As asset managers, you understand the importance of balancing growth with capital protection, especially in volatile markets. July 2025 presented a complex landscape for the cryptocurrency market, with significant price surges, regulatory advancements, and end-of-month consolidation. These shifts prompted asset managers to adjust their portfolios accordingly.

This report leverages Finestel’s internal data alongside insights from KuCoin, offering an in-depth look at the crypto market trends observed in July 2025, providing actionable intelligence for asset managers and professional traders. The data reflects portfolio adjustments, trading activity, and institutional flows. The accuracy of these insights is driven by the granular data from these platforms, providing reliable trends to guide strategic decision-making. By analyzing real-time user data, this report offers not only a snapshot of July’s market activity but also a forward-looking view of the dynamics shaping August’s opportunities.

The Crypto Market Trends: Surge to Stabilization

July began with Bitcoin navigating tariff-related uncertainty, fluctuating in the $105,000–$110,000 range during the first week as managers monitored deadline extensions. By week two, a 9.04% rally pushed it past $120,000, aligning with ETF inflows and on-chain buying absorption that encouraged Finestel users to lean into core holdings. Consolidation followed in weeks three and four, with prices settling around $117,000—a net 8% monthly gain—prompting a shift toward protective measures like higher stablecoin allocations to buffer volatility.

Ethereum’s narrative was one of steady outperformance, climbing 17.3% to $3,800 and testing $4,000 resistance, driven by ecosystem rotations and staking rates hitting 29.4% of supply. This strength led asset managers on our platform to boost ETH-linked exposures, capitalizing on correlations with DeFi (0.77) and RWAs (0.98). Altcoins mirrored this, with volumes spiking 42.86% in week two and 48.23% in week three before easing 8.12% to $1.323 trillion in week four, as rotations favored compliance tokens like XRP and HBAR post-CLARITY Act.

Overall capitalization rose 13.2% to $3.85 trillion, with daily volumes averaging $161 billion (up 56%), and Bitcoin dominance dipping to 60.6% before a late 0.18% rebound. The Fear & Greed Index hovered at 70–75, sustaining optimism but dipping slightly by end-month, signaling managers’ cue to diversify. Finestel data shows this prompted a 2% average increase in altcoin sleeves, as users sought yield amid dominance declines.

| Metric | Week 1 Value | Week 2 Value | Week 3 Value | Week 4 Value | Monthly Trend | Finestel User Adjustment Notes |

|---|---|---|---|---|---|---|

| Bitcoin Price (USD) | ~$108,000 | $120,000+ | $118,000 | $117,000 | +8% | Increased core holdings mid-month; trimmed 1% in consolidation |

| Ethereum Price (USD) | ~$3,000 | $3,800+ | ~$3,800 | $3,800 | +17.3% | Boosted ecosystem exposure by 3% on ETF flows |

| Market Cap (Trillion USD) | ~$3.4 | $3.771 | $3.905 | $3.919 | +13.2% | Rotated 2% to altcoins on cap peaks |

| Avg. Daily Volume (Billion USD) | ~$98 | $139 | $161 | $161 | +56% | Scaled trading bots for volume spikes |

| BTC Dominance (%) | High | -0.69 | -3.75 | +0.18 | Net decline | Diversified 4% on dips |

On-Chain Trends: Accumulation and Market Stability

Bitcoin’s on-chain data throughout July revealed key insights into crypto market trends, showing a shift from aggressive trading to accumulation. In week 3, transactions peaked at 736,600 BTC, then dropped by 50% to 367,000 BTC in week 4. This shift suggests a move towards long-term holding rather than speculative trading.

The support levels for Bitcoin established between $117k–$119k were reinforced by 665,000 BTC added during week 3. Meanwhile, profit-taking decreased from 300,000 BTC in week 3 to 150,000 BTC in week 4, indicating a shift to a more stable market environment.

Institutions remained bullish on Bitcoin, adding 60,107 BTC in week 4, while long-term holders sold a total of 150,000 BTC throughout the month. This institutional buying activity helped maintain a strong support structure.

Key On-Chain Signals:

- Bullish: Strong support at $117k suggests potential for Bitcoin to test $130k on favorable macros.

- Bearish: Profit-taking and distribution patterns signal possible dips to $105k–$108k.

- Neutral: Stable velocity supports altcoin rotations as Bitcoin dominance wanes.

Institutional Flows: Continued Growth in Crypto Asset Allocations

Institutional demand in July 2025 showed a clear trend of growing confidence in the crypto market. Bitcoin ETFs attracted $12.8 billion, with $6 billion allocated to Bitcoin and $5.43 billion to Ethereum. BlackRock captured 75% of the new inflows, increasing its assets under management to $84 billion.

Corporate treasuries also remained active, adding 60,107 BTC in week 4, bringing the total increase since April to 147,000 BTC. MicroStrategy continued its role as a key institutional player, reporting $10 billion in Q2 revenue from its Bitcoin holdings, signaling institutional commitment to Bitcoin as a reserve asset.

Expanding the DeFi Ecosystem: Institutional Adoption and Growth

The rise of DeFi in July 2025 was a significant trend, with institutional players embracing DeFi protocols for yield generation. Ethereum’s 29.4% staking rate played a crucial role in driving DeFi growth. As compliance tokens gained popularity, institutional investors were attracted to DeFi projects that fit into a regulated framework, such as those stemming from the CLARITY Act.

On Finestel, asset managers increased their DeFi exposure to 10% of their portfolios, capitalizing on yield-generating opportunities from Ethereum-based projects. Additionally, tokenized assets, particularly Real-World Assets (RWAs), continued to gain traction, further bolstering the growth of DeFi platforms.

Regulatory and Macroeconomic Insights: Key Catalysts for Market Growth

Regulatory advancements and macroeconomic factors played a pivotal role in shaping crypto market trends in July 2025. Key legislative measures such as the CLARITY Act and GENIUS Act provided much-needed clarity, driving growth in compliance tokens and stablecoins while enhancing institutional confidence.

The CLARITY Act: Defining Digital Assets and Exempting DeFi

The CLARITY Act provided definitive classifications for digital assets, distinguishing between securities and commodities, which helped reduce regulatory ambiguity. This was particularly important for DeFi projects, which were exempted from certain securities regulations. As a result, compliance tokens like XRP, HBAR, and ADA saw significant growth, benefiting from clearer regulatory standing. These tokens have experienced price increases of 20–45%, as institutional investors now feel more comfortable incorporating them into their portfolios.

The CLARITY Act has positioned these compliant assets as safer investments for institutional clients, leading to increased capital inflows from both hedge funds and family offices, who have been adjusting their allocations toward these more clearly regulated assets.

The GENIUS Act: Stablecoin Reserves and CBDC Ban

The GENIUS Act mandates stablecoin reserves, ensuring that these digital assets are fully backed by real-world assets, thus boosting their credibility and stability. The legislation also bans CBDCs (Central Bank Digital Currencies), reinforcing the role of private stablecoins in the broader crypto economy. This has been beneficial for stablecoins like USDC and Tether, which continue to grow as important tools for managing market volatility and hedging risk.

Moreover, the growth of Real-World Assets (RWAs)—which are projected to reach a market size of $16 trillion by 2030—has further contributed to the adoption of stablecoins and tokenized assets. The GENIUS Act’s introduction of stablecoin reserves is helping to legitimize the stablecoin market, making it an essential part of institutional portfolios.

Global Regulatory Efforts: Enhancing Market Confidence

Alongside these domestic measures, global regulatory efforts like the MiCA (Markets in Crypto-Assets) framework in the European Union and Hong Kong’s crypto licensing have added to the growing confidence in crypto assets. These regulations aim to standardize compliance across jurisdictions, providing institutional investors with clearer guidelines for operating within the crypto space.

These regulatory shifts have made it easier for asset managers to navigate the complex crypto market. In particular, the regulatory clarity surrounding DeFi and stablecoins has encouraged institutions to increase their exposure to compliant digital assets, further boosting market liquidity and participation.

Sector Trends: Rotation into Compliant Assets and DeFi

The rise of DeFi and tokenized assets has become a central theme in crypto market trends. Ethereum remains the dominant player in DeFi, with staking and yield generation driving investor interest. As institutional confidence in compliance tokens like XRP and HBAR continues to grow, asset managers are shifting their focus toward these tokens for stable returns in the rapidly growing DeFi ecosystem.

Platforms like Robinhood and xStocks have emerged as popular choices for regulated trading, with xStocks offering DeFi integration, global flexibility, and opportunities for lending and mining. This trend highlights the growing preference for regulated platforms that can provide secure, compliant avenues for trading and investing in cryptocurrencies.

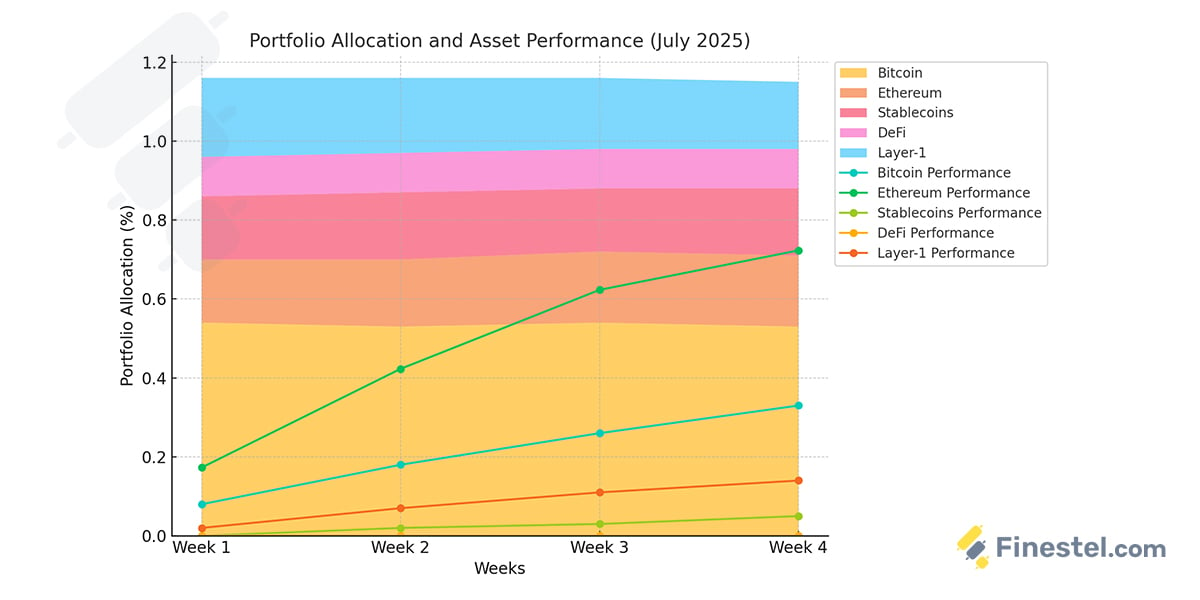

Portfolio Adjustments: Shifts in Response to Market Conditions

July saw significant portfolio adjustments from asset managers, particularly as crypto market trends shifted from volatility to consolidation. The key changes include:

- BTC + ETH: 54% (trimmed by 1% to reduce volatility)

- Stablecoins: 16% (up 1% to hedge against market fluctuations)

- DeFi: 10% (up 1% to capture yield in compliance-driven opportunities)

- Layer-1: 20% (down 2% due to cooling rotations)

As institutional flows favored Bitcoin and Ethereum, asset managers increased altcoin allocations by 2%, optimizing their portfolios for yield generation amid a decline in Bitcoin dominance.

August Outlook: Monitoring Key Market Catalysts

Looking ahead, Bitcoin faces a pivotal test at the $117k level. A weaker market could push prices to $105k–$108k, while favorable macroeconomic conditions could propel Bitcoin to $130k. Key events to watch in August include:

- Solana’s Seeker Ships launch (August 4), which could spark Layer-1 rotations.

- Economic data such as CPI and GDP reports (mid-month), impacting the Fed’s rate cut expectations.

With Ethereum’s momentum and staking at 29.4%, Ethereum is likely to continue to test $4,000, while altcoins may see increased volatility. DeFi and RWAs are expected to perform well, benefiting from ongoing regulatory support.

For portfolio management in August, adjusting BTC + ETH to 53%, stablecoins to 17%, and maintaining DeFi at 10% offers flexibility. Using automation tools for rebalancing will help mitigate risks and optimize returns in the evolving market.

Conclusion

This report provides a comprehensive view of the crypto market trends in July 2025, offering valuable insights for professional traders and asset managers. By combining Finestel’s internal data with insights from KuCoin, we deliver accurate, real-time analytics to inform your portfolio strategies. Our in-depth analysis of institutional flows, regulatory changes, and on-chain data positions us as a trusted source for actionable insights in the cryptocurrency space.

Leave a Reply