So you have a strategy and want it automated? Or maybe you’re Dollar-Cost Averaging Bitcoin for the future and want to buy instantly at certain levels. You’ll definitely need a crypto signal bot. They’ve become very popular over the recent years, and there’s a reason for that. In this article, we’ll talk about the best crypto signal bots you can get your hands on today.

A crypto signal bot is basically your automated trading sidekick. It takes real-time market alerts based on your strategy and turns them into orders on your exchange. The idea is simple: remove emotion, react faster, and stay active. No matter what time it is.

What Is a Crypto Signal Bot?

A crypto signal bot is an automation tool that takes your strategy-based alerts, like those from TradingView, Telegram groups, or custom scripts, and turns them into actual trading signals. These bots then send the signals to your exchange account and execute trades automatically via secure API connections.

In simple terms: you define the logic, the bot listens for the alerts, and when they’re triggered, it places the trade for you. This helps you act instantly on your strategies without needing to be on their screens all the time. It removes delays, reduces emotion, and keeps your trading consistent.

How Crypto Signal Bots Work

Crypto signal bots automate trading by acting on signals that identify potential trade opportunities. They don’t typically generate signals but execute trades based on external inputs. Here’s the process:

- Signal Input:

- Signals come from platforms like TradingView (using PineScript for indicators like RSI or Bollinger Bands), Telegram groups, or market data APIs (e.g., CoinGecko).

- You can set custom triggers (e.g., price crossing a moving average) or subscribe to expert signal providers.

- Signal Processing:

- Bots connect to these sources via webhooks, APIs, or automation tools like Zapier.

- They parse incoming signals to extract trade details (e.g., buy/sell, price, volume).

- Trade Execution:

- Using your exchange API keys (e.g., for Binance, Kraken, or Coinbase), the bot places trades on your behalf.

- Features like stop-loss, take-profit, or trailing stops can be set to manage risk. Some bots support advanced options like dollar-cost averaging or portfolio balancing.

Execution: Manual vs. Automated

Once a signal is received, you can choose how you want to act on it. There are generally three options:

- Manual Execution: The bot sends an alert, and you make the trade manually.

- Semi-Automated: Some bots enter trades automatically but require your manual confirmation for exits or managing positions.

- Fully Automated: The bot handles the entire trade lifecycle. I mean from entry, stop-loss, and take-profit settings, to trailing features, and even portfolio rebalancing.

Automated executions happen through secure API connections to supported exchanges such as Binance, Bybit, OKX, Gate, Bitget, and others. The best crypto signal bots also offer IP whitelisting and 2FA to protect your account.

Integration with Trading Platforms

Popular bots often integrate with platforms like TradingView for strategy scripting (via PineScript and using PineConnector) or receive signals directly from chart setups. Many allow you to build complex trading flows using low-code platforms such as MAKE or connect to data sources like the CoinGecko API.

So, if you’re a coder, you can even write custom bots in Python or JavaScript. And if not, you’re also covered.

Benefits of Using the Best Crypto Signal Bots

Crypto trading moves fast. Unless you’re watching the charts all the time, it’s easy to miss profitable setups. Even worse, you might make hasty, emotional decisions that cost you money.

Using the best crypto signal bots can significantly help you. Here’s how they make a difference:

Automated Trading 24/7

One of the biggest advantages of using a proper crypto signal bot is round-the-clock trading. Bots don’t sleep, get tired, or panic when the market dumps. They follow logic. Always.

So, I mean, when the market hits your entry trigger at 3 AM, and you’re asleep (hopefully), the bot takes the trade. No delays, no hesitation. And this is very helpful in crypto.

No Emotions Involved

Another benefit is that bots stick to the plan. They don’t get greedy or panic. Emotions can make you hesitate on executing a winning trade or hold a loser for much longer than you should. A signal bot doesn’t have these problems.

Bots are Quick

Bots can monitor dozens or even hundreds of pairs at once. You can’t do that manually. They also react in milliseconds, which again, you can’t. So you get faster entries and less slippage, and also more opportunities with bots.

Almost Anyone Can Use them

You don’t have to be a coder to use the best crypto signal bots anymore. This means you can use pre-configured templates or follow signals from expert traders. Or if you’re a pro, you can plug in your own TradingView alerts, PineScript strategies, or connect external signal providers.

Risk Management Tools are Available

The best crypto signal bots don’t just catch setups and execute. They also help you manage risk. Most platforms include these features:

- Stop-loss & take-profit automation

- Trailing stops

- Hedge modes

- Multi-exit strategies

- Position sizing & capital allocation controls

Some Connect to Multiple Exchanges

Another advantage of the best crypto signal bots is that some of them, like Finestel, can operate across several exchanges at the same time. This is great if you’ve got funds split across Binance, KuCoin, Bybit, or OKX. You can run unified strategies across all of them with a single interface.

Best Crypto Signal Bots in 2025 Compared

So, now that you know how crypto signal bots work and what they can add to your trading, let’s check out the best crypto signal bots right now.

|

Bot |

Best For |

Key Features |

Supported Exchanges |

Pricing |

Pros |

Cons |

Mobile App |

|

Finestel |

Professionals, asset managers, TradingView Users, traders who need any custom signal source to be supported |

TradingView bot, custom signal integration, multi-account sync, white-label solution |

5 (Binance, Bybit, KuCoin, OKX, Gate; Bitget/Coinbase planned) |

7-day trial, plans varied |

Highly customizable, white-label, custom signal support |

Limited exchange support |

Yes |

|

3Commas |

TradingView users, intermediate traders |

TradingView webhooks, long/short trades, advanced filters, 200 pairs |

15+ (Binance, Bybit, Kraken, etc.) |

$4–$79/month, free trial |

Deep customization, broad exchange support, robust features |

Past security breaches, not beginner-friendly |

Yes |

|

WunderTrading |

TradingView users, copy trading |

Webhook automation, copy trading, revenue-sharing, smart terminal |

18 (Binance, OKX, Kraken, etc.) |

Free plan, $4.95–$89.95/month, 7-day trial |

Easy TradingView integration, copy trading, free plan |

Limited signal sources, occasional API issues |

Yes |

|

Cryptohopper |

Beginners, copy trading |

130+ indicators, strategy marketplace, AI optimization, backtesting |

16–17 (Binance, Coinbase Pro, Kraken) |

Free plan, $19–$99/month, 3–7-day trial |

Beginner-friendly, extensive indicators, strong community |

Advanced features paywalled, complex for absolute novices |

Yes |

|

Altrady |

Alert-based traders, all-in-one |

Webhook support, smart terminal, market scanner, journaling |

17 spot, 4 futures (Binance, KuCoin, etc.) |

Free plan, up to $70/month |

Flexible webhooks, free plan, unique tools like journaling |

No copy trading, smaller community |

Yes |

Note: Signal bot accuracy depends on signal quality, market conditions, and user configuration. No bot guarantees profits. Always use secure API keys with trading-only permissions.

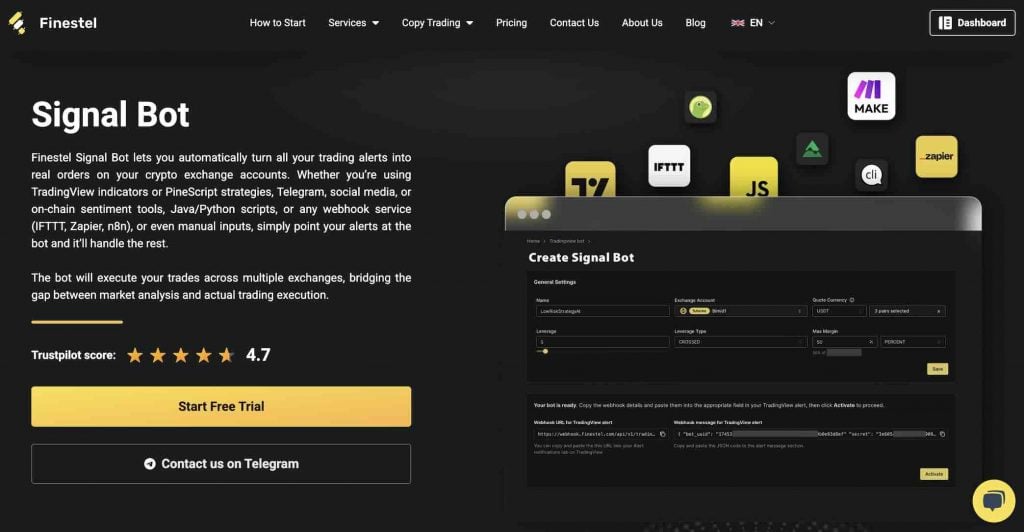

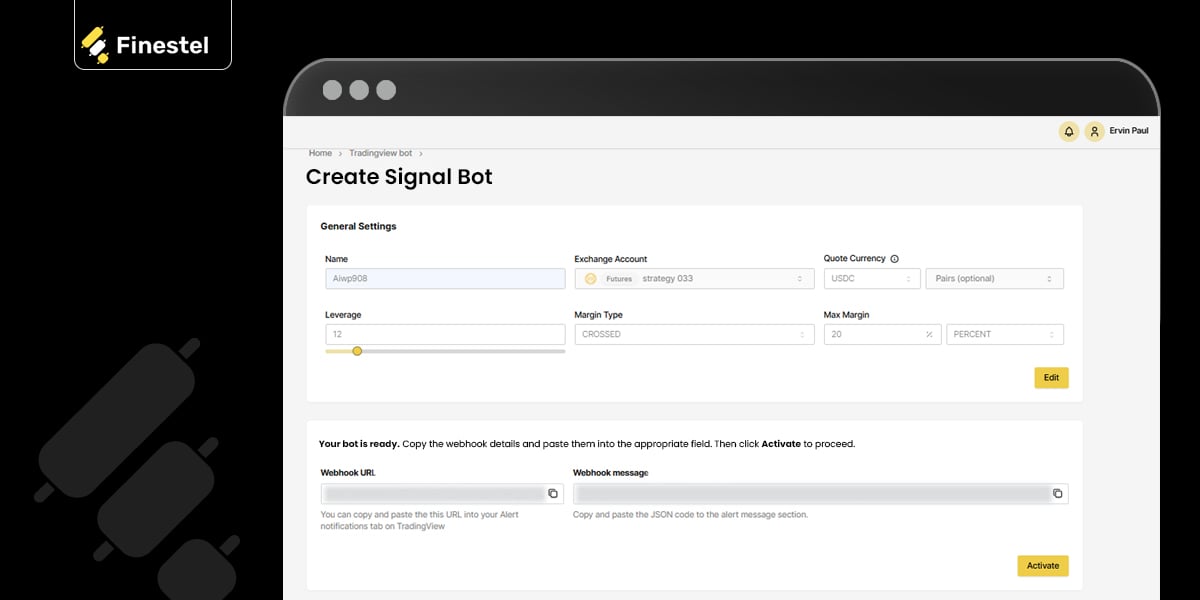

1. Finestel

Best For: Professional traders, asset managers, and signal providers who want full control, automation, and custom integrations in one place.

Finestel’s Signal Bot is a powerful tool designed to automate cryptocurrency trading by instantly converting trading signals into live orders across one or multiple exchanges. Compatible with sources like TradingView, Telegram, on-chain analytics, social media, or custom Python/Java scripts, it supports platforms such as Binance, Bybit, KuCoin, OKX, and Gate.

With our recently launched TradingView Bot, Finestel bridges the gap between strategy creation and real-time execution across major exchanges.

You can automate trades directly from TradingView alerts using PineScript strategies or technical indicators, and connect signals from Telegram, on-chain analytics, social media, or even custom Python or JavaScript code. This makes it one of the most flexible automation tools out there. Sign-up here.

Key Features

- TradingView bot for real-time strategy execution

- Custom signal bot that accepts alerts from TradingView, Telegram, social media, Python/JS scripts, n8n, IFTTT, and any other custom sources users may need

- Supports Binance, Bybit, KuCoin, OKX, Gate (Bitget and Coinbase coming soon)

- Multi-account support with real-time sync

- Handles up to 200 trading pairs at once

- Advanced tools: trailing stops, multi-take-profit, spot, and futures trading

- Full white-label solution for asset managers

- You can request support for supporting a new signal source, and they will work to integrate it for you.

- 7-day free trial available

- Extremely customizable and reactive to real signals

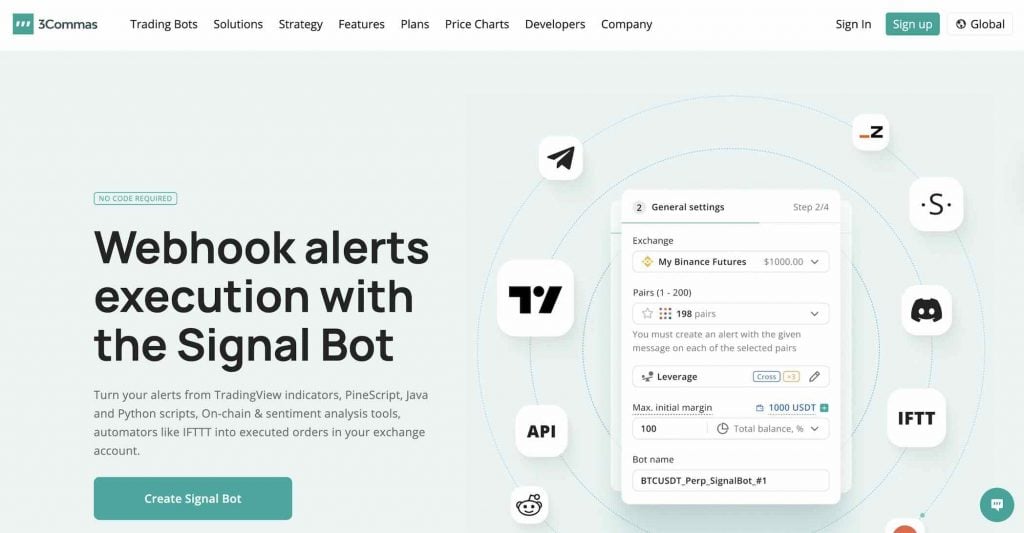

2. 3Commas

Best For: TradingView users, strategy builders, and intermediate traders.

3Commas is another name you might’ve heard of in crypto automation. And well, there’s a reason. Their Signal Bot is a powerful tool for anyone who already has a solid strategy and wants to automate it without coding. It works almost perfectly with TradingView, so when your custom alerts go off, the bot executes instantly.

You can run both long and short strategies in a single bot, fine-tune position sizes, use advanced filters, and even combine multiple entry conditions.

Key Features

- Real-time TradingView signal integration via webhooks

- Supports long and short trades in the same bot

- Custom filters like price deviation and signal counters

- Adjustable position scaling and take profit settings

- Works with up to 200 pairs per bot

- Advanced tools like trailing take-profit, cooldowns, and safety orders

- Compatible with over 15 major exchanges

3. WunderTrading

Best For: TradingView power users and those offering or copying signals.

WunderTrading is great if you want to take your TradingView strategies and turn them into fully automated trades, without touching any code. It connects directly to your TradingView alerts using webhooks, meaning the second your alert hits, a bot takes action on your exchange. But it’s not just for solo traders. WunderTrading also has a copy trading system where you can follow top-performing traders or share your own signals for others to copy.

Key Features

- Webhook-based TradingView automation

- Copy trading with signal provider support

- Smart terminal for manual trading

- Supports long and short trading

- Works with major exchanges like Binance, OKX, Kraken, KuCoin, and Bybit

- Revenue-sharing option for signal providers

4. Cryptohopper

Best For: Beginner traders who are into custom strategies, copy trading, or hooking bots up to TradingView alerts.

Cryptohopper is a well‑rounded, cloud‑based trading bot platform. It lets you run bots across 16–17 major exchanges like Binance, Kraken, Coinbase Pro, and more. It has a slick interface and tools for both newbies and advanced users and is built for those of you who want automation, customization, and a community vibe.

Key Features

- Build strategies using drag-and-drop with 130+ indicators and test them historically before going live.

-

Supports dollar-cost averaging, basic arbitrage, and market-making bots for Hero-tier subscribers.

5. Altrady

Best For: TradingView users, alert-based signal traders, and semi-automated strategy builders.

Our last entry to the list of the best crypto signal bots is Altrady. Altrady isn’t as hyped as some of the bigger names, but it’s a super underrated platform if you like using alerts and external signals to automate trades. Their Signal Bot feature lets you connect pretty much any webhook source, like TradingView alerts, Discord bots, or other signal providers, and trigger trades in real time. It supports major exchanges like Binance, KuCoin, OKX, Coinbase, and a bunch more.

You also get access to smart trading tools, real-time portfolio tracking, and even a built-in trading terminal. But the main highlight for signal traders is how easy it is to automate alerts into actual orders with flexible controls.

Key Features

- Signal Bot with webhook support (ideal for TradingView alerts)

- Supports 10+ major exchanges (Binance, KuCoin, OKX, etc.)

- Smart trading terminal with ladder orders, OCO, trailing, etc.

- Strategy automation with conditions and triggers

- Real-time market scanner and position tracking

- Desktop, web, and mobile access

Key Features of the Best Crypto Signal Bots

Before picking a bot, there are some features you should check for. Here are the key features of the best crypto signal bots:

Accuracy

The real job of a signal bot isn’t to create signals; it’s to receive them and execute trades accurately, based on those signals. A good signal bot will copy signals from sources like TradingView, Telegram, n8n, IFTTT, or any other custom scripts and turn them into real orders with precision.

So when you’re choosing a bot, look at how accurately and quickly it can execute trades when alerts are triggered. The best bots minimize delays, avoid duplicate orders, and handle multiple pairs or accounts at once without errors.

Exchange Support

Make sure the bot works with your exchange. Also, check that it connects safely with secure API keys and IP whitelisting. For example, Finestel, which is the best crypto signal bot at the moment, supports major exchanges like Binance, Bybit, Kucoin, and more.

Custom Options

You should be able to set your own rules when using the best crypto signal bots. That includes using TradingView alerts, adding take-profits, stop-losses, or even trailing stops. Coders might want support for PineScript, Python, or webhook tools like n8n.

Support and Community

Just like any other thing, crypto signal bots also break. You need help, and you need it fast. Look for bots with active Telegram or Discord groups, tutorials, and customer support. It makes a huge difference.

How to Choose and Use the Best Crypto Signal Bots

Let’s take a look at some tips on how to choose and use the best crypto signal bots:

- Pick based on your skill level: I mean, if you’re a beginner, you should try easy platforms like Cryptohopper or ProfitFarmers. Advanced traders can go with customizable bots like Finestel or 3Commas.

- Think about your budget: Some bots offer free trials. Others need a paid plan. If you trade often, lifetime deals might save you more. So, plan the budget carefully.

- Check risk tools: Look for bots with stop-loss, trailing stop, and position sizing. These features help protect your capital.

- Test before going live: Use paper trading to try out strategies without risking real money. Platforms like Altrady and CryptoRobotics are good for this.

- Use more than one signal source: Mix technical indicators, AI, and news-based insights for stronger signals.

- Start small: Don’t go all-in on day one. I always recommend starting with small amounts to test the bot’s performance.

- Stay involved: Bots need monitoring. Markets change, and strategies need updates. Check in regularly, even if you use the best crypto signal bots.

Conclusion

Well, to wrap it up, it’s clear that using the best crypto signal bots can be of great help for a lot of us traders. But, of course, only if we use them right. They take the pressure off and help us catch opportunities 24/7. But remember: bots aren’t magic money machines. They’re tools. You still need a good strategy and strong risk management.

So, I recommend that you start small, test carefully, and don’t just chase win rates. Look at the features and good customer support. Platforms like Finestel and 3Commas offer advanced tools for serious traders, while Wundertrading and Cryptohopper make things easy for beginners. So, choose wisely depending on your preferences and experience.

Leave a Reply