In a world where the crypto market evolves at an astonishing pace, an increasing number of individuals are turning to crypto trading as a way to make money. They often stumble upon Binance, the most renowned and arguably the best cryptocurrency centralized exchange out there. But what sets Binance apart from its competitors? Is it just the enormous variety of trading pairs it offers, or is it primarily due to successful marketing strategies? As you can already guess, the answer is beyond that, and Binance crypto trading tools and bots are also significant factors contributing to its uniqueness.

Binance offers a comprehensive suite of trading bots and tools, enabling traders from any level of expertise to move toward their goals. Whether you are a novice trader raring to dip your toes in crypto trading or a seasoned one seeking sophisticated solutions, Binance is there for you.

In this article by Finestel, we briefly explain crypto trading and introduce Binance. Moving on, we turn our attention to various tools and trading bots Binance offers, describing each in detail. Finally, we illustrate how Finestel’s services can complement Binance’s crypto trading tools and bots, creating a professional experience for serious traders.

What Does Automated Trading Refer to?

Automated trading systems, auto trading, mechanical trading, or algorithmic trading refer to automating trading sessions or any trading-related activities such as market analysis, strategy backtesting, and so on, using partially or completely autonomous bots.

What is Crypto Bot Trading?

Cryptocurrency bot trading is an automated trading method that involves using specialized software known as a trading bot to execute orders. Developers program these bots to follow algorithms based on various trading strategies. Crypto bot trading aims to maximize efficiency by removing emotions and human error from trading. Therefore, it enables you to manage your assets more systematically.

Are Crypto Trading Bots Profitable?

You might be wondering, are crypto bots legit? Or you may ask, do crypto bots work? Similar to all other trading strategies and methods, crypto bot trading’s profitability also depends on several factors. These include the implemented trading strategy, market conditions, and the crypto trading bot’s configuration. Risk is inevitable when you engage in trading, and bot trading is not an exception. While many traders fail to develop a profitable trading bot, some professional traders and developers have achieved considerable success using this automated trading method.

Does Binance Have Bots?

Traders from all around the world choose Binance as their go-to cryptocurrency trading platform. Firstly, Binance is a standout choice for traders of all skill levels due to its user-friendliness. The platform ensures that whether you are just starting or have years of trading under your belt, you will experience a seamless crypto trading adventure.

Another major strength of Binance lies in the large variety of crypto pairs it offers. You name it, they’ve likely got it. Plus, they handle an enormous amount of trading volume, which translates to reasonable trading fees and almost instant trade executions.

Yet, Binance goes beyond the basics as it provides a wide range of crypto trading and analysis tools. These equip traders with valuable insights that assist them in making informed trading decisions. But does Binance have a trading bot or other automation solutions?

The answer to the question “Does Binance have bots?” is YES. For those of you who want to take trading a step further, Binance’s automation solutions, including copy trading and crypto trading bots, can empower you to move beyond manual trading and potentially earn passive income with automatically executed trades. In this article, we introduce some of the best free Binance trading bots.

If you’re interested in crypto trading bots, you can check out the12 best crypto trading bots that have been tested and reviewed.

Binance’s Arsenal of Trading Tools & Bots

In this section of the article, we are going to introduce and comprehensively analyze Binance crypto trading tools and bots. It can get quite confusing for traders, especially inexperienced ones, to understand what each of these tools are, what they do, and how they work. Therefore, we are here to present a simple explanation and categorize these services to make things easier for you.

Binance’s Market Data

As already mentioned, Binance has the highest trading volume among cryptocurrency exchanges. As a result, it can offer a vast amount of data that can be processed into insightful metrics and information. Binance’s market data can be divided into the categories below:

- Orderbook Data: As a crypto exchange, Binance offers its orderbook data to users. You can analyze the depth and structure of orderbooks, aiding in your understanding of buy and sell dynamics in the market.

- On-Chain Data: Millions of Binance users worldwide deposit their coins to Binance or withdraw them, making tons of on-chain transaction data. This information helps you monitor network activity.

- Trading Volume Data: Through the trades done on Binance’s platform, large amounts of data are created. Volume is one of the most significant factors in the market and with the volume data, you can gauge where the liquidity and buying/selling interest are.

- Whale Data: While being a sub-category of the on-chain data, whale data is too significant to not mention. It allows you to analyze large transactions on Binance to figure out what the whales are up to.

- Futures Market Data: Binance hosts the largest perpetual futures market among crypto exchanges. So, using the futures market data you can build and closely observe key futures market metrics like the open interest, maker/taker volume, liquidations, and funding rates. These indicators can help you evaluate market sentiment.

- Historical Price Data: Using historical price data, you can backtest your trading strategies to ensure they are able to perform consistently profitably. You can easily do so with a backtesting crypto bot for Binance, and evaluate your strategy’s performance.

Binance’s Analysis Tools

Every professional trader’s first task when they get to work is analysis. A valid trade idea is almost always formed based on thorough, accurate analysis. The Binance trading software excels in this area, as it provides useful analysis tools in its trading interface. Here are the most important ones:

- Charting Tools: A price chart is the core of technical analysis. As a Binance trader, you can utilize TradingView-powered charts to visualize price movements, identify patterns, and implement technical indicators to frame your trade setups and execute effectively.

- Orderbook: On Binance’s trading interface, you have access to the exchange’s order book data in real time. So, you can view buy limit and sell limit orders, helping you measure market sentiment and anticipate potential price movements.

- Depth of Market: Similar to the orderbook, you can use the depth of the market panel to see the distribution of buy and sell orders at various price levels. This information is highly valuable as it enables you to locate potential support and resistance levels.

- Live Trades: With the trades list panel, live trade data, including recent transactions and trade history, are presented. This tool allows you to track market activity and execute timely trades.

- Margin and Risk Analysis: This panel demonstrates your account’s margin and risk metrics. You can manage your positions and assess your exposure in the market to ensure a sustainable, low-risk trading journey.

Binance’s Investing and Passive Income Tools

In case you are more of an investor rather than a day trader or scalper, Binance has got you covered. Various investing and passive income tools are offered by Binance, enabling you to earn passive income while investing in the crypto market for the long term. The most prominent of these services are explained below:

- Binance Simple Earn: With Binance Simple Earn, you can deposit your cryptocurrencies for flexible or locked periods of time and earn daily rewards. While the flexible plan allows you to withdraw your assets at almost any time, the locked plan offers a higher return.

- Binance Launchpad: Binance Launchpad is an innovative platform that secures crowdfunding for newly developed crypto projects. It introduced the concept of Initial Exchange Offerings (IEOs) and provides a trusted platform for blockchain projects to raise capital. You can invest early in crypto projects using Binance Launchpad.

- Binance Launchpool: Somehow similar to Launchpad, Binance Launchpool combines decentralized finance (DeFi) with the convenience of a centralized exchange. It allows you to stake your crypto assets in liquidity pools and earn new tokens as rewards through a process known as yield farming.

- Binance DeFi Staking: Binance DeFi Staking allows you to participate in DeFi projects with ease. It handles the process of staking cryptocurrency to support blockchain networks that use a proof-of-stake consensus mechanism. It simplifies DeFi staking participation for you and obtains and distributes earnings on your behalf.

Binance’s Trading Automation Tools and Bots

Binance is a powerhouse in the world of cryptocurrencies, especially when it comes to trading automation solutions. It offers an extensive array of trade automation tools and bots.

While you can search online forums for what these bots and tools are and how they work (like searching “Binance crypto bot Reddit”), we introduce some of the primary Binance automated trading solutions:

- Copy Trading: Binance’s copy trading bot allows users to follow and automatically replicate the trading strategies of successful crypto traders. The followers are called copy traders and the lead traders are the ones whom they follow. At the end of each period, profits are shared between the copiers and the lead traders at a predetermined rate.

- Grid Trading Bot: Binance’s grid trading bot is both a spot and a futures trading bot. It is designed to execute buy-low and sell-high orders in a predefined price range, seeking to capitalize on price moves during market consolidations.

- Rebalancing Bot: Binance’s rebalancing bot is a handy tool for traders and investors who are looking to maintain a stable asset allocation in their portfolios. This bot automatically sells overweight crypto assets within a portfolio and uses the funds to purchase underweighted assets. This way, it brings the allocation portions back to the desired levels.

- Spot DCA Bot: Binance’s Spot DCA bot is a valuable tool for implementing dollar-cost averaging in the crypto market. You can specify how much to buy, when to buy, and when to sell, and this useful Binance crypto bot will take care of the rest automatically.

- Triangular Arbitrage Bot: Binance’s triangular arbitrage bot is an advanced trading tool. It exploits price discrepancies between three different cryptocurrencies. Therefore, the trader can profit from market inefficiencies. The bot automates the process of exchanging these three crypto assets for one another.

- Tradingview Signal Bot: The Binance TradingView signal bot allows users, specifically those with paid TradingView subscriptions to create alerts or execute trading strategies using webhooks. These webhooks create real-time data communication with Binance and enable automated trade executions on Binance with signals from TradingView.

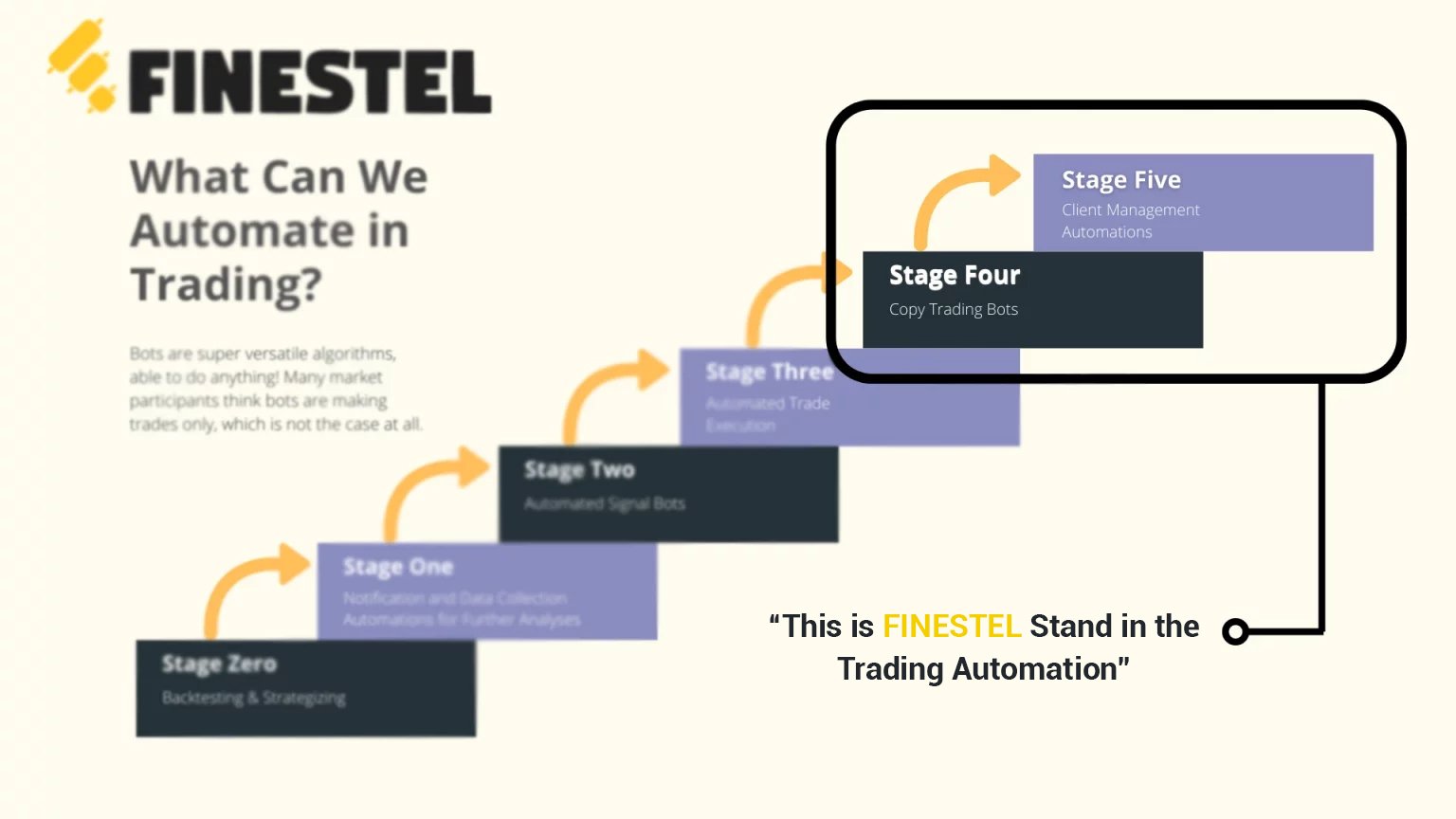

What Can We Automate in a Trading Session?

- Bots are super versatile algorithms, able to do anything! Many market participants think bots are making trades only, which is not the case at all. From sending the detected trading signal via notifications or emails to your mobile phone, up to building, modifying, and executing trading strategies, from Binance spot & Binance futures automated copy trading bots up to automated digital crypto asset management firms! For real! Let’s break down the automation stages one-by-one:

#0 Backtesting & Strategizing:

Professional trading starts with carving out strategies; you might’ve heard plenty. Automations step in to help you right from the beginning of a trading session.

Some to-be-tested trading strategies are easily backtest-able via codes and automated backtesting bots, which will fine-tune your trading strategy that you’ve built based on preferred factors such as indicators, time-frames, balance, and so on and so forth.

#1 Notification and Data Collection Automation for Further Analyses

Now, your strategy is waiting for the right condition to provide a trading set-up (TP, SL, order size, etc.). Bots at this stage of automation read market movements and notify you through alerts and via notifications, that your predetermined conditions have been met.

Those conditions could be a price or any other technical indicator change, or a chain of actions that creates the perfect situation for your strategy to be executed.

Besides notifying, data collections & categorizations might also be taken care of to be used by the next stage automation you read below:

#2 Automated Signal Bots

Trading signals are usually in the form of a set of orders like this:

-

- Trading pair BTC/USDT

- Entry Price: $$$

- Stop-loss: $$$

- Order size: X%

- Take Profit 1: $$$

- Take Profit 2: $$$

- Take Profit 3: $$$

-

- Bots can turn the collected data – through the previous stage – into a set of orders based on the risk management, technical indicators, and other conditions you’ve defined for them.It’s worth noting that many traders might do a couple or most of these stages manually and prefer not to use automated trading systems because of possible glitches, miss-calculations, and so on. However, these systems are mandatory for trading styles like high-frequency trades and have had significant improvements recently.

#3 Automated Trade Execution!

Put simply; they execute orders based on your trading strategies and the trading signals we talked about above. But that’s not all!

There are auto trading bots that execute the whole order set on multiple accounts and proportional to their balances. Automated crypto portfolio management is one of the groundbreaking solutions our little bot friends provide.

#4 Copy Trading Bots

These are the guys I’ve been talking about. They copy orders of a strategy (SL, TP, OCO, etc.) from one account and then execute them on multiple other accounts.

Copy trading bots have become super sophisticated nowadays and can execute orders proportional to the receiver accounts’ balances through API connections with almost all crypto exchange accounts at the speed of light; maybe a hair short!

These bots can handle specific scenarios and even detect and report possible bugs and glitches from the exchange side, between exchanges, or the bot itself.

#5 Client Management Automations

It’s like an autonomous CRM. From notifying a community of clients up to settlements and support, it’s not possible to keep up with the pace and accuracy that the previous stages of automation provide.

- Especially in the crypto investment management industry, this stage of automation plays crucial roles that Finestel and Finestel Pro provide.

How Finestel Complements Binance’s Automated Trading Solutions

While Binance’s crypto trading tools and bots seem very comprehensive, there is always more you can do. Essentially, Binance’s crypto trading bots are not sufficient for many professional traders. Then there is Finestel, with its innovative trading automation solution for traders looking for more sophisticated tools. Finestel’s trading bots for Binance enhance efficiency and significantly facilitate your trading and asset management operations.

For instance, there is no native Binance market maker bot. However, with Finestel, you can connect your trading account to a market-making bot and automatically engage in market-making. Moreover, you can link Finestel’s portfolio tracker bot to your Binance account to carefully monitor your trading and asset management performance over time. It’s unnecessary to emphasize the benefits these tools can bring to a Binance trader’s arsenal.

Signal automation is another area where Finestel offers a set of useful products. You can use Binance signal bots like TradingView bots or even connect a Binance Telegram bot to your account with Finestel. We help you develop these bots and ensure they work seamlessly. You can easily manage all these solutions and other Binance auto-trading software programs in one place via your Finestel dashboard.

Furthermore, you can utilize various trading automation bots like Binance futures bots, scalping bots, and other Binance algo trading bots using Finestel. We can develop these bots based on your strategy and take care of the whole trading automation process for you. As a result, you can conveniently engage in automatic crypto trading on Binance. Our Binance copy trading bot enables you to follow any trader or algorithmic strategy with maximum precision and efficiency.

Feel free to compare Finestel’s offering to other trading automation solution providers. Here is a link to the 3commas Review article.

Utilize AI Trading Crypto Trading Bots with Finestel

Several white-label asset managers on Finestel develop and use Binance AI trading bots. In case you are willing to invest in AI-powered trading bots and strategies, you can access these asset managers on Finestel’s strategy marketplace and replicate their executions with our Binance copy trading bot.

You can also develop your own Binance Jet-bot and connect it to your personal account or that of your investors using our automation solutions. All Binance bot prices and fee structures are listed on Finestel’s strategy marketplace.

You Can Request Access to Finestel’s Binance Python Bot Library

Finestel’s copy trading uses Python programming language. The copy trading, strategy marketplace, portfolio tracker, and other services are all coded with Python. If you request, we might grant you access to the Binance crypto bot Python libraries. For instance, we can license the source codes for you. However, it all depends on the level and structure of our partnership.

Conclusion

Binance is a household name in the rapidly evolving crypto landscape. It offers an extensive toolkit for analyzing the price and market data, as well as trading automation. If you are a novice, a to-learn trader, or even a seasoned one seeking more advanced solutions, Binance crypto trading tools & bots have you covered. In this article, we thoroughly analyzed Binance crypto trading tools and bots, categorized them, and explained how they work.

Meanwhile, Finestel enters the scene for those searching for more sophisticated trading tools. Finestel’s offerings complement those of Binance. The innovative trading automation solutions and bots introduced by Finestel are tailored for serious crypto traders and asset managers. Whether you aim to become a market maker, track your portfolio’s performance, or utilize signal automation, Finestel provides a comprehensive suite of tools to amplify your Binance trading experience.

The synergy between Binance’s platform and Finestel’s advanced solutions opens doors to a more sophisticated crypto trading journey, where strategies can be seamlessly executed, signals can be effectively utilized, and, most importantly, all can be done automatically.

Satoshi Nakamoto invented bitcoin and Chuck Norris invented Satoshi Nakamoto!

Appreciate the recommendation. Will try it out.