This Talos Review breaks down what the platform actually offers for institutional crypto trading. I should first state that Talos is not a broker. It’s a SaaS system that connects you to exchanges, OTC desks, and other providers. It focuses on execution, order workflows, and the full trade lifecycle.

So, if you’re the owner of a trading business or institution, and you’ve ever felt your trading ops were split across too many solutions, Talos is built to fix that. It brings routing, algos, and many post-trade tools into one place.

What Is Talos?

As I’ve already mentioned, Talos is a Service-as-a-Solution platform built for institutions that trade and manage digital assets at scale. It supports the full trade lifecycle, from price discovery to execution and settlement. Both buy-side and sell-side firms can use Talos, which includes hedge funds, asset managers, brokers, OTC desks, and even banks.

As one of the best crypto asset management tools, Talos’s product suite includes a Trading Platform, White Label, Portfolio Construction, Portfolio & Risk Management, Treasury & Settlement, and Post-Trade Analytics. On the trading side, Talos offers connectivity (including FIX), multi-dealer RFQ, execution algos, and smart order routing. It also connects you to prime brokers, exchanges, OTC desks, and more through its Provider Network.

One key point is that Talos is software, not a broker itself. It does not provide pre-negotiated arrangements with liquidity providers, and you still need to negotiate those relationships directly.

Talos Solutions and Features

This part of our Talos review shows you how it’s a full “operating layer” for institutional trading. It’s not just an execution screen. It’s a group of tools that cover trading, portfolio work, risk, post-trade, and operational control. The main modules below are how Talos breaks it down.

Trading Platform

Talos Trading Platform is built to support the full trade lifecycle in one place. It connects buy-side and sell-side firms with exchanges, OTC desks, prime brokers, and more.

The main highlights, in my opinion, are liquidity aggregation, a smart order router, and the advanced algo suite. Options trading is also supported. You also get API access through FIX, REST, or WebSocket. The interesting part is that Talos also won Trading Platform of the Year at the 2024 Hedgeweek Global Digital Assets Awards. So, we’re not dealing with a generic trading platform here.

White Label Solution

If you’re looking for customization, Talos has a white-label solution for brokers that want to offer crypto trading under their own brand. They describe it as “a brokerage in a box,” with a white-label UI and APIs. The Talos white-label solution also has a customer pricing engine, auto-hedging, and a transaction ledger.

But the big thing you need to understand is the scope. This is a technology platform only. It does not provide registrations, and it does not cover KYC/AML, legal, or compliance duties you may need to run a brokerage. So, the regulatory and operational obligations still sit with you.

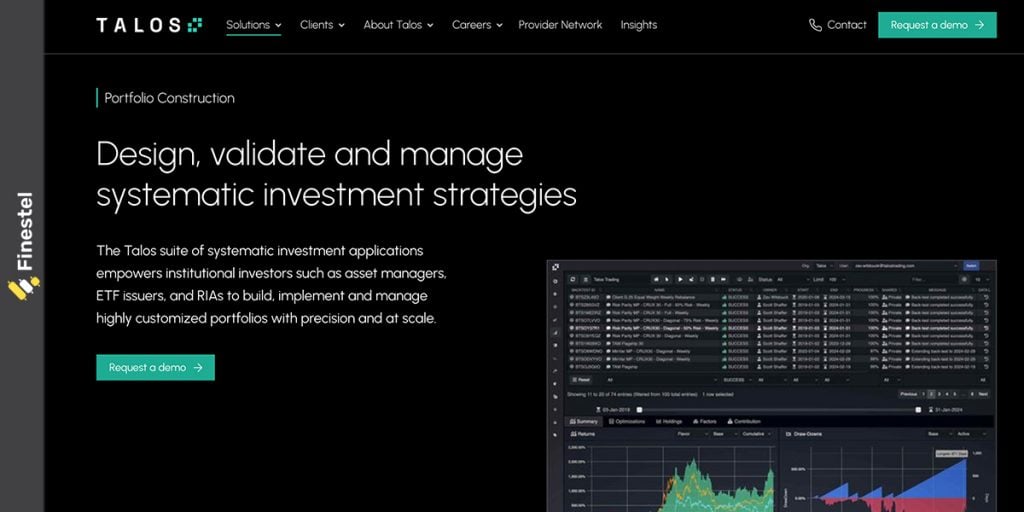

Portfolio Construction

Talos Portfolio Construction is built for systematic investors who want to design and run portfolios, at a large scale, of course. Asset managers, ETF issuers, and RIAs are the user base for this solution. It helps them build customized strategies and validate them, and even move them into live execution without breaking the workflow.

When analyzing the platform to write this Talos review, the thing that stood out to me was how “investment research” and “trading” are meant to connect. You get a portfolio optimizer that also does rebalancing, and a backtester that plugs into the Talos trading platform.

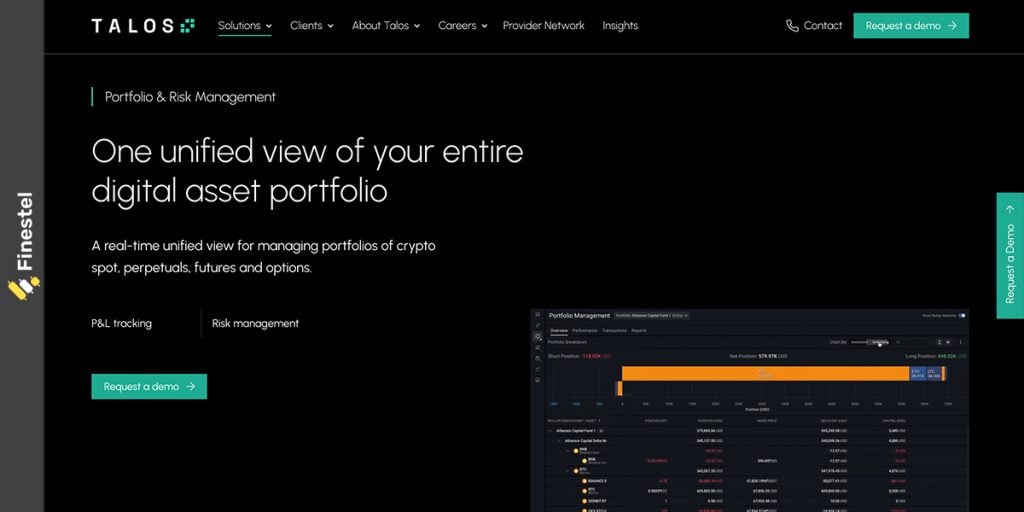

Portfolio and Risk Management Tools

Now, this part is all about clarity. Talos gives you one unified view of your crypto portfolio, and this view is in real time. What I most appreciate is that spot, perps, futures, and options are all in the same place. Even fiat is included in the view, which matters a lot when you’re trying to measure your true exposure.

From my perspective, this is one of those modules that can quietly save you from bad decisions. When positions sit across multiple venues, it’s easy to miss the real risk. But that’s not the case with Talos’s portfolio and risk management tools. You can also customize how portfolios roll up, so it matches your funds or strategies.

Treasury and Settlement Solution

The Talos Treasury & Settlement is the post-trade side of the suite. I mean, it allows you to monitor positions, balances, asset transfers, and credit across exchanges and other custodians.

Managing multiple venues can get quite messy. So, Talos leans into real-time reconciliation, sub-account controls, and reporting through UI or API. One-click settlement is also available through integrations with custody providers.

Data and Analytics

Finally, Talos Analytics is designed to measure your execution quality in real time and after the fact. To do so, it uses real-time pricing, in-flight transaction cost analysis (TCA), and post-trade analytics. So, comparing fills to benchmarks gets quite easy, and it helps you keep best-execution standards tighter even in fragmented crypto liquidity.

Now, I also think that the fact that Talos acquired Coin Metrics helps a lot. Coin Metrics is a major crypto financial intelligence provider. That move points to deeper datasets inside the same workflow.

Who Are Talos’s Clients?

As I’ve already mentioned in this Talos review, the solution is mainly for institutional market participants. On the buy side, that includes asset managers, ETF issuers, hedge funds, crypto funds, and proprietary trading firms. On the sell side, it’s banks, retail investment platforms, OTC desks, and broker-dealers. It also connects with service providers like custodians and payment service providers.

That’s why it’s usually not a fit for small crypto trading businesses or those at the beginning of their journey. Talos is clearly for firms that trade across many venues, need strong controls, and care about execution analytics, reporting, and post-trade workflows. It also assumes you’ll manage your own relationships with liquidity providers and run a more complex setup.

Talos Alternatives

If you’re comparing Talos at the institutional layer, you’re usually looking at platforms that do the same “hub” job. One screen (or API) to connect venues, execute across markets, and manage institutional workflows. The closest competitors are other institutional EMS/OEMS platforms, plus a few prime stacks that blend execution with operations. Here’s an overview of Talos’s main alternatives:

| Platform | Best for | Core scope | Connectivity focus | Analytics / TCA | What stands out |

| Talos | Buy-side + sell-side institutions | Full trade lifecycle + multi-product suite | Exchanges, OTC desks, primes, providers | Real-time pricing + in-flight TCA + post-trade analytics | Broad “suite” approach beyond just execution |

| Wyden | Banks, brokers, and institutions wanting end-to-end workflow | End-to-end lifecycle (treasury → execution → settlement/accounting) | “Preferred counterparties” + best execution workflow | Best-execution-oriented tooling | Strong “bank-style” lifecycle framing |

| Elwood | Institutions needing execution + risk tools | EMS/OEMS + risk + portfolio monitoring | Liquidity providers + crypto & TradFi venues | Algo tooling + execution optimization | Strong execution + risk stack in one vendor |

| CoinRoutes | Firms that care most about execution quality | EMS with heavy algo + smart routing | Multi-venue access + routing tech | Strong emphasis on SOR + execution analytics/TCA | Execution-first specialist (routing + algos) |

Finestel: A Simpler Talos Alternative

Now, if you’re a smaller crypto business or one in the beginning stages, Talos can feel like too much too early. I’ve written this Talos review for large institutions with complex execution, but also for crypto asset managers who want simplicity. And Talos is not the best fit for the latter. I mean, it’s great when you’re already operating at an institutional level, but not anything lower.

That’s where Finestel makes more sense as a Talos alternative. The setup is straightforward. You link API keys and set your fees. Then, you onboard your clients and run everything from a single dashboard. In my opinion, that “all-in-one” approach matters more than advanced institutional features when you’re early. Because your biggest bottleneck in this stage is launching, onboarding, billing, and keeping clients happy.

How Finestel Works

The operating model is also easy to explain to clients. Traders connect with read-only API keys. Clients connect with trade-only API keys. Trades get copied proportionally. That’s the core loop. You also get Finestel’s cutting-edge copy trading software plus portfolio tracking, automation tools like signal bots, and a trading terminal option.

The other reason I’d put Finestel in the “early-stage + scalable” category is the business layer. White label dashboard, client management, billing models, reporting, and even marketing/sales tools. You can start lean. Then add modules as you grow. So instead of building a tech stack piece by piece, you start with one system and expand it over time.

Conclusion

At this point, you can see why Talos is considered an institutional-grade platform. It’s built to connect venues, run execution with serious routing and algos, and keep your portfolio, risk, and post-trade workflows under control. So, if you’re one of those institutional clients that operate across multiple exchanges, desks, and custody setups, Talos can make the whole stack feel more organized and scalable.

That’s the key takeaway from this Talos Review. I mean, Talos is ideal when you already have complexity and need stronger infrastructure. But if you’re still early and want a simpler setup to launch, onboard clients, and grow, Finestel can be the more practical starting point.

Leave a Reply