ByBit officially launched in March 2018 in Singapore as a cryptocurrency derivatives trading platform that has recently gained immense popularity. Bybit is best known for its futures market, easy-to-use interface, lightning-fast execution speeds, high liquidity, and competitive fees.

Despite its popularity due to regulatory issues, the Bybit ban in Canada has gained attention in Canada and the entire world. This ban was announced by the Canadian Securities Administrators (CSA), citing Bybit’s lack of compliance with the regulations that govern cryptocurrency derivatives trading in the country. However, Canadian users will need help accessing the Bybit platform since Bybit does not currently offer trading services to Canadians because Bybit is not a registered securities dealer in Canada.

In this article from Finestel Academy, you will get familiar with the background of Bybit, its features and benefits, the regulatory issues surrounding Bybit’s ban in Canada, and what Canadian users need to know if they want to access Bybit’s platform. We will also explore the broader regulatory landscape for cryptocurrency trading in Canada and what it means for investors and traders.

Overview of the Bybit Ban in Canada

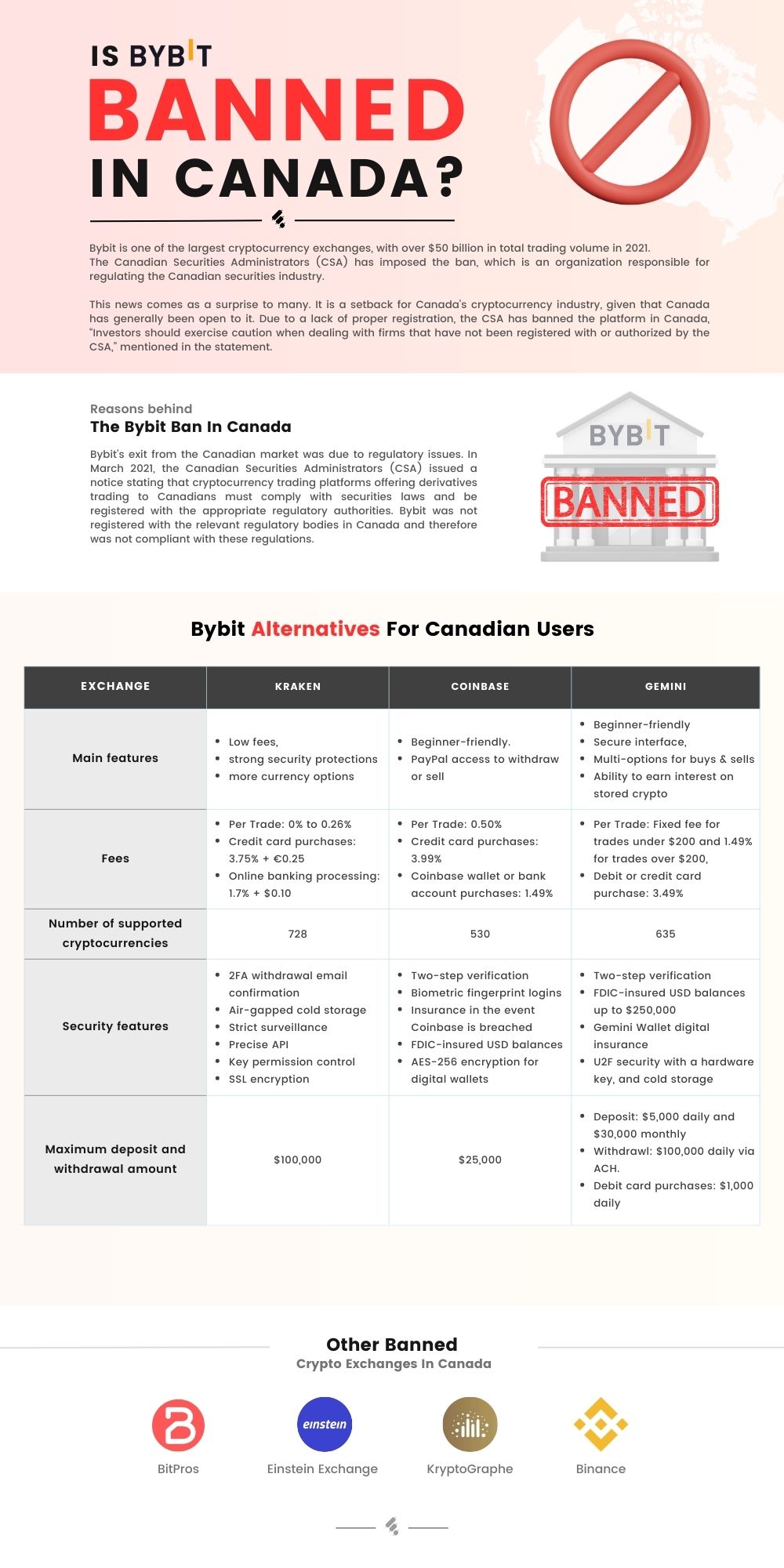

Bybit is one of the leading cryptocurrency exchanges globally, with over 10 million users. When CSA (an organization responsible for regulating the Canadian securities industry) banned ByBit, the news surprised many. It may be a setback for Canada’s cryptocurrency industry, given that Canada has generally been open to it.

Due to a lack of proper registration, CSA banned the platform from working in Canada. “Investors should exercise caution when dealing with firms that have not been registered with or authorized by the CSA,” mentioned in the statement.

The report said that the ban extends to domestic and international users, meaning that Bybit customers in Canada can no longer use their services. Despite having some of the most progressive regulations for the cryptocurrency industry, the CSA has remained determined to keep the industry regulated. How the ban will affect Bybit’s overall business remains to be seen.

Time of the Announcement of Bybit’s Ban in Canada

As stated in Section 12.3 of the Service Agreement, Bybit does not offer services or products to Users in a few excluded jurisdictions, including the United States, mainland China, Singapore, Quebec (Canada), Ontario (Canada), North Korea, Cuba, Iran, Russian-controlled regions of Ukraine (currently including the Crimea).

Bybit’s Canadian users will no longer have access to make new deposits or enter new contracts on the platform from July 31, 2023. The company said Bybit will no longer accept new registrations from Canadian residents and nationals though they can still withdraw funds.

Reasons Behind the Bybit Ban in Canada

Bybit’s exit from the Canadian market was due to regulatory issues. In March 2021, the Canadian Securities Administrators (CSA) issued a notice. It stated that cryptocurrency platforms offering derivatives trading to Canadians must comply with securities laws and be registered with the appropriate regulatory authorities. Bybit was not registered with the relevant regulatory bodies in Canada and therefore was not compliant with these regulations.

The Bybit ban in Canada highlights the challenges and complexities of regulating cryptocurrency trading. Different countries have different rules and regulations for cryptocurrency trading, making it difficult for trading platforms to operate in multiple jurisdictions. Investors and traders need to be aware of the regulatory environment in which they operate and stay informed about the latest developments.

The Bybit ban in Canada is a reminder that the cryptocurrency market is still evolving, and regulations are still being developed to keep up with this fast-moving industry. As the market grows, we will likely see further developments and changes in the regulatory landscape. It’s essential for investors and traders to stay informed and to seek professional advice to ensure compliance with all applicable laws and regulations.

Impact of the Bybit Ban on Canadian Traders

The ban on Bybit in Canada has significantly impacted Canadian traders, who had come to trust the platform’s ease of use, competitive fees, and high liquidity. Its removal from the market has created a sense of distrust and uncertainty among traders, who are now left searching for alternative options to trade derivatives. This has been particularly challenging for new traders, who may be reluctant to invest in cryptocurrency due to the lack of available exchanges.

The ban has also raised questions among traders about the ability of regulators to properly regulate the cryptocurrency space and ensure the safety of investments. If this trend continues, it could seriously impact new investors entering the market and could have long-term effects on the industry’s growth in Canada. Regulators need to find a way to balance the need for investor protection with the need to encourage innovation and development in the cryptocurrency industry.

In conclusion, the Bybit ban in Canada has significantly impacted the cryptocurrency trading landscape in the country. While traders are left searching for alternative options, regulators must find a way to balance investor protection with innovation and growth in the industry. Only then can the industry thrive and attract new investors in Canada.

How to Navigate the Bybit Ban as a Canadian Trader

Canadian users looking for an alternative to Bybit can use the platforms below. These platforms provide a safe and efficient way to buy and sell cryptocurrencies. Each platform is compliant with Canadian regulations, and all of them offer competitive fees and excellent customer service.

Finestel has successfully addressed the challenge for Canadian users by establishing Finestel-Bybit subaccount. Canadian users can effortlessly utilize Finestel Copy Trading and other tools through Bybit exchange sub-account.

Canadians looking to diversify their portfolio with cryptocurrency trading should consider one of these three platforms:

- Kraken (best crypto exchange overall in Canada)

- Coinbase (best Canadian crypto exchange for beginners)

- Gemini (best crypto exchange in Canada for security)

Comparing Bybit Alternatives for Canadians

Numerous trustworthy cryptocurrency exchanges are available in Canada for acquiring digital assets, making it challenging for investors to select the most suitable one among the many choices. To assist you, we have examined some crypto platforms and meticulously compiled a list of the highest-rated cryptocurrency exchanges in Canada, enabling you to make a well-informed decision.

| Kraken | Coinbase | Gemini | |

| Main platform features | Low fees, strong security protections, and more currency options | Easy to use for beginners and can use PayPal to withdraw or sell | Beginner-friendly and secure interface, multiple buying and selling options, and ability to earn interest on stored crypto |

| Fees | 0% to 0.26% per trade, 3.75% + €0.25 for credit card purchases, and 1.7% + $0.10 for online banking processing | 0.50% per trade, 3.99% for credit card purchases, and 1.49% for Coinbase wallet or bank account purchases | Fixed fee for trades under $200 or 1.49% for trades over $200, 3.49% debit or credit card purchase |

| Markets | 728 | 530 | 635 |

| Security features | 2FA withdrawal email confirmation, air-gapped cold storage, strict surveillance, precise API key permission control, SSL encryption | Two-step verification, biometric fingerprint logins, insurance in the event Coinbase is breached, FDIC-insured USD balances, AES-256 encryption for digital wallets | Two-step verification, FDIC-insured USD balances up to $250,000, Gemini Wallet digital insurance, U2F security with a hardware key, and cold storage |

| Maximum deposit and withdrawal amount | $100,000 | $25,000 | $5,000 daily and $30,000 a month for deposits and $100,000 daily for withdrawals via ACH. $1,000 daily for debit card purchases. |

Regulatory Landscape for Crypto Exchanges in Canada

The CSA oversees and enforces the regulation of securities, derivatives, and cryptocurrency exchanges. Under current CSA rules, crypto exchanges in Canada must comply with existing securities laws and KYC/AML requirements. KYC/AML ensures the exchange complies with anti-money laundering laws and regulations. In addition, under the mentioned regulations, exchanges must have adequate internal security measures. Know-Your-Transaction (KYT), obtaining retail deposits would become necessary.

The second major requirement is registering the exchange as a money services business (MSB) with the Financial Transactions and Reports Analysis Center of Canada (FINTRAC). To be registered as an MSB, exchanges must demonstrate compliance with FINTRAC’s requirements. This includes maintaining a complete customer registry and obtaining certain customer identification information.

Crypto exchanges must have a fully automated and digitally secure system to ensure that trades are conducted securely and fairly. Furthermore, these systems must be regularly monitored and updated to comply with Canadian laws and regulations. In the end, exchanges must comply with foreign laws and regulations. This includes obtaining regulatory approval from other jurisdictions where the exchange will operate.

Other Banned Crypto Exchanges in Canada

Several other cryptocurrency exchanges have been banned in Canada.

Here are a few examples:

Binance, the world’s largest crypto exchange, On May 12, 2023, announced it was pulling out of the country because it didn’t agree with new regulations put in place by the Canadian Securities Administrators.

Einstein Exchange is another example of a banned crypto exchange platform in Canada. The Vancouver-based crypto exchange shut down in November 2019 after the British Columbia Securities Commission (BCSC) conducted an investigation and found numerous instances of misappropriation of funds.

BitPros is another exchange that, due to governmental obligations, has to stop working in Canada. The Canadian financial regulator, the Canadian Securities Administrators (CSA), issued a warning against BitPros in December 2019 because the exchange was selling derivatives without providing any investor protection.

The CSA found that KryptoGraphe is not compliant with Canadian securities and derivatives regulations and failed to provide the required level of investor protection. The result was banning this platform from working in Canada.

Conclusion

The Bybit ban in Canada has brought attention to the challenges and complexities of regulating cryptocurrency trading. The ban was a setback for Canada’s cryptocurrency industry, and Canadian traders are left searching for alternative options. The regulatory landscape for cryptocurrency exchanges in Canada is still evolving, and investors and traders must stay informed about the latest developments. While Bybit is no longer an option for Canadian traders, several compliant platforms are available. Traders must conduct due diligence and choose exchanges compliant with relevant laws and regulations. The Bybit ban in Canada is a reminder that the cryptocurrency market is still evolving, and regulations are still being developed to keep up with this fast-moving industry.

FAQ

How long will the Bybit ban in Canada last?

It’s currently unclear how long the ban on Bybit in Canada will last. The Ontario Securities Commission (OSC) has taken action against Bybit, alleging that the exchange has failed to comply with Ontario securities laws. Bybit has stated that it is working to address the concerns raised by the OSC and is committed to complying with all applicable laws and regulations.

What are the regulatory requirements for cryptocurrency exchanges in Canada?

First, register a company in Canada with Canadian regulators before onboarding users as a Money Services Business (MSB), open a bank account, and prepare annual accounting and tax statements. Crypto exchanges must have enhanced protections for Canadian clients’ custody and segregation of crypto assets. Offering margin, credit, or other forms of leverage is prohibited in Canada. We recommend that you visit the CSA official website for more information.

Are there any alternative cryptocurrency exchanges available to Canadian traders?

Yes, there are several alternative cryptocurrency exchanges available to Canadian traders, including Kraken (the best crypto exchange overall in Canada), Coinbase (the best Canadian crypto exchange for beginners), Gemini (the best crypto exchange in Canada for security).

Leave a Reply