Crypto moves fast. One day, your portfolio looks balanced, and the next, one coin doubles while another tanks. Suddenly, your allocation is off, and the risk you planned for isn’t the risk you’re holding anymore. That’s where you’ll need crypto portfolio rebalancing tools.

Rebalancing keeps your portfolio aligned with your original plan. It’s how pros manage risk, lock in profits, and avoid emotional trading. In this guide, we’ll break down what crypto portfolio rebalancing really means, and when and how to do it. We’ll also look at some of the best crypto portfolio rebalancing tools out there, including the Finestel Terminal.

What Is Crypto Portfolio Rebalancing?

Crypto portfolio rebalancing is simply adjusting your holdings to get back to your original allocation plan. Let’s say you start with 50% Bitcoin and 50% Ethereum. After a few weeks, Bitcoin pumps hard, and now it’s 65% of your portfolio.

That means your risk exposure has changed. I mean, you’re now more tied to Bitcoin’s price swings than you planned, right? Well, rebalancing fixes that by selling a bit of BTC and buying more ETH until you’re back to 50–50.

I know, it might sound small. But over time, this habit can make a massive difference. You will take profits from assets that have grown too much and reinvest them into the ones that might still be undervalued. Basically, you’re buying low and selling high in a disciplined way.

In traditional finance, rebalancing is standard practice. Big funds and institutions do it all the time to manage risk. In crypto, it’s even more crucial because volatility can distort your portfolio much faster than you think.

When Should You Rebalance a Crypto Portfolio?

There’s no single answer to this question. The right time to rebalance depends on you, and by you, I mean your strategy, trading style, and risk tolerance. But in general, there are three main ways to do it: periodic, threshold-based, and event-based.

Periodic Rebalancing

Periodic rebalancing means you do it on a schedule. Maybe once a week, once a month, or once a quarter. It’s simple and predictable.

This method works well if you’re managing multiple portfolios or clients and don’t want to micromanage every price swing.

Threshold-based rebalancing

Threshold-based rebalancing happens when your portfolio drifts too far from your targets.

For example, if Bitcoin jumps from 40% to 50% of your portfolio, you might set a rule to rebalance once the deviation hits 10%. This one is a bit more sophisticated than rebalancing based on a calendar.

Event-based rebalancing

Event-based rebalancing is more dynamic. You do it when major market events happen, like big volatility spikes, Bitcoin halvings, or even regulatory news that affects a specific asset.

This is the most complex way for rebalancing your portfolio, as it requires decent knowledge and expertise in portfolio management and even economics.

How Should You Rebalance?

Rebalancing isn’t complicated, but it does require structure. Here’s a basic overview of how you can do it:

- Set your target allocation: Decide how much of each asset you want. For example, 50% BTC, 30% ETH, 20% stablecoins. This becomes your reference point.

- Check your weights consistently: Markets move fast, so your current portfolio might be far from that plan. Track your percentages to see what’s off.

- Adjust the positions: Sell a bit of what’s overweight and buy what’s underweight until you’re back in line.

- Review and repeat: Rebalancing isn’t a one-time thing. You need to monitor your portfolio weights all the time, and also performance, fees, and slippage.

Now, what I’ve explained above is the process you should go through manually. Manual rebalancing can work for small portfolios, but once you’re handling size or clients, automation becomes a must.

That’s why crypto portfolio rebalancing tools like rebalancing bots and software are becoming so popular. You’ll still do the first step by setting your rules and target allocations. But then, the rebalancing bots will follow your rules automatically, calculate drifts, and execute trades in seconds.

How Different Entities Approach Rebalancing

Not everyone should rebalance their portfolio the same way. It really depends on who’s managing the money and what tools they use. So I’m definitely not suggesting a single method for everyone.

Retail traders usually do it manually. They check allocations and make trades by hand. Some people also use apps like Shrimpy or CoinStats to automate part of the process, but most keep it simple and periodic.

Professional traders and asset managers, however, take it a step further. They usually use trading terminals or dashboards that connect to multiple exchanges. These platforms can rebalance entire portfolios automatically. They even allow bulk actions across several client accounts at once.

Crypto funds and DAOs often use smart contracts for rebalancing. The logic is written into the blockchain itself. When conditions are met, the contract rebalances automatically. It’s transparent and rule-based, which is perfect for decentralized asset management.

Exchanges and custodians do internal rebalancing too. They might shift liquidity between wallets or adjust exposure to maintain hedges.

After all, the main difference is scale and automation. Retail investors do it occasionally. Pros build systems that rebalance continuously. It’s quite obvious that the more capital you manage, the more you need automated crypto portfolio rebalancing tools to handle risk.

Discover How Binance Rebalancing Works; Start Optimizing Today

How to Build a Rebalancing Strategy

Building a good rebalancing strategy is about more than just picking when to rebalance. You should also know why you’re doing it and what outcome you want.

First, define your goal. Are you aiming to reduce volatility or lock in profits? Or maybe you just want to keep exposure balanced among sectors?

Next, set clear parameters. For example, what’s an acceptable drift? How much are you willing to trade each time? This way, you would avoid over-rebalancing, which can eat into profits through trading fees.

Your strategy should also consider market conditions. During high volatility, tighter control might make sense. In quiet markets, wider thresholds are better.

Tracking and analytics matter too. Review your performance after each rebalance period. See if your adjustments actually improved returns or just increased costs.

If you manage multiple accounts or investors, automation becomes key. Tools like Finestel’s upcoming rebalancing system will let you apply your rules across all portfolios instantly.

Best Crypto Portfolio Rebalancing Tools

If you’ve got multiple assets or manage funds, doing all the rebalancing by hand is a nightmare. That’s why almost all crypto asset management tools are built for automation, tracking, and execution. Speaking of which, here are some of the best crypto portfolio rebalancing tools in 2025:

|

Tool |

Best For |

Rebalancing Type |

Unique Feature |

Automation Level |

Non-Custodial |

|

Finestel Terminal |

Asset managers, crypto firms, and trading teams |

Custom rule-based (multi-account) |

Integrated portfolio and rebalancing suite with investor account control |

Fully automated |

Yes |

|

Shrimpy |

Retail and professional traders |

Automatic, rule-based |

Social portfolio automation and smart indexing |

Fully automated |

Yes |

|

3Commas |

Active traders using bots |

Manual or semi-automatic |

SmartTrade Terminal with DCA and grid bot integration |

Semi-automated |

Yes |

|

CoinStats |

Manual investors and data-focused traders |

Manual (tracking-based) |

Real-time multi-wallet syncing with DeFi and NFT support |

Manual only |

Yes |

|

Bitsgap |

Active traders running bots |

Smart bot-assisted balancing |

Smart Rebalancer works alongside live grid and DCA bots |

Semi-automated |

Yes |

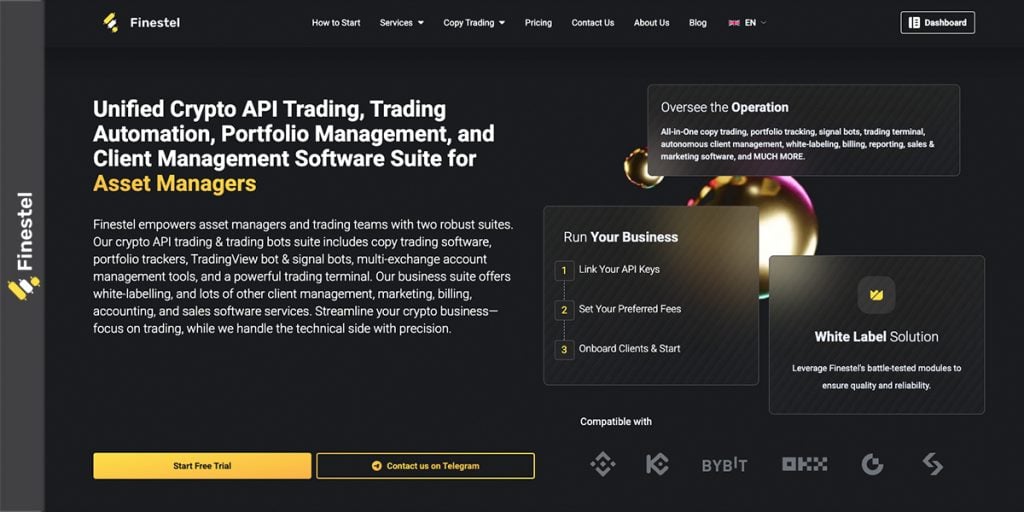

1. Finestel Terminal

Finestel trading terminal is built for pros. I mean, asset managers, crypto firms, and trading teams. These are the guys who handle multiple exchange accounts and clients, and they need something sophisticated.

Finestel’s product is not just an automated trading platform, a crypto portfolio rebalancing tool, or a simple portfolio tracker. We offer a full asset management suite. And by that, I mean all these features are included.

You can monitor your portfolio’s performance and manage several investor accounts on supported exchanges. And soon, you can also automate rebalancing across all these portfolios, and even build portfolios from one place. Our crypto rebalancing software will let you set custom allocation rules, triggers, and timeframes.

And the best part, in my opinion, is that it’s non-custodial. Your funds stay on your connected exchanges, and trades are executed securely through APIs. We also offer white-label copy trading software, signal bots, and other automated trading solutions to elevate your asset management business.

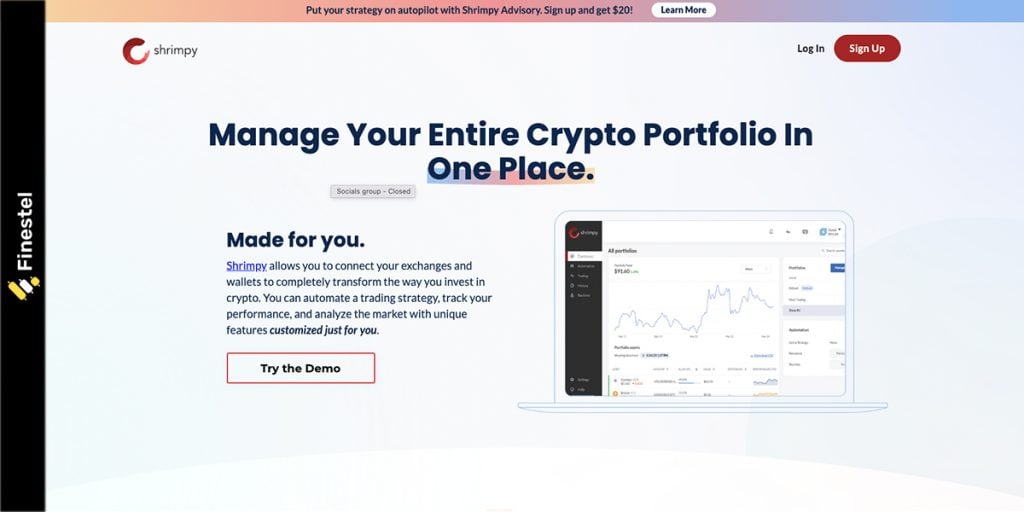

2. Shrimpy

Shrimpy is the second entry on our list of the best crypto portfolio rebalancing tools. In fact, it’s one of the most popular platforms that traders use to rebalance crypto portfolios automatically. You can connect it to several exchanges, and it automatically rebalances your assets. This rebalancing is, of course, based on the targets you set.

Shrimpy’s unique feature is social portfolio automation. You can copy other traders’ allocations or share your own. It also supports smart indexing, which lets you build portfolios that track market sectors and not just coins. That’s quite similar to the stock market.

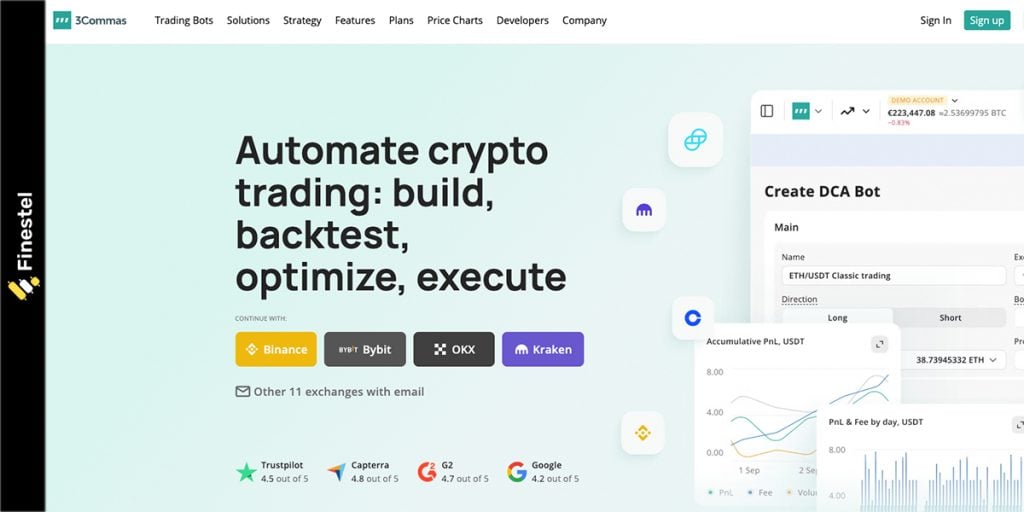

3. 3Commas

3Commas is a full trading automation tool. It combines portfolio management with bots, smart trading terminals, and advanced order types.

The SmartTrade Terminal is 3Commas’ main product. You can rebalance and set stop-loss and take-profit targets. Also, you’re able to run DCA or grid bots alongside their crypto rebalance software.

If you want manual control with automation support and features more advanced than those Shrimpy offers, then I’d recommend 3Commas.

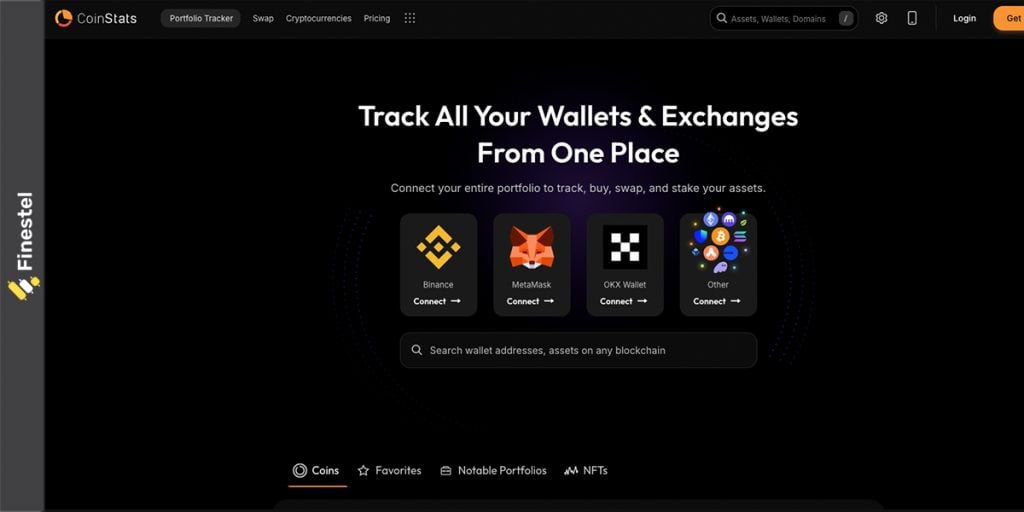

4. CoinStats

CoinStats is another well-known name on our list of the best crypto portfolio rebalancing tools. However, I’d personally classify it as a portfolio tracker, but it’s also incredibly useful for manual rebalancing. It pulls all your wallets and exchange accounts into one dashboard so you can see exactly where your portfolio stands.

Its unique feature is real-time multi-wallet syncing. It gives you a clear view of your entire portfolio. And yes, that includes DeFi positions and NFTs.

Yet, remember that it isn’t automated and doesn’t execute trades for you. CoinStats just gives the data and alerts you need to decide when and how to rebalance.

5. Bitsgap

Bitsgap is the last crypto portfolio rebalancing tool on our list, but it’s not inferior. It mixes portfolio management, arbitrage, and trading bots.

The unique feature Bitsgap offers is the Smart Rebalancer that works alongside your active bots. You can keep running grid or DCA bots. Meanwhile, it also maintains your target allocations automatically.

Common Mistakes to Avoid When Rebalancing

Rebalancing keeps your portfolio in shape, but doing it wrong can easily backfire. One common mistake is over-rebalancing. Some traders adjust their allocations too often. They react to every small price move. That creates unnecessary fees and reduces returns. It’s better to set a clear schedule or deviation threshold and let small market swings play out.

Another mistake is ignoring trading fees and slippage. Every rebalance involves buying and selling. Naturally, those costs add up quickly, and that can become significant when managing multiple portfolios. Always check if the rebalance makes financial sense after fees. Sometimes, it’s smarter to wait.

Another important mistake I’ve been personally guilty of is not adapting to market conditions. A strategy that works in a trending market might fail in a choppy one. Your rebalancing rules should evolve as volatility and liquidity change.

Many traders also forget taxes. In some countries, every rebalance triggers a taxable event if it involves asset withdrawals from the exchange. If you’re managing several portfolios, ignoring this can turn a good year into a messy one.

Lastly, some traders rebalance without tracking performance. They adjust allocations but never measure the results. You need to know if your rebalancing strategy is actually improving returns or just keeping you busy.

The Best Crypto Portfolio Rebalancing Tools Infographic

Conclusion

Rebalancing isn’t just a routine task. It keeps your portfolio healthy and your strategy disciplined. Markets change fast, and without rebalancing, even a solid plan can drift off course.

Manual rebalancing can work for small portfolios, but once you’re managing larger capital or many clients, I’d suggest going down the automated route. Tools like Shrimpy, 3Commas, CoinStats, and Bitsgap already make it easier, but Finestel Terminal takes it to a professional level, and now you clearly know why.

Leave a Reply