In the financial markets, Managed accounts have evolved increasingly as a concept of secure trading among traders and investors. These accounts suggest skilled traders and money managers have the chance to benefit from their expertise. Among the various types of managed accounts, PAMM (Percent Allocation Management Module), LAMM (Lot Allocation Management Module), and MAM (Multi-Account Manager) are the most well-known options.

This article from Finestel is about PAMM vs. LAMM vs. MAM trading systems with different investment structures. Besides discussing the aspects of their structure, control, risk management, and sharing the profits, it provides details about the usefulness of each method for money managers and investors. In addition, it also suggests tips on selecting the proper investment layout based on trading strategies and evaluates the performance of PAMM vs. LAMM vs. MAM in both markets.

Understanding Managed Accounts in Crypto & Forex Market

Managed accounts are a type of investment account where a professional money manager trades on your behalf. The platforms are available for various asset classes, including Forex and Crypto. Managed Forex accounts are becoming increasingly popular, with many top brokers investing in technology that allows traders to build additional sources of revenue.

Managed accounts, whether in traditional forex trading or cryptocurrency trading, are professionally managed portfolios where an investment corporation, individual manager, or automatic trading system manages the trading on behalf of the investor.

There are many providers of managed Forex and crypto accounts. Some of the top-rated managed account providers include eToro, AvaSocial, Finestel, VantageFX PAMM, Capital.com MT4 Signals, and Pepperstone MAM.

Introduction to PAMM, LAMM, and MAM

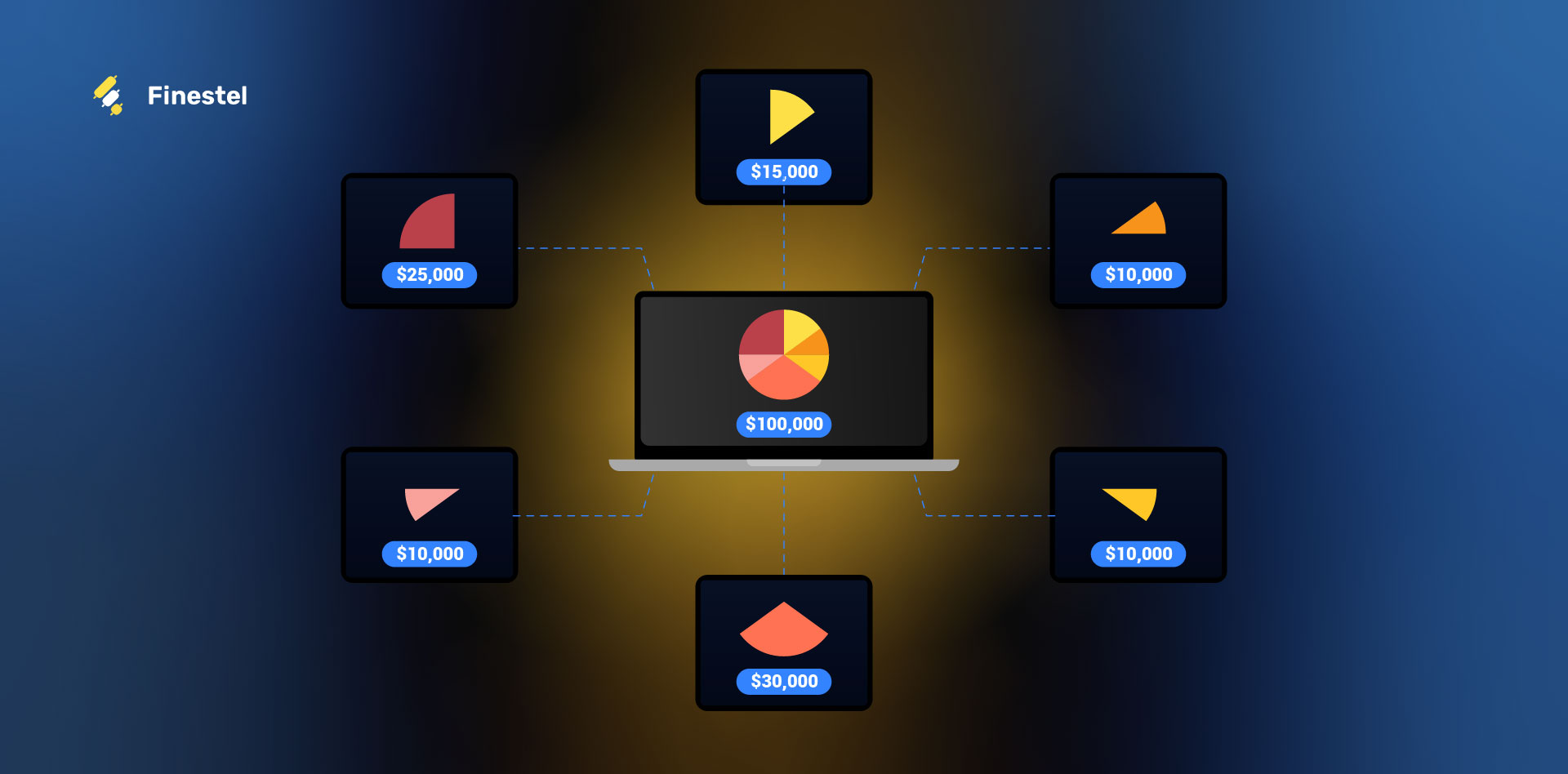

PAMM vs. LAMM vs. MAM is a challenging topic. These managed account systems allow investors to delegate the fund management process to experienced professionals while maintaining control over investment decisions.

PAMM enables investors to allocate capital to managers based on percentage ratios, with profits that distribute accordingly. It allows for portfolio diversification and a broad selection of professional managers.

LAMM replicates trades to accounts that belong to investors without pooling capital, offering easy and quick disconnection from the copying service. It is appropriate for larger trading capitals.

MAM merges the features of PAMM and LAMM by utilizing percentage allocation and providing flexibility for managers to allocate fixed lots based on risk profiles. This system empowers managers to exercise greater control over risk management and customize strategies for individual investor accounts.

Key Differences between PAMM, LAMM, and MAM

PAMM, LAMM, and MAM are three types of investment management structures. PAMM pools investor funds, LAMM allows investors more control over their investments, and MAM combines percentage and lot allocation for profit sharing.

Structure and Control

The structure and control for investors and managers differ in PAMM vs. LAMM vs. MAM.

PAMM: Investors’ funds are collected into a single account managed by the manager. The manager has absolute control, while investors have limited control and rely on the manager’s expertise.

LAMM: Investors keep individual accounts connected to the manager’s strategy. They control their trades and can disconnect from the copying service when desired, providing more control and monitoring capabilities.

MAM: It merges PAMM’s percentage allocation with flexible lot allocation. Managers can customize trades based on investor risk profiles. Managers have increased control over strategies, while investors maintain control over their accounts and real-time monitoring.

Risk Management

Risk management varies in PAMM vs. LAMM vs. MAM.

PAMM: Money managers have maximum control over trades and risk management. Investors are committed to relying on the manager’s expertise for risk mitigation.

LAMM: Investors preserve individual accounts and have more control over risk management. They can set their risk parameters and adjust position sizes.

MAM: Managers can adjust risk parameters based on each investor’s risk levels. Investors can control their accounts and cooperate with managers on risk management decisions.

Profit Sharing

The profit distribution faces distinct approaches in PAMM vs. LAMM vs. MAM.

In PAMM, profits are distributed proportionally among investors based on their investment percentage, while the manager acquires a performance fee. Distribution is transparent and can be monitored in real-time.

LAMM operates similarly, with profits shared based on account balance and equity percentage. Investors can monitor their trades and profit allocation in real-time.

MAM allows managers to customize profit sharing. Based on agreed terms with investors, they can set their fee structures, including management and performance fees. This flexibility enables adapting the fee structure to trading strategies and investor preferences.

Which Investment Structure Is Ideal for Money Managers?

Money managers’ ideal investment structure depends on their preferences and trading strategies. PAMM accounts offer complete control to managers confident in generating consistent profits, while LAMM accounts provide more flexibility for managers who want to give investors control over their trades. MAM accounts combine both benefits, allowing managers to customize strategies for individual investors while maintaining greater control over risk management and capital allocation.

Ultimately, the choice between PAMM, LAMM, and MAM should be based on the manager’s trading style, risk approach, and personal preferences.

Which Structure is Suitable for Investors?

When choosing between PAMM, LAMM, and MAM accounts, investors should consider their trading goals, risk tolerance, and desired level of control.

PAMM accounts are ideal for investors who prefer a hands-off approach and want to delegate trading decisions to experienced money managers. LAMM accounts provide more control to investors who want to set their own risk parameters while still benefiting from a manager’s expertise. MAM accounts offer a balance between control and professional management, allowing investors to customize their trading strategies with the help of a manager.

Finally, the best choice for an investor will depend on their individual needs and preferences.

How to Choose the Right Investment Structure

To select the optimal investment structure, Consider the following metrics when choosing the right investment system:

- Regulation: Make sure that the chosen platform and money manager are regulated. Try prioritizing safety measures by seeking insurance coverage and a regulator’s license.

- Track Record and Performance: Try to evaluate the manager’s track record and performance history. Better to seek constant profits and low drawdowns, especially in cryptocurrency trading.

- Risk Management: Evaluate the manager’s risk management policy. Look for practical strategies to safeguard investor funds.

- Fees and Profit Sharing: Compare fee structures and profit-sharing arrangements. Think about the value provided in terms of performance.

- Transparency and Communication: Prioritize structures that offer transparency in trading decisions and profit allocation. Ensure effective communication between both investors and managers.

Evaluating Performance: Comparing PAMM, LAMM, and MAM in Forex & Crypto

When evaluating the performance of PAMM, LAMM, and MAM accounts in Forex and Crypto trading, it’s crucial to understand the unique characteristics of these markets and how these account types operate within them.

In Forex trading, PAMM accounts distribute profits and losses proportionally based on the capital invested by each participant. This can be advantageous in the highly liquid Forex market, where even small gains can lead to significant profits when using leverage.

LAMM accounts in Forex allocate trades based on a fixed number of lots, regardless of the investors’ account sizes. This can benefit investors with larger accounts who can handle the higher risk associated with larger lot sizes.

MAM accounts in Forex allow managers to assign different risk levels to each sub-account, catering to the diverse risk tolerances and investment goals of investors.

In Crypto trading, the high volatility of the market makes proportional distribution of profits and losses in PAMM accounts beneficial. This allows investors to share in the potential high returns while also sharing the risk.

LAMM accounts in Crypto trading can be risky for investors with larger accounts due to the high volatility and potential for large price swings, resulting in larger absolute profits and losses.

MAM accounts in Crypto trading offer the advantage of assigning different risk levels to each sub-account, enabling investors to customize their risk exposure based on their individual risk tolerance.

In summary, the performance of PAMM, LAMM, and MAM accounts in Forex and Crypto trading depends on factors such as the manager’s skill, market conditions, and the risk tolerance and investment goals of the investors. It’s essential for investors to consider these factors and select the account type that aligns with their specific needs and preferences.

PAMM vs. LAMM vs. MAM Infographic

Conclusion

To conclude about PAMM vs. LAMM vs. MAM, their accounts offer distinct advantages for money managers and investors in the crypto and forex markets. PAMM provides centralized trading, LAMM grants investor control, and MAM combines flexibility with percentage allocation.

Investors should consider goals, risk tolerance, and control when choosing an investment structure. Other crucial steps are evaluating managers based on profitability, risk management, transparency, and communication.

There is no all-in-one solution to fit all, and the optimal choice depends on individual preferences and strategies. Thorough research will help investors make informed decisions and increase their chances of success.

FAQ

How do PAMM, LAMM, and MAM differ from each other?

PAMM, LAMM, and MAM differ in structure, control, and profit sharing, with PAMM pooling funds, LAMM offering investor control, and MAM combining percentage and lot allocation.

How does LAMM differ from PAMM and MAM in terms of risk management?

LAMM provides investors more control over risk management compared to PAMM and MAM.

What are the typical fees associated with PAMM, LAMM, and MAM accounts?

Fees vary for PAMM, LAMM, and MAM accounts, including management and performance fees determined by the platform and agreement.

Which platforms offer PAMM, LAMM, or MAM services for cryptocurrencies?

Platforms like eToro, ZuluTrade, and AvaTrade offer PAMM, LAMM, and MAM services for cryptocurrencies, emphasizing the need for reputable and regulated platforms.

Leave a Reply