October threw everything at crypto markets. We saw Bitcoin hit $126k (a new record), then dump 13% in a single day. That’s the kind of volatility that makes even experienced traders uncomfortable. Tariff threats, government shutdown chaos, bank failures, and then suddenly trade de-escalation and a Fed rate cut. If you felt whipsawed this month, you weren’t alone.

Markets ended October cautiously optimistic. Bitcoin closed around $109k, Ethereum held near $3800, and institutional money stayed mostly defensive. The sharp corrections exposed how fragile liquidity really is, especially in altcoins where some projects dropped over 80%. But the late-month recovery, backed by cooling inflation and dovish Fed signals, suggests the structure’s still intact underneath all that noise.

This October crypto market report breaks down what actually happened, how professional traders adjusted, and what to watch heading into November. We’re pulling from KuCoin‘s institutional insights with Finestel’s exclusive asset manager dataplus broader market data to give you a practical view of where things stand.

Macro Environment: Shutdown Meets Trade Wars Meets Fed Pivot

The US government shutdown that started September 30 is still ongoing. That’s a problem because we’re flying blind on key economic data. No non-farm payrolls. No official CPI releases from government sources. The Fed’s trying to make policy decisions without complete information, which adds uncertainty to everything.

Early October was rough. President Trump escalated tariffs on China, specifically targeting edible oils while denying reports of broader 100% tariffs. Markets freaked out. Regional banks like Zions and Western Alliance disclosed fraud losses and bad debts, which triggered credit concerns across risk assets. Bitcoin dropped along with stocks.

Then things started improving. Gaza ceasefire on October 14. China-US trade talks on October 18. China bought US soybeans on October 28. Trump floated cutting the proposed fentanyl-related tariff in half. Each piece of news took a bit of pressure off.

The Fed cut rates by 25 basis points on October 29, which was expected. More importantly, Powell hinted at potentially ending quantitative tightening sooner than planned. That’s significant because it means more liquidity potentially flowing back into risk assets. Reuters surveys now project two more cuts in 2025, though 2026 remains uncertain.

Meanwhile, September CPI came in at 3%, below the 3.1% expectation. Not dramatic, but enough to support the dovish narrative. The Bank of Japan continues talking about rate hikes if their economy cooperates, which contrasts with Fed dovishness and affects dollar flows.

By month-end, the macro picture looked better than mid-October, but the shutdown’s still unresolved. That means data gaps continue, which keeps some uncertainty baked in.

Bitcoin: Record High to Panic Sell to Recovery

Technical indicators showed exactly what you’d expect from that kind of volatility. Bollinger Bands expanded significantly. The BTC Volatility Index spiked mid-month before settling down. Nothing surprising there, the market was pricing in real uncertainty.

What’s more interesting is what happened on-chain. Long-term holders barely moved, remaining stable throughout the swings and even slowing their selling in lower ranges like 60k-68k. Short and medium-term holders, the ones who bought between $108k-$124k near the highs, actively sold during the correction, with reductions concentrated around 116.9k. On-chain transfers hit 2.1 million BTC, the highest since December 2024, and over 300,000 BTC changed hands in high-volume price ranges.

By month-end, accumulation zones had shifted higher despite the net drawdown. Early October showed buying support building at $104k-$112k, with institutional chips reinforcing around $117k initially. By late October, that support had consolidated to $108k-$110k, bolstered by surges in buying orders at 107.3k-108.5k (109,000 units added at 106k-107k) and 109.8k-111.1k, plus increased holdings at 108.7k. That’s a positive sign; it suggests the correction reset the structure at higher levels rather than breaking it, with reduced selling pressure from long-term holders under 100,000 shares.

Bitcoin dominance climbed from 58% to 59.48%, peaking at 59.31% mid-month. That’s a clear flight to quality. When markets get volatile, capital moves to Bitcoin and out of riskier altcoins.

Ethereum: Steady Performance, Staking Provides Floor

Ethereum mirrored Bitcoin’s volatility but with less dramatic swings. Gained about 3% for the month, closing near $4,600. Not exciting, but not terrible either.

What kept ETH relatively stable was its role in institutional portfolios through staking. Participation rates held around 30%. Platforms like Lido and EigenLayer continued seeing inflows. When you’re earning 6-8% yield on ETH through staking, that provides a floor during corrections.

Real-world asset (RWA) tokenization on Ethereum also helped. Tools like Pendle, which is approaching $7 billion in TVL, give institutions a way to earn yield on tokenized assets. That’s defensive appeal during volatile periods.

Ethereum underperformed Bitcoin this month, which makes sense. Capital concentrated in BTC as the “safe” crypto asset. But on-chain data showed institutional buying aligned with staking opportunities. Active addresses rose about 8%, tied to staking activity.

The takeaway: ETH’s not leading this market, but it’s holding up based on fundamental utility rather than just speculation.

Altcoins Performance in October 2025 Crypto Market Report: Brutal Corrections, Liquidity Problems Exposed

This was an ugly month for altcoins. Most saw drawdowns exceeding 80% during the correction phase. Bitcoin dominance rising to 59.48% tells you where the capital went, out of alts, into BTC.

The corrections exposed structural problems. Many altcoin markets have terrible liquidity. When selling pressure hits, prices collapse because there aren’t enough bids to absorb the selling. This isn’t new information, but October provided a harsh reminder.

Late-month trade de-escalation sparked partial recoveries in mainstream Layer 1s like Solana and Avalanche. Some narratives around AI integration and DeFi showed signs of life. But the capital rotation from Bitcoin into alts remained limited.

Professional managers shortened their holding periods significantly. They’re playing event-driven trades now, new listings, specific catalysts, rather than holding positions through volatility. That approach makes sense when liquidity’s this fragile.

October Performance Summary

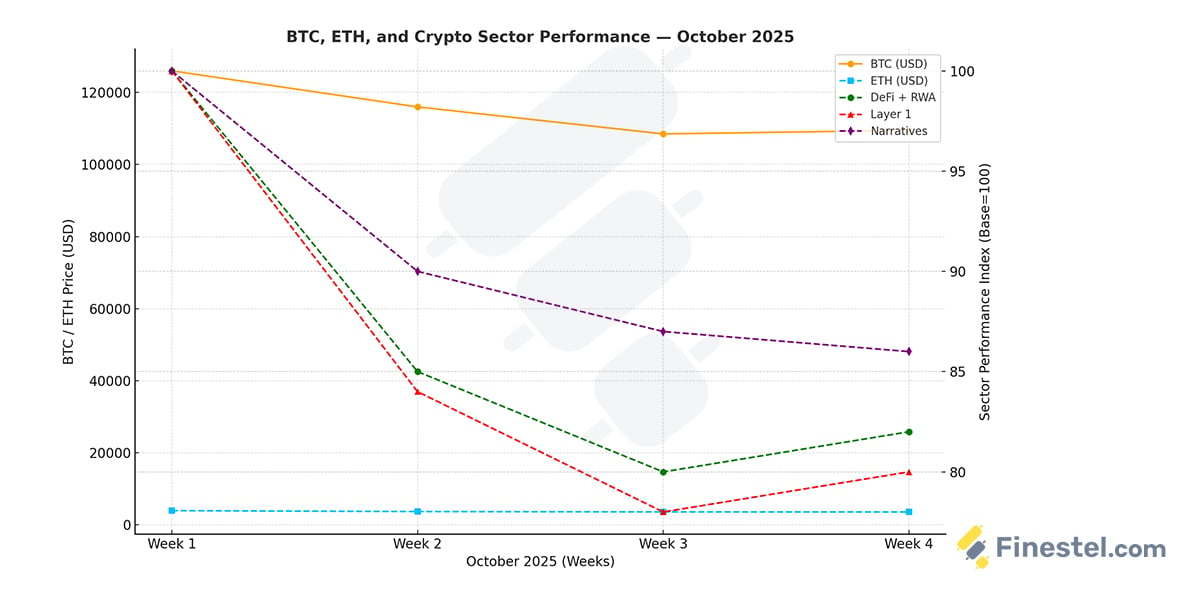

| Metric | Week 1 (Oct 1–5) | Week 2 (Oct 6–12) | Week 3 (Oct 13–19) | Week 4 (Oct 20–26) | Week 5 (Oct 27–31) | Monthly Trend |

|---|---|---|---|---|---|---|

| BTC Price | $114k–$125k | $104k–$126k | $106k–$116k | $106k–$115k | $106k–$116k | -4% |

| ETH Price | ~$4,146–$4,616 | ~$3,843–$4,755 | ~$3,833–$4,293 | ~$3,808–$4,178 | ~$3,682–$4,251 | -11% |

| Market Cap | $4.01T | $3.85T | $3.78T | $3.92T | $3.70T | -7.5% |

| Avg. Daily Volume | $145B | $160B | $155B | $140B | $125B | +5% |

| BTC Dominance | 58% | 59.48% | 59.2% | 59% | 58% | 0% |

Week 2 was the pain point, that’s when Bitcoin hit $126k then crashed. Market cap dropped $160 billion. Volume spiked as people scrambled. The recovery started Week 3 and continued through month-end, though volumes stayed elevated.

Derivatives: Hedging Over Speculation

Derivatives markets dominated trading volume at over 75% of total turnover. Options open interest hit record highs as traders hedged against policy uncertainty and potential volatility around Fed decisions.

Futures positions and leverage ratios fell to yearly lows. That’s significant. Even as prices recovered, traders stayed cautious about leverage. After watching 82% of liquidations hit long positions during the correction, that caution makes sense.

Platforms like dYdX and GMX saw perpetual futures volume surge, but the positioning shifted. Early month was bullish. By mid-month, traders focused on volatility strategies rather than directional bets. Around FOMC and major trade announcements, the market was basically saying “we don’t know which way this goes, just that it’ll move.”

Professional traders used spreads and collar strategies around major events. They’re betting on upside after potential QT ending, but protecting downside with defined-risk positions.

On-Chain Data: Accumulation at Higher Levels

Active addresses grew 7% mid-month as new capital flowed in. Whale distributions hit highs during the $126k peak, large holders took profits. But OTC accumulation continued, with wallet counts growing 4%. That’s institutional money coming in through private deals rather than exchanges.

Stablecoin inflows reached $2.8 billion, but velocity dropped 20%. That means stablecoins are sitting on sidelines rather than immediately deploying. It’s dry powder waiting for opportunities.

Short-term holders who bought the highs exited quickly during corrections. That’s healthy; it purges weak hands. Long-term holders didn’t move, which signals confidence in the longer-term trajectory despite short-term chaos.

The support zone reshaping higher, from $104k-$112k early month to $108k-$110k late month, suggests accumulation is setting a higher floor under Bitcoin.

Institutional Activity: Cautious but Still Buying

Bitcoin spot ETFs saw strong inflows early October, around $1.4 billion in one week, the second-highest on record. That slowed during the mid-month correction as publicly traded companies paused their buying programs. But as prices recovered, BlackRock and others resumed inflows.

Corporate treasuries added approximately 15,000 BTC. Companies like Bitdeer and Hut 8 were buyers. That’s continuation of the trend we’ve seen all year, companies treating Bitcoin as a treasury asset.

Custody infrastructure expanded. Fireblocks partnered with traditional finance banks to provide crypto custody services. That’s groundwork for institutional adoption down the road.

RWA platforms processed about $600 million in tokenized assets. Not huge numbers, but it’s steady growth in institutional-grade products.

Regulation: More Clarity, Less Uncertainty

Regulatory developments leaned positive this month. US-China trade discussions on October 26 ruled out 100% tariffs and opened talks on fentanyl cooperation. EU sanctions on Russian oil aligned with US policy. South Korea and UK pushed forward stablecoin frameworks.

Trump’s public criticisms of the Fed and Powell’s hints about ending QT sparked compliant inflows to tokens like XRP and LINK, assets with clearer regulatory positioning.

Overall, increased regulatory clarity encouraged family offices to consider 1-2% crypto allocations. Not massive moves, but directionally positive for institutional adoption.

Sector Activity: Defensive Positioning

Key narrative sectors showed defensive rotation. AI-focused projects like NEAR’s analytics tools gained attention during volatility as traders looked for data advantages. Perpetual DEX volume grew 150% as traders needed liquidity outside centralized exchanges during the chaos.

Tokenized RWAs via platforms like Maple and Pendle processed $2.8 billion, attracting traditional finance interest. These yield-bearing assets provide stability compared to pure speculation plays.

High-beta sectors cooled significantly. Emphasis shifted to scalable projects with real revenue or yield generation rather than narrative-driven speculation.

How Professional Traders Adjusted

Professional managers made several clear shifts this month. Understanding what they did and why helps frame positioning going forward.

Why they moved:

- Bitcoin’s 6.9% drop near $126k on tariff shocks pushed them to hedge long positions and rotate capital into stablecoins for protection

- Low volatility periods favored ETH staking yields (6-8%), so they increased staking allocations for carry during uncertainty

- Altcoin drawdowns exceeding 80% exposed liquidity problems, prompting cuts to 10-12% allocations focused on mainstream Layer 1s only

- Built stablecoin positions to 20.5% as dry powder for policy-driven dips around FOMC and trade negotiations

- Increased AI-powered monitoring tools usage (now 70% adoption) to automate volatility alerts and optimize entries during rapid swings

How they implemented:

Position sizing shifted:

- Core BTC/ETH: Maintained 48-55% of portfolios, trimming near $124k, adding at $108k supports or on reclaims above $115k

- Narrative plays and RWAs: Cut to 4-8%, diversified across 4-6 positions, exiting if funding rates spiked without price follow-through

- Stablecoins: Increased to ~20% for tactical deployment

Entry and exit rules:

- BTC: Buy failed breakdowns below $106k or confirmed closes above $120k following Fed announcements

- ETH: Rotate into staking when yields exceed stablecoins by 400 basis points and gas fees are low

- Perpetual futures: Maintained neutral skew around major events rather than directional bets

Option strategies:

- Used volatility calendar spreads positioning for QT ending

- Put protection below $104k to define downside risk

Risk management that mattered:

- Maximum loss per position sleeve: 7-9%

- Portfolio Value-at-Risk kept under 9%

- If support levels broke twice, cut 30% of tactical positions and wait for new signals

- Diversified beta exposure to limit correlation with single trade outcomes

Daily monitoring focused on:

- On-chain URPD (Unspent Transaction Output Realized Price Distribution) showing $108k-$110k support and $124k supply

- Options skew and max pain levels for event-driven positioning

- Funding rates and open interest to distinguish healthy builds from overheated positioning

- ETF flow confirmations for institutional sentiment

- Trade negotiation headlines as triggers for risk-on moves

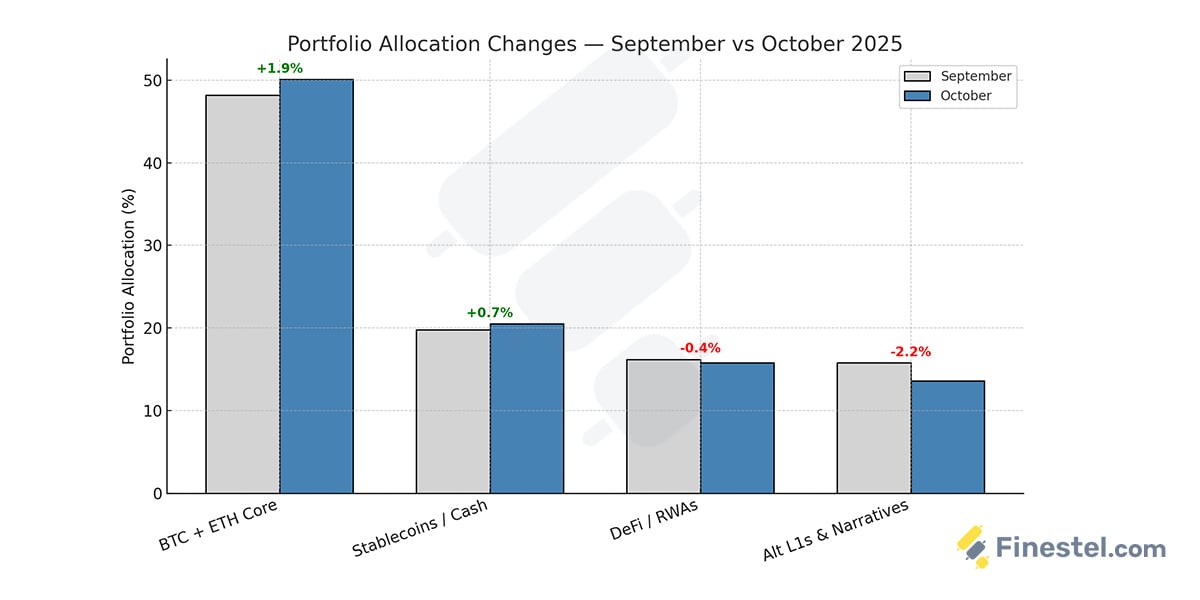

Allocation changes:

| Asset Class | September | October |

|---|---|---|

| BTC + ETH Core | 48.2% | 50.1% |

| Stablecoins / Cash | 19.8% | 20.5% |

| DeFi / RWAs | 16.2% | 15.8% |

| Alt L1s & Narratives | 15.8% | 13.6% |

The pattern’s clear: professionals hedged corrections, accumulated at support levels, prioritized yield in ETH and DeFi, maintained cash for macro events, and used options for defined risk rather than leveraged directional bets.

November Outlook: Volatility Continues with Breakout Potential

November 2025 sets up for continued volatility around several key catalysts. Markets will digest the October 29 Fed cut and watch for follow-up signals about quantitative tightening and future rate decisions. The government shutdown might resolve or extend, either way, that affects data availability and market uncertainty.

Bitcoin’s positioned for potential upside. If support holds above $108k, there’s a path toward testing $120k and potentially higher. But renewed macro risks, tariff escalations, weak labor data, shutdown extension, could pressure prices back down.

Key catalysts to monitor:

Macro and policy events:

- November 7: US Employment Report, Unemployment Rate, Trade Balance, Factory Orders. These will be critical for assessing labor market strength and trade impact, especially if it’s the first major data release post-shutdown.

- PCE inflation data (potentially delayed but expected mid-month if shutdown ends): Could reinforce expectations for two more Fed cuts in 2025.

- China-US negotiations following Trump-Xi meeting framework: Potential summit or deal early November on tariffs, rare earths, and fentanyl cooperation. Success here boosts risk appetite significantly.

- EU/UK stablecoin frameworks rolling out: Regulatory clarity supports institutional adoption.

Crypto-specific events:

- Blockchain Futurist Conference USA (November 5-6, Miami): Web3 networking and ecosystem discussions

- Cardano Summit 2025 (November 11-13, Berlin): Ecosystem updates could spark ADA momentum

- Finance Magnates London Summit (November 25-27): Fintech and digital assets focus for institutional crowd

Altcoin activity:

- Monad ($MON) airdrop claims end November 3: Distributing to 230k+ wallets with potential $12-13 billion fully diluted valuation. This could drive short-term alt rotation.

- Q4 airdrops expected from Base, Metamask, Solana L2s: Large holders are accumulating SOL, ETH, LINK, and TAO in anticipation.

Tech earnings spillovers: Q4 earnings from tech companies could influence risk sentiment, especially if AI and blockchain integrations feature prominently in guidance. Watch for spillovers into crypto narratives like AI tokens (NEAR, Bittensor) and RWAs.

Recommended positioning:

- BTC + ETH: 52% core allocation. Target $120k+ on Bitcoin breakout, defend $108k. Ethereum for staking yields during volatility.

- Stablecoins: 19-20%. Deploy on dips below support levels or following weak economic data.

- DeFi / RWAs: 16%. Focus yield-bearing assets like Pendle for stability and consistent returns.

- Alt L1s & Narratives: 12-13%. Selective exposure: SOL/AVAX for event-driven plays, AI tokens like TAO for tech sector synergy.

Risks to watch:

- Prolonged shutdown delaying critical data releases (PCE, employment figures)

- Tariff deal failures reigniting risk-off selling

- Weak November 7 jobs data signaling potential recession

- Credit stress from regional banks spreading

Upside scenarios:

- Fed liquidity injections if QT ends

- Positive China-US trade outcomes

- Strong employment data confirming soft landing

- Institutional ETF inflows accelerating

Monitor on-chain stablecoin inflows, options skew around major events, and ETF creation/redemption data for confirmation signals. If catalysts align positively, November could mark the beginning of a Q4 rally with Bitcoin potentially testing $130k+ by year-end.

Final Thoughts

In October 2025 crypto market report, we saw extreme volatility, structural shifts toward mainstream assets, and professional money positioning defensively while still accumulating at strategic levels. Sentiment recovered on policy relief and trade de-escalation, setting up November as a potential inflection point.

The corrections, while painful, likely purged excessive leverage and reset support structures at higher levels. Institutional interest remains intact despite the volatility, which is arguably more important than short-term price action.

For November, stay flexible. Favor data-backed entry points over FOMO. Hedge uncertainty with defined-risk strategies. Use on-chain signals for confirmation before deploying capital. The market’s giving opportunities for those willing to be patient and selective.

For real-time updates, follow KuCoin Institutional on X @KuCoinInst

Leave a Reply