This Autowhale Review is for traders and teams who want to understand what Autowhale really offers. I spent time researching this platform and their tools, pricing, and even the type of clients they serve. There’s no Autowhale Trustpilot page with user feedback, so you might have to rely on this Autowhale review for now.

But no need to worry, as I’ll break everything down in this Autowhale review. You’ll see what Autowhale does and who it works best for. Also, we’ll talk about how much it may cost, and whether there are simpler alternatives or not, which, of course, depends on your requirements.

What Is Autowhale?

From what I’ve seen in the crypto space, most tools fall into two groups: simple retail bots or huge custom systems that only big funds can build. Well, in my opinion, Autowhale sits somewhere else. It’s a full trading infrastructure and crypto asset management system for teams and serious traders who need real structure behind their operations.

When I started digging into the company for this Autowhale Review, it stood out right away that they don’t sell “signals” or a basic bot. They sell the actual backbone of a professional trading setup, or at least they claim to.

Because I work with algo trading, exchanges, and trading systems almost every day, I can tell when a product is built for retail and when it’s built for people who run real strategies. Autowhale is definitely in the second group.

Their whole idea is simple: if you already have the alpha, they give you the infrastructure to run it. Instead of spending months or years building execution tools, portfolio systems, or reporting dashboards, they hand you a ready system. It connects to many exchanges and can run anything from regular trading to high-frequency (using the Autowhale HFT software).

How Autowhale Works

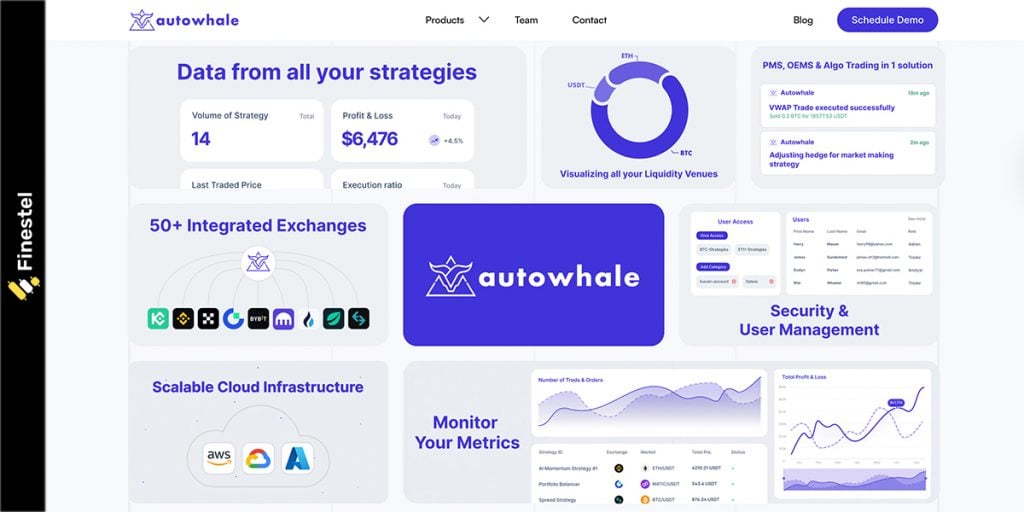

After going through Autowhale’s website and looking at how they present their system, it’s clear that their entire product is built around one idea: giving institutions everything they need to run a crypto fund in one place.

They combine DEX/CEX execution (OEMS), asset management tools, portfolio management (PMS), algo trading, and even AI tools inside a single infrastructure. For someone like me who has worked with exchanges, algo systems, and back-office setups, this is basically the kind of structure you normally have to build yourself. Autowhale just packages it for you.

Autowhale Asset Management System

At the center of their infrastructure is their Digital Asset Management System, which is built to scale. You can run many strategies, across many markets, and on dozens of exchanges.

The system handles API keys securely and supports user roles. They’ve also integrated more than 40–50 exchanges, including top-tier names like Binance, Coinbase, KuCoin, Kraken, and Bitget. That matters because managing multiple APIs manually is a nightmare, and Autowhale solves that part completely.

Customization

Another thing that I particularly like is how customizable the Autowhale asset management system is. Of course, every fund or team has different needs. So, they tailor the setup.

If you need specific logs, custom execution rules, different user permissions, or special reporting formats, they build that into your version. They also allow you to test environments, either with exchange sandboxes or dummy trades.

Mobile Optimization

They also give you a mobile-optimized Autowhale terminal. You can check performance, see charts and metrics, manage roles, start or stop bots, and monitor markets directly from your phone.

As someone who trades and works with teams, I know how useful this is. When something moves fast in the market, you don’t always have a laptop with you.

Long-Term Scaling

The final piece I found quite valuable is their long-term setup. There’s modular architecture and the extendable Autowhale HFT software. You can also deploy them on your own hardware (AWS, Azure, or your own servers).

Demo and Pricing

Well, as the heading suggests, in order to have a closer look at the Autowhale terminal and crypto asset management system, you should book a demo. You’d go through an onboarding process, which basically includes discussing what you need and them showing you what they have to offer.

Autowhale pricing is also not publicly stated, and you’d find out about it after you discuss your requirements. They’ll tailor the solution for you and present the cost. So, there’s no fixed Autowhale cost and pricing, and it depends on what you need.

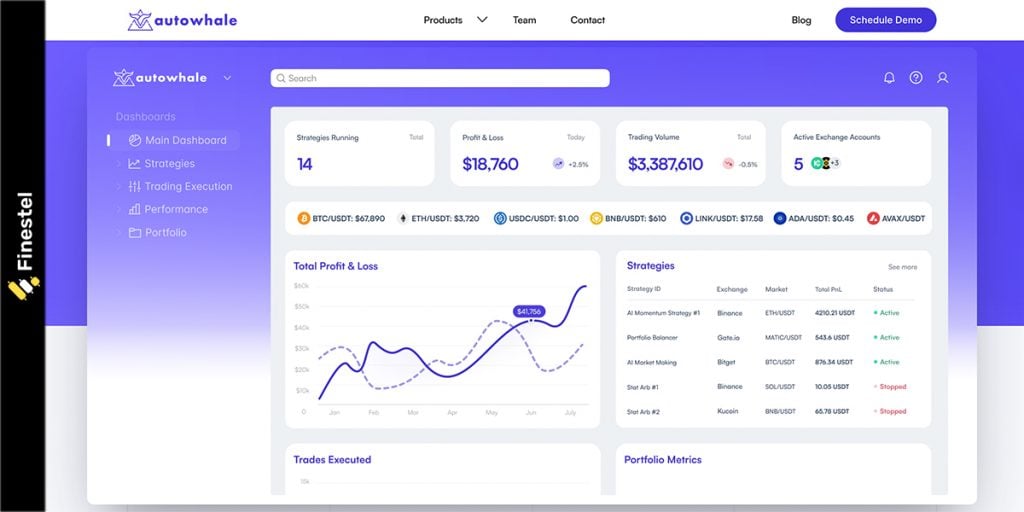

Autowhale Features and Tools

Autowhale packs all its main tools into one system: the trading terminal, the asset-management dashboard, strategy controls, and the execution layer. The Autowhale terminal, as I said earlier, is clean, mobile-friendly. Their asset management side also lets you track balances, organize accounts, assign user roles, and manage multiple traders under one structure.

It reminds me a bit of what we offer at Finestel, but Autowhale goes more complex on the technical trading side, especially with strategy control and advanced execution logic. Again, as I mentioned in this Autowhale review, they also give you testing environments using exchange sandboxes or dummy trades.

Now, what I like about Autowhale the most is their support for custom strategies and high-frequency trading. Also, the way they integrate with 40–50+ exchanges. If you’ve ever dealt with API trading or tried to run algos across several venues, you know how valuable that is.

Their system also includes encrypted API storage, access control, and detailed logs and reporting. This is quite comparable to what Finestel covers on the portfolio tracking and multi-account execution side.

Who Is Autowhale for?

Up to this part of our Autowhale review, we’ve talked about what the company offers and how its features work. Now, let’s see who Autowhale is for and what use cases it offers to each group:

|

User Type |

How They Use It |

Why It Fits Them |

|

Crypto Hedge Funds |

Run strategies, manage accounts, trade across many exchanges. |

They need a full, stable infrastructure. |

|

Algo / Quant Traders |

Deploy custom algos, test, and run HFT or MM models. |

Designed for speed, data, and complex logic. |

|

Prop Trading Teams |

Manage traders, limit permissions, and monitor performance. |

Clean roles and logging keep teams organized. |

|

Market Makers |

Use or modify premade MM algos across exchanges. |

Fast execution and deep integrations. |

|

Token Projects |

Handle treasury trading and liquidity operations. |

Saves them from building a trading engine. |

|

Exchanges |

Manage liquidity or build tools for clients. |

Quick way to add institutional-grade execution. |

|

Family Offices / HNW |

Run automated strategies with reporting. |

Institutional structure without building it themselves |

Autowhale Alternatives

Autowhale is positioned as a full institutional-grade trading infrastructure, but depending on your setup, budget, and technical depth, there are other platforms that may serve you better or cover similar parts of the stack.

Some alternatives focus on algo research, others on market making, and some on advanced trading terminals. The table below compares Autowhale directly with four relevant alternatives so you can clearly see where each one stands.

|

Platform |

Best For |

Core Focus |

Key Strengths |

|

Autowhale |

Funds, prop desks, institutional teams |

Full trading infrastructure (OEMS, PMS, HFT) |

Multi-exchange execution, asset management, custom strategies, HFT support |

|

Finestel |

Asset managers, trading businesses, master traders |

Automation, copy trading, and client management |

White-label copy trading, signal & TradingView bots, investor dashboards, and billing |

|

QuantConnect |

Quant & algo developers |

Strategy research & backtesting |

Advanced backtesting, multi-asset support, cloud R&D environment |

|

Hummingbot |

Market makers, dev teams |

Market making & liquidity bots |

Open-source, customizable MM strategies, broad exchange support |

|

Altrady |

Active discretionary traders |

Multi-exchange trading terminal |

Smart order management, portfolio tracking, and clean UI |

Is Finestel an Autowhale Alternative?

From my own experience in the crypto space, I see Autowhale and Finestel solving two very different problems. I mean, Autowhale is built like a full trading engine for institutions. These firms already have deep technical setups and want high-frequency execution, or even custom infrastructure. They also have an internal team running everything.

Finestel, on the other hand, focuses more on the business layer of trading, which includes things like white-label copy trading, account management, subscription systems, and investor-facing tools.

|

Category |

Autowhale |

Finestel |

|

Main Purpose |

Institutional trading infrastructure |

Tools for asset managers & trading businesses |

|

Target Users |

Quant teams, funds, HFT desks |

Crypto asset managers, master traders, signal providers |

|

Copy Trading / Social Trading |

Not focused on it |

Full white-label copy trading system |

|

Signal & Bot Services |

Strategy execution only |

Signal Bot, Trading Bot, TradingView Bot |

|

Trading Terminal |

Institutional OEMS/PMS |

User-friendly Trading Terminal for clients & managers |

|

Investor/Client Management |

Basic roles & permissions |

Advanced investor dashboards, KYC, billing, subscriptions |

|

MLM or Referral Systems |

Not offered |

Built-in MLM Software for trading communities |

|

Setup Speed |

Longer onboarding |

Quick launch, no coding needed |

|

Best For |

Teams with their own algos & devs |

Trading businesses, funds, asset managers, master traders |

I’d classify Finestel as a better fit for trading businesses, asset managers, and master traders who want a turnkey system to scale their brand without building a quant engine from scratch.

Where Finestel Goes Further

Now, not everyone is an institutional investor. But over the years, lots of retail traders have also grown fond of automation and advanced crypto trading solutions.

So, to bridge this gap, Finestel also offers products that Autowhale doesn’t focus on at all. Products like signal bots, TradingView bots, and a brand new, cutting-edge trading terminal to manage and trade on several accounts. Finestel even offers MLM Software for trading communities.

These tools make it easier to build a real trading business, even for you and me. At Finestel, we actually allow you to create your own one-man crypto asset management system or hedge fund and trade like a pro.

You do the trading, and our products handle the executions, signaling, portfolio tracking, and even client management and billing. In terms of practicality and speed, Finestel gets you to market much faster than other complex solutions like Autowhale.

Conclusion

So, after a detailed look into the product, Autowhale is a solid choice for teams that already run serious strategies and need a full institutional engine behind them. If you need advanced execution, multi-exchange access, and long-term technical stability, it does the job well.

But during my research for this Autowhale review, I also found out that most crypto asset managers and trading businesses, Finestel is the easier and faster path. You get copy trading, bots, terminals, and client management without building anything yourself. Autowhale is great for deep technical teams, but Finestel makes more sense for most crypto asset managers.

Leave a Reply