Welcome to an exclusive analysis of the highly anticipated Binance 2023 crypto research report. In this article, we dive deep into the key trends and developments that have shaped the crypto market during the first half of the year. As one of the leading cryptocurrency exchanges, Binance provides valuable insights into the ever-evolving landscape of digital assets.

From Bitcoin’s dominance to the rise of NFTs, gaming, DeFi, and stablecoins, we explore the significant highlights and milestones outlined in the Binance report. Join us at Finestel, as we uncover the latest market trends, investment opportunities, and the transformative forces that have shaped the crypto industry in H1 2023.

The Layer-1 Landscape in H1 2023

The first half of 2023 saw significant growth and development across major Layer 1 blockchain networks. Bitcoin gained market dominance and saw higher trading volume due to the advent of innovations like Ordinals, Inscriptions, and BRC-20 tokens. Ethereum saw growth in liquid staking through LST and LSTfi products.

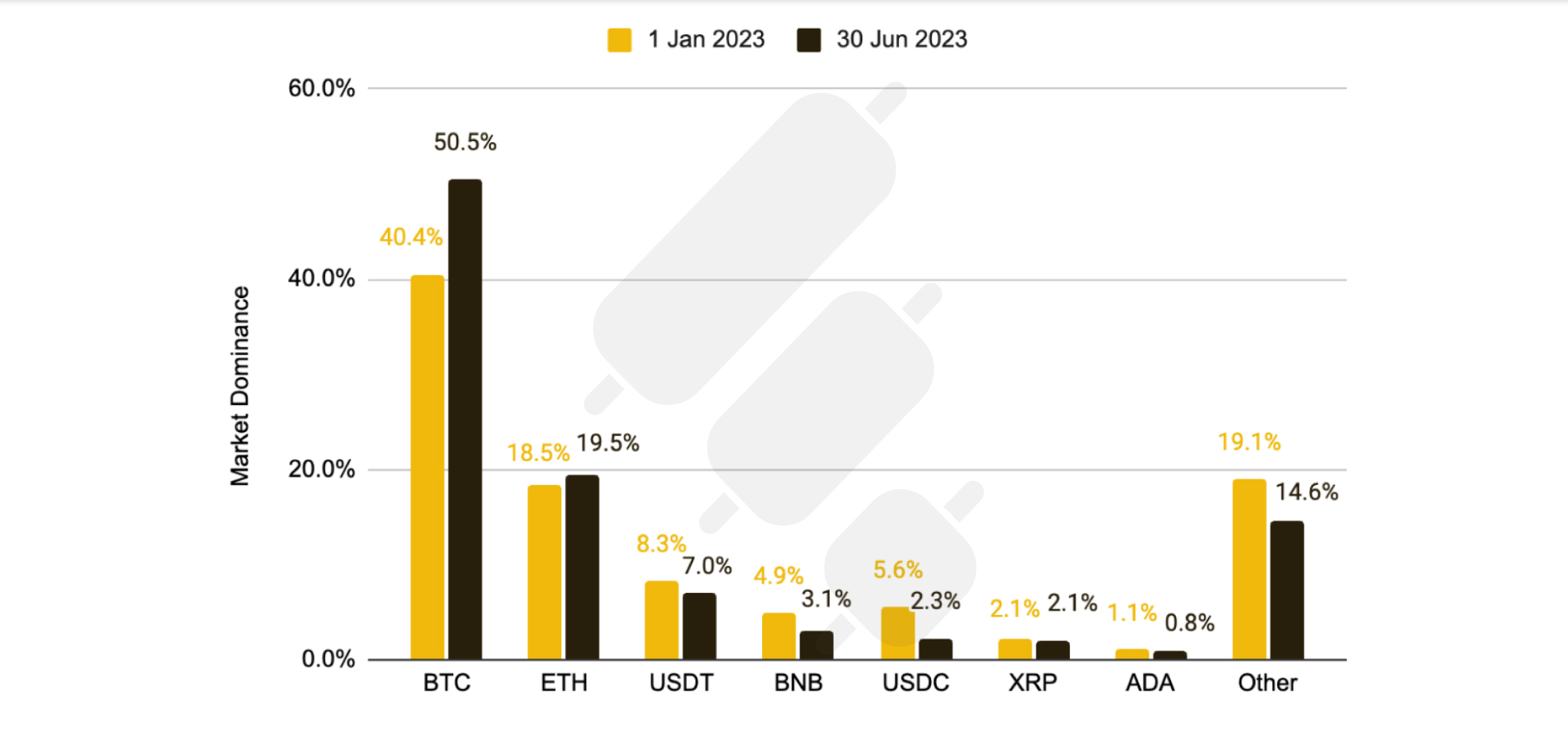

Bitcoin demonstrated a sharp increase in market dominance in H1 2023

Other networks also made progress. BNB Chain focused on scaling solutions like opBNB and infrastructure projects. Solana launched tools to enable Web3 on Android and improve performance. Tron saw significant growth in USDT supply and market share. Polygon was upgrading to a zkEVM validium L2 and proposed changing its token name from MATIC to POL. Avalanche launched Subnets and developer tools to improve scalability and the developer experience. Overall, while Bitcoin remained dominant, other Layer 1 blockchains made headway in areas like scalability, security and infrastructure to support further growth.

Bitcoin

Bitcoin has gained market dominance due to innovations like Ordinals, Inscriptions, and BRC-20 tokens. According to the provided report, the correlation between Bitcoin and traditional finance (TradFi) is at multi-year lows. This indicates that Bitcoin’s price movements are less influenced by traditional financial markets. The report also mentions that there is increased excitement and energy within the broader Bitcoin ecosystem due to new developments such as Ordinals and Inscriptions. This suggests that there is a positive outlook for continued development and innovation in the Bitcoin ecosystem in the coming months.

Dominance and Growth

- Bitcoin’s market dominance increased significantly from 40.4% to 50.5% in H1 2023, reclaiming its position as the largest cryptocurrency.

- Bitcoin’s market cap increased 87.7% to over $600 billion, nearly double the total crypto market cap growth of 47.6%.

- Trading volume and transaction activity also saw notable increases, indicating higher user engagement and positive sentiment.

Ordinals and Inscriptions

- The advent of Ordinals, which assign unique IDs to satoshis, enabled the creation of Inscriptions (Bitcoin NFTs).

- The first Inscriptions were minted in December 2022 and grew to over 10,000 by April 2023.

- Inscriptions and BRC-20 tokens contributed to higher transaction fees and block sizes on the Bitcoin network.

In summary, key developments like Ordinals and Inscriptions helped drive Bitcoin’s dominance and growth in H1 2023. Metrics like market cap, volume and activity were all significantly higher compared to the start of the year.

Ethereum

According to Binance 2023 crypto research report, Ethereum remains the leading L1 blockchain, with the highest market cap, trading volume and revenue generation compared to other competitors. It saw growth in liquid staking through LST and LSTfi.

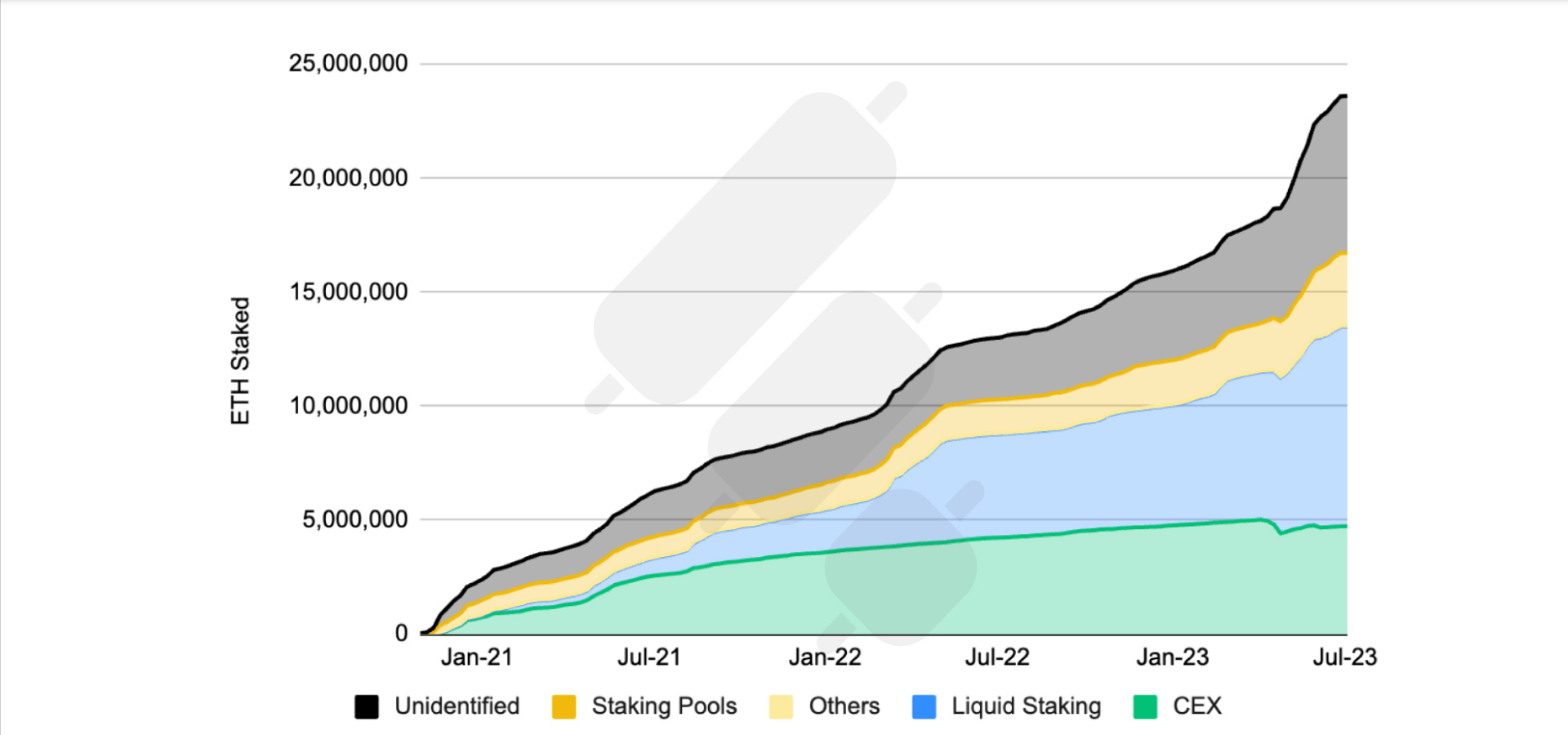

Liquid staking commands 37.1% of the total ETH staking market

Network Metrics

However, Ethereum’s network metrics have been impacted by its relatively high transaction fees. Other competitors have surpassed Ethereum in metrics like transactions per second and average fees.

Developments

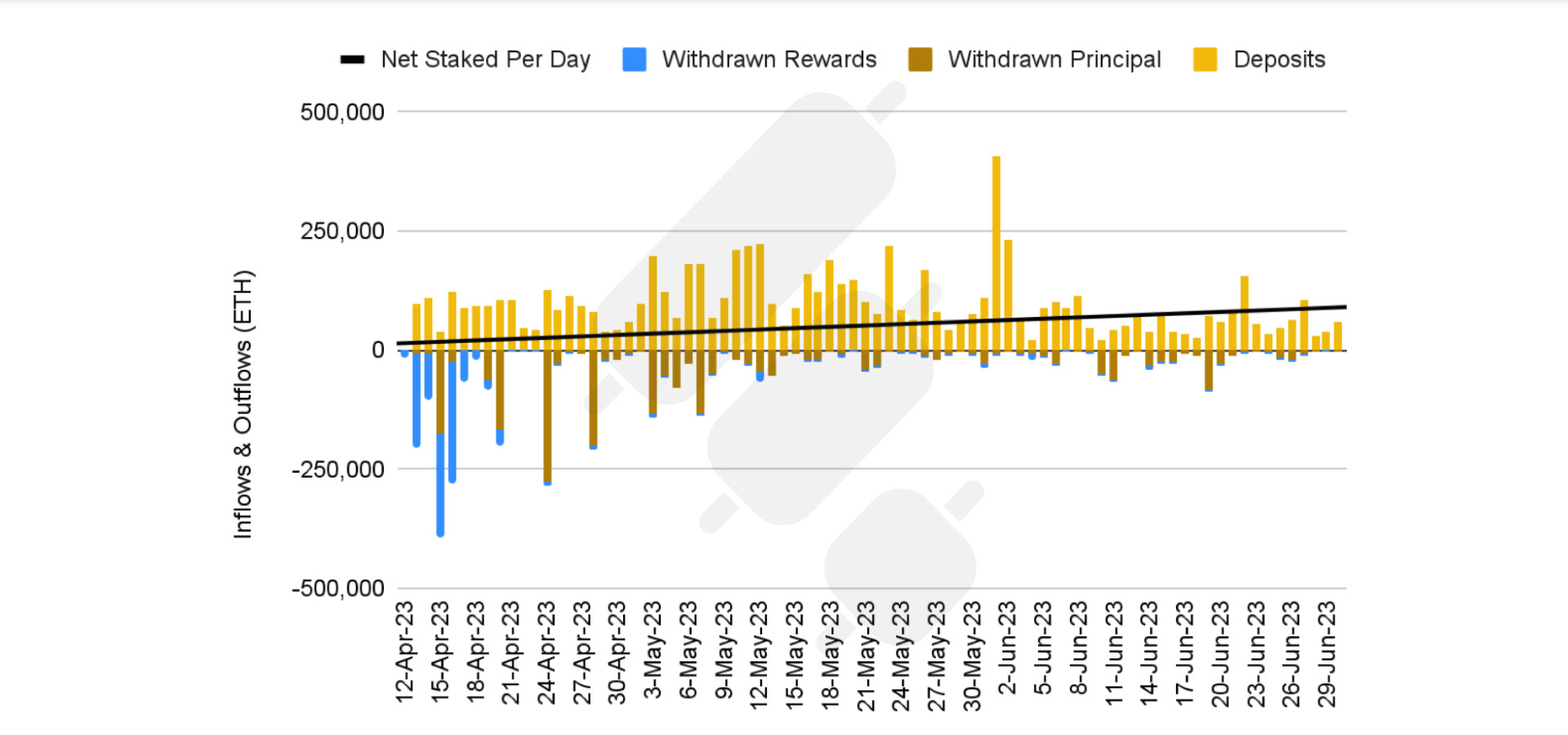

- The Shanghai upgrade enabled ETH staking withdrawals, which led to an increase in staked ETH.

- Liquid staking solutions like LST and LSTfi grew, with liquid staking now accounting for over 37% of total staked ETH.

- Emerging LSTfi DeFi protocols allow users to utilize their liquid staked ETH in DeFi.

ETH staking has been dominated by inflows since the Shanghai Upgrade

In summary, while Ethereum maintained its lead in financial metrics, its network performance has lagged competitors due to high fees. Developments around staking and liquid staking showed some progress in H1 2023.

BNB Chain

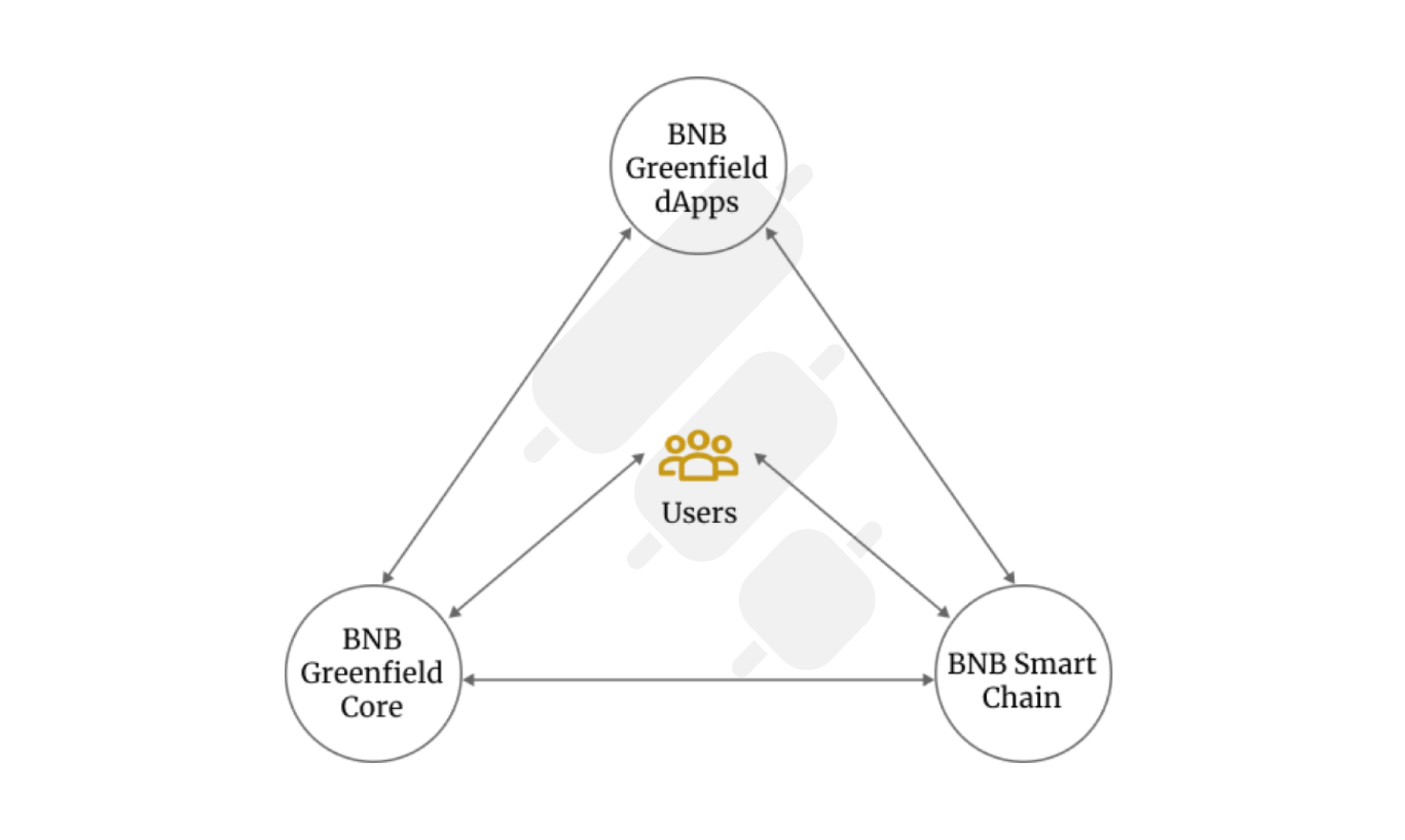

BNB Chain’s focus in H1 2023 has been on improving scalability through solutions like opBNB and building infrastructure through projects like BNB Greenfield. This, combined with its already low fees, has helped drive growth and activity on the network.

Scalability and Infrastructure

- BNB Chain saw strong growth in transactions and active addresses due to its extremely low fees.

- It launched opBNB, an L2 scaling solution that aims to provide over 4,000 TPS with transaction fees lower than $0.005.

- BNB Greenfield was also launched to provide a decentralized data storage infrastructure for the BNB Chain ecosystem.

BNB Greenfield’s ecosystem is envisioned as a trinity of entities working together to provide a novel decentralized data storage solution

Solana

Solana launched a mobile phone and mobile stack to enable Web3 on Android. The Firedancer validator client aims to boost scalability and performance.

Growth and Adoption

-

Solana bounced back well from the FTX issues in late 2022, with growing market cap and trading volume in H1 2023.

-

It also has the lowest average transaction fees and highest staking ratio among major L1 blockchains.

Developments

-

Solana launched the Saga phone and mobile stack to enable Web3 on Android, which could boost adoption of Solana dApps.

-

Firedancer, a new validator client, is being developed to improve Solana’s scalability and performance. It has processed over 1 million TPS in tests.

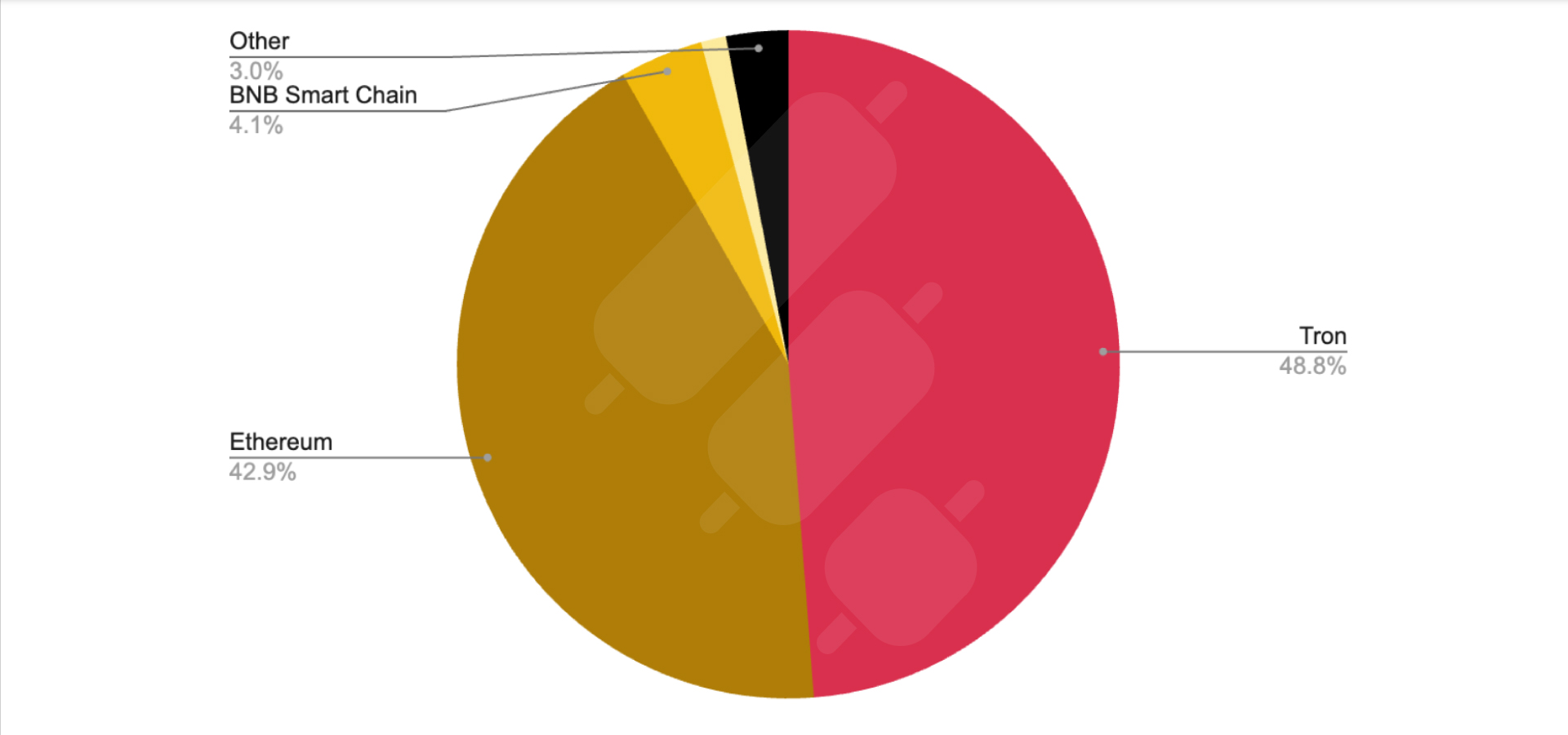

Tron

The supply of USDT on the Tron blockchain has increased by 29% and surpassed $40 billion, mainly due to users switching from other stablecoins. Tron has experienced significant growth in the liquidity of the USDT stablecoin, with USDT now accounting for more than 92% of all stablecoins on the Tron network. The overall market value of stablecoins on Tron has risen by 31% to reach $43.9 billion. Tron’s objective is to establish a blockchain network that is scalable without limits, much like the internet.

Tron is the largest source of USDT supply across all blockchains

Growth of USDT on Tron

- There was significant growth in the amount of USDT stablecoin hosted on the Tron network.

- USDT supply on Tron grew from $31.7 billion at the start of 2023 to over $40.6 billion by the end of H1 2023, an increase of 29%.

- USDT’s dominance on the Tron network also increased significantly, reaching over 92% of the total stablecoin market cap on Tron.

In summary, the growth of USDT on Tron’s network, driven by the migration of stablecoin liquidity from other networks, was a major highlight for Tron in H1 2023. However, the report does not mention any other major developments on the Tron network during this period.

Polygon

Polygon launched a zkEVM validium scaling solution, which uses ZK proofs to guarantee transaction validity while storing data off-chain. This is meant to provide higher throughput compared to Polygon’s zkEVM rollup. Polygon has formed many partnerships, especially with NFT and gaming projects as well as payment companies like Stripe.

zkEVM and Polygon 2.0 Vision

- Polygon’s focus in H1 2023 has been on zkEVM, its zero-knowledge rollup solution.

- It launched its zkEVM product in March 2023 to compete with zkSync.

- Polygon also announced its Polygon 2.0 vision, which aims to create a “Value Layer of the Internet” through a network of zk-powered L2 chains.

- As part of this vision, Polygon plans to upgrade its Polygon PoS sidechain to a zkEVM validium by the end of Q1 2024.

- It also proposed changing its token name from MATIC to POL to coordinate its ecosystem.

In summary, Polygon’s developments in H1 2023 have centered around its zkEVM rollup and its Polygon 2.0 vision of creating a network of scalable and interoperable zk-based L2 chains.

Avalanche

Avalanche Subnets allow for the creation of custom blockchains for different uses, providing an “out-of-the-box” solution. The Glacier API service indexes Avalanche Subnets and collects data from Avalanche and Ethereum networks to provide real-time and historical data for developers.

Subnets and Developer Tools

- Avalanche launched new Subnets that allow for custom blockchains tailored to specific use cases.

- It launched tools like HyperSDK and Glacier API to improve the developer experience and make it easier to build on Avalanche.

Partnerships

Avalanche partnered with AWS and Tencent Cloud to promote its infrastructure and Subnets to enterprises.

In summary, Avalanche’s focus in H1 2023 has been on expanding its ecosystem through new Subnets, developer tools, and partnerships. This aims to improve the scalability, interoperability, and enterprise usage of the Avalanche network.

In summary, H1 2023 saw major Layer-1 blockchains focus on scaling, performance improvements, and enabling new use cases to drive growth.

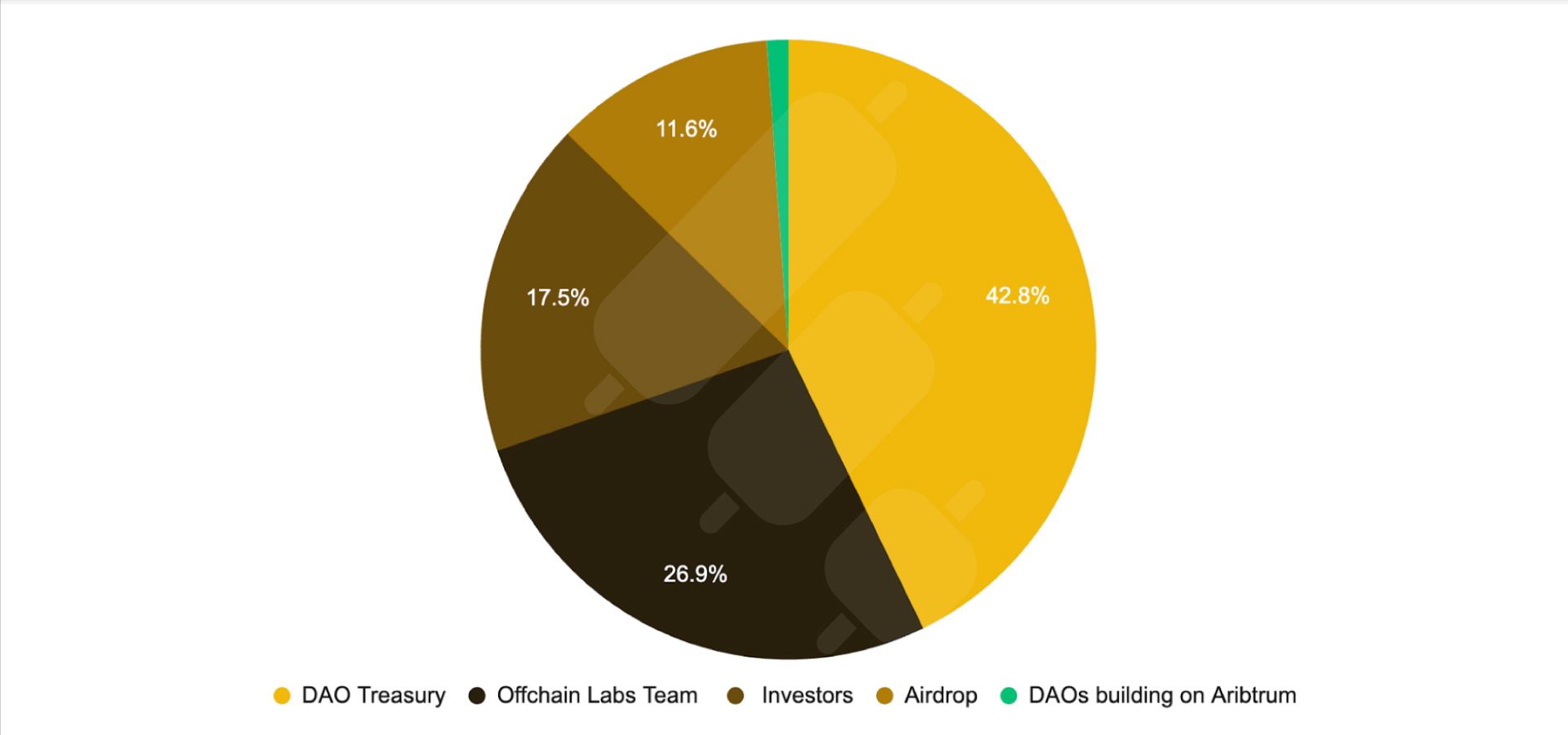

Layer 2 Landscape in Binance 2023 Crypto Research Report

Arbitrum: It has maintained its dominant position among optimistic rollups, holding over 60% of the layer 2 market share in the first half of 2023. It has consistently processed the most daily transactions and paid the most fees to the Ethereum layer 1. The ARB token airdrop in March 2023 helped boost its ecosystem.

ARB token distribution

Optimism: Optimism remains the second largest optimistic rollup behind Arbitrum. While it processed more daily transactions than Arbitrum initially in 2023, Arbitrum has pulled ahead for most of the year. Upgrades like Bedrock have helped reduce costs for users.

zkSync: zkSync Era launched in March 2023, representing zkSync’s transition from zkSync Lite. It has seen strong TVL growth, with an 88.9% increase from April to May 2023. Matter Labs, the creator of zkSync, envisions zkSync becoming part of a “Hyperchain” to improve scalability and interoperability.

StarkNet: It has been focused on developing its zkEVM capabilities. It recently raised funding for its testnet launch in August 2023. StarkNet aims to improve performance with its Quantum Leap upgrade in Q3 2023, targeting 100 TPS. It ultimately wants to pioneer the first “Hyperchain”.

Polygon zkEVM: Polygon zkEVM is an early-stage zk-rollup with around 0.5% of the layer 2 market share. Polygon has discussed plans for Polygon 2.0, which would create a network of ZK-powered layer 2 chains optimized for different use cases like gaming and social apps.

Linea and Scroll: Upcoming zk-rollup launches Linea and Scroll are scheduled for Q3 2023. Linea has been testing its mainnet through a series of challenges. Scroll aims to launch its mainnet in early 2024.

Layer 3s and Superchains: Many layer 2 networks are exploring layer 3 and “Superchain” architectures to improve scalability, security, and interoperability even further. This includes Arbitrum Orbit, Starknet’s Hyperchain vision, and Matter Lab’s ZK Stack. Projects are experimenting with different architectures optimized for specific use cases.

In summary, while optimistic rollups still dominate layer 2, ZK rollups are gaining ground through major launches and upgrades in the first half of 2023. Many projects are exploring layer 3 and superchain concepts to push the boundaries of scalability and flexibility for decentralized applications.

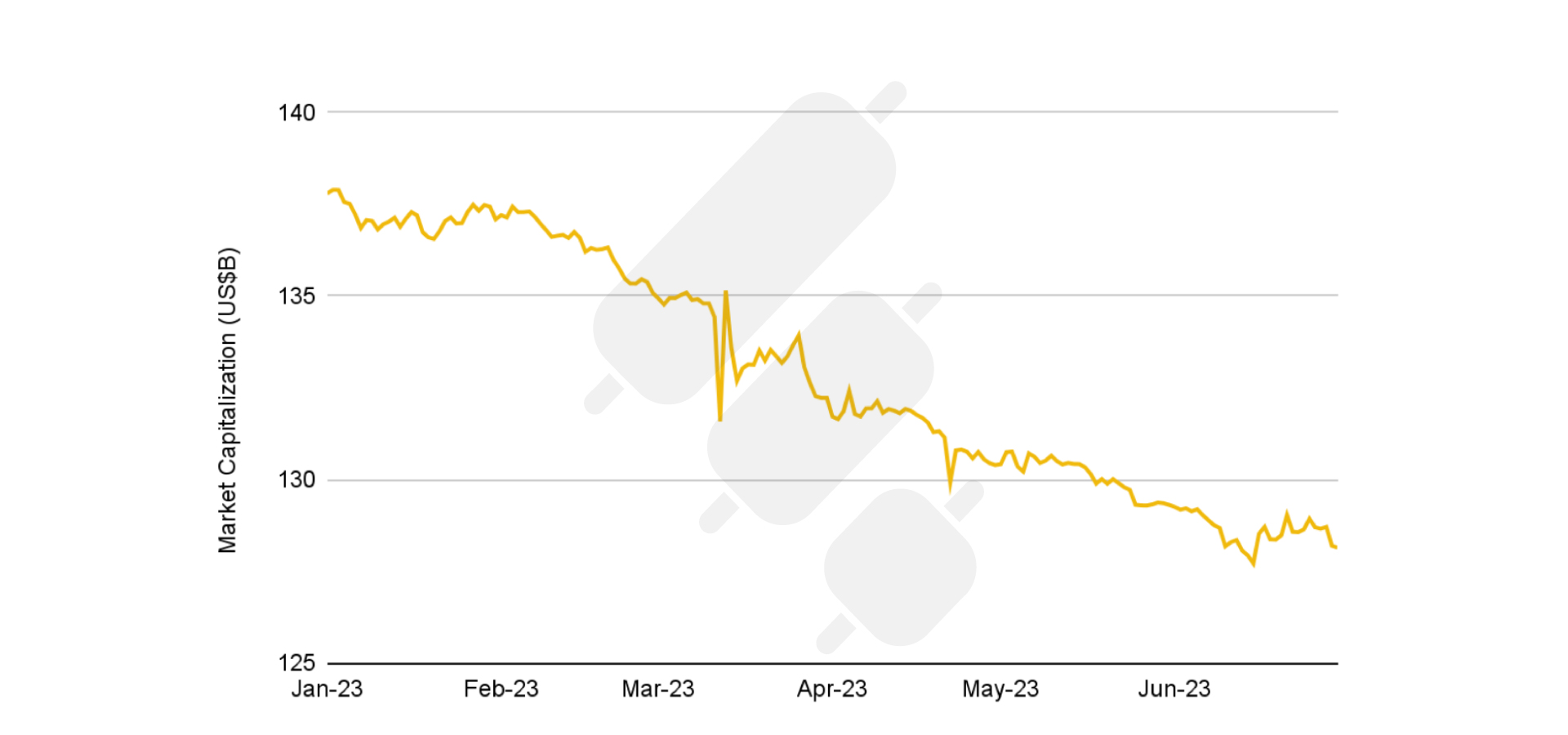

Stablecoins Landscape in H1 2023 Binance Report

The stablecoin market has undergone significant changes in the first half of 2023.

The global stablecoin market has been on a downwards trajectory in 2023

Contraction in Market Size: The total stablecoin market cap has declined, driven by the changing regulatory environment. Centralized stablecoins still dominate, making up over 90% of the market.

USDT’s Dominance Growing: Tether (USDT) has expanded its market share significantly at the expense of other stablecoins like USDC and BUSD. USDT now controls over 65% of the total stablecoin supply. Its presence across exchanges and platforms has helped drive this growth.

DAI Gaining Ground: Among decentralized stablecoins, MakerDAO’s DAI remains the leader. However, Frax Finance’s FRAX has been gaining ground. DAI is positioning itself to overtake BUSD, demonstrating resilience in a market dominated by centralized players.

Transparency and Stability: Stablecoin users are placing more emphasis on the transparency and stability of the reserves backing stablecoins. Issuers are diversifying their reserves beyond just cash and cash equivalents to meet this demand.

Emerging New Stablecoins: Several new stablecoins have launched in H1 2023, though their impact remains to be seen given the dominance of incumbents like USDT. Proprietary stablecoins from protocols like Curve Finance aim to capitalize on composability within DeFi.

In summary, while the total market size has contracted, the stablecoin landscape has seen USDT consolidate its dominance. Transparency, stability and diversification of reserves have become more important. New stablecoins are emerging but will need to differentiate themselves to gain significant market share. The first half of 2023 has been a period of transition for the stablecoin sector.

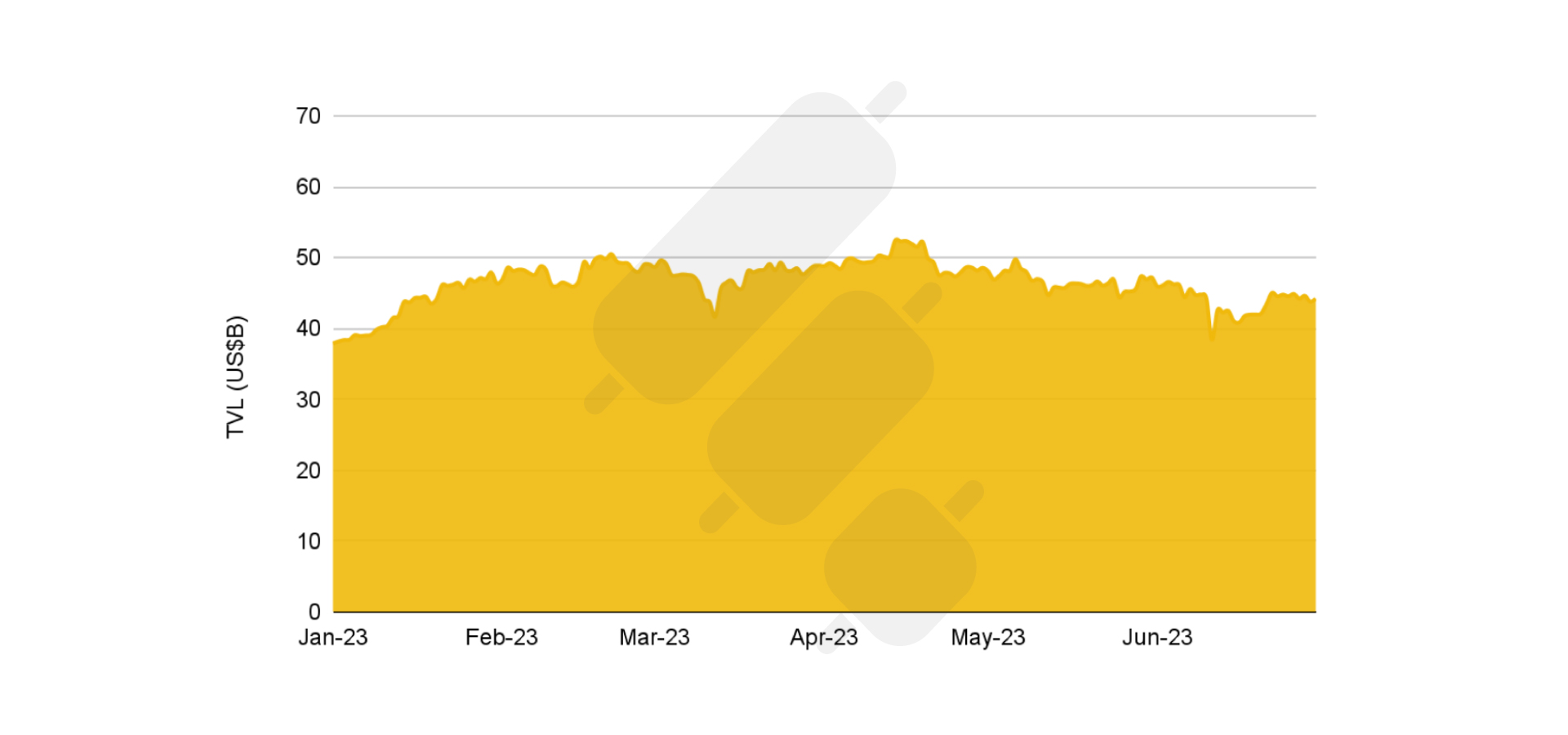

Binance 2023 Crypto Research Report; State of DeFi

Despite a tempered growth in 2022, the first half of 2023 has marked a steady upward progression for decentralized finance. DeFi TVL has increased an estimated 16.7% YTD to $44.2 billion. This continued inflow of capital indicates DeFi’s pivotal role within the crypto industry.

DeFi TVL has remained relatively stable in H1 2023, increasing 16.7% YTD

Liquid Staking Dominance: A notable development has been the rise of liquid staking protocols. Liquid staking has emerged as the top gainer in TVL market share, surging from 14% at the start of the year to 24% currently. This is largely due to the benefits that liquid staking offers like easier access to staked funds.

DEX Growth: Decentralized exchanges have seen noticeable growth in trading volumes. The DEX to CEX spot ratio has appreciated from 9.6% to 16.8%, indicating a migration of users towards decentralized alternatives. Protocols like Uniswap and new entrants like Maverick Protocol are capitalizing on this trend.

Lending Continues to Grow: Lending remains a vital DeFi component, with a TVL of $14.5 billion. While Aave dominates the sector, protocols like JustLend, Morpho and Radiant Capital are making strides by targeting niche customer segments.

Derivatives Gain Popularity: Though still in its early stages, the decentralized derivatives market has expanded its scope in H1 2023. Perpetual futures dominate the sector due to their inherent leverage. Protocols like GMX and dYdX are leading the way.

In summary, key trends in the first half of 2023 include the rise of liquid staking, growth of DEX volumes, continued expansion of lending and derivatives markets, and the emergence of niche players targeting specific customer segments. This points to an evolving DeFi landscape with room for more innovation and specialization.

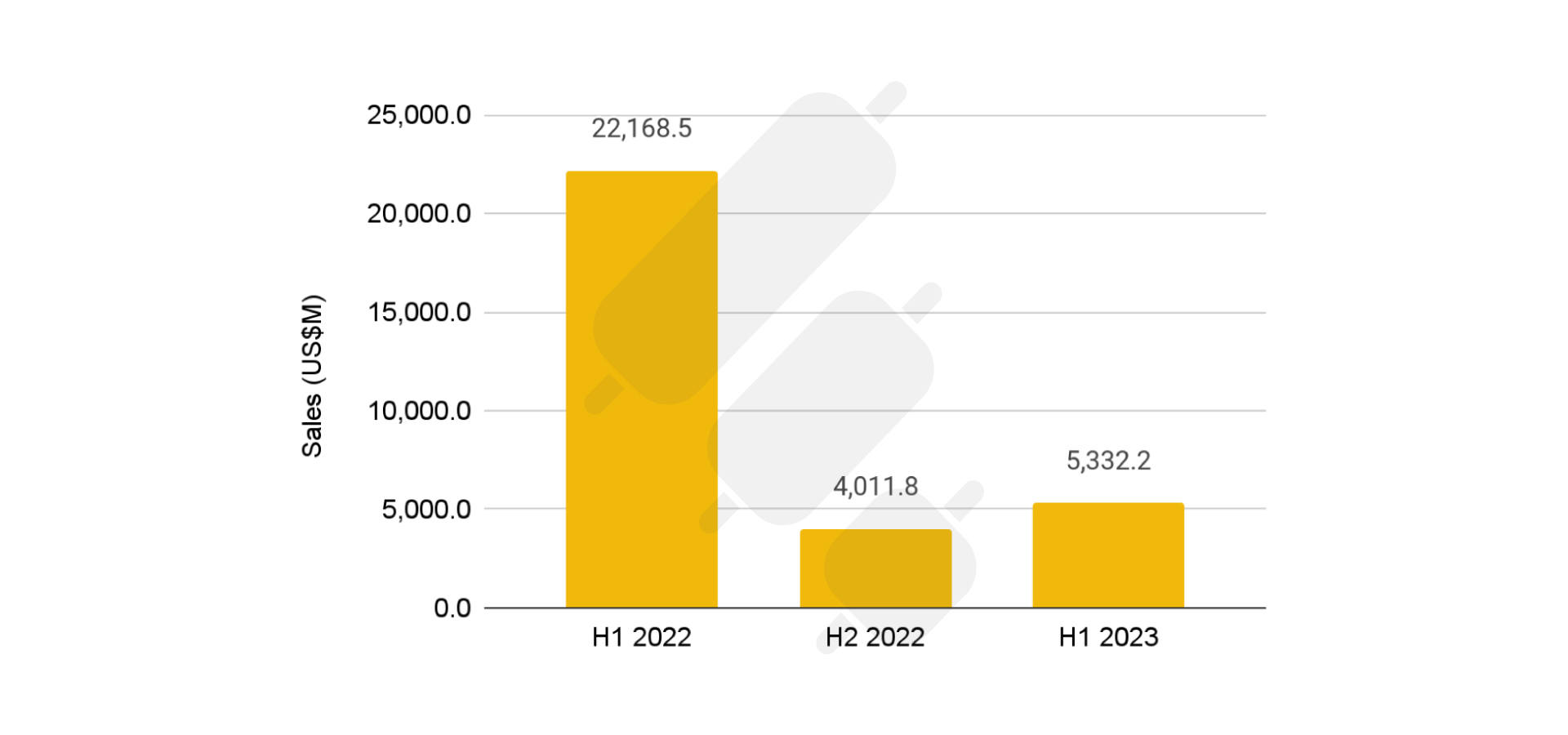

NFT Market Review in H1 2023; Sluggish Sales but Signs of Stabilization

NFT sales recorded $5.3 billion in volume in the first half of 2023, representing a 75.9% decline year-over-year. However, sales increased 32.9% compared to the second half of 2022, showing some signs of stabilization.

H1 2023 NFT sales have fallen on a year-on-year basis but have shown some signs of stabilization

Monthly NFT sales peaked in February, likely due to the Blur airdrop, but declined afterwards. The sharp year-over-year decline in sales was mainly due to a 74.9% drop in average NFT sale prices. However, the total number of transactions increased 41.8% on a half-on-half basis and 0.6% year-over-year, showing some underlying activity.

NFT Marketplace Competition Heats Up

Blur overtook OpenSea to become the largest NFT marketplace by volume in December 2022, capturing up to 77.2% of the market. OpenSea launched OpenSea Pro in April 2023 to compete with Blur. While Blur still leads in volume, OpenSea Pro has exceeded Blur in terms of transaction count and active wallets.

However, activity on both platforms may be influenced by incentives and not reflect organic demand. It remains to be seen how the competition will play out.

Growth of NFT Lending

NFT lending saw a resurgence in H1 2023, driven by the launch of Blur’s lending platform, Blend. Monthly borrowing volumes hit a record high of $823 million in June 2023. Blend quickly dominated the NFT lending market, capturing 92.8% of lending volume. However, lending activity may be inflated by airdrop farming.

H1 2023 Gaming and Metaverse Landscape

In 2021 and early 2022, there was a lot of excitement around X-to-Earn games and Metaverses. However, currently, there is less interest from retail investors in the gaming and Metaverse sectors. Despite this, the market capitalization of gaming-related tokens has grown due to the overall market recovery. Game developers understand that creating high-quality games takes time and are still dedicated to building them. Although the adoption of Metaverses is in its early stages, many institutions acknowledge the potential advantages it offers for the future.

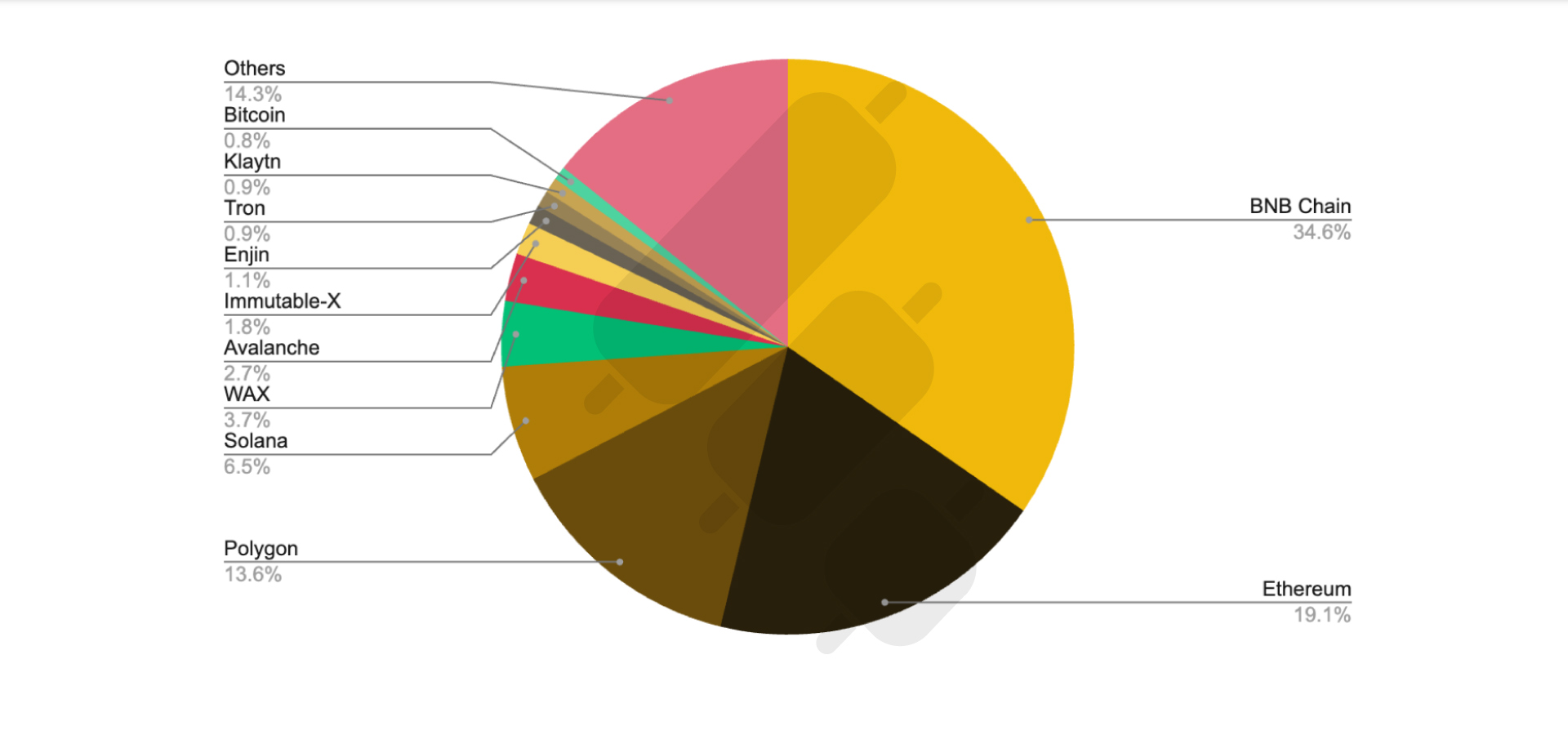

Blockchain Gaming

BNB Chain, Ethereum, and Polygon lead the blockchain gaming market, with over 67% of games built on these chains. While many criticize the lack of quality games in the sector, developers note that AAA games take years to develop. Currently, only 27.6% of blockchain gaming projects are live while the rest are in development.

BNB Chain, Ethereum, and Polygon lead the blockchain gaming market

On-chain gaming activity has declined compared to the start of the year. Weekly unique active wallets have fallen steadily in H1 2023 and currently stand at 5.2M. However, on-chain data understates actual gaming activity as not all actions require blockchain interactions.

The market cap of gaming-related tokens grew 48% YTD to $12.1B in H1 2023, benefiting from the broader market recovery. Most top gaming tokens performed positively in H1 2023.

Metaverse State in Binance 2023 Crypto Research Report

While the Metaverse is estimated to generate $5T in value by 2030, public interest and transactions have declined significantly in H1 2023.

However, a majority of institutions still believe the Metaverse will have a huge impact on businesses, enabling higher revenue and profits. Most institutions are currently investing less than 5% of their tech budget on the Metaverse and are waiting for higher customer demand.

In summary, while the gaming and Metaverse sectors face challenges, the long-term potential remains vast. Keeping track of emerging trends will be key to navigating this evolving landscape.

Fundraising Activity & Institutional Adoption in H1 2023

While overall crypto deal activities and venture capital funding declined in the first half of 2023, some VC firms remained optimistic about opportunities in Web3 technologies and infrastructure. Notable fundraising activities during this period include:

– Hub71+ Digital Assets raised $2 billion from organizations in Abu Dhabi to fund Web3 startups.

– Hashkey Capital announced a $500 million crypto and blockchain focused fund.

– Theory Ventures debuted a $230 million fund focused on data, Web3, and machine learning.

Most of the fundraising happened during the early stages for seed and Series A rounds, suggesting VCs see new opportunities. However, average deal sizes fell due to market conditions.

Institutional Adoption

Several developments showed institutions embracing blockchain:

Building Infrastructures

- Many central banks expanded or launched CBDC pilot programs, including China, Hong Kong, Colombia, Japan, the Bank of England, and Thailand.

- Financial institutions partnered with blockchain firms to explore use cases, like Swift collaborating with Chainlink.

Expanding Access to Trading Cryptocurrencies

- Some banks and financial firms started offering crypto trading to customers, such as DZ Bank, DWPBank, Fidelity Investments, and Blackrock filing for a Bitcoin ETF.

- EDX markets, a new crypto exchange backed by Citadel Securities and others, launched.

Real World Assets

- Siemens issued a $63 million digital bond on Polygon.

- DeFi protocols like MakerDAO began investing in traditional financial assets for yield and treasury management.

In summary, while the market conditions remained challenging, there were still healthy funding flows and institutions continued experimenting with and building blockchain infrastructure in the first half of 2023.

Binance 2023 Crypto Research Report Infographic

Conclusion

The first half of 2023 was a turbulent period marked by increased institutional interest and adoption, as well as heightened regulatory scrutiny. This led to volatility in the markets as investors exercised caution and reduced their exposure. While many projects faced challenges with slowing activity and drying funding, blue-chip assets like Bitcoin performed exceptionally well, surpassing traditional financial investments and reaching multi-year highs in dominance. This strong performance has instilled confidence among investors.

Despite the uncertainties, institutions have shown unprecedented interest in the crypto industry, actively exploring and participating in the market. The “Bitcoin ETF” season has further fueled the market’s momentum, with Bitcoin reaching new highs for the year. As we enter the second half of the year, we anticipate further innovations, increased adoption, and a promising future for the industry.

Leave a Reply