Copy trading has gained significant traction in recent years, revolutionizing how individuals engage in financial markets. Investors can replicate trades of successful traders, leveraging their expertise for similar investment outcomes. This innovative approach appeals to seasoned traders and newcomers, offering an opportunity to tap into experienced professionals’ wisdom. With explosive cryptocurrency growth and user-friendly platforms, copy trading surges in popularity, providing a convenient solution for navigating market complexities. In this post on Finestel, we will answer the crucial question: Is copy trading legal?

Before exploring the legal aspects, it’s important to understand the potential benefits and risks associated with this practice. These factors significantly impact the viability and regulatory stance of copy trading, shaping its landscape. By evaluating the advantages and drawbacks, investors can make informed decisions while considering the legality and regulatory implications of copy trading platforms and activities.

Why is Copy Trading Forbidden in Some Countries?

Copy trading, a widespread investment practice faces restrictions and outright bans in certain countries. Understanding the reasons behind the prohibition provides valuable insights into the regulatory landscape and investor protection measures. Several factors contribute to copy trading being forbidden in some jurisdictions.

Firstly, regulatory concerns play a significant role. Authorities in certain countries may view copy trading as a form of financial service that requires licensing or registration. Without proper oversight, there is a risk of fraudulent activities, insufficient disclosure of risks, or inadequate investor protection. Consequently, these countries may enforce strict regulations to safeguard their financial systems and the interests of investors.

Secondly, cultural and ethical considerations influence the legality of copy trading. In some regions, the concept of copying someone else’s trades contradicts societal values related to individualism and self-reliance. These cultural factors may lead to the prohibition or limited acceptance of copy-trading practices.

Furthermore, risk management is another crucial aspect. Copy trading involves mirroring the trades of others, which inherently carries risks. Some countries may consider the potential for inexperienced investors to blindly follow high-risk strategies without fully comprehending the associated dangers. To protect investors from potential losses, these jurisdictions may choose to prohibit or impose restrictions on copy trading activities.

Lastly, varying interpretations of existing financial regulations and legal frameworks contribute to the discrepancies in copy trading legality across countries. Different jurisdictions may interpret regulations differently, resulting in divergent stances on copy trading and its permissibility.

Is Copy Trading Legal and Available on Binance?

The legality and availability of copy trading on the popular cryptocurrency exchange platform, Binance, is a subject of interest for many investors. Copy trading’s permissibility on Binance depends on both legal considerations and the platform’s features. Regarding its legality, copy trading’s status varies across jurisdictions due to differing regulatory frameworks. Users should familiarize themselves with the specific laws governing copy trading in their region to ensure compliance.

As for Binance, the platform offers various trading services, including social trading platforms that facilitate copy trading. Users can connect with experienced traders, analyze their strategies, and choose to replicate their trades. However, it is important to note that the availability and functionality of copy trading on Binance may be subject to regional restrictions and compliance requirements. Users should review Binance’s terms of service and platform features to understand any limitations specific to their jurisdiction.

Read more about Binance’s top 5 copy trading platforms.

What is the Legal Status of Copy Trading on Coinbase?

Coinbase, a leading cryptocurrency exchange, offers a native copy trading feature. Additionally, third-party platforms and services have emerged to facilitate copy trading for Coinbase users. These services connect to your Coinbase account via API keys, enabling them to execute trades on your behalf. While using such services is not illegal, caution must be exercised. It is crucial to ensure the reliability and security of the chosen platform. Thoroughly research and verify the credibility of any third-party service before granting them access to your account.

Overview of Copy Trading Regulations on Kraken

Kraken, a renowned cryptocurrency exchange, operates in compliance with applicable copy trading regulations. The platform follows regulatory guidelines set by financial authorities, ensuring a secure and transparent copy trading environment.

It is important for users to review copy trading platform policies and guidelines to understand the specifics of the copy trading features and any associated restrictions or requirements.

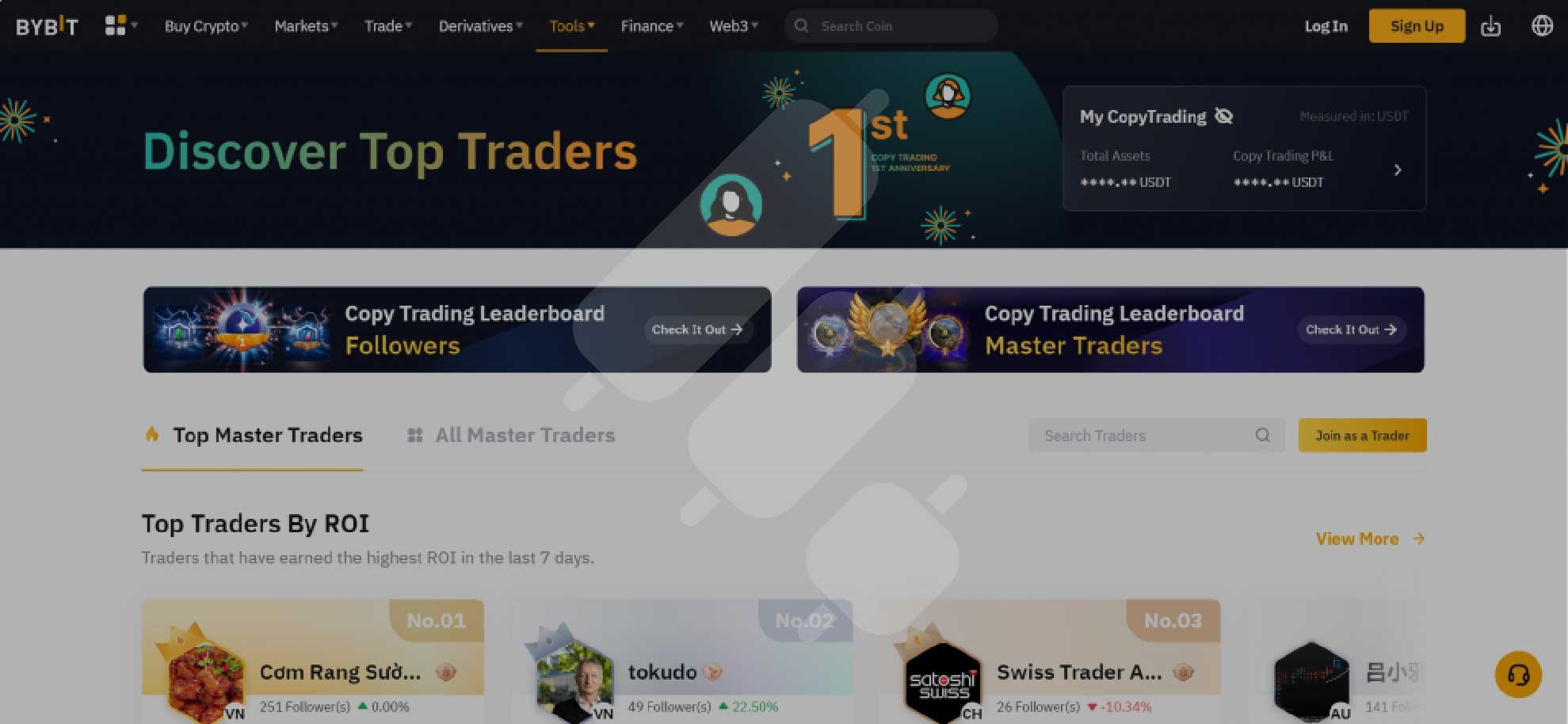

Are Copy Trading Services Offered by Bybit Legal?

Yes, Bybit, a prominent cryptocurrency derivatives exchange, offers copy trading services to its users. Copy trading services offered by Bybit are legal. Bybit is a reputable cryptocurrency exchange that complies with relevant regulations and holds necessary licenses.

It provides a secure and regulated platform for users to engage in copy trading activities. The legal status of Bybit copy trading may vary depending on the jurisdiction where users reside. Users must review and comply with the applicable laws and regulations governing copy trading in their region.

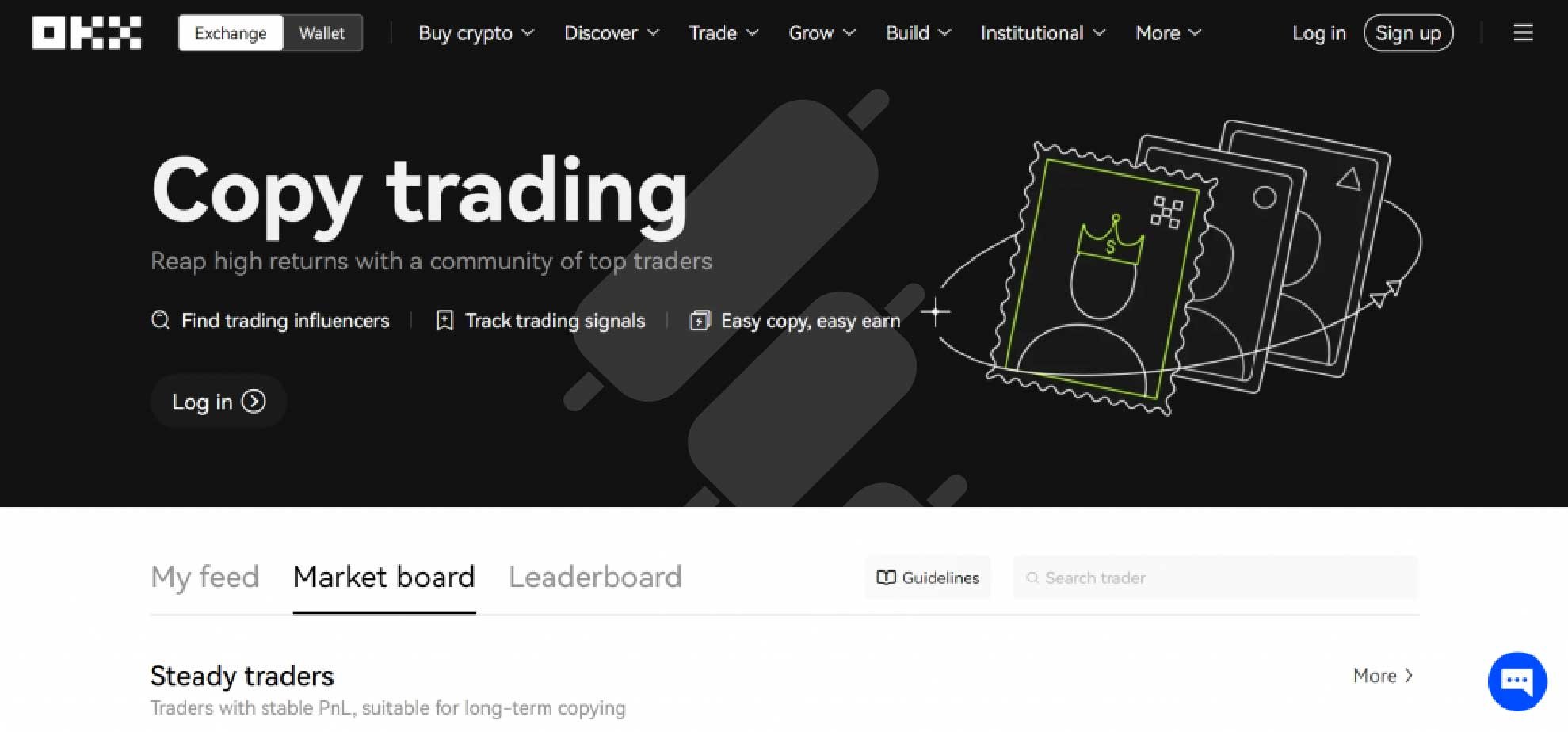

Is OKX a Legitimate Platform for Copy Trading?

Yes, OKX is a legitimate platform for copy trading. As one of the leading cryptocurrency exchanges, OKX operates under regulatory frameworks and complies with relevant laws to ensure a secure and transparent trading experience for its users.

However, it is important to note that the legal status and regulatory requirements for copy trading may vary depending on the jurisdiction where users reside. Users should review OKX’s terms of service, platform policies, and any guidelines specific to copy trading to ensure compliance with the applicable laws and regulations. By conducting thorough research and understanding the platform’s offerings, users can confidently engage in copy trading on OKX.

Is Copy Trading Legal in the US?

Yes, copy trading is legal in the US. However, it is important to note that the legal status and regulatory framework for copy trading may vary depending on the specific practices and platforms involved. In the US, copy trading activities are subject to regulatory oversight by the Securities and Exchange Commission (SEC) and other relevant authorities. It is essential for individuals and platforms engaging in copy trading to comply with the applicable securities laws and regulations to ensure legality and investor protection.

Is Copy Trading Allowed in Australia? A Legal Analysis

Copy trading is allowed in Australia, subject to compliance with the regulatory framework. The Australian Securities and Investments Commission (ASIC) oversees copy trading activities and requires platforms to hold an Australian Financial Services (AFS) license. The regulations focus on ensuring fair and transparent practices, investor protection, and risk management. Traders and investors in Australia can engage in copy trading by using licensed platforms that adhere to the regulatory requirements.

Overview of Copy Trading Regulations in Canada

Copy trading is allowed in Canada, subject to compliance with applicable securities laws. The regulatory framework for copy trading in Canada falls under the oversight of the Canadian Securities Administrators (CSA). While there are no specific regulations that prohibit copy trading, platforms and individuals offering copy trading services must ensure compliance with registration requirements and investor protection measures. It is essential to conduct a legal analysis and review platform policies.

Is Copy Trading Legal in India?

Currently, the legal status of copy trading in India remains unclear. The regulatory framework for copy trading activities in India is yet to be fully defined by the Securities and Exchange Board of India (SEBI) or other relevant authorities. As a result, there is ambiguity regarding the legality and regulatory requirements for copy trading in India. It is advisable for individuals and platforms interested in copy trading to closely monitor any developments in the regulatory landscape.

Overview of Copy Trading Regulations in the UAE

In the United Arab Emirates (UAE), copy trading is generally considered legal, as long as it adheres to the regulations set forth by the relevant financial authorities. The UAE has a well-regulated financial market.

In the UAE, copy trading regulations aim to provide a framework for investor protection. The Securities and Commodities Authority (SCA) regulates copy trading activities and requires platforms to obtain necessary licenses and comply with specific guidelines. These regulations include capital requirements, risk disclosure, investor suitability assessments, and transparency in trade execution. By implementing these measures, the UAE authorities seek to foster a safe and transparent copy trading environment for investors in the country.

Is Copy Trading Legal in the UK?

Yes, copy trading is legal in the UK. The regulatory framework for copy trading activities in the UK is governed by the Financial Conduct Authority (FCA), which oversees financial services and markets. Platforms and individuals offering copy trading services must comply with the relevant regulations, such as obtaining the necessary licenses and adhering to investor protection measures.

Key Islamic Finance Principles Related to Copy Trading

Several key concepts in Islamic finance are relevant to analyzing the permissibility of copy trading according to sharia law. Riba refers to prohibited interest-based gains, while maisir describes excessive speculation, which is also forbidden. Gharar relates to excessive uncertainty in contracts or transactions. Mudharabah allows for joint business efforts through one party authorizing another to invest capital. Zakat requires Muslims to purify wealth by allocating a portion of their assets to charity. Finally, halal investing principles prohibit ownership in certain sin sectors like tobacco, financial companies charging interest, entertainment stocks, and other prohibited industries. Determining copy trading’s alignment with these guidelines requires thorough evaluation.

Does Copy Trading Involve Riba (Interest)?

The actual practice of mirroring other traders’ positions does not intrinsically involve riba, as simply mimicking trades does not generate interest-based returns. However, some copy trading platforms integrate opportunities for margin trading with interest charges or maintain interest-bearing accounts for cash balances. This would expose traders on those platforms to prohibited riba. Carefully vetting the copy trading provider and avoiding any use of leverage or margin trading is key for halal compliance. Overall, the copy trading mechanism itself does not bear interest, but aspects of some platforms demand scrutiny.

Does Copy Trading Violate Maisir (Excessive Speculation)?

At first glance, copy trading may seem to encourage excessive speculation, as investors are blindly following the trades of others rather than developing independent strategies. This type of “mirror investing” appears similar to gambling. However, there are counterarguments that with proper due diligence on traders’ statistics and risk management constraints, copy trading can satisfy Islamic requirements for prudent investment practices.

While the mirroring aspect remains a concern for some interpretations, norms of evaluating traders, limiting position sizes, and avoiding undisciplined practices could potentially allow copy trading to avoid violations of maisir provisions.

Is There Excessive Gharar (Uncertainty) in Copy Trading?

Related to maisir, gharar prohibits excessive uncertainty in contracts and transactions. Because copy traders lack visibility into the analysis and rationale behind the positions they are mirroring from other traders, some claim this introduces unacceptable uncertainty and ignorance of key details (jahala).

However, copy trading platforms often provide transparency measures like showing a trader’s full history of trades, statistical metrics, and even communication channels to request explanations for their current positions. Such transparency around trader practices and ongoing portfolio exposure can reduce the unknowns in copy trading to reasonable levels. Overall, gharar here merits careful evaluation.

Does Copy Trading Align with Mudharabah Joint Venture Parameters?

Some analysts argue that authorizing a copy trading platform to mirror other traders’ positions essentially makes the platform an investment manager, thereby structuring copy trading similarly to an acceptable mudharabah joint venture arrangement. However, others point out the lack of direct asset ownership in copy trading raises issues here, as investors do not own a share of tangible assets under management as in typical mudharabah agreements. This question of whether copy trading sufficiently meets joint venture guidelines remains actively debated among Islamic scholars. There are merits to both perspectives on this specific issue.

Can Zakat Obligations Be Met Through Copy Trading?

Assuming copy trading is deemed permissible according to Islamic standards, the potential profits generated through successful copy trading approaches could enable Muslim traders to fulfill religious obligations like zakat meaningfully. Giving 2.5% of earned assets to benefit the poor is easier when profits are higher. However, losing money through unsuccessful copy trading could conversely impair one’s ability to pay zakat. Here again, careful analysis of a given trading strategy is required.

Is Copy Trading HALAL? Cases for Copy Trading Being Halal

Some Islamic finance researchers and religious authorities argue copy trading qualifies as permissible under sharia law. They contend that if riba, leverage, and excessive speculation are avoided, merely mirroring others’ trades constitutes authorized investment management per mudharabah principles, making it broadly halal. The ability to thoroughly screen the platform and individual traders provides avenues to enable compliance as well. If managed properly, the profit potential of copy trading could also benefit zakat contributions. Based on these factors, reputable scholars have built cases for copy trading’s halal status.

Is Copy Trading HARAM? Arguments Against Halal Status of Copy Trading

However, notable scholars contest the permissibility of copy trading under orthodox interpretations of Islamic guidelines. Critics contend the inherent lack of transparency into other traders’ practices and reasoning, as well as the absence of direct oversight on mirrored positions, enables gambling-like speculation. This would violate maisir prohibitions. The lack of actual asset ownership also raises issues regarding mudharabah parameters. Overall, opponents emphasize the risks of unchecked speculation and potential encouragement of improper practices render copy trading haram according to classical sharia standards.

Analysis of Major Islamic Fiqh Council Fatwas on Copy Trading

Given scholarly disagreements, reviewing major fatwas from authoritative councils like the AAOIFI and European Council for Fatwa and Research (ECFR) provides insight. But even here, positions diverge. ECFR prohibits copy trading due to its speculative nature, while AAOIFI conditionally allows it with proper trader analysis. Such divisions underscore the nuanced, complex analysis required in applying traditional prohibitions to modern fintech practices. Understanding the reasoning in major fatwas can guide investor evaluations.

Screening Platforms for Halal Compliance

Muslim investors who believe copy trading can satisfy sharia standards should still carefully evaluate platforms for compliance. Avoiding those that integrate interest-based margin trading or maintain accounts with riba is imperative. Reviewing fee structures to prevent unknown interest charges is also important. Platforms with transparent trader histories and selective copying enable better due diligence. Seeking providers that allow screening and restrictions of haram sectors aids compliance. Overall, careful platform vetting enables copy trading with reduced halal risks.

Is Copy Trading a Scam?

Copy trading is a legitimate investment strategy that allows individuals (crypto asset managers, networkers, traders, and investors) to replicate the trades of others. While there are scams in the investment world, it is essential to understand that copy trading itself is not a scam. It offers an opportunity for investors to leverage the expertise and strategies of experienced traders to achieve similar investment outcomes potentially.

However, it is crucial to exercise caution and conduct thorough research when choosing a copy trading platform or service. Look for reputable and regulated platforms such as Finestel that prioritize transparency, provide verified performance data, and offer risk management tools. Last but not least, by selecting a reliable platform and making informed investment decisions, individuals can participate in copy trading safely and potentially benefit from the wisdom of seasoned traders.

How to Identify Legitimate and Safe Copy Trading Platforms

- Conduct thorough research on copy trading platforms.

- Look for platforms regulated by reputable financial authorities.

- Consider the platform’s track record and reputation.

- Evaluate the platform’s transparency and security measures.

- Read user reviews and testimonials.

- Review the platform’s terms and conditions, fee structures, and customer support options.

- Ensure the platform uses encryption and offers two-factor authentication.

- Check if the platform aligns with your investment goals and strategies.

- Consider the platform’s user interface and ease of use.

- Seek recommendations from experienced users.

Finestel – A Halal and Legally Compliant Copy Trading Platform

Finestel offers advanced copy trading technology with customizability for Islamic finance compliance and operating within legal frameworks like Canada. Its services empower asset managers to provide halal trading services.

The Finestel Copy Trading Bot executes trades at high speeds while allowing customization of prohibited assets and screening for prudent risk practices. This supports sharia-aligned mirror investing.

For larger managers, Finestel provides a White Label solution for launching customized platforms. Partners can shape their interface, disclosures, restrictions to align with halal principles under their own brand. This aids transparency.

Based in Canada, Finestel operates under applicable regulations without excessive burdens. Managers can focus on lawful practices while Finestel handles technical aspects.

With its emphasis on trader screening, customization, and transparent operations, Finestel empowers halal and legal copy trading. Asset managers and investors wanting sharia-compliant mirror investing within a clear jurisdiction should evaluate Finestel’s innovative solutions.

Conclusion

FAQ

Is copy trading regulated?

Yes, copy trading is regulated in many countries worldwide to ensure investor protection and market integrity. Naturally, regulations vary by jurisdiction and are enforced by financial authorities and securities commissions.

How can I ensure that I am engaging in copy trading within legal boundaries?

To ensure that you are engaging in copy trading within legal boundaries, it is essential to follow these steps. Firstly, research and understand the regulations and laws surrounding copy trading in your country. Secondly, choose a reputable and regulated copy trading platform that complies with applicable laws. Lastly, adhere to the platform’s terms and conditions, including risk management guidelines, and stay updated with any regulatory changes.

Is copy trading HALAL or HARAM?

Copy trading’s permissibility under Islamic law is complex. However, platforms like Finestel allow customization to support halal compliance by avoiding riba and speculation. With proper diligence, copy trading can potentially satisfy sharia standards, but interpretations vary. Investors must weigh considerations carefully.

What practices make copy trading compliant with sharia finance principles?

Screening platforms/traders to avoid riba and extreme uncertainty enables halal copy trading. Finestel facilitates this through its transparency and restriction capabilities. Capping copied trades, diversifying, and requesting rationale from traders also promotes compliance. Diligent practices empower sharia-aligned investing.

Which copy trading platforms best enable legal and compliant operations?

Regulated platforms like Finestel based in Canada enable legal, halal copy trading through appropriate disclosures and risk frameworks. Allowing customization of trade restrictions and evaluations of traders also aids compliance. Finestel’s emphasis on flexibility and diligence procedures supports suitable copy trading.

Leave a Reply