Bitcoin dropped 16% in November, from $109k to a mid-month low of $80k before recovering to $91k. Altcoins got crushed harder. This wasn’t the volatility we flagged in October; it was worse. The government shutdown lasted longer than anyone expected, macro liquidity tightened, and risk assets sold off across the board.

Sentiment hit multi-year lows. BTC dominance pushed past 60% as money fled altcoins. By month-end things stabilized, barely. On-chain data showed massive liquidations but also some bottom-feeding. Institutional money kept flowing out.

This November 2025 crypto market report pulls from Finestel‘s internal data, KuCoin‘s weekly institutional insights and broader market data, breaking down where money moved and what professionals actually did.

Macro Economics: Everything Went Wrong at Once

The US government shutdown dominated November and killed sentiment. Key data like non-farm payrolls got delayed, financing spreads widened, rate cut expectations became unstable. Private sector layoffs ran about 10k per week. There was a brief rally around November 11 when a procedural vote looked promising, but the data gaps and labor weakness kept suppressing risk assets.

Trade tensions with China eased slightly (consultations happened, some tariff relief), but sanctions on Russian entities stayed in place and threats lingered. The Fed dropped dovish hints late in the month, including possible QT adjustments, which gave some relief. But the Bank of Japan went the opposite direction with rate hikes, strengthening the yen and adding pressure. Inflation metrics cooled, but regional bank vulnerabilities and credit concerns swept through markets.

Macro headwinds peaked mid-month. Crypto briefly decoupled from U.S. stocks; in the wrong direction, though end-of-month policy optimism synced partial recoveries.

Timeline of what actually happened:

- Nov 3: Manufacturing contracted for the eighth straight month

- Nov 4: Shutdown set a duration record

- Nov 5: ADP employment beat expectations at 42k; ISM Services hit 52.4; China paused some tariffs

- Nov 7: One-year inflation came in at 4.7% (higher than expected); consumer confidence fell to second-lowest ever

- Nov 9-13: Senate and House passed bills to end shutdown; Trump signed on Nov 13, funding agencies until Jan 30, 2026

- Nov 14: Fed’s Logan said she couldn’t support a December cut; Bostic was undecided

- Nov 17: At least three Fed members opposed a December cut

- Nov 19: Nvidia beat Q3 revenue expectations

- Nov 20: September non-farm payrolls revised to +119k; unemployment hit 4.4% (highest since October 2021)

- Nov 21: Williams signaled room for near-term cuts; December cut probability jumped to 70%

October CPI never got released. November CPI was rescheduled for December 18.

Bitcoin in November 2025: History’s Top-5 Capitulation

Bitcoin started November near $109k, peaked briefly, then cascaded to $80k lows before closing at $91k; a 16% monthly loss. Early consolidation unraveled with shutdown drags. Mid-month triggered one of history’s top-5 capitulation events, with 99.9% of realized value from losses. Rebounds emerged on shutdown resolution news and bottom-feeding, but volatility stayed elevated. Fear hit 3-year lows.

On-chain showed intense restructuring. Long-term holders distributed about 180k BTC. Short and medium-term holders sold heavily at $108k–$124k, with over 840k BTC transferred weekly at peaks; highest since December 2024. This created vacuum zones at $70k–$93k post-liquidation. By month-end, supports consolidated higher at $82k–$85k and $100k–$112k, bolstered by native accumulation, about 600k BTC sitting at $112k resistance, chips in the $100k-$112k range balanced out.

Analysts are calling this a mid-cycle reset. $96.8k is the bull-bear line. Holding above that signals consolidation. Below that risks deeper correction.

Technicals featured expanded Bollinger Bands and mid-month Volatility Index spikes, easing late as fear bottomed.

BTC’s correlation with Nasdaq futures rebounded to 0.53 over 30 days. Russell 2000 correlation hit 0.95; a new high, highlighting small-cap beta traits in liquidity squeezes.

Ethereum: Down 20%, Staking Held Up

Ethereum tracked Bitcoin’s volatility with amplified losses, dropping about 20% to close near $2,800. Staking participation held steady around 30%. Lido and EigenLayer saw continued inflows, and RWA tokenization via Pendle (TVL ~$7B) offered defensive yields. ETH underperformed because capital fled to BTC, but institutional buying tied to DeFi showed up on-chain.

Altcoins: Liquidity Vanished

BTC dominance surged from 59% to over 60% as altcoins imploded. Most segments dropped 80%+ in vulnerable liquidity pools. High-beta plays collapsed, exposing structural cracks. Late rebounds in L1s like SOL and AVAX hinted at selective recovery, but narratives in AI and privacy flickered without spillover. Managers slashed holdings and favored event-driven shorts.

Altcoin market cap proportion stayed stable despite slight rebounds, mainly technical recoveries without real risk appetite expansion.

November 2025 Crypto Market Report by the Numbers

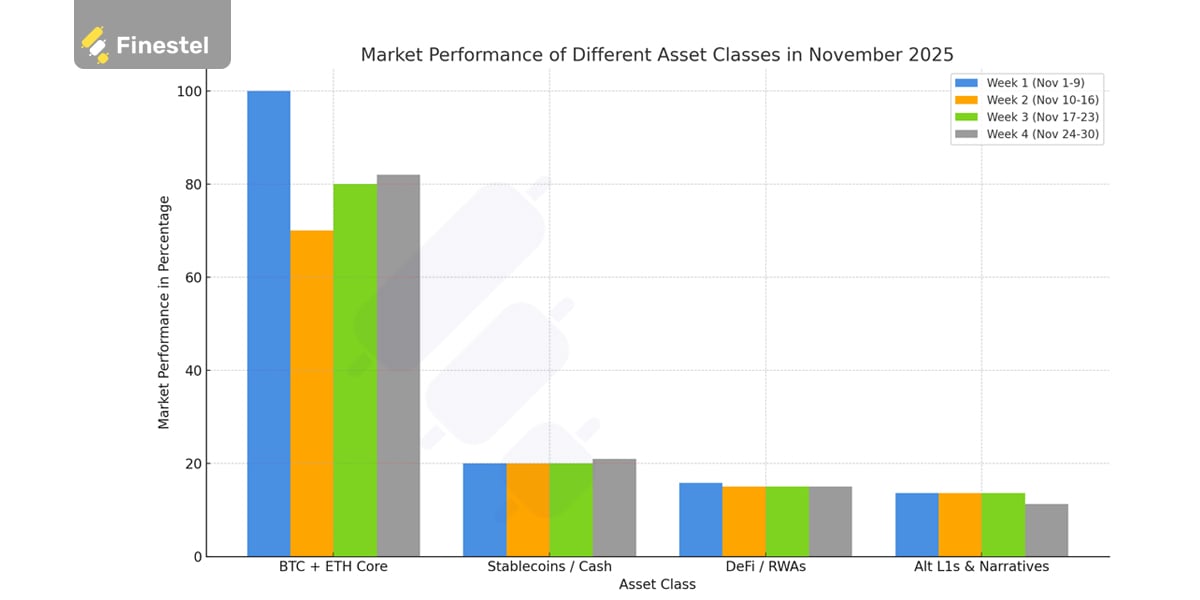

| Metric | Week 1 (Nov 1-9) | Week 2 (Nov 10-16) | Week 3 (Nov 17-23) | Week 4 (Nov 24-30) | Monthly |

|---|---|---|---|---|---|

| BTC Price | $100k-$112k | $70k-$93k | $80k-$96k | $82k-$91k | -16% |

| ETH Price | $3,500-$3,800 | $3,000-$3,500 | $2,900-$3,200 | $2,700-$2,800 | -20% |

| Market Cap | $3.79T | $3.20T | $2.98T | $3.10T | -18% |

| Avg. Daily Volume | $150B | $145B | $130B | $135B | -10% |

| BTC Dominance | 59.48% | 60% | 60.5% | 60.2% | +1.2% |

Derivatives: Elevated Vol Bets, Leverage at Lows

Derivatives held over 75% market share. Options open interest at highs hedging policy risks. Futures leverage hit yearly lows, reflecting subdued appetite. Liquidations skewed long-biased early (82%). Platforms like dYdX saw perp surges, but skew shifted volatility-focused around FOMC nodes.

Our November 2025 crypto market report shows that the pros deployed spreads for QT bets, with upside wagers post-end-month. Implied volatility stayed high but gradually declined after the November 11 extreme liquidation, indicating incomplete shock digestion and short-term repricing.

On-Chain: Massive Liquidations, Bottom-Feeding Started

November 2025 crypto market onchain data shows active addresses dipped mid-month during outflows. BTC whale distributions were countered by 4% OTC growth. Stablecoin inflows hit $2.8B, velocity down 20%, dry powder prepping for dips. ETH active addresses up 8% on staking.

Short-term chips cleared rapidly, forming vacuums. Long-term holders stayed stable, signaling macro confidence despite the reset. Turnover rate surged with large native bottom-feeding capital converging at $82k-$85k. Short-term panic selling slowed early but erupted mid-month. Long-term holders accelerated distribution, with bottom-fishing funds staying cautious.

Valuation: Where’s the Fair Value of Crypto Assets?

To help navigate post-capitulation recoveries, we applied a Metcalfe’s Law-based valuation model: network value is proportional to the square of active users. For BTC: Fair Value ≈ k * (Active Addresses)², where k is a calibration constant from historical data (about 0.0001 based on 2024-2025 averages).

Using November’s on-chain data for this November 2025 crypto market report, about 500k daily active addresses mid-capitulation, rising to 550k by month-end, BTC’s estimated fair value ranged from $75k (pessimistic, factoring liquidity crunch) to $95k (optimistic, assuming user growth rebound). At close ($91k), BTC traded at a 10-15% premium to this model. That suggests overvaluation risk if adoption stalls, upside if network effects strengthen post-shutdown.

For ETH, blend with staking metrics: Adjusted Value ≈ Metcalfe Value * (Staking Rate / 30%), yielding about $2,500-$3,000 fair range.

You can replicate this by tracking Glassnode active addresses and applying the formula in spreadsheets for real-time assessments. This framework helps identify entry points during resets, we saw similar patterns in the 2022 bear market recovery.

Institutions: ETF Outflows Persist, Treasury Builds Slow

BTC spot ETFs saw $3.55B monthly outflows, with 3-4 consecutive weeks negative. Listed firms like Sequans sold 970 BTC for debt. Renewed interest from BlackRock lagged. Corporate treasuries added about 15k BTC via Bitdeer and Hut 8. Custody expanded with Fireblocks TradFi ties. RWAs processed $600M+.

Regulation: Advances Boost Adoption, Centralization Push

U.S.-China pacts progressed, ruling out extreme tariffs. EU centralized crypto regs. Switzerland allowed stablecoins. Brazil eyed BTC reserves. Venezuela integrated BTC and stablecoins. Trump’s Bitcoin for America Act proposed tax eliminations. South Korea banned order sharing.

Sector Momentum: Defensive Shift to Privacy, ZK, and AI

Narratives turned protective. Privacy sector surged, ZEC up 444%. ZK rose on Vitalik praise, up 111%. Perp DEX volumes jumped 150% on liquidity hunts. RWAs via Maple and Pendle hit $2.8B, attracting TradFi. High-beta cooled, focus shifted to yield assets.

What Finestel’s Pros Actually Did

Why they shifted (cause → effect):

BTC down 16% monthly: Liquidity crunch hit betas; pros hedged longs, boosted stables for safety

ETH staking up 1%: Volatility favored yields (6-8%); increased restaking for carry in uncertainty

Altcoins down 80%+ capitulations: Liquidity dried up; slashed to 8-10%, mainstream L1s only

Stablecoins to 21%: Powder for policy bottoms (shutdown end, trade deals)

AI monitoring (72% usage; +12% efficiency): Volatility alerts optimized dips

How they implemented it (simple playbook):

Position bands:

- Core BTC/ETH: 50-57%; trim at $112k+, add at $82k supports or $96k reclaims

- Narratives/RWAs: 3-7%, 3-5 names; exit on funding lags

Entries/exits:

- BTC buys: Below $80k if breakdowns fail, or above $96.8k post-data

- ETH staking: Rotate when yields beat stables by 400bps, low gas

- Perp overlays: Vol skew on events

- Option strategies: Calendars for QT; puts below $80k

Risk rules that mattered:

- Per-sleeve max loss: 8-10%; VaR ≤10%

- If supports break twice: Cut 35% of tactical positions

- Diversify betas: Cap trade exposure

Read our comparison article about the best asset management tools for the pros.

Risk Management: VaR Calculation for Crypto Portfolios

To quantify downside during volatile markets like November’s capitulation, use this Value at Risk (VaR) template. VaR estimates the maximum potential loss over a time horizon (like 1 day) at a confidence level (like 95%).

Steps for Historical VaR (works in Excel or Python):

- Collect daily returns for your portfolio (BTC/ETH weights)

- Sort returns ascending; find the 5th percentile (for 95% confidence)

- VaR = Portfolio Value * |5th Percentile Return|

Example: $100k BTC-heavy portfolio with November returns (about -16% monthly, average daily -0.5%), 95% VaR ≈ $5k daily loss.

Or use Variance-Covariance: VaR = Z * σ * √t * Value, where Z=1.65 (95%), σ=volatility, t=time.

In Python: Use pandas for returns, numpy for calculations. This tool helped pros cap VaR at 10% during dips, avoiding over-leverage.

Data to Watch Daily

- URPD: $82k-$85k support, $96.8k supply

- Options skew/max pain: Pin risks

- Funding rates/OI: Overheated signals

- ETF flows: Reversal confirms

- Trade/policy headlines: Easing triggers

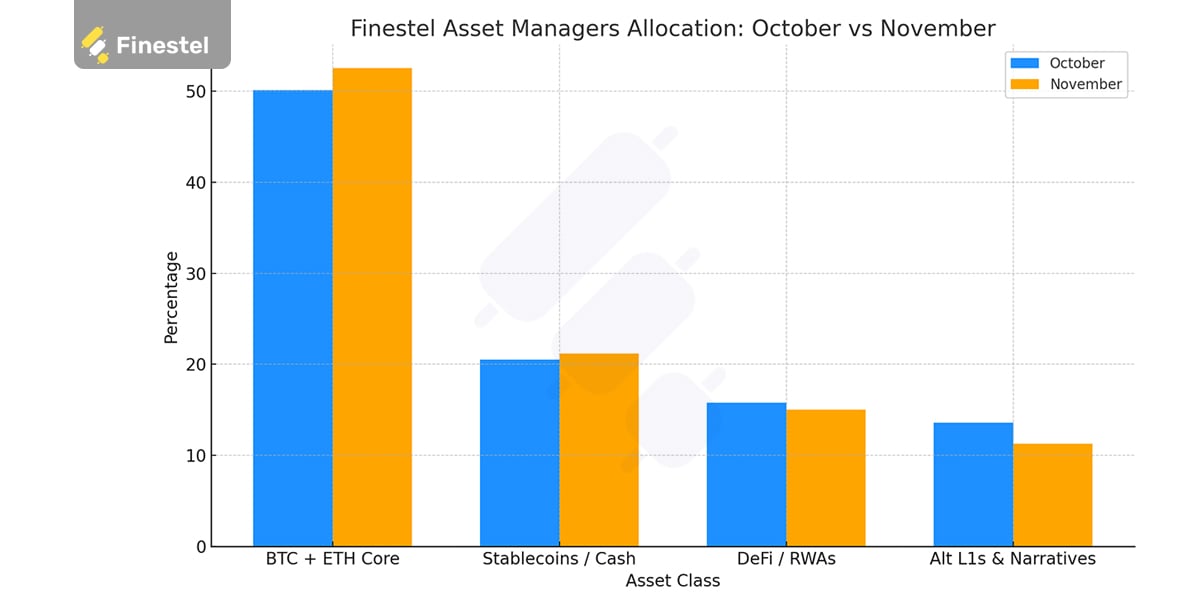

Finestel’s Asset Managers Allocation Snapshot

| Asset Class | October | November |

|---|---|---|

| BTC + ETH Core | 50.1% | 52.5% |

| Stablecoins / Cash | 20.5% | 21.2% |

| DeFi / RWAs | 15.8% | 15.0% |

| Alt L1s & Narratives | 13.6% | 11.3% |

Bottom line: Pros hedged deep corrections, accumulated bottoms, emphasized ETH and DeFi yields, hoarded cash for macro turns, and used options for risk management during capitulation.

December 2025 Crypto Market Outlook

December 2025 could see volatility ease as markets eye liquidity injections from QT end and shutdown resolution. BTC might target $100k+ if $96.8k holds, but defenses needed against ongoing trade risks.

Scenarios (Based on Historical Analogs)

Drawing from past cycles; 2020 COVID crash (50% BTC drop, 9-month recovery) and 2022 bear (12-month recovery post-capitulation); we see three paths with probabilities:

- Base Case (60% probability): Dovish QT and Fed cuts plus trade thaw lead to 20% BTC rebound by mid-December ($110k), mirroring 2023 post-FTX recovery. Altcoin spillover if dominance dips below 60%.

- Bull Case (25%): Shutdown ends early, PCE cools, BTC tests $120k (like 2021 stimulus rally).

- Bear Case (15%): Delayed data or tariff failures drop BTC to $70k (like 2022 extended bear).

Use Monte Carlo simulations: Input volatility (30%), correlations (BTC-Russell 0.95), run 1,000 paths for outcomes. This helps time entries post-capitulation signals like fear lows.

Key Catalysts to Watch

Macro and Policy:

- Dec 15: CBOE BTC/ETH futures launch

- Mid-Dec: Fed meeting for rate signals (two cuts eyed)

- PCE if released reinforces dovishness

- Potential China-US summit on tariffs/fentanyl

Crypto-Specific:

- Events like fintech summits spilling from November

- New ETF listings (continuous futures)

Tech Earnings and Sector Momentum:

- Q4 reports from AI/blockchain firms could boost narratives like ZK/privacy

Altcoin Airdrops and Launches:

- Q4 drops from Solana L2s, retroactives drive rotations

Recommended Positioning

- BTC + ETH: 54% core ($100k+ BTC breakout, $82k defend; ETH yields in volatility)

- Stablecoins: 20-21% (dips post-data)

- DeFi / RWAs: 15% (yield focus like Pendle)

- Alt L1s & Narratives: 10-11% (ZK/privacy selective)

Risks: Delayed data, tariff reignition, weak jobs signaling slowdown

Upside: Liquidity returns, positive deals

Monitor on-chain, skew, ETF inflows. Aligned catalysts could spark Q4 rally, BTC to $110k+ year-end.

Final Thoughts

November 2025 crypto market report shows this month forced resilience tests. Macro crunches reshaped portfolios toward safer assets. Institutions paused, sentiment bottomed, volatility set Q4 pivots. Stay nimble, data-driven, hedge downsides, watch on-chain for alpha.

For updates, follow KuCoin Institutional on X @KuCoinInst.

Leave a Reply