You’ve been thinking about launching your own investment management platform for months, maybe years. You’ve priced out development teams ($150K+), considered hiring engineers (6-12 month timeline), and wondered if you’d need to learn to code.

Here’s the truth: you don’t need any of that.

With Finestel’s white-label solution, you can have a fully branded, professional-grade platform operational before the weekend. No technical background required. No massive upfront investment. Just a clear path from signup to your first client.

Let me show you exactly how.

What is a White-Label Solution?

Think of white-label like buying a house that’s already built, then decorating it to match your style. Instead of spending years designing blueprints, hiring contractors, and managing construction, you move into a ready-made home and make it yours with paint, furniture, and personal touches.

That’s exactly what Finestel’s white-label solution does for your investment management business.

Here’s how it works: Finestel built a professional-grade trading and client management platform. You rebrand it with your logo, colors, and domain name—then launch it as if you built it yourself. Your clients never know Finestel exists. They see your brand, your name, your platform.

The difference? You skip 12+ months of development and $150K+ in costs. Instead, you’re operational this weekend.

Why Asset Managers Choose White-Label

The Math is Simple

Custom development costs $100K-$250K and takes a year before it’s usable. Then you’re paying $3K-$10K monthly for maintenance and fixes. You’re bleeding money with zero revenue. Finestel costs $224-$749/month. Live in less than 24 hours. Earning revenue next week.

Speed Equals Money

Every month building is a month not earning. If you could onboard 30 clients at $200/month, you’re losing $6,000 monthly while developers code. With Finestel, you’re live this weekend. First client pays you Monday.

It Scales When You Do

Custom platforms work fine for 10 clients. At 50, they lag. At 100, they break during volatility and you’re hunting down freelance developers. Finestel has processed billions across thousands of accounts. When you grow from 10 to 100 clients, the platform just handles it.

Completely Your Brand

Not “powered by Finestel.” Your domain, your logo everywhere, your colors, your branded apps, your name on every email. Clients recommend “Sarah’s platform,” not “that white-label thing.”

Built for Asset Managers

Trading automation with copy trading, signal execution, and TradingView strategies. Client management with portfolio tracking, automated reports, and custom risk controls. Business operations with billing, invoicing, and revenue analytics. Everything you’d eventually build if you had unlimited time and budget, already done.

Zero Technical Skills Needed

If you can use Shopify, you can run this. Point-and-click interface. Support responds in an hour, not three days.

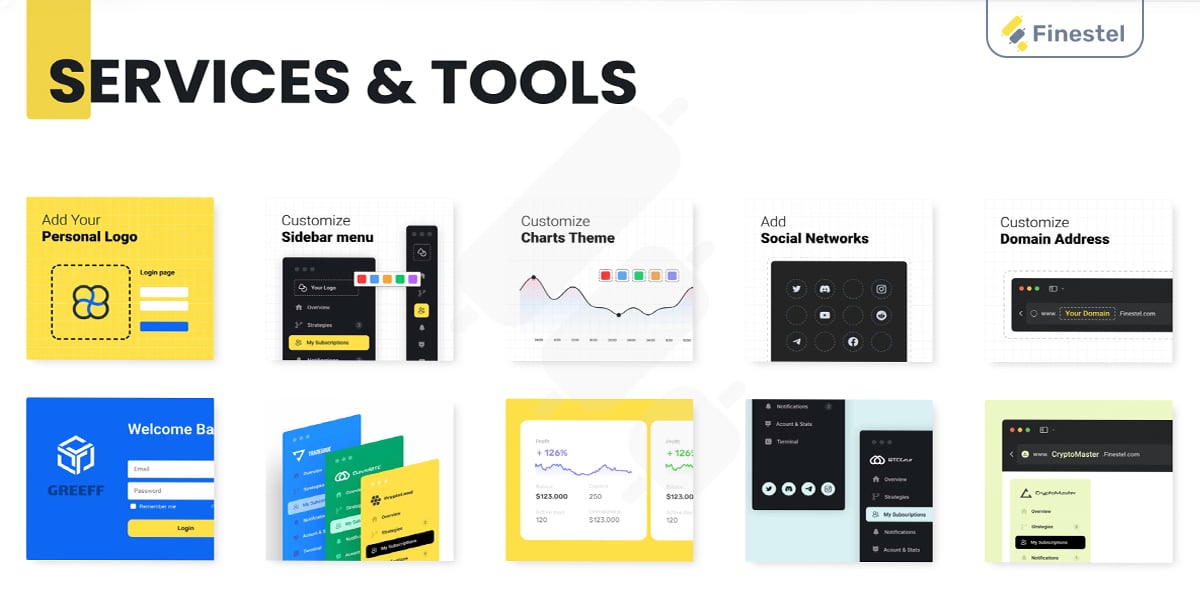

What Tools Do You Get (All Under Your Brand)?

When you launch Finestel’s white-label solution, you’re not getting a basic dashboard. You’re getting a complete trading infrastructure:

Copy Trading (trade copier) software: Automatically replicate trades from master accounts across all client portfolios with proportional position sizing. One trade executes across unlimited count of accounts simultaneously, no manual work.

Signal Bot: Connect your custom source of signal, such as Telegram and other social media signal channels, custom webhooks, or third-party signals and execute trades automatically when signals trigger. Your analysis translates to instant execution.

TradingView Bot: Convert your TradingView strategies and PineScript indicators into live trades. Your charts directly control real positions across multiple exchanges.

Unified Trading Terminal: Manage all client accounts from a single interface instead of logging into multiple exchanges. Execute trades, monitor positions, and adjust strategies across Binance, Bybit, KuCoin, OKX, Gate, and others simultaneously. Execution speeds under half a second reduce slippage.

Portfolio Tracker: Real-time monitoring of every client account with live P&L, asset allocation, risk metrics, and performance analytics. See your entire book of business on one screen.

Client Management System: Onboard clients, manage subscriptions, generate automated reports, and track individual performance. Everything clients need to understand their investments, delivered professionally under your brand.

Integrated Billing: Process subscription fees, performance-based commissions, or hybrid models through automated invoicing. Accept credit cards, bank transfers, or cryptocurrency payments. Your revenue flows directly to you.

White-Label Mobile Apps: Your clients access their portfolios through branded iOS and Android apps (Enterprise) or progressive web apps (Business plan). Your icon on their home screen, your branding throughout.

The entire stack, automation, execution, reporting, billing, operates under your brand as if you built it yourself. Your clients see your company name everywhere. You own the relationship. Finestel provides the infrastructure invisibly.

Your Complete Finestel’s White Label Setup Roadmap

This guide walks you through every screen, button, and decision you’ll encounter when launching your white-label platform on Finestel. No fluff, no assumptions, just the exact steps in the order you’ll actually do them.

From the moment you click “Sign Up” to the moment your first client logs in, we’ve documented the entire process. Expect to spend 4-6 hours total, though most partners spread this over a weekend. By Monday, you’ll have a fully operational, branded investment platform.

Let’s get started.

Step 1: Create Your Account (5 minutes)

⏱️ Time needed: 5 minutes

🎯 Quick win: You’ll have dashboard access immediately, no approval waiting period

Setting up your Finestel account is deliberately simple. We’ve watched too many platforms bury their signup process in bureaucracy.

Here’s what you do:

- Visit Finestel’s website and click “Sign-Up”

- Choose your plan

- Complete payment

The moment your payment processes, you’re in. No verification delays, no “we’ll review your application.” You’ll land directly in your admin dashboard, ready to build.

Choosing Your Plan: Business vs. Enterprise

Business Plan – $224.30/month (+ $499 one-time white-label setup fee)

Perfect for: New operators, asset managers testing the market, or managing up to 100 client accounts

What you get:

- Up to 100 exchange accounts

- Copy trading software (fully operational)

- Portfolio tracker with real-time analytics

- Dedicated support team

- White-label on your custom domain

- White-label PWA (mobile web-application for iOS and Android)

- Rate limit: 30 orders per minute per account

- Signal bot & TradingView bot

Who this is for: You’re launching your first investment management operation, managing friends/family portfolios, or validating demand before scaling. The 100-account limit sounds restrictive but covers most operators for their first 6-12 months.

Enterprise Plan – From $749/month (white-label setup fee waived)

Perfect for: Established firms, serious operators planning rapid growth, or those needing custom infrastructure

What you get (everything in Business, plus):

- Unlimited exchange accounts (customizable to your exact needs)

- Customizable rate limits (high-frequency trading support)

- Technical development services (custom feature builds)

- MLM software integration (if you’re building a referral/network structure)

- Dedicated servers on demand (no shared infrastructure bottlenecks)

- White-label TWA (native iOS and Android mobile apps, not just web)

- Trading algorithm development (our team builds custom strategies for you)

- Priority support (phone/chat with faster response times)

- Signal bot & TradingView bot (launching soon)

Who this is for: You’re migrating an existing book of clients (100+ accounts), need custom trading algorithms developed, require dedicated infrastructure for performance, or plan to scale aggressively from day one. The $749 price point pays for itself if you’re managing 150+ clients or charging premium fees (think $500+/month per client).

💡 Pro tip from successful partners: Don’t overthink the plan choice. Most partners start with Business and upgrade within 1 month as they onboard more clients. You can switch anytime without losing your customization work.

⚠️ One exception: If you already have 80+ clients ready to migrate, start with Enterprise. The last thing you want is to hit the 100-account ceiling during onboarding and need to upgrade mid-migration.

Step 2: Brand Your Platform (30 minutes)

⏱️ Time needed: 30 minutes

🎯 Quick win: Clients will see your brand at every touchpoint, not ours

This is where your platform stops looking like a white-label solution and starts looking like your million-dollar proprietary system. Everything is customizable; and I mean everything.

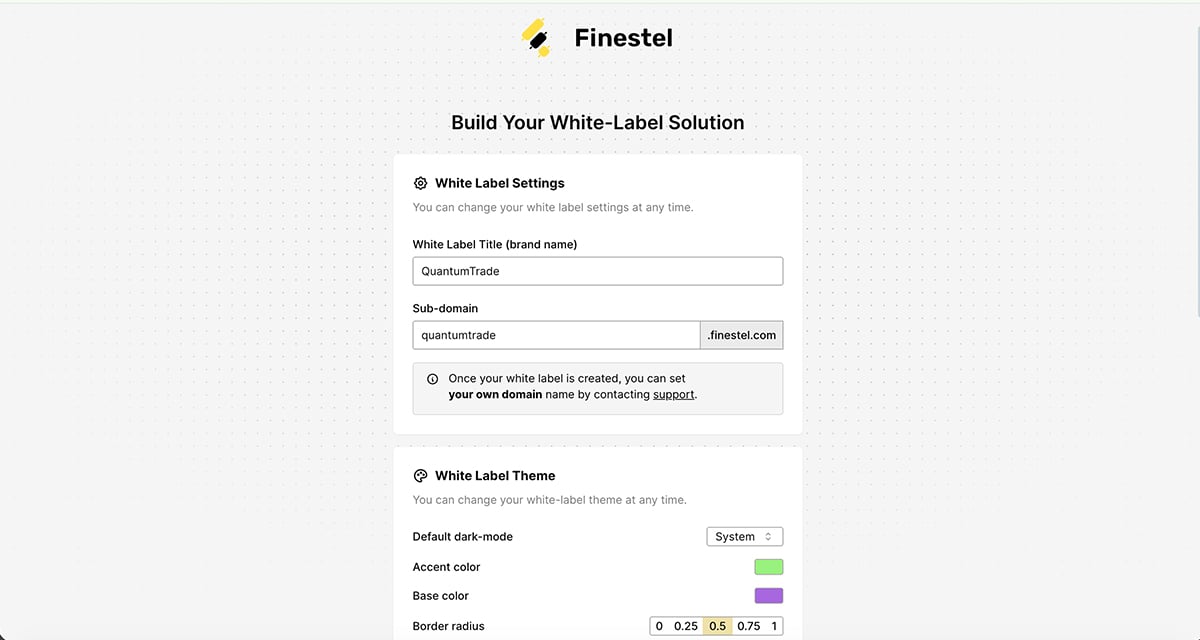

Section 1: White Label Settings; Your Brand Foundation

First, you’ll establish your brand identity and domain.

Brand Name & Domain:

- Enter your brand name: This is what clients see everywhere, navigation headers, email footers, support messages. Make it match your registered business name or your marketing brand.

- Set your domain: Instead of clients visiting a Finestel’s subdomain address, they’ll go to yourbrand.com. Just choose a domain name, then contact sales, and we’ll create your domain address.

Section 2: White Label Theme; Colors That Pop

Next, you’ll define your visual identity. This is where design meets psychology.

Color Selection:

- Primary color: This is your brand’s dominant color. It appears in buttons, headers, active states, and key CTAs. Think of it as your “action” color; what do you want users to feel when they click something?

- Secondary color: Your supporting color for accents, hover states, and secondary elements. This should complement your primary without competing for attention.

Live Preview: Here’s the genius part, as you adjust colors, you’ll see a live preview of your platform. Toggle between light and dark modes to ensure readability. Check how buttons look, how navigation renders, how charts display.

⚠️ Common mistake: Choosing colors that look great on your brand guidelines but tank readability on screens. Use the preview heavily. If text is hard to read, adjust until it’s crystal clear.

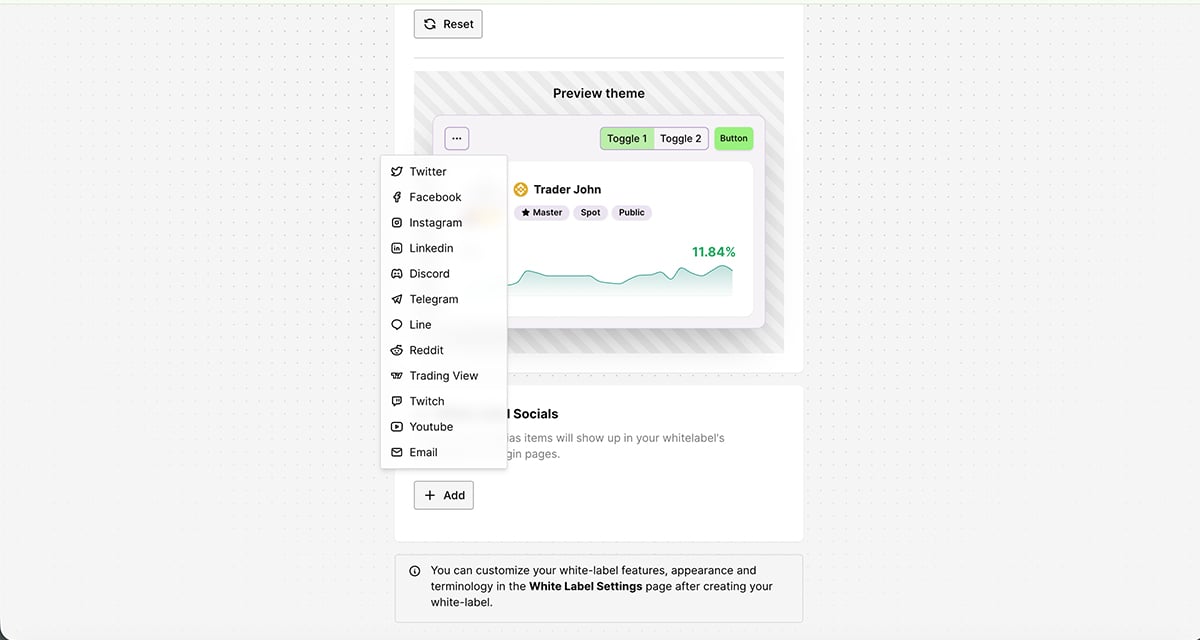

Social Media Links: Once your colors are set, you’ll add your social proof.

- Instagram: Your handle or profile URL

- LinkedIn: Company page or your professional profile

- X (Twitter): Your account link

- Other platforms: Facebook, YouTube, TikTok.

Section 3: Visual Assets; Logo, Icons, and Details

Final step: upload your visual identity and configure technical details.

Logo Upload:

- Main logo: Appears in navigation, emails, and desktop views

- Mobile logo: A simplified or icon version for small screens

- Recommended specs: 512x512px minimum, with transparent background

- Pro tip: Upload SVG files if you have them, they scale perfectly on any screen size without quality loss

TWA Icon (Mobile App):

- This is the icon users see on their phone home screens if they’re using your native mobile app (Enterprise) or progressive web app (Business)

- Required size: 512x512px, square format

- Design tip: Simple, recognizable, works at tiny sizes. Your full logo might be too detailed, consider using just your brand mark or initials

Technical Configuration:

- Hostname: Confirm your custom domain (this auto-populates from Page 1, but double-check)

- Platform title: What appears in browser tabs and bookmarks (e.g., “Apex Wealth – Portfolio Tracker”)

Once you hit “Save,” your branding is live. Every new client who signs up, every email that goes out, every mobile login, it’s all your brand now, not ours.

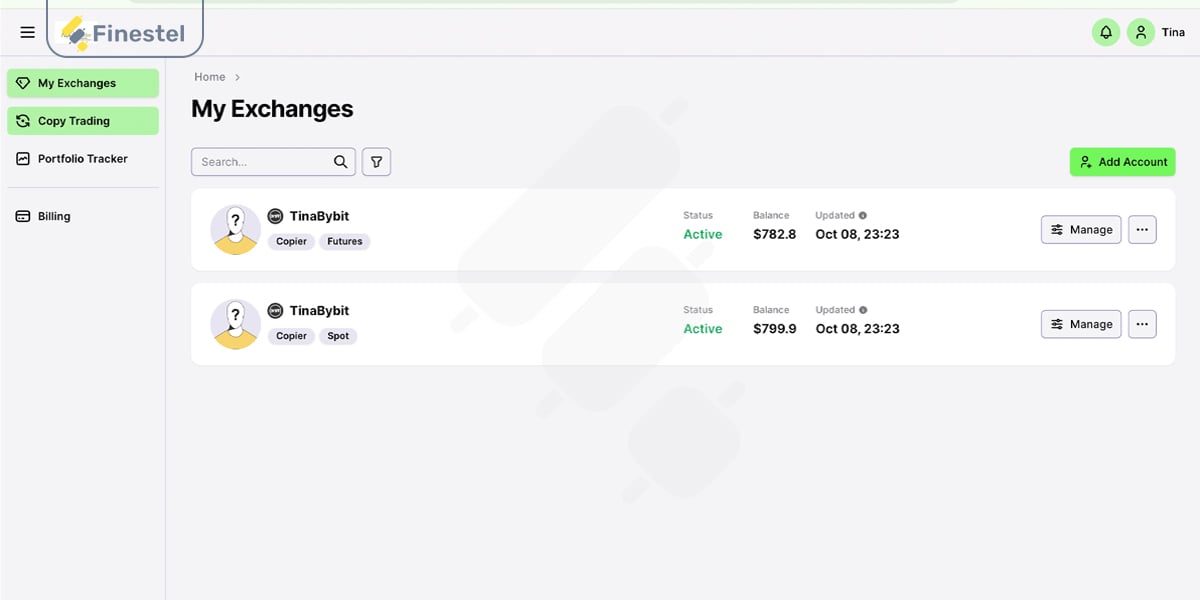

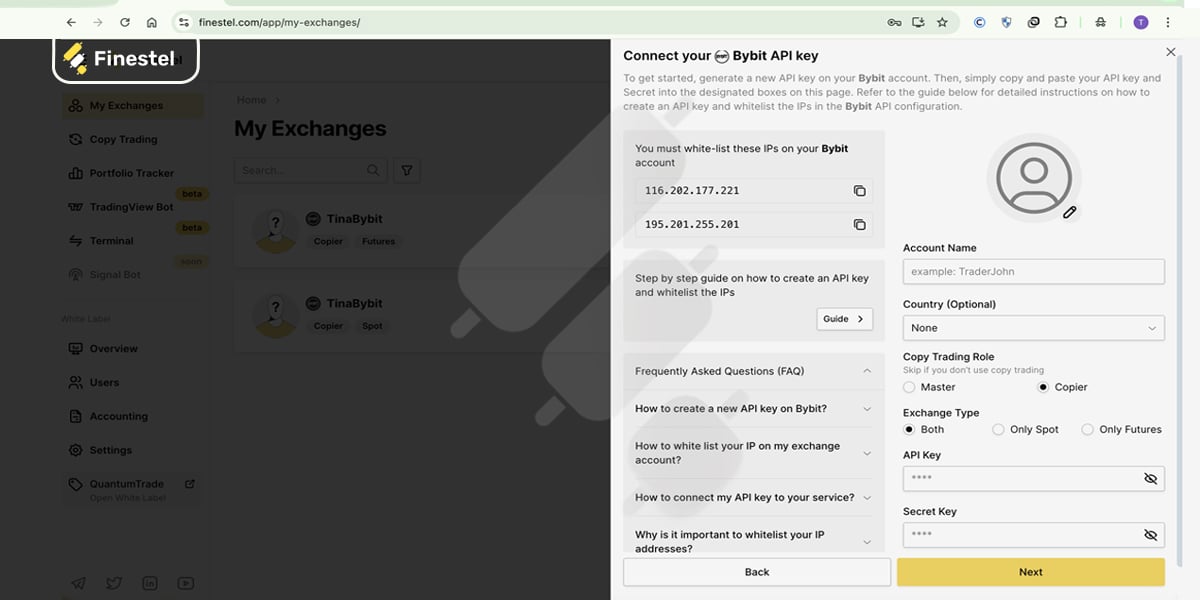

Step 3: Connect Your Exchange Account (5 minutes)

⏱️ Time needed: 5 minutes for your first exchange

🎯 Quick win: Connect one exchange now, then you’ll add client accounts

Before you can manage client portfolios, you need to connect your own exchange account. This is your master account that enables the platform to execute trades and access market data.

Here’s the exact process:

Navigate to Exchange Accounts

In your dashboard, find the “My Exchange” section and click “Add Account”.

Select Your Exchange

Choose which exchange you’re connecting:

- Binance

- Bybit

- KuCoin

- OKX

- Gate

- Bitget

- And others

Generate API Keys from Your Exchange

Now you’ll leave the Finestel platform temporarily and go to your chosen exchange.

On the exchange (using Binance as an example):

- Log into your exchange account.

- Navigate to API Management (usually under Account Settings or Security)

- Click “Create New API Key”

- Critical: Set the correct permissions

- ✅ Enable “Read” permission (required to view balances and market data)

- ✅ Enable “Trade” permission (required to execute buy/sell orders)

- ❌ Don’t enable “Withdrawal” permission (this is critical for security)

- Complete any 2FA verification the exchange requires

- Copy your API Key and Secret Key (you’ll only see the secret once, save it securely)

Enter Your API Keys into Finestel

Back in the Finestel platform, you’ll see fields for:

- API Key: Paste the key you just copied

- Secret Key: Paste your secret key

- API Passphrase (if required by your exchange, some like KuCoin need this)

- Account Label: Give this account a name you’ll recognize (e.g., “Binance Master Account”)

Click “Connect” or “Save”.

🔒 Let’s Talk Security: Why This is Actually Safer Than You Think

If you’re nervous about connecting exchange accounts via API keys, that’s healthy skepticism. Let’s address it directly.

What API Keys CAN Do:

- ✅ Read your account balance and positions

- ✅ Execute trades (buy/sell) you authorize through the platform

- ✅ View your trade history and open orders

What API Keys CANNOT Do:

- ❌ Withdraw funds (you deliberately disabled this permission)

- ❌ Change your exchange account settings

- ❌ Modify security settings or passwords

- ❌ Transfer assets to external wallets

Your funds never leave the exchange. They stay in your exchange account, protected by the exchange’s security infrastructure. The API key is simply permission to read data and execute trades, nothing more.

Step 3: Explore in Your White Label Dashboard

Now that your branding is configured, let’s explore what you actually see when you log into your dashboard. This is mission control for your entire operation.

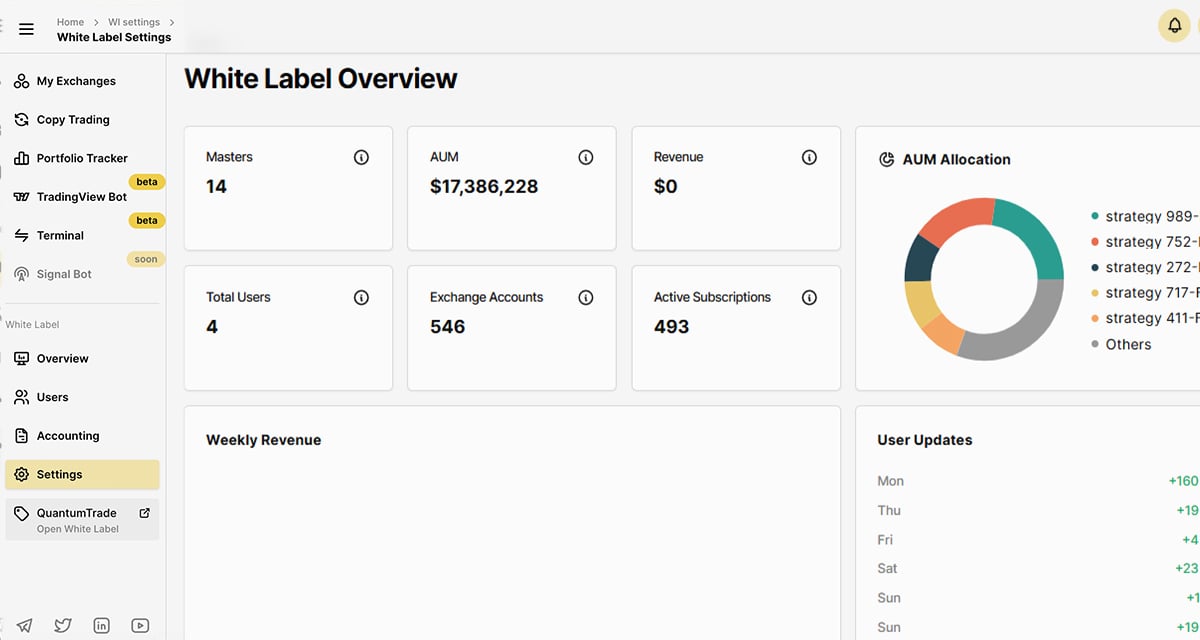

Finestel’s White Label Overview Tab: Your Business at a Glance

When you first land in your dashboard, you’ll see your key performance metrics:

Business Health Metrics:

- Masters: Number of master traders you’re copying (if using copy trading features)

- AUM (Assets Under Management): Total value of all client portfolios you’re managing

- Revenue: Your earnings from subscription fees, performance fees, or your chosen model

- Total Users: How many clients are registered on your platform

- Exchange Accounts: Total connected exchange accounts across all users

- Active Subscriptions: Clients currently paying for your services

Visual Insights:

- AUM Allocation Chart: See how client capital is distributed across different assets (BTC, ETH, altcoins, stablecoins)

- Weekly Revenue Graph: Track your revenue trends over time—spot growth patterns or drops that need attention

💡 Why this matters: This single screen tells you if your business is healthy. Growing AUM + steady subscriptions = you’re doing something right. Flat revenue + declining users = time to improve service or marketing.

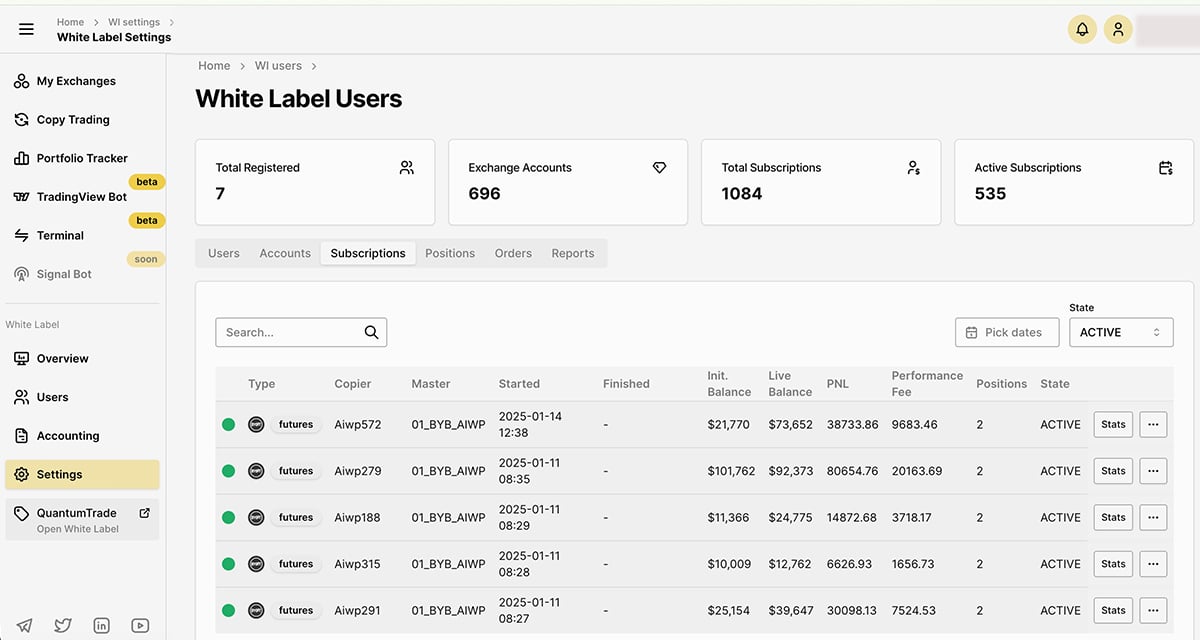

Users Tab: Deep Dive into Your Client Base

Click into the Users tab to see granular data about your clients.

Top-Level Stats:

- Total Registered: Everyone who’s signed up (includes free trials and inactive users)

- Exchange Accounts: Combined number of exchange connections across all clients

- Total Subscriptions: Lifetime subscription count (including cancelled ones)

- Active Subscriptions: Currently paying clients, this is your MRR (Monthly Recurring Revenue) source

Detailed Views (Sub-tabs):

- Users: Individual client profiles, contact info, registration dates, subscription status

- Accounts: All connected exchange accounts, balances, and connection health

- Subscriptions: Payment history, billing cycles, upcoming renewals, overdue payments

- Positions: Every open trade across all client accounts in real-time

- Orders: Complete trade history, every buy/sell executed through your platform

- Reports: Pre-generated analytics for each client (perfect for monthly client calls)

⚠️ Common use case: Checking “Active Subscriptions” before launching a new feature to calculate how many clients you’ll need to support. Or reviewing “Orders” after market volatility to ensure all trades executed correctly.

White Label Accounting Tab, Follow the Money

This is where you track every dollar (or sat) flowing through your business.

Three Critical Views:

Balance: Your platform’s current financial snapshot. If you’re collecting fees through Finestel’s billing system, this shows your available balance before payout.

My Transactions: Your business transactions, when clients pay you, when you withdraw earnings, when subscription renewals process. This is your revenue audit trail.

User Transactions: Individual client payment activity, who paid, who’s overdue, refund requests, failed payment attempts. Essential for following up on billing issues.

💡 Pro tip: Export “My Transactions” monthly for your bookkeeper. Clean records make tax season infinitely less painful.

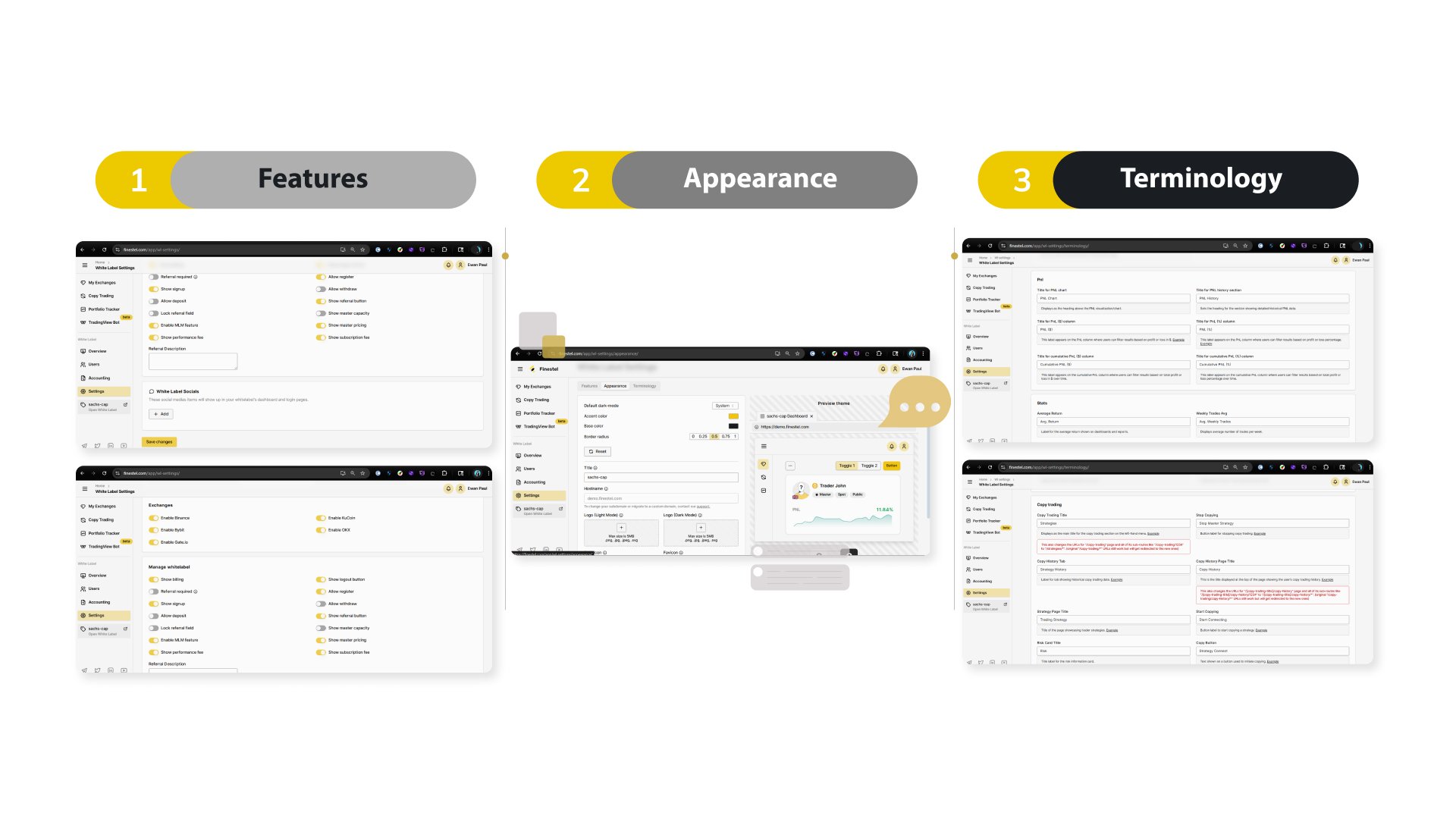

White Label Settings Tab; Fine-Tune Your Business Model

This is where strategy meets execution. You’ll configure exactly how your platform operates.

Click into the White Label Settings tab and you’ll see three powerful sub-sections:

- Features: Control your business logic and revenue model

- Appearance: Adjust your visual branding anytime

- Terminology: Customize the language your platform speaks

Features Tab; Your Business Logic Controls

Features Tab; Your Business Logic Controls

This section determines what features your clients see and how your revenue model works.

Copy Trading Settings: Configure your fee structure (subscription fees, performance fees, free trials), payment deadlines, and what happens when clients cancel their subscriptions.

Exchange Toggles: Enable or disable specific exchanges (Binance, KuCoin, Bybit, OKX, Gate.io). Only turn on exchanges you’re actively supporting, quality over quantity.

Manage White Label: Control platform behavior like billing visibility, deposit/withdrawal options, referral systems, MLM features, and client registration settings.

💡 Key decision: Most successful partners use a hybrid pricing model (base subscription + performance fee) and keep deposit/withdrawal disabled to reduce regulatory complexity.

Appearance Tab; Real-Time Visual Control

This is your design command center. Adjust colors, upload new logos, modify domain settings, update social media links, and change mobile app icons, all with live preview. Your brand evolves, and this section lets you adapt instantly without needing a developer.

Why it matters: Test seasonal themes, rebrand entirely, or just fix that logo that’s been bugging you—all without disrupting your service.

Terminology Tab; Speak Your Clients’ Language

Finestel’s default language is optimized for “copy trading platforms,” but you can customize every term to match your positioning.

Examples:

- Running an AI fund? Change “Master Traders” to “Algorithmic Models”

- Traditional wealth management? Change “Subscription Fee” to “Advisory Fee”

- Hedge fund positioning? Change “Copy Trading” to “Managed Portfolios”

Your terminology signals your market positioning. Budget platforms say “copy trading.” Premium platforms say “portfolio management.” Choose language that matches your pricing tier and target clients.

Step 4: Test, Launch, and Scale (1-2 hours)

⏱️ Time needed: 1-2 hours for thorough testing

🎯 Quick win: Run your own portfolio through the system first, you’ll catch any issues and understand the client experience. You’re 90% there. Before you open the floodgates to clients, let’s make sure everything works flawlessly.

Your pre-launch checklist:

Test Everything

- Execute a test trade using automation to confirm bots work

- Generate a sample client report to verify formatting and data accuracy

- Send yourself a test invoice to check billing emails

- Access your platform from mobile to ensure responsive design

- Test the client onboarding flow from their perspective

💡 Smart move: Create a “test client” account using your own portfolio. Run it for 1-2 weeks before bringing on real clients. You’ll discover UI quirks, refine your strategy, and build confidence in the system.

Go Live

Once testing looks good:

- Update your domain DNS settings to point to your custom domain (Finestel provides instructions)

- Activate client registration if you’re allowing self-service signups

- Turn on email notifications so clients get updates

- Double-check all branding elements are displaying correctly

You’re live. Your platform is now operational, professional, and ready to serve clients.

Step 5: Onboard Your First Clients

Within 24 hours of completing your setup, you’ll receive your custom domain (yourbrand.com). That’s your platform’s login page, the link you share with clients.

The client onboarding process is simple: Send them your platform link. They sign up with their email and password. Then they connect their exchange accounts using API keys, exactly the same way you did in Step 3. Read and Trade permissions only, no withdrawals. Their accounts label will be copier, while your account is the master one.

Once their exchange account is connected, they’re live on your platform. They can see their portfolio, choose which trading strategies to follow, and start investing.

Your Next Steps

You’ve read the guide. You understand the process. Now the only question is: when do you start?

Option 1: Start Today

Sign up for Finestel, follow this guide, and have your platform live by the next 24 hours. The sooner you launch, the sooner you’re generating revenue.

Option 3: Contact Us

Have specific questions about your use case? Not sure which plan fits your needs? Want to discuss custom features or enterprise requirements?

Our team has helped hundreds of asset managers launch successful white-label platforms. We’ll walk you through the setup process, answer technical questions, and help you determine the best configuration for your business model.

Option 3: See It First

Book a meeting and a live demo where we’ll walk through the entire platform, answer your specific questions, and show you real client dashboards from successful partners.

Get Started Now → | Contact us on Telegram → | Sent an email to book a meeting→

Leave a Reply