Some of the most popular and reliable trading bots in crypto are the DCA bots. As the name suggests, all they do is automate the Dollar-Cost Averaging process. You can build positions gradually and over time, and the best part is that you won’t need to worry about getting that sniper entry. Your capital will be divided into several smaller orders to build a single position with a certain average.

In this article, we’ll talk about what DCA bots are, how they work, and which are the best DCA bots in 2025. Of course, for those of you who don’t know what Dollar-Cost Averaging is, we’ll begin by explaining how this strategy works and the main concept behind it.

What Is DCA (Dollar-Cost Averaging)?

Dollar-Cost Averaging (DCA) is a trading method where you invest a fixed amount at regular intervals. You don’t need to care about the asset’s price. That’s because instead of buying everything at once, you spread your entries over time. Clearly, this reduces the impact of short-term market swings.

Let me clarify with an example. If you decide to buy $500 worth of Bitcoin every Monday, that’s Dollar-Cost Averaging. Of course, some weeks you buy at a higher price, other weeks at a lower one. But, over time, your purchase price becomes an average of all these orders.

The reason behind using this strategy is that it smooths out the volatility. I mean, you won’t bear the risk of putting down all your available capital and entering at a single price. We all know how it feels when we go all-in and experience even a small drawdown. With DCA, this is largely mitigated.

What Are DCA Bots and Strategies?

Now, let’s move on to DCA bots and strategies. As I’ve already explained, Dollar-Cost Averaging is a strategy where you enter a position gradually instead of buying all at once. Now, DCA bots can help you make this simple idea automated.

Using a DCA bot, you can divide your total investment into smaller ones. With the right settings, the bot will make scheduled purchases over time, either at certain time intervals, or at certain price levels.

I mean, you’ll end up buying every hour, once a day, or even when the price drops by a certain percentage. What makes it perfect is that you won’t even need to be on the chart. The bot automatically executes your orders based on the rules you give it.

Now, DCA strategies can be applied in two main ways:

- First, there is the spot DCA. The bot builds a position by purchasing the asset in the spot market over time.

- Then, we have the futures DCA. If you have a higher risk tolerance, you can scale into leveraged positions. The bot executes long or short orders gradually to build the position you want.

Why Should You Use DCA Bots?

By explaining what DCA is and how DCA bots work, I think you have a pretty good idea about why traders use DCA. But let’s have a deeper dive and check out the main applications of DCA strategies:

Long-Term Investment vs. Short-Term Trading

DCA is more popular with long-term investors who want to steadily build positions. These individuals don’t want to worry about daily price moves, and DCA bots help with that.

Yet, there’s also a short-term use case. Some traders also use DCA bots or even apply the concept manually to scale into positions during market pullbacks. As a result, they’ll get a better average entry price and won’t need to care about getting that pinpoint entry.

Risk management benefits for volatile assets

One of the primary advantages of using DCA bots and strategies is managing risk. With the massive volatility the crypto markets experience every week, this method can be a lifesaver.

DCA will remove the risk of going all-in at the wrong price and the wrong time. With the entries spreading over different prices, you can smooth out volatility and mitigate the damage a single bad entry can have.

Algo Trading and Asset Management

Two somewhat larger-scale use cases for DCA bots are from algorithmic traders and asset managers. Algo traders use DCA bots to automate scaling into trades. The strategies they use are often more complex, however, compared to the generic Dollar-Cost Averaging, and include some other technical triggers too.

Crypto asset managers also apply DCA for client portfolios to manage large orders without moving the market. This is essential for these fund managers and high-net-worth traders, as their orders would otherwise move the market, and they’ll get bad order fills.

Types of DCA Bots

Moving on, it is necessary to understand that there is a range of different DCA bots. Here are the ones that are mostly used by traders and investors:

Time-based DCA bots

These bots execute trades at fixed intervals. For example, they buy every hour, every day, or every week. Clearly, market price is not a concern here, as the bot only relies on time.

Price-based DCA bots

This type of DCA bots trigger your orders when the market moves by a certain percentage or at specific price levels. This criterion is, of course, set by the user, but overall, it’s a great approach to take advantage of price dips to accumulate more volume.

Hybrid DCA bots

Now this one is much more interesting and is used by more advanced users. Hybrid DCA bots operate on a set of rules that factor in both price movement and time. In other words, they place regular orders but can also accelerate buying during sharp drops.

Exchange-specific DCA bots

Some exchanges like Binance, Bybit, and KuCoin offer built-in DCA bots. The rules and criteria are usually the same as the other types mentioned above, but they’re clearly limited to the specific exchange.

Third-party DCA bots

As with the exchange-specific DCA bots, some third-party platforms like 3Commas also offer DCA bots that are more customizable and can operate on a set of different rules. These bots will then connect to your exchange account via API connections and execute the orders on the exchange.

How to Apply the Best DCA Bot Settings

As I’ve already mentioned, some bots, specifically the third-party ones, allow you to set up your own configurations. In this part, we’ll talk about the primary factors you have to consider to set up the best DCA bot according to your needs.

Adapt Based on the Asset

First and foremost, you should adapt your DCA bot based on the asset you’re trading. Also, you should consider whether it’s a futures DCA bot or a spot one.

I mean, a 10 or 20% movement interval might be good for accumulating smaller coins, but for BTC and ETH, it might be too much as they’re less volatile.

Define position sizing and risk allocation

Arguably, the most important part of setting up a bot is position sizing and risk management. You should decide how much capital you want to commit per trade, and this can be based on your goals and risk tolerance. Always set a maximum position size to avoid overexposure.

Select the right timeframe

Then again, the timeframe is also important. I’m not specifically talking about the chart timeframe here. Our discussion is about the time intervals that you’re bot executes trades (if it’s not solely price-based DCA). For example, if you’re accumulating for the long term, you should use longer intervals.

Set entry triggers

The trigger is the condition that should occur for your bot to execute. For time-based bots, stick to regular intervals. For price-based or hybrid bots, you can use conditions like a percentage drop or even technical indicators such as RSI or moving averages to trigger buys.

Manage exits

Even in DCA, and especially if you’re leaning on the shorter-term side, you need clear take-profit and stop-loss rules. You can use fixed targets or trailing take-profits to lock in gains. Holding indefinitely without a plan is not logical for a trader who is sophisticated enough to use a bot, right?

Backtest and optimize

The final point, which is the most notable, is backtesting. Run historical simulations to see how your settings would have performed in the past. Track metrics like drawdown, profit factor, and win rate. With the resulting data in hand, you can adjust your bot. However, avoid overfitting your strategy to past data. This is a common error in bot optimization.

Best DCA Bots in 2025

Now, it’s finally time to see which are the best DCA bots available in 2025. Carefully read through these options to see which one is the best fit for you.

|

Platform |

Pricing / Subscription |

Strengths |

|

3Commas |

Free (demo only, limited), Pro $37/mo, Expert $59/mo, Asset Manager $374/mo |

Deep customization, TradingView integration, multi-pair mode, risk controls |

|

Binance |

Free (built-in) – Regular trading fees apply |

Simple setup, massive asset selection, integrated with the Binance ecosystem |

|

Bybit |

Free (built-in) – Regular Bybit trading fees |

Low entry barrier, easy multi-asset setup, auto-adjusting take-profit |

|

KuCoin |

Free (built-in) Free (built-in) – Regular Ku fees apply |

Huge altcoin range, works for long & short DCA, dynamic take-profit |

|

WunderTrading |

Free (1 DCA bot), Basic $19.95/mo, Pro $39.95/mo |

Turns TradingView alerts into bots, supports dynamic DCA, and flexible scripting |

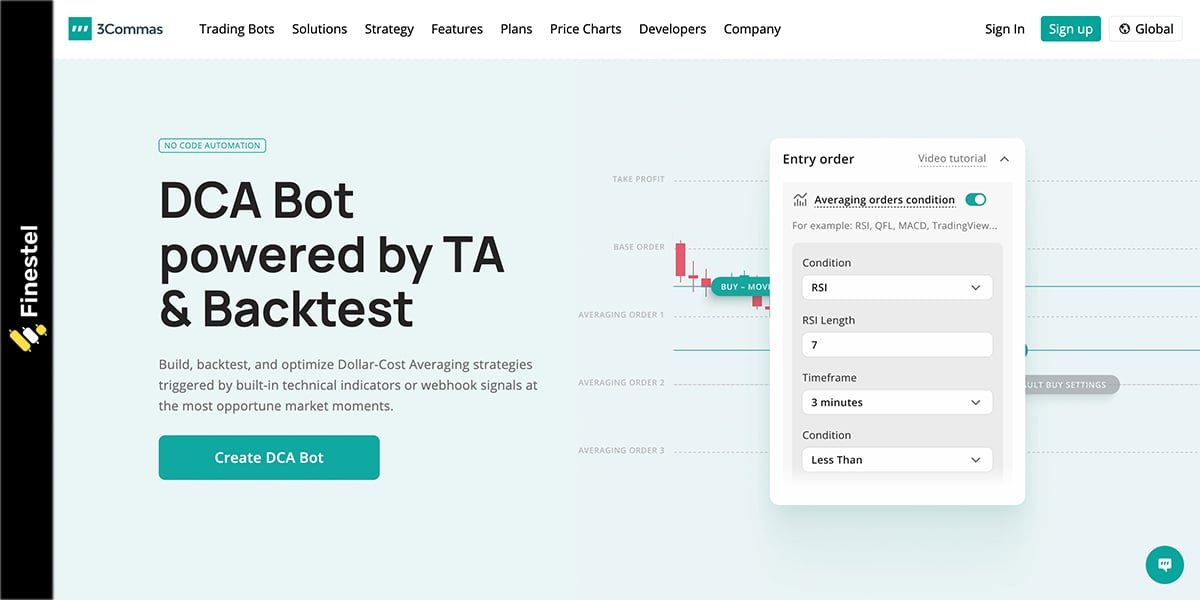

3Commas DCA Bot

The 3Commas DCA bot is built for traders who want deep control over their automation. You can set multiple safety orders and adjust order sizes by percentage. There’s even the option to use trailing stop-loss or breakeven levels. So, it’s not really a “set and forget” tool, and is best for more advanced traders and asset managers who want to fine-tune every stage of the trade.

The 3Commas DCA bot also connects with TradingView alerts through webhooks. That means you can build strategies in TradingView and have them execute instantly on 3Commas. Some other interesting features include multi-pair mode and blacklist filters, which you can read more about on the 3Commas help center.

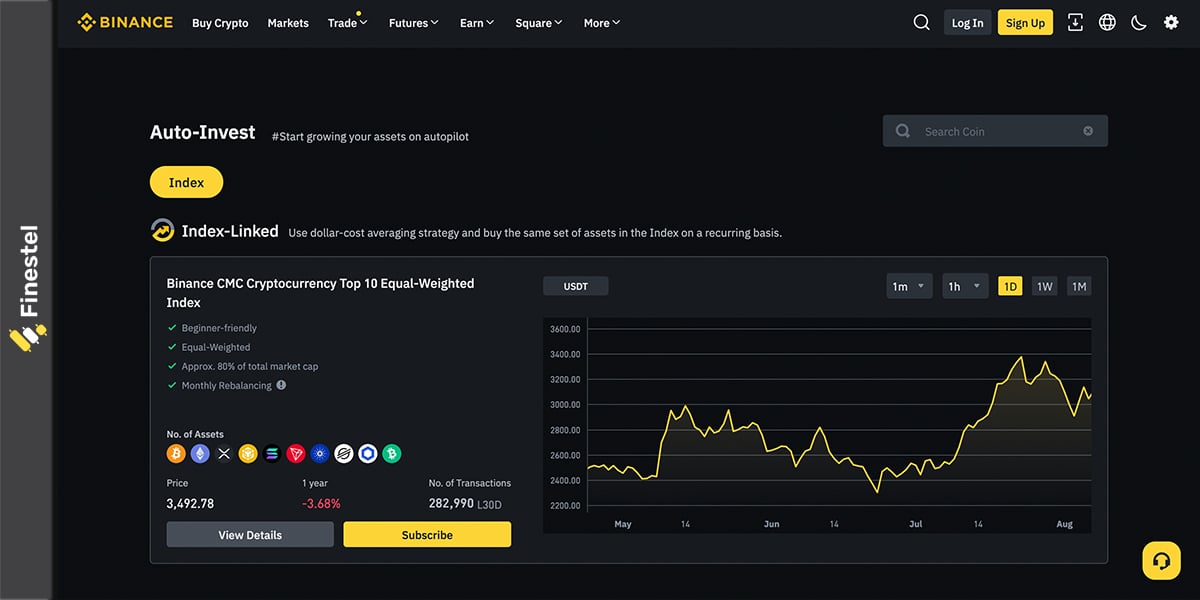

Binance DCA Bot

Who would’ve thought that the biggest exchange in the world has one of the most reliable DCA bots, right? Well, Binance actually gives you two main ways to automate DCA.

- First is the Spot DCA bot, which lets you layer buys as the price drops and take profits when it recovers.

- The second is Auto-Invest, which is perfect for recurring buys over weeks or months.

Because it’s built into the Binance ecosystem, the setup is obviously fast and quite simple for any trader to use. You can focus on numerous tokens that are listed on Binance and run flexible plans. Even earning yield is possible on certain assets as you accumulate. So, it’s a great choice if you already trade on Binance and want simple automation.

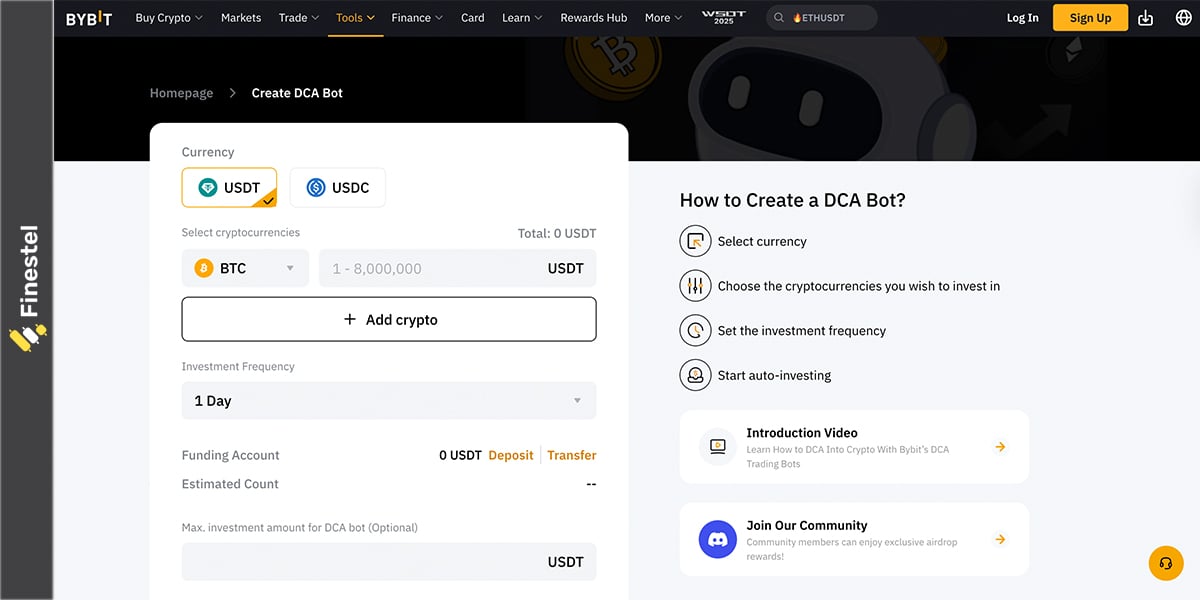

Bybit DCA Bot

Bybit is another popular crypto exchange that has decent automation tools, and its DCA bot is one of them. The Bybit DCA bot focuses on straightforward automation with very low entry barriers. I mean, you can start with as little as $1 (I don’t know why someone would do that, but you can anyway). Your portfolio can include up to five crypto assets at a time. Orders run on your chosen schedule, and take-profit levels adjust automatically as your average entry changes.

Similar to Binance and other exchanges, there are no bot service fees. You only pay the regular spot trading fee. So, again, it’s great for beginners and those of you who just want to test automatic Dollar-Cost averaging.

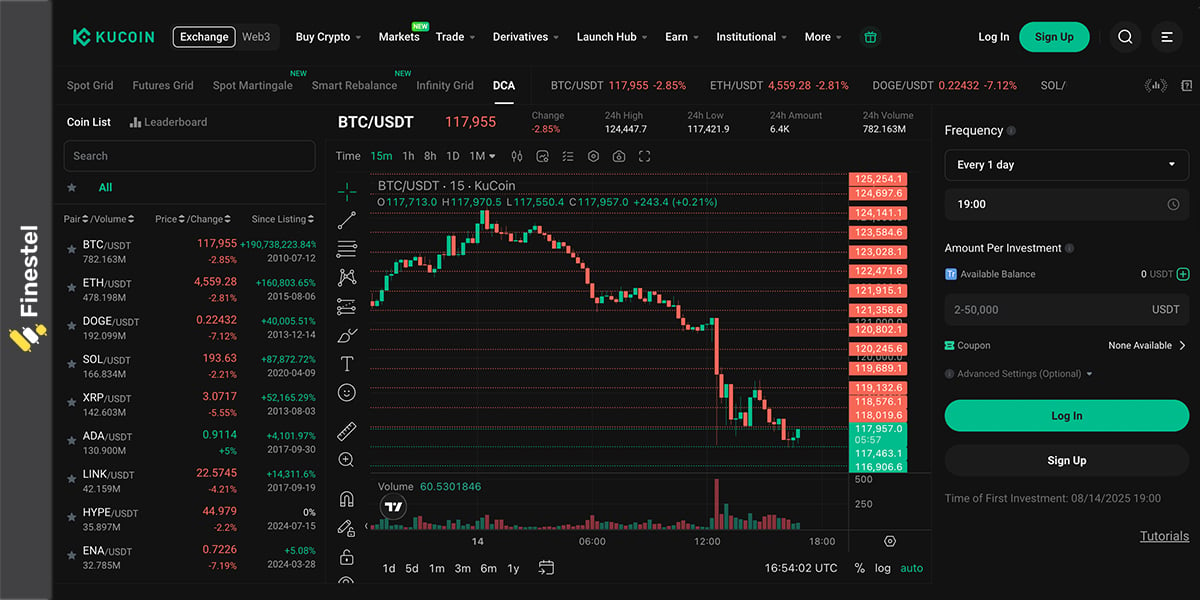

KuCoin DCA Bot

The next top exchange with a native DCA bot is KuCoin. The KuCoin DCA bot is also free to use, and the main selling point is that you can DCA on tokens that are not even listed on other exchanges like Binance. That’s a big-time appeal to crypto gem hunters.

The process starts by setting the investment amount, choosing your frequency, and letting it run. The bot automatically updates take-profit levels with each new buy.

It works for both long and short strategies via futures DCA, and it’s arguably the perfect tool for building diversified crypto portfolios of smaller tokens without extra bot fees.

WunderTrading DCA Bot

WunderTrading is another big name in crypto automation. It can basically turn any TradingView alert into a DCA bot, and that’s why it’s on our list. You can combine custom indicators, scripts, and multiple conditions to build advanced strategies.

The WunderTrading DCA bot also supports “dynamic DCA,” meaning your position sizing and order logic can adapt as market conditions change. For traders who want complete control and the ability to experiment with custom logic, this is the platform that delivers.

Scaling DCA Bots With Finestel

I am now talking to the asset managers and master traders. If you manage multiple client accounts, running a Grid trading bot or DCA strategy on just one isn’t enough. You need that execution mirrored across your client’s portfolio. Finestel’s copy trading system makes it simple. Execute trades on a master account and have them instantly replicated to unlimited client accounts with speed and precision.

Prefer an API-driven setup? Our TradingView Bot and Signal Bot let you trigger DCA or Grid strategies from custom alerts or external signals. So, they’ll execute across all connected accounts in a fraction of a second.

Risk controls are also built in. You can set allocation rules, cap exposure, and combine Grid with DCA for a more advanced approach. And with Finestel’s white-label service, you can offer clients a fully branded experience and scale your strategies without extra operational work.

Conclusion

DCA bots take one of the most reliable trading strategies in crypto and make it automated. Automation ensures every order is executed exactly as planned. And, needless to say, there’s no emotion or hesitation involved.

Yet, the real edge comes from matching the right bot to your style. If you want plug-and-play simplicity, exchange bots from Binance, Bybit, or KuCoin will do the job. If you need deep customization and advanced triggers, 3Commas or WunderTrading open the door to far more complex setups.

Finally, for those asset managers among you, pairing your DCA or Grid strategy with Finestel’s copy trading and signal bots is the fastest way to scale across accounts and take care of executions automatically while keeping control over risk.

Leave a Reply