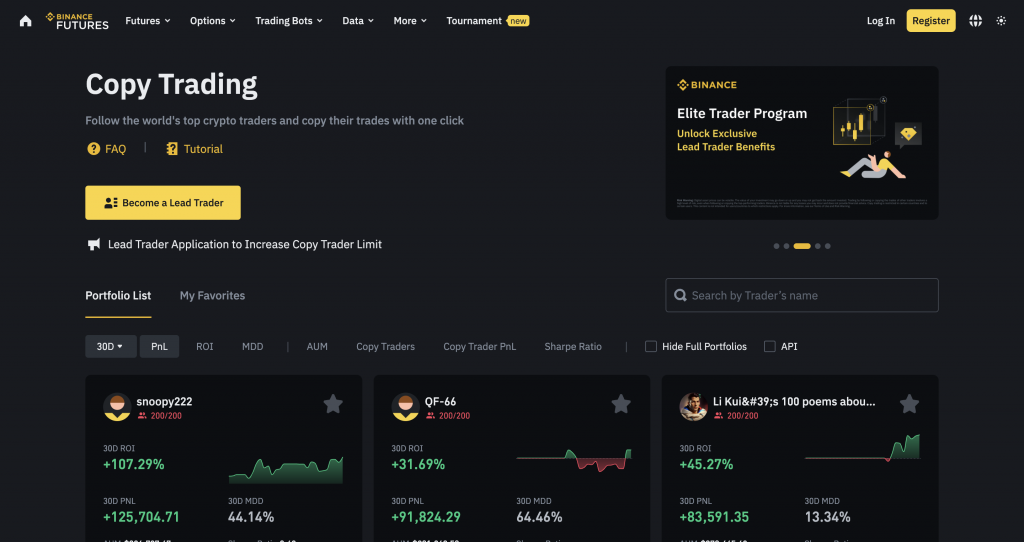

Binance Copy Trading

Binance is the most renowned name in the world of cryptocurrencies. Starting as a centralized crypto exchange, Binance offers a plethora of features and products to crypto investors and traders, and copy trading is one of these features. With over 400 crypto assets to trade and advanced functionalities in both spot and perpetual futures trading, Binance is one of the best choices when it comes to copy trading.

Traders and investors can use their Binance accounts to take part in copy trading partnerships, either as investors or lead traders. Having the deepest market among crypto exchanges and providing the most user-friendly copy trading platform, Binance is a logical alternative to BingX. Binance’s profit share for lead traders is a fixed 10%, like many other crypto copy trading platforms.

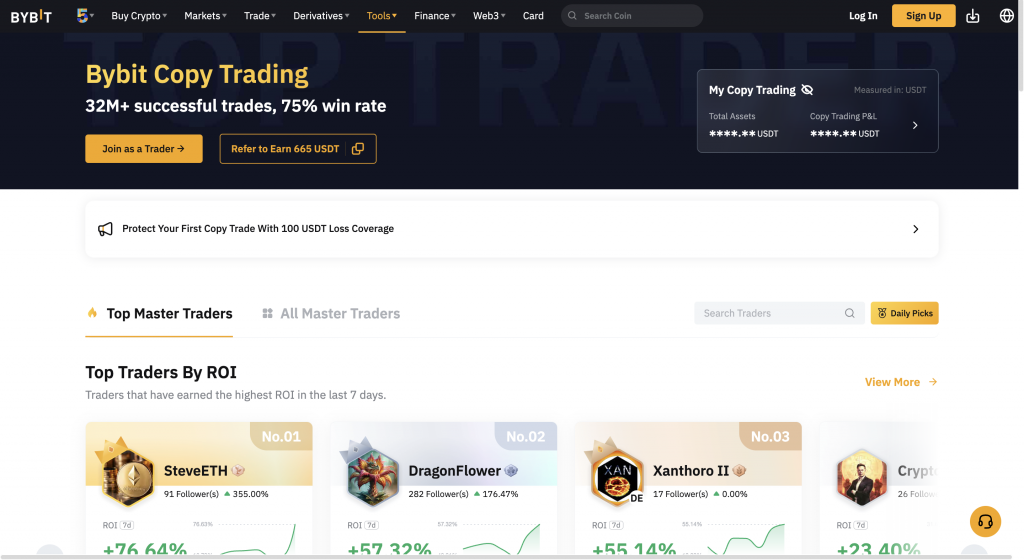

Bybit

Bybit is one of the most popular crypto exchanges, and its copy trading platform also stands for its user-friendliness. Bybit’s users can easily replicate the trading strategies of successful traders. Due to its diverse range of features and master traders, it is suitable for seasoned traders and beginners, For novice traders looking to gain profits from the crypto market, copying Bybit’s professional traders is a great opportunity. On the other hand, due to Bybit’s enormous user base, copy traders can also magnify their returns by attracting copiers and enjoy a 10%-15% profit sharing.

Considering the fact that Bybit is one of the largest cryptocurrency exchanges worldwide, liquidity issues and technical failures are less of a deal for Bybit copy trading. Additionally, the option to replicate traders is also available on the Bybit mobile app, accessible on both Android and iOS. These features make Bybit’s copy trading a great alternative to BingX.

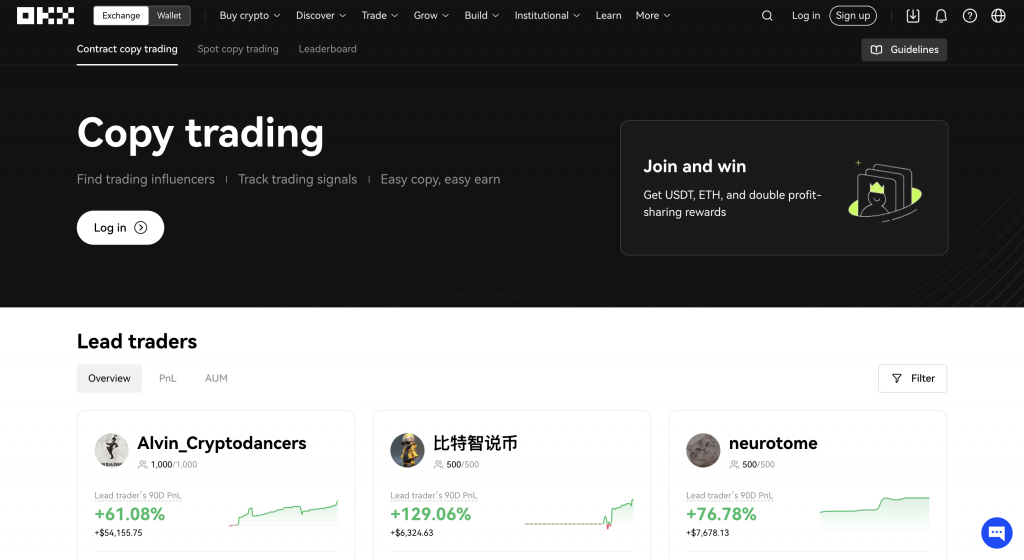

OKX

OKX is another top crypto exchange that offers its customers a copy trading feature. OKX’s top-notch copy trading platform allows both traders and investors to benefit from a potential asset management partnership. With over 600 hundred trading pairs, significant trading volume, and loads of successful traders, it is one of the go-to destinations for both copy traders and investors.

OKX offers its traders a fixed 13% profit share in case they generate gains for their followers. The platform also provides comprehensive stats of traders’ performances, helping investors choose the most suitable trader to copy. Being a top crypto exchange with a decent track record, OKX copy trading can be one of the best alternatives for BingX copy trading.

Wundertrading

Wundertrading is not an exchange but a dedicated social trading platform for cryptocurrencies. Copy trading is one of the main features Wundertrading offers its users. It enables them to engage in crypto asset management as both traders and investors. The platform connects professional crypto traders to investors looking for money managers to trade crypto with their funds. This provides a mutually beneficial opportunity for both groups.

With Wundertrading, you can manage multiple trading accounts from various exchanges. You might even want to engage in automated crypto trading, and Wundertrading offers trading bot services to you. Moreover, Wundertrading offers a tiered subscription plan and customizable profit shares to traders. Being a dedicated social trading service and utilizing top exchanges’ liquidity, it does not have the liquidity and technical issues associated with BingX copy trading.

Conclusion

In this article, we provided a detailed BingX copy trading review, analyzing its advantages and disadvantages. We then briefly explained how you can engage in BingX copy trading either as an investor or a trader and introduced the top alternatives for BingX for crypto copy trading.

While being a user-friendly exchange and social copy trading platform, technical and liquidity issues are problems threatening BingX users. Therefore, serious traders and investors can opt for its alternatives, such as Finestel, to have a more professional experience and fewer worries for their capital.

Don’t use BingX for copy trading

Don’t use BingX for copy trading. I lost $1.5k this week by copying trades from a trader called Oracle®, and it was due to his trading method.

While he suggested a 5% margin (with which you can only have a maximum of 20 positions), he opened up to 100 positions, and this happened every time he was traded.

The initial positions copied by users were all negative. This means that while the trader’s performance may appear positive to other users, the positive positions benefit the trader, and the negative positions affect you.

Additionally, BingX allows traders to block comments from users who copy them, preventing anyone from posting feedback.