In September 2025, crypto markets entered a pivotal phase. With the Federal Reserve initiating a rate cut cycle, ETF optimism rebounding, and emerging sectors like Perp DEX and tokenized real-world assets gaining traction, investors witnessed the start of what may be a Q4 inflection. While Bitcoin (BTC) remained in a tight trading range, capital rotated toward high-beta altcoins and DeFi yield strategies. Decentralized exchanges and derivatives protocols, in particular, led growth as institutional narratives returned to the forefront.

This detailed report draws on KuCoin‘s weekly institutional data insights and Finestel’s asset managers portfolio analytics, offering a comprehensive breakdown of market structure, asset flows, and strategic reallocations made by professional traders.

Macro Overview: Rate Cut Sparks Risk-On Sentiment

The U.S. Federal Reserve cut the federal funds rate by 25 basis points on September 18, its first rate reduction since March 2024. Although Fed Chair Jerome Powell emphasized a cautious outlook, the updated dot plot revealed a growing internal divide within the FOMC. Five members projected two more rate cuts by the end of 2025, with others holding steady.

This dovish policy shift came amid softening labor data and stagnating consumer confidence, with job creation revised downward to 258,000 and consumer sentiment indexes falling to 2023 levels. Equity markets rallied on the news, with the Nasdaq gaining 3.4% in the week following the announcement.

In crypto, the shift towards monetary easing increased risk appetite. Traders rotated capital from BTC into altcoins, and institutional desks began rebalancing their positions in anticipation of ETF approvals and Q4 upside volatility.

Bitcoin: Tight Range, Low Volatility, Strategic Accumulation

Bitcoin’s price traded between $110K and $117K throughout the month. While this range signaled healthy consolidation, the inability to break above $117K indicated exhaustion in short-term bullish momentum. Technical indicators like Bollinger Bands tightened throughout the month, and the Volatility Index for BTC dropped to 3.05%; its lowest in five months.

On-chain metrics supported a mixed narrative. Whale-tier wallets distributed over 106,000 BTC in the $115K–$117K range, while new chip accumulation zones were detected at $111K–$113K. This created a defensive structure that protected against further drawdowns.

Over 300,000 BTC exchanged hands within this range, with transaction counts falling early in the month but surging during ETF-related optimism mid-September. Analysts treated this distribution-accumulation pattern as a sign of market maturity and a prelude to trend formation.

Ethereum: Quiet Strength Through Staking and RWAs

Ethereum gained 3.8% in September, closing the month near $4,480. Although its relative performance lagged high-flying altcoins, ETH remained a core component of institutional portfolios due to staking yield and deep DeFi liquidity.

The staking participation rate rose to 30.1%. Lido, EigenLayer, and EtherFi led validator services, while new entrants like Redacted Cartel and Flashstake introduced novel yield dynamics. Pendle’s total value locked (TVL) hit $6.94B, reflecting strong interest in fixed-income DeFi products.

More importantly, ETH became central to real-world asset (RWA) tokenization platforms. OpenTrade, Maple Finance, and MatrixDock used Ethereum rails for bond issuance, real estate tokens, and tokenized credit products. These integrations are expected to anchor ETH’s role in institutional compliance and TradFi partnerships.

Altcoin Rotation: Sector-Specific Gains and Narrative Momentum

Bitcoin’s dominance dropped from 59.1% to 58.0% during the month, as capital flowed into altcoins. Leading this charge were:

- Perp DEX tokens: ASTER (+1851%) and AVNT (+152%) saw explosive growth due to narrative momentum, product updates, and increased perpetual volume.

- BSC ecosystem coins: BNB gained 12% amid progress in Binance’s legal negotiations.

- Layer-1 comeback: AVAX and NEAR showed signs of life, boosted by DeFi and AI integrations.

- Solana: With JitoSOL ETF filings and partnership updates, SOL recaptured market attention.

Selective altcoins benefited from utility-based narratives. LINK surged on reserve plans and institutional staking, while TRX and BNB gained through their financing utility networks.

New listings drove initial speculative bursts, but by week three many tokens corrected sharply. This led asset managers to adopt shorter holding periods and event-driven strategies.

September Weekly Market Performance Metrics

| Metric | Week 1 | Week 2 | Week 3 | Week 4 | Monthly Trend |

|---|---|---|---|---|---|

| BTC Price | $111.2K–$116.4K | $110.8K–$117K | $113K–$115.5K | $111.6K–$114K | +1.2% |

| ETH Price | ~$4,350 | ~$4,490 | ~$4,520 | ~$4,480 | +3.8% |

| Market Cap | $3.91T | $3.96T | $3.99T | $4.01T | +3.6% |

| Avg. Daily Volume | $132B | $141B | $138B | $139B | -2.2% |

| BTC Dominance | 59.1% | 58.5% | 58.2% | 58.0% | -1.1% |

Derivatives Markets: The Real Volume Engine

September saw the derivatives market account for over 70% of total crypto turnover. BTC options open interest reached $18.2B, with traders pricing in volatility around the “Three Witches Day” expiry on September 26.

Key dynamics included:

- 82% of liquidation volume was long-biased, triggered after Fed commentary.

- Perpetuals on platforms like dYdX, GMX, and Hyperliquid surpassed centralized exchange volume for select pairs.

- ASTER and AVNT perpetuals dominated retail and institutional flows.

Options desks shifted from bullish skew early in the month to neutral/bearish by the third week. Professionals utilized collars and spreads to hedge ETF event risks.

On-Chain Intelligence: Flow Signals and Address Behavior

New BTC wallets surged mid-month, while active address count for ETH rose by 8.7%.

- BTC Distribution: Long-term holders reduced positions above $115K.

- ETH Accumulation: Institutional ETH buying increased, aligning with staking and DeFi flows.

- Stablecoin Signals: USDT and USDC saw inflows of $3.1B, mostly during week 3. Transaction velocity dropped 24%, suggesting reserve accumulation over transactional use.

Whales actively reduced leveraged long exposure as ETF uncertainty approached. AI-based address clustering identified 4.5% growth in OTC accumulation wallets.

Institutional Catalysts: ETFs, Treasury Growth, and Custody

ETF optimism dominated institutional discussions. BTC and ETH ETFs recorded $1.37B in net inflows, with BlackRock, Invesco, and Franklin Templeton leading.

Google-backed Fireblocks secured major custody deals with HSBC and Societe Generale. Bitdeer, Hut 8, and Metaplanet added a combined 17,211 BTC to treasuries. Family offices initiated 1–3% allocations to crypto baskets, mixing BTC, ETH, staking pools, and yield protocols.

Corporate demand for tokenized bonds and RWAs accelerated. Maple and OpenTrade processed $500M in RWA-linked instruments, pushing DeFi into TradFi discussions.

Regulation: Clarity Spurs Adoption

- U.S.: Binance neared a DOJ settlement. Trump’s previous approvals of crypto in 401(k) plans began to take effect.

- UK: Passed the Digital Securities Regulation Bill.

- EU: Continued MiCA framework rollouts.

- Asia: South Korea aligned stablecoin policies with MiCA. Laos launched a 300MW BTC mining project.

These moves reduced regulatory uncertainty, encouraging fund inflows into compliant tokens like XRP, HBAR, and LINK.

Sector Momentum: AI, Perp DEX, Tokenized Assets

Three major narratives defined September’s growth sectors:

-

AI in Crypto: NEAR’s “Crypto Chat AI” launched as a hybrid chatbot and analytics tool. Arkham and Rejuve explored LLM-based monitoring and predictive modeling.

-

Perp DEXs: ASTER and AVNT recorded over 1851% and 152% growth in volume, with institutions testing order execution algorithms.

-

Tokenized RWAs: Pendle, Maple, OpenTrade, and MatrixDock processed over $2.5B in tokenized assets.

These themes attracted capital due to their scalability and integration with institutional infrastructure.

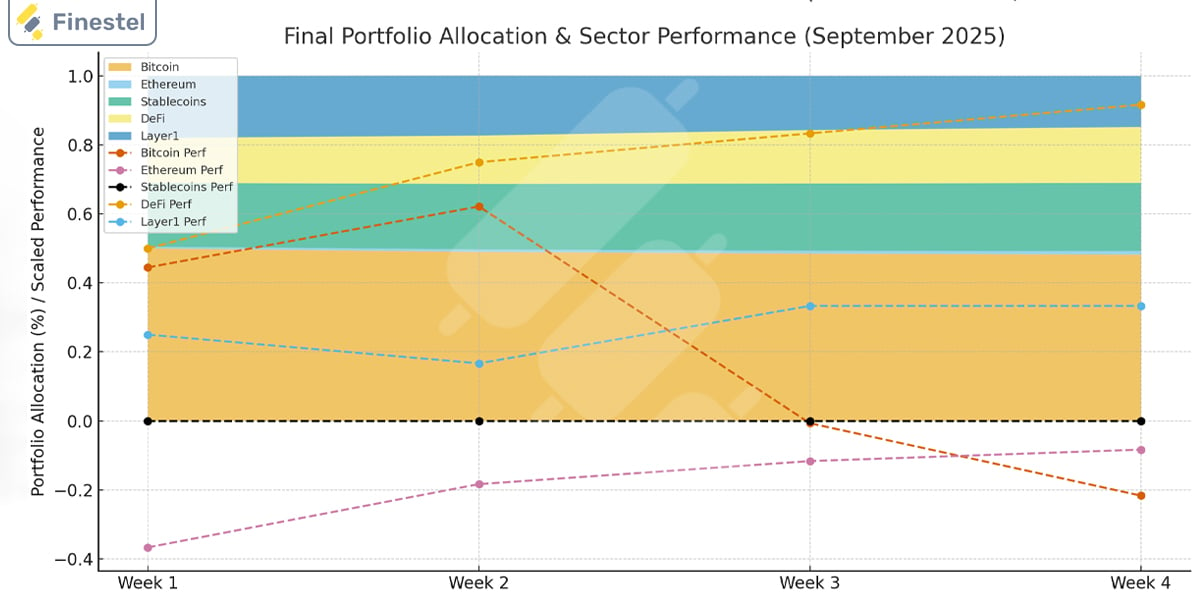

Strategic Shifts by Professionals: What Changed and How to Use It

Why the shifts (cause → effect)

- BTC −2.5% near $116–117K: Multiple rejections at a well-known supply zone. Pros trimmed into resistance to free cash for better entries and alt setups.

- ETH staking +2.1% (Lido/EigenLayer): With volatility low, yield > price beta. Managers parked part of ETH in staking/restaking to earn carry (5–10%) while waiting for catalysts.

- Perp DEX +3.8% (AVNT, ASTER): On-chain perps volume and liquidity rose. Pros added a small satellite sleeve for growth, sized tightly with hard risk limits.

- Stablecoins to 19.8%: Built dry powder for event trades (FOMC, options expiry, ETF headlines).

- AI bots (67% usage; +~13% Sharpe): Automated bands, tightened stops, and avoided emotional trades during fast flips.

How they implemented (simple playbook)

Position bands:

- Core BTC/ETH: 45–52% range; trim near band top (e.g., $116–117K), add near $110–112K.

- Perp DEX/Narratives: 3–7% total, spread across 3–5 names; skim if a name gains ≥35–50% in a week.

Entries/exits:

- BTC adds: on failed breakdown & reclaim of $110–112K, or daily close > $117K.

- ETH staking: rotate when staking yield beats stablecoin yield by 300–500 bps and gas is calm.

- Perp DEX: add when OI rises and funding stays tame; cut if funding spikes while spot lags.

Option overlays:

- Covered calls near $117–120K to monetize ceilings.

- Put spreads below $110K into events for defined downside.

- Short-near / long-next month calendars if you expect a short-term pin, then trend.

Risk rules that mattered

- Per-sleeve max loss: 6–8%; portfolio VaR ≤ 8–10%.

- If $117K fails twice: cut 25–33% of tactical longs; wait for fresh signal.

- Diversify drivers: don’t let all “hot” names share the same beta.

Data to watch (daily)

- Spot VD (who’s more aggressive: buyers or sellers).

- Options skew & max-pain (pin risk near big expiries).

- URPD/cost clusters: $108–110K support, $117K supply.

- Funding + OI (healthy build vs blow-off).

- ETF creates/redemptions (flow confirmation).

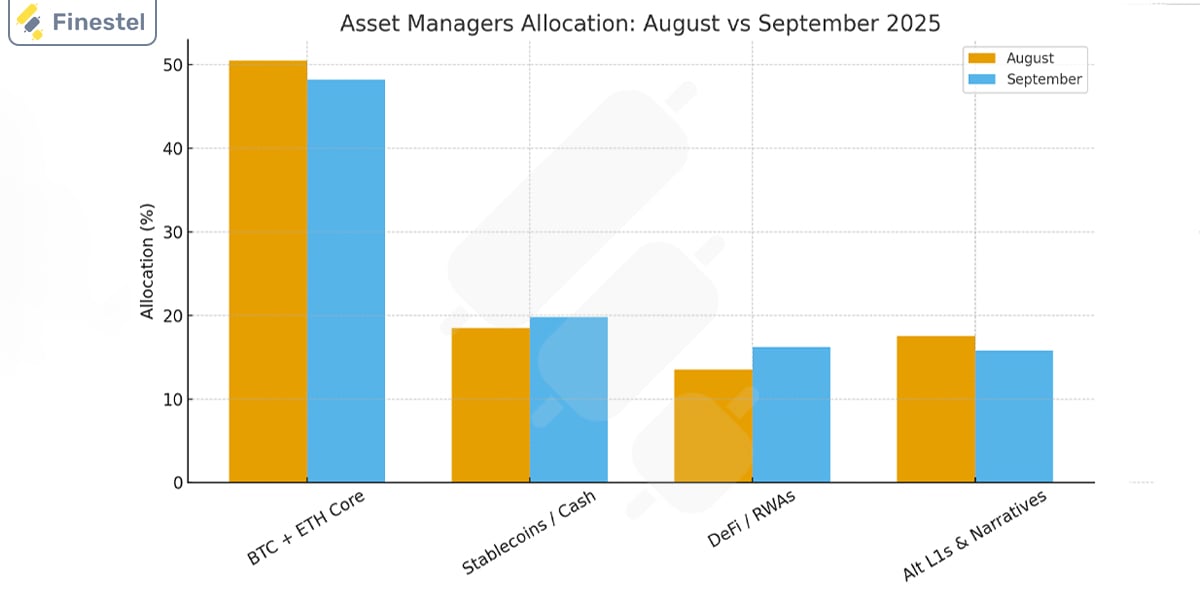

Allocation snapshot

| Asset Class | August | September |

|---|---|---|

| BTC + ETH Core | 50.5% | 48.2% |

| Stablecoins / Cash | 18.5% | 19.8% |

| DeFi / RWAs | 13.5% | 16.2% |

| Alt L1s & Narratives | 17.5% | 15.8% |

Bottom line: Pros trimmed into resistance, earned carry on ETH, added a small but fast-growth sleeve in Perp DEX, and kept cash for event-driven entries, executed with tight options hedges and strict risk caps.

October Outlook: Preparing for Breakout Catalysts

For more detailed insights, check out the July 2025 market report and August crypto market reports, and see the August vs. September allocation comparison in this chart:

With ETF decisions due in October and macro volatility rising, professionals are preparing for potential breakouts.

Recommended positioning:

-

BTC + ETH: 50% (watch $117K breakout and $110K support)

-

Stablecoins: 18–19% (used for dip entries)

-

DeFi / Perp DEX / RWAs: 15–16%

-

Altcoins / AI tokens / L1s: 15–17%

Upcoming catalysts include:

-

SEC spot ETF verdicts

-

U.S. inflation reports

-

Altcoin rotation post-ETF approval

-

Token airdrops (e.g., MetaMask utility token)

Final Thoughts: September as the Setup Month

September 2025 was not a month of price explosions, but it was a setup month. Institutional flows returned, macro risk eased, and high-potential narratives gained steam. Professionals sharpened their strategies, rotated capital smartly, and deployed data-driven execution.

October promises to be decisive. Traders and asset managers should stay nimble, prioritize yield-backed assets, monitor ETF-driven momentum, and continue leveraging automation and analytics for alpha generation.

For continuous updates and institutional insights, follow us on Finestel Telegram channel and X (Twitter) @KuCoinInst.

Leave a Reply