PAMM accounts present a unique investment avenue, enabling individuals to access the financial markets and potentially generate returns through the expertise of skilled traders. In this practice, three sides are involved, including the investor, trader, and broker. This system is mostly used by Forex traders and, recently, by cryptocurrency traders. The procedure is straightforward, where traders use the allocated funds by investors to trade in financial markets in a Forex broker or crypto exchange.

By reading this post on Finestel, you will understand what a PAMM account and its types are. Also, in what terms are they different from LAMM or MAM account types? Going further, we have provided the readers with the benefits a Percentage Allocation Management Module account has and reviewed equal distribution and percentage allocation in a Percentage Allocation Management Module account. Also, a step-by-step guide about how to use a PAMM account in the crypto market and the fee structure of a PAMM account. Hopefully, at the end of this post, the reader will know PAMM account types and their benefits and risks in the market.

Understanding the Concept of PAMM Accounts

PAMM account is yet another investment account solution that enables individuals to participate in the financial markets without having to trade themselves. Forex traders commonly use this investment solution, which stands for the Percentage Allocation Management Module. Taking a closer look, the percentage in PAMM refers to the manager’s share percentage, profit distribution percentage, or investor’s allocation percentage.

Going further, allocation in PAMM refers to the funds that investors assign or allocate to the PAMM account for trading purposes. Finally, the management module suggests that PAMM is an investment solution or a money management model that traders can choose to reap profit. Overall, PAMM accounts are a simple way for investor’s pick to benefit from profits with the slightest contribution.

PAMM in Crypto

The concept of PAMM was there for several years, and forex traders used it. However, with the growth of the crypto market, it is now gaining popularity, and many crypto traders and investors use PAMM accounts. The PAMM accounts in crypto do not offer unique characteristics; however, the difference lies inherently in the crypto market. First, the trading hour in the crypto market is 24/7, and the traders can trade any time they wish; this will provide them with more opportunities.

Then, the regulatory issues in the crypto market are less since the market is yet to grow; however, overnight regulation can damage traders’ portfolios. Also, traders and investors who have a PAMM account in a crypto exchange must be aware of market volatility since the crypto market is highly volatile. Finally, the asset classes in PAMM accounts in crypto are far more in numbers, and they include Bitcoin, Ethereum, and other digital currencies, to name a few.

PAMM in Forex

The PAMM account types in Forex have their origins back to the early 2000s when Alpari offered this account type in 2005. The Percentage Allocation Management Module account type was an innovative approach to trading and gained popularity as time passed. Currently, there are many forex brokers that offer PAMM account types to traders and investors. So let’s dive into the details and see what are the characteristics of a PAMM account in Forex.

First, unlike the crypto market, the trading hours in Forex are 24/5, and things go off at weekends in the Forex market. Second, the structure of the PAMM account is the same in both Forex and crypto markets. Where Investors allocate their funds to professional traders who manage trades on their behalf. Third, regarding diversification, the traders in the Forex market have less access to more asset classes, and they trade on currencies. Finally, While there are differences in terms of the specific market focus and asset class, the core concept of PAMM accounts remains the same in both the crypto and forex markets.

PAMM Revenue Model for Asset Managers and Traders

The revenue model for asset managers and traders is varied and depends on the brokers’ fee structure, volume, and commission. However, there are still other variables that we have tried to explain the cash flow for asset managers and traders.

- Profit sharing: case-by-case sharing of a proportion of profit based on investor’s and manager’s negotiation.

- IB Fees: it is the abbreviation for introducing brokers, and it is compensation to managers and traders for introducing new investors.

- Volume Commission: a commission paid to traders and managers based on trading volume and activity.

- Management Fees: an additional fee that traders and investors agree upon and calculated per the total funds under management.

- Performance Fees: it is the main cash flow for managers and is calculated per the profit earned by the PAMM account.

PAMM, MAM, and LAMM in a Nutshell

As you may have suggested, they are all investment solutions with slight differences. The common feature is that PAMM, MAM, and LAMM are investment structures allowing investors to benefit from traders’ expertise. However, the differences lie in the functions they offer.

- PAMM: trader or manager deals with a pooled investment fund, and the investor’s profit or loss is calculated based on the allocation percentage.

- MAM: trader or manager accesses a professional account wherein they manage position and risk management on a per-account basis.

- LAMM: L here stands for lot, and it means the lot size of trades is allocated proportionally to the investors’ account.

Overall, PAMM, MAM, and LAMM are investment solutions that follow the same objective in a different manners.

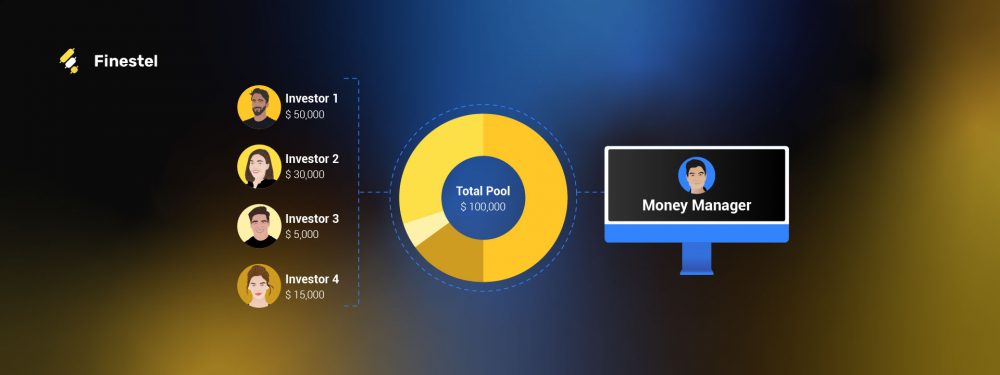

How Does PAMM Work?

In a Percentage Allocation Management Module account, there are three participants, including a broker, trader, and investor. Simply put, a trader uses an investor’s capital to trade, and the broker connects these two. So let’s see how this process works in more detail.

- The investor or the fund owner and the trader or manager create a PAMM account on a brokerage (in Forex) or software (in crypto market).

- The investor allocates a portion of their capital to the manager’s account.

- The trader uses the total capital of investors pooled together to trade.

- After trading, the profits and losses are calculated and distributed per the agreed specifications.

- The PAMM platform tracks the trading activity and performance of fund managers.

- The fund manager receives the fees and compensation for their service.

Allocation Methods in PAMM: Equal Distribution vs. Percentage Allocation

Equal distribution and percentage allocation are two used allocation methods in PAMM. In the equal distribution method, the percentage of allocated funds is equally distributed among managers or strategy. Simply put, suppose you have $10,000 in a PAMM account.

Then, if you allocate $5000 to strategy A and $5000 to strategy B, you have equally allocated your strategy to the manager. On the other hand, in percentage allocation, the investor can determine how much to allocate, and it could be varied. For example, %10 to Strategy A, %40 to Strategy B, and %30 to strategy c. In simple terms, the fund allocation in equal distribution is the same for all strategies; however, it can vary in percentage allocation.

Advantages of PAMM Accounts: Exploring the Benefits

PAMM accounts provide traders and investors with several opportunities for potential profits. Traders can act as an account manager and make money using investors funds. Also, investors who contribute to a PAMM account benefit from potential profits made by managers or traders. Here we have provided a list of advantages for both investors and traders.

Advantages for traders

- Earn additional income

- Broader investor base

- Performance-based fee structure

- Increased visibility and credibility

Advantages for investors

- Benefit from trader’s experience and expertise

- Investment diversification

- Passive income

- Potential for capital appreciation

In addition, investors can withdraw at will whenever they are convinced they are not satisfied with the trader’s performance. Finally, traders benefit from the transparent conditions, where they can rest assured that automatic fund distribution impedes fraudulent activities.

PAMM Account Performance Fees: How Managers Earn Profits

As mentioned earlier, the performance fee is a revenue stream for traders and managers who operate in a PAMM account. Exploring further, the performance fee is the percentage of profit generated by traders, which is agreed upon by the fund manager and investor. In addition, the performance fee has many forms and details like profit sharing, high-water mark principle, and incentive alignment.

First, the high watermark principle is the highest profit that a PAMM account has reached. After that, the performance fee is charged on new profits. Afterwards, the profit sharing takes place and is calculated per the percentages of new profits generated by the fund manager. Finally, another cash flow for managers is through incentive alignment, where the alignment of interest motivates fund managers to make successful trading decisions.

PAMM Vs. Profit Sharing

They are both investment solutions with different structures, where in PAMM, multiple traders are included and in profit sharing, investor and trader. To have an overall view of both and to inspect the difference easier, we have listed the properties.

Percentage Allocation Management Module

- Multiple investors pool their funds, and trader manages them.

- Traders execute trades on investors’ behalf, and profits distribute based on investors’ allocations.

- The managers charge a fee based on the total assets under management.

- Depending on the profits, the fund managers may also earn a performance fee.

Profit sharing

- An agreement between trader and investor to share profits generated from trading activities.

- Investors contribute capital, and traders use this capital to trade, and the profits distribute based on the agreed profit-sharing ratio.

- A fund manager may not involve; instead, traders and investors participate in trading activities.

- The flexibility factor is more expected, and investors may say the final yes or no.

How to Invest in PAMM Accounts in the Crypto Market

Percentage Allocation Management Module accounts do not offer a unique feature in the crypto market; however, the difference lies in the asset class, volatility, and blockchain technology. What is mentioned are intrinsic values that the crypto market bears, which both traders and investors should take into account. Here we mentioned the steps to invest in PAMM accounts in the crypto market.

- Select an exchange or software like Finestel that offers PAMM account services.

- Look for managers who are experts in crypto trading with a track record.

- After selecting an exchange, follow the tutorials and open a PAMM account.

- Read the terms and conditions provided by the software and review the regulatory issues.

- Fund your PAMM account.

- Decide and select the amount you want to allocate to your PAMM account.

- Review and monitor the trader’s performance.

- Withdraw your profit to see how it works and, if desired, reinvest the profits made.

How to Become a Money Manager in PAMM

Becoming a fund manager or trader in PAMM requires some general steps together with some specific requirements. Here we have provided an overview of both general and specific guidelines for becoming a money manager in a Percentage Allocation Management Module system.

General Guidelines

- Show consistent performance and create a proven track record.

- Obtain certifications related to trading and investment management.

- Develop a clear and well-defined trading strategy.

- Maintain open communication with investors.

Specific guidelines

- Identify reputable PAMM platforms or brokers that offer PAMM account services.

- Understand the requirements of chosen PAMM platform.

- Set up a PAMM account after reading the terms and conditions.

- Promote and market your PAMM account to the potential investors.

PAMM Account Types: Choosing the Right Option for You

Choosing the right PAMM account for you is sometimes difficult since your expectations are subjective and the market has an objective nature. However, before choosing the right account type, consider the factors like investment goals, risk tolerance, investment capital, and your investment capital. Going further, depending on the needs and preferences of investors, the following Percentage Allocation Management Module account types exist.

- Individual PAMM account: individual investors who deal with a specific fund manager.

- Pooled PAMM account: multiple investors pool their funds together, and fund managers execute trades.

- VIP PAMM account: this PAMM account offers personalized services and dedicated account managers.

- Corporate PAMM account: corporate entities or institutional investors use this account type.

Overall, to choose the right PAMM account type, consult with the exchange and review the terms and conditions together with reviews of the platform.

Are PAMM Accounts Safe?

The safety of Percentage Allocation Management Module accounts depends on to what extent you are familiar with the factors like transparency, regulations, and risk management. Furthermore, some factors are related to the exchange or platform you choose, and some other factors depend on the market conditions and unpredictable events. We have listed all factors separately for the convenience of readers.

PAMM platform and manager

- Select a reputable and well-known exchange.

- Check the regulations and if a regulatory body authorizes the platform.

- See if the broker offers transparent reporting on the PAMM managers.

- Investigate the measures that the broker offers regarding investor protection.

Investor

- The investor should be aware of the practices taken by traders and see if they have a disciplined approach.

- Diversifying your investment across multiple PAMM accounts can mitigate the risks.

Risks Associated with PAMM Accounts

What we have reviewed so far was related to the Percentage Allocation Management Module accounts feature and the benefits they offer. However, there are some risks associated with this investment solution that must be reviewed as well. First, the market is highly volatile, and managers may take preliminary measures; however, they may not succeed, and your capital will be at risk.

Then, the fact that a trader manages your capital means that you have no control over it, and the trader may not succeed. Next, your funds may be inaccessible as a result of a lack of liquidity, and the withdrawal process may be restricted.

Then, since all activities take place in the online setting, technological failures, cyber threats, or trade execution errors are expected. Overall, understanding these risks can help traders and investors prevent them, and investors who ask professionals for advice can mitigate the risks.

An Overview Infographic: PAMM

Conclusion

In this post, we have tried to shed light on the concept of PAMM accounts and how traders and managers can benefit from it. We have reviewed how this investment solution and how it is different from MAM and LAMM. Furthermore, we have tried to inspect the allocation in PAMM and address the differences between equal allocation and percentage allocation. Regarding profits, we have specified the readers with revenue streams and how the account manager’s performance fees work. In addition, we have specified the ways to use a PAMM account in the crypto market for those crypto enthusiasts. Finally, as all markets have risks, we have warned the traders and investors of the risks and how they can mitigate them.

Overall, PAMM accounts are one of the dozens of investment solutions that exist, especially for those who want to benefit from a passive income. This practice takes place in a platform that offers a PAMM account type, and the manager and investors will use it expecting to reap gains. Investing in a PAMM account is a win-win situation where traders and investors benefit.

FAQ

What does PAMM stand for?

PAMM stands for Percentage Allocation Management Module. Also, it is an investment solution that allows investors to allocate their funds in a PAMM account to a manager.

How can I invest in a PAMM account?

The initiative is to choose a broker or exchange that offers a Percentage Allocation Management Module account. Then, set up your account and deposit funds in your account. Afterwards, select a money manager that suits you most and allocate your funds to the chosen the manager.

Are PAMM accounts legal?

Like many other investment solutions, PAMM accounts legality depends on where you are operating from. In some countries or jurisdictions, they are offered by a regulated broker; however, in others, they may exist some restrictions. Overall, these accounts are not highly warned by governmental bodies, and in many places, they are legal.

How can I monitor the performance of a PAMM account?

Most of the brokers or exchanges that offer a PAMM account provide reporting and analysis tools. Also, in account statements provided by brokers, you will access the information on trades executed. Furthermore, you can find other communication channels with your PAMM manager or read feedback and reviews if available.

Are there any fees associated with investing in a PAMM account?

Yes, investing in a PAMM account involve fees, and some of them are performance fee, management fee, and brokerage commission. Understanding the fee structure associated with the PAMM account is an important measure metric to understand the concept of a PAMM account.

Is PAMM account profitable?

Like many other skills, profitability depends on skill and performance. In the PAMM investment structure, market conditions, managers’ performance, and risk management are crucial. The profitability is not guaranteed; however, by considering the mentioned metrics, traders and investors can benefit from unlimited profit in the market.

Leave a Reply