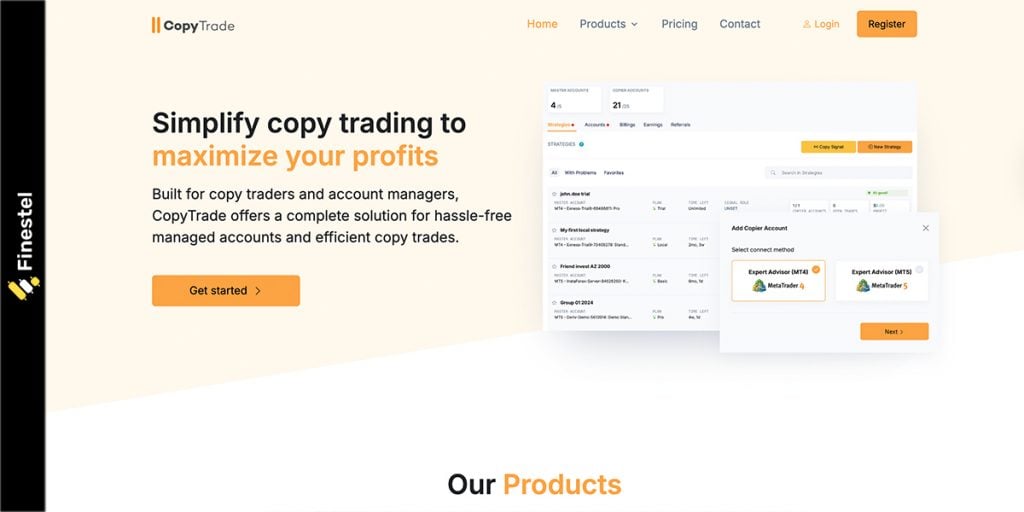

If you’re into automated trading, signal services, or copy trading, you’ve probably seen CopyTrade.net around. I’ve tested the platform for myself to write this CopyTrade.net review. I’ve run some trades and checked the dashboard. I wanted to see how it performs in real market conditions. My goal here is simple: share what actually works and what doesn’t.

CopyTrade.net looks simple at first. I paid attention to the execution speed, the trader lists, the analytics, and how easy it is to follow or manage strategies. So in this CopyTrader.net review, I’ll break down my experience so you can decide if it fits you or not.

What Is CopyTrade.net?

I’d like to begin this CopyTrade.net review by introducing what the platform is, or claims to be. It’s a platform that offers copy trading, which means it lets you mirror the trades of others automatically.

So, instead of building your own strategy, you choose to trust another trader with your capital, kind of like they’re your asset manager. Then, the platform executes the same trades on your account in real time.

Now, when I tested it, the platform felt like a mix between a signal service and a managed trading system. You get a list of traders, performance metrics, risk scores, and details about their strategies. Then you can choose someone to follow, and CopyTrade.net handles the execution through API connections to your exchange. Simple as that.

Key Features

The core part of this CopyTrade.net review is analyzing its features. It offers a flexible and scalable system that both retail traders and small asset-management teams can use. The core strength is in providing fast execution and compatibility with popular trading platforms and brokers.

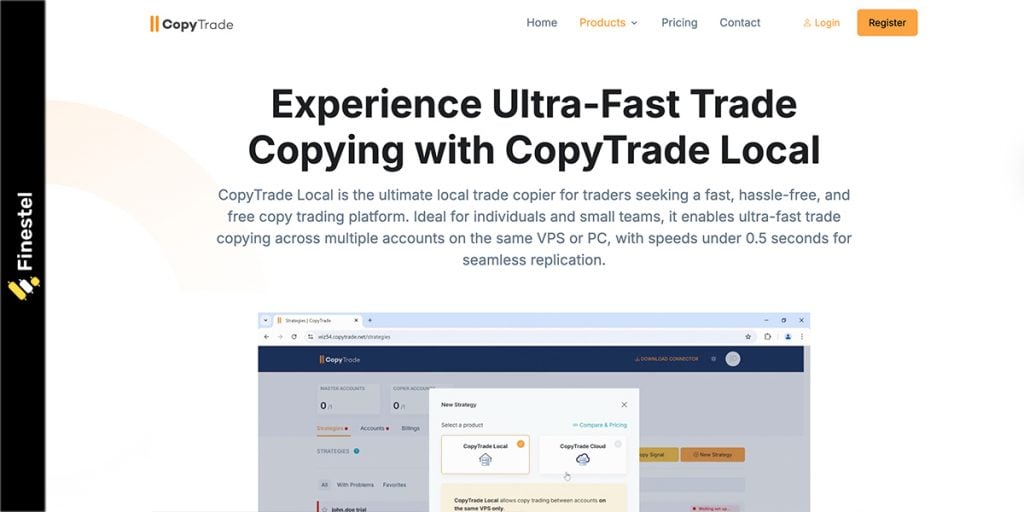

CopyTrade Local

So the first product, which is called CopyTrade Local, is for those traders who want no-delay copy trading on the same VPS or PC. And I think they’ve done a good job with it, as the software delivers sub-0.5-second execution. As it’s compatible with both MetaTrader 4 and MetaTrader 5, you get stable performance whether you trade forex, indices, or crypto CFDs.

That said, CopyTrade Local is still a local copier, meaning everything happens on a single machine. For more professional environments, like prop-style scaling, cross-region execution, or syncing hundreds of follower accounts, and trading crypto directly on exchanges instead of CFDs on a broker account, I’d still prefer Finestel’s copy trading software.

CopyTrade Cloud

The next product, CopyTrade Cloud, offers a scalable and secure way to manage multiple MT4 and MT5 accounts from anywhere. So, it basically supports unlimited account growth and works with all major brokers. There’s also a clean cloud dashboard that makes remote trade copying simple.

It also includes a Signals Marketplace, where providers can list strategies and followers can subscribe to them. That said, I think it still lacks advanced automation and deeper risk controls, which must come with a fully professional infrastructure.

White-labeling

An interesting part of this CopyTrade.net review for me is discussing their white-label option. It essentially helps you launch your own branded copy trading platform without building the technology from scratch, similar to what Finestel offers as an extra on top of our copy trading software.

Again, it supports both MT4 and MT5, and through them, connects to all major brokers. It’s under your branding, your domain, and your user management flow.

How CopyTrade.net Works

We shall continue our CopyTrade.net review by explaining how it works. Well, it operates on a simple Master–Follower structure you see on almost every other copy trading platform.

The Master account places trades, and all connected follower accounts automatically replicate those trades in real time. Remember, since the platform runs through MT4 and MT5, the execution depends on broker conditions, VPS speed, and liquidity. Yet, in most cases, I’ve found it fast enough to keep slippage minimal, especially on the Local version.

However, one important point is that CopyTrade.net doesn’t include built-in equity protection or risk modules. As a follower, you’d simply mirror the Master’s trades as they are. For traders running client funds or larger groups of followers, this lack of risk control is something to consider, especially compared to professional systems like Finestel that offer more structured risk tools.

Take a look at our Insilico Terminal review, Bitsgap review, and Coinroutes review.

Pricing and Plans

CopyTrade.net keeps its pricing simple enough with only two main products: Local and Cloud. Both support unlimited copier accounts, MT5 compatibility, order filtering, lot multiplier, and basic risk controls. The pricing actually depends on whether you copy trades locally or through the cloud.

|

Feature |

Local ($20/mo per strategy) |

Cloud ($7.5/mo per account) |

|

Max Copier Accounts |

Unlimited |

Unlimited |

|

Copying Latency |

0.5s |

1s |

|

Supports MT5 |

Yes |

Yes |

|

Lot Multiplier |

Yes |

Yes |

|

Order Filtering |

Yes |

Yes |

|

Risk Control |

Yes |

Yes |

|

Copy Signals |

Yes |

Yes |

|

Sell Your Signals |

No |

Yes |

Is CopyTrade.net Worth it?

The most important question I’m going to answer in this CopyTrade.net review is whether it’s worth it or not. Based on user discussions on Copytrade Reddit threads, the Local plan seems to satisfy most retail traders running everything on one VPS. The fast copying, unlimited accounts, and simple setup make it a good fit for people managing a few MT4/MT5 accounts on brokers like Exness.

The Cloud plan offers more flexibility and introduces CopyTrade cloud technology, plus the ability to sell signals. Traders who want to build small communities appreciate this, but some users compare it to Copytrade on GMGN and feel the ecosystem is smaller and less transparent. It covers similar needs to Finestel’s signal bots, but not at the same scale or depth, especially for crypto traders.

So yes, for small teams and retail traders, CopyTrade.net provides fair value. But if you’re running a more professional operation, especially one involving multiple strategies, client portfolios, or crypto infrastructure, the limitations become clear. In that case, stronger alternatives exist.

Best CopyTrade.net Alternatives

Now, if you like what CopyTrade.net offers but want to compare it with the best crypto copy trading platforms, there are a few strong alternatives. But your choice will depend on the type of trading you do.

|

Platform |

Key Features |

Best For |

|

CopyTrade.net |

Local & Cloud copier, MT4/MT5 support, signals marketplace |

Retail & small teams |

|

Finestel |

TradingView bots, signal bots, trading terminal, white-label copy trading |

Professional traders & asset managers |

|

MQL5 Signals |

Huge signal marketplace, automated copying |

Retail MT4/MT5 traders |

|

ZuluTrade |

Social copy trading, regulated, multi-asset |

Social traders |

|

GMGN |

Strategy stats, social analytics, trade mirroring tools |

Community traders & signal followers |

Finestel: CopyTrade.net Alternative for Crypto Asset Managers

When you compare CopyTrade.net with Finestel, the biggest difference is who they’re built for. CopyTrade.net focuses on straightforward copying, either local or cloud. It offers fast execution and support for unlimited MT4/MT5 accounts. So, I’d say it’s great for traders running small account groups or simple follower setups.

Finestel, on the other hand, is designed for professional operations. You get a full ecosystem that includes TradingView bots, signal bots, a multi-exchange trading terminal, and a fully customizable white-label copy trading solution for asset managers and trading brands.

It also provides equity-based risk controls, portfolio analytics, and a more scalable infrastructure. So, I’d always suggest Finestel for traders and firms who need enterprise-level tools and long-term growth in their asset management business.

Conclusion

To wrap up this CopyTrade.net review, I’d say it’s a solid choice for traders who want fast and reliable copy trading. The setup is also simple, so that’s a plus. Both the Local and Cloud versions are easy to use and work with any MT4/MT5 broker.

However, if you’re looking to scale into something more professional, you’ll need deeper automation, advanced risk controls, or a full white-label ecosystem. Finestel offers a much more complete solution. CopyTrade.net is a strong choice for many retail traders, while Finestel is built for asset managers and professional traders who want to scale long-term.

Leave a Reply