The cryptocurrency landscape in Canada has witnessed significant growth and widespread adoption, with cryptocurrencies playing a pivotal role in the Canadian economy. Understanding and staying up-to-date with crypto regulations in Canada is crucial for individuals, businesses, traders, asset managers, and investors in Canada. Active involvement in regulatory compliance ensures the security and transparency of cryptocurrency transactions, safeguards consumer interests, and mitigates potential risks and fraud.

The article covers important aspects of crypto regulations in Canada, including the legal status of cryptocurrencies, regulatory bodies overseeing the industry, compliance requirements for ICOs and mining operations, taxation guidelines for individuals and businesses, and upcoming changes in regulations. By reading this article, readers will gain a thorough understanding of the evolving crypto landscape and the legal environment surrounding cryptocurrencies in Canada.

Overview of Crypto Regulations in Canada

In Canada, cryptocurrency is treated as a security, which means that the regulations for securities also apply to cryptocurrencies. Securities are financial assets that can be traded, including stocks, bonds, ETFs, hedge fund investments, options, and futures. People often invest in securities with the expectation that their value will rise.

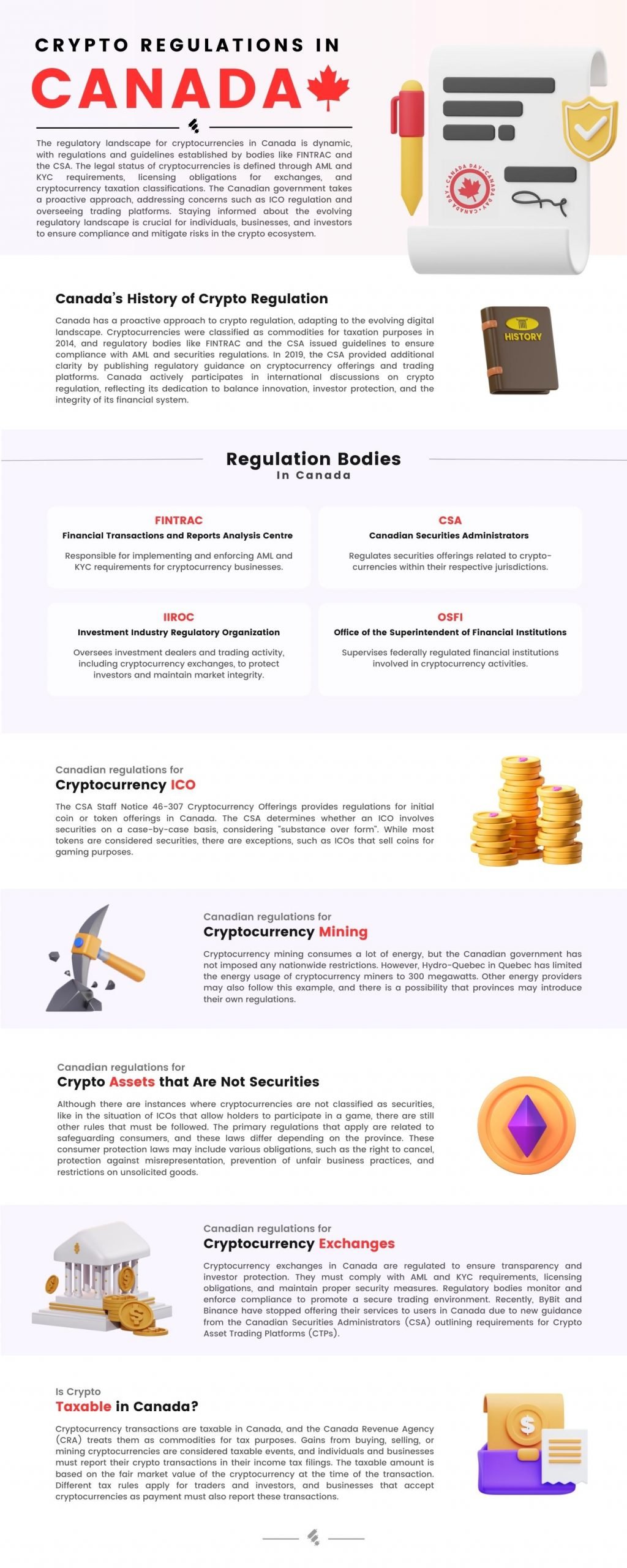

The regulatory landscape for cryptocurrencies in Canada is dynamic, with regulations and guidelines established by bodies like FINTRAC and the CSA. The legal status of cryptocurrencies is defined through AML and KYC requirements, licensing obligations for exchanges, and cryptocurrency taxation classifications. The Canadian government takes a proactive approach, addressing concerns such as ICO regulation and overseeing trading platforms. Staying informed about the evolving regulatory landscape is crucial for individuals, businesses, and investors to ensure compliance and mitigate risks in the crypto ecosystem.

Federal vs. Provincial Regulation

In Canada, cryptocurrency regulation involves a combination of federal and provincial oversight. While the federal government sets the overarching regulatory framework, provincial authorities also play a significant role. The federal government focuses on areas such as AML and KYC requirements, while provinces can regulate aspects related to securities and trading platforms. Also, this decentralized approach allows for a more tailored response to regional needs and considerations.

However, it also means that businesses and individuals operating in the crypto space must navigate a complex regulatory landscape that can vary from province to province. It is essential to understand the specific regulations and requirements in the jurisdiction where crypto activities are conducted. This includes compliance with federal laws, such as FINTRAC guidelines, as well as adhering to any additional provincial regulations that may apply.

| Regulation Aspect | Provincial Regulations | Federal Regulations |

|---|---|---|

| Licensing | Provinces may have their own licensing requirements for cryptocurrency businesses. | Federal regulations may require registration or licensing for certain cryptocurrency activities. |

| Securities | Provinces have securities commissions that regulate cryptocurrency offerings. | The Canadian Securities Administrators (CSA) sets federal guidelines for cryptocurrency securities. |

| Anti-Money Laundering (AML) | Provinces have AML regulations that apply to cryptocurrency businesses. | The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) enforces federal AML regulations. |

| Consumer Protection | Provinces have consumer protection laws that apply to cryptocurrency transactions. | The Competition Bureau of Canada enforces federal laws related to consumer protection. |

| Taxation | Provinces have their own tax regulations for cryptocurrencies. | The Canada Revenue Agency (CRA) sets federal tax guidelines for cryptocurrencies. |

Regulatory Bodies in Canada

In Canada, several regulatory bodies oversee the cryptocurrency industry and ensure compliance with the established regulations. These bodies play a crucial role in maintaining the integrity and security of the crypto ecosystem. The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) is the federal agency responsible for implementing and enforcing AML and KYC requirements for cryptocurrency businesses.

The Canadian Securities Administrators (CSA) comprises provincial and territorial regulators responsible for regulating securities offerings, including those related to cryptocurrencies, within their respective jurisdictions. The Investment Industry Regulatory Organization of Canada (IIROC) oversees investment dealers and trading activity, including cryptocurrency exchanges, to protect investors and maintain market integrity. Additionally, the Office of the Superintendent of Financial Institutions (OSFI) supervises federally regulated financial institutions involved in cryptocurrency activities.

Canada’s History of Crypto Regulation

Canada has proactively engaged with crypto regulation, adapting to the evolving digital landscape. The journey began with the early recognition of cryptocurrencies as legal payment methods. Measures were introduced to address risks and protect investors. In 2014, cryptocurrencies were classified as taxable commodities. Regulatory bodies like FINTRAC and the CSA issued guidelines for AML and securities compliance. The CSA provided further clarity in 2019 with regulatory guidance on crypto offerings and platforms.

This history reflects Canada’s commitment to balancing innovation, investor protection, and integrity of the financial system. The CSA’s Notice 21-332, “Guidance on the Application of Securities Legislation to Entities Facilitating the Trading of Crypto Assets,” provides guidance on securities legislation for crypto platforms. It ensures compliance and enhances clarity in crypto asset trading.

FINTRAC and Crypto in Canada

FINTRAC plays a pivotal role in regulating cryptocurrencies in Canada. As the federal agency responsible for implementing AML and KYC requirements, FINTRAC ensures the transparency and integrity of cryptocurrency transactions. It requires businesses engaged in crypto-related activities to register as money services businesses (MSBs) and comply with reporting obligations.

Additionally, Crypto exchanges and custodial wallet providers fall under the regulatory purview of FINTRAC, with obligations to conduct due diligence on their customers, report suspicious transactions, and keep records. Thus, Failure to comply with FINTRAC regulations can result in penalties and sanctions. FINTRAC’s oversight contributes to a more secure crypto environment, helping to prevent money laundering, terrorist financing, and other illicit activities.

Regulatory Landscape for Cryptocurrencies in Canada

The regulatory landscape for cryptocurrencies in Canada is multifaceted and continuously evolving. The regulatory framework aims to strike a balance between fostering innovation and protecting investors. It is important for businesses and individuals to stay informed about the evolving regulations, adhere to compliance requirements, and actively engage with regulatory bodies. This approach ensures a transparent, secure, and well-regulated environment for cryptocurrencies in Canada.

Canadian Crypto Trading Regulations

Crypto trading regulations in Canada are designed to ensure transparency and investor protection. The regulations encompass AML and KYC requirements, licensing obligations for exchanges, and guidelines for ICOs. Cryptocurrency exchanges must comply with registration and reporting obligations set by regulatory bodies. Investors are encouraged to conduct due diligence and exercise caution when engaging in crypto trading.

The regulatory framework aims to mitigate risks associated with fraud, market manipulation, and money laundering. By establishing clear guidelines and oversight, the Canadian government promotes a secure and trustworthy environment for crypto trading, fostering confidence among investors and supporting the growth of the cryptocurrency industry in the country.

Regulations for Cryptocurrency Mining

Cryptocurrency mining in Canada is subject to some regulatory requirements and considerations. While there are currently no specific regulations governing mining activities, miners are still subject to existing laws and regulations related to taxation and electricity consumption. The Canadian government recognizes mining as an economic activity and expects miners to comply with tax obligations. Additionally, miners must adhere to environmental regulations and ensure responsible energy usage.

However, in Quebec, Hydro-Quebec is limiting the energy that cryptocurrency miners can use to 300 megawatts. Experts predict that other energy providers may follow suit. They also do not rule out the chance that provinces will also place registrations.

Cryptocurrency ICO Regulations in Canada

The CSA Staff Notice 46-307 Cryptocurrency Offerings provides guidelines for initial coin or token offerings, including how to determine if an ICO is a security or a software product. The CSA considers the substance of the offering rather than just its form. Ultimately, the CSA evaluates each ICO on a case-by-case basis to determine if it involves securities. For instance, if an ICO’s coin value is linked to a company’s future success or profits, it would likely involve securities. On the other hand, an ICO that sells coins for use on a gaming platform would not involve securities.

Canadian Regulations for Crypto Assets that Are Not Securities

Although there are instances where cryptocurrencies are not classified as securities, like in the situation of ICOs that allow holders to participate in a game, there are still other rules that must be followed. The primary regulations that apply are related to safeguarding consumers, and these laws differ depending on the province. These consumer protection laws may include various obligations, such as the right to cancel, protection against misrepresentation, prevention of unfair business practices, and restrictions on unsolicited goods.

Cryptocurrency Exchanges Regulation in Canada

Cryptocurrency exchanges in Canada are subject to regulatory oversight to ensure transparency and investor protection. Exchanges must comply with AML and KYC requirements, which include customer due diligence and transaction monitoring. Licensing obligations are also imposed to regulate exchange operations. The regulatory framework aims to mitigate risks associated with fraud, market manipulation, and money laundering. Additionally, exchanges need to maintain proper security measures to safeguard customer funds.

Regulatory bodies, such as FINTRAC and provincial authorities, actively monitor and enforce compliance with regulations to promote a secure and reliable trading environment. Recently, ByBit and Binance, two major exchanges have stopped offering their services to users in Canada. This is due to the new guidance mentioned in Canadian Securities Administrators (CSA) notice 21-332, which outlines a long list of requirements that Crypto Asset Trading Platforms (CTPs) must meet.

Are There Any Specific Regulations for Stablecoins in Canada?

As of now, Canada does not have specific regulations solely dedicated to stablecoins. However, stablecoin activities may fall under existing regulatory frameworks, such as securities or payment regulations, depending on their characteristics. The Canadian government assesses stablecoins on a case-by-case basis to determine if they meet the definition of a security or if they fall within the scope of payment regulations.

Which Provinces in Canada Are Crypto Friendly?

Several provinces in Canada have shown a positive stance towards cryptocurrencies and blockchain technology. Ontario, the most populous province, has been at the forefront of fostering innovation and creating a favorable environment for crypto-related businesses. British Columbia is another province known for its crypto-friendly approach, with initiatives to attract blockchain companies and promote technological advancements. Alberta has also embraced cryptocurrencies, recognizing their potential economic benefits and encouraging blockchain projects.

Additionally, provinces like Saskatchewan and Nova Scotia have taken steps to explore blockchain applications and support the growth of the crypto industry. While each province has its own regulations and considerations, these provinces have demonstrated a welcoming attitude towards cryptocurrencies, making them attractive destinations for crypto businesses and enthusiasts in Canada.

Do Canadian Banks Allow Cryptocurrency?

Is Crypto Taxable in Canada?

Conclusion

The article explored Canada’s crypto regulations and their implications for stakeholders. The regulatory framework covers AML, KYC, licensing, and taxation. Federal and provincial regulations, overseen by bodies like FINTRAC and the CSA, ensure compliance. Understanding and staying updated with regulations are crucial to mitigate risks. Copy trading and stablecoin regulations are evolving, and accurate record-keeping is necessary for taxable transactions.

As you might already know, the Canadian government aims to balance innovation and investor protection. Additionally, future developments will introduce new regulations, address challenges, and capitalize on opportunities. Collaboration between regulatory bodies, stakeholders, and the government is key. Practical advice includes staying informed, seeking professional guidance, maintaining records, implementing AML and KYC procedures, and choosing compliant exchanges.

In summary, Canada’s crypto regulations have a broad scope, covering various aspects of the crypto industry. Staying informed, seeking professional advice, and complying with AML and KYC requirements are crucial for individuals, businesses, and investors. Future developments will shape the regulatory landscape, requiring collaboration and adaptability. Following these recommendations will help navigate the Canadian crypto regulatory environment effectively.

FAQ

Is Canada crypto friendly?

Yes, Canada is considered crypto-friendly due to its proactive approach in developing regulations and fostering innovation in the crypto industry.

How does Canada tax crypto?

Canada taxes crypto transactions by treating them as taxable events, subject to capital gains tax.

What is Canada’s limit for crypto?

Canada does not have a specific limit for crypto, but it imposes regulations and taxation based on the value and nature of the transactions.

Is Binance legal in Canada?

Yes, Binance is legal and operates in Canada, but it must comply with Canadian regulations and licensing requirements.

Is crypto trading banned in Canada?

No, crypto trading is not banned in Canada. It is regulated and individuals can engage in trading activities following the established guidelines and compliance requirements.

What is the most crypto-friendly city in Canada?

Toronto is considered the most crypto-friendly city in Canada, with a vibrant blockchain and cryptocurrency ecosystem.

Leave a Reply