Proprietary trading, or prop trading in short, is done when financial institutions aim to gain profits directly from the markets, rather than looking to commissions or fees from clients as revenue sources. Various financial institutions like banks and hedge funds engage in proprietary trading. The reason is that this method offers distinct advantages that investing on behalf of clients does not.

In this article by Finestel, we first begin by introducing what prop trading is, how it works, and what benefits it offers. We then narrow our attention to prop trading firms and state how traders can use them to magnify their profits. We also provide another point of view, explaining how these prop firms operate and what their business model is. Finally, we mention different types of proprietary trading, risks, and regulations related to these firms and some of the top prop firms around.

What is Proprietary Trading?

Prop trading is an investing and trading strategy that is typically conducted by financial institutions and intermediaries. These institutions invest in the financial markets using their own money, rather than managing the portfolios of clients. Therefore, all the profits gained from their investments are theirs. This is in contrast to receiving fees and commissions from clients to invest their money on their behalf.

Importance in Financial Markets

The main importance of prop trading in the financial markets is based on providing liquidity. Proprietary trading is an attractive venue for financial institutions to invest in the markets, therefore adding volume and liquidity to the markets. The more liquid a market is, the more efficiently it can operate and the less risky it becomes for participants as a whole.

Benefits of Proprietary Trading

There are various benefits that the market, its participants and the financial institutions engaged in prop trading can reap. Some of these benefits are a result of an increase in liquidity, as mentioned above. However, there are other advantages that prop trading offers:

- Revenue Generation and Diversification: Prop trading introduces a new form of revenue for financial institutions. Therefore it further diversifies the revenue streams of these firms. It also helps them in gaining more profits and solidify their place in a ruthless industry.

- Increased Market Liquidity: As mentioned previously, prop trading provides an additional pathway for the financial markets to invest in the markets. This inflow of money enhances market liquidity, reducing liquidity risk.

- Price Discovery: More buying and selling in the financial markets, is one of the direct results of prop trading. This additional volume facilitates the price discovery of financial assets, making the markets more efficient.

- Talent Development: Prop trading firms can attract talented traders, analysts, and developers. While creating new jobs in finance, they further develop these talents. A more skilled workforce in the financial industry can be beneficial for everyone.

- Economic Growth: The injection of money by prop trading firms into the markets and the profits gained by them can lead to economic growth. The additional investments can definitely help various sectors of the economy.

- Opportunity for Trades: Prop firms provide massive opportunities for traders to access and manage larger capital. Therefore, they would be able to magnify their returns while having limited liability.

What Is a Prop Trading Firm?

A prop trading firm is a type of financial institution that specifically engages in proprietary trading. These firms use their own capital to invest and trade in various markets, rather than investing outside money. They also provide opportunities for professional traders to manage the firm’s money on their behalf.

Prop firms have become extremely popular in the trading industry over recent years. These firms offer traders the chance to trade large capital, with a limited amount of risk. To do so, traders need to meet the criteria of having sufficient trading and risk management skills, by passing challenges or other evaluation methods.

How to Join a Prop Trading Firm Challenge?

Most prop firms require traders to pass certain challenges to offer them the chance to manage the firm’s capital. These challenges are often explained thoroughly on their websites, including the passing and failing criteria. They also offer different sizes of trading accounts to traders, mostly ranging from $10,000 to $500,000. Traders should visit their chosen prop firm’s website to gather more information and participate in their challenges.

What Is Prop Firms Business & Revenue Model?

Prop firms have two main sources of income. The first one is profit sharing with traders. Professional traders manage the firm’s money and gain profits, if they trade successfully. These profits are then shared between the firm and the trader. Moreover, prop firms charge traders with an initial cost for participating in the challenge. Therefore, their second revenue source is selling challenges to traders. Interestingly, this second income stream is said to be significantly larger than the first one, as the majority of traders fail challenges and try over and over again, paying the cost each time.

Do Some Prop Firms Use Questionable Practices?

Prop firms provide traders access to large trading accounts in exchange for a share of any profits made. This allows traders to leverage more capital than they could on their own. Some prop firms have been accused of shady practices, similar to Ponzi schemes.

One large prop firm, My Forex Funds, was recently accused of using software to deliberately cause their funded traders to lose money. The CFTC has stated most traders at this firm were actually trading on simulated accounts, not real markets.

This suggests My Forex Funds misled traders about trading real capital when it was simulated. Their business model relies heavily on revenue from traders purchasing evaluation accounts or challenges. The profits shared with successful traders may come more from these challenge purchases rather than actual trading profits. This model of paying out profits to some using funds from new participants resembles a Ponzi scheme.

While My Forex Funds may have misled traders, most prop firms do aim to profit when their traders are profitable. However, traders should research any prop firm carefully before joining to ensure they operate with integrity. Prop firms can provide great opportunities but some may use questionable practices.

Types of Proprietary Trading

Prop trading is becoming a popular strategy for participating in different financial markets. These markets include the stock market, forex, commodities, and even cryptocurrencies. There are also various types of proprietary trading methods used across the industry. Some of the most prominent types of prop trading are introduced below.

Market Making

Market making is a common trading strategy. Firms that engage in market-making activities, continuously offer to buy and sell securities, therefore, providing liquidity for the market. Market makers profit from the difference between the bid and the ask prices, which is called the spread. These firms play a vital role in increasing market efficiency.

Statistical Arbitrage

Statistical arbitrage is a trading strategy that involves using short-term price discrepancies between related assets to gain profits. For instance, you can utilize individual stocks or stock indices and exchange-traded funds (ETFs) for statistical arbitrage. This strategy is highly reliant on statistical models and instrument correlations.

High-Frequency Trading

High-frequency trading, or HFT, involves executing a large number of trades in a short period of time. Traders that implement this strategy, aim to capture the smallest market movements, but on a consistent basis. These strategies are mostly automated, as they require high speed and accuracy and have no room for human error.

Event Driven Strategies

Event-driven strategies are based on economic or even non-economic events. They involve capitalizing on sudden, large market movements that are a result of certain events or news. Traders should analyze the potential impact of different scenarios on asset prices beforehand, to be able to act swiftly upon the occurrence of the event.

Trend Following Strategies

To follow the trend, you must first identify the potential direction of the market or you can hop on when the market is already trending. Trend followers aim to capture the largest moves in the market, as they remain in their positions for an extensive period of time until they perceive that the market is reversing.

Volatility Trading

Volatility traders focus on markets that demonstrate large, frequent price fluctuations. Their goal is to capture short-term movements in either direction but to do so consistently. The first step for implementing this strategy is to identify volatile assets.

Hedge Fund vs. Prop Fund

Being two of the most popular investment avenues in the financial industry, hedge funds and prop trading firms have distinct characteristics. Hedge funds are financial institutions that specialize in investing their clients’ funds in various financial markets and instruments. They capitalize on almost every opportunity to profit from the markets, having different strategies like arbitrage, mergers and acquisitions, and even long-only strategies. They conduct investment activities on behalf of their clients in return for receiving management and performance fees.

Prop firms, on the other hand, invest their own money in the markets. Therefore, they own the majority of profits earned as a result of their trading activities. Propriety trading firms also use various trading strategies, some even similar to hedge funds. Some prop firms operate somewhat in complete contrast to hedge funds, as they leave their funds to professional traders to manage and share the profits with them.

Risk Factors in Prop Trading

While prop trading is a popular way to participate in trading and the financial markets, there are significant risks threatening both prop firms and traders working with them. Here are some of the most prevalent ones:

- Market Risk: Both the prop firms and the prop firm traders are exposed to market risk. By market risk, we mean adverse price movement, which results in financial losses.

- Liquidity Risk: Prop firms offer relatively large accounts to traders. These accounts, accompanied by the leverage the brokers provide, enable taking large positions. These large executions might not be filled from time to time, due to lack of liquidity.

- Counterparty Risk: Traders face the risk that the prop firm does not share the realized profits with them. To avoid this risk, traders should always work with highly regulated firms.

- Financing Risk: Prop firms might be operating on a considerable proportion of borrowings. In case they get a low credit score, they would encounter problems in funding, as no one would be willing to lend them.

- Regulatory Risk: Just like any institution or business active in the financial markets, prop trading firms are also subject to strict rules and regulations. Therefore, they are always under the threat of legal action from governing bodies, especially if they do not abide by the regulations.

Proprietary Trading Regulations

Governments and other regulatory entities are always highly sensitive about the financial markets, and rightfully so. The 2008 credit crisis was a case in point that how a malfunction in the financial system can cripple an entire economy. Proprietary trading, as one of the common activities in the markets, is also subject to strict regulations. We have briefly discussed some of the most prominent rules in this field below.

The Volcker Rule

The creation Volcker rule and its addition to the United States law was a result of the 2008 financial crisis. Named after Paul Volcker, a former Federal Reserve chairman, this rule aims to limit risky trading activities by investment banks. So, the Volcker rule does not permit banks to engage in proprietary trading. Yet, they are still able to continue their market-making activities.

MiFID II (Markets in Financial Instruments Directive II)

MiFID II is a regulation for the European Union. It aims to harmonize the institutions and businesses active in the European financial markets. The primary goals of MiFID II are protecting the investors, ensuring transparency, and incentivizing competition. As a result, prop trading firms are bound to provide accurate reports about their trading activities to the EU regulators on a periodic basis, or on demand.

Basel III

Basel III is mainly aimed at protecting retail investors. This rule prohibits risky investments under a certain amount of capital. Therefore, only investors that meet these capital requirements are allowed to participate in riskier investments. So, Basel III also impacts the smaller proprietary trading firms, as they would not be able to engage in any arbitrary investing activity.

MAR (Market Abuse Regulation)

Being another rule specific to the European Union, MAR is aimed at combating insider trading and market manipulation. These two issues have always been two of the main talking points of regulators in the finance industry. It requires firms to effectively control their internal procedures and offer full transparency about their transactions. Of course, prop firms are not an exception.

How to Run Your Prop Trading Firm?

As you are now familiar with how prop trading firms work, you might be wondering whether you can run your own prop firm or not. We’ve got you covered. With Finestel’s trading technology services, you are able to create your own prop firm. You can link your personal exchange accounts to traders who are willing to manage your capital and to whom you deem suitable and sufficiently skilled. These API keys and Finestel’s white-label trade terminal allow traders to trade on your firm’s capital, without having the access to withdraw any money. These links are also unlimited, meaning that you can work with as many traders as you wish.

Furthermore, you can track traders’ performance using the insightful, comprehensive metrics that Finestel provides in your back-office dashboard. We are also working on integrating demo accounts from top crypto exchanges like Binance and OKX. These demo accounts will enable you to test the traders that apply to manage your funds, as you can track their results for a month or two and monitor their trading behavior and risk management capabilities. In other words, these demo accounts work just like prop firm challenges, because they can be utilized to separate the professional traders from the unskilled ones.

Top 5 Prop Trading Firms in 2023

We have comprehensively explained what proprietary trading is, what benefits it provides, and how prop firms work. Now is the right time to introduce the top 5 prop trading firms in 2023, based on market share, and user and expert reviews.

FTMO

FTMO is the most reputable name in the world of prop firms. Starting their operations in 2020, they have experienced immense growth due to their reliability, acceptable trading rules, and reasonable pricing. FTMO is widely considered the company that popularized prop firms in the retail trading industry.

My Forex Funds

MFF is considered a top two prop trading firm in the industry. They have more flexible trading rules and better pricing compared to FTMO. Yet, they are as reliable and efficient and are arguably the best prop firm around that is suitable for almost any trader.

The Funded Trader

One of the fastest-growing proprietary trading firms, TFT has made it to the top of the list. The Funded Trader has simple trading rules, excellent customer support, and reasonable spreads and commissions.

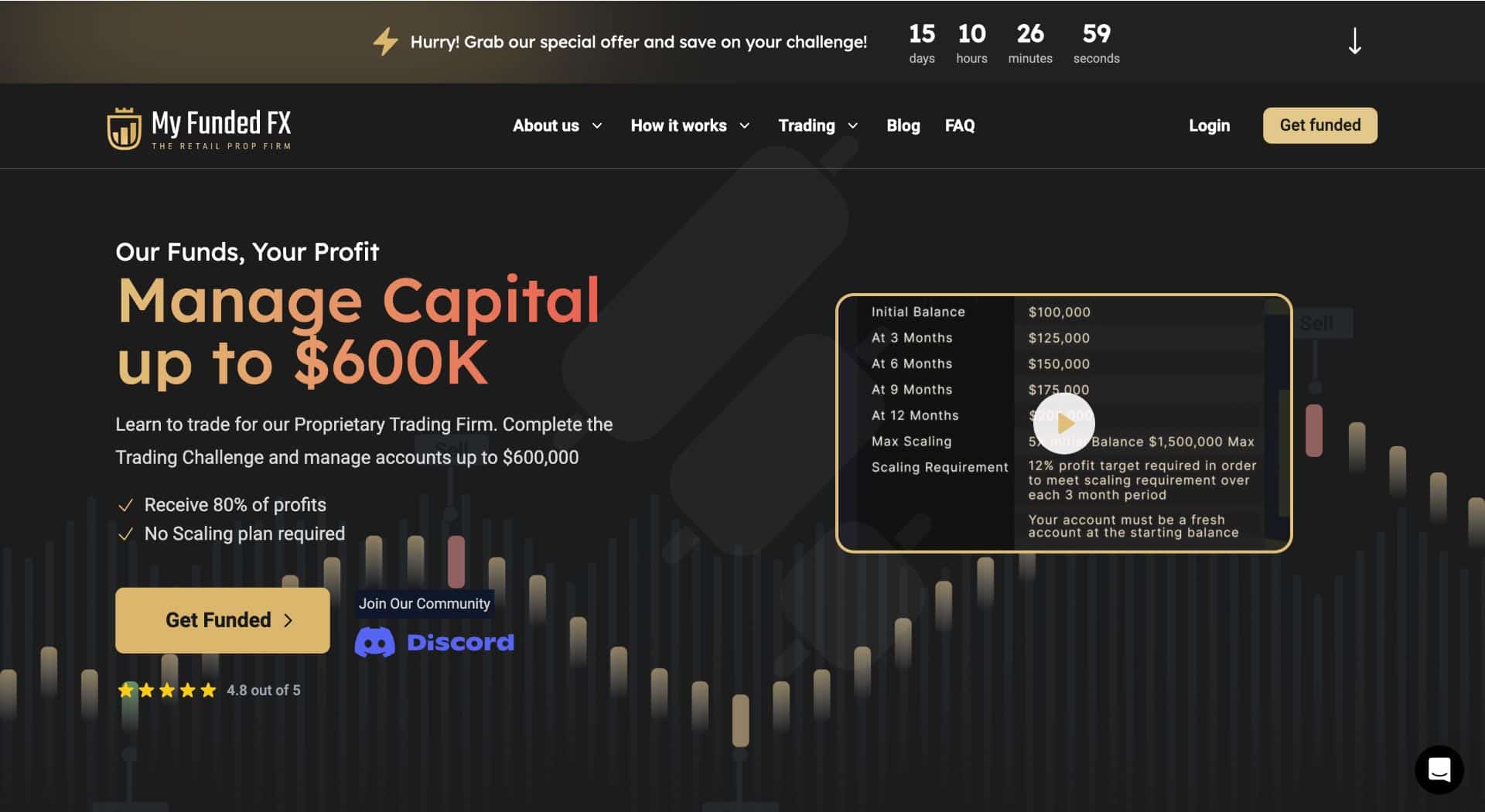

My Funded FX

My Funded FX is an up-and-coming prop firm offering the best deals for challenges and the most flexible rules for traders that want to achieve funding as soon as possible. They also have competitive profit split policies, that can attract more and more traders in the long run.

True Forex Funds

True Forex Funds is another new player in the prop firm scene. Yet, they are one of the most reliable and highly regulated prop trading firms around the world. Therefore, TFF might be worth giving a shot to traders looking for new alternatives to household names like FTMO and MFF, especially with their no-time-limit policy for challenges.

Prop Firm Alternatives

Using Finestel’s copy trading or white-label asset management software, you can work with private investors and even some hedge funds that offer traders capital to trade on. Yet, in this case, you would need a legitimate track record. The portfolio tracker that Finestel offers would cater to this need, as it keeps your trading track record and provides comprehensive performance analytics.

Conclusion

In this article by Finestel, prop trading was introduced and thoroughly analyzed. We first started by providing a definition for proprietary trading and then moved on to explain how it works and what benefits it provides for the market. Then, we analyzed the risks and regulations associated with prop trading. Lastly, we briefly explained how you can run your own crypto prop trading firm using Finestel’s white-label solution. We also introduced the top 5 prop firms in 2023.

As discussed in the article, prop firms offer enormous opportunities to skilled traders to access larger capital. Proprietary trading also injects additional funds into the market, increasing liquidity and market efficiency. Yet, just like any activity in the financial markets, prop trading is also subject to various risk factors. So, traders and firms should aim to mitigate these threats by utilizing effective risk management strategies.

FAQ

What is proprietary trading?

Proprietary trading is a strategy utilized by financial institutions. These firms use their own capital to trade various markets, instead of managing clients’ assets.

How does proprietary trading differ from other forms of trading?

Proprietary trading uses the firm’s own funds and focuses on profit generation for the institution itself. Moreover, prop trading offers limited risk and increased potential returns for traders.

Why is prop trading becoming so popular?

Prop trading is gaining immense popularity as it provides massive opportunities for skillful traders who do not have access to sufficient funds.

How much do prop traders make?

Prop traders’ income varies widely. It depends on their skill set, the firm they are working for, their AUM, etc.

Why do firms engage in proprietary trading?

Firms engage in prop trading mainly to diversify their revenue sources, and increase their investment profits.

How do proprietary trading firms make money?

Prop firms make money when their traders realize profits, as they are entitled to a predetermined share of those gains. Traders should also pay for challenges, and this is the prop firms’ second income stream.

How to build my own prop trading platform?

Using Finestel’s white-label solution, you can create your own prop firm by linking your account to professional traders and letting them manage your money for you and split the profits at the end of the trading period.

Leave a Reply