If you’ve ever found yourself logging into Binance, then switching to Bybit, then opening another tab for OKX, you already know the problem. Managing multiple cryptocurrency exchange accounts means juggling different interfaces, repeating the same actions over and over, and constantly switching contexts. It’s inefficient, mentally exhausting, and leaves plenty of room for costly mistakes.

Finestel’s Trading Terminal exists to solve exactly this problem. Instead of treating each exchange as a separate island, it brings everything into one unified workspace. You connect your accounts once, and from that point forward, you can trade across all of them from a single screen. More importantly, you can execute the same trade across multiple accounts simultaneously, adjust settings in bulk, and maintain consistency without the repetitive manual work.

Whether you’re managing client portfolios, running the same strategy across different exchange accounts, or simply trying to keep your personal trading organized, the terminal gives you the control and efficiency that makes professional-grade trading possible.

Getting Started in Finestel’s Trading Terminal User Guide: Your First Connection

Before you can use the terminal, you need to connect Finestel and your exchange accounts. This happens through API keys, which are essentially permission slips that let Finestel see your balances and execute trades on your behalf.

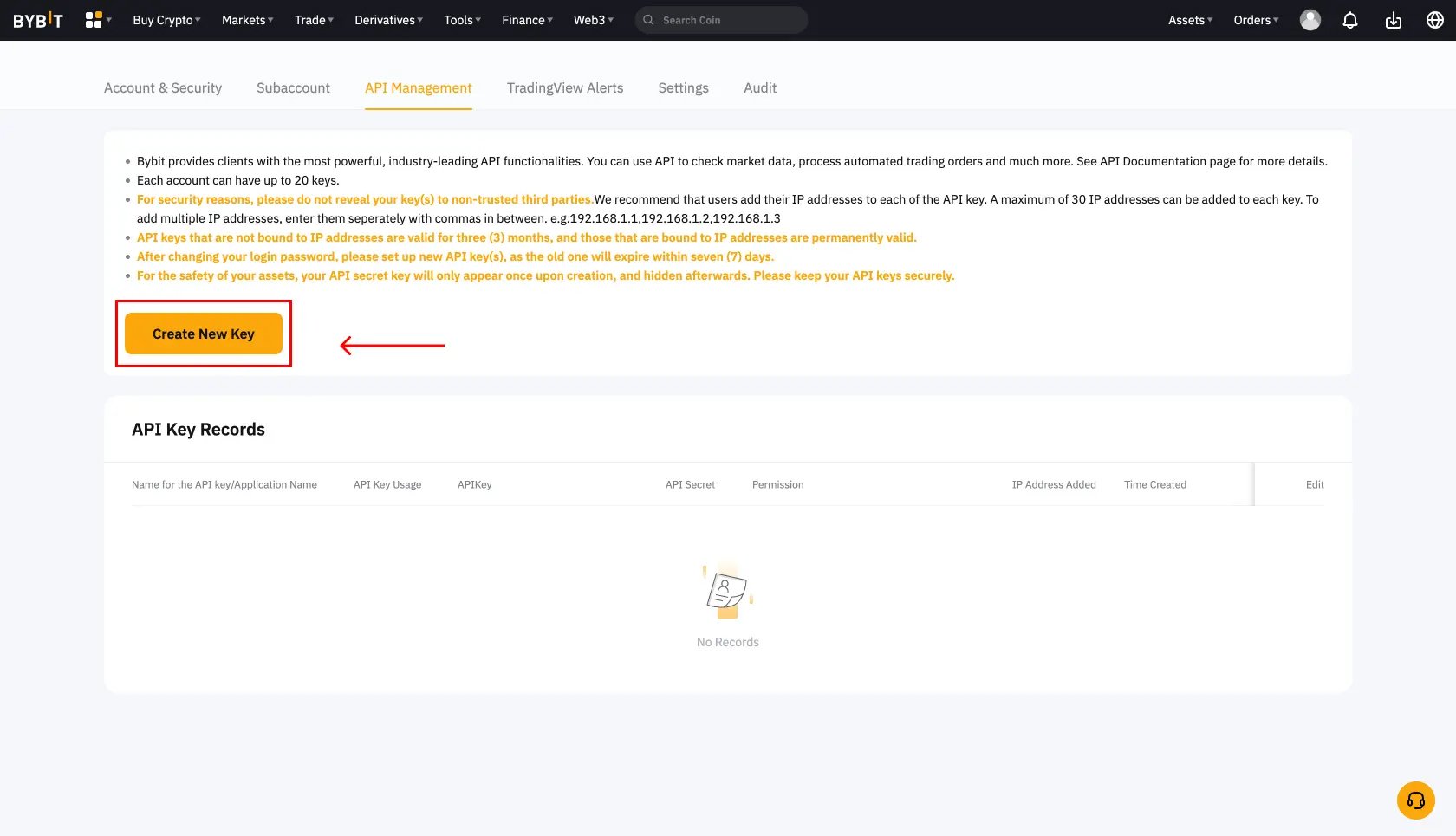

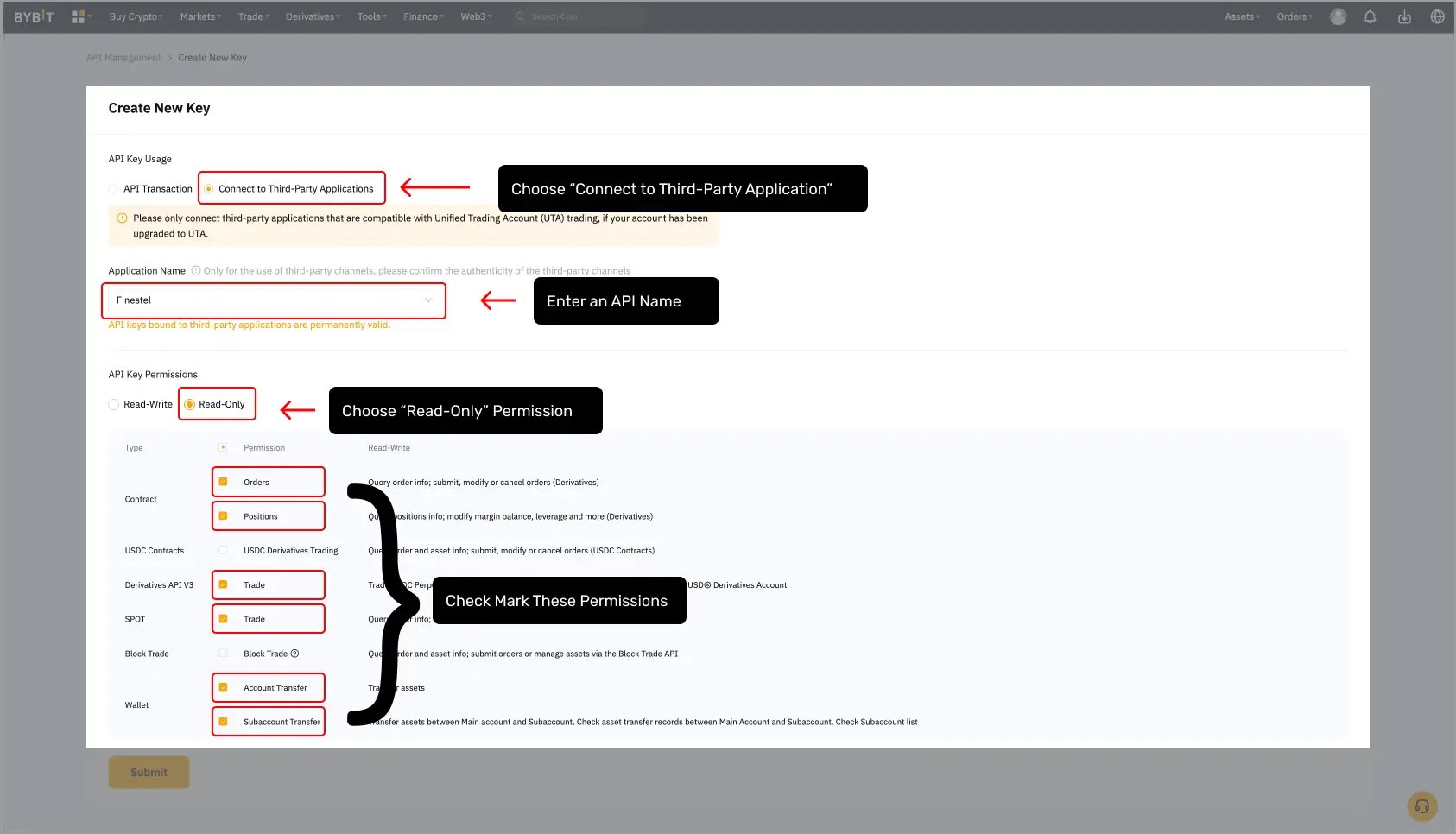

Step 1: Create Your API Key

Start on the exchange itself. Log into your account (let’s say Bybit), navigate to API Management, and create a new API key. Here’s what matters: enable Read and Trade permissions, but never Withdrawal permissions. This means even if someone gained access to your API key, they could place trades but couldn’t move your funds off the exchange.

The exchange will show you two pieces of information: an API Key and a Secret Key. Copy both carefully. You’ll only see the Secret Key once, so if you lose it, you’ll need to create a new key entirely.

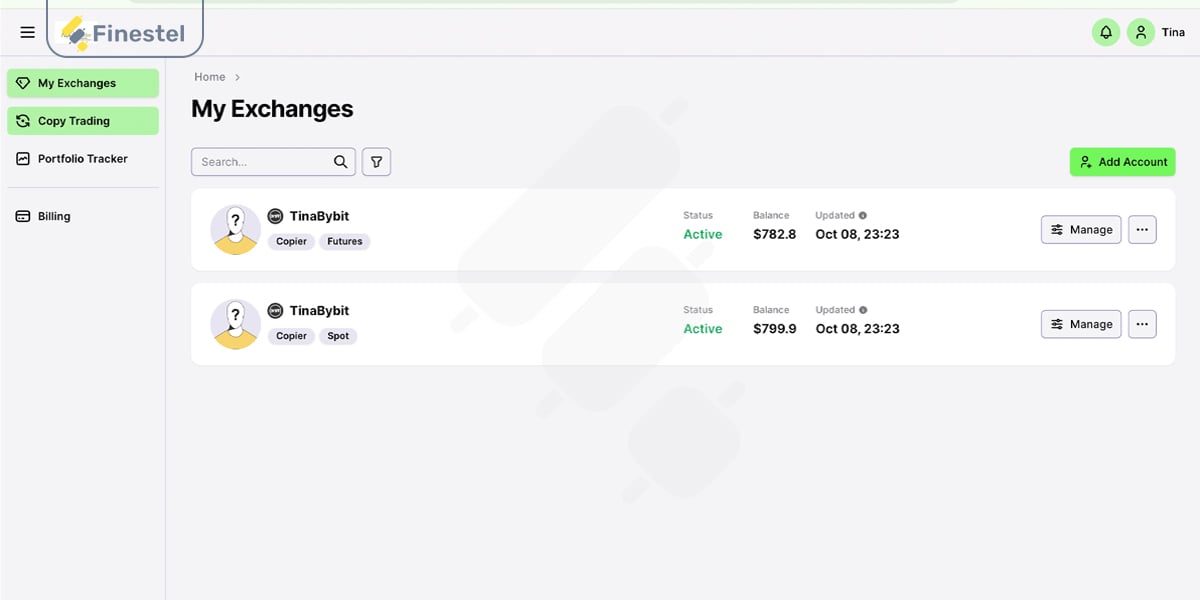

Step 2: Connect to Finestel

Open the Finestel terminal and look for account settings in the top-right corner. Click to add a new account, and you’ll see a form asking for the exchange name, your API Key, your Secret Key, and a nickname. Choose a descriptive nickname like “Personal_Bybit” or “Master_John_Bybit” so you can distinguish accounts at a glance.

After you submit, the terminal attempts to connect. If everything works, your account appears in the account selector and you’ll see your balance. If you get an error, check that your API credentials are correct and that you enabled the right permissions.

Finestel supports eight major exchanges: Binance, Binance.US, Bybit, OKX, KuCoin, Gate.io, Bitget, and MEXC. You can connect accounts from all of them.

Ready to connect your first account? Start using Finestel Terminal now and experience unified multi-exchange trading.

Understanding the Workspace

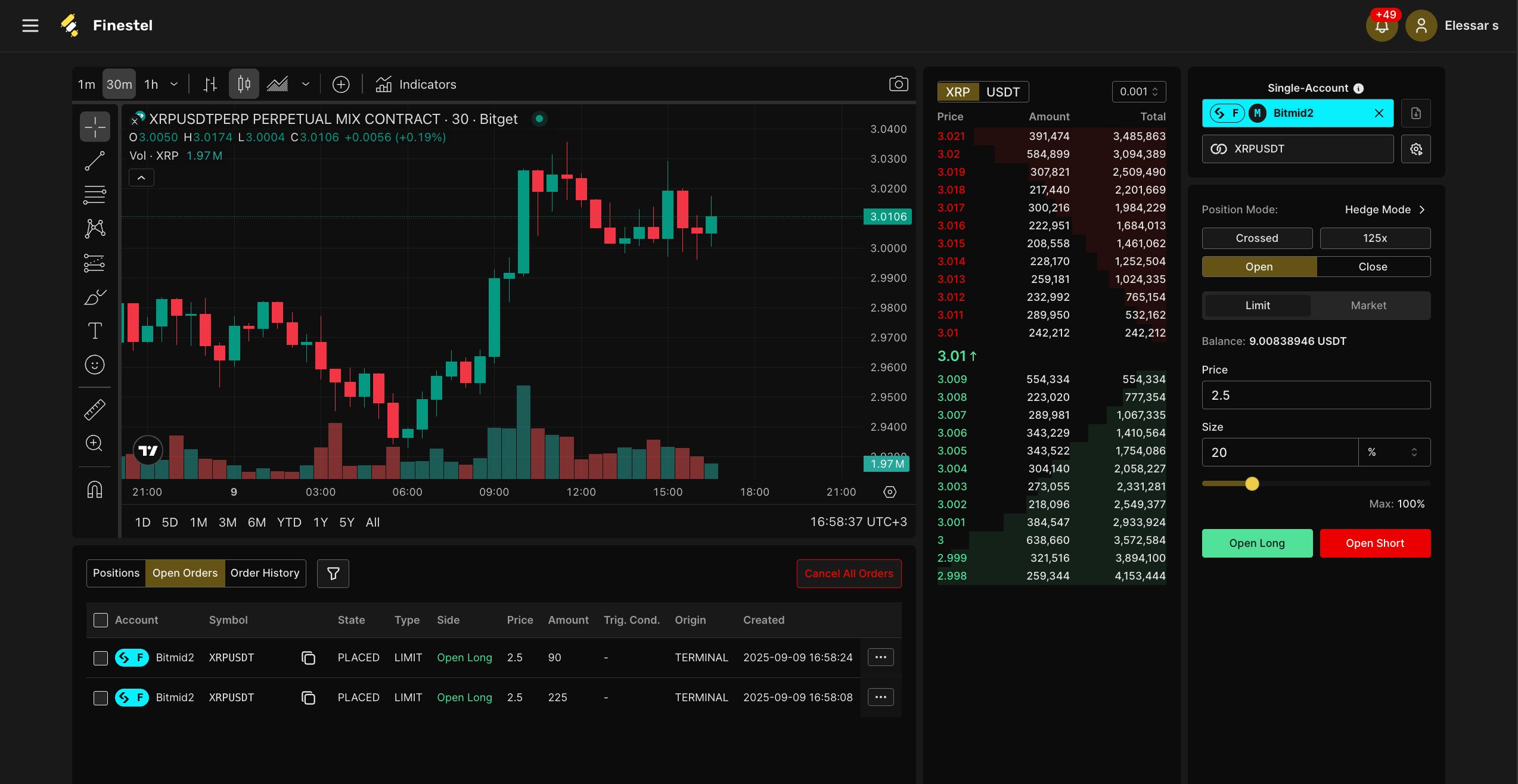

The terminal layout is straightforward. The center shows a TradingView chart with all the professional tools you’re used to, timeframes, indicators, drawing tools. The left sidebar gives you quick access to chart settings and technical analysis tools.

The right panel is where the action happens. At the top, you’ll see which trading pair you’re viewing (like BTC/USDT or ETH/USDC) and the live order book below it. The most important element is the mode selector, where you choose between Single-Account and Multi-Account trading.

In Single-Account mode, you’re working with one specific exchange account. In Multi-Account mode, you’re commanding multiple accounts simultaneously. This distinction is fundamental to how the terminal works.

Below that is the trading interface: order type selection (Limit, Market, or Conditional), position size entry, and execution buttons. You’ll also see your current position mode, leverage, and available balance.

At the bottom are tabs for Positions (your open trades), Open Orders (pending limit orders), and Order History. You’ll spend most of your time in the Positions tab, monitoring active trades and their real-time profit and loss.

Trading with a Single Account

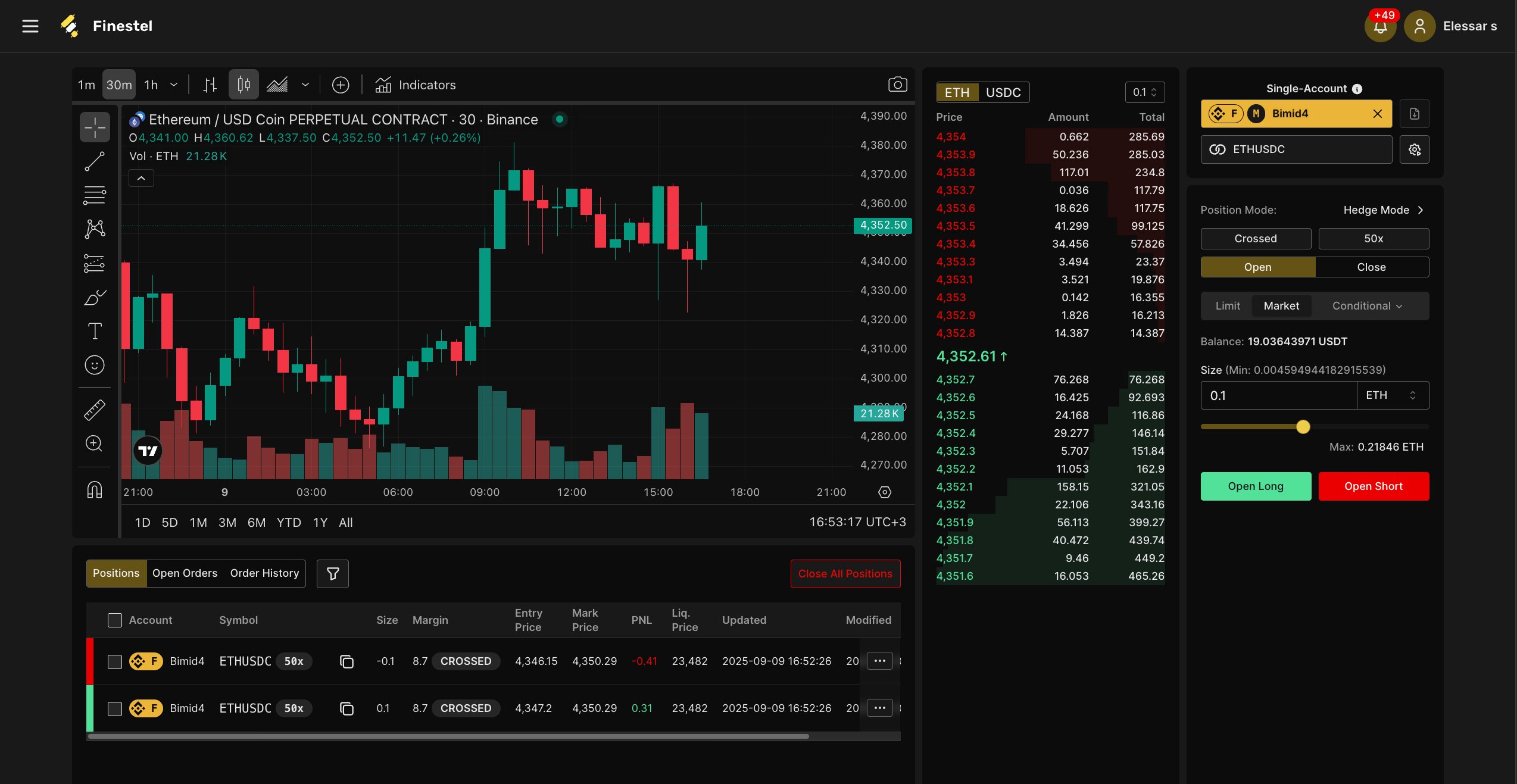

Single-Account mode is how you trade when you want to focus on one specific exchange account. Click the account selector and make sure you’re in Single-Account mode, then choose which account you want to use.

Understanding Your Settings

Before placing your first trade, look at the settings in the trading panel:

Position Mode can be One-Way or Hedge. In One-Way mode, you can only hold either long or short, not both. If you’re long and place a short order, it closes your long first. In Hedge mode, you can hold both simultaneously, useful for advanced strategies but potentially confusing.

Margin Mode determines your risk exposure. Crossed margin means your entire account balance backs every position, the system can use your full balance to prevent liquidation. Isolated margin allocates a specific amount to each position. If that position gets liquidated, it doesn’t affect your other funds. Isolated is safer for risky trades.

Leverage is your multiplier. At 50x leverage, you can open a position worth 50 times your margin. Higher leverage means higher potential returns but dramatically higher liquidation risk. Start with 5-10x if you’re new to this.

Step 3: Place Your First Trade

Let’s place a market order. Market orders execute immediately at the best available price, perfect when you want quick entry or exit.

Make sure you’re looking at the correct trading pair. Select Market in the order type tabs. Enter the size of your position (denominated in the base currency, so for ETH/USDC you’re entering how much ETH). When ready, click Open Long if you think the price will rise, or Open Short if you think it will fall.

The order executes within 0.5 seconds, and your new position appears in the Positions tab.

Using Limit Orders

Limit orders wait for your specified price instead of executing immediately. Select Limit, enter your desired price and position size, then click Open Long or Open Short. Your order sits in the Open Orders tab until the market reaches your price. If it doesn’t, the order stays pending until you cancel it.

Managing Positions

In the Positions tab, you see everything: entry price, current market price, unrealized profit or loss, and liquidation price. To close a position entirely, click on it and use the Close button. For partial closes, enter the amount you want to close and execute—the platform reduces your position while keeping the rest active.

The Power of Multi-Account Trading

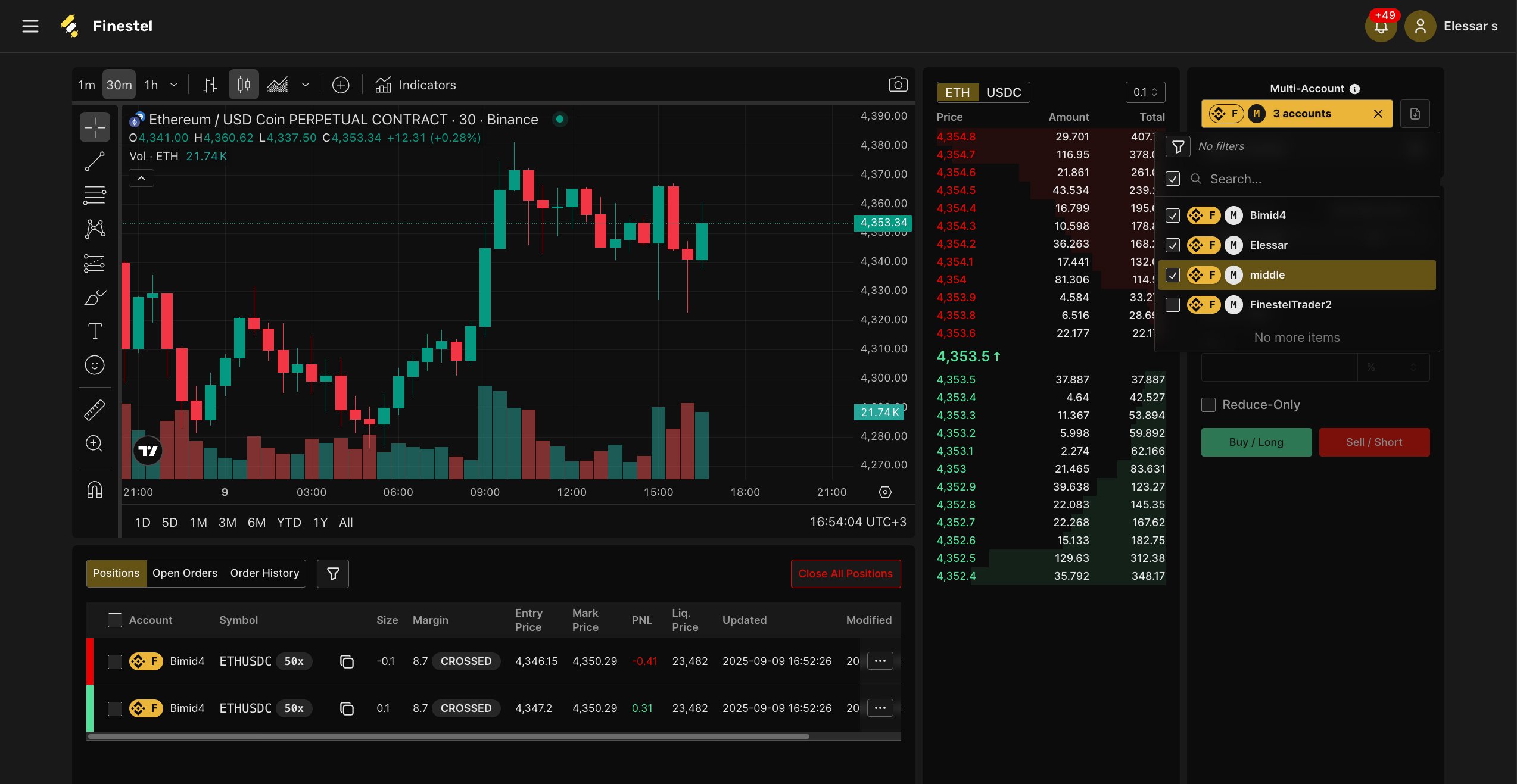

This is where Finestel becomes something more than just another trading interface. Multi-Account mode lets you control multiple exchange accounts as if they were one.

Switch to Multi-Account mode using the selector at the top right. Choose which accounts participate, let’s say three accounts: two on Bybit and one on Binance. The interface shows “3 accounts” and displays a new dropdown: “Actions on 3 Exchanges.”

Executing Bulk Trades

The trading panel looks similar to single-account mode, but instead of “Open Long” and “Open Short,” you see “Buy/Long” and “Sell/Short.” These buttons now trigger bulk execution across all selected accounts.

Here’s a practical example: You’ve analyzed ETH/USDC and want to open a long position with $1,000 on each account. That’s $3,000 total across three accounts. Select Market order type, enter 1000 in the size field, and click Buy/Long.

Within seconds, the terminal places three separate orders simultaneously. You don’t switch contexts, re-enter sizes, or risk mistakes. Your three positions appear in the Positions tab, each showing individual entry prices and profit/loss.

Sizing Options

Size entry in multi-account mode is flexible. You can enter a fixed amount (same dollar value on each account) or use percentage-based sizing (calculates position size as a percentage of each account’s balance). Percentages work well when accounts have different sizes but you want proportional exposure.

The Reduce-Only checkbox is a safety feature. When enabled, orders can only decrease existing positions, never open new ones. Perfect for taking profits or implementing stop-losses without accidentally increasing exposure.

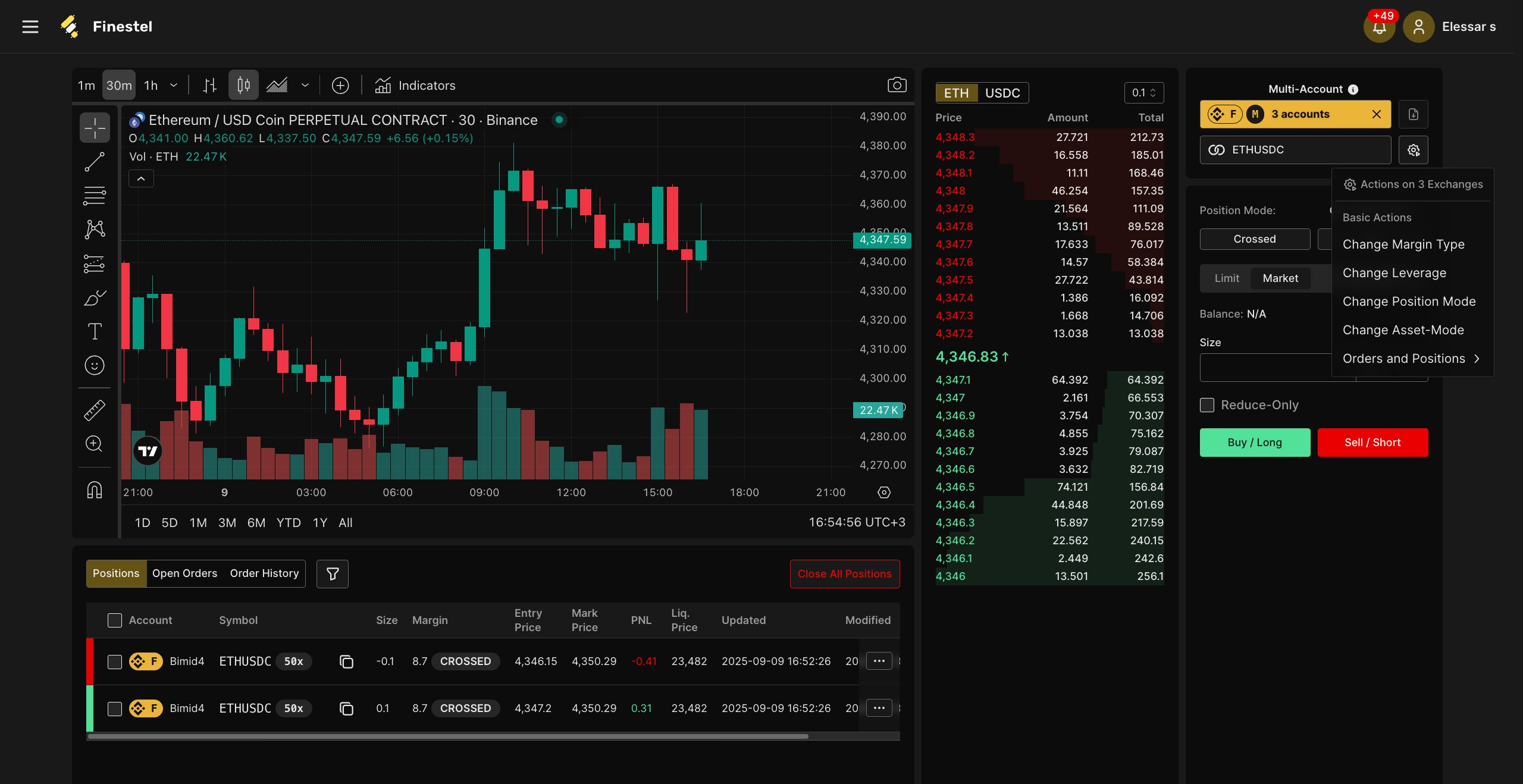

Bulk Operations: Standardizing Your Accounts

Multi-account trading requires consistent configuration. If one account uses 20x leverage and another uses 50x, the same position size represents very different risk levels. Bulk operations solve this.

Click “Actions on 3 Exchanges” to see settings you can change across all selected accounts simultaneously.

Experience the efficiency yourself: Try Finestel Terminal free and see how multi-account trading transforms your workflow.

Synchronizing Leverage

Want to standardize all accounts to 20x leverage? Select “Change Leverage,” enter 20, and confirm. The terminal adjusts leverage across all accounts within moments. Different exchanges have different maximum limits, so if you try to set 125x and one exchange only allows 100x, the terminal uses the closest available value.

Changing Margin Type

Switching all accounts from Crossed to Isolated margin is one click. Select “Change Margin Type” and choose Isolated. This is particularly useful before risky trades where you want strict downside limits.

Adjusting Position Mode

Transitioning from one-directional strategies to hedging? Switch all accounts from One-Way to Hedge mode at once. This ensures consistent behavior when you start placing hedged positions.

Managing Orders and Positions

The “Orders and Positions” submenu lets you modify or close positions across multiple accounts. Want to close all ETH positions everywhere? One command. Need to cancel all pending limit orders? One click.

At the bottom of the Positions tab, there’s a red “Close All Positions” button. This is the nuclear option—it closes every open position across all selected accounts immediately. Use it for emergencies when you need to get flat fast.

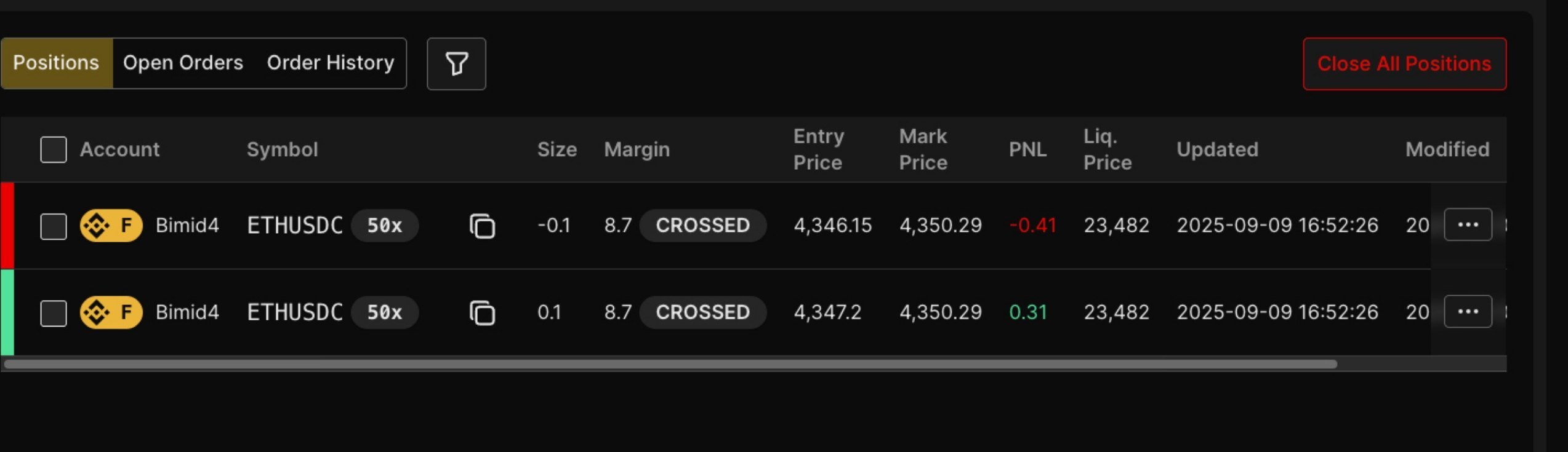

Understanding the Bottom Panel: Positions, Orders, and History

At the bottom of the terminal, you’ll find three tabs that give you complete visibility into your trading activity. Each serves a specific purpose, and understanding how to read them is essential for effective position management.

The Positions Tab

This is your command center for active trades. Every open position appears here, whether you’re in single-account or multi-account mode.

The Account column shows which exchange account holds the position, marked with the account’s icon and name. The Symbol column tells you what you’re trading (like ETHUSDC). Next to it, you’ll see the leverage multiplier (something like 50x) which reminds you of your risk exposure at a glance.

Size shows your position amount. Positive numbers indicate long positions, negative numbers indicate shorts. The Margin column displays whether you’re using CROSSED or ISOLATED margin for that specific position.

Entry Price is where you opened the position. Mark Price is the current market price. The difference between these determines your profit or loss. Speaking of which, the PNL column shows your unrealized profit and loss. Green numbers mean you’re winning, red means you’re losing. This updates in real time as the market moves.

Liq. Price (liquidation price) is critical. This is the price level where your position will be automatically closed by the exchange to prevent your losses from exceeding your margin. With high leverage, this can be relatively close to your entry price, so keep an eye on it.

The Updated timestamp shows the last time the position data refreshed, while Modified shows when you last manually changed something about the position.

In the top-right corner of the Positions tab, there’s a red button: Close All Positions. Click this and every open position across all selected accounts closes immediately. It’s there for emergencies, but use it carefully, there’s no undo.

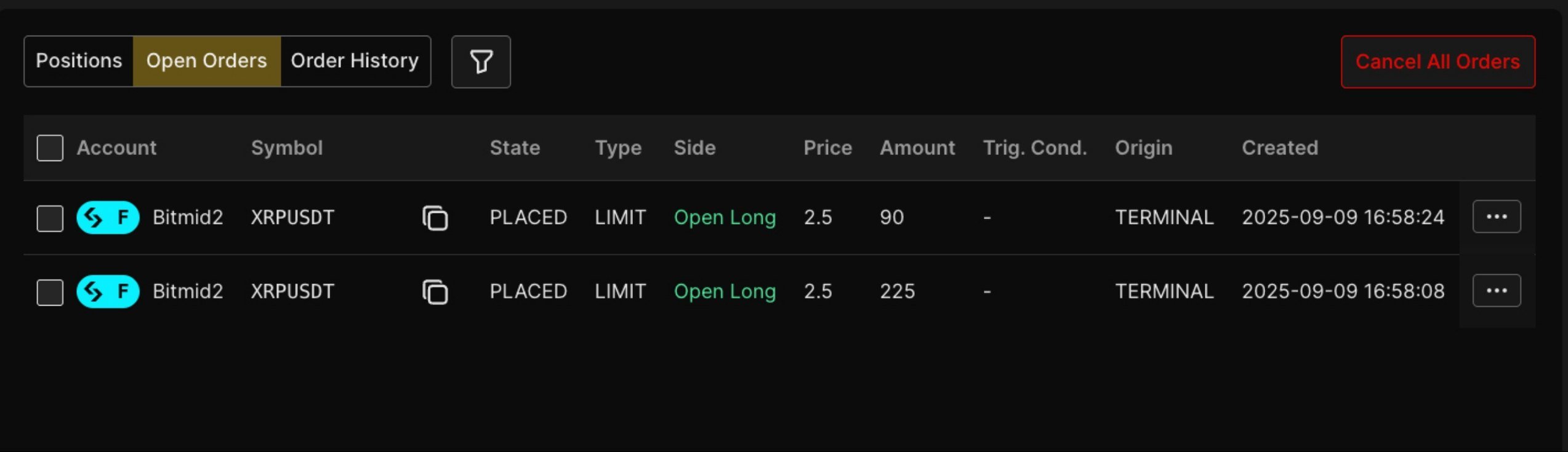

The Open Orders Tab

This tab shows all your pending limit orders, trades that haven’t executed yet because the market hasn’t reached your specified price.

Each row shows the Account and Symbol for the order. The State column will show PLACED for active orders waiting to execute. Type indicates what kind of order it is (usually LIMIT for this tab). Side tells you whether it’s an Open Long or Open Short order.

Price is your limit price; the level where you want the order to execute. Amount shows how much you’re trying to buy or sell. The Trig. Cond. column is for trigger conditions if you set any. Origin shows where the order came from (usually TERMINAL). Created displays when you placed the order.

You can select individual orders using the checkboxes on the left and cancel them, or use the Cancel All Orders button in the top-right to clear everything at once. This is useful when your pending orders are no longer relevant to your current strategy.

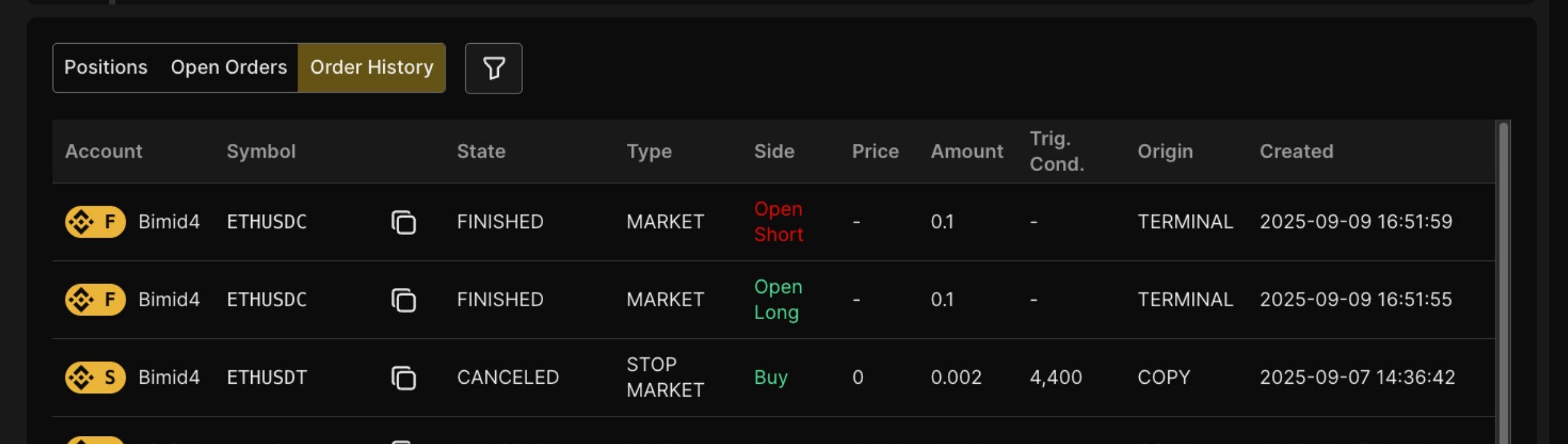

The Order History Tab

This is your trading record; every order you’ve placed through the terminal, whether it executed, got canceled, or failed.

The columns are similar to Open Orders, but there are key differences. The State column now shows FINISHED (for executed orders), CANCELED (for orders you canceled), or other status indicators. The Type column shows MARKET for market orders, LIMIT for limit orders, and STOP MARKET for stop-loss orders.

The Side column is particularly informative in Order History because it shows you exactly what action the order took: Open Long, Open Short, Buy (which could be closing a short), or Sell (which could be closing a long).

This historical view is valuable for reviewing your trading patterns, checking exact execution prices, and understanding what happened during fast-moving markets. If you’re wondering “did that order fill?” or “what price did I actually get?”, this tab has the answers.

Conclusion

The Finestel Trading Terminal solves a simple problem: trading across multiple exchange accounts manually is inefficient and error-prone. The terminal consolidates everything into one interface where your orders execute simultaneously, your settings change in bulk, and you focus on strategy instead of mechanical repetition.

The learning curve is gentle. Single-account trading feels familiar immediately. Multi-account trading clicks after trying it once or twice. Start simple, connect one account, get comfortable, then expand to multiple accounts and bulk operations.

Trading is about making good decisions under uncertainty. The terminal doesn’t make those decisions for you, but it removes friction from execution. You get more time to think and less time clicking. Use it thoughtfully, respect the risks inherent in leveraged trading, and it will serve you well.

Stop juggling multiple exchange tabs. Start using Finestel Terminal today and trade smarter across all your accounts from one powerful interface.

Leave a Reply