We warned in our November outlook that central bank shifts and geopolitical friction were likely to trigger volatility. Our 2025’s December crypto market report shows that December didn’t just meet those expectations; it intensified them.

The month became a battleground where hawkish Fed signals collided with early liquidity boosts, all exacerbated by anxiety over AI regulation, a capitulation in precious metals, and escalating global tensions. While the broader crypto market faced a gauntlet of support tests, worsened by ETF outflows and thin holiday liquidity, it wasn’t a total washout. Regulatory tailwinds out of the US, Japan, and South Korea provided a distinct floor, fostering resilience in specific sectors like privacy and AI tokens.

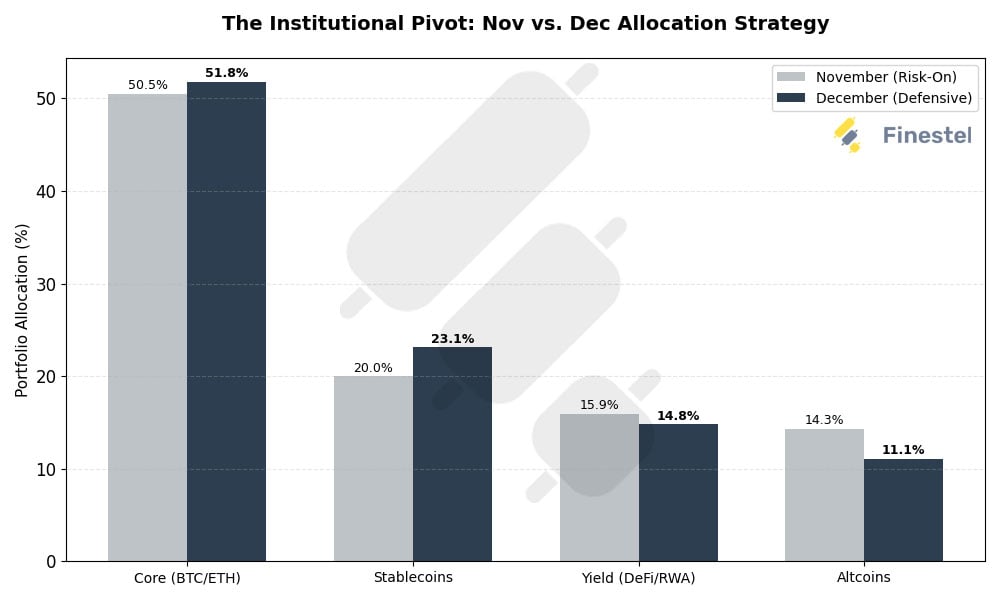

The Institutional Pivot (Finestel Data), is how the smart money survived the chaos. Finestel’s trackings reveals a clear strategy: professional managers executed progressive defensive realignments. By aggressively ramping up stablecoins and trimming altcoin exposure.

This report synthesizes data from Finestel and KuCoin internal data, on-chain forensics from Glassnode and Chainalysis.

The Month in Numbers: Key Performance Metrics and Market Data

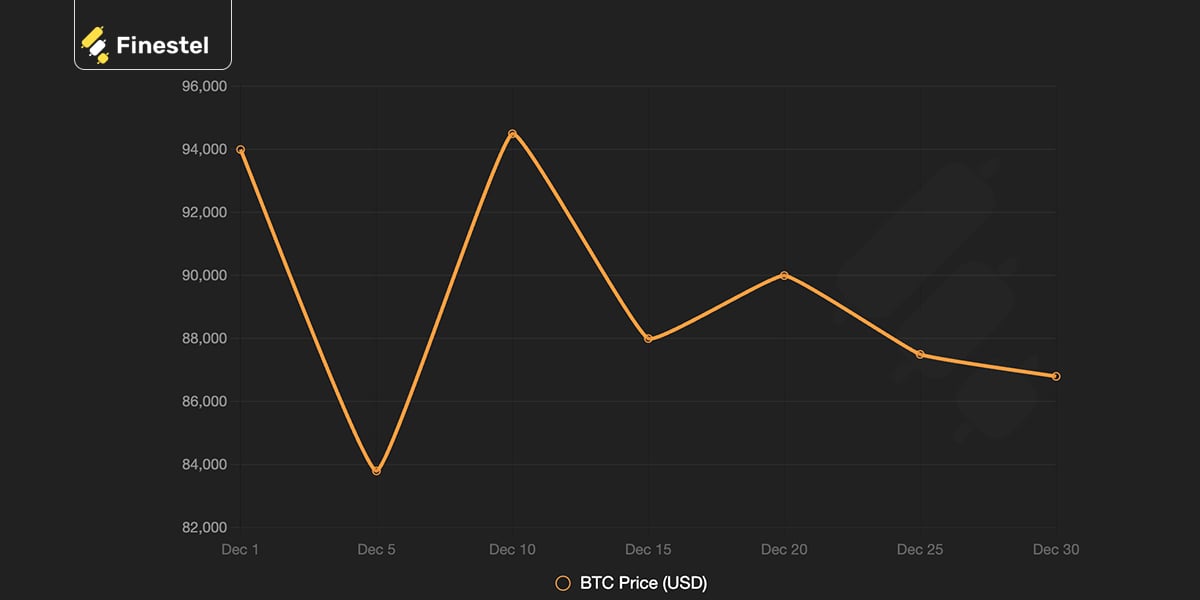

Bitcoin kicked off December looking strong at ~$94,000, still riding the momentum from November’s QT termination. But the smooth sailing didn’t last. The price action quickly turned into a series of sharp reactions to macro headlines: an early flush to $83,800 (Dec 2–3) on BoJ rate hike fears, followed by a “buy the rumor” rally to $94,500 ahead of the FOMC (Dec 9–10).

That optimism hit a wall with the Fed’s hawkish projections, triggering a consolidation down to $88,000 by mid-month. Despite a late-month surge, we saw a final reversal to close the year right near that $88,000 mark.

- The Damage: Down 6.4% for the month.

- The Context: Still up 114% YTD from the ~$41,000 entry in January.

Ethereum charted a similar, albeit uglier, path. After ranging between $4,100–$4,400 early on, it broke down through support levels (hitting an interim low of $3,900) before flushing to finish the month at ~$2,970. That’s a 7.8% MoM decline, though it holds a 62% YTD gain.

The “December Capitulation”

The broader market metrics were brutal. Total crypto market cap peaked mid-month at ~$3.91 trillion before violently contracting to $3.00 trillion by Dec 31. That is a 23% haircut, erasing ~$910 billion in value. Analysts are calling it the “December Capitulation”, a move that echoes the 2022 year-end downturns but actually surpassed them in scale.

Activity dried up as prices fell. Trading volumes dropped 18% to $862 billion, with perpetual futures dominating the flow (68% of volume) as holiday liquidity thinned out.

Divergence: The Haves and Have-Nots

While the general altcoin market suffered average drawdowns of 10–15%, capital didn’t leave the room, it just rotated.

- The Winners: Privacy and AI were the clear outliers. $NIGHT surged 45% (SEC tailwinds/Midnight collab), and $TAO jumped 25% (halving event + Grayscale launch). $ZBT was the standout regional play, rocketing 67% on Korean inflows.

- The Speculators: Meme coins like $Whitewhale saw violent 200% pumps followed by immediate, sharp corrections.

- Flight to Quality: Amid the chaos, investors huddled in Bitcoin. BTC dominance climbed from 58% to 61.2%.

Volatility & Correlation The market is tense. BTC’s 30-day realized volatility spiked to 32% (up from 22% in Nov), with a massive 5.8% intraday swing recorded on Dec 30 as precious metals capitulated alongside crypto. Interestingly, we are still moving in lockstep with traditional risk assets, the BTC-Nasdaq 30-day correlation held firm at 0.72.

Closing Snapshot (Dec 31):

- $BTC: $88,000 (-6.4% MoM)

- $ETH: $2,970 (-7.8% MoM)

- $SOL: $145 (-4.2% MoM, buoyed by Firedancer)

- $AVAX: $62 (-3.5% MoM, ecosystem TVL +9%)

- $TAO: $420 (+25% MoM, halving catalyst)

- $NIGHT: $18 (+45% MoM, regulatory tailwinds)

- Gold ($XAUT): $4,120 (-5.2% MoM, caught in the sell-off)

Macroeconomic Drivers: Policy Hawks, Japanese Shocks, and Tech Spillovers

December’s market dynamics were essentially a tug-of-war that the bears won. We spent the month caught between liquidity injections and restrictive signals, all while external shocks hammered a market already thinning out for the holidays.

The Macro Head Fake

The month opened with what looked like a green light. On Dec 2, the Fed wrapped up QT with a $13.5 billion repo injection and committed to $40 billion in monthly net asset purchases. At the same time, Kevin Hassett’s odds for the Fed Chair nomination surged to 78%, fueling the “Hassett trade”, the market started front-running aggressive easing and 50bp cuts.

But the data refused to play along. ADP employment dropped by 32,000 (Dec 4), missing expectations badly, while core PCE ticked up 0.2% MoM, reminding everyone that inflation is still sticky. When the national debt crossed $30 trillion, the caution flags went up.

The Fed Pivot That Wasn’t

The turning point was the Dec 9-10 FOMC meeting. We got the headline cut, 25bps down to 3.6%, but the details were hawkish.

- The Dot Plot: The real killer. The Fed signaled only one cut each for 2026 and 2027, crushing the market’s expectation of two.

- Revisions: They bumped GDP forecasts up (1.7% for ’25, 2.3% for ’26) and kept PCE inflation elevated at 2.9%. Powell’s “meeting-by-meeting” stance, combined with open dissent from regional presidents (Goolsbee wanting data, Schmid worrying about inflation), effectively killed the easing optimism.

Japan Wakes Up (The Carry Trade unwind)

To make matters worse, Japan compounded the uncertainty. With 2-year yields hitting 1% on Dec 1 and BoJ Governor Ueda telegraphing a hike with 96% probability, the writing was on the wall. They pulled the trigger on Dec 19, raising rates by 25bps. Even with an 18.3 trillion yen stimulus package, this disrupted the carry trade and forced risk-off flows across global markets.

The Tech & Commodity Spillover

By mid-month, the narrative shifted from macro to sector-specific pain.

- Tech: Oracle delayed its OpenAI data center on Dec 13, sending the Nasdaq down 1.62%. Crypto, highly correlated, followed it down.

- Commodities: Post-Christmas, we saw a total capitulation in precious metals (Gold -5.2%, Silver -7%). This mirrored the equity retreat and amplified Bitcoin’s sharp surge-reversal on Dec 30.

The Whimper Ending

We closed the year on a cautious note. The Dec 31 FOMC minutes forced markets to digest that hawkish stance all over again amid thin liquidity. Crypto managed a modest 0.5% uptick to reclaim a $3.00T market cap, but Bitcoin failed to sustain above $90,000, hovering near $88,700 as ETF inflows fought against the broader weakness. It was a disrupted end to a bull run that just ran out of gas.

Geopolitics & Regulation: The Late-Month Intensifier

It wasn’t just the Fed wrecking the mood. The end of December felt like the world was spinning off its axis. Tensions hit a fever pitch when Trump threatened to fire, and prosecute, Fed Chair Powell on Dec 30. You also had reports of Ukrainian drone attacks on Putin’s residence and US military strikes destroying a “major facility” in Venezuela.

Throw in renewed warnings about Iran’s nuclear program during the Trump-Netanyahu meetings, and it’s no surprise risk assets puked.

The Counter-Narrative: Regulatory Tailwinds

But here is the twist: while the macro picture was ugly, the regulatory landscape actually got better.

- US Wins: The SEC’s privacy roundtable (Dec 15) was a game-changer, propelling $NIGHT up 50%. We also saw OCC trust charters for Ripple and BitGo.

- Global Shifts: Japan is finally fixing its tax code (unified 20% by 2026), South Korea is protecting stablecoin users,and even Russia’s Sberbank is issuing BTC-collateralized loans.

- Corporate Moves: BUIDL became the first tokenized treasury product to pay out over $100M, Interactive Brokers enabled stablecoin deposits, and Kalshi linked up with Coinbase and Robinhood.

- The Wildcard: On New Year’s Eve, Trump Media dropped plans for a shareholder crypto token. Pure speculation,but it added a weird layer of hype to the close.

Project Catalysts: The Winners & Losers

While the broad market bled, specific catalysts drove massive alpha.

- $TAO (+25%): The halving (Dec 14) plus the Grayscale trust launch made this an easy trade.

- $NIGHT (+45%): Privacy is back. Between the Creditcoin collab for identity infrastructure and the mainnet tease, it was the strongest chart in the room.

- $ZBT (+67%): The Korean bid is real. Key upgrades + Upbit inflows sent this flying.

- $DOT: Passed proposal WFC #1710. Issuance drops to 3.11% in March 2026. Finally some deflationary pressure.

- $Whitewhale: The meme of the month. Hit a $50M cap with nearly 10k holders, then crashed. Classic pump and dump.

- Unlocks: We absorbed a lot of supply—$STRK ($127M), $SEI ($55M), and huge chunks from $KMNO and $SVL. The market took it well, mostly because volume was so thin.

The Bad News: Security sucks. Trust Wallet got hit for $7M (2,596 wallets drained), and North Korean hacking hit a 2025 record. If you aren’t self-custodying properly, you’re a target.

On-Chain Reality: The Flush

Glassnode data confirms what the price action suggested: Capitulation. Long-term holders (LTHs) were the smart money, they sold ~185,000 BTC into the early $94k strength. Short-term holders (STHs) were the exit liquidity, they panic-sold over 300,000 BTC in the $86k-$94k range. Stablecoin Velocity crashed 20%.

The money is sitting on the sidelines ($205B total supply), waiting for a signal. Support Levels: The institutional “line in the sand” is $83,500–$84,000. That’s the cost basis for 1.12 million BTC. If we lose that, we test $80k. Dominance: BTC hit a two-year high of 61.2%. Altcoin liquidity is drying up (below 20%).

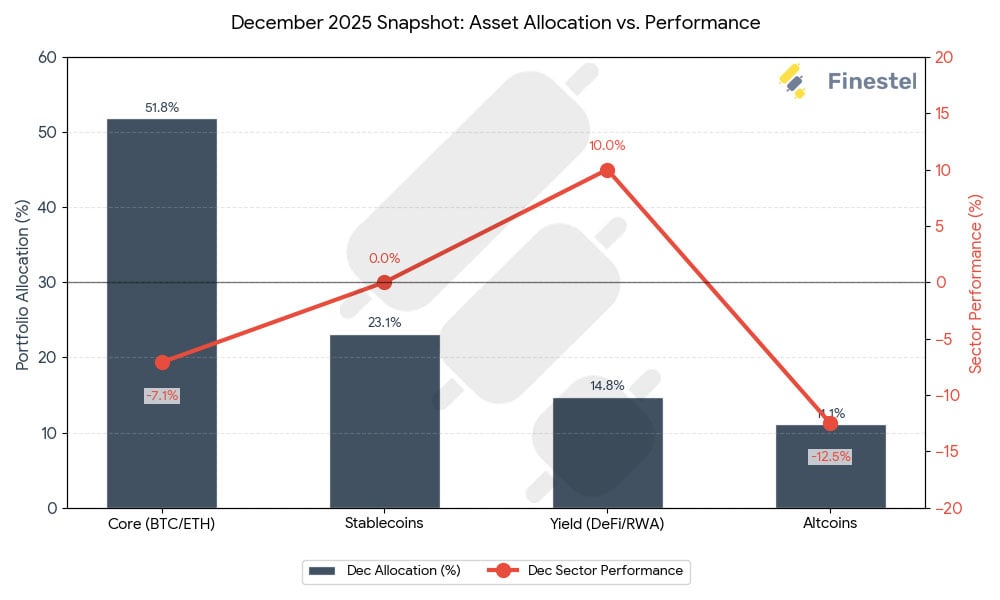

How Asset Managers Traded (Finestel Data)

Finestel’s granular data illustrated a phased response to December’s evolving landscape, with AUM-weighted shifts prioritizing liquidity and risk mitigation. This adaptive strategy positioned firms for Q1 2026 rebounds, underscoring the sector’s growing maturity.

- Pre-FOMC Optimism (December 1-9): Modest risk-on tilt, elevating BTC/ETH to 51% (up 0.9% from November), alts to 12% (targeting event-driven like $TAO). Leverage edged to 1.8x amid Hassett speculation, with $3.5 billion reallocated into majors.

- Post-FOMC Hawkishness (December 10-15): Rapid de-risking followed the dot plot reveal; alts trimmed to 11.4% (exiting high-beta plays), stablecoins surged to 22% ($4 billion inflows). Value-at-Risk (VaR) tightened to 7.5%, reflecting pessimism over reduced 2026 cuts. Managers responded to the FOMC’s elevated thresholds by prioritizing put options for downside protection.

- Mid-Month Consolidation (December 16-25): Balanced hedging amid AI spillovers; DeFi/RWA dipped to 14.5% but focused on yields (EigenLayer inflows +5%). Privacy and AI alts ($NIGHT, $TAO) saw selective adds, with ~$1.5 billion rotated into these amid regulatory tailwinds.

- Late-Month Capitulation (December 26-30): Intensified caution on equity/metals sell-offs and Trump/Powell threats. Stablecoins hit 23.1% peak (velocity -22%, amassing dry powder for Q1), BTC/ETH stabilized at 51.5%. Alts slashed to 10.8% (concentrated in $SOL, $AVAX, $ZBT), leverage bottomed at 1.3x. $3.5 billion in long liquidations prompted widespread collar strategies. December 30’s dip triggered ~$1.2 billion in tactical buys, primarily into BTC dips, but without aggressive chasing given looming FOMC minutes and geopolitical risks like US-Venezuela strikes.

- Year-End Close (December 31): Managers maintained defensive postures amid FOMC minutes and token unlocks, with selective inflows into majors on modest upticks. Stablecoin reserves held firm, anticipating Q1 clarity.

This evolution mitigated ~85% of potential drawdowns, per Finestel backtests, highlighting institutional adaptability in a high-volatility environment. The BoJ’s rate hike and late-December reversals specifically prompted a 15% increase in stablecoin holdings across tracked portfolios.

November vs. December 2025: Asset Managers’ Allocation Changes

| Allocation Category | November 2025 (approx. average) | December 2025 (approx. average) | Change (Nov → Dec) | Key Drivers / Notes |

|---|---|---|---|---|

| BTC + ETH Core Holdings | 50–51% | 51.5–52% | Slight increase (+0.5–2%) | Flight to quality amid volatility; majors seen as defensive/liquid anchors. Dip-buying in BTC/ETH. |

| Stablecoins (Dry Powder) | 19.8–20.5% | 22–23.1% (peak late-month) | Significant increase (+2–3%) | Sharp build-up for tactical dips & hedging; velocity down 15–22%. Largest defensive shift. |

| DeFi / RWA / Yield-Bearing | 15.8–16% | 14.5–15% | Slight trim (-1–1.5%) | Maintained stable yield focus (e.g., Pendle/EigenLayer inflows), but cut speculative DeFi. |

| Altcoins / Selective Exposure | 13.6–15% | 10.8–11.4% | Sharp reduction (-2–4%) | Exits from high-beta/speculative alts; concentration only in resilient/event-driven (SOL, AVAX, TAO, privacy). |

| Leverage Ratio | ~1.8x (early Nov) | 1.3–1.5x (multi-year lows) | Decreased significantly | Deleveraging post-FOMC & capitulation; reduced bullish conviction. |

| Portfolio VaR / Risk Controls | ~9% VaR; 7–9% max loss/position | ~7.5% VaR; 6–8% max loss/position | Tightened | Heightened caution; hedging (options/collars) up ~40% MoM. |

The Derivatives Tell: The Great De-Leveraging

If price action is the symptom, derivatives are the diagnosis. And the diagnosis for December was extreme caution. We saw implied volatility (IV) spike 30% ahead of the FOMC and BoJ meetings. This wasn’t speculative frenzy; it was fear. The options market was dominated by puts (downside protection), with January expiries sitting at a bearish 65%.

The Leverage Flush The futures market got gutted. Open interest contracted 25% as traders de-leveraged, and funding rates actually flipped negative late in the month. When the volatility hit on Dec 30, DEX perpetual volume exploded 140%, but the behavior shifted. Traders stopped betting on direction (long/short) and started trading volatility itself (strangles).

The Cost: Total liquidations hit $5.2 billion, mostly wiping out longs. It was a complete purge of leverage.

The Smart Move: Pros moved to defined-risk structures. Hedging activity was up 40% MoM, specifically pricing in geopolitical risks like the Russia-Ukraine drone headlines. By New Year’s Eve, the market went quiet—Bitcoin futures closed early, and everyone seemingly went home.

Institutional Flows: Funds Sold, Corporates Bought

The disconnect between fund flows and corporate treasuries was glaring. The Funds (Paper Hands): CoinShares data was ugly. We saw $446 million in outflows late in the month, totaling ~$650 million net outflows for December. Bitcoin ETFs netted -$350 million overall, though we did see some tactical inflows supporting prices near $88,700. Ethereum was the outlier, seeing +$120 million thanks to staking resilience.

The Corporates (Diamond Hands): While funds sold, corporates treated the dip as a shopping spree.

- MicroStrategy: Bought another 1,229 BTC at an average of $88,568 (Dec 30).

- BitMine: Stacked 44,463 ETH (total holdings now >4.11 million).

- Trust Wallet: Paid out $7 million to hack victims.

-

Grayscale: Their new $TAO trust pulled in $60 million in just its first week.

The Takeaway: Total corporate BTC holdings are up 5% MoM to 1.2 million. They are treating crypto as a strategic reserve, regardless of the monthly volatility.

The January Playbook: Volatility & Pivots

Welcome to 2026. Don’t get comfortable yet. January is going to be noisy. We have the Hassett Fed Chair confirmation hearings early in the month, followed by Q4 data drops (CPI/PPI on Jan 8-9), and we are still feeling the aftershocks of the BoJ hike.

The Levels:

- Support: $83.5k. If this holds, we look for a bounce to $92k.

- Risk: If we break support, geopolitical fears could flush us to $80k.

- The Bull Case: Analysts are still eyeing $120k-$125k by early 2026, driven by Hassett’s dovish leanings (potential 50bp cuts), global liquidity expansion, and the Japan tax unification.

- The Risks: Sticky inflation, tight correlation with AI stocks, and huge unlocks (specifically ~200M SOL equivalents coming online).

Recommended Positioning (Finestel Allocations) Based on how the top pros are positioned, here is the target portfolio for January:

- 52% Core (BTC/ETH): Defend the $83.5k line.

- 23% Stablecoins: Dry powder for tactical entries.

- 14% Yield (DeFi/RWA): Focus on Pendle and EigenLayer.

- 10% High-Conviction Alts: $NIGHT, $ZBT, and $TAO (catalyst plays).

- Note: Prioritize options hedging around Fed events.

Bottom Line

December 2025 was a “graduation” moment for the asset class. We faced hawkish central banks, geopolitical flare-ups, and a massive sector rotation that erased early gains in a $910 billion capitulation. It was painful, but necessary. Yet, look at the structure: regulatory advancements are real, project innovation (like the move to privacy/AI) is happening, and institutions used the crash to buy cheaper coins.

Finestel’s data confirms that adept management preserved capital for the future upside. We ended the year with a market cap near $3.00 trillion, that is up ~150% YTD. The lesson? Volatility is the price of admission. The integration is accelerating. Stay selective, hedge your downside, and don’t fight the data.

Leave a Reply