Generally, two types of crypto copy trading exist. First, copy trading on an exchange as a service or feature, such as eToro, Bybit, and so on, is simple and a good option for beginners to dip a toe into the industry. The second model, copy trading via API access (or API copy trading), although still simple to understand, has lots of capabilities that no crypto exchange can compete with.

“Third-party copy trading” and “trading bot” or “auto-trading” platforms are the most popular types of API copy trading. Alongside those, we’ll introduce a brand new system called copy trading SaaS to you, which is primarily designed for pro traders with a community of clients.

So, in this review, comparison-ish paper, we’ll tell you about the benefits and capabilities of API copy trading, briefly break down the existing models, and then see, based on the trader’s needs, which one’s the best option to pick.

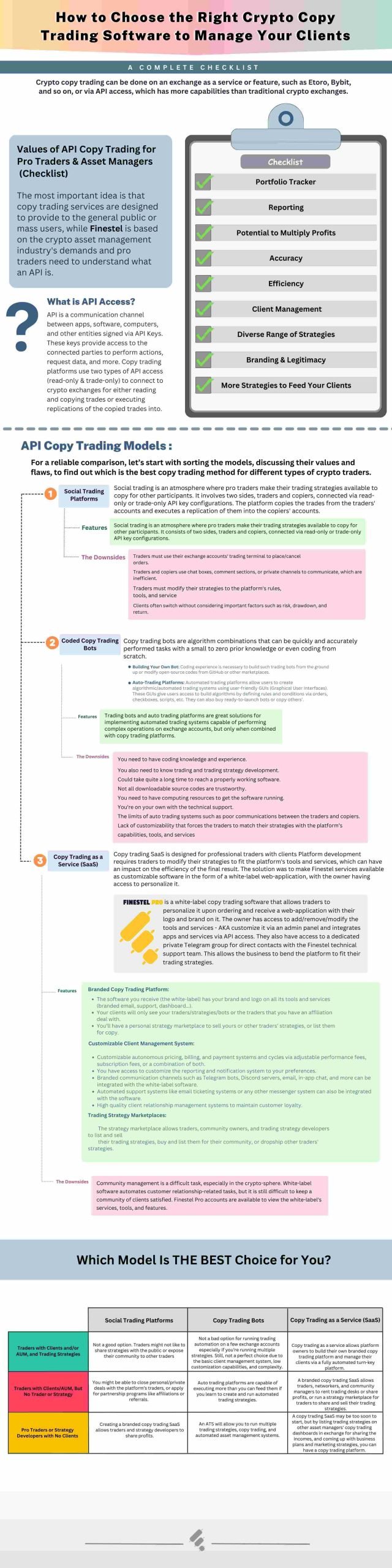

Values of API Copy Trading for Crypto Pro Traders (Checklist)

Available copy trading services are mainly designed to provide to the general public or mass users. Finestel on the other hand, was designed based on the crypto asset management industry’s demands and what pro traders need. So, we look at things from the traders’ perspective mostly. First, let’s see what an API is.

What is API Access?

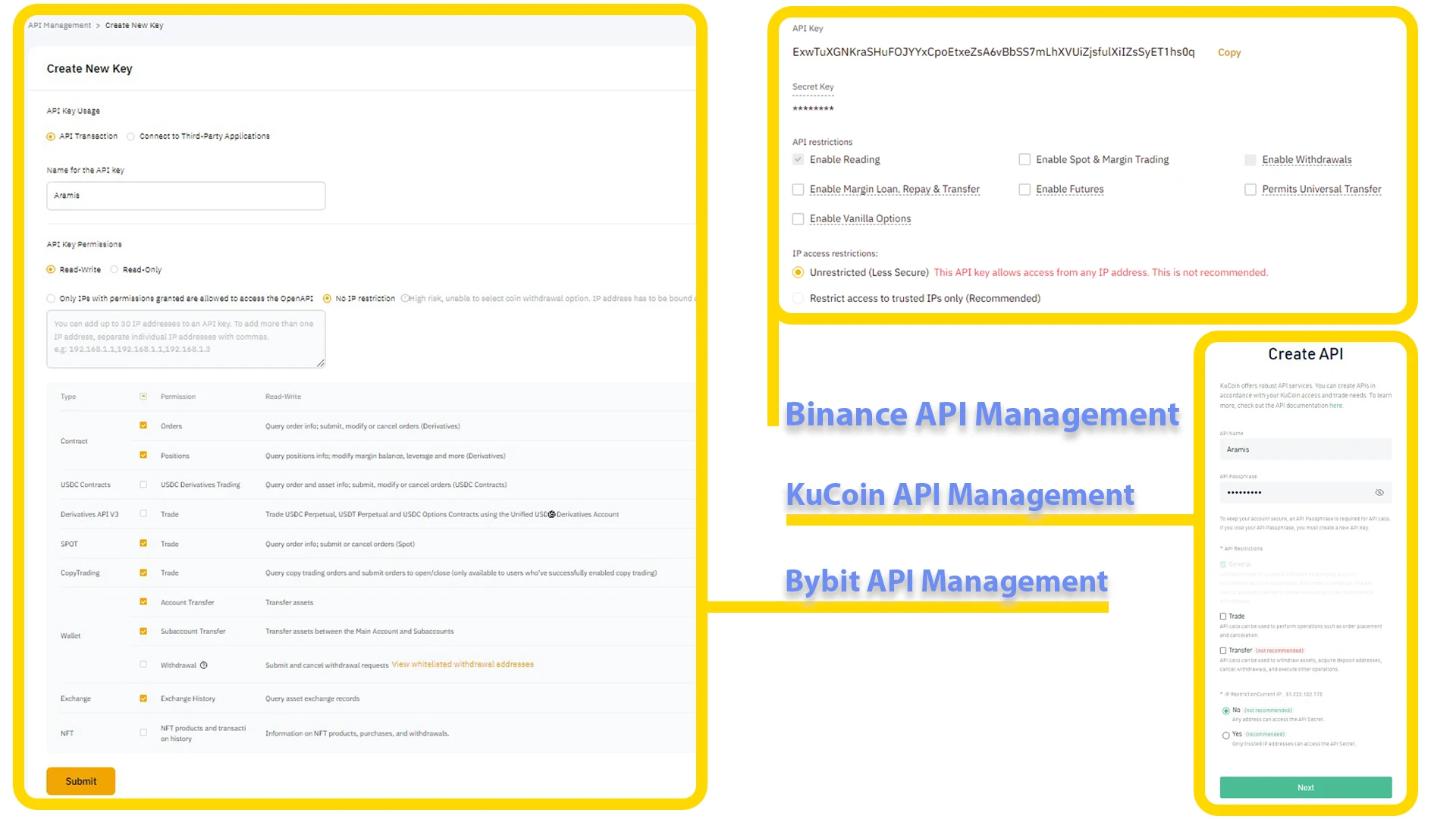

API (Application Programming Interface) is a communication channel between apps, pieces of software, and computers…, signed via “API Keys.” The keys grant certain access to the connected parties to perform actions, request data, and so on and so forth.

Copy trading platforms usually use two types of API access (read-only & trade-only) to connect to crypto exchanges for either reading and copying trades from, (trader accounts via read-only API keys) or executing replications of the copied trades into (copier accounts via trade-only API keys).

Now, let’s get into the values:

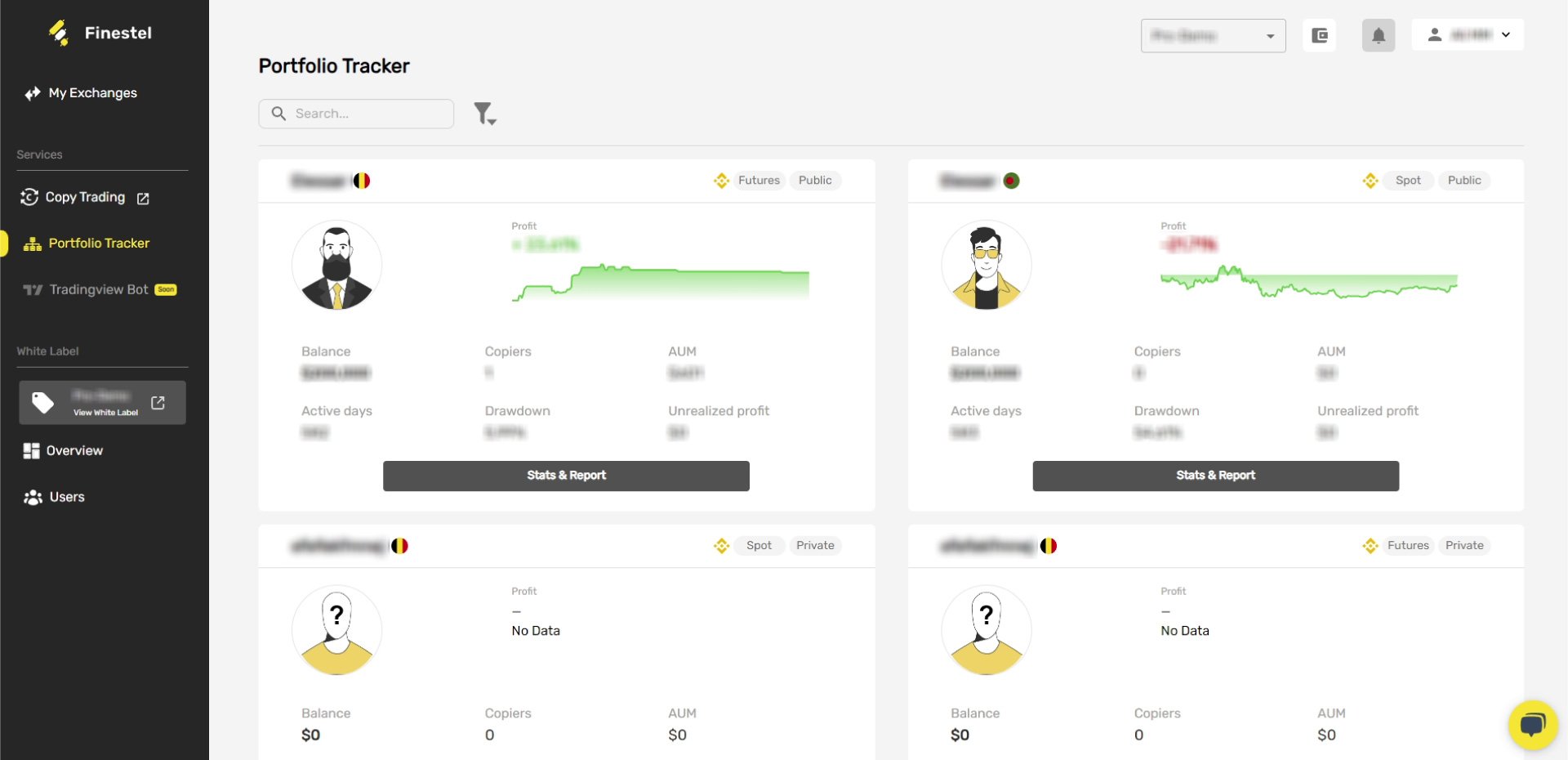

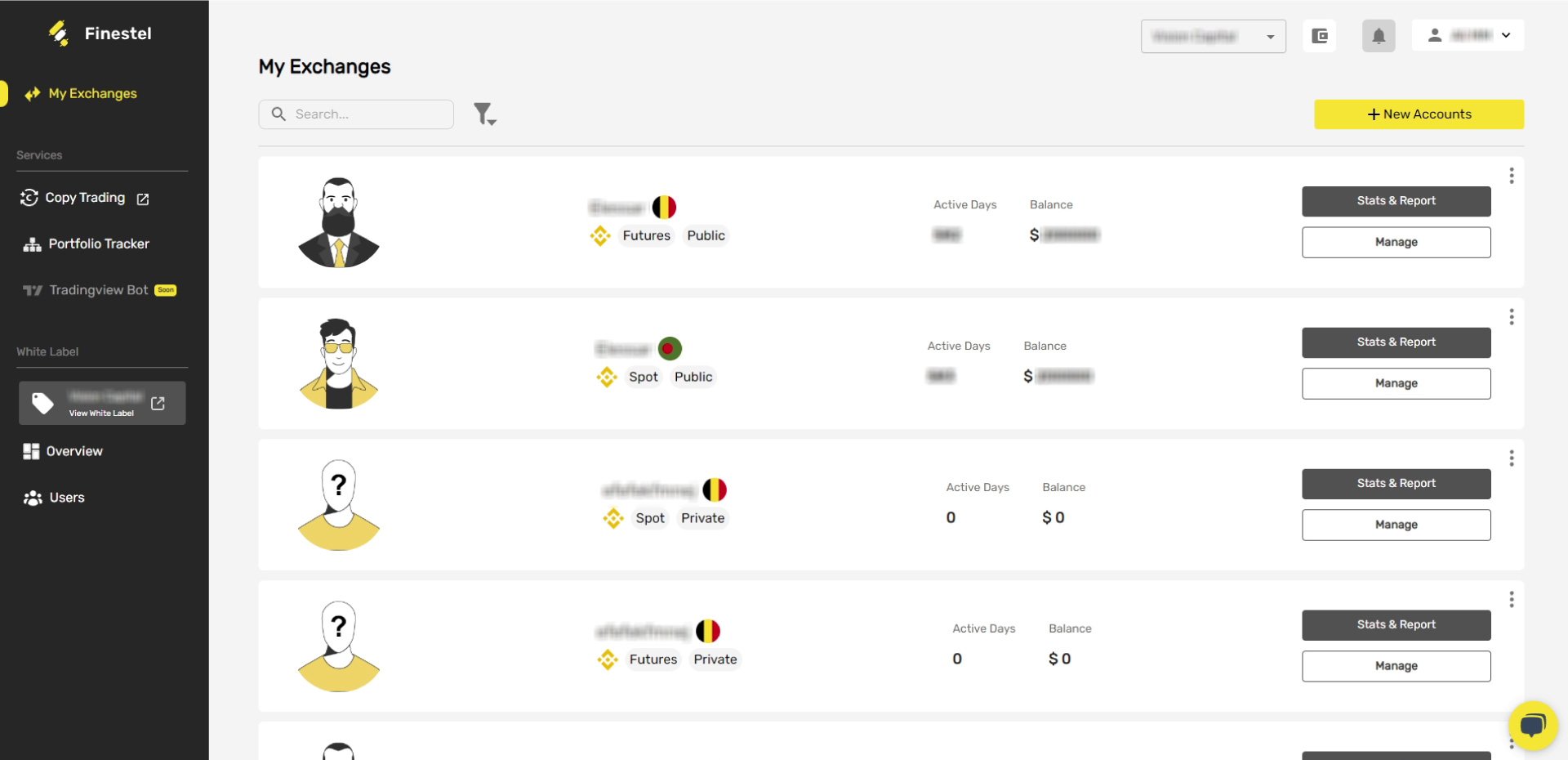

1. Portfolio Tracker

Most platforms have an embedded portfolio tracker as it’s mandatory for running copy trading properly. However, you’ll find much more sophisticated portfolio tracking services on independent copy trading and auto trading platforms than what you see on crypto exchanges.

Portfolio tracker apps can simultaneously monitor multiple connected exchange accounts which will allow the users to get rid of frequent log in/out and the risks it has. You can instantly switch between your connected accounts to extract reports, check your open positions, and so on.

Discover the top 5 crypto portfolio trackers in 2024.

2. Reporting

Live indicators that show your portfolio changes and historical track records that are available to export in popular formats are another value of copy trading. Although crypto exchanges do have reporting systems available, just like portfolio trackers, independent copy trading and bot platforms perform the service much more sophisticatedly usually. Copy trading SaaS makes it possible for the trader to customize their preferred reporting service, with their brand on it.

3. Potential to Multiply Profits

Copy trading in any form has the potential to make multiple times more money than the copied trade does, although it depends on the platform’s pricing models. Some platforms have a single pricing model (e.g. Bybit’s profit sharing), some others allow more choices for the trader (e.g. performance, management, and subscription fees), and then some platforms like Finestel allow the trader to customize pricing methods or personal/private payment systems.

4. Accuracy

Copy trading is usually implemented via fully or partially autonomous algorithms or trading bots. Depending on the design sophistication, copy trading bots are capable of executing trade replications at a rapid pace and laser accuracy, yet proportionally.

These bots not only can execute a huge number of trades simultaneously, but also perform P&L calculations, payment and transaction automation, and so on. They can significantly reduce human errors and emotional decision-making in trading sessions.

5. Efficiency

Advanced copy trading bots can proportionally distribute trades on a network of investors (copiers, followers, clients…) consisting of an infinite number of accounts. The outcome of such ability is automated asset management being performed in a fully non-custodial manner.

Plus, well-designed copy trading platforms also have client management automation, portfolio tracking, and reporting services, which are mandatory to have if you have a high AUM (Assets Under Management).

6. Client Management

Pro traders use copy trading platforms for efficient portfolio management strategy implementations into their community of clients’ accounts, and the outcomes will be way too much to be handled manually. You’ll need automated reporting, notification, payment management, and billing systems, which are much more accurate and efficient than us humans.

API Copy Trading Models

For a reliable comparison, let’s start with sorting the models, discussing their values and flaws, to find out which is the best copy trading method for different types of crypto traders.

Social Trading Platforms

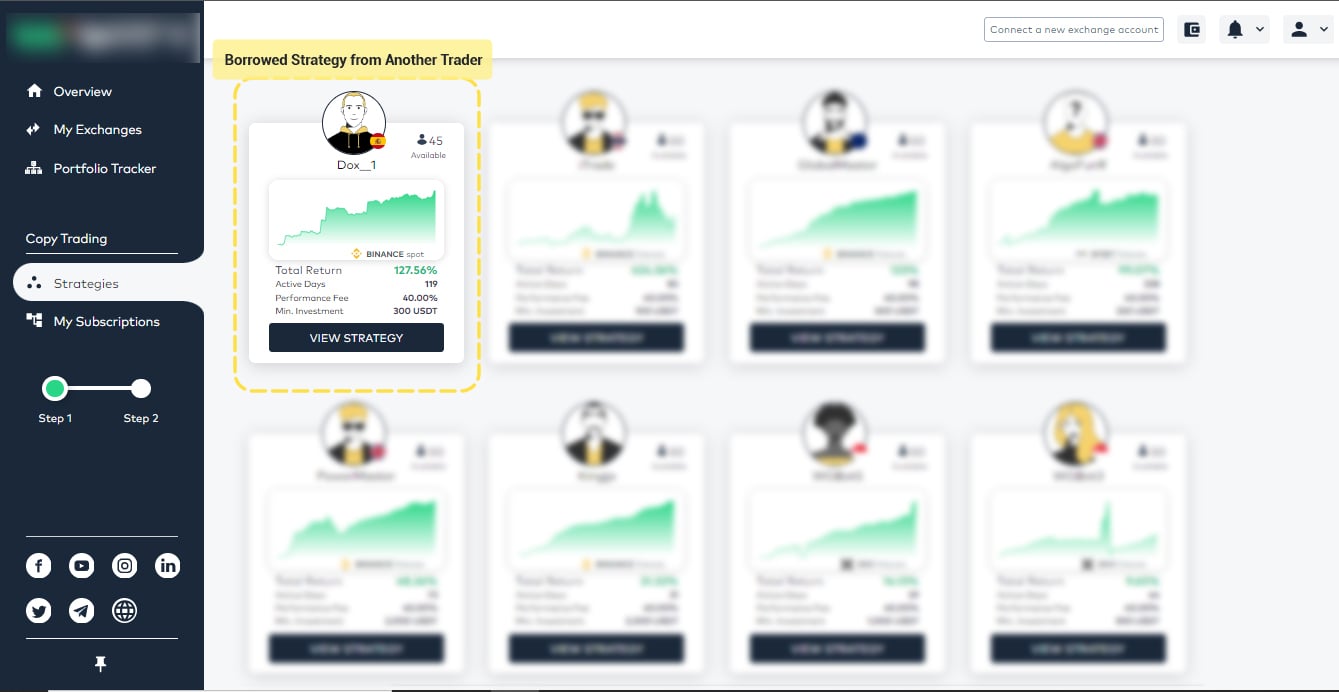

The “platform” could be a subsection of a crypto exchange (e.g. Bybit, OKX), or an independent platform (website, app, etc.) that executes trades on crypto exchanges via API connections (e.g. finestel.com). In other words, social trading is an atmosphere in which pro traders make their trading strategies available to copy for other participants.

Social trading consists of two sides, traders and copiers. Traders (or strategies) are exchange accounts, connected via read-only (or trade-only in some cases) API key configurations, which the platform copies the trades from and executes a replication of them into the copiers’ accounts (connected via trade-only API key configurations).

Crypto Social Trading Features & Downsides

Crypto social trading is perfect for newbie traders, public investors and also pro traders who want to gain more income from their trades, due to the non-custodial AUM.

Social trading usually comes with most of the values we mentioned further above; depending on the development sophistications though.

The Downsides:

- Some platforms don’t allow the traders to use their exchange accounts’ trading terminal and the traders have to place/cancel orders – aka trade – through the platform’s terminal only.

- The means of communication between the copy trading parties (traders and copiers) comes down to a chat box, comment section only, or a private communications channel, which is not efficient at all.

- Lack of customizability forces traders to modify their trading strategies to the platform’s rules, tools, and services.

- Clients’ low loyalty is another problem on social copy trading platforms. For example, clients usually see other traders’ performance and switch immediately without considering crucial factors such as risk level, drawdown, return…

Copy Trading Bots (Automated Algorithms)

Copy trading bots are algorithm combinations, fully or partially autonomous, and capable of executing complicated tasks automatically. Copy trading bots exist in many different forms and can be built with a little to zero prior knowledge or super sophisticated by coding from scratch; check below:

- Building Your Own Bot: Some Python experience will get you going. You’re able to code the software (trading bot) from the ground up or just download and modify open-source codes you might find on GitHub or certain marketplaces.

- Auto-Trading Platforms: It’s a much simpler way than creating from scratch. There are a lot of bot development platforms – AKA auto trading platforms – out there that allow you to run algorithmic/automated trading systems using user-friendly GUIs (Graphical User Interfaces).

The GUI gives you access to build algorithms by defining rules and conditions via, orders, checkboxes, scripts, etc. Plus, you can also buy ready-to-launch bots or even copy the others’.

Check the best Binance crypto trading bots and tools.

Auto Trading Bots Features & Downsides

Building from scratch gives you limitless versatility but requires knowledge and experience, while auto trading platforms allow you to build a bot instantly with no prior trade automation knowledge.

However, both options are great solutions for implementing automated trading systems capable of performing complex operations on your exchange accounts. It’s not rare to see copy trading being available for trading bots, and it works; although it does not match the main purpose of trading bots.

The real magic happens when trading bots get combined with copy trading platforms. The auto trading system (bot) deploys the strategies and the copy trading bot or platforms distribute them across a network of clients’ exchange accounts (copiers).

The Downsides:

- You need to have coding knowledge and experience.

- You also need to know trading and trading strategy development.

- Could take quite a long time to reach a properly working software.

- Not all downloadable source codes are trustworthy.

- You need to have computing resources to get the software running.

- You’re on your own with the technical support.

- The limits of auto trading systems such as poor communication between the traders and copiers.

- Lack of customizability forces traders to match their strategies with the platform’s capabilities, tools, and services.

Copy Trading as a Personalized and customizable Solution (SaaS)

Unlike most social trading platforms or crypto exchanges, copy trading SaaS is designed specifically for professional traders (asset or portfolio managers) with a community of clients.

Here’s the point. No matter how properly or user-friendly your platform is developed, it will force the trader to modify their strategies to fit the platform’s tools and services. Considering how complicated trading strategy development is, forcing the developer to follow certain rules will impact the efficiency of the final result, right

Thus, we came up with the solution of making all Finestel services (proportional copy trading, automated client management, etc.) available as customizable software in the form of a white-label web-application. FYI, a white-label product does not have a logo or brand name and the owner has access to make it their own by fully personalizing it.

Example:

On Finestel’s white-label copy trading software, Pro traders with a community of investors personalize it upon ordering, which means they’ll receive the web-application with their logo and brand on it, under their domain address, and brand colors…

After receiving the branded white-label software, the owner will have access to add/remove/modify almost all of its tools and services – AKA customize it – via an admin panel. Besides, the owner is able to integrate apps and services (reporting, support, marketing, etc.) they’ve been running so far with the software via API access.

Moreover, the owners will have access to a dedicated private Telegram group for direct contact with the Finestel technical support team. Please note that no one from the Finestel team will have direct access to your community.

Finestel literally allows its owner to bend the platform to fit their trading strategies not vice versa!

Customizable Copy Trading as a Service (SaaS) Features & Downsides

A copy trading SaaS allows its owner to run crypto asset management automations or make an automated portfolio management business official, on top of a handful of customizable, yet autonomous bots.

In terms of tools and services, you have access to all the common options such as the portfolio tracker app, reporting, copy trading, support, and even more. But, speaking of features, a SaaS system has two knacks that other forms of copy trading cannot compete with, personalization and customizability.

Let’s use Finestel features as an example:

Cutting Edge Copy Trading

Finestel provides two main copy trading solutions suited for different needs:

Copy Trading Bot: A straightforward bot allows manually connecting master and copier accounts to replicate trades with precision and efficiency. Ideal for smaller-scale traders.

White Label Copy Trading: A fully customizable branded platform equips asset managers to automatically mirror strategies across unlimited investor accounts. Comprehensive admin tools provide control and oversight for large communities.

Client Management Automation

The admin dashboard centralizes control over billing cycles, tailored notifications, API integrations, promotions programs, and more. Reduce repetitive manual work.

Performance Analytics

Insightful analytics track portfolio changes, trading effectiveness, client subscriptions, and other KPIs to inform strategic decisions.

Private Strategy Marketplace

A members-only marketplace matches qualified talent with platform owners seeking additional trading signals, driving benefit for all parties.

Seamless Brand Integration

Apply branding visual identity across the platform interface, emails, chat channels, dashboard reports and more for an immersive business atmosphere.

Innovative Telegram Bot

A dedicated Telegram bot completely transforms copy trading operations by consolidating vital functions directly within Telegram itself – portfolio tracking, mirroring trades, performance analytics, client admin and more.

This automation and consolidation saves traders hours of daily manual work tracking metrics and broadcasting alerts across disjointed platforms. The bot provides at-a-glance access to key data and commands right in Telegram.

Read more about the best crypto Telegram bots tested and reviewed.

The Downsides:

Honestly, the only thing that comes to our mind is community management, which is a super tough job, especially in the crypto-sphere. Although the white-label software automates almost anything customer relationship-related, it’s still not easy to keep a community of clients satisfied.

If you’re thinking of other disadvantages regarding copy trading SaaS that we’ve missed, please leave it in the comment section below; we appreciate it.

Plus, you can apply for a Finestel account to see all the white-label’s services, tools, and features for yourself.

To get thorough details please read the What is Finestel article.

Which Model Is THE BEST Choice for You?

After a couple of years of providing crypto copy trading services, we’ve hosted three different trader categories so far.

1. Traders with Clients, AUM, and Trading Strategies

Crypto asset management firms with multiple trading desks and portfolio managers are in this category.

- Social Trading Platforms:

Not a good option. Traders might not like to share strategies with the public or expose their community to other traders.

- Auto Trading Platforms:

A very good option for running trading automation especially if you’re running multiple strategies. Still, not a perfect choice due to the basic client management system, low customization capabilities, and complexity.

- Copy Trading as a Service:

Copy trading as a service allows customizations and personalizations to the owner. It means the platform owners are able to build a branded copy trading platform that they always expected from the industry’s service providers. Various pricing models, customizable payment methods, reporting, autonomous billing and transaction systems, a branded marketplace, marketing campaigns, and more can be implemented via Finestel’s white-label copy trading software.

2. Traders with Clients, AUM, But No Trader or Strategy

Crypto community owners who don’t have traders or trading strategies are in this category.

- Social Trading Platforms:

You might be able to close personal/private deals with the platform’s traders or apply for partnership programs like affiliations or referrals.

- Auto Trading Platforms:

The trading strategy is still required for this option. Some auto trading platforms offer AI generated trading strategies over subscription fees or even for free; not recommended really.

However, if you manage to learn to create and run automated trading strategies, auto trading platforms are capable of executing far more than you can feed them!

- Copy Trading as a Service:

If you get a branded copy trading SaaS, traders and strategy developers can rent trading desks on your platform, or get listed and share the profits, or any other model you can come up with.

You might want to run only the strategy marketplace for traders to sell and sell trading strategies.

3. Pro Traders or Strategy Developers with No Clients

If your trading journey is flashing green, has low drawdowns and high returns, but you have no private or public community or clients, you belong to this category.

- Social Trading Platforms:

Might be quite the perfect option to start copy trading. The main problem you’d encounter is low client loyalty, especially in the long-term even if you’re profitable. But due to its simplicity, social trading is a very great option to get familiar with copy trading. - Auto Trading Platforms:

Running automated trading systems is what you really want to consider learning if you haven’t already. An ATS will allow you to run multiple trading strategies fully automatic, which you can combine with copy trading and run automated asset management systems. - Copy Trading as a Service:

If you’re not into building your community or are new to the whole copy trading concept, a copy trading SaaS might be a little too soon, to begin with. Otherwise, by listing your trading strategies on your branded platform (especially if you’re running ATSs already) and coming up with some business plans and marketing strategies, you’ll have a copy trading platform. -

Finestel’s Private Strategy Marketplace:

A key feature is the private strategy marketplace connecting skilled traders looking to monetize strategies with white label platform owners who want to expand offerings to clients. Mutually beneficial revenue share models are available. Check Finestel’s Private Strategy Marketplace PDF for more details.

Leave a Reply