I tried TradeSanta a while ago when I wanted to check out tools that would help automate crypto trades. It looks simple, connected easily to exchanges like Binance and Coinbase, and doesn’t need any coding. But I’ll go in more depth in this TradeSanta review, and explain all the features and who it’s actually useful for.

What Is TradeSanta?

Let me begin this TradeSanta review by introducing what it is. Well, it’s a cloud-based crypto trading bot that helps you automate your trades across popular exchanges like Binance, Coinbase, OKX, and others. You connect your exchange using API keys and then set up your strategy. This strategy is usually a DCA or Grid trading, and the bot handles the rest.

So, with TradeSanta, everything runs online, and you don’t need to keep your computer on or be glued to the charts. There’s also a mobile app, and setting it up is pretty easy once you create your TradeSanta account and connect your exchange.

The platform’s been around for a few years and has built a decent community. You’ll find plenty of discussions on Reddit, Trustpilot, and other forums where traders share results and bot settings.

So, if you’re new to automated trading bots for crypto strategies, TradeSanta is a good starting point, especially if you want something easy to use without technical setup.

How Does TradeSanta Work?

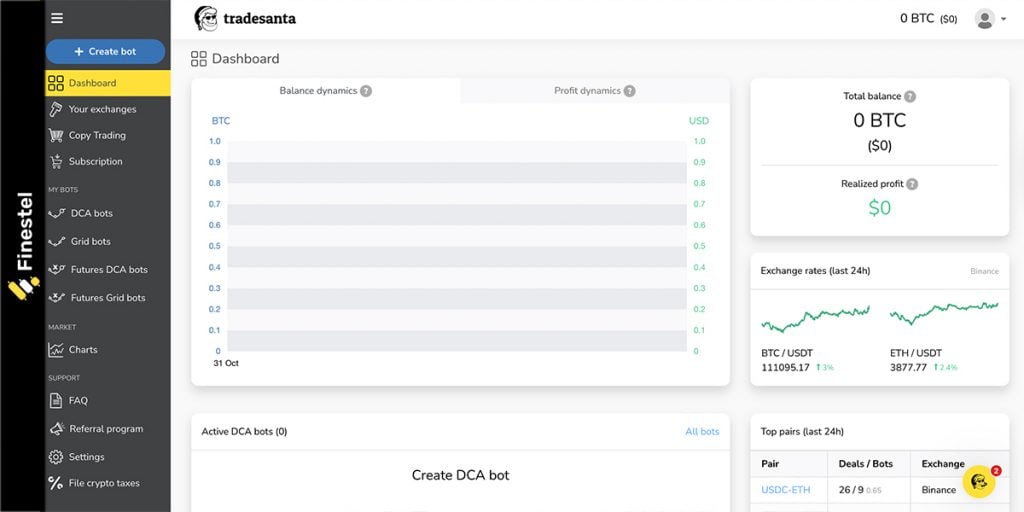

Getting started with TradeSanta is pretty simple. At least, it was simple for me, and I’m gonna show it in this TradeSanta review. You create an account, connect your exchange using API keys, and the bot trades directly on your account. It’s non-custodial, so it never holds your funds. Also, everything runs in the cloud, so you don’t need to keep your computer on.

Once you’re connected, you pick a trading pair and choose the bot type. TradeSanta mainly offers two strategies: DCA and Grid.

The DCA bot (Dollar-Cost Averaging) adds more positions when the price moves against your trade. It keeps averaging your entry until the market recovers, then sells everything once your take-profit target is reached.

The Grid bot splits your capital into several smaller orders within a price range. It buys low and sells high over and over. I really like it in a sideways or ranging markets. And remember, each trade has its own take-profit level, so you’re locking in small profits as the price bounces around.

You can also add TradingView signals, set up stop-loss, or use trailing take-profit to protect gains. It also supports both spot and futures trading.

From my own use, the setup was quick and smooth. I tested both bot types. The TradeSanta DCA bot worked well during slow pullbacks, and the TradeSanta Grid bot made sense when the market moved sideways. But, after all, it’s just an automation tool. The results depend on market conditions and the settings you choose.

TradeSanta Features Overview

Now, in this part of our TradeSanta review, it’s fit for us to analyze the features. Well, TradeSanta has a decent mix of automation tools and strategy options. It might look better suited for beginners, but it also includes a few advanced features for more experienced traders.

Trading Strategies

As I’ve said earlier, the platform’s main focus is on DCA bots and Grid bots. You can pick between long or short positions, set your take-profit and stop-loss levels. You can also adjust how aggressive you want the bot to be.

For example, when using TradeSanta DCA bots, you can define how many extra orders the bot places and at what intervals. TradeSanta Grid bots, on the other hand, let you choose the price range and number of levels.

There’s also a Smart Order feature, which lets you place one-time automated trades with take-profit and stop-loss in a single setup.

Finally, TradeSanta also offers a marketplace where you can copy other traders’ strategies, just like other copy trading platforms work.

Automation and Customization

The TradeSanta app also supports TradingView integration. This means you can link your custom signals and let the bot open or close trades automatically. This is something a lot of us traders require nowadays.

It also allows trailing take-profit, stop-loss, and templates to save and reuse your favorite strategies.

I also like the fact that it lets you customize the bots. I mean, you can use indicators like RSI, MACD, or Bollinger Bands as triggers. These help the bot decide when to start or pause trades instead of just running 24/7.

Supported Exchanges and Devices

TradeSanta currently works with major exchanges like Binance, Coinbase, Kraken, Bybit, OKX, and a few others.

Again, as everything is cloud-based, you can monitor your bots using the TradeSanta app on mobile or through the web dashboard.

TradeSanta Pricing and Plans

One of the most important sections of our TradeSanta review is the pricing overview. TradeSanta offers three paid plans: Basic, Advanced, and Maximum. Each one is designed for different levels of activity and features. There’s also a free trial for all plans, so you can test everything before committing.

Below is an updated breakdown of the current pricing and what each plan includes:

|

Plan |

Monthly Price |

Bots Included |

Key Features |

|

Basic |

$25 / month |

Up to 49 bots |

All strategies, Trading terminal |

|

Advanced |

$45 / month |

Up to 99 bots |

All strategies, Trading terminal, Trailing Take Profit, TradingView Screener signals |

|

Maximum |

$90 / month |

Unlimited bots |

All strategies, Trading terminal, Trailing Take Profit, TradingView Screener signals, Custom TradingView signals, Futures bots |

Each plan includes access to the main dashboard, cloud hosting, and API integration with the supported exchanges I mentioned earlier.

Now, from my experience, the Basic plan works fine for testing and small accounts. The Advanced plan unlocks the tools most traders need, especially trailing take-profit and TradingView screener signals. But if you’re serious about automation or running multiple strategies, the Maximum plan makes more sense since it allows unlimited TradeSanta bots and futures trading.

Does TradeSanta Work Well?

In other words, is TradeSanta legit? Well, in terms of profit, it really depends on your strategy and market conditions. The TradeSanta trading bots follow your rules. They don’t predict the market.

Some TradeSanta Trustpilot reviews and Reddit feedback have shared solid results, while others say profits dropped in volatile markets.

So, the feedback is mixed, but the consensus is clear: TradeSanta works well if you use the right settings and understand your strategy.

Who Is TradeSanta Best For?

So, as someone who’s tested the platform, TradeSanta is best suited for individual traders who want to automate simple crypto strategies without coding or building custom systems.

If you’re someone who trades on Binance, Coinbase, or other big exchanges and just wants to run bots on the side, it’s an easy platform to get started with.

The DCA and Grid bots are good for traders who prefer steady, rule-based systems. Beginners will also appreciate the clean interface and the free trial that lets you test everything first.

But, in my opinion, it’s not built for professionals or anyone managing clients, investors, or even trading teams. There’s no built-in client management, performance fee tracking, or advanced analytics like you’d find in tools designed for fund managers or copy trading businesses.

So, if you’re running a trading business or managing other people’s money, you’ll likely outgrow it pretty fast.

Finestel: The Best TradeSanta Alternative

It wouldn’t be a well-written TradeSanta review if we didn’t check out the alternatives. Well, since I’m part of the Finestel team and have seen both sides, using TradeSanta for personal bot trading and working with Finestel for professional setups, here’s how I’d explain why Finestel stands out when you’re serious about scaling a crypto-trading business.

|

Feature |

TradeSanta |

Finestel |

|

Main Focus |

Personal trading automation |

Professional trading and business infrastructure |

|

Best For |

Retail traders automating their own strategies |

Pro traders, fund managers, prop firms, and copy trading providers |

|

Bot Types |

DCA, Grid, and Smart Order bots |

Copy Trading, TradingView Bot, Signal Bot, DCA & custom strategies |

|

Automation Level |

Fully automated per-exchange setup |

Multi-exchange automation, real-time replication across accounts |

|

TradingView Integration |

Yes – connect alerts manually |

Yes – with full API integration and signal automation |

|

Client Management Tools |

None |

Built-in CRM, billing, and performance tracking |

|

White-Label Option |

Not available |

Launch your own branded copy trading platform |

|

Portfolio Analytics |

Basic performance data |

Advanced analytics, reporting, and investor dashboards |

|

Profit-Sharing / Billing |

Not supported |

Automated billing and profit-sharing system |

Who Finestel is built for

If you’re just trading your own account, then TradeSanta might cover your needs. But if you’re managing multiple accounts, offering copy trading to others, or want to build a branded platform, that’s exactly where Finestel shines:

- For professional traders, asset managers/funds, and businesses who want to manage many accounts and many clients. Finestel supports multi-exchange, client dashboards, and white-labeling.

- For signal providers, strategy developers, or communities wanting to launch their own service and brand rather than just plug-and-play a bot.

- For businesses that need more than bot automation. I mean those who need client management, billing, analytics, branding, and infrastructure.

Key Features of Finestel

Here’s what really sets Finestel apart from regular trading automation platforms:

- Copy Trading & White-Label Platform: Our bot instantly replicates trades across multiple follower accounts (spot and futures) with proportional sizing. You can even launch your own branded copy trading platform with custom pricing, billing, and referral tools.

- TradingView bot & Signal Bots: Connect your TradingView alerts or custom signals from Telegram, on-chain data, or scripts, and let Finestel execute them automatically across all accounts.

- Unified Trading Terminal: Manage multiple exchanges like Binance, Bybit, OKX, or KuCoin in one dashboard. Trade spot and futures, and send bulk orders across accounts at once.

- Business Infrastructure: Includes client dashboards, automated billing, profit-sharing, MLM tools, and analytics.

- Security & Scale: 100% non-custodial, with encrypted APIs and low-latency trade replication built to handle large-scale operations.

How Finestel Differs from TradeSanta

With TradeSanta, you’re mainly managing your own account using automated bots. So, as I’ve already mentioned in TradeSanta review, it can be great for personal trading. But once you try to manage other people’s money or multiple accounts, the limits become clear.

Finestel, on the other hand, gives you everything TradeSanta offers in terms of automation, plus a full business infrastructure on top. You can manage clients and investors, create your own branded platform, handle billing and fees, and scale your trading operation professionally.

If you plan to run a copy trading service, manage followers, or build a team of traders, these tools aren’t just extra features, they’re essential. Finestel is built for that level of operation.

Conclusion

To conclude our TradeSanta review, I should say it is a good choice for traders who want to automate their crypto strategies without diving into complex setups. It’s easy to use, works with major exchanges, and offers flexible tools like DCA and Grid bots that fit different market conditions.

That said, if you’re someone who manages multiple accounts or runs a trading business, you might eventually need something more advanced. That’s where Finestel comes in. It’s built for professional traders, funds, and prop firms who need client management, billing, analytics, and full white-label tools to scale their operations.

For personal trading, TradeSanta is more than enough. But for professionals aiming to grow beyond individual automation, Finestel is the next step up.

Leave a Reply