Privacy is becoming rare in crypto. Most big exchanges now ask for full KYC before you can trade, withdraw, or even open an account. For many traders, both small and big, it’s a headache. That’s why in this article, we will introduce the top 20 no KYC crypto exchanges in 2025.

In 2025, crypto exchanges without KYC are still attractive. They give you (almost) the same features as other exchanges, but provide a backup option when you can’t or don’t want to send in documents. In this guide, we’ll go through the Top 20 no KYC crypto exchanges in 2025, and I’ll break down why they’re useful and how you can choose the right option.

What is KYC and Why Do Exchanges Use It?

KYC stands for Know Your Customer. It’s the process where exchanges ask for your ID, address, and sometimes even income proof, before letting you trade freely. Basically, they want to know who you are.

Why? Because regulators push for it. Governments don’t want anonymous money moving around. They want to stop money laundering, scams, and tax evasion. Exchanges comply because if they don’t, they risk getting shut down.

For the trader, though, KYC feels like a roadblock. You have to upload documents, wait hours or even days for approval, and sometimes get limited or banned if your country is flagged. Even worse, your personal data is stored somewhere, and leaks are not rare in crypto.

So while KYC has its reasons, many traders just want fast access without the extra checks. After all, Bitcoin was meant to be anonymous, right? So, if you also are not cool with uploading your sensitive documents online, knowing the top 20 no KYC crypto exchanges in 2025 is necessary.

Why Would Someone Need No KYC Exchanges?

Not everyone has the same reason for skipping KYC. For some, it’s about keeping things private. For others, it’s just about speed and flexibility. Let’s take a look at both sides that might need to buy crypto without KYC: retailers and asset managers.

KYC For Retail Traders

For regular traders, the top 20 no KYC crypto exchanges we’ve listed in this article are often a better choice than platforms that demand full ID checks. You don’t need to share your passport or wait days for approval. Just sign up, deposit, and trade in minutes.

Privacy is another big reason. Many traders don’t want their activity tied to their identity. With data leaks in the past, that concern is fair. These exchanges also work as a backup if your main account gets locked or you’re traveling without documents.

KYC For Asset Managers and Pro Traders

Now, let me flip the perspective. For asset managers and pros, it’s more about flexibility. The top 20 no KYC crypto exchanges we introduce let you run multiple accounts without endless verification delays.

That’s key for strategies like arbitrage, where seconds matter. Liquidity is another factor, since pro traders need deep order books across markets. And in regions where big exchanges limit service, a crypto exchange without verification gives you the access you need.

Top 20 No KYC Crypto Exchanges in 2025

Let’s take a closer look at the top 20 no KYC crypto exchanges. Each one has its own style, strengths, and target audience. So, there’s an option for everyone.

|

Exchange |

Type |

No KYC Features / Limits |

Main Strengths |

Best For |

|

MEXC |

CEX |

Spot & futures, no KYC up to high limits |

High liquidity, wide altcoin coverage |

Retail + Pro |

|

Margex |

CEX |

No mandatory KYC for crypto trading |

Risk control features, up to 100x leverage |

Pro traders |

|

HTX |

CEX |

Trade & withdraw up to ~0.06 BTC/day without KYC |

Big exchange, strong liquidity, wide coin support |

Retail (small trades) |

|

PrimeXBT |

CEX |

Crypto deposits/withdrawals w/o KYC |

Leverage trading, multi-asset exposure |

Professionals |

|

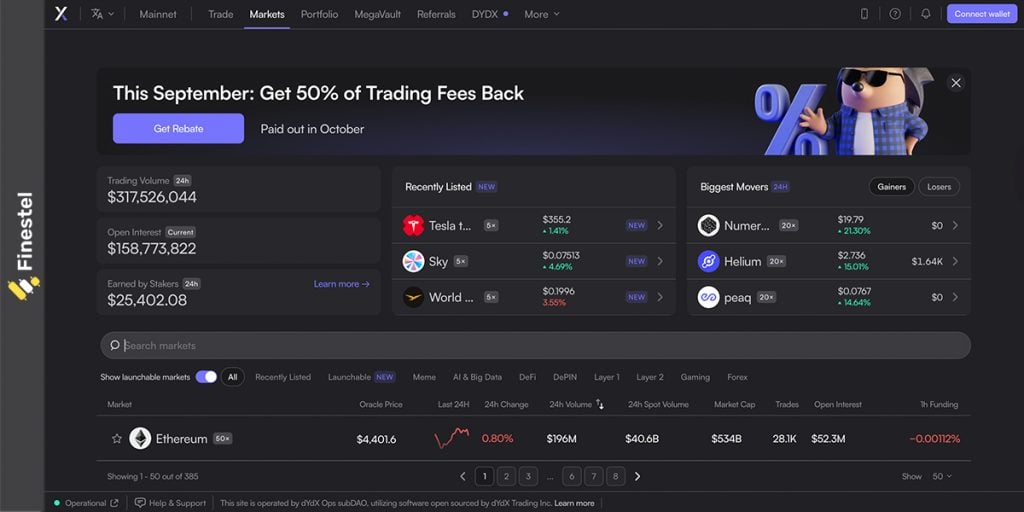

dYdX |

DEX |

Decentralized, no ID required |

Top perpetuals DEX, deep liquidity |

Professionals |

|

CoinEx |

CEX |

Withdrawals allowed without KYC |

Easy interface, reliable CEX |

Retail |

|

Hodl Hodl |

P2P |

P2P BTC trades, no KYC |

Simple escrow system, Bitcoin-only |

Retail privacy users |

|

KCEX |

CEX |

No KYC for trading & withdrawals (limits) |

Fast-growing futures platform, solid liquidity |

Retail + Pro |

|

Uniswap |

DEX |

Wallet connect, no KYC |

Biggest DEX for ERC-20 tokens |

Retail + DeFi users |

|

Bisq |

P2P DEX |

No KYC, runs on Tor |

True privacy, fully decentralized |

Privacy-focused |

|

PancakeSwap |

DEX |

Wallet connect, no KYC |

BSC tokens, high liquidity pools |

Retail + DeFi users |

|

CoinFutures |

CEX |

No KYC for trading & withdrawals (limits) |

Futures-focused, simple interface, crypto-only |

Retail + Pro |

|

SimpleSwap |

Swap |

Instant swaps, no account needed |

Easy UI, quick token exchanges |

Retail |

|

Changelly |

Swap |

No account swaps (small limits) |

Long-standing service, fiat on-ramp |

Retail |

|

Pionex |

CEX |

Some bots & spot w/o KYC (limits apply) |

Built-in trading bots, good liquidity |

Retail |

|

ProBit |

CEX |

No KYC for basic accounts |

Asian market reach, broad coin listing |

Retail |

|

Bitcoin Well |

Hybrid |

No KYC Bitcoin buy/sell (region-based) |

Focused on Bitcoin cash-out options |

Retail |

|

Peach Bitcoin |

P2P |

No KYC peer-to-peer |

Mobile-first Bitcoin buying |

Retail BTC buyers |

|

Robosats |

P2P |

Tor-based, no KYC |

Lightning BTC trades, great privacy |

Privacy traders |

|

Haveno |

P2P DEX |

Privacy-first Monero marketplace |

Monero focused, privacy maxed |

Privacy pros |

1. MEXC

MEXC is one of the few big exchanges still letting you trade spot and futures without KYC. You can withdraw up to 30 BTC a day with just an email signup, which is more than enough for most traders. The platform has deep liquidity, especially on altcoins that other exchanges don’t list. That’s why it tops our list of the top 20 no KYC crypto exchanges.

It also offers launchpads, staking, and copy trading features. These features are not available on many no KYC exchanges, and that’s why it’s also very attractive for professional traders. So, if you’re after a mix of speed, liquidity, and variety, MEXC is my top suggestion.

2. Margex

Margex is a Bitcoin-based derivatives exchange that doesn’t force KYC for crypto deposits and trading. You can fund your account with BTC, USDT, USDC, DAI, ETH, and a few others. And catch this, the leverage goes up to 100x.

What sets Margex apart is its focus on risk control. It uses an AI-driven system to prevent price manipulation and unfair liquidations. This is something that smaller exchanges often struggle with. The interface also includes a unique feature called MP Shield, which protects traders from pump-and-dump schemes, which are quite common on small exchanges.

3. HTX

HTX, formerly known as Huobi, still allows limited trading without full KYC. You can open an account, deposit crypto, and withdraw up to around 0.06 BTC per day without verifying your ID. That makes it usable for small trades, though most advanced features like higher limits and fiat options require KYC.

The exchange supports hundreds of coins, offers strong liquidity, and has been a big player in Asia for years. Compared to other no KYC platforms, HTX is more of a “low-KYC” option, but it’s still handy for traders who want access to a large exchange while staying under the radar with smaller amounts.

4. PrimeXBT

PrimeXBT is different from most of our top 20 no KYC crypto exchanges list because it’s not just for crypto. The platform also lets you trade forex, commodities, and stock indices. And that’s without mandatory KYC.

It also has unique tools like Covesting copy trading, where you can follow pro traders’ strategies directly, or become a master trader yourself. These features make PrimeXBT especially attractive for crypto asset managers and high-net-worth traders.

5. dYdX

dYdX is a decentralized exchange. But it’s for perpetual futures trading. That in itself makes it a unique addition to our Top 20 no KYC crypto exchanges list. There’s no ID upload and not even a sign-up process! You should just connect your wallet, and you’re in.

The professional-level order book is another thing that makes dYdX unique. I mean, most DEXs I know of don’t have it. You also get leverage up to 20x and advanced tools that can almost rival centralized exchanges like Binance.

6. CoinEx

CoinEx has been around since 2017 and has built a reputation. You can still buy crypto without KYC, which makes it stand out in 2025 when most CEXs force full verification. The platform supports over 700 coins and pairs.

One of CoinEx’s strong points is its reliability during high-volatility periods. Unlike many exchanges that freeze or slow down, CoinEx handles traffic smoothly. It also has its own token, CET, which lowers fees and unlocks perks for active users.

7. Hodl Hodl

Now, we have a p2p crypto exchange with no KYC, Hodl Hodl. In two words, it’s simple and private, things Bitcoiners love. You won’t need to hand over your personal info. Also, no custodial risk since trades happen directly between users.

The platform uses multisig escrow to keep both sides safe. Hodl Hodl is especially popular for anonymous fiat-to-Bitcoin trades. That’s what makes it arguably the best option in this top 20 no KYC exchanges list for Bitcoiners.

8. KCEX

KCEX is one of the newer exchanges making a name for itself in 2025. Yet, it has solid liquidity on futures and spot markets. You don’t need KYC to trade or withdraw. Make no mistake; there are limits. But they’re pretty generous for unverified accounts. What I like about KCEX the most is that it doesn’t lag when markets get wild.

9. Uniswap

Uniswap is the king of DEXs. I’m sure it’s one of the more familiar names on this top 20 no KYC crypto exchanges list. And it’s also a top choice, because there’s no signup or KYC. Like many Dexs, just connect your wallet and you’re ready to trade.

It’s the main marketplace for ERC-20 tokens on Ethereum, and if a coin exists in the Ethereum ecosystem, chances are you’ll find it on Uniswap first. But the big draw is liquidity.

10. Pionex

Pionex is a crypto exchange without verification for small trades. It offers free built-in trading bots that we’ve mentioned a few times already in our past Finestel articles. It supports over 300 coins, has good liquidity, and low fees compared to many exchanges. These features make it a very appealing option on our list of the top 20 no KYC crypto exchanges. For higher withdrawal limits or fiat options, however, you’ll need KYC.

11. Bisq

Bisq is a privacy-focused P2P Bitcoin exchange that runs over Tor with no central server and no KYC. You download the app and trade directly with users through multisig escrow. It’s slower and has less liquidity than Hodl Hodl, but offers stronger anonymity, making it a solid choice for traders who value privacy over convenience.

12. PancakeSwap

PancakeSwap is the largest DEX on Binance Smart Chain. It lets you swap tokens by just connecting your wallet. Therefore, you can buy crypto with no KYC. Fees are much lower than Ethereum, and liquidity is strong across BSC pairs. It also has extras like staking, farming, and lotteries. However, the downside is that it’s limited to the BSC ecosystem compared to Uniswap’s broader reach.

13. CoinFutures

CoinFutures is a smaller centralized exchange that focuses mainly on crypto futures trading. You don’t need KYC to open an account, deposit, or trade, though withdrawal limits apply if you stay unverified. The platform keeps things simple with a clean interface and a strong focus on derivatives rather than a wide spot market. Yet, it doesn’t have the same liquidity as giants like Bybit or MEXC.

14. SimpleSwap

SimpleSwap is an instant swap service where you can trade over 1,500 crypto and fiat currencies without creating an account or doing KYC. You pick what to send and receive, and the swap completes in minutes. Rates can be fixed or floating. But note that fees are built into the rate, so it’s a bit more expensive than regular exchanges.

15. Changelly

Changelly is one of the oldest instant swap platforms. You can exchange crypto-to-crypto without KYC for smaller trades. It supports over 1,000 coins. You can buy crypto without KYC using fiat through partners like Visa, Mastercard, Apple Pay, and Google Pay. Just remember, going above about 1 BTC/day may trigger KYC.

16. ProBit

ProBit is a centralized exchange popular in Asia that lets you trade without KYC. Yet, withdrawal limits stay low unless you verify. It lists over 500 coins, including many smaller projects not found on big exchanges. Probit also runs regular IEOs. In my opinion, it’s a decent choice for smaller trades and altcoin access without ID checks.

17. Bitcoin Well

Bitcoin Well is a service mainly for buying and selling Bitcoin with cash or bank transfer. It’s non-custodial and doesn’t ask for KYC in many cases, but it’s limited to certain regions. Compared to big CEXs like MEXC or Bybit, it has very low liquidity and only supports Bitcoin, which is why it’s further down our list of the top 20 no KYC crypto exchanges in 2025.

18. Peach Bitcoin

Peach Bitcoin is a mobile app for P2P Bitcoin trading. It’s easy to use and doesn’t need KYC. Yet, it’s still new and has a smaller user base. Meanwhile, compared to Hodl Hodl or Bisq, the liquidity and options are certainly limited.

19. Robosats

Robosats is another simple, Tor-based P2P platform for trading Bitcoin. But this one works mainly over the Lightning Network. It’s fully private and doesn’t need KYC, but the volume is small. And, of course, it only supports Bitcoin. It’s more private compared to other options, but also only useful for small volumes.

20. Haveno

Haveno is the last entry on our top 20 no KYC crypto exchanges list. It’s a P2P exchange built for Monero. Havana is open-source and privacy-first, but adoption is still low, and consequently, liquidity is thin. Compared to other P2P exchanges we’ve mentioned, it’s very limited since it only supports Monero trades, which is why it sits at the bottom of the list.

How to Choose from The Top 20 No KYC Crypto Exchanges

When picking a No KYC exchange, think about what matters most for your trading. Liquidity and trading volume decide how easy it is to get in and out of positions. Asset coverage tells you if the exchange fits your style.

Privacy is also key, but balance it with security and trust. Check withdrawal and deposit options, since some platforms are crypto-only while others support fiat.

Jurisdiction and reputation matter too. Some exchanges are safer than others. Finally, I recommend that you choose based on who you are: a retail trader who needs speed and simplicity, or an asset manager who needs deeper liquidity and tools. Either way, our list of the top 20 no KYC crypto exchanges in 2025 will definitely help you decide.

How Finestel Adds Value

No KYC crypto exchanges are useful, but managing them can be messy. That’s where Finestel helps. We give traders and businesses tools to trade smarter and faster across multiple accounts.

With our copy trading software, you can build your own branded platform, manage everything through API, and start copy trading without writing a single line of code. You even get the first month free.

We also offer bots that cut out the manual work:

- TradingView Bot, which turns your TradingView alerts into instant trades on your exchange accounts.

- Signal Bot that connects to indicators, PineScript strategies, Telegram, or even webhooks like Zapier, then places orders automatically.

- Advanced Trading Bots that run your strategies across top exchanges like Binance, KuCoin, Bybit, OKX, and Gate from one dashboard.

- White Label MLM Software, which is fully customizable and has up to 10 levels. It’s built to grow crypto businesses with automated tracking and blockchain transparency.

With Finestel, you save time, cut out emotions, and scale your trading or business in ways you can’t with an exchange alone.

Top 20 No KYC Exchanges Infographic

Conclusion

No KYC exchanges are still important in 2025. They give traders speed, privacy, and flexibility when big exchanges demand too much. Our list of the top 20 no KYC crypto exchanges in 2025 includes large CEXs like MEXC to smaller P2P options like Hodl Hodl, and each platform has its own strengths and limits.

So, the key is picking the one that fits your needs. And if you want to take it further, Finestel can help you manage accounts, run bots, and even launch your own platform.

Leave a Reply